On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 10.11.2025

## 🧠Quote(s) of the week:

> If we don't diagnose and treat the core of the problem, people are only going to continue moving closer to the polar ends of the political spectrum. Broken money is at the core of today's issues. Until that is widely acknowledged, nothing will get fixed. - Marty Bend

## 🧡Bitcoin news🧡

Before we start. Over the past few weeks, I stepped away for a moment — no weekly recaps, no updates. Life had its way of asking me to slow down, reset, and catch my breath. It was necessary, and honestly, it felt good to disconnect for a bit.

But I’m back now, fully recharged and ready to dive in again. Thanks for sticking around — let’s pick up where we left off.

Photos hosted by Azzamo (

Azzamo

Azzamo | Web Hosting, Bitcoin Payment & Nostr Relay Services

Azzamo offers fast web hosting, BTCpay & LNbits hosting, and Nostr relays. Build your online presence with secure, reliable solutions.

)

**On the 3rd of November:**

➡️'Bitcoin has averaged over 40% gains in November since 2013.

)

➡️Norway reports a 30% rise in taxpayers declaring digital assets in 2024, with holdings exceeding US$4B.

**On the 4th of November:**

➡️Wicked: 'Everyone who first started daily DCA'ing bitcoin anytime over the past year is now at a loss on their investment, price lower than cost basis. If bitcoin were to drop down to $83k, then everyone who started as early as the last halving, on April 20, 2024, would also be at a loss.'

➡️'Bitcoin officially enters bear market territory, now down -20% since its record high seen on October 6th. We are living in the most exciting market in history.' -TKL

➡️Joe Consorti: 'Bitcoin is now down 20% from its all-time high—in equity terms, this would be considered the start of a bear market. We've already seen two 30%+ drawdowns this cycle. Nothing new under the sun. This is just capitulation from spot Bitcoin holders.' -Joe Consorti

➡️Largest re-accumulation event in the history of the asset class 300-500k.

➡️Pierre Rochard: We need more Bitcoin education. The mispricing is a result of growing information asymmetry. Check out and share:

Satoshi Nakamoto Institute

Advancing and preserving bitcoin knowledge

➡️This is bitcoin's 2nd-worst day of the year, down over 6%, now officially a bigger drawdown than last month's liquidation event.

➡️'Sequans becomes the first Bitcoin Treasury Company to officially sell part of its Bitcoin holdings. The firm announced it had sold 970 BTC to redeem 50% of its convertible debt from its July 7, 2025, offering. This move reduces Sequans’ total outstanding debt from $189M to $94.5M. Its Bitcoin holdings now stand at 2,264 BTC, down from 3,234 BTC. CEO Georges Karam called the sale a “tactical decision aimed at unlocking shareholder value” amid current market conditions.' -Bitcoin News

**On the 5th of November:**

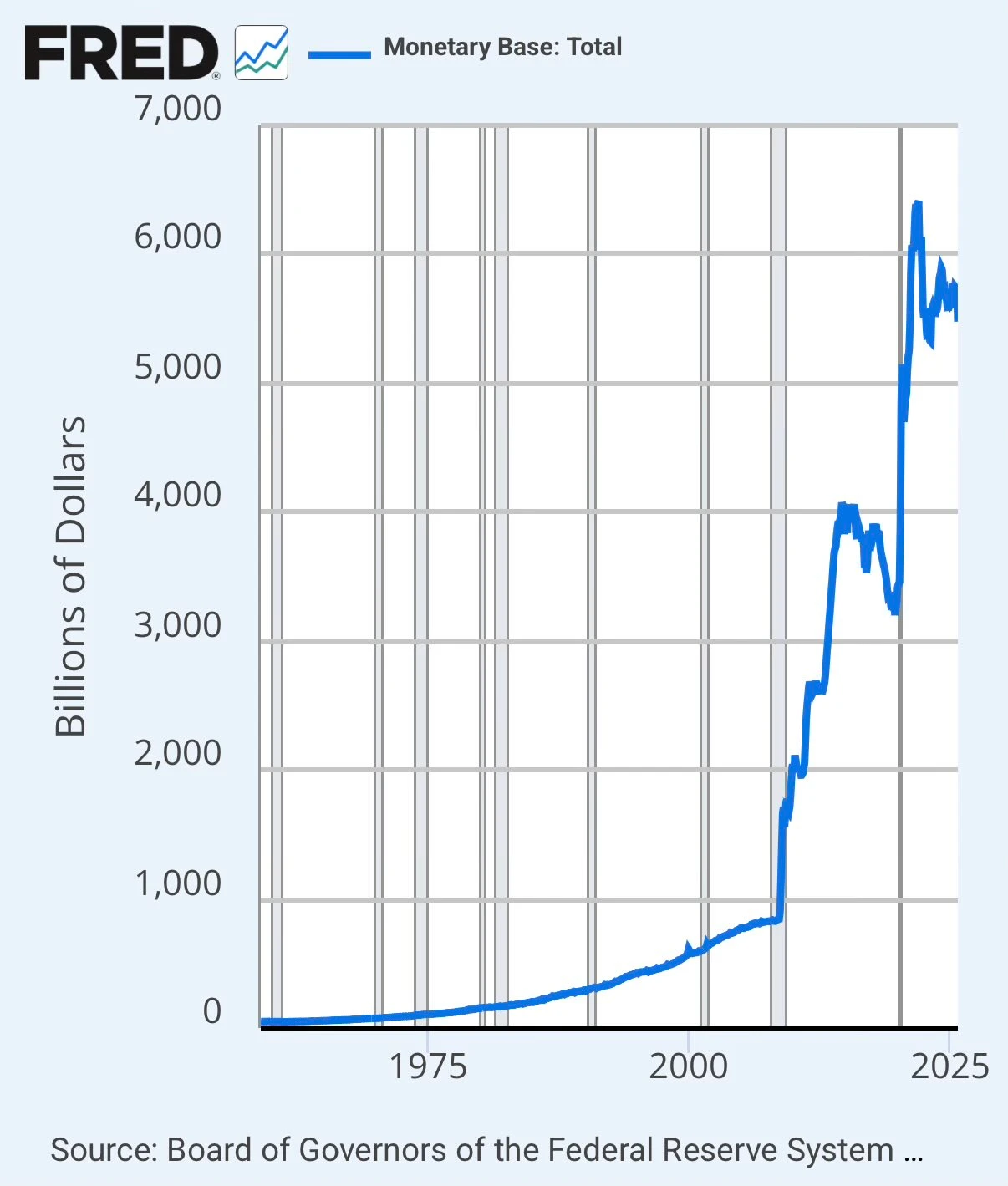

➡️DenverBitcoin: "78% of all US Dollars in existence were created after 2019.

)

When people say “Capitalism doesn’t work.”

What they really mean is, “The limitless + costless creation of money doesn’t work.”

Your money is broke. Opt out."

Study Bitcoin

➡️Pullbacks in Bitcoin price are a feature of bull runs, not a bug. The recent drawdown of -21% from the all-time high doesn’t even make this list.

)

**On the 6th of November:**

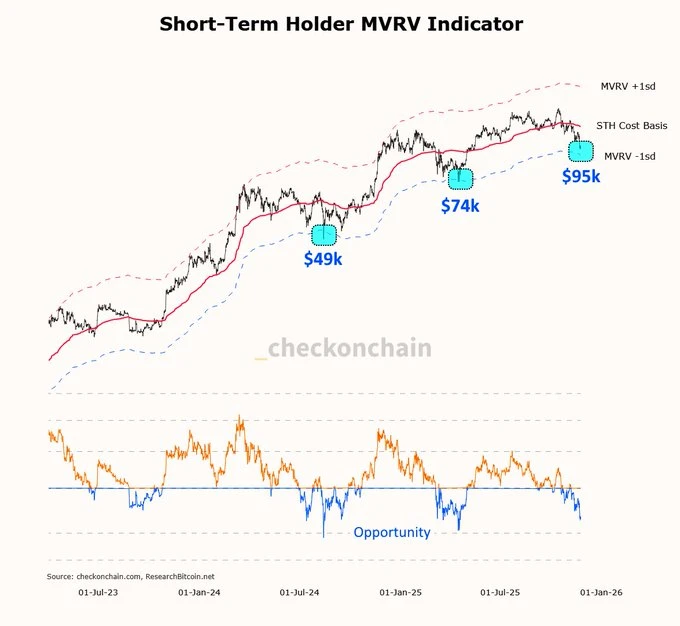

➡️BITCOIN MIMICS APRIL CRASH

Bitcoin Archive:

In April, Bitcoin fell 30% to $74K before rallying 70% to $126K Several indicators marked the low in hindsight, including MVRV, Supply in Loss %, 365DMA, and RSI. Today, those same indicators are signaling a potential reversal.

Structurally, it all looks the same. My theory is that people are just down and tired of being chopped up throughout the year.

➡️Wicked: "In dollars, prices of houses have more than doubled. In Bitcoin, they continue to collapse, trending toward zero. Wake me up when the average new house costs less than 1 BTC."

)

➡️Institute of Technology and Renewable Energies to sell 97 Bitcoin ($10M), originally bought for $10,000 in 2012 during a blockchain research project.

➡️Normally, the following I would place the following in the segment Macro/geopolitics.

Mark Mitchell: 'This chart is damning. The death of true capitalism.'

)

The chart is real. The conclusion is not.

Great response by Rock Chartrand: 'What you’re calling “the death of true capitalism” is actually the triumph of government-managed markets. When the state rigs the rules, prices signal politics instead of value. Capitalism didn’t fail. It was replaced. If productivity rises but your paycheck doesn’t, the first question is: Who inserted themselves between you and the value you produce? The answer is never “capitalism.” It’s always “the people who claim to be protecting you.”

Opt out, study Bitcoin.

WTF Happened In 1971?

WTF Happened In 1971?

https://inflationdata.com/articles/2022/08/10/u-s-cumulative-inflation-since-1913/ "I don't believe we shall ever have a good money again befo...

➡️JPMorgan analysts see Bitcoin reaching about $170,000 within the next 6 to 12 months. They cite leverage resets, improving volatility relative to gold, and a market correction of nearly 20 percent from recent highs. Analysts also noted record futures liquidations on Oct. 10 and renewed security concerns after the $120 million Balancer exploit as reasons for recent concern.

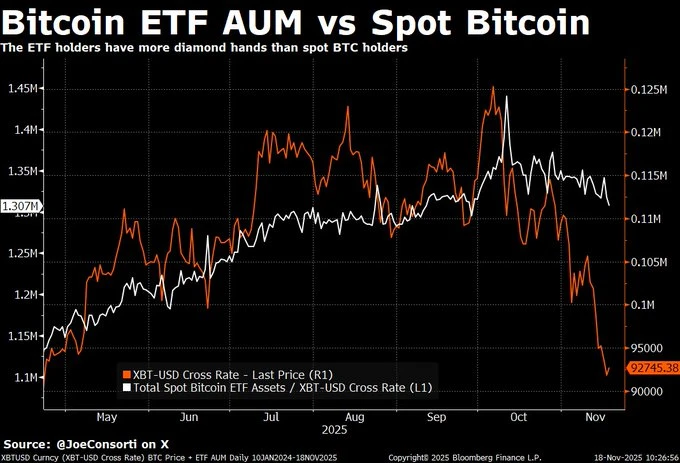

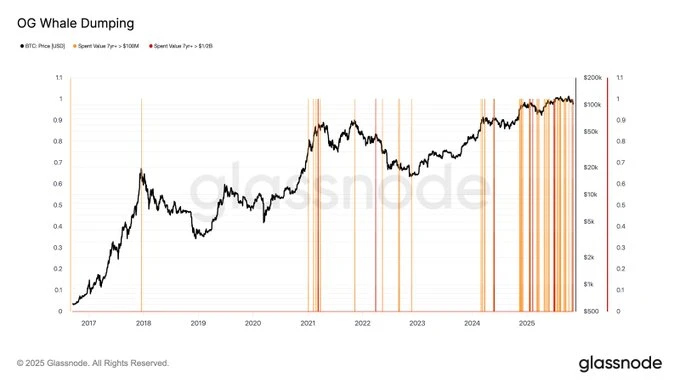

'OG bitcoin whales are dumping, and sentiment is horrible. Meanwhile, JPMorgan has a $170k price target, and 99.5% of funds in the spot bitcoin ETFs haven't sold in this 20% drawdown. A complete inversion of pre-2024 norms. This is a totally different market now.' - Joe Consorti

➡️Checkmate: '2025 has been the year when the most old coin $ value has come back to life.

$13.3B worth of coins aged 10yrs+ (with ~$9.5B from that one guy with 80k BTC).

$16.2B from 7 to 10-year coins

$22.7B From 5y to 7y (1-2 cycle holders)

Total 5y+ revived supply in 2025 is $52.2B

➡️With an average purchase price of $107,911, Metaplanet (#4 largest Bitcoin Treasury Company) is now down over $30 million on their Bitcoin holdings.

➡️BlackRock just sold $478 million worth of Bitcoin through Coinbase Prime.

➡️Ark Invest CEO Cathie Wood reduces her 2030 Bitcoin target from $1.5M to $1.2M.

➡️Bitcoin accumulator addresses doubled to 262,000 in just two months, 375,000 BTC added in 30 days.

**On the 7th of November:**

➡️Charles Edwards:

OG Bitcoin whales are dumping.

)

'This chart gives a good visual of how many super whales are cashing out of Bitcoin. All lines here are 7+ year on-chain spends from pre-2018 era OG Bitcoin Hodlers.

Orange = $100M OG dumps.

Red = $500M OG dumps.

The chart is VERY colorful in 2025. OGs are cashing out.'

➡️'Largest business cycle bull div yet. Reversal = Parabolic market' - TechDev

)

'The US Government seeks a maximum 5-year sentence for Samourai Wallet developers. In its sentencing memo, prosecutors barely mention the actual charge of operating an unlicensed money transmitter. Instead, they focus on dropped allegations of money laundering and sanctions evasion.' - Bitcoin News

➡️Blackrock bought 921 BTC today. Has sold 5,300 this week. Still holds 798,000 BTC.

➡️Japan's Financial Services Agency to support the country's three largest banks in developing a stablecoin. More liquidity for Bitcoin.

➡️Smart money isn’t selling 99.5% of spot bitcoin ETF investors held through the 20% drawdown.

➡️'What's different this time about Bitcoin Long-term holder (LTH) selling? Bitcoin Long-term holders selling is a normal occurrence in bull markets. LTH takes profits as prices reach new highs.

What's important to analyze each time is whether there's growing Bitcoin demand that can absorb the LTH selling at higher prices. For example, in Jan-March and Nov-Dec 2024, increasing LTH sales occurred as demand was growing (green areas), so the price reached new ATHs.

However, since October, LTH sales have increased (nothing new here), but demand is contracting (red areas), unable to absorb LTH supply at higher prices.' -Julio Moreno

➡️U.S. Bitcoin ETFs bought $240 MILLION BTC yesterday, ending six days of outflows.

➡️Joe Consorti: 'Bitcoin is now in "extreme fear" with its price now 20% off the all-time high and falling. The market has been more fearful twice this cycle:

1. After 8 months of consolidation in 2024,

2. This April, near the bottom of a 32% drawdown

If we're still in a bull, this means we're nearing the local bottom.

If we're moving into a bear (I don't think so), then look out down below.'

➡️'Since 1987, every major bottom in the University of Michigan Consumer Sentiment Index has aligned with a bottom in the Russell 2000. And over the past 15 years, every parabolic bitcoin bull market has coincided with a Russell 2000 breakout, which may be forming again now.'- Joe Burnett

)

➡️'They print the money, fund the crimes, and walk free, but the dev who built a privacy wallet gets 5 years.' - TFTC

➡️71% of traditional hedge funds plan to increase Bitcoin and crypto exposure over the next year - AIMA

➡️The Trump family’s American Bitcoin continues stacking, adding ~₿139 since the October 24, 2025 announcement. Total holdings now stand at ₿4,004, with Satoshis per Share (SPS) rising to 432.

)

**On the 8th of November:**

➡️Satoshi Nakamoto Explains ‘Difficulty Adjustment’ “As computers get faster and the total computing power applied to creating bitcoins increases, the difficulty increases proportionally to keep the total new production constant. Thus, it is known in advance how many new Bitcoins.”

)

➡️Wicked: The NASDAQ 100 just edged out Bitcoin, comparing their 4-year CAGR.

)

➡️A Ledger blog article explaining multi-sig is restricted to citizens in the UK “due to new rules.”

➡️Bitcoin News: 'On Friday, Nov. 7, with the price of Bitcoin hovering just above $100,000, a 2016-era whale moved 216.95 BTC worth $22.47 million after 9 years and 4 months of dormancy.'

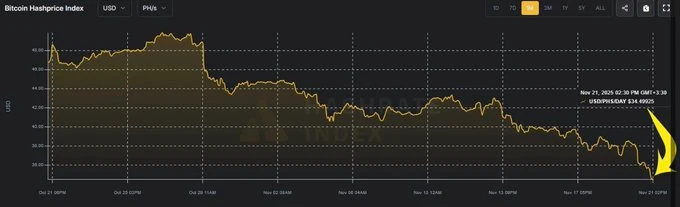

➡️Bitcoin miners are under renewed pressure as the hash price, a key profitability metric measuring daily revenue per petahash per second, falls to around $42, nearing the $40 “survival” threshold that could push smaller operators offline.

**On the 9th of November:**

➡️The S&P 500 is up in nominal terms, flat in gold terms, and down in Bitcoin terms.

)

➡️Josh Mandell reports losing over $1.2 million on IBIT call options, which he bought after predicting Bitcoin would reach $444,000 by November 8.

➡️The Winklevoss twins send 250 BTC to Gemini hot wallets.

➡️Wicked: 'Block by block, sat by sat...save and HODL bitcoin for a better future.'

)

➡️$1,200 Covid stimulus check is now worth $21,270 if you bought bitcoin with it, 1,672% return.

**On the 10th of November:**

➡️Retail is selling Bitcoin while large investors are buying.

)

➡️"On October 15, as gold was hitting a blow-off top, people in Australia were lining up for hours to buy it. Today, after an 11% correction over the past couple of weeks, those lines have vanished, even though gold has already bounced 5% off the lows." -Bitcoin News

Fascinating how market psychology works; you can apply that to Bitcoin as well.

➡️APPLE CO-FOUNDER STEVE WOZNIAK: "Bitcoin is mathematical purity"

)

➡️4 million Square merchants can now accept Bitcoin with no fees starting today. Square just announced Bitcoin payments live via Lightning. Instant settlement. No banks. The rails of fiat are breaking. The rails of Bitcoin are being built. Their sellers can now receive Bitcoin to Bitcoin, Bitcoin to fiat, fiat to Bitcoin, or fiat to fiat.

Allen Farrington: But why would Square want merchants to accept bitcoin?

)

➡️Ethiopia's Bitcoin mining operation has made $82 MILLION in just 3 months.

➡️Strategy has acquired 487 BTC for ~$49.9 million at ~$102,557 per bitcoin and has achieved BTC Yield of 26.1% YTD 2025. As of 11/9/2025, they hodl 641,692 Bitcoin acquired for ~$47.54 billion at ~$74,079 per Bitcoin.

➡️'Bank of England proposes £20k cap on retail stablecoin holdings. They can only control you because you are using their money. Opt out, study Bitcoin. HODL it in self-custody. F*CK THEM!' - CarlBMenger

➡️'HIVE just reached 24 EH/s, up 147% YoY, and completed its 300 MW Paraguay site. Now it’s turning Bitcoin mining profits into AI data centers across Canada!' - Simply Bitcoin

➡️No, the EU will not require ID for every Bitcoin transaction.

But the AMLR is still a massive pile of trash.

Now let's break it down...

"Lots of fake news about the EU’s Anti-Money Laundering Package flooded the timeline last weekend, so here’s a quick breakdown of what these new regulations actually mean.

First, the EU *is not* requiring an ID for every bitcoin transaction, as widely misreported. The EU’s AMLR only applies to so-called CASPs, or Crypto Asset Service Providers, which are defined custodians under the Markets in Crypto Assets Regulation (MiCAR) and was adopted 1.5 years ago.

This is bad because it effectively requires most custodians to KYC their users, which is a major blow to small software firms trying to innovate.

Second, the AMLR requires CASPs to conduct due diligence on any funds that are sent to and from non-custodial wallets below 1000 EUR, and requires proof of proof-of-ownership of the non-custodial addresses when payments exceed 1000 EUR.

This also isn’t great because it effectively hinders the use of bitcoin as money, but it also isn’t KYC – due diligence is defined as a risk-based approach, which CASPs have some room to define, e.g., via the use of chain analysis firms. For transactions above 1000 EUR, most CASPs require something called the Satoshi Test, where you make a small transaction to the CASP to prove that the address belongs to you.

Again, this isn’t news and was implemented at the beginning of this year via the Travel Rule.

Third, the EU bans cash transactions over 10k EUR for business transactions, but this too is already in effect in most countries, which have bans on cash transactions as low as 1000 EUR, e.g., France or Spain. What *is* new is that the AMLR bans CASPs from offering privacy coins – but some exchanges, such as Kraken EU, have already delisted coins like Monero as the EU considers them to be risk-carrying assets.

I hope this helps clear up some of the misconceptions and reminds you to read primary news sources yourself instead of relying on AI-fueled news aggregators feeding a frenzy for monetized clicks.

The AMLR is an absolute disaster, and there’s no need to make it worse than it sounds, because things are already pretty bad in the EU for Bitcoin.' -Independent Journalist L0laL33tz

Here's what the new regulations mean. Full story:

The Rage

No, The EU Will Not Require ID For Every Bitcoin Transaction

But the AMLR is still a massive pile of trash.

Now, why am I writing the recaps? The main reason to share information and knowledge. Bring more people into Bitcoin and teach them how to use freedom tech.

People should learn how to use Bitcoin, try many wallets, Lightning Network, and VPN's to evade censorship.

But let me make one thing very clear. You can clearly see the trend here. They are closing the gates to escape. They will soon start to confiscate or regulate YOU out of the equation.

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did - Bitcoin Power Law: The End of Exponential Growth | Matthew Mezinskis

Matthew Mezinskis is a macroeconomic researcher, host of Crypto Voices, and creator of Porkopolis Economics. In this episode, Matthew breaks down why Bitcoin doesn’t grow exponentially like traditional finance; it grows on a power curve. He explains why this difference matters for sustainability, how it challenges credit-based systems, and what it means for the long-term coexistence of Bitcoin and fiat money. They discuss how the power law reveals Bitcoin’s proportional and sustainable growth, why exponential systems like debt-driven markets inevitably face booms and busts, and how Bitcoin could eventually pull TradFi into a Bitcoin world rather than be absorbed by it. Matthew also explores Bitcoin’s growing dominance as base money, comparing its scale to global cash and reserves, and why its next major milestone is surpassing U.S. cash in circulation.

Click here:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: **PocketBitcoin **, especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Do you think this post is helpful? If so, please share it with your friends, family co-workers, and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐️ Many thanks⭐️

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Do you think this post is helpful? If so, please share it with your friends, family co-workers, and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐️ Many thanks⭐️

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Photos hosted by Azzamo (

Photos hosted by Azzamo (

On the 22nd of November:

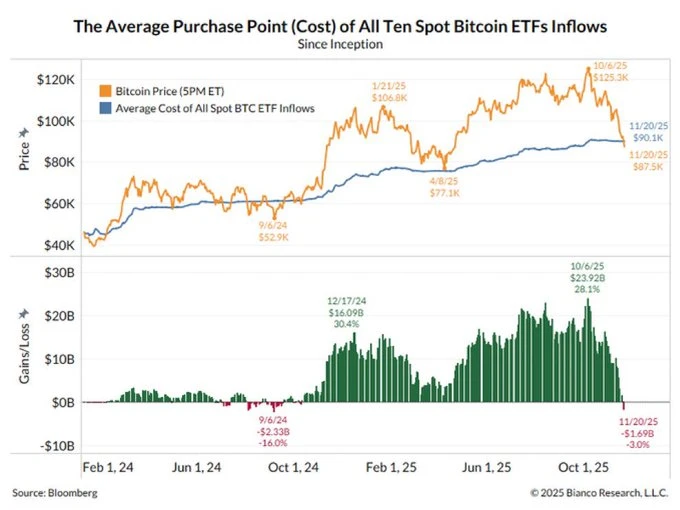

➡️Bitcoin fell below the average Bitcoin ETFs purchase price.-Quinten

On the 22nd of November:

➡️Bitcoin fell below the average Bitcoin ETFs purchase price.-Quinten

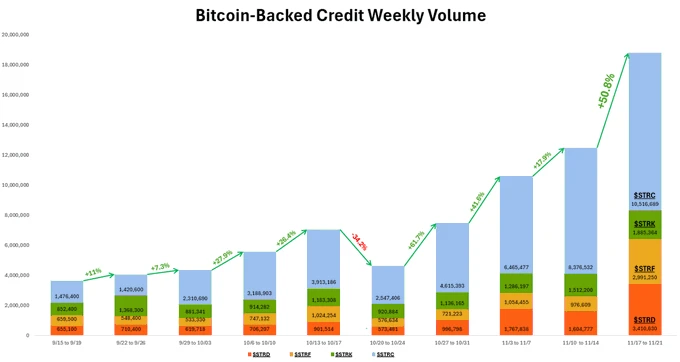

➡️Sales of Strategy’s Bitcoin-backed credit products jumped 50 percent week over week. Despite the unprecedented FUD aimed at the company this week, the numbers tell a very different story. - Bitcoin News

➡️Sales of Strategy’s Bitcoin-backed credit products jumped 50 percent week over week. Despite the unprecedented FUD aimed at the company this week, the numbers tell a very different story. - Bitcoin News

➡️'Bitcoin: It's not complicated. **Not Financial Advice**

My odds of knowing where the bottom is.

85% = $70,000 to $80,000

10% = $60,000 to $70,000

4.9% = $50,000 to $60,000

0.1% = $50,000 or less.' - Plan C

Luke Broyles put it out perfectly:

'Anyway, Bitcoin going to $150,000 after buying Bitcoin at $126,000 is a 19% gain. Bitcoin going to $150,000 after buying Bitcoin at $85,000 is a 76% gain.

Your % return is now 4x better.

This is a bummer, but only for the over-leveraged.'

Honey Badger DGAF!

➡️'Bitcoin: It's not complicated. **Not Financial Advice**

My odds of knowing where the bottom is.

85% = $70,000 to $80,000

10% = $60,000 to $70,000

4.9% = $50,000 to $60,000

0.1% = $50,000 or less.' - Plan C

Luke Broyles put it out perfectly:

'Anyway, Bitcoin going to $150,000 after buying Bitcoin at $126,000 is a 19% gain. Bitcoin going to $150,000 after buying Bitcoin at $85,000 is a 76% gain.

Your % return is now 4x better.

This is a bummer, but only for the over-leveraged.'

Honey Badger DGAF!

➡️Bitcoin flashed the most oversold signal since $25,000.

➡️'Only the 6th time in Bitcoin history that it has been this oversold. Historic major bounces have occurred between 25 and 35—we are currently at 35.' -PlanC

Could this be the end of the bear market?

➡️Fed Chair Jerome Powell claims that Bitcoin is “just like digital gold”.

Bitcoin is not a competitor with the dollar but is a competitor with gold misses the overarching point that both gold and Bitcoin are serious competitors with the dollar. The dollar and all fiat currencies are doomed.

➡️Bitcoin News: A Bitcoin whale who had held since 2011 just cashed out their entire position, walking away with $1.3 billion in profits and zero BTC.

On the 23rd of November:

➡️Forum user asks Satoshi Nakamoto on November 22nd, 2009, “Are there any plans to make this service anonymous?” Satoshi responds, “There will be proxy settings in version 0.2 so you can connect through TOR.”

➡️Bitcoin News: JP Morgan dumped 25% of their MSTR position right before MSCI announced Bitcoin companies can’t enter major indexes. Totally normal timing, right?

➡️Bitcoin flashed the most oversold signal since $25,000.

➡️'Only the 6th time in Bitcoin history that it has been this oversold. Historic major bounces have occurred between 25 and 35—we are currently at 35.' -PlanC

Could this be the end of the bear market?

➡️Fed Chair Jerome Powell claims that Bitcoin is “just like digital gold”.

Bitcoin is not a competitor with the dollar but is a competitor with gold misses the overarching point that both gold and Bitcoin are serious competitors with the dollar. The dollar and all fiat currencies are doomed.

➡️Bitcoin News: A Bitcoin whale who had held since 2011 just cashed out their entire position, walking away with $1.3 billion in profits and zero BTC.

On the 23rd of November:

➡️Forum user asks Satoshi Nakamoto on November 22nd, 2009, “Are there any plans to make this service anonymous?” Satoshi responds, “There will be proxy settings in version 0.2 so you can connect through TOR.”

➡️Bitcoin News: JP Morgan dumped 25% of their MSTR position right before MSCI announced Bitcoin companies can’t enter major indexes. Totally normal timing, right?

Just a giant bank with perfect timing, selling right before a decision they definitely didn’t know about in advance. Pure coincidence. Nothing to see here.

➡️A major academic study on Bitcoin bans finds that Bitcoin bans can't stop BTC. Researchers analyzed 19 countries from 2013 to 2024 and discovered that Bitcoin’s decentralized network keeps markets integrated even under strict bans. China and Russia showed only partial segmentation, while smaller markets saw counterintuitive increases in integration after bans. The study concludes that unilateral restrictions are largely ineffective.

➡️Bitcoin Archive: SAYLOR ON POTENTIAL LIQUIDATION:

"As long as Bitcoin goes up 1.25% a year, we can pay the dividend forever." "If Bitcoin stops going up, we've got 80 years to figure out what we're going to do about that." I think they'll be alright.

➡️Overnight, 630,000 Bitcoin were removed from exchanges.

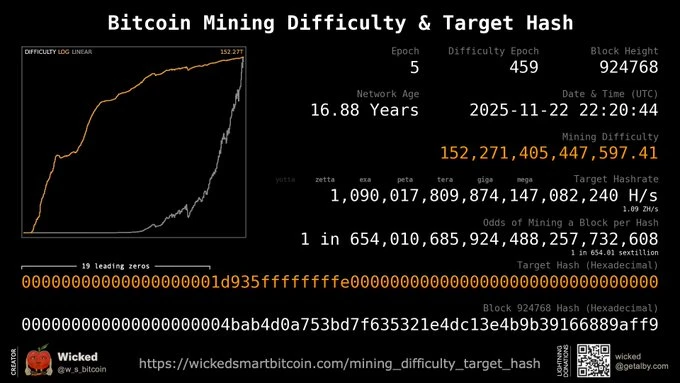

➡️'Rising difficulty. Shrinking target. Same result: tick tock, next block.

Assuming a network efficiency of 12–18 J/TH and a hashrate of 1.09 ZH/s, Bitcoin is consuming roughly 13–20 GW of power right now.

Just a giant bank with perfect timing, selling right before a decision they definitely didn’t know about in advance. Pure coincidence. Nothing to see here.

➡️A major academic study on Bitcoin bans finds that Bitcoin bans can't stop BTC. Researchers analyzed 19 countries from 2013 to 2024 and discovered that Bitcoin’s decentralized network keeps markets integrated even under strict bans. China and Russia showed only partial segmentation, while smaller markets saw counterintuitive increases in integration after bans. The study concludes that unilateral restrictions are largely ineffective.

➡️Bitcoin Archive: SAYLOR ON POTENTIAL LIQUIDATION:

"As long as Bitcoin goes up 1.25% a year, we can pay the dividend forever." "If Bitcoin stops going up, we've got 80 years to figure out what we're going to do about that." I think they'll be alright.

➡️Overnight, 630,000 Bitcoin were removed from exchanges.

➡️'Rising difficulty. Shrinking target. Same result: tick tock, next block.

Assuming a network efficiency of 12–18 J/TH and a hashrate of 1.09 ZH/s, Bitcoin is consuming roughly 13–20 GW of power right now.

I don't think people understand just how ridiculously large a zettahash is...1,000,000,000,000,000,000,000, and that's per second! Bitcoin's proof of work is uncontested.' - Wicked

People who have no idea what this is, or what it means, will tell you Bitcoin doesn’t work. This is the largest distributed computer in existence. Gets bigger every day. Gets more efficient every day. The network is alive and thriving.

Oliver L. Velez: The three tools that have historically kept the masses blind, poor, and away from winning:

1) Fear campaigns of a pending threat. "Stay away!" (quantum);

2) Distraction with temporarily shinier-seeming alternatives to the clear winner (Zcash); If these aren't working so well...

3) Divide and conquer from within (Core Knots).

Bitcoin won't succumb to these age-old tactics, though. Its anti-fragility will only lead to these things making it stronger. BTC solved the Byzantine Generals' Dilemma. Look it up. The future is very bright, and we're stronger and stronger than ever.

➡️A SOLO MINER JUST HIT THE JACKPOT! A miner with a tiny setup running only 6 terahashes per second, so small it barely even registers on the Bitcoin network, managed to mine a full block and earn 3.146 BTC plus fees worth about $265,000.

➡️Bitcoin is Simple:

'1) DCA. 1A) Lump-Sum once Fear and Greed hit “Extreme Fear”. 2) Move Coins to Cold Storage. 3) Never sell. Rinse and Repeat. Your entire bloodline will be forever grateful.' - CarlBMenger

➡️Not really Bitcoin related, but in the end, yeah, Bitcoin related:

JPMorgan Chase, Citibank, and Morgan Stanley are among those that have been notified by Situsamc that their client data may have been taken- The New York Times

KYC = kill your customer

➡️Bitcoin News: Anchorage Digital has added support for Mezo, an EVM-compatible Bitcoin DeFi chain, giving institutions new ways to earn rewards and access liquidity without selling BTC. Clients can now use Anchorage’s self-custody wallet, Porto, to borrow against their BTC at fixed rates starting at 1%.

➡️The number of Bitcoin addresses holding at least 10K BTC hits a 5-month high of 90.

➡️Percentage Decline From Record High:

1. Oracle: -44%

2. Palantir: -30%

3. Meta: -27%

4. AMD: -27%

5. Tesla: -22%

And you think Bitcoin is dead because it's down 30% from its all-time high? - Bitcoin News

On the 24th of November:

➡️165,000 Bitcoin taken off Coinbase over the weekend! Cause TBD. But the last comparable plunge was just after FTX collapsed. Bitcoin was $16K' - Charles Edwards

➡️'China Discovers One of the Largest Gold Deposits in History, about 1,444 Tonnes of pure Gold. You can find more Gold, but you can’t mine more Bitcoin 21 million forever.' - CarlBMenger

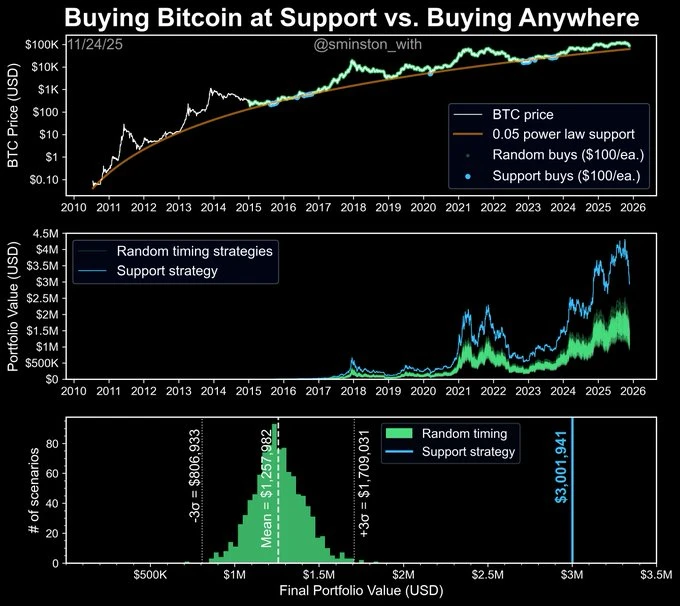

➡️Sminston With:

I talk about Bitcoin's power law support line a lot, so... - - -

I finally ran a test everyone (probably) wonders about: How much does “buying the power law support” actually beat random timing in Bitcoin? It’s not even close. Comparing the two strategies from Jan 2015 → Nov 2025 (current ~$87k BTC.

Support strategy: (Buy $100 every single time BTC dips below the long-term power law floor):

→ 236 buys

→ Total cash invested: $23,600

→ BTC accumulated: 34.56 BTC

→ Final portfolio value today: $3,001,941. Yes, 3 mill from 23 G's.

Random timing strategy (1,000 simulations):

→ 236 buys (same as other strategy)

→ Total cash invested ($23,600) (also the same)

→ Average outcome: $1.26M → 3 std deviations (top ~0.15%): $1.71M

Even the luckiest bastard in this pile is not even half as well off as the support strategist.

The support buyer crushed every single random-timing simulation. Not 90%. Not 99%. 100% of the 1,000 random paths lost to buying the power law support. NOW CONSIDER: I believe understanding where the support line is is WAY easier than trying to understand where the tops are.

The peaks/bubbles are noise. Find the orange line. Mind the orange line.'

I don't think people understand just how ridiculously large a zettahash is...1,000,000,000,000,000,000,000, and that's per second! Bitcoin's proof of work is uncontested.' - Wicked

People who have no idea what this is, or what it means, will tell you Bitcoin doesn’t work. This is the largest distributed computer in existence. Gets bigger every day. Gets more efficient every day. The network is alive and thriving.

Oliver L. Velez: The three tools that have historically kept the masses blind, poor, and away from winning:

1) Fear campaigns of a pending threat. "Stay away!" (quantum);

2) Distraction with temporarily shinier-seeming alternatives to the clear winner (Zcash); If these aren't working so well...

3) Divide and conquer from within (Core Knots).

Bitcoin won't succumb to these age-old tactics, though. Its anti-fragility will only lead to these things making it stronger. BTC solved the Byzantine Generals' Dilemma. Look it up. The future is very bright, and we're stronger and stronger than ever.

➡️A SOLO MINER JUST HIT THE JACKPOT! A miner with a tiny setup running only 6 terahashes per second, so small it barely even registers on the Bitcoin network, managed to mine a full block and earn 3.146 BTC plus fees worth about $265,000.

➡️Bitcoin is Simple:

'1) DCA. 1A) Lump-Sum once Fear and Greed hit “Extreme Fear”. 2) Move Coins to Cold Storage. 3) Never sell. Rinse and Repeat. Your entire bloodline will be forever grateful.' - CarlBMenger

➡️Not really Bitcoin related, but in the end, yeah, Bitcoin related:

JPMorgan Chase, Citibank, and Morgan Stanley are among those that have been notified by Situsamc that their client data may have been taken- The New York Times

KYC = kill your customer

➡️Bitcoin News: Anchorage Digital has added support for Mezo, an EVM-compatible Bitcoin DeFi chain, giving institutions new ways to earn rewards and access liquidity without selling BTC. Clients can now use Anchorage’s self-custody wallet, Porto, to borrow against their BTC at fixed rates starting at 1%.

➡️The number of Bitcoin addresses holding at least 10K BTC hits a 5-month high of 90.

➡️Percentage Decline From Record High:

1. Oracle: -44%

2. Palantir: -30%

3. Meta: -27%

4. AMD: -27%

5. Tesla: -22%

And you think Bitcoin is dead because it's down 30% from its all-time high? - Bitcoin News

On the 24th of November:

➡️165,000 Bitcoin taken off Coinbase over the weekend! Cause TBD. But the last comparable plunge was just after FTX collapsed. Bitcoin was $16K' - Charles Edwards

➡️'China Discovers One of the Largest Gold Deposits in History, about 1,444 Tonnes of pure Gold. You can find more Gold, but you can’t mine more Bitcoin 21 million forever.' - CarlBMenger

➡️Sminston With:

I talk about Bitcoin's power law support line a lot, so... - - -

I finally ran a test everyone (probably) wonders about: How much does “buying the power law support” actually beat random timing in Bitcoin? It’s not even close. Comparing the two strategies from Jan 2015 → Nov 2025 (current ~$87k BTC.

Support strategy: (Buy $100 every single time BTC dips below the long-term power law floor):

→ 236 buys

→ Total cash invested: $23,600

→ BTC accumulated: 34.56 BTC

→ Final portfolio value today: $3,001,941. Yes, 3 mill from 23 G's.

Random timing strategy (1,000 simulations):

→ 236 buys (same as other strategy)

→ Total cash invested ($23,600) (also the same)

→ Average outcome: $1.26M → 3 std deviations (top ~0.15%): $1.71M

Even the luckiest bastard in this pile is not even half as well off as the support strategist.

The support buyer crushed every single random-timing simulation. Not 90%. Not 99%. 100% of the 1,000 random paths lost to buying the power law support. NOW CONSIDER: I believe understanding where the support line is is WAY easier than trying to understand where the tops are.

The peaks/bubbles are noise. Find the orange line. Mind the orange line.'

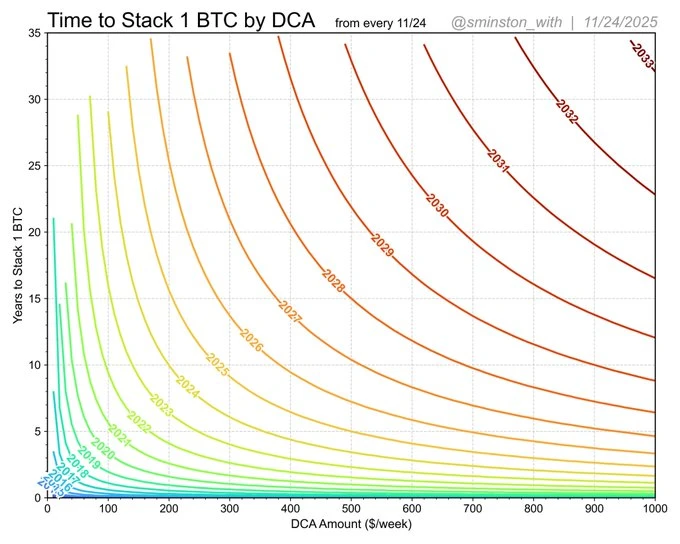

➡️Another Smintson With banger:

Bitcoin has a way of getting away from you. Lines represent how long it takes to stack 1 Bitcoin if you start that year.

If you start now, stacking $500/week can get you to 1 Bitcoin in 5 years.

If you wait 4 more years to begin, it will take you 22 years. Stack. Early. Stack. Hard.

➡️Another Smintson With banger:

Bitcoin has a way of getting away from you. Lines represent how long it takes to stack 1 Bitcoin if you start that year.

If you start now, stacking $500/week can get you to 1 Bitcoin in 5 years.

If you wait 4 more years to begin, it will take you 22 years. Stack. Early. Stack. Hard.

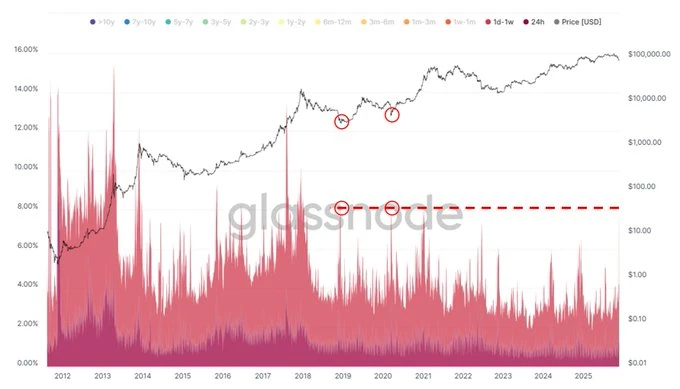

➡️'More than 8% of all Bitcoin moved in the last 7 days. The last two times this happened?

1. March 2020 - $5,000 BTC

2. December 2018 - $3,500 BTC

This makes the latest drawdown one of the most significant on-chain events in Bitcoin’s history.' - Joe Burnett

➡️'More than 8% of all Bitcoin moved in the last 7 days. The last two times this happened?

1. March 2020 - $5,000 BTC

2. December 2018 - $3,500 BTC

This makes the latest drawdown one of the most significant on-chain events in Bitcoin’s history.' - Joe Burnett

On the 26th of November:

➡️'Have fun with all your Bitcoin Thanksgiving conversations.... Every year (except 24'), Bitcoins have been way off the annual high, and 2025 is no exception. Average drawdown: 37.16% from the year high. Median drawdown: 32.92% from the year high. Fun Fact: Bitcoin's epic bull run in 2017 still saw BTC price down -58.96% ($8,118) on Thanksgiving, and was only just weeks away from its December peak of $19,783. - Mark Moss

On the 26th of November:

➡️'Have fun with all your Bitcoin Thanksgiving conversations.... Every year (except 24'), Bitcoins have been way off the annual high, and 2025 is no exception. Average drawdown: 37.16% from the year high. Median drawdown: 32.92% from the year high. Fun Fact: Bitcoin's epic bull run in 2017 still saw BTC price down -58.96% ($8,118) on Thanksgiving, and was only just weeks away from its December peak of $19,783. - Mark Moss

➡️'HOW JPMORGAN’S NEW BITCOIN PRODUCT WORKS.

The product is linked to BlackRock’s Bitcoin ETF (IBIT). If IBIT is at or above a target price in one year, investors automatically get a guaranteed 16 percent gain.

If IBIT is below that target, the investment continues until 2028. If IBIT rises by then, investors can make up to 1.5 times their money with no cap. If IBIT is down in 2028 but not more than 30 percent, investors get all their money back.

If it’s down more than 30 percent, investors take the loss past that point.' -Bitcoin News

On the 27th of November:

➡️Bitcoin extends gains and rises above $91,500, now up +14% since the November 21st low.

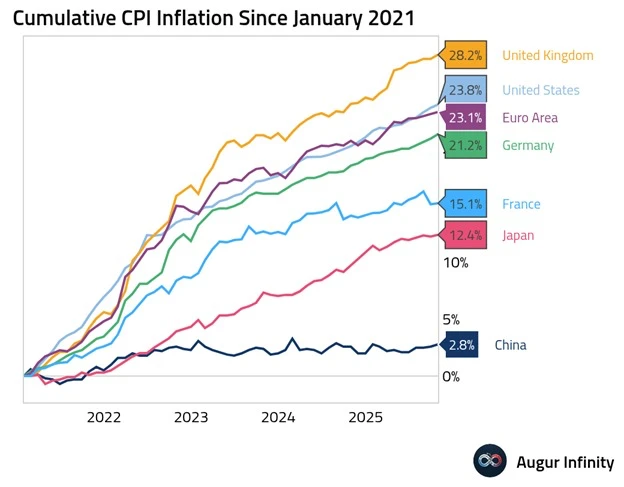

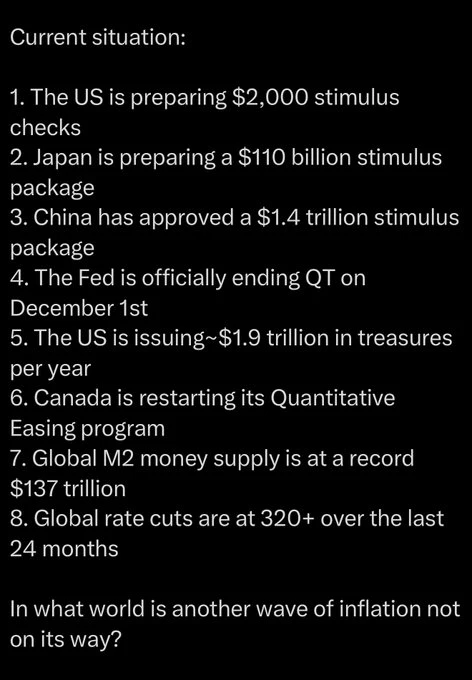

➡️'Compounding inflation is a global crisis:

Since January 2021, the UK gas experienced the largest surge in prices among major economies, at +28.2%.

The US saw cumulative inflation of +23.8%, followed by the Euro Area at +23.1% and Germany at +21.2%. France’s cumulative inflation reached +15.1%, while Japan recorded +12.4% over the same period.

On the other hand, China saw only a +2.8% cumulative CPI increase, as the country has been struggling with weak domestic demand and a real estate downturn.

Put simply, consumers in major economies have lost 21% to 28% of their purchasing power since January 2021. Own assets or be left behind.'- TKL

➡️'HOW JPMORGAN’S NEW BITCOIN PRODUCT WORKS.

The product is linked to BlackRock’s Bitcoin ETF (IBIT). If IBIT is at or above a target price in one year, investors automatically get a guaranteed 16 percent gain.

If IBIT is below that target, the investment continues until 2028. If IBIT rises by then, investors can make up to 1.5 times their money with no cap. If IBIT is down in 2028 but not more than 30 percent, investors get all their money back.

If it’s down more than 30 percent, investors take the loss past that point.' -Bitcoin News

On the 27th of November:

➡️Bitcoin extends gains and rises above $91,500, now up +14% since the November 21st low.

➡️'Compounding inflation is a global crisis:

Since January 2021, the UK gas experienced the largest surge in prices among major economies, at +28.2%.

The US saw cumulative inflation of +23.8%, followed by the Euro Area at +23.1% and Germany at +21.2%. France’s cumulative inflation reached +15.1%, while Japan recorded +12.4% over the same period.

On the other hand, China saw only a +2.8% cumulative CPI increase, as the country has been struggling with weak domestic demand and a real estate downturn.

Put simply, consumers in major economies have lost 21% to 28% of their purchasing power since January 2021. Own assets or be left behind.'- TKL

Anyway, people, study Bitcoin.

➡️Highest amount of unrealized Bitcoin losses since the 2022 bear market.

Anyway, people, study Bitcoin.

➡️Highest amount of unrealized Bitcoin losses since the 2022 bear market.

➡️TFTC: The number of wallets holding 0.1 BTC went DOWN during the dip. Wallets with 1000+ BTC? Up. Newcomers are selling into weakness. Veterans accumulating. This is why most people don't make it. You know the game, freaks. Stay humble, stack sats.

On the 28th of November:

➡️Bitcoin extends gains and rises above $92.500, now up +15% since the November 21st low.

➡️VANECK: “By 2050, Bitcoin becomes a reserve asset that's used in global trade and held by global central banks at a 2% weight. In that model, we arrive at a $3,000,000 price target for Bitcoin.” "Into the MILLIONS over the medium term is a HIGH conviction call."

I always think it is funny to hear those kinds of predictions. I have always learned that you can only predict one thing, either price or time, not both.

And VanEck is into CrYpTo, and it's a speculative model—actual outcomes depend on adoption and global factors.

Meanwhile, BlackRock CEO Larry Fink says he changed his mind on Bitcoin. After years of calling it “the domain of money launderers and thieves,” he tells 60 Minutes, “there is a role for crypto in the same way there is a role for gold,” and says markets made him “relook at assumptions”.

Anyway:

➡️TFTC: The number of wallets holding 0.1 BTC went DOWN during the dip. Wallets with 1000+ BTC? Up. Newcomers are selling into weakness. Veterans accumulating. This is why most people don't make it. You know the game, freaks. Stay humble, stack sats.

On the 28th of November:

➡️Bitcoin extends gains and rises above $92.500, now up +15% since the November 21st low.

➡️VANECK: “By 2050, Bitcoin becomes a reserve asset that's used in global trade and held by global central banks at a 2% weight. In that model, we arrive at a $3,000,000 price target for Bitcoin.” "Into the MILLIONS over the medium term is a HIGH conviction call."

I always think it is funny to hear those kinds of predictions. I have always learned that you can only predict one thing, either price or time, not both.

And VanEck is into CrYpTo, and it's a speculative model—actual outcomes depend on adoption and global factors.

Meanwhile, BlackRock CEO Larry Fink says he changed his mind on Bitcoin. After years of calling it “the domain of money launderers and thieves,” he tells 60 Minutes, “there is a role for crypto in the same way there is a role for gold,” and says markets made him “relook at assumptions”.

Anyway:

➡️“70% of Bitcoin’s wealth sits ABOVE $85K.” – Checkmate

The ancient-history charts—$30K, $10K, $5K—don’t reflect today’s reality. This is now a game of sovereigns, banks, and price-insensitive allocators.

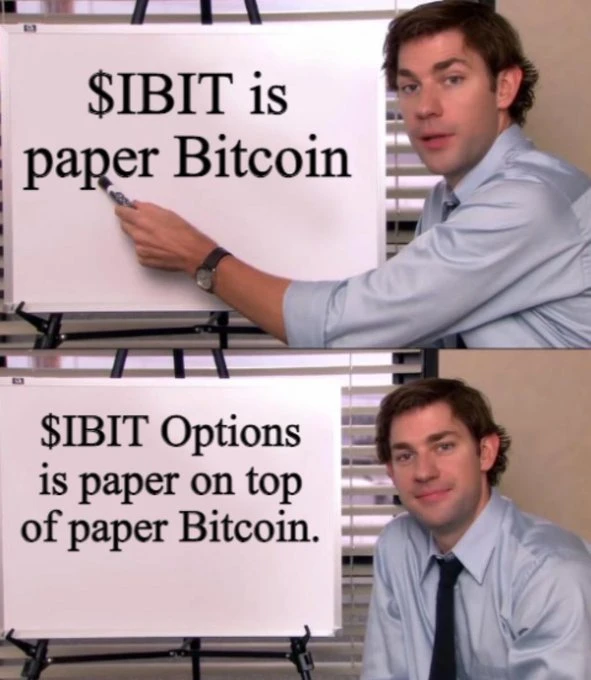

➡️IBIT shenanigans. 'At last, IBIT options are finally getting the treatment they deserve— Nasdaq just filed to increase options limit to 1 MILLION (from 25k a year ago). Institutional vol is finally here.

The rule filing literally says they’re doing this because IBIT has reached the same level of market cap, liquidity, and trading frequency as the biggest stocks. This is the category reserved for: AAPL, NVDA, MSFT, SPY, QQQ. That’s the club Bitcoin is now in.

It’s a simple story: Bigger limits → institutional size selling options(short vol. for structured product) → more market makers → easy to buy options → more retail.'

But remember >>>

➡️“70% of Bitcoin’s wealth sits ABOVE $85K.” – Checkmate

The ancient-history charts—$30K, $10K, $5K—don’t reflect today’s reality. This is now a game of sovereigns, banks, and price-insensitive allocators.

➡️IBIT shenanigans. 'At last, IBIT options are finally getting the treatment they deserve— Nasdaq just filed to increase options limit to 1 MILLION (from 25k a year ago). Institutional vol is finally here.

The rule filing literally says they’re doing this because IBIT has reached the same level of market cap, liquidity, and trading frequency as the biggest stocks. This is the category reserved for: AAPL, NVDA, MSFT, SPY, QQQ. That’s the club Bitcoin is now in.

It’s a simple story: Bigger limits → institutional size selling options(short vol. for structured product) → more market makers → easy to buy options → more retail.'

But remember >>>

➡️Quinten:

> 'Bitcoin dips -30%

> People’s reaction: extreme fear

> Black Friday -30% sale on junk

> People’s reaction: take my money

> This is why most people stay poor.

> They buy liabilities on sale and sell assets on fear, the exact opposite of how wealth is built.'

➡️Bitcoin falls below STH cost basis. Another buy-the-dip indicator flashes on Black Friday.

➡️Daniel Batten: All 12 Sustainability Media Outlets that cover Bitcoin Mining are now covering its environmental benefits!

1. Renewables Now: Bitcoin helps green energy adoption and grid stabilization.

➡️Quinten:

> 'Bitcoin dips -30%

> People’s reaction: extreme fear

> Black Friday -30% sale on junk

> People’s reaction: take my money

> This is why most people stay poor.

> They buy liabilities on sale and sell assets on fear, the exact opposite of how wealth is built.'

➡️Bitcoin falls below STH cost basis. Another buy-the-dip indicator flashes on Black Friday.

➡️Daniel Batten: All 12 Sustainability Media Outlets that cover Bitcoin Mining are now covering its environmental benefits!

1. Renewables Now: Bitcoin helps green energy adoption and grid stabilization.

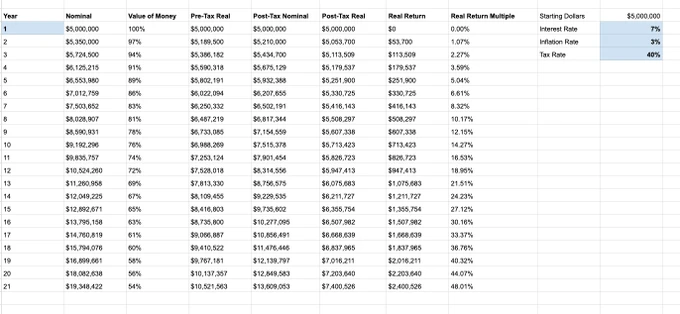

➡️You mathematically can't compound your way to wealth anymore... 20 years, 7% returns, 3% inflation, 40% taxes -- best case you 1.5x your investment. That is why the kids YOLO it... plain and simple.' -Sam Lessin.

Now the post is a bit of clickbait, and it is applicable to the U.S.; the moral of the story is the same, though.

➡️You mathematically can't compound your way to wealth anymore... 20 years, 7% returns, 3% inflation, 40% taxes -- best case you 1.5x your investment. That is why the kids YOLO it... plain and simple.' -Sam Lessin.

Now the post is a bit of clickbait, and it is applicable to the U.S.; the moral of the story is the same, though.

And oh yeah, if only inflation were just 3%...anyway:

This is the hard truth people do not want to say out loud: You cannot compound when the system is subtracting faster than you can add. When inflation eats the base, taxes skim the flow, and real yields stay negative, the old compounding model becomes a museum artifact. That is why the young do not invest in “prudence.” They invest in convexity. When linear paths die, people reach for asymmetric ones. It is not irrational. It is adaptive. The math changed. The behavior followed.

Study Bitcoin!

➡️'Thirteen years ago today, Bitcoin’s first ‘halving’ program reduced the new mining block reward in half from 50 coins to 25 coins. This event marked the first time in history a decentralized monetary system automatically maintained new issuance on an open-source schedule of code.' - Documenting Bitcoin

(

And oh yeah, if only inflation were just 3%...anyway:

This is the hard truth people do not want to say out loud: You cannot compound when the system is subtracting faster than you can add. When inflation eats the base, taxes skim the flow, and real yields stay negative, the old compounding model becomes a museum artifact. That is why the young do not invest in “prudence.” They invest in convexity. When linear paths die, people reach for asymmetric ones. It is not irrational. It is adaptive. The math changed. The behavior followed.

Study Bitcoin!

➡️'Thirteen years ago today, Bitcoin’s first ‘halving’ program reduced the new mining block reward in half from 50 coins to 25 coins. This event marked the first time in history a decentralized monetary system automatically maintained new issuance on an open-source schedule of code.' - Documenting Bitcoin

( )

## 🎁If you have made it this far, I would like to give you a little gift:

Lyn Alden: The So-Called “Debasement Trade”

My December macro newsletter is now available.

It discusses the debasement trade, changing macro conditions, and the large dislocation between the economy and markets.

)

## 🎁If you have made it this far, I would like to give you a little gift:

Lyn Alden: The So-Called “Debasement Trade”

My December macro newsletter is now available.

It discusses the debasement trade, changing macro conditions, and the large dislocation between the economy and markets.

The Latest Bitcoin & Macro news: Weekly Recap 22.11.2025

If you would rather read the long format, enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity. (outside of Nostr) Click here:

The Latest Bitcoin & Macro news: Weekly Recap 22.11.2025

If you would rather read the long format, enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity. (outside of Nostr) Click here:

## 🧡Bitcoin news🧡

Just want to start with the following...

What produces inflation? Milton Friedman had the answer decades ago: “Too much government spending and too much government creation of money - and nothing else.”

Study Bitcoin!

Photos hosted by Azzamo (

## 🧡Bitcoin news🧡

Just want to start with the following...

What produces inflation? Milton Friedman had the answer decades ago: “Too much government spending and too much government creation of money - and nothing else.”

Study Bitcoin!

Photos hosted by Azzamo ( ➡️Bitcoin News: Bitcoin just hit its 4th “death cross” of this cycle. The last three marked excellent buying opportunities. Historically, one year after a death cross, Bitcoin has been higher 50% of the time, with an average return of 85%.

➡️Bitcoin News: Bitcoin just hit its 4th “death cross” of this cycle. The last three marked excellent buying opportunities. Historically, one year after a death cross, Bitcoin has been higher 50% of the time, with an average return of 85%.

On the 17th of November:

➡️

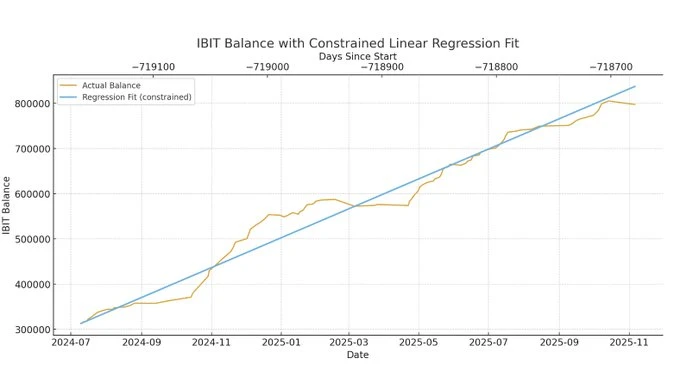

> 'IBIT alone is buying 1,200 BTC / day (all day average). All ETFs + MSTR 2,000 BTC / day = 1 MM BTC+ every 2 Years. (R2 = 93%).

> Most of the freely tradable supply will be bought in the next decade.' - Fred Krueger

On the 17th of November:

➡️

> 'IBIT alone is buying 1,200 BTC / day (all day average). All ETFs + MSTR 2,000 BTC / day = 1 MM BTC+ every 2 Years. (R2 = 93%).

> Most of the freely tradable supply will be bought in the next decade.' - Fred Krueger

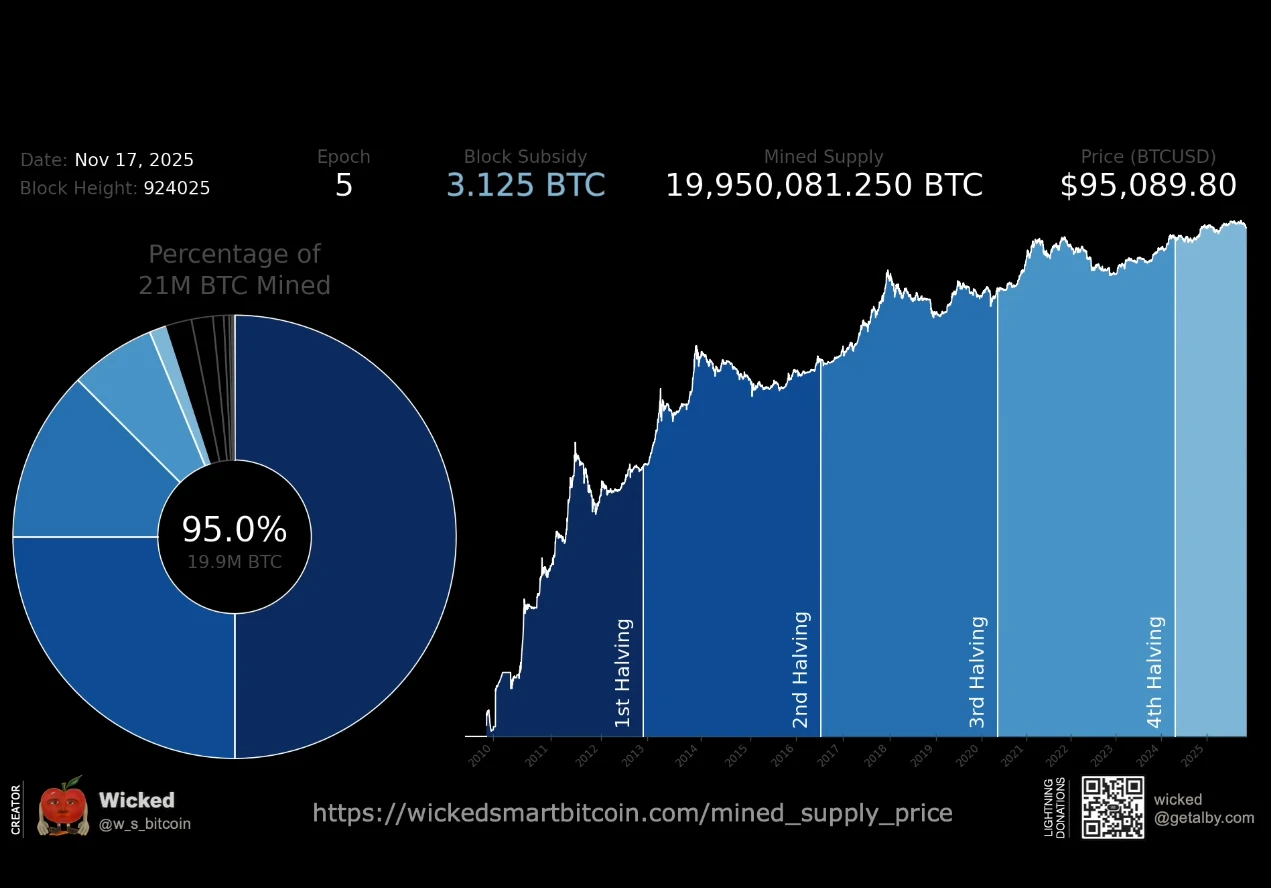

➡️95% of the total Bitcoin supply has now been mined.

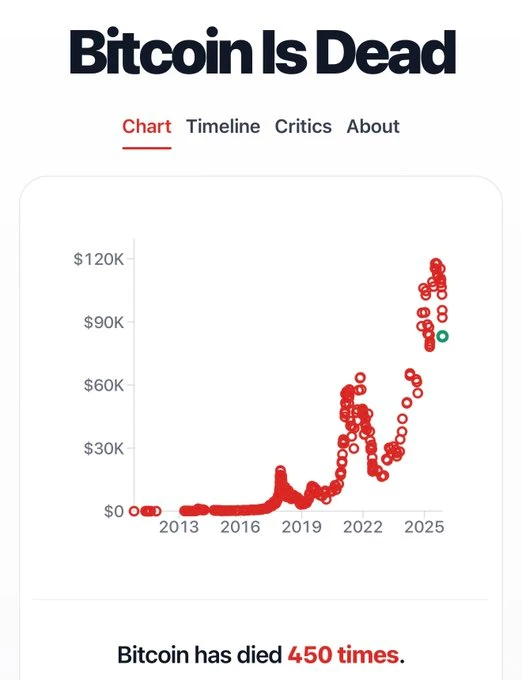

➡️Jeff Swanson: Bitcoin continues its collapse, ultimately going to zero. You can really see it here on this chart.

*On the 18th of November:*

➡️Bitcoin whales bought the dip below $100k

➡️95% of the total Bitcoin supply has now been mined.

➡️Jeff Swanson: Bitcoin continues its collapse, ultimately going to zero. You can really see it here on this chart.

*On the 18th of November:*

➡️Bitcoin whales bought the dip below $100k

➡️The last time Bitcoin was here, global liquidity was $7 trillion lower.

➡️BTCosmonaut: 'This is without a doubt one of the most dangerous bear traps in Bitcoin history. Plebs are losing the plot and selling to Blackrock, Harvard, UAE, Czech, etc., because their WATCH is telling them to. Unfortunately, they will never see that Bitcoin again.'

➡️Joe Consorti: 'Bitcoin may be at its lowest price since April, but the assets held by spot ETFs are ~200,000 BTC higher. Don't let Goldman Sachs be more bullish than you.'

➡️The last time Bitcoin was here, global liquidity was $7 trillion lower.

➡️BTCosmonaut: 'This is without a doubt one of the most dangerous bear traps in Bitcoin history. Plebs are losing the plot and selling to Blackrock, Harvard, UAE, Czech, etc., because their WATCH is telling them to. Unfortunately, they will never see that Bitcoin again.'

➡️Joe Consorti: 'Bitcoin may be at its lowest price since April, but the assets held by spot ETFs are ~200,000 BTC higher. Don't let Goldman Sachs be more bullish than you.'

➡️Pre Black Friday deal: Bitcoin's on sale. 30% discount.

➡️El Salvador just bought $100 MILLION Bitcoin during the dip.

➡️'95% of the 21 million Bitcoins have officially been mined. Only 5% of BTC supply left to be mined over the next 114 years!' - Wicked

➡️Pre Black Friday deal: Bitcoin's on sale. 30% discount.

➡️El Salvador just bought $100 MILLION Bitcoin during the dip.

➡️'95% of the 21 million Bitcoins have officially been mined. Only 5% of BTC supply left to be mined over the next 114 years!' - Wicked

> Chapo:

> '21M total BTC

> 3M lost = 18M

> 75% owned by institutions, govts, funds

> Only ~4M BTC available for individuals globally to own.

> Individual average ownership = 1/2000 (0.0005) Bitcoin

> If you own anywhere close to a whole Bitcoin, you are rich AF.'

*On the 19th of November:*

➡️Bitcoin has broken below the 0.75 cost-basis quantile, a level that has historically marked bear-market territory. Across cycles, reclaiming and holding above it has been key to restoring bullish structure. Bulls will want to see this level regained. -Glassnode

➡️New Hampshire launches First Bitcoin-backed municipal bond.

*On the 20th of November:*

➡️'Short-term holders underwater:

• 2020 COVID crash 92% in a loss of $3,850

• 2022 FTX collapse 94% in a loss of $16,000

• Today: 99% in a loss at $89,000

This is the highest short-term holder capitulation ever recorded.'

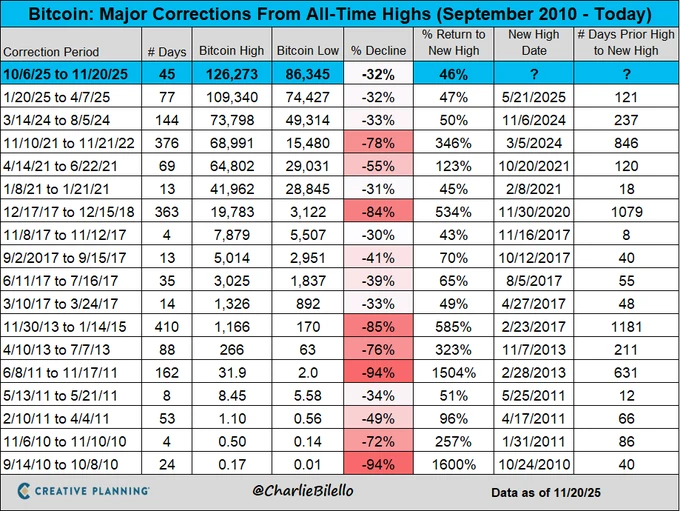

➡️Charlie Bilello: At $86,000, Bitcoin is now down around 32% from its all-time high of $126,000 in early October. That's the biggest drawdown since April, but not unusual at all given its historical volatility.

> Chapo:

> '21M total BTC

> 3M lost = 18M

> 75% owned by institutions, govts, funds

> Only ~4M BTC available for individuals globally to own.

> Individual average ownership = 1/2000 (0.0005) Bitcoin

> If you own anywhere close to a whole Bitcoin, you are rich AF.'

*On the 19th of November:*

➡️Bitcoin has broken below the 0.75 cost-basis quantile, a level that has historically marked bear-market territory. Across cycles, reclaiming and holding above it has been key to restoring bullish structure. Bulls will want to see this level regained. -Glassnode

➡️New Hampshire launches First Bitcoin-backed municipal bond.

*On the 20th of November:*

➡️'Short-term holders underwater:

• 2020 COVID crash 92% in a loss of $3,850

• 2022 FTX collapse 94% in a loss of $16,000

• Today: 99% in a loss at $89,000

This is the highest short-term holder capitulation ever recorded.'

➡️Charlie Bilello: At $86,000, Bitcoin is now down around 32% from its all-time high of $126,000 in early October. That's the biggest drawdown since April, but not unusual at all given its historical volatility.

➡️ Bitcoin's weekly RSI is at a level historically reserved for the bottom of bear market cycles, yet we're only 30% off the highs. It might be the fastest washout in Bitcoin history.

➡️Strategy: 'At current $BTC levels, we have 71 years of dividend coverage assuming the price stays flat. And any $BTC appreciation beyond 1.41% a year fully offsets our annual dividend obligations.'

Market: "We're gonna take Bitcoin down and force liquidate Saylor." Strategy: "Okay, sure. Assuming we do nothing else, you know that we have 71 years of dividends at this current Bitcoin price, right?"

Market: "Oh...um...well..."

On the 21st of November:

➡️At $80,600, Bitcoin is now down around 36% from its all-time high of $126,300 in early October. That's the biggest correction off an all-time high since 2022. Is this unusual volatility for Bitcoin? Not at all. We've seen similar or bigger drawdowns every year.

➡️ Bitcoin's weekly RSI is at a level historically reserved for the bottom of bear market cycles, yet we're only 30% off the highs. It might be the fastest washout in Bitcoin history.

➡️Strategy: 'At current $BTC levels, we have 71 years of dividend coverage assuming the price stays flat. And any $BTC appreciation beyond 1.41% a year fully offsets our annual dividend obligations.'

Market: "We're gonna take Bitcoin down and force liquidate Saylor." Strategy: "Okay, sure. Assuming we do nothing else, you know that we have 71 years of dividends at this current Bitcoin price, right?"

Market: "Oh...um...well..."

On the 21st of November:

➡️At $80,600, Bitcoin is now down around 36% from its all-time high of $126,300 in early October. That's the biggest correction off an all-time high since 2022. Is this unusual volatility for Bitcoin? Not at all. We've seen similar or bigger drawdowns every year.

I saw Bitcoin crash from $20k to $3k, from $69k to $16k, and from $126k to $80k. Every dip was said to be Bitcoin's death, while in reality, every single one was a once-in-a-lifetime buying opportunity. Zoom out, chill, and HODL. Bitcoin will recover.

I saw Bitcoin crash from $20k to $3k, from $69k to $16k, and from $126k to $80k. Every dip was said to be Bitcoin's death, while in reality, every single one was a once-in-a-lifetime buying opportunity. Zoom out, chill, and HODL. Bitcoin will recover.

Aged like fine red wine.

➡️Bitcoin News: Bitcoin's Mean Reversion Oscillator just printed its first green (oversold) bar since April this year.

Aged like fine red wine.

➡️Bitcoin News: Bitcoin's Mean Reversion Oscillator just printed its first green (oversold) bar since April this year.

➡️The number of Bitcoin addresses worth over $100K has dropped 30% over the last two weeks.

➡️Bitcoin realized losses surge to levels last seen during the FTX collapse (Glassnode)

➡️'Binance spot orderbook just printed the single largest positive Depth Delta spike on record (deepest depth). Buy orders now massively outnumber sell orders below price, the strongest absorption signal we’ve seen all cycle. Previous extremes like this marked local lows within hours/days.' - ExitpumpBTC

➡️Bitcoin realized losses have surged to levels last seen during the FTX collapse, with short-term holders driving the bulk of the capitulation. The scale and speed of these losses reflect a meaningful washout of marginal demand as recent buyers unwind into the drawdown. - Glassnode

➡️Bit Paine: If this dip is truly being caused by a liquidity contraction before a wave of stimulus, then the only real historical comparison we have is the 2019 COVID crash, like the ocean going out before a tidal wave.

➡️The number of Bitcoin addresses worth over $100K has dropped 30% over the last two weeks.

➡️Bitcoin realized losses surge to levels last seen during the FTX collapse (Glassnode)

➡️'Binance spot orderbook just printed the single largest positive Depth Delta spike on record (deepest depth). Buy orders now massively outnumber sell orders below price, the strongest absorption signal we’ve seen all cycle. Previous extremes like this marked local lows within hours/days.' - ExitpumpBTC

➡️Bitcoin realized losses have surged to levels last seen during the FTX collapse, with short-term holders driving the bulk of the capitulation. The scale and speed of these losses reflect a meaningful washout of marginal demand as recent buyers unwind into the drawdown. - Glassnode

➡️Bit Paine: If this dip is truly being caused by a liquidity contraction before a wave of stimulus, then the only real historical comparison we have is the 2019 COVID crash, like the ocean going out before a tidal wave.

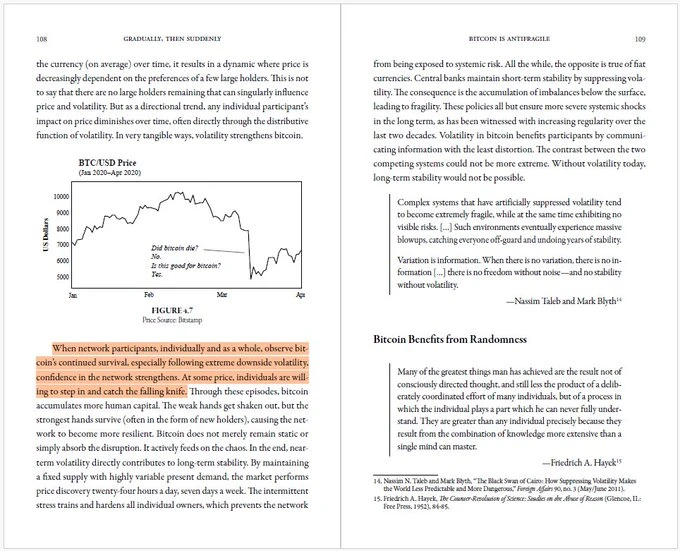

➡️Parker Lewis: "The most important learning from bitcoin's volatility is that bitcoin doesn't die. No central coordination, no bailouts, no moral hazard. On March 12th, 2020, Bitcoin crashed by 50% in a single day to $4,000. Did Bitcoin die? No. Is this good for Bitcoin? Yes. Same story."

➡️Parker Lewis: "The most important learning from bitcoin's volatility is that bitcoin doesn't die. No central coordination, no bailouts, no moral hazard. On March 12th, 2020, Bitcoin crashed by 50% in a single day to $4,000. Did Bitcoin die? No. Is this good for Bitcoin? Yes. Same story."

➡️SOLO BLOCK FOUND A home miner with only ~6.73TH/s of total hashrate just mined a block for 3.146 BTC, totaling $264,558. The device that mined block 924569 appears to be a Bitaxe Gamma at 1.2TH/s.

*On the 22nd of November:*

➡️Bitcoin's weekly RSI has only been this low twice before:

1. 2019 bear market

2. 2022 bear market.

➡️Even if Bitcoin adoption completely froze today, its price could still track M2 money supply growth at about 8% per year. ~8% more USD. ~0% more BTC. Each year. But adoption is accelerating, not stopping, so a CAGR of 30% - 50%+ is more realistic.

➡️Billy Boone: 'If Bitcoin closes in the red in 2025, it will break the pattern, and everything you've ever thought to be predictable about the asset is over. In uncharted territory, macro makes the rules. And macro is ALWAYS forced to appreciate scarce assets eventually. Remember, we live in a world denominated in pieces of paper represented by numbers on a screen.'

➡️SOLO BLOCK FOUND A home miner with only ~6.73TH/s of total hashrate just mined a block for 3.146 BTC, totaling $264,558. The device that mined block 924569 appears to be a Bitaxe Gamma at 1.2TH/s.

*On the 22nd of November:*

➡️Bitcoin's weekly RSI has only been this low twice before:

1. 2019 bear market

2. 2022 bear market.

➡️Even if Bitcoin adoption completely froze today, its price could still track M2 money supply growth at about 8% per year. ~8% more USD. ~0% more BTC. Each year. But adoption is accelerating, not stopping, so a CAGR of 30% - 50%+ is more realistic.

➡️Billy Boone: 'If Bitcoin closes in the red in 2025, it will break the pattern, and everything you've ever thought to be predictable about the asset is over. In uncharted territory, macro makes the rules. And macro is ALWAYS forced to appreciate scarce assets eventually. Remember, we live in a world denominated in pieces of paper represented by numbers on a screen.'

➡️SwanDesk: 'Bitcoin Hashprice COLLAPSES to all-time low of $34.49/PH/s, down over -50% in weeks and the lowest in BTC’s entire history. This is much worse than even the 2021 China ban or the 2022 bear market. Miners are now hemorrhaging cash, which means forced selling and shutdowns are imminent.'

➡️SwanDesk: 'Bitcoin Hashprice COLLAPSES to all-time low of $34.49/PH/s, down over -50% in weeks and the lowest in BTC’s entire history. This is much worse than even the 2021 China ban or the 2022 bear market. Miners are now hemorrhaging cash, which means forced selling and shutdowns are imminent.'

Miners capitulating at historic lows isn't a crisis; it's the reset Bitcoin needed. Weak hands exit, difficulty adjusts down, survivors mine profitably again. This is how BTC self-heals.

Anyway, people, just calm your tits and behold,

The Great Bitcoin Collapse:

Miners capitulating at historic lows isn't a crisis; it's the reset Bitcoin needed. Weak hands exit, difficulty adjusts down, survivors mine profitably again. This is how BTC self-heals.

Anyway, people, just calm your tits and behold,

The Great Bitcoin Collapse:

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Bitcoin, AI & The Fourth Turning | George Bodine**

George Bodine joins the show for a wild conversation about the fourth turning, AI, quantum, and why he believes the next 3–5 years will be the most volatile period in Bitcoin history. We get into his insane life story — from trailer parks to flying F-18s at Top Gun, ejecting from a crashing jet, working underground as a miner, becoming a pro artist, and eventually going all-in on Bitcoin. George breaks down why he thinks the financial crisis never ended, how AI and robotics will erase millions of jobs, the global arms race for compute and energy, and why quantum could hit faster than people expect. We dig into Bitcoin’s real threats — mining centralisation, quantum-vulnerable coins, BIP444, and the Core vs Knots fight dividing the community.

Click here:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: **PocketBitcoin **, especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (from now on, full KYC, so be aware)

> Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Bitcoin, AI & The Fourth Turning | George Bodine**

George Bodine joins the show for a wild conversation about the fourth turning, AI, quantum, and why he believes the next 3–5 years will be the most volatile period in Bitcoin history. We get into his insane life story — from trailer parks to flying F-18s at Top Gun, ejecting from a crashing jet, working underground as a miner, becoming a pro artist, and eventually going all-in on Bitcoin. George breaks down why he thinks the financial crisis never ended, how AI and robotics will erase millions of jobs, the global arms race for compute and energy, and why quantum could hit faster than people expect. We dig into Bitcoin’s real threats — mining centralisation, quantum-vulnerable coins, BIP444, and the Core vs Knots fight dividing the community.

Click here:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: **PocketBitcoin **, especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (from now on, full KYC, so be aware)

> Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃ )

➡️Norway reports a 30% rise in taxpayers declaring digital assets in 2024, with holdings exceeding US$4B.

**On the 4th of November:**

➡️Wicked: 'Everyone who first started daily DCA'ing bitcoin anytime over the past year is now at a loss on their investment, price lower than cost basis. If bitcoin were to drop down to $83k, then everyone who started as early as the last halving, on April 20, 2024, would also be at a loss.'

➡️'Bitcoin officially enters bear market territory, now down -20% since its record high seen on October 6th. We are living in the most exciting market in history.' -TKL

➡️Joe Consorti: 'Bitcoin is now down 20% from its all-time high—in equity terms, this would be considered the start of a bear market. We've already seen two 30%+ drawdowns this cycle. Nothing new under the sun. This is just capitulation from spot Bitcoin holders.' -Joe Consorti

➡️Largest re-accumulation event in the history of the asset class 300-500k.

➡️Pierre Rochard: We need more Bitcoin education. The mispricing is a result of growing information asymmetry. Check out and share:

)

➡️Norway reports a 30% rise in taxpayers declaring digital assets in 2024, with holdings exceeding US$4B.

**On the 4th of November:**

➡️Wicked: 'Everyone who first started daily DCA'ing bitcoin anytime over the past year is now at a loss on their investment, price lower than cost basis. If bitcoin were to drop down to $83k, then everyone who started as early as the last halving, on April 20, 2024, would also be at a loss.'

➡️'Bitcoin officially enters bear market territory, now down -20% since its record high seen on October 6th. We are living in the most exciting market in history.' -TKL

➡️Joe Consorti: 'Bitcoin is now down 20% from its all-time high—in equity terms, this would be considered the start of a bear market. We've already seen two 30%+ drawdowns this cycle. Nothing new under the sun. This is just capitulation from spot Bitcoin holders.' -Joe Consorti

➡️Largest re-accumulation event in the history of the asset class 300-500k.

➡️Pierre Rochard: We need more Bitcoin education. The mispricing is a result of growing information asymmetry. Check out and share:

)

When people say “Capitalism doesn’t work.”

What they really mean is, “The limitless + costless creation of money doesn’t work.”

Your money is broke. Opt out."

Study Bitcoin

➡️Pullbacks in Bitcoin price are a feature of bull runs, not a bug. The recent drawdown of -21% from the all-time high doesn’t even make this list.

When people say “Capitalism doesn’t work.”

What they really mean is, “The limitless + costless creation of money doesn’t work.”

Your money is broke. Opt out."

Study Bitcoin

➡️Pullbacks in Bitcoin price are a feature of bull runs, not a bug. The recent drawdown of -21% from the all-time high doesn’t even make this list.

)

**On the 6th of November:**

➡️BITCOIN MIMICS APRIL CRASH

Bitcoin Archive:

In April, Bitcoin fell 30% to $74K before rallying 70% to $126K Several indicators marked the low in hindsight, including MVRV, Supply in Loss %, 365DMA, and RSI. Today, those same indicators are signaling a potential reversal.

Structurally, it all looks the same. My theory is that people are just down and tired of being chopped up throughout the year.

➡️Wicked: "In dollars, prices of houses have more than doubled. In Bitcoin, they continue to collapse, trending toward zero. Wake me up when the average new house costs less than 1 BTC."

**On the 6th of November:**

➡️BITCOIN MIMICS APRIL CRASH

Bitcoin Archive:

In April, Bitcoin fell 30% to $74K before rallying 70% to $126K Several indicators marked the low in hindsight, including MVRV, Supply in Loss %, 365DMA, and RSI. Today, those same indicators are signaling a potential reversal.

Structurally, it all looks the same. My theory is that people are just down and tired of being chopped up throughout the year.

➡️Wicked: "In dollars, prices of houses have more than doubled. In Bitcoin, they continue to collapse, trending toward zero. Wake me up when the average new house costs less than 1 BTC."

)

➡️Institute of Technology and Renewable Energies to sell 97 Bitcoin ($10M), originally bought for $10,000 in 2012 during a blockchain research project.

➡️Normally, the following I would place the following in the segment Macro/geopolitics.

Mark Mitchell: 'This chart is damning. The death of true capitalism.'

➡️Institute of Technology and Renewable Energies to sell 97 Bitcoin ($10M), originally bought for $10,000 in 2012 during a blockchain research project.

➡️Normally, the following I would place the following in the segment Macro/geopolitics.

Mark Mitchell: 'This chart is damning. The death of true capitalism.'

)

The chart is real. The conclusion is not.

Great response by Rock Chartrand: 'What you’re calling “the death of true capitalism” is actually the triumph of government-managed markets. When the state rigs the rules, prices signal politics instead of value. Capitalism didn’t fail. It was replaced. If productivity rises but your paycheck doesn’t, the first question is: Who inserted themselves between you and the value you produce? The answer is never “capitalism.” It’s always “the people who claim to be protecting you.”

Opt out, study Bitcoin.

)

The chart is real. The conclusion is not.

Great response by Rock Chartrand: 'What you’re calling “the death of true capitalism” is actually the triumph of government-managed markets. When the state rigs the rules, prices signal politics instead of value. Capitalism didn’t fail. It was replaced. If productivity rises but your paycheck doesn’t, the first question is: Who inserted themselves between you and the value you produce? The answer is never “capitalism.” It’s always “the people who claim to be protecting you.”

Opt out, study Bitcoin.

)

'This chart gives a good visual of how many super whales are cashing out of Bitcoin. All lines here are 7+ year on-chain spends from pre-2018 era OG Bitcoin Hodlers.

Orange = $100M OG dumps.

Red = $500M OG dumps.

The chart is VERY colorful in 2025. OGs are cashing out.'

➡️'Largest business cycle bull div yet. Reversal = Parabolic market' - TechDev

'This chart gives a good visual of how many super whales are cashing out of Bitcoin. All lines here are 7+ year on-chain spends from pre-2018 era OG Bitcoin Hodlers.

Orange = $100M OG dumps.

Red = $500M OG dumps.

The chart is VERY colorful in 2025. OGs are cashing out.'

➡️'Largest business cycle bull div yet. Reversal = Parabolic market' - TechDev

)

'The US Government seeks a maximum 5-year sentence for Samourai Wallet developers. In its sentencing memo, prosecutors barely mention the actual charge of operating an unlicensed money transmitter. Instead, they focus on dropped allegations of money laundering and sanctions evasion.' - Bitcoin News

➡️Blackrock bought 921 BTC today. Has sold 5,300 this week. Still holds 798,000 BTC.

➡️Japan's Financial Services Agency to support the country's three largest banks in developing a stablecoin. More liquidity for Bitcoin.

➡️Smart money isn’t selling 99.5% of spot bitcoin ETF investors held through the 20% drawdown.

➡️'What's different this time about Bitcoin Long-term holder (LTH) selling? Bitcoin Long-term holders selling is a normal occurrence in bull markets. LTH takes profits as prices reach new highs.

What's important to analyze each time is whether there's growing Bitcoin demand that can absorb the LTH selling at higher prices. For example, in Jan-March and Nov-Dec 2024, increasing LTH sales occurred as demand was growing (green areas), so the price reached new ATHs.

However, since October, LTH sales have increased (nothing new here), but demand is contracting (red areas), unable to absorb LTH supply at higher prices.' -Julio Moreno

➡️U.S. Bitcoin ETFs bought $240 MILLION BTC yesterday, ending six days of outflows.

➡️Joe Consorti: 'Bitcoin is now in "extreme fear" with its price now 20% off the all-time high and falling. The market has been more fearful twice this cycle:

1. After 8 months of consolidation in 2024,

2. This April, near the bottom of a 32% drawdown

If we're still in a bull, this means we're nearing the local bottom.

If we're moving into a bear (I don't think so), then look out down below.'

➡️'Since 1987, every major bottom in the University of Michigan Consumer Sentiment Index has aligned with a bottom in the Russell 2000. And over the past 15 years, every parabolic bitcoin bull market has coincided with a Russell 2000 breakout, which may be forming again now.'- Joe Burnett

'The US Government seeks a maximum 5-year sentence for Samourai Wallet developers. In its sentencing memo, prosecutors barely mention the actual charge of operating an unlicensed money transmitter. Instead, they focus on dropped allegations of money laundering and sanctions evasion.' - Bitcoin News

➡️Blackrock bought 921 BTC today. Has sold 5,300 this week. Still holds 798,000 BTC.

➡️Japan's Financial Services Agency to support the country's three largest banks in developing a stablecoin. More liquidity for Bitcoin.

➡️Smart money isn’t selling 99.5% of spot bitcoin ETF investors held through the 20% drawdown.

➡️'What's different this time about Bitcoin Long-term holder (LTH) selling? Bitcoin Long-term holders selling is a normal occurrence in bull markets. LTH takes profits as prices reach new highs.

What's important to analyze each time is whether there's growing Bitcoin demand that can absorb the LTH selling at higher prices. For example, in Jan-March and Nov-Dec 2024, increasing LTH sales occurred as demand was growing (green areas), so the price reached new ATHs.

However, since October, LTH sales have increased (nothing new here), but demand is contracting (red areas), unable to absorb LTH supply at higher prices.' -Julio Moreno

➡️U.S. Bitcoin ETFs bought $240 MILLION BTC yesterday, ending six days of outflows.

➡️Joe Consorti: 'Bitcoin is now in "extreme fear" with its price now 20% off the all-time high and falling. The market has been more fearful twice this cycle:

1. After 8 months of consolidation in 2024,

2. This April, near the bottom of a 32% drawdown

If we're still in a bull, this means we're nearing the local bottom.

If we're moving into a bear (I don't think so), then look out down below.'

➡️'Since 1987, every major bottom in the University of Michigan Consumer Sentiment Index has aligned with a bottom in the Russell 2000. And over the past 15 years, every parabolic bitcoin bull market has coincided with a Russell 2000 breakout, which may be forming again now.'- Joe Burnett

)

➡️'They print the money, fund the crimes, and walk free, but the dev who built a privacy wallet gets 5 years.' - TFTC

➡️71% of traditional hedge funds plan to increase Bitcoin and crypto exposure over the next year - AIMA

➡️The Trump family’s American Bitcoin continues stacking, adding ~₿139 since the October 24, 2025 announcement. Total holdings now stand at ₿4,004, with Satoshis per Share (SPS) rising to 432.

➡️'They print the money, fund the crimes, and walk free, but the dev who built a privacy wallet gets 5 years.' - TFTC

➡️71% of traditional hedge funds plan to increase Bitcoin and crypto exposure over the next year - AIMA

➡️The Trump family’s American Bitcoin continues stacking, adding ~₿139 since the October 24, 2025 announcement. Total holdings now stand at ₿4,004, with Satoshis per Share (SPS) rising to 432.

)

**On the 8th of November:**

➡️Satoshi Nakamoto Explains ‘Difficulty Adjustment’ “As computers get faster and the total computing power applied to creating bitcoins increases, the difficulty increases proportionally to keep the total new production constant. Thus, it is known in advance how many new Bitcoins.”

**On the 8th of November:**

➡️Satoshi Nakamoto Explains ‘Difficulty Adjustment’ “As computers get faster and the total computing power applied to creating bitcoins increases, the difficulty increases proportionally to keep the total new production constant. Thus, it is known in advance how many new Bitcoins.”

)

➡️Wicked: The NASDAQ 100 just edged out Bitcoin, comparing their 4-year CAGR.

➡️Wicked: The NASDAQ 100 just edged out Bitcoin, comparing their 4-year CAGR.

)

➡️A Ledger blog article explaining multi-sig is restricted to citizens in the UK “due to new rules.”

➡️Bitcoin News: 'On Friday, Nov. 7, with the price of Bitcoin hovering just above $100,000, a 2016-era whale moved 216.95 BTC worth $22.47 million after 9 years and 4 months of dormancy.'

➡️Bitcoin miners are under renewed pressure as the hash price, a key profitability metric measuring daily revenue per petahash per second, falls to around $42, nearing the $40 “survival” threshold that could push smaller operators offline.

**On the 9th of November:**

➡️The S&P 500 is up in nominal terms, flat in gold terms, and down in Bitcoin terms.

➡️A Ledger blog article explaining multi-sig is restricted to citizens in the UK “due to new rules.”

➡️Bitcoin News: 'On Friday, Nov. 7, with the price of Bitcoin hovering just above $100,000, a 2016-era whale moved 216.95 BTC worth $22.47 million after 9 years and 4 months of dormancy.'

➡️Bitcoin miners are under renewed pressure as the hash price, a key profitability metric measuring daily revenue per petahash per second, falls to around $42, nearing the $40 “survival” threshold that could push smaller operators offline.

**On the 9th of November:**

➡️The S&P 500 is up in nominal terms, flat in gold terms, and down in Bitcoin terms.

)

➡️Josh Mandell reports losing over $1.2 million on IBIT call options, which he bought after predicting Bitcoin would reach $444,000 by November 8.

➡️The Winklevoss twins send 250 BTC to Gemini hot wallets.

➡️Wicked: 'Block by block, sat by sat...save and HODL bitcoin for a better future.'