On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Yakihonne. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 22.11.2025

🧠Quote(s) of the week:

> 'What’s the common denominator with all of these issues?

> High rent — Money

> Can’t buy homes — Money

> Groceries too damn high — Money

> Student debt — Money

> Credit card debt — Money

> Health insurance — Money

> Saving to invest — Money

> Dating and marriage — Money (heavy burden because of monetary costs), Trust in institutions — shattered because of broken money

>

> Belief in the future — not possible when your money is GUARANTEED to lose value in the future BY DESIGN

> No meaning — heavy time and energy pressure because your time and energy decline when your money, which is a representation of your time and energy, declines in value

>

> Maybe the money is the problem??

> Spoiler alert: it is.

>

> A socialist mayor or leader of your country isn’t going to fix it.

> Broken money breaks the world.

> All of these issues, including one of the biggest cities in the world electing a socialist, stem from the money being broken.

> The world will not be fixed until the money is fixed.

> The solution is here. All that remains is understanding.

> Study Bitcoin.' - Cole Walmsley

## 🧡Bitcoin news🧡

Just want to start with the following...

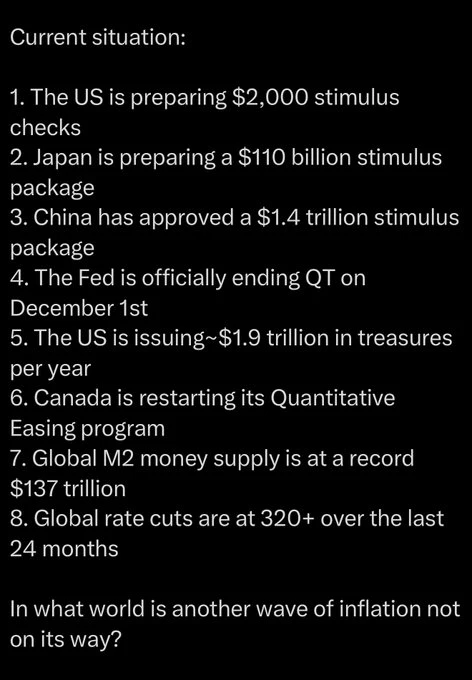

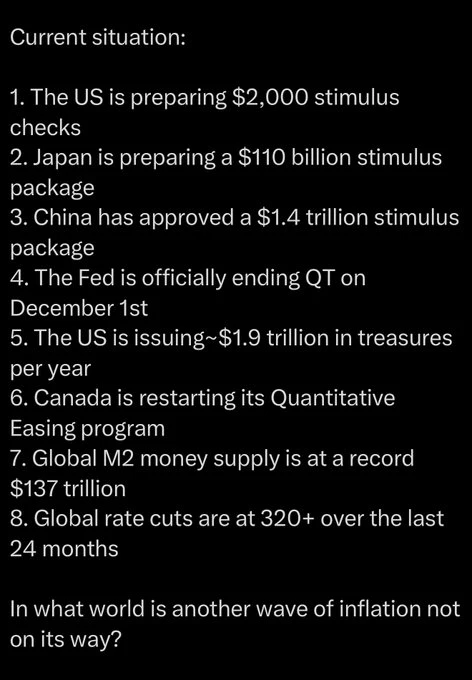

What produces inflation? Milton Friedman had the answer decades ago: “Too much government spending and too much government creation of money - and nothing else.”

Study Bitcoin!

Photos hosted by Azzamo (

Azzamo

Azzamo | Web Hosting, Bitcoin Payment & Nostr Relay Services

Azzamo offers fast web hosting, BTCpay & LNbits hosting, and Nostr relays. Build your online presence with secure, reliable solutions.

)

On the 16th of November:

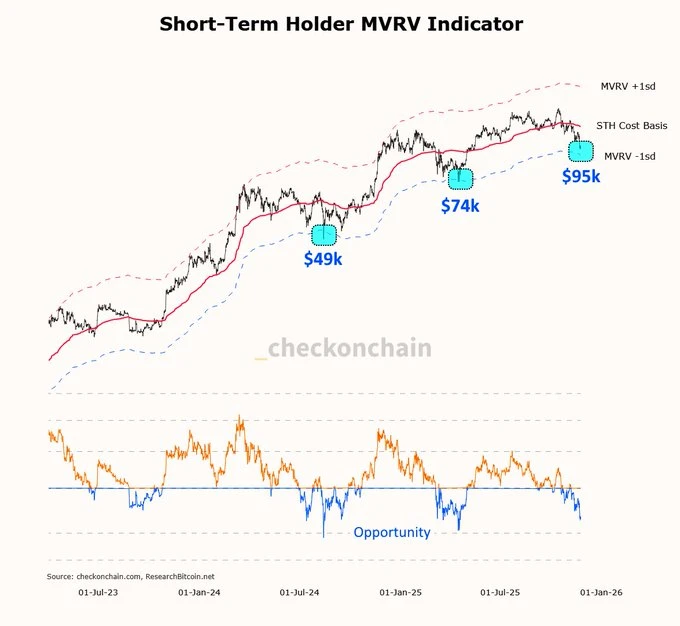

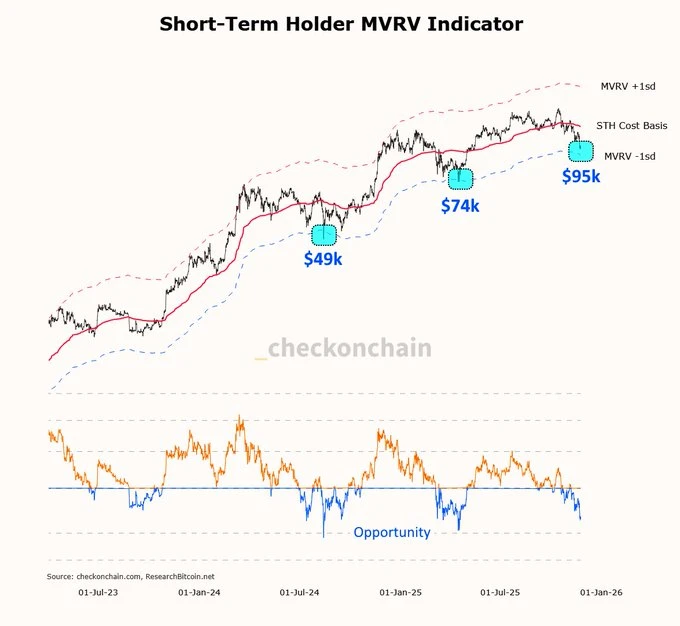

➡️I’m a buyer of standard deviation moves to the downside; they don’t come often, but they tend to be excellent opportunities.

➡️Bitcoin News: Bitcoin just hit its 4th “death cross” of this cycle. The last three marked excellent buying opportunities. Historically, one year after a death cross, Bitcoin has been higher 50% of the time, with an average return of 85%.

On the 17th of November:

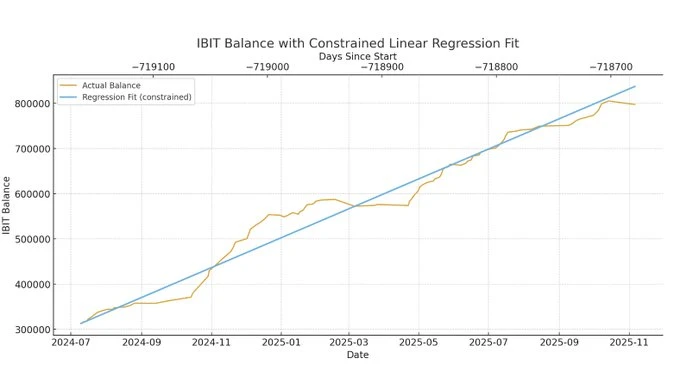

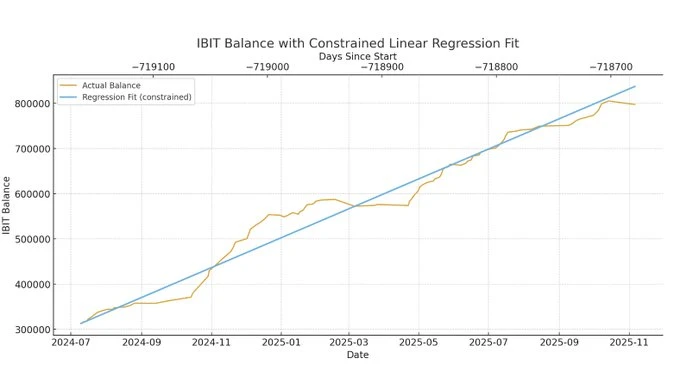

➡️

> 'IBIT alone is buying 1,200 BTC / day (all day average). All ETFs + MSTR 2,000 BTC / day = 1 MM BTC+ every 2 Years. (R2 = 93%).

> Most of the freely tradable supply will be bought in the next decade.' - Fred Krueger

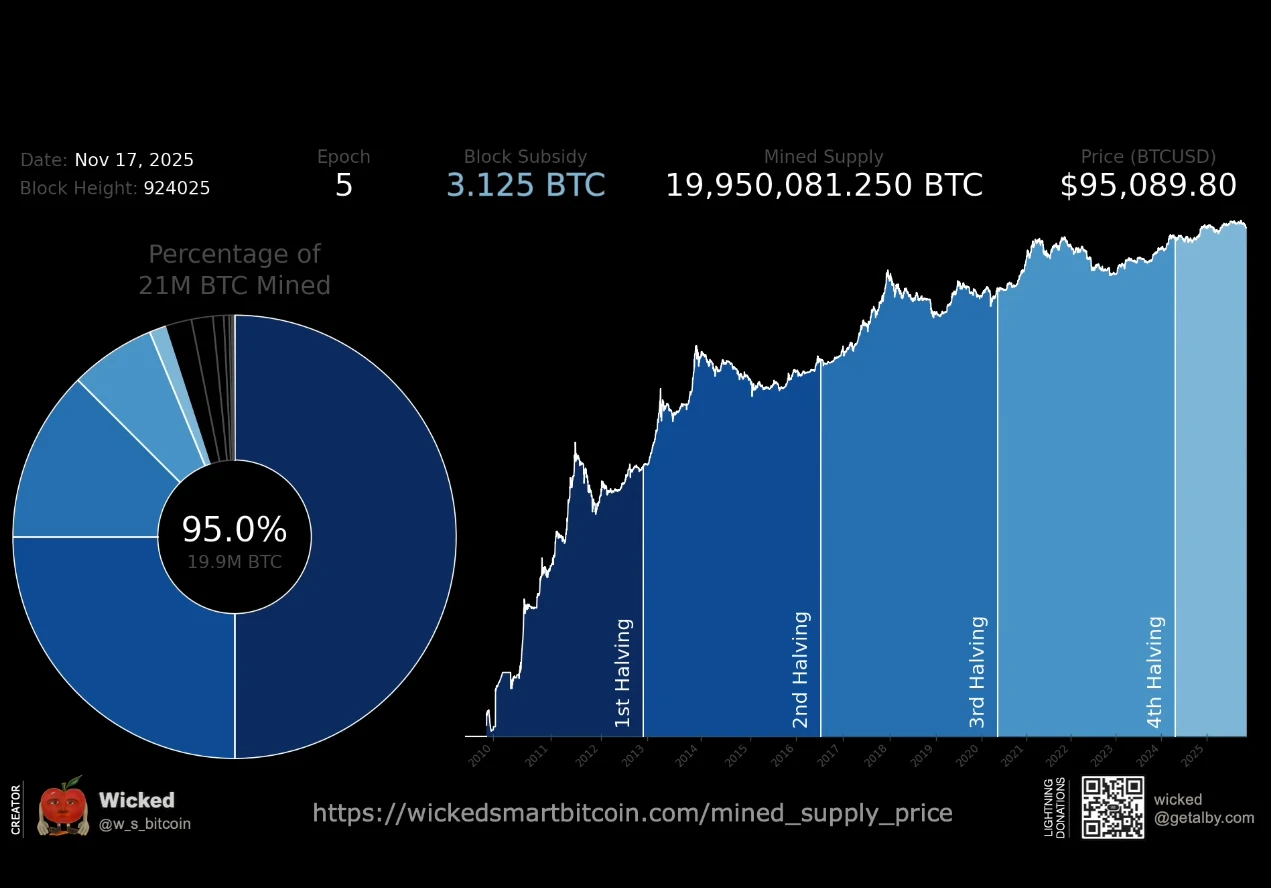

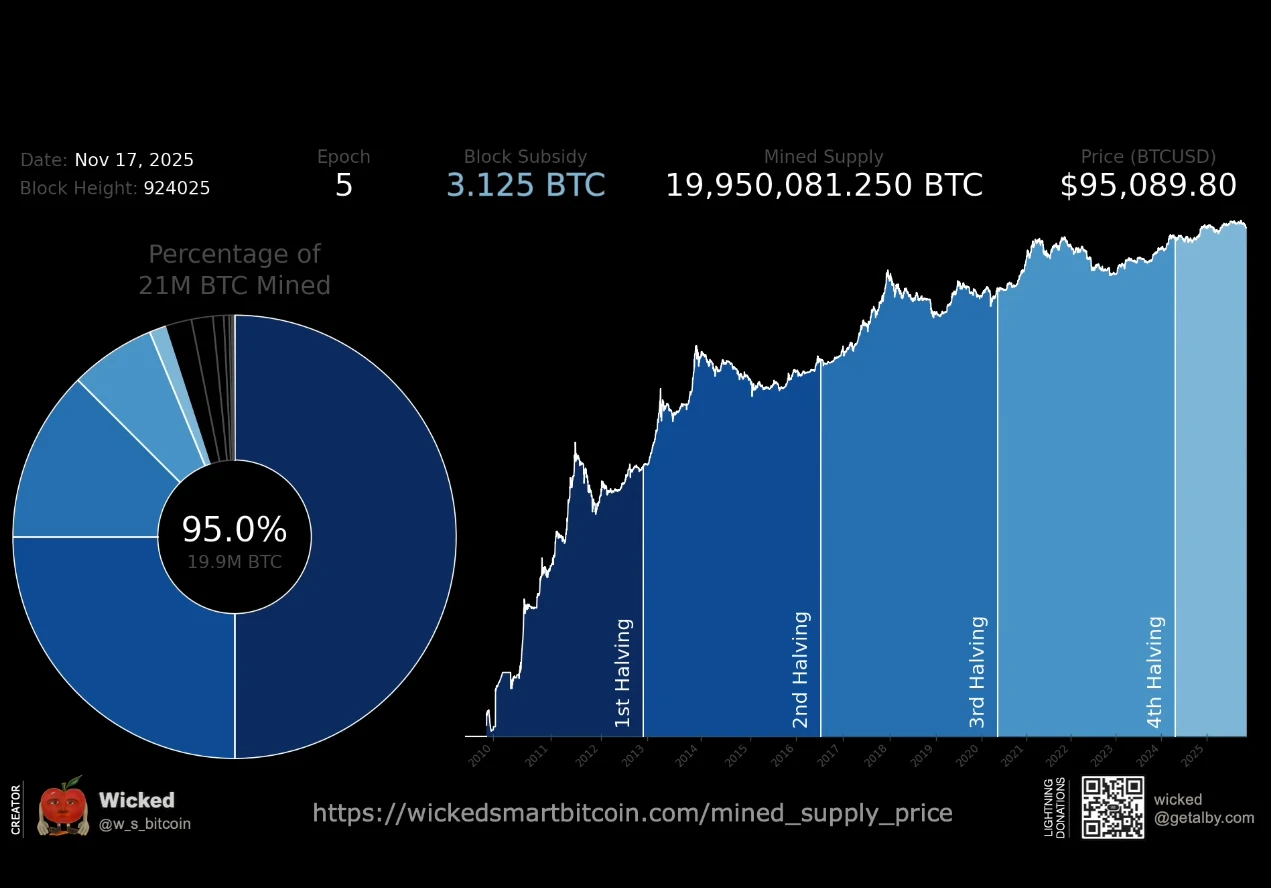

➡️95% of the total Bitcoin supply has now been mined.

➡️Jeff Swanson: Bitcoin continues its collapse, ultimately going to zero. You can really see it here on this chart.

*On the 18th of November:*

➡️Bitcoin whales bought the dip below $100k

➡️The last time Bitcoin was here, global liquidity was $7 trillion lower.

➡️BTCosmonaut: 'This is without a doubt one of the most dangerous bear traps in Bitcoin history. Plebs are losing the plot and selling to Blackrock, Harvard, UAE, Czech, etc., because their WATCH is telling them to. Unfortunately, they will never see that Bitcoin again.'

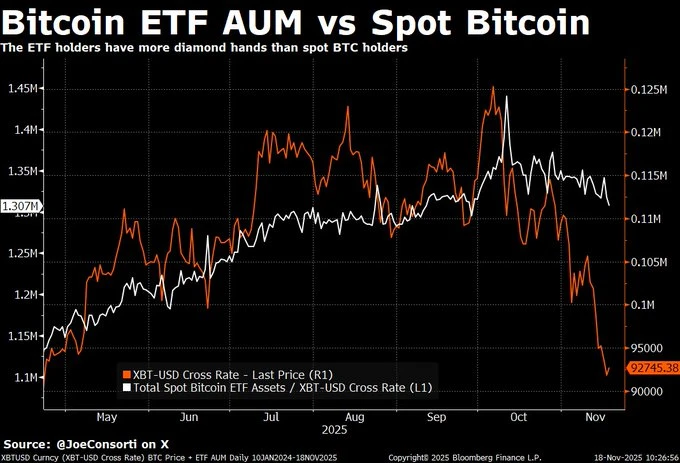

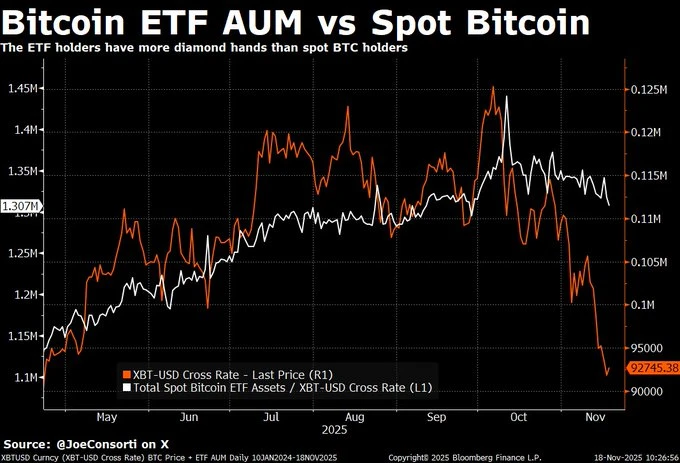

➡️Joe Consorti: 'Bitcoin may be at its lowest price since April, but the assets held by spot ETFs are ~200,000 BTC higher. Don't let Goldman Sachs be more bullish than you.'

➡️Pre Black Friday deal: Bitcoin's on sale. 30% discount.

➡️El Salvador just bought $100 MILLION Bitcoin during the dip.

➡️'95% of the 21 million Bitcoins have officially been mined. Only 5% of BTC supply left to be mined over the next 114 years!' - Wicked

> Chapo:

> '21M total BTC

> 3M lost = 18M

> 75% owned by institutions, govts, funds

> Only ~4M BTC available for individuals globally to own.

> Individual average ownership = 1/2000 (0.0005) Bitcoin

> If you own anywhere close to a whole Bitcoin, you are rich AF.'

*On the 19th of November:*

➡️Bitcoin has broken below the 0.75 cost-basis quantile, a level that has historically marked bear-market territory. Across cycles, reclaiming and holding above it has been key to restoring bullish structure. Bulls will want to see this level regained. -Glassnode

➡️New Hampshire launches First Bitcoin-backed municipal bond.

*On the 20th of November:*

➡️'Short-term holders underwater:

• 2020 COVID crash 92% in a loss of $3,850

• 2022 FTX collapse 94% in a loss of $16,000

• Today: 99% in a loss at $89,000

This is the highest short-term holder capitulation ever recorded.'

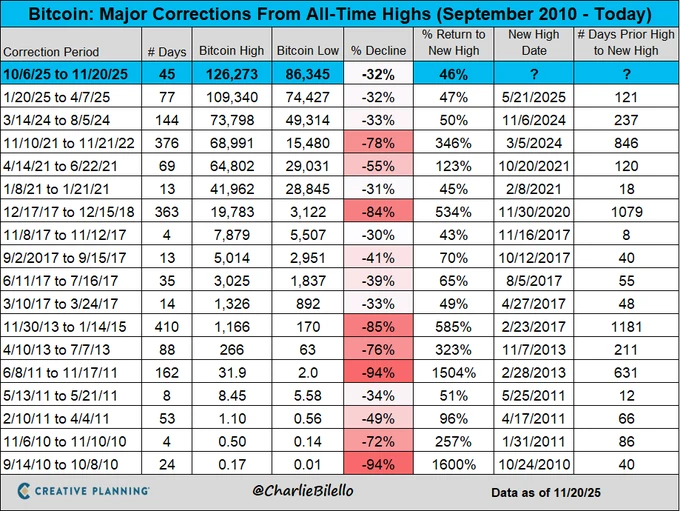

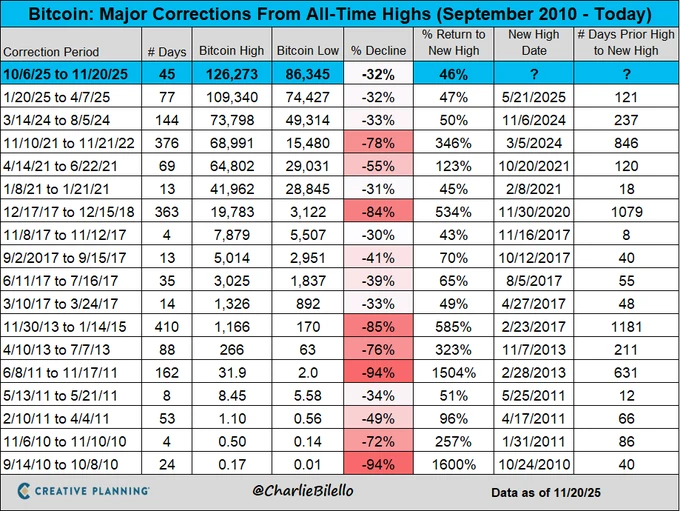

➡️Charlie Bilello: At $86,000, Bitcoin is now down around 32% from its all-time high of $126,000 in early October. That's the biggest drawdown since April, but not unusual at all given its historical volatility.

➡️ Bitcoin's weekly RSI is at a level historically reserved for the bottom of bear market cycles, yet we're only 30% off the highs. It might be the fastest washout in Bitcoin history.

➡️Strategy: 'At current $BTC levels, we have 71 years of dividend coverage assuming the price stays flat. And any $BTC appreciation beyond 1.41% a year fully offsets our annual dividend obligations.'

Market: "We're gonna take Bitcoin down and force liquidate Saylor." Strategy: "Okay, sure. Assuming we do nothing else, you know that we have 71 years of dividends at this current Bitcoin price, right?"

Market: "Oh...um...well..."

On the 21st of November:

➡️At $80,600, Bitcoin is now down around 36% from its all-time high of $126,300 in early October. That's the biggest correction off an all-time high since 2022. Is this unusual volatility for Bitcoin? Not at all. We've seen similar or bigger drawdowns every year.

I saw Bitcoin crash from $20k to $3k, from $69k to $16k, and from $126k to $80k. Every dip was said to be Bitcoin's death, while in reality, every single one was a once-in-a-lifetime buying opportunity. Zoom out, chill, and HODL. Bitcoin will recover.

Aged like fine red wine.

➡️Bitcoin News: Bitcoin's Mean Reversion Oscillator just printed its first green (oversold) bar since April this year.

➡️The number of Bitcoin addresses worth over $100K has dropped 30% over the last two weeks.

➡️Bitcoin realized losses surge to levels last seen during the FTX collapse (Glassnode)

➡️'Binance spot orderbook just printed the single largest positive Depth Delta spike on record (deepest depth). Buy orders now massively outnumber sell orders below price, the strongest absorption signal we’ve seen all cycle. Previous extremes like this marked local lows within hours/days.' - ExitpumpBTC

➡️Bitcoin realized losses have surged to levels last seen during the FTX collapse, with short-term holders driving the bulk of the capitulation. The scale and speed of these losses reflect a meaningful washout of marginal demand as recent buyers unwind into the drawdown. - Glassnode

➡️Bit Paine: If this dip is truly being caused by a liquidity contraction before a wave of stimulus, then the only real historical comparison we have is the 2019 COVID crash, like the ocean going out before a tidal wave.

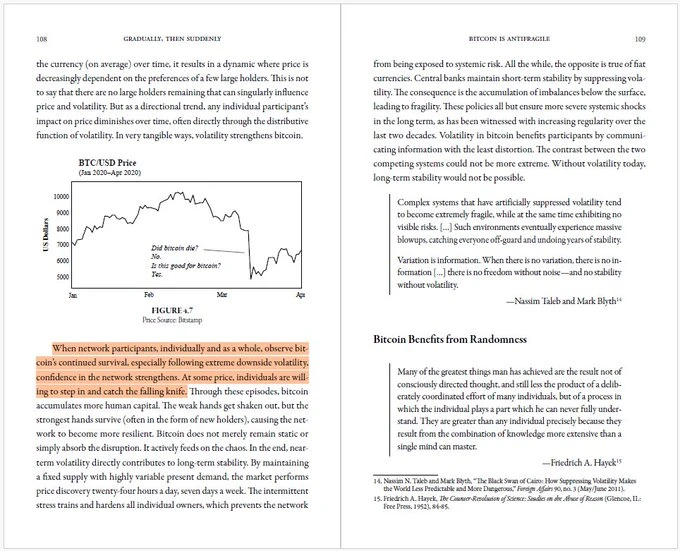

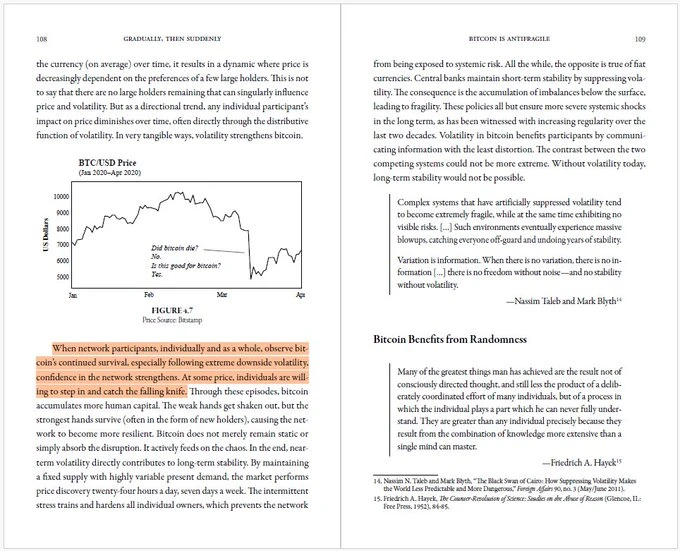

➡️Parker Lewis: "The most important learning from bitcoin's volatility is that bitcoin doesn't die. No central coordination, no bailouts, no moral hazard. On March 12th, 2020, Bitcoin crashed by 50% in a single day to $4,000. Did Bitcoin die? No. Is this good for Bitcoin? Yes. Same story."

➡️SOLO BLOCK FOUND A home miner with only ~6.73TH/s of total hashrate just mined a block for 3.146 BTC, totaling $264,558. The device that mined block 924569 appears to be a Bitaxe Gamma at 1.2TH/s.

*On the 22nd of November:*

➡️Bitcoin's weekly RSI has only been this low twice before:

1. 2019 bear market

2. 2022 bear market.

➡️Even if Bitcoin adoption completely froze today, its price could still track M2 money supply growth at about 8% per year. ~8% more USD. ~0% more BTC. Each year. But adoption is accelerating, not stopping, so a CAGR of 30% - 50%+ is more realistic.

➡️Billy Boone: 'If Bitcoin closes in the red in 2025, it will break the pattern, and everything you've ever thought to be predictable about the asset is over. In uncharted territory, macro makes the rules. And macro is ALWAYS forced to appreciate scarce assets eventually. Remember, we live in a world denominated in pieces of paper represented by numbers on a screen.'

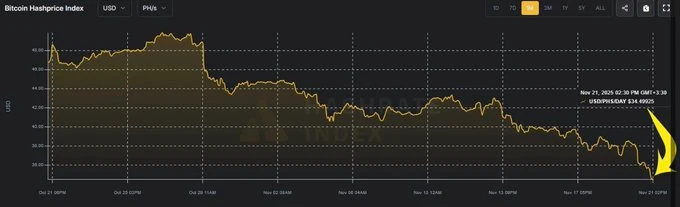

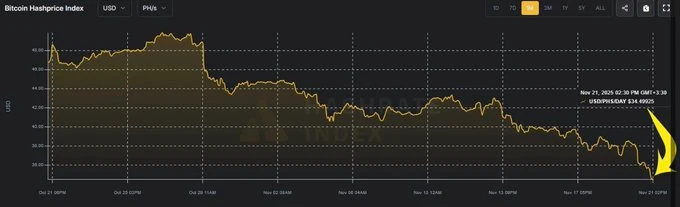

➡️SwanDesk: 'Bitcoin Hashprice COLLAPSES to all-time low of $34.49/PH/s, down over -50% in weeks and the lowest in BTC’s entire history. This is much worse than even the 2021 China ban or the 2022 bear market. Miners are now hemorrhaging cash, which means forced selling and shutdowns are imminent.'

Miners capitulating at historic lows isn't a crisis; it's the reset Bitcoin needed. Weak hands exit, difficulty adjusts down, survivors mine profitably again. This is how BTC self-heals.

Anyway, people, just calm your tits and behold,

The Great Bitcoin Collapse:

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Bitcoin, AI & The Fourth Turning | George Bodine**

George Bodine joins the show for a wild conversation about the fourth turning, AI, quantum, and why he believes the next 3–5 years will be the most volatile period in Bitcoin history. We get into his insane life story — from trailer parks to flying F-18s at Top Gun, ejecting from a crashing jet, working underground as a miner, becoming a pro artist, and eventually going all-in on Bitcoin. George breaks down why he thinks the financial crisis never ended, how AI and robotics will erase millions of jobs, the global arms race for compute and energy, and why quantum could hit faster than people expect. We dig into Bitcoin’s real threats — mining centralisation, quantum-vulnerable coins, BIP444, and the Core vs Knots fight dividing the community.

Click here:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: **PocketBitcoin **, especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (from now on, full KYC, so be aware)

> Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Do you think this post is helpful? If so, please share it with your friends, family co-workers, and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐️ Many thanks⭐️

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Do you think this post is helpful? If so, please share it with your friends, family co-workers, and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐️ Many thanks⭐️

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

The Latest Bitcoin & Macro news: Weekly Recap 22.11.2025

If you would rather read the long format, enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity. (outside of Nostr) Click here:

The Latest Bitcoin & Macro news: Weekly Recap 22.11.2025

If you would rather read the long format, enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity. (outside of Nostr) Click here:

## 🧡Bitcoin news🧡

Just want to start with the following...

What produces inflation? Milton Friedman had the answer decades ago: “Too much government spending and too much government creation of money - and nothing else.”

Study Bitcoin!

Photos hosted by Azzamo (

## 🧡Bitcoin news🧡

Just want to start with the following...

What produces inflation? Milton Friedman had the answer decades ago: “Too much government spending and too much government creation of money - and nothing else.”

Study Bitcoin!

Photos hosted by Azzamo (

➡️Bitcoin News: Bitcoin just hit its 4th “death cross” of this cycle. The last three marked excellent buying opportunities. Historically, one year after a death cross, Bitcoin has been higher 50% of the time, with an average return of 85%.

➡️Bitcoin News: Bitcoin just hit its 4th “death cross” of this cycle. The last three marked excellent buying opportunities. Historically, one year after a death cross, Bitcoin has been higher 50% of the time, with an average return of 85%.

On the 17th of November:

➡️

> 'IBIT alone is buying 1,200 BTC / day (all day average). All ETFs + MSTR 2,000 BTC / day = 1 MM BTC+ every 2 Years. (R2 = 93%).

> Most of the freely tradable supply will be bought in the next decade.' - Fred Krueger

On the 17th of November:

➡️

> 'IBIT alone is buying 1,200 BTC / day (all day average). All ETFs + MSTR 2,000 BTC / day = 1 MM BTC+ every 2 Years. (R2 = 93%).

> Most of the freely tradable supply will be bought in the next decade.' - Fred Krueger

➡️95% of the total Bitcoin supply has now been mined.

➡️Jeff Swanson: Bitcoin continues its collapse, ultimately going to zero. You can really see it here on this chart.

*On the 18th of November:*

➡️Bitcoin whales bought the dip below $100k

➡️95% of the total Bitcoin supply has now been mined.

➡️Jeff Swanson: Bitcoin continues its collapse, ultimately going to zero. You can really see it here on this chart.

*On the 18th of November:*

➡️Bitcoin whales bought the dip below $100k

➡️The last time Bitcoin was here, global liquidity was $7 trillion lower.

➡️BTCosmonaut: 'This is without a doubt one of the most dangerous bear traps in Bitcoin history. Plebs are losing the plot and selling to Blackrock, Harvard, UAE, Czech, etc., because their WATCH is telling them to. Unfortunately, they will never see that Bitcoin again.'

➡️Joe Consorti: 'Bitcoin may be at its lowest price since April, but the assets held by spot ETFs are ~200,000 BTC higher. Don't let Goldman Sachs be more bullish than you.'

➡️The last time Bitcoin was here, global liquidity was $7 trillion lower.

➡️BTCosmonaut: 'This is without a doubt one of the most dangerous bear traps in Bitcoin history. Plebs are losing the plot and selling to Blackrock, Harvard, UAE, Czech, etc., because their WATCH is telling them to. Unfortunately, they will never see that Bitcoin again.'

➡️Joe Consorti: 'Bitcoin may be at its lowest price since April, but the assets held by spot ETFs are ~200,000 BTC higher. Don't let Goldman Sachs be more bullish than you.'

➡️Pre Black Friday deal: Bitcoin's on sale. 30% discount.

➡️El Salvador just bought $100 MILLION Bitcoin during the dip.

➡️'95% of the 21 million Bitcoins have officially been mined. Only 5% of BTC supply left to be mined over the next 114 years!' - Wicked

➡️Pre Black Friday deal: Bitcoin's on sale. 30% discount.

➡️El Salvador just bought $100 MILLION Bitcoin during the dip.

➡️'95% of the 21 million Bitcoins have officially been mined. Only 5% of BTC supply left to be mined over the next 114 years!' - Wicked

> Chapo:

> '21M total BTC

> 3M lost = 18M

> 75% owned by institutions, govts, funds

> Only ~4M BTC available for individuals globally to own.

> Individual average ownership = 1/2000 (0.0005) Bitcoin

> If you own anywhere close to a whole Bitcoin, you are rich AF.'

*On the 19th of November:*

➡️Bitcoin has broken below the 0.75 cost-basis quantile, a level that has historically marked bear-market territory. Across cycles, reclaiming and holding above it has been key to restoring bullish structure. Bulls will want to see this level regained. -Glassnode

➡️New Hampshire launches First Bitcoin-backed municipal bond.

*On the 20th of November:*

➡️'Short-term holders underwater:

• 2020 COVID crash 92% in a loss of $3,850

• 2022 FTX collapse 94% in a loss of $16,000

• Today: 99% in a loss at $89,000

This is the highest short-term holder capitulation ever recorded.'

➡️Charlie Bilello: At $86,000, Bitcoin is now down around 32% from its all-time high of $126,000 in early October. That's the biggest drawdown since April, but not unusual at all given its historical volatility.

> Chapo:

> '21M total BTC

> 3M lost = 18M

> 75% owned by institutions, govts, funds

> Only ~4M BTC available for individuals globally to own.

> Individual average ownership = 1/2000 (0.0005) Bitcoin

> If you own anywhere close to a whole Bitcoin, you are rich AF.'

*On the 19th of November:*

➡️Bitcoin has broken below the 0.75 cost-basis quantile, a level that has historically marked bear-market territory. Across cycles, reclaiming and holding above it has been key to restoring bullish structure. Bulls will want to see this level regained. -Glassnode

➡️New Hampshire launches First Bitcoin-backed municipal bond.

*On the 20th of November:*

➡️'Short-term holders underwater:

• 2020 COVID crash 92% in a loss of $3,850

• 2022 FTX collapse 94% in a loss of $16,000

• Today: 99% in a loss at $89,000

This is the highest short-term holder capitulation ever recorded.'

➡️Charlie Bilello: At $86,000, Bitcoin is now down around 32% from its all-time high of $126,000 in early October. That's the biggest drawdown since April, but not unusual at all given its historical volatility.

➡️ Bitcoin's weekly RSI is at a level historically reserved for the bottom of bear market cycles, yet we're only 30% off the highs. It might be the fastest washout in Bitcoin history.

➡️Strategy: 'At current $BTC levels, we have 71 years of dividend coverage assuming the price stays flat. And any $BTC appreciation beyond 1.41% a year fully offsets our annual dividend obligations.'

Market: "We're gonna take Bitcoin down and force liquidate Saylor." Strategy: "Okay, sure. Assuming we do nothing else, you know that we have 71 years of dividends at this current Bitcoin price, right?"

Market: "Oh...um...well..."

On the 21st of November:

➡️At $80,600, Bitcoin is now down around 36% from its all-time high of $126,300 in early October. That's the biggest correction off an all-time high since 2022. Is this unusual volatility for Bitcoin? Not at all. We've seen similar or bigger drawdowns every year.

➡️ Bitcoin's weekly RSI is at a level historically reserved for the bottom of bear market cycles, yet we're only 30% off the highs. It might be the fastest washout in Bitcoin history.

➡️Strategy: 'At current $BTC levels, we have 71 years of dividend coverage assuming the price stays flat. And any $BTC appreciation beyond 1.41% a year fully offsets our annual dividend obligations.'

Market: "We're gonna take Bitcoin down and force liquidate Saylor." Strategy: "Okay, sure. Assuming we do nothing else, you know that we have 71 years of dividends at this current Bitcoin price, right?"

Market: "Oh...um...well..."

On the 21st of November:

➡️At $80,600, Bitcoin is now down around 36% from its all-time high of $126,300 in early October. That's the biggest correction off an all-time high since 2022. Is this unusual volatility for Bitcoin? Not at all. We've seen similar or bigger drawdowns every year.

I saw Bitcoin crash from $20k to $3k, from $69k to $16k, and from $126k to $80k. Every dip was said to be Bitcoin's death, while in reality, every single one was a once-in-a-lifetime buying opportunity. Zoom out, chill, and HODL. Bitcoin will recover.

I saw Bitcoin crash from $20k to $3k, from $69k to $16k, and from $126k to $80k. Every dip was said to be Bitcoin's death, while in reality, every single one was a once-in-a-lifetime buying opportunity. Zoom out, chill, and HODL. Bitcoin will recover.

Aged like fine red wine.

➡️Bitcoin News: Bitcoin's Mean Reversion Oscillator just printed its first green (oversold) bar since April this year.

Aged like fine red wine.

➡️Bitcoin News: Bitcoin's Mean Reversion Oscillator just printed its first green (oversold) bar since April this year.

➡️The number of Bitcoin addresses worth over $100K has dropped 30% over the last two weeks.

➡️Bitcoin realized losses surge to levels last seen during the FTX collapse (Glassnode)

➡️'Binance spot orderbook just printed the single largest positive Depth Delta spike on record (deepest depth). Buy orders now massively outnumber sell orders below price, the strongest absorption signal we’ve seen all cycle. Previous extremes like this marked local lows within hours/days.' - ExitpumpBTC

➡️Bitcoin realized losses have surged to levels last seen during the FTX collapse, with short-term holders driving the bulk of the capitulation. The scale and speed of these losses reflect a meaningful washout of marginal demand as recent buyers unwind into the drawdown. - Glassnode

➡️Bit Paine: If this dip is truly being caused by a liquidity contraction before a wave of stimulus, then the only real historical comparison we have is the 2019 COVID crash, like the ocean going out before a tidal wave.

➡️The number of Bitcoin addresses worth over $100K has dropped 30% over the last two weeks.

➡️Bitcoin realized losses surge to levels last seen during the FTX collapse (Glassnode)

➡️'Binance spot orderbook just printed the single largest positive Depth Delta spike on record (deepest depth). Buy orders now massively outnumber sell orders below price, the strongest absorption signal we’ve seen all cycle. Previous extremes like this marked local lows within hours/days.' - ExitpumpBTC

➡️Bitcoin realized losses have surged to levels last seen during the FTX collapse, with short-term holders driving the bulk of the capitulation. The scale and speed of these losses reflect a meaningful washout of marginal demand as recent buyers unwind into the drawdown. - Glassnode

➡️Bit Paine: If this dip is truly being caused by a liquidity contraction before a wave of stimulus, then the only real historical comparison we have is the 2019 COVID crash, like the ocean going out before a tidal wave.

➡️Parker Lewis: "The most important learning from bitcoin's volatility is that bitcoin doesn't die. No central coordination, no bailouts, no moral hazard. On March 12th, 2020, Bitcoin crashed by 50% in a single day to $4,000. Did Bitcoin die? No. Is this good for Bitcoin? Yes. Same story."

➡️Parker Lewis: "The most important learning from bitcoin's volatility is that bitcoin doesn't die. No central coordination, no bailouts, no moral hazard. On March 12th, 2020, Bitcoin crashed by 50% in a single day to $4,000. Did Bitcoin die? No. Is this good for Bitcoin? Yes. Same story."

➡️SOLO BLOCK FOUND A home miner with only ~6.73TH/s of total hashrate just mined a block for 3.146 BTC, totaling $264,558. The device that mined block 924569 appears to be a Bitaxe Gamma at 1.2TH/s.

*On the 22nd of November:*

➡️Bitcoin's weekly RSI has only been this low twice before:

1. 2019 bear market

2. 2022 bear market.

➡️Even if Bitcoin adoption completely froze today, its price could still track M2 money supply growth at about 8% per year. ~8% more USD. ~0% more BTC. Each year. But adoption is accelerating, not stopping, so a CAGR of 30% - 50%+ is more realistic.

➡️Billy Boone: 'If Bitcoin closes in the red in 2025, it will break the pattern, and everything you've ever thought to be predictable about the asset is over. In uncharted territory, macro makes the rules. And macro is ALWAYS forced to appreciate scarce assets eventually. Remember, we live in a world denominated in pieces of paper represented by numbers on a screen.'

➡️SOLO BLOCK FOUND A home miner with only ~6.73TH/s of total hashrate just mined a block for 3.146 BTC, totaling $264,558. The device that mined block 924569 appears to be a Bitaxe Gamma at 1.2TH/s.

*On the 22nd of November:*

➡️Bitcoin's weekly RSI has only been this low twice before:

1. 2019 bear market

2. 2022 bear market.

➡️Even if Bitcoin adoption completely froze today, its price could still track M2 money supply growth at about 8% per year. ~8% more USD. ~0% more BTC. Each year. But adoption is accelerating, not stopping, so a CAGR of 30% - 50%+ is more realistic.

➡️Billy Boone: 'If Bitcoin closes in the red in 2025, it will break the pattern, and everything you've ever thought to be predictable about the asset is over. In uncharted territory, macro makes the rules. And macro is ALWAYS forced to appreciate scarce assets eventually. Remember, we live in a world denominated in pieces of paper represented by numbers on a screen.'

➡️SwanDesk: 'Bitcoin Hashprice COLLAPSES to all-time low of $34.49/PH/s, down over -50% in weeks and the lowest in BTC’s entire history. This is much worse than even the 2021 China ban or the 2022 bear market. Miners are now hemorrhaging cash, which means forced selling and shutdowns are imminent.'

➡️SwanDesk: 'Bitcoin Hashprice COLLAPSES to all-time low of $34.49/PH/s, down over -50% in weeks and the lowest in BTC’s entire history. This is much worse than even the 2021 China ban or the 2022 bear market. Miners are now hemorrhaging cash, which means forced selling and shutdowns are imminent.'

Miners capitulating at historic lows isn't a crisis; it's the reset Bitcoin needed. Weak hands exit, difficulty adjusts down, survivors mine profitably again. This is how BTC self-heals.

Anyway, people, just calm your tits and behold,

The Great Bitcoin Collapse:

Miners capitulating at historic lows isn't a crisis; it's the reset Bitcoin needed. Weak hands exit, difficulty adjusts down, survivors mine profitably again. This is how BTC self-heals.

Anyway, people, just calm your tits and behold,

The Great Bitcoin Collapse:

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Bitcoin, AI & The Fourth Turning | George Bodine**

George Bodine joins the show for a wild conversation about the fourth turning, AI, quantum, and why he believes the next 3–5 years will be the most volatile period in Bitcoin history. We get into his insane life story — from trailer parks to flying F-18s at Top Gun, ejecting from a crashing jet, working underground as a miner, becoming a pro artist, and eventually going all-in on Bitcoin. George breaks down why he thinks the financial crisis never ended, how AI and robotics will erase millions of jobs, the global arms race for compute and energy, and why quantum could hit faster than people expect. We dig into Bitcoin’s real threats — mining centralisation, quantum-vulnerable coins, BIP444, and the Core vs Knots fight dividing the community.

Click here:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: **PocketBitcoin **, especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (from now on, full KYC, so be aware)

> Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Bitcoin, AI & The Fourth Turning | George Bodine**

George Bodine joins the show for a wild conversation about the fourth turning, AI, quantum, and why he believes the next 3–5 years will be the most volatile period in Bitcoin history. We get into his insane life story — from trailer parks to flying F-18s at Top Gun, ejecting from a crashing jet, working underground as a miner, becoming a pro artist, and eventually going all-in on Bitcoin. George breaks down why he thinks the financial crisis never ended, how AI and robotics will erase millions of jobs, the global arms race for compute and energy, and why quantum could hit faster than people expect. We dig into Bitcoin’s real threats — mining centralisation, quantum-vulnerable coins, BIP444, and the Core vs Knots fight dividing the community.

Click here:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: **PocketBitcoin **, especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (from now on, full KYC, so be aware)

> Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃