Imo, people are too concerned about mining centralization. The physical ownership and operation of mining rigs is pretty decentralized (even the big miners are a small % of the network).

I would like to see a bit more mining outside of North America, and I’m also supportive of efforts like Stratum V2 to provide further decentralization assurances for transactions. So there are opportunities for improvement but the incentives generally make sense.

On the other hand, what I don’t see talked about enough is supply chain centralization. The production of the chips themselves has a lot more centralization to it. This is true for most advanced semiconductors in general (and thus is a geopolitical issue) but is of particular concern for a decentralized protocol.

Thread

Login to reply

Replies (21)

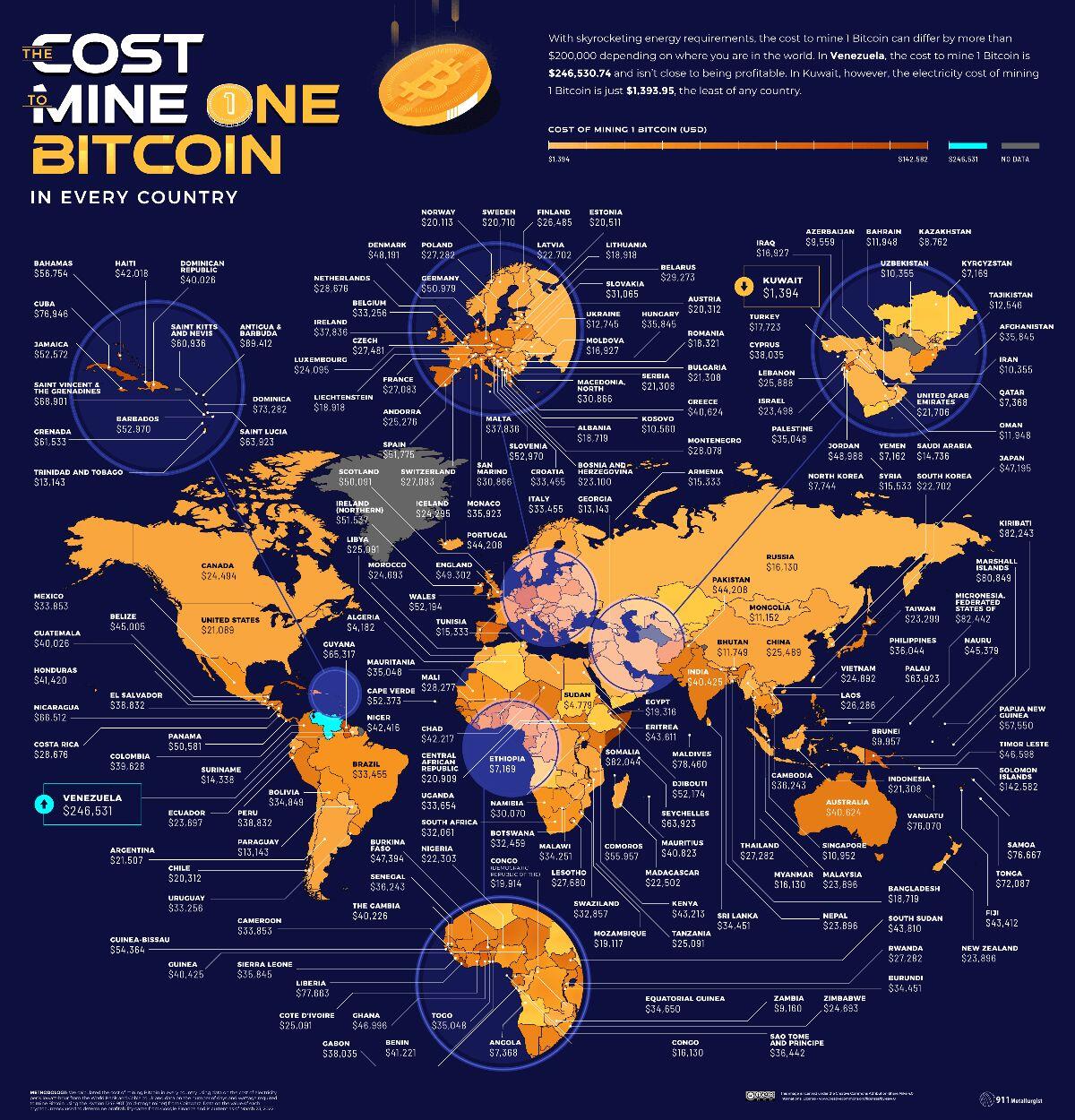

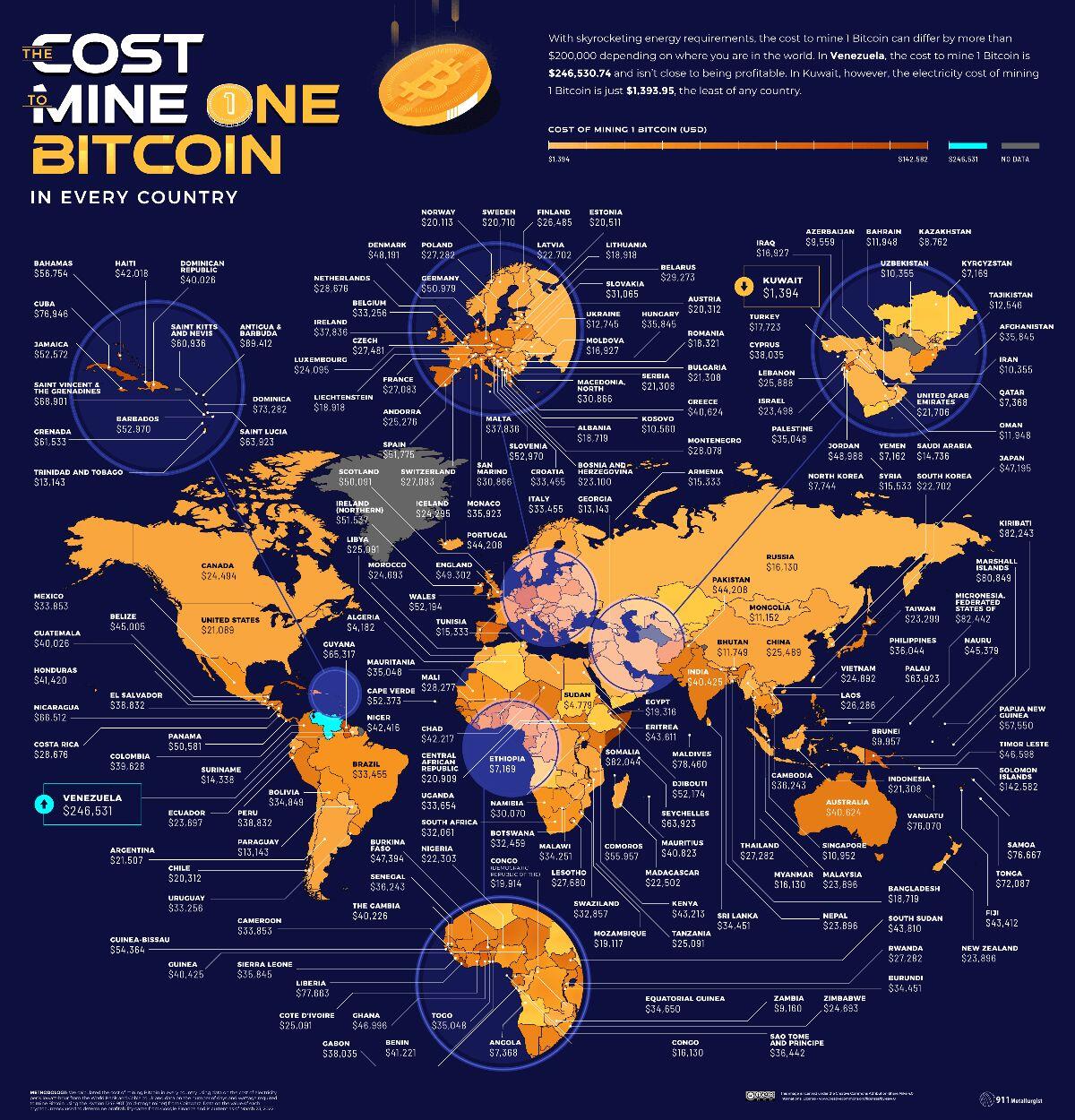

I really like to but mining a 25.000€ bitcoin in Germany cost >50.000€ (plus hardware, rent, staff, insurance,....)

North America looks like the best place to set up mining operations, it is a technologically advanced region, good infrastructure, has affordable and stable electricity, is a functioning nation and so forth. Energy prices will only go up in Europe, there will be no European mining operation except proof of concepts or for educational purpose in the foreseeable future. I say the North American bitcoin mining industry keeps growing.

Data for the map collected in March 2022

Data for the map collected in March 2022

Data for the map collected in March 2022

Data for the map collected in March 2022Hey,

thank you Lyn for your thoughts.

I'm indeed concerned about this topic too.

Would love to know what you think about the Bitcoin concentration by the major Fiat houses like Grayscale and Blackrock? They already hold a siginificant amount of Bitcoin even before they open the Fiat gates to Bitcoin.

I see the risk that we enter a phase of massive manipulation.

Holding bitcoin does not equal control over bitcoin. That's the beauty of proof of work. I welcome them to try to manipulate the price of an asset in which bailouts are impossible.

Yes, of course this would be interesting to watch from our perspective. But they are like small kids playing with TNT.

Their behaviour enables a scenario (even if right now with less certainty) that burns down the compleate Fiat world with really massive impact on most people on earth. It would be like a first time global hyperinflation.

Not worried about either.

Last time I checked, ASICS chips were fillers for chip makers.

There are already plenty of ASICS plugged and unplugged, and I don’t see how any actor could:

A) pay enough the chip makers to get in the front of the line of production/deliveries, as they are competing with the like of NVidia and AMD.

B) find enough cheap energy to plug all these hypothetical ASICS

C) do it covertly enough so there are no repercussions, whether it’s social or economical.

And no, I don’t see how any country could justify politically to do this, unless they go full Bitcoin Standard, which has 0 chance to happen in any country that would have enough economical power to pull it off.

Plus, the incentives of bitcoin could even potentially decentralize chip r&d and production as it becomes a "national security" issue to participate in the network

Opposite. Not enough people care about decentralising mining. The very fact taproot could get in off a few closed door agreements with miners IS an issue.

Wrong. Just because Taproot was put in after some closed door arguments does not make it so that it was put in by the miners. The rest of the network still had to come to consensus about Taproot. That means all nodes, not just miners, put in Taproot. Check your bias.

It is true that some aspects of mining may be overstated.

For now, perhaps to say that the network is in danger because a high percentage of miners are in North America and perhaps the government can coerce the miners. I don't see that as likely right now.

But it never hurts for miners to find other geographic locations outside of North America. Of course, because they offer the best opportunities.

The name of the game here is:

Preciosa of cheap electricity and legal certainty.

Let's see how the competition will adjust after Halving and see which ones are the best fit.

“Competition is for losers”

As soon as it becomes feasible miners will start to engage in anti competitive behavior.

Bitcoin mining is in its very very early days. Bitcoin mining will grow out where energy is being wasted, stranded or has high potential that isn't being used.

Because these things are physically located all over the world, it will be difficult to centralize in the long run. I'm the short term growth may seem a bit centralized based on who can build and allocate time, resources and capital the fastest.

View quoted note →

Any thoughts on mining pool centralization?

Not a big deal since they don’t custody the machines. If a pool misbehaves, a miner can point processing power to another pool.

Plus Stratum V2 and other upgrades can also further reduce mining pool influence.

reminds me of a story where a mining rig was used to heat a swimming pool.

actually brilliant.

I guess you could separate the important parts (selecting and checking transactions and receiving and sending blocks) from the number crunching. The first could be done on inefficient chips. Many countries should have the means to make them and only a small number is needed.

The efficient chips could still boycott for example transactions from a known binance wallet.

My latest article is exactly about those centralizing factors and how the bitcoin network is dealing with them -->

Bitcoin’s Weak Spot: Mining Centralization and How We're Working on It | HackerNoon

In bitcoin mining, centralizing factors abound. Learn how the bitcoin network is responding to ASIC monopolies, industrialization, and mining pools...

It is my dream to see Bitcoin mining bootstrapped in Brazil. That needs to be done top-down. Colonies are not known for being able to autonomously break the glass ceilings they are put in.

could you please translate it in english ?

Agreed!

I also wish more would consider other miners than the ones from Bitmain and MicroBT. I mean Canaan have been around for quite some time, yet many people are reluctant to using them.

Canaan just released a new miner A1466I 170T with an efficiency of under 20 J/T.

This is the single biggest weak point in Bitcoins armour - if chip manafacturing isn't secured then the network can only survive for so long. Options; either Bitcoiners but the machinery and acquire the vast knowledge and skills needed for everything from digging up the minerals to refinement to chip design and production, or...orange pill all the existing industrialists responsible.

View quoted note →