🌊 SURF 'N TURF 🏝️

-THE BORACAY ISLAND LIFE-

Off Grid Survival Tips from The Amish.

The Amish first arrived in the United States in the mid 1700’s. Of course it was still a British colony at the time but since that time the Amish population in the U.S. has grown to almost 300,000. They live in communities across the country and are known for their firm commitment to a simpler, pioneer lifestyle.

Contrary to some assumptions, the Amish do not shun all technology. They have been known to use diesel powered generators, propane powered refrigerators and freezers, and commonly use solar, wind and water power. The only issues they have with technology are when it is interconnected.

The Amish believe that to retain their independence and freedom from the temptations and evil of modern society, they must avoid those technologies that connect to society in general. This would include the power grid, Internet, broadcast TV and radio signals, and any other technology that is part of a network or system connected to the general public.

Want to save this post for later? Click Here to Pin It On Pinterest!

The Off-Grid Pioneers

As a result, the Amish have been pursuing an off-grid lifestyle for more than 500 years. And while there was no such thing as a power-grid 500 years ago, there were still networks of connection that they avoided. They have occasionally if not reluctantly accepted some forms of technology, but it usually requires approval from the local Amish community. This approval varies from community to community.

One surprising example is that some Amish farmers have wireless mobile phones. They don’t usually access the Internet nor do many of the other things most of us do, but many Amish are in business to sell products they produce and need some way to connect to stores and suppliers.

In spite of their occasional use of cell phones they still don’t have hard line phones in their homes. That would be “too connected” to the outside world.

Centuries of Preparedness

As much as some of us worry about a massive grid failure, water shortages and cyberattacks on the Internet, the Amish have been calmly living a prepared life as a matter of course and a matter of choice. There are lessons to be learned here and they go beyond skills and hand tools to a mindset and a state of mind.

A Life Defined by Self-Reliance

It would be a stretch to believe that the Amish never go to a store, but it’s a rare occurrence and their shopping is both specific and limited. One store that has both a catalog and an online presence is Lehman’s. They sell a line of products uniquely tailored to the Amish lifestyle and work style. This includes many of the hand-powered tools and equipment that is no longer made, or only found in antique stores and flea markets.

Just about everything else they need they either grow, make, build or barter for. It’s a lifestyle motivated by a daily commitment to self-reliance and the discipline to make that happen.

One of their mindsets is the fact that every day is a to-do list of chores; some routine, some seasonal, and others necessary or pursued. Kids are often involved in the daily chores both as a means of learning self-reliant skills, and as a necessary set of extra helping hands. To the Amish, hard work is both noble and expected.

They dress very traditionally and their fashion choices haven’t changed for more than 100 years. Their clothes are usually handmade, their food is homegrown, and everything is home cooked, canned or preserved.

We’re going to step back and look at the various actions, skills and behaviors of a typical Amish community to identify some of those actions, skills and behaviors we could and maybe should adopt for our own self-reliance and independence.

The Basic Skills

To begin, the Amish are predominantly farmers. They chose farming because it allowed them to not only live independently but to locate in rural areas away from the sins and opinions of the city.

√ Farming

This isn’t about farming in the traditional sense. Few Amish actively grow, harvest and sell large quantities of a single crop to sell on the open market.

Most of their farming activity is focused on growing their own food to eat, growing some to sell either at their own farm stand or to local grocers, and food as barter for other goods and services they might need within the Amish community and the local community at large.

Mechanical, motor driven equipment is rarely used and instead horses are the literal horsepower of choice.

It’s rare that you would see a gas powered roto-tiller, but some Amish have used diesel powered hay bailers and other diesel-powered equipment for tasks that are either too difficult or too dangerous to do by hand.

Every aspect of farming and gardening is mostly done by hand from tilling to planting, harvesting and storing. Horse-drawn wagons and equipment pull the heavy loads but tasks that can be done by hand are done by hand.

The Amish always harvest seeds from every crop and store them for the next season. They compost everything from weeds to straw to table scraps to manure and chicken droppings.

√ Building

The Amish are master builders. They are known for their carpentry skills and their handmade furniture is highly regarded. They are also masters of timber frame construction and work together in their community to raise barns, sheds and homes for their families and neighbors.

Many are accomplished masons and their sturdy brick walls have rolled across the hills and valleys of their farms for centuries. From barn foundations to bricking a water well; masonry and the ability to use stone, mortar and masonry tools are second to only carpentry in their wheelhouse of skills.

√ Harnessing Water

Many Amish farms and properties feature water wheels powered by creeks and streams to grind flower, pump water to their homes and to irrigate their farms, and even to power saw mills and timber pulleys.

They are accomplished at digging wells and their use of hand pumps to pump water is not only common but expected. They are expert at collecting rainwater and harvesting water from lakes, ponds and streams.

They are accomplished at crafting water filters from gravel, sand and charcoal and heat their water with wood-fired cook stoves with a reservoir attached. They also heat water with rooftop solar water heaters and sometimes simply heat the water in a large stockpot over an open fire.

√ Harnessing Wind

Few Amish farms are without their share of windmills. They’re used to do everything from pumping water to generating electricity. Long before wind-power became a buzzword for green energy, farmers like the Amish were harnessing the wind.

The wind was also used to dry the laundry and of course separate the wheat from the chaff. Windmills also powered small grain mills and even small water pumps to direct water to a livestock trough or small garden.

If there was a force of nature that could provide power to accomplish a task, the Amish harnessed it and put it to good use.

√ Preserving Foods

Food preservation was another primary skill pursued by the Amish. Canning was a regular activity and their pantries and root cellars were always filed with the results of their canning efforts.

They were also expert at curing and smoking meats and a smokehouse was a common and often necessary addition to any Amish farm. The smokehouse was used to both smoke the cured meats and to store them over time.

Dehydrating foods and vegetables using the sun was another common Amish practice. From raisins to sun-dried tomatoes, if it could be sun-dried it found its place in the Amish sun.

Just as many foods were fermented and given the German origins of some Amish communities, sauerkraut was often found in every Amish pantry.

√ Animal Husbandry

Amish livestock went well beyond the standard flock of chickens. Horses had a constant and necessary presence in every Amish barn. Cows were raised for their milk and other dairy products. Pigs, goats and sheep were also on the farm. And of course, there were always chickens.

√ Off-Grid Heating

Wood burning stoves were a standard addition to an Amish farmhouse and chopping wood was a daily chore. Most homes also had fireplaces both for heat and cooking.

Many Amish farms also had “summer kitchens.” These were dedicated structures removed from the main house where wood-fired stoves could be used for daily cooking without making the heat unbearable in the main house in summer.

√ Off-Grid Cooking

Wood burning cook stoves were the primary centerpiece in any Amish kitchen and they not only provided additional heat in winter, but were used to cook everything.

The Amish also cooked outside whether they were roasting whole hogs, chickens on a spit or boiling down tree sap for syrup.

√ Off-Grid Cooling

Many pioneers and native people across North America used innovative ways to keep cool in summer. The Amish kept cool using many of those traditional techniques from well designed venting to the use of cold traps.

Basements and root cellars were always a cool location and the Amish were also mindful about keeping their animals cool.

Foods were kept cool in root cellars, basements, and with modern conveniences like propane powered refrigerator/freezers.

Ice was often harvested from ponds and lakes in winter and dedicated ice-houses were used for year-round cold storage of foods. They also were quick to use ice-boxes in their kitchens and have even been known to use old electric refrigerators without electricity to both contain the ice for cooling, and to take advantage of the insulation properties of any refrigerator.

√ Alternative Power

Off-grid doesn’t mean the electricity is always off to the Amish. It means they are not connected to a networked power grid, but they still find ways today to generate electricity.

Solar power is both used and embraced by many Amish communities as an independent source of power. One reference to the use of solar power by the Amish referred to it as connecting to “God’s-grid.”

The solar panels are sometimes hooked to a solar generator, and rooftop solar setups even heat water for use in the Amish household.

Windmills to generate power are also embraced, and if a stream or creek is running through their property both ram pumps for pumping water, and water wheels for power generation are quick to appear.

Much of the electricity generated is used to power wood working tools like planers, saws and other workshop tools. The power is also used to generate electricity for basic lighting and appliances.

√ Let There be Light

Lighting options for the Amish are wide-ranging from oil filled hurricane lamps to kerosene lanterns, candles and candle lanterns, and even LED flashlights and lamps powered by solar rechargeable batteries. Hand-cranked flashlights are another option.

Some of it sounds like technology the Amish would shun and some Amish communities would agree. On the other hand, they are embraced by other Amish communities given the fact that these off-grid lighting options are independent of the grid.

√ Transportation

A horse and carriage are the traditional mode of transportation for the Amish. But they also use bicycles often with an attached buggy-cart, and some of the younger Amish generation has been spotted on roller skates and skateboard scooters.

Whenever long distance travel is required the Amish usually arrange for someone else to drive them to their destination. They won’t own or drive a traditional car, van or truck but when necessary will accept the need to travel as a passenger.

√ First Aid & Herbal Medicine

It’s rare for the Amish to visit a doctor or hospital with any frequency, although they will not hesitate in a desperate emergency. In many instances, the Amish turn to herbal medicine and natural treatments for their ailments.

The Amish are generally in very good health due to the amount of their strenuous physical activity and their essentially organic diet of farm raised foods. They also shun alcohol, tobacco and the other excesses of society that often lead to health issues.

There are books about Amish natural remedies and many of their herbal treatments that have been used and improved over hundreds of years.

√ Crafts

Some of us think of crafts as a hobby. To the Amish, crafts are a way of life. In a social group that typically avoids the commercial offerings of modern society the ability to do-it-yourself is both necessary and expected. Here are just a few of the craft skills the Amish have both mastered and pursue on a regular basis:

Furniture making

Quilting

Candle making

Soap making

Pottery

Beekeeping

Maple sugaring

Cider making

Cider Vinegar

Sewing

Knitting and crochet

There’s more and if there’s something that needs to be made by hand it’s a good bet the Amish are making it.

√ Home Schooling

It didn’t take a pandemic to motivate the Amish to home-school their children.

It’s totally consistent with their philosophy and the fear that outside and corrupt influences will affect their children and their community.

Traditionally, the Amish home-schooled their children up through 8th grade. At that point, some shifted their children’s education to mastery of a specific trade as a source of future income and security.

√ Self-Reliant Trades

The trades taught to Amish children started much like all trades are acquired. It started with an apprenticeship usually guided by an expert in the community. The product of their trades were then used to either generate income; used as barter or to supply the immediate family with necessary goods and skills.

These dedicated trade skills were in addition to the previously mentioned craft skills that were seen as expected and common knowledge. The trades that the Amish are known for include:

Carpentry

Masonry

Blacksmithing

Food Preservation

Farming and Gardening

Wheelwright

Cobbling

Barrel Cooper

√ Foraging

In addition to farming and animal husbandry, the Amish are expert at wild foraging. Their ability to recognize trees, wild berries, wild mushrooms and other edible wild plants not only supplemented their farming efforts, but provided additional nutrition beyond conventional vegetables and fruits.

√ Barter

Traditional commerce was often a challenge for the Amish. As a community that actively avoided the outside world, the idea of a traditional job with a paycheck was not always a viable possibility. As a result, barter was a very important part of Amish commerce and trade.

The barter items ranged from eggs to fruits and vegetables and even meat and dairy products. They also bartered their crafts from handmade furniture to anything else they could craft or make.

In addition, the Amish bartered their skills for goods and services both within their community and the surrounding local community as well.

√ Acquiring an Amish Mindset

Beyond the skills, crafts and creations generated by Amish communities is a mindset worth considering.

It begins with a dedication to self-reliance.

It’s built on a work-ethic that embraces and respects hard work.

It’s fueled by an independent spirit.

It is fortified by a community designed around cooperation and sharing.

It’s dedicated to a commitment to preparedness.

It’s very accomplished at meeting the challenges of living off-grid.

Anyone with a mindset towards preparedness and self-reliance would be well-served by some of the behaviors and lessons from the Amish communities.

It’s gotten them through the last 500 years, and there’s no reason to believe it won’t take them well into the next millennium.

"Pure signal, no noise"

Credits Goes to the respective

Author ✍️/ Photographer📸

🐇 🕳️

Off Grid Survival Tips from The Amish.

The Amish first arrived in the United States in the mid 1700’s. Of course it was still a British colony at the time but since that time the Amish population in the U.S. has grown to almost 300,000. They live in communities across the country and are known for their firm commitment to a simpler, pioneer lifestyle.

Contrary to some assumptions, the Amish do not shun all technology. They have been known to use diesel powered generators, propane powered refrigerators and freezers, and commonly use solar, wind and water power. The only issues they have with technology are when it is interconnected.

The Amish believe that to retain their independence and freedom from the temptations and evil of modern society, they must avoid those technologies that connect to society in general. This would include the power grid, Internet, broadcast TV and radio signals, and any other technology that is part of a network or system connected to the general public.

Want to save this post for later? Click Here to Pin It On Pinterest!

The Off-Grid Pioneers

As a result, the Amish have been pursuing an off-grid lifestyle for more than 500 years. And while there was no such thing as a power-grid 500 years ago, there were still networks of connection that they avoided. They have occasionally if not reluctantly accepted some forms of technology, but it usually requires approval from the local Amish community. This approval varies from community to community.

One surprising example is that some Amish farmers have wireless mobile phones. They don’t usually access the Internet nor do many of the other things most of us do, but many Amish are in business to sell products they produce and need some way to connect to stores and suppliers.

In spite of their occasional use of cell phones they still don’t have hard line phones in their homes. That would be “too connected” to the outside world.

Centuries of Preparedness

As much as some of us worry about a massive grid failure, water shortages and cyberattacks on the Internet, the Amish have been calmly living a prepared life as a matter of course and a matter of choice. There are lessons to be learned here and they go beyond skills and hand tools to a mindset and a state of mind.

A Life Defined by Self-Reliance

It would be a stretch to believe that the Amish never go to a store, but it’s a rare occurrence and their shopping is both specific and limited. One store that has both a catalog and an online presence is Lehman’s. They sell a line of products uniquely tailored to the Amish lifestyle and work style. This includes many of the hand-powered tools and equipment that is no longer made, or only found in antique stores and flea markets.

Just about everything else they need they either grow, make, build or barter for. It’s a lifestyle motivated by a daily commitment to self-reliance and the discipline to make that happen.

One of their mindsets is the fact that every day is a to-do list of chores; some routine, some seasonal, and others necessary or pursued. Kids are often involved in the daily chores both as a means of learning self-reliant skills, and as a necessary set of extra helping hands. To the Amish, hard work is both noble and expected.

They dress very traditionally and their fashion choices haven’t changed for more than 100 years. Their clothes are usually handmade, their food is homegrown, and everything is home cooked, canned or preserved.

We’re going to step back and look at the various actions, skills and behaviors of a typical Amish community to identify some of those actions, skills and behaviors we could and maybe should adopt for our own self-reliance and independence.

The Basic Skills

To begin, the Amish are predominantly farmers. They chose farming because it allowed them to not only live independently but to locate in rural areas away from the sins and opinions of the city.

√ Farming

This isn’t about farming in the traditional sense. Few Amish actively grow, harvest and sell large quantities of a single crop to sell on the open market.

Most of their farming activity is focused on growing their own food to eat, growing some to sell either at their own farm stand or to local grocers, and food as barter for other goods and services they might need within the Amish community and the local community at large.

Mechanical, motor driven equipment is rarely used and instead horses are the literal horsepower of choice.

It’s rare that you would see a gas powered roto-tiller, but some Amish have used diesel powered hay bailers and other diesel-powered equipment for tasks that are either too difficult or too dangerous to do by hand.

Every aspect of farming and gardening is mostly done by hand from tilling to planting, harvesting and storing. Horse-drawn wagons and equipment pull the heavy loads but tasks that can be done by hand are done by hand.

The Amish always harvest seeds from every crop and store them for the next season. They compost everything from weeds to straw to table scraps to manure and chicken droppings.

√ Building

The Amish are master builders. They are known for their carpentry skills and their handmade furniture is highly regarded. They are also masters of timber frame construction and work together in their community to raise barns, sheds and homes for their families and neighbors.

Many are accomplished masons and their sturdy brick walls have rolled across the hills and valleys of their farms for centuries. From barn foundations to bricking a water well; masonry and the ability to use stone, mortar and masonry tools are second to only carpentry in their wheelhouse of skills.

√ Harnessing Water

Many Amish farms and properties feature water wheels powered by creeks and streams to grind flower, pump water to their homes and to irrigate their farms, and even to power saw mills and timber pulleys.

They are accomplished at digging wells and their use of hand pumps to pump water is not only common but expected. They are expert at collecting rainwater and harvesting water from lakes, ponds and streams.

They are accomplished at crafting water filters from gravel, sand and charcoal and heat their water with wood-fired cook stoves with a reservoir attached. They also heat water with rooftop solar water heaters and sometimes simply heat the water in a large stockpot over an open fire.

√ Harnessing Wind

Few Amish farms are without their share of windmills. They’re used to do everything from pumping water to generating electricity. Long before wind-power became a buzzword for green energy, farmers like the Amish were harnessing the wind.

The wind was also used to dry the laundry and of course separate the wheat from the chaff. Windmills also powered small grain mills and even small water pumps to direct water to a livestock trough or small garden.

If there was a force of nature that could provide power to accomplish a task, the Amish harnessed it and put it to good use.

√ Preserving Foods

Food preservation was another primary skill pursued by the Amish. Canning was a regular activity and their pantries and root cellars were always filed with the results of their canning efforts.

They were also expert at curing and smoking meats and a smokehouse was a common and often necessary addition to any Amish farm. The smokehouse was used to both smoke the cured meats and to store them over time.

Dehydrating foods and vegetables using the sun was another common Amish practice. From raisins to sun-dried tomatoes, if it could be sun-dried it found its place in the Amish sun.

Just as many foods were fermented and given the German origins of some Amish communities, sauerkraut was often found in every Amish pantry.

√ Animal Husbandry

Amish livestock went well beyond the standard flock of chickens. Horses had a constant and necessary presence in every Amish barn. Cows were raised for their milk and other dairy products. Pigs, goats and sheep were also on the farm. And of course, there were always chickens.

√ Off-Grid Heating

Wood burning stoves were a standard addition to an Amish farmhouse and chopping wood was a daily chore. Most homes also had fireplaces both for heat and cooking.

Many Amish farms also had “summer kitchens.” These were dedicated structures removed from the main house where wood-fired stoves could be used for daily cooking without making the heat unbearable in the main house in summer.

√ Off-Grid Cooking

Wood burning cook stoves were the primary centerpiece in any Amish kitchen and they not only provided additional heat in winter, but were used to cook everything.

The Amish also cooked outside whether they were roasting whole hogs, chickens on a spit or boiling down tree sap for syrup.

√ Off-Grid Cooling

Many pioneers and native people across North America used innovative ways to keep cool in summer. The Amish kept cool using many of those traditional techniques from well designed venting to the use of cold traps.

Basements and root cellars were always a cool location and the Amish were also mindful about keeping their animals cool.

Foods were kept cool in root cellars, basements, and with modern conveniences like propane powered refrigerator/freezers.

Ice was often harvested from ponds and lakes in winter and dedicated ice-houses were used for year-round cold storage of foods. They also were quick to use ice-boxes in their kitchens and have even been known to use old electric refrigerators without electricity to both contain the ice for cooling, and to take advantage of the insulation properties of any refrigerator.

√ Alternative Power

Off-grid doesn’t mean the electricity is always off to the Amish. It means they are not connected to a networked power grid, but they still find ways today to generate electricity.

Solar power is both used and embraced by many Amish communities as an independent source of power. One reference to the use of solar power by the Amish referred to it as connecting to “God’s-grid.”

The solar panels are sometimes hooked to a solar generator, and rooftop solar setups even heat water for use in the Amish household.

Windmills to generate power are also embraced, and if a stream or creek is running through their property both ram pumps for pumping water, and water wheels for power generation are quick to appear.

Much of the electricity generated is used to power wood working tools like planers, saws and other workshop tools. The power is also used to generate electricity for basic lighting and appliances.

√ Let There be Light

Lighting options for the Amish are wide-ranging from oil filled hurricane lamps to kerosene lanterns, candles and candle lanterns, and even LED flashlights and lamps powered by solar rechargeable batteries. Hand-cranked flashlights are another option.

Some of it sounds like technology the Amish would shun and some Amish communities would agree. On the other hand, they are embraced by other Amish communities given the fact that these off-grid lighting options are independent of the grid.

√ Transportation

A horse and carriage are the traditional mode of transportation for the Amish. But they also use bicycles often with an attached buggy-cart, and some of the younger Amish generation has been spotted on roller skates and skateboard scooters.

Whenever long distance travel is required the Amish usually arrange for someone else to drive them to their destination. They won’t own or drive a traditional car, van or truck but when necessary will accept the need to travel as a passenger.

√ First Aid & Herbal Medicine

It’s rare for the Amish to visit a doctor or hospital with any frequency, although they will not hesitate in a desperate emergency. In many instances, the Amish turn to herbal medicine and natural treatments for their ailments.

The Amish are generally in very good health due to the amount of their strenuous physical activity and their essentially organic diet of farm raised foods. They also shun alcohol, tobacco and the other excesses of society that often lead to health issues.

There are books about Amish natural remedies and many of their herbal treatments that have been used and improved over hundreds of years.

√ Crafts

Some of us think of crafts as a hobby. To the Amish, crafts are a way of life. In a social group that typically avoids the commercial offerings of modern society the ability to do-it-yourself is both necessary and expected. Here are just a few of the craft skills the Amish have both mastered and pursue on a regular basis:

Furniture making

Quilting

Candle making

Soap making

Pottery

Beekeeping

Maple sugaring

Cider making

Cider Vinegar

Sewing

Knitting and crochet

There’s more and if there’s something that needs to be made by hand it’s a good bet the Amish are making it.

√ Home Schooling

It didn’t take a pandemic to motivate the Amish to home-school their children.

It’s totally consistent with their philosophy and the fear that outside and corrupt influences will affect their children and their community.

Traditionally, the Amish home-schooled their children up through 8th grade. At that point, some shifted their children’s education to mastery of a specific trade as a source of future income and security.

√ Self-Reliant Trades

The trades taught to Amish children started much like all trades are acquired. It started with an apprenticeship usually guided by an expert in the community. The product of their trades were then used to either generate income; used as barter or to supply the immediate family with necessary goods and skills.

These dedicated trade skills were in addition to the previously mentioned craft skills that were seen as expected and common knowledge. The trades that the Amish are known for include:

Carpentry

Masonry

Blacksmithing

Food Preservation

Farming and Gardening

Wheelwright

Cobbling

Barrel Cooper

√ Foraging

In addition to farming and animal husbandry, the Amish are expert at wild foraging. Their ability to recognize trees, wild berries, wild mushrooms and other edible wild plants not only supplemented their farming efforts, but provided additional nutrition beyond conventional vegetables and fruits.

√ Barter

Traditional commerce was often a challenge for the Amish. As a community that actively avoided the outside world, the idea of a traditional job with a paycheck was not always a viable possibility. As a result, barter was a very important part of Amish commerce and trade.

The barter items ranged from eggs to fruits and vegetables and even meat and dairy products. They also bartered their crafts from handmade furniture to anything else they could craft or make.

In addition, the Amish bartered their skills for goods and services both within their community and the surrounding local community as well.

√ Acquiring an Amish Mindset

Beyond the skills, crafts and creations generated by Amish communities is a mindset worth considering.

It begins with a dedication to self-reliance.

It’s built on a work-ethic that embraces and respects hard work.

It’s fueled by an independent spirit.

It is fortified by a community designed around cooperation and sharing.

It’s dedicated to a commitment to preparedness.

It’s very accomplished at meeting the challenges of living off-grid.

Anyone with a mindset towards preparedness and self-reliance would be well-served by some of the behaviors and lessons from the Amish communities.

It’s gotten them through the last 500 years, and there’s no reason to believe it won’t take them well into the next millennium.

"Pure signal, no noise"

Credits Goes to the respective

Author ✍️/ Photographer📸

🐇 🕳️

Off Grid Survival Tips from The Amish.

The Amish first arrived in the United States in the mid 1700’s. Of course it was still a British colony at the time but since that time the Amish population in the U.S. has grown to almost 300,000. They live in communities across the country and are known for their firm commitment to a simpler, pioneer lifestyle.

Contrary to some assumptions, the Amish do not shun all technology. They have been known to use diesel powered generators, propane powered refrigerators and freezers, and commonly use solar, wind and water power. The only issues they have with technology are when it is interconnected.

The Amish believe that to retain their independence and freedom from the temptations and evil of modern society, they must avoid those technologies that connect to society in general. This would include the power grid, Internet, broadcast TV and radio signals, and any other technology that is part of a network or system connected to the general public.

Want to save this post for later? Click Here to Pin It On Pinterest!

The Off-Grid Pioneers

As a result, the Amish have been pursuing an off-grid lifestyle for more than 500 years. And while there was no such thing as a power-grid 500 years ago, there were still networks of connection that they avoided. They have occasionally if not reluctantly accepted some forms of technology, but it usually requires approval from the local Amish community. This approval varies from community to community.

One surprising example is that some Amish farmers have wireless mobile phones. They don’t usually access the Internet nor do many of the other things most of us do, but many Amish are in business to sell products they produce and need some way to connect to stores and suppliers.

In spite of their occasional use of cell phones they still don’t have hard line phones in their homes. That would be “too connected” to the outside world.

Centuries of Preparedness

As much as some of us worry about a massive grid failure, water shortages and cyberattacks on the Internet, the Amish have been calmly living a prepared life as a matter of course and a matter of choice. There are lessons to be learned here and they go beyond skills and hand tools to a mindset and a state of mind.

A Life Defined by Self-Reliance

It would be a stretch to believe that the Amish never go to a store, but it’s a rare occurrence and their shopping is both specific and limited. One store that has both a catalog and an online presence is Lehman’s. They sell a line of products uniquely tailored to the Amish lifestyle and work style. This includes many of the hand-powered tools and equipment that is no longer made, or only found in antique stores and flea markets.

Just about everything else they need they either grow, make, build or barter for. It’s a lifestyle motivated by a daily commitment to self-reliance and the discipline to make that happen.

One of their mindsets is the fact that every day is a to-do list of chores; some routine, some seasonal, and others necessary or pursued. Kids are often involved in the daily chores both as a means of learning self-reliant skills, and as a necessary set of extra helping hands. To the Amish, hard work is both noble and expected.

They dress very traditionally and their fashion choices haven’t changed for more than 100 years. Their clothes are usually handmade, their food is homegrown, and everything is home cooked, canned or preserved.

We’re going to step back and look at the various actions, skills and behaviors of a typical Amish community to identify some of those actions, skills and behaviors we could and maybe should adopt for our own self-reliance and independence.

The Basic Skills

To begin, the Amish are predominantly farmers. They chose farming because it allowed them to not only live independently but to locate in rural areas away from the sins and opinions of the city.

√ Farming

This isn’t about farming in the traditional sense. Few Amish actively grow, harvest and sell large quantities of a single crop to sell on the open market.

Most of their farming activity is focused on growing their own food to eat, growing some to sell either at their own farm stand or to local grocers, and food as barter for other goods and services they might need within the Amish community and the local community at large.

Mechanical, motor driven equipment is rarely used and instead horses are the literal horsepower of choice.

It’s rare that you would see a gas powered roto-tiller, but some Amish have used diesel powered hay bailers and other diesel-powered equipment for tasks that are either too difficult or too dangerous to do by hand.

Every aspect of farming and gardening is mostly done by hand from tilling to planting, harvesting and storing. Horse-drawn wagons and equipment pull the heavy loads but tasks that can be done by hand are done by hand.

The Amish always harvest seeds from every crop and store them for the next season. They compost everything from weeds to straw to table scraps to manure and chicken droppings.

√ Building

The Amish are master builders. They are known for their carpentry skills and their handmade furniture is highly regarded. They are also masters of timber frame construction and work together in their community to raise barns, sheds and homes for their families and neighbors.

Many are accomplished masons and their sturdy brick walls have rolled across the hills and valleys of their farms for centuries. From barn foundations to bricking a water well; masonry and the ability to use stone, mortar and masonry tools are second to only carpentry in their wheelhouse of skills.

√ Harnessing Water

Many Amish farms and properties feature water wheels powered by creeks and streams to grind flower, pump water to their homes and to irrigate their farms, and even to power saw mills and timber pulleys.

They are accomplished at digging wells and their use of hand pumps to pump water is not only common but expected. They are expert at collecting rainwater and harvesting water from lakes, ponds and streams.

They are accomplished at crafting water filters from gravel, sand and charcoal and heat their water with wood-fired cook stoves with a reservoir attached. They also heat water with rooftop solar water heaters and sometimes simply heat the water in a large stockpot over an open fire.

√ Harnessing Wind

Few Amish farms are without their share of windmills. They’re used to do everything from pumping water to generating electricity. Long before wind-power became a buzzword for green energy, farmers like the Amish were harnessing the wind.

The wind was also used to dry the laundry and of course separate the wheat from the chaff. Windmills also powered small grain mills and even small water pumps to direct water to a livestock trough or small garden.

If there was a force of nature that could provide power to accomplish a task, the Amish harnessed it and put it to good use.

√ Preserving Foods

Food preservation was another primary skill pursued by the Amish. Canning was a regular activity and their pantries and root cellars were always filed with the results of their canning efforts.

They were also expert at curing and smoking meats and a smokehouse was a common and often necessary addition to any Amish farm. The smokehouse was used to both smoke the cured meats and to store them over time.

Dehydrating foods and vegetables using the sun was another common Amish practice. From raisins to sun-dried tomatoes, if it could be sun-dried it found its place in the Amish sun.

Just as many foods were fermented and given the German origins of some Amish communities, sauerkraut was often found in every Amish pantry.

√ Animal Husbandry

Amish livestock went well beyond the standard flock of chickens. Horses had a constant and necessary presence in every Amish barn. Cows were raised for their milk and other dairy products. Pigs, goats and sheep were also on the farm. And of course, there were always chickens.

√ Off-Grid Heating

Wood burning stoves were a standard addition to an Amish farmhouse and chopping wood was a daily chore. Most homes also had fireplaces both for heat and cooking.

Many Amish farms also had “summer kitchens.” These were dedicated structures removed from the main house where wood-fired stoves could be used for daily cooking without making the heat unbearable in the main house in summer.

√ Off-Grid Cooking

Wood burning cook stoves were the primary centerpiece in any Amish kitchen and they not only provided additional heat in winter, but were used to cook everything.

The Amish also cooked outside whether they were roasting whole hogs, chickens on a spit or boiling down tree sap for syrup.

√ Off-Grid Cooling

Many pioneers and native people across North America used innovative ways to keep cool in summer. The Amish kept cool using many of those traditional techniques from well designed venting to the use of cold traps.

Basements and root cellars were always a cool location and the Amish were also mindful about keeping their animals cool.

Foods were kept cool in root cellars, basements, and with modern conveniences like propane powered refrigerator/freezers.

Ice was often harvested from ponds and lakes in winter and dedicated ice-houses were used for year-round cold storage of foods. They also were quick to use ice-boxes in their kitchens and have even been known to use old electric refrigerators without electricity to both contain the ice for cooling, and to take advantage of the insulation properties of any refrigerator.

√ Alternative Power

Off-grid doesn’t mean the electricity is always off to the Amish. It means they are not connected to a networked power grid, but they still find ways today to generate electricity.

Solar power is both used and embraced by many Amish communities as an independent source of power. One reference to the use of solar power by the Amish referred to it as connecting to “God’s-grid.”

The solar panels are sometimes hooked to a solar generator, and rooftop solar setups even heat water for use in the Amish household.

Windmills to generate power are also embraced, and if a stream or creek is running through their property both ram pumps for pumping water, and water wheels for power generation are quick to appear.

Much of the electricity generated is used to power wood working tools like planers, saws and other workshop tools. The power is also used to generate electricity for basic lighting and appliances.

√ Let There be Light

Lighting options for the Amish are wide-ranging from oil filled hurricane lamps to kerosene lanterns, candles and candle lanterns, and even LED flashlights and lamps powered by solar rechargeable batteries. Hand-cranked flashlights are another option.

Some of it sounds like technology the Amish would shun and some Amish communities would agree. On the other hand, they are embraced by other Amish communities given the fact that these off-grid lighting options are independent of the grid.

√ Transportation

A horse and carriage are the traditional mode of transportation for the Amish. But they also use bicycles often with an attached buggy-cart, and some of the younger Amish generation has been spotted on roller skates and skateboard scooters.

Whenever long distance travel is required the Amish usually arrange for someone else to drive them to their destination. They won’t own or drive a traditional car, van or truck but when necessary will accept the need to travel as a passenger.

√ First Aid & Herbal Medicine

It’s rare for the Amish to visit a doctor or hospital with any frequency, although they will not hesitate in a desperate emergency. In many instances, the Amish turn to herbal medicine and natural treatments for their ailments.

The Amish are generally in very good health due to the amount of their strenuous physical activity and their essentially organic diet of farm raised foods. They also shun alcohol, tobacco and the other excesses of society that often lead to health issues.

There are books about Amish natural remedies and many of their herbal treatments that have been used and improved over hundreds of years.

√ Crafts

Some of us think of crafts as a hobby. To the Amish, crafts are a way of life. In a social group that typically avoids the commercial offerings of modern society the ability to do-it-yourself is both necessary and expected. Here are just a few of the craft skills the Amish have both mastered and pursue on a regular basis:

Furniture making

Quilting

Candle making

Soap making

Pottery

Beekeeping

Maple sugaring

Cider making

Cider Vinegar

Sewing

Knitting and crochet

There’s more and if there’s something that needs to be made by hand it’s a good bet the Amish are making it.

√ Home Schooling

It didn’t take a pandemic to motivate the Amish to home-school their children.

It’s totally consistent with their philosophy and the fear that outside and corrupt influences will affect their children and their community.

Traditionally, the Amish home-schooled their children up through 8th grade. At that point, some shifted their children’s education to mastery of a specific trade as a source of future income and security.

√ Self-Reliant Trades

The trades taught to Amish children started much like all trades are acquired. It started with an apprenticeship usually guided by an expert in the community. The product of their trades were then used to either generate income; used as barter or to supply the immediate family with necessary goods and skills.

These dedicated trade skills were in addition to the previously mentioned craft skills that were seen as expected and common knowledge. The trades that the Amish are known for include:

Carpentry

Masonry

Blacksmithing

Food Preservation

Farming and Gardening

Wheelwright

Cobbling

Barrel Cooper

√ Foraging

In addition to farming and animal husbandry, the Amish are expert at wild foraging. Their ability to recognize trees, wild berries, wild mushrooms and other edible wild plants not only supplemented their farming efforts, but provided additional nutrition beyond conventional vegetables and fruits.

√ Barter

Traditional commerce was often a challenge for the Amish. As a community that actively avoided the outside world, the idea of a traditional job with a paycheck was not always a viable possibility. As a result, barter was a very important part of Amish commerce and trade.

The barter items ranged from eggs to fruits and vegetables and even meat and dairy products. They also bartered their crafts from handmade furniture to anything else they could craft or make.

In addition, the Amish bartered their skills for goods and services both within their community and the surrounding local community as well.

√ Acquiring an Amish Mindset

Beyond the skills, crafts and creations generated by Amish communities is a mindset worth considering.

It begins with a dedication to self-reliance.

It’s built on a work-ethic that embraces and respects hard work.

It’s fueled by an independent spirit.

It is fortified by a community designed around cooperation and sharing.

It’s dedicated to a commitment to preparedness.

It’s very accomplished at meeting the challenges of living off-grid.

Anyone with a mindset towards preparedness and self-reliance would be well-served by some of the behaviors and lessons from the Amish communities.

It’s gotten them through the last 500 years, and there’s no reason to believe it won’t take them well into the next millennium.

"Pure signal, no noise"

Credits Goes to the respective

Author ✍️/ Photographer📸

🐇 🕳️

Off Grid Survival Tips from The Amish.

The Amish first arrived in the United States in the mid 1700’s. Of course it was still a British colony at the time but since that time the Amish population in the U.S. has grown to almost 300,000. They live in communities across the country and are known for their firm commitment to a simpler, pioneer lifestyle.

Contrary to some assumptions, the Amish do not shun all technology. They have been known to use diesel powered generators, propane powered refrigerators and freezers, and commonly use solar, wind and water power. The only issues they have with technology are when it is interconnected.

The Amish believe that to retain their independence and freedom from the temptations and evil of modern society, they must avoid those technologies that connect to society in general. This would include the power grid, Internet, broadcast TV and radio signals, and any other technology that is part of a network or system connected to the general public.

Want to save this post for later? Click Here to Pin It On Pinterest!

The Off-Grid Pioneers

As a result, the Amish have been pursuing an off-grid lifestyle for more than 500 years. And while there was no such thing as a power-grid 500 years ago, there were still networks of connection that they avoided. They have occasionally if not reluctantly accepted some forms of technology, but it usually requires approval from the local Amish community. This approval varies from community to community.

One surprising example is that some Amish farmers have wireless mobile phones. They don’t usually access the Internet nor do many of the other things most of us do, but many Amish are in business to sell products they produce and need some way to connect to stores and suppliers.

In spite of their occasional use of cell phones they still don’t have hard line phones in their homes. That would be “too connected” to the outside world.

Centuries of Preparedness

As much as some of us worry about a massive grid failure, water shortages and cyberattacks on the Internet, the Amish have been calmly living a prepared life as a matter of course and a matter of choice. There are lessons to be learned here and they go beyond skills and hand tools to a mindset and a state of mind.

A Life Defined by Self-Reliance

It would be a stretch to believe that the Amish never go to a store, but it’s a rare occurrence and their shopping is both specific and limited. One store that has both a catalog and an online presence is Lehman’s. They sell a line of products uniquely tailored to the Amish lifestyle and work style. This includes many of the hand-powered tools and equipment that is no longer made, or only found in antique stores and flea markets.

Just about everything else they need they either grow, make, build or barter for. It’s a lifestyle motivated by a daily commitment to self-reliance and the discipline to make that happen.

One of their mindsets is the fact that every day is a to-do list of chores; some routine, some seasonal, and others necessary or pursued. Kids are often involved in the daily chores both as a means of learning self-reliant skills, and as a necessary set of extra helping hands. To the Amish, hard work is both noble and expected.

They dress very traditionally and their fashion choices haven’t changed for more than 100 years. Their clothes are usually handmade, their food is homegrown, and everything is home cooked, canned or preserved.

We’re going to step back and look at the various actions, skills and behaviors of a typical Amish community to identify some of those actions, skills and behaviors we could and maybe should adopt for our own self-reliance and independence.

The Basic Skills

To begin, the Amish are predominantly farmers. They chose farming because it allowed them to not only live independently but to locate in rural areas away from the sins and opinions of the city.

√ Farming

This isn’t about farming in the traditional sense. Few Amish actively grow, harvest and sell large quantities of a single crop to sell on the open market.

Most of their farming activity is focused on growing their own food to eat, growing some to sell either at their own farm stand or to local grocers, and food as barter for other goods and services they might need within the Amish community and the local community at large.

Mechanical, motor driven equipment is rarely used and instead horses are the literal horsepower of choice.

It’s rare that you would see a gas powered roto-tiller, but some Amish have used diesel powered hay bailers and other diesel-powered equipment for tasks that are either too difficult or too dangerous to do by hand.

Every aspect of farming and gardening is mostly done by hand from tilling to planting, harvesting and storing. Horse-drawn wagons and equipment pull the heavy loads but tasks that can be done by hand are done by hand.

The Amish always harvest seeds from every crop and store them for the next season. They compost everything from weeds to straw to table scraps to manure and chicken droppings.

√ Building

The Amish are master builders. They are known for their carpentry skills and their handmade furniture is highly regarded. They are also masters of timber frame construction and work together in their community to raise barns, sheds and homes for their families and neighbors.

Many are accomplished masons and their sturdy brick walls have rolled across the hills and valleys of their farms for centuries. From barn foundations to bricking a water well; masonry and the ability to use stone, mortar and masonry tools are second to only carpentry in their wheelhouse of skills.

√ Harnessing Water

Many Amish farms and properties feature water wheels powered by creeks and streams to grind flower, pump water to their homes and to irrigate their farms, and even to power saw mills and timber pulleys.

They are accomplished at digging wells and their use of hand pumps to pump water is not only common but expected. They are expert at collecting rainwater and harvesting water from lakes, ponds and streams.

They are accomplished at crafting water filters from gravel, sand and charcoal and heat their water with wood-fired cook stoves with a reservoir attached. They also heat water with rooftop solar water heaters and sometimes simply heat the water in a large stockpot over an open fire.

√ Harnessing Wind

Few Amish farms are without their share of windmills. They’re used to do everything from pumping water to generating electricity. Long before wind-power became a buzzword for green energy, farmers like the Amish were harnessing the wind.

The wind was also used to dry the laundry and of course separate the wheat from the chaff. Windmills also powered small grain mills and even small water pumps to direct water to a livestock trough or small garden.

If there was a force of nature that could provide power to accomplish a task, the Amish harnessed it and put it to good use.

√ Preserving Foods

Food preservation was another primary skill pursued by the Amish. Canning was a regular activity and their pantries and root cellars were always filed with the results of their canning efforts.

They were also expert at curing and smoking meats and a smokehouse was a common and often necessary addition to any Amish farm. The smokehouse was used to both smoke the cured meats and to store them over time.

Dehydrating foods and vegetables using the sun was another common Amish practice. From raisins to sun-dried tomatoes, if it could be sun-dried it found its place in the Amish sun.

Just as many foods were fermented and given the German origins of some Amish communities, sauerkraut was often found in every Amish pantry.

√ Animal Husbandry

Amish livestock went well beyond the standard flock of chickens. Horses had a constant and necessary presence in every Amish barn. Cows were raised for their milk and other dairy products. Pigs, goats and sheep were also on the farm. And of course, there were always chickens.

√ Off-Grid Heating

Wood burning stoves were a standard addition to an Amish farmhouse and chopping wood was a daily chore. Most homes also had fireplaces both for heat and cooking.

Many Amish farms also had “summer kitchens.” These were dedicated structures removed from the main house where wood-fired stoves could be used for daily cooking without making the heat unbearable in the main house in summer.

√ Off-Grid Cooking

Wood burning cook stoves were the primary centerpiece in any Amish kitchen and they not only provided additional heat in winter, but were used to cook everything.

The Amish also cooked outside whether they were roasting whole hogs, chickens on a spit or boiling down tree sap for syrup.

√ Off-Grid Cooling

Many pioneers and native people across North America used innovative ways to keep cool in summer. The Amish kept cool using many of those traditional techniques from well designed venting to the use of cold traps.

Basements and root cellars were always a cool location and the Amish were also mindful about keeping their animals cool.

Foods were kept cool in root cellars, basements, and with modern conveniences like propane powered refrigerator/freezers.

Ice was often harvested from ponds and lakes in winter and dedicated ice-houses were used for year-round cold storage of foods. They also were quick to use ice-boxes in their kitchens and have even been known to use old electric refrigerators without electricity to both contain the ice for cooling, and to take advantage of the insulation properties of any refrigerator.

√ Alternative Power

Off-grid doesn’t mean the electricity is always off to the Amish. It means they are not connected to a networked power grid, but they still find ways today to generate electricity.

Solar power is both used and embraced by many Amish communities as an independent source of power. One reference to the use of solar power by the Amish referred to it as connecting to “God’s-grid.”

The solar panels are sometimes hooked to a solar generator, and rooftop solar setups even heat water for use in the Amish household.

Windmills to generate power are also embraced, and if a stream or creek is running through their property both ram pumps for pumping water, and water wheels for power generation are quick to appear.

Much of the electricity generated is used to power wood working tools like planers, saws and other workshop tools. The power is also used to generate electricity for basic lighting and appliances.

√ Let There be Light

Lighting options for the Amish are wide-ranging from oil filled hurricane lamps to kerosene lanterns, candles and candle lanterns, and even LED flashlights and lamps powered by solar rechargeable batteries. Hand-cranked flashlights are another option.

Some of it sounds like technology the Amish would shun and some Amish communities would agree. On the other hand, they are embraced by other Amish communities given the fact that these off-grid lighting options are independent of the grid.

√ Transportation

A horse and carriage are the traditional mode of transportation for the Amish. But they also use bicycles often with an attached buggy-cart, and some of the younger Amish generation has been spotted on roller skates and skateboard scooters.

Whenever long distance travel is required the Amish usually arrange for someone else to drive them to their destination. They won’t own or drive a traditional car, van or truck but when necessary will accept the need to travel as a passenger.

√ First Aid & Herbal Medicine

It’s rare for the Amish to visit a doctor or hospital with any frequency, although they will not hesitate in a desperate emergency. In many instances, the Amish turn to herbal medicine and natural treatments for their ailments.

The Amish are generally in very good health due to the amount of their strenuous physical activity and their essentially organic diet of farm raised foods. They also shun alcohol, tobacco and the other excesses of society that often lead to health issues.

There are books about Amish natural remedies and many of their herbal treatments that have been used and improved over hundreds of years.

√ Crafts

Some of us think of crafts as a hobby. To the Amish, crafts are a way of life. In a social group that typically avoids the commercial offerings of modern society the ability to do-it-yourself is both necessary and expected. Here are just a few of the craft skills the Amish have both mastered and pursue on a regular basis:

Furniture making

Quilting

Candle making

Soap making

Pottery

Beekeeping

Maple sugaring

Cider making

Cider Vinegar

Sewing

Knitting and crochet

There’s more and if there’s something that needs to be made by hand it’s a good bet the Amish are making it.

√ Home Schooling

It didn’t take a pandemic to motivate the Amish to home-school their children.

It’s totally consistent with their philosophy and the fear that outside and corrupt influences will affect their children and their community.

Traditionally, the Amish home-schooled their children up through 8th grade. At that point, some shifted their children’s education to mastery of a specific trade as a source of future income and security.

√ Self-Reliant Trades

The trades taught to Amish children started much like all trades are acquired. It started with an apprenticeship usually guided by an expert in the community. The product of their trades were then used to either generate income; used as barter or to supply the immediate family with necessary goods and skills.

These dedicated trade skills were in addition to the previously mentioned craft skills that were seen as expected and common knowledge. The trades that the Amish are known for include:

Carpentry

Masonry

Blacksmithing

Food Preservation

Farming and Gardening

Wheelwright

Cobbling

Barrel Cooper

√ Foraging

In addition to farming and animal husbandry, the Amish are expert at wild foraging. Their ability to recognize trees, wild berries, wild mushrooms and other edible wild plants not only supplemented their farming efforts, but provided additional nutrition beyond conventional vegetables and fruits.

√ Barter

Traditional commerce was often a challenge for the Amish. As a community that actively avoided the outside world, the idea of a traditional job with a paycheck was not always a viable possibility. As a result, barter was a very important part of Amish commerce and trade.

The barter items ranged from eggs to fruits and vegetables and even meat and dairy products. They also bartered their crafts from handmade furniture to anything else they could craft or make.

In addition, the Amish bartered their skills for goods and services both within their community and the surrounding local community as well.

√ Acquiring an Amish Mindset

Beyond the skills, crafts and creations generated by Amish communities is a mindset worth considering.

It begins with a dedication to self-reliance.

It’s built on a work-ethic that embraces and respects hard work.

It’s fueled by an independent spirit.

It is fortified by a community designed around cooperation and sharing.

It’s dedicated to a commitment to preparedness.

It’s very accomplished at meeting the challenges of living off-grid.

Anyone with a mindset towards preparedness and self-reliance would be well-served by some of the behaviors and lessons from the Amish communities.

It’s gotten them through the last 500 years, and there’s no reason to believe it won’t take them well into the next millennium.

"Pure signal, no noise"

Credits Goes to the respective

Author ✍️/ Photographer📸

🐇 🕳️

Doug Casey: Politically, and in every other way, it’s all about Trump. As Shakespeare said of Julius Caesar, “he doth bestride the narrow world. Like a Colossus, and we petty men. Walk under his huge legs and peep about. To find ourselves dishonorable graves.”

Trump has his finger in everything, in all countries, all spheres of enterprise, everywhere. He’s a political phenomenon with authoritarian tendencies. Which is a natural consequence of an unstable “democracy.” In fact, Caesar rose to power because of the late Roman Republic’s chronic political instability—much of which he caused. Trump could be America’s answer to Caesar.

I made that observation to a friend who, like me, is prone to classical references. He countered that perhaps Trump sees himself as a Cincinnatus lookalike. Cincinnatus, you’ll recall, was a patrician citizen appointed dictator in about 458 BC to deal with a military emergency. He quickly did so. Instead of serving out the rest of his six-month term, he handed back his power and returned to his farm.

Trump sees that the US is on the cusp of a cultural crisis, and wants to avert it. He’s certainly a cultural conservative who wants to return the country to the halcyon days of yesteryear, the way it was in “Leave it to Beaver” and “Father Knows Best.” But he’s also a narcissist and a megalomaniac, trying to reorder the world by signing hundreds of Executive Orders, creating chaos with his tariffs, subsidies, threats, attacks, and arbitrary blustering. At heart, Trump is a Caesar, not a Cincinnatus,

Economically, the U.S. is imitating Argentina. His actions are pretty much those of Perón, who was responsible for the destruction of the Argentine economy: tariffs to protect domestic industries, lots of arbitrary regulations, and government “partnerships” with corporations. Both Peron and Trump are reminiscent of Mussolini. It’s a slippery slope.

He’s surrounded himself with sycophants and lickspittles. His tariffs have an excellent chance of upending both the domestic and world economies. He claims that he will replace the income tax with tariffs, which sounds great. It’s true that tariffs paid for over 75% of government expenditures up to 1916. But that was when Federal spending was tiny, about 1.5% of GDP. Today, the only way to reduce taxes is to reduce spending—but Trump loves spending. DOGE is long forgotten. I predict he’ll outdo FDR by every measure in spending.

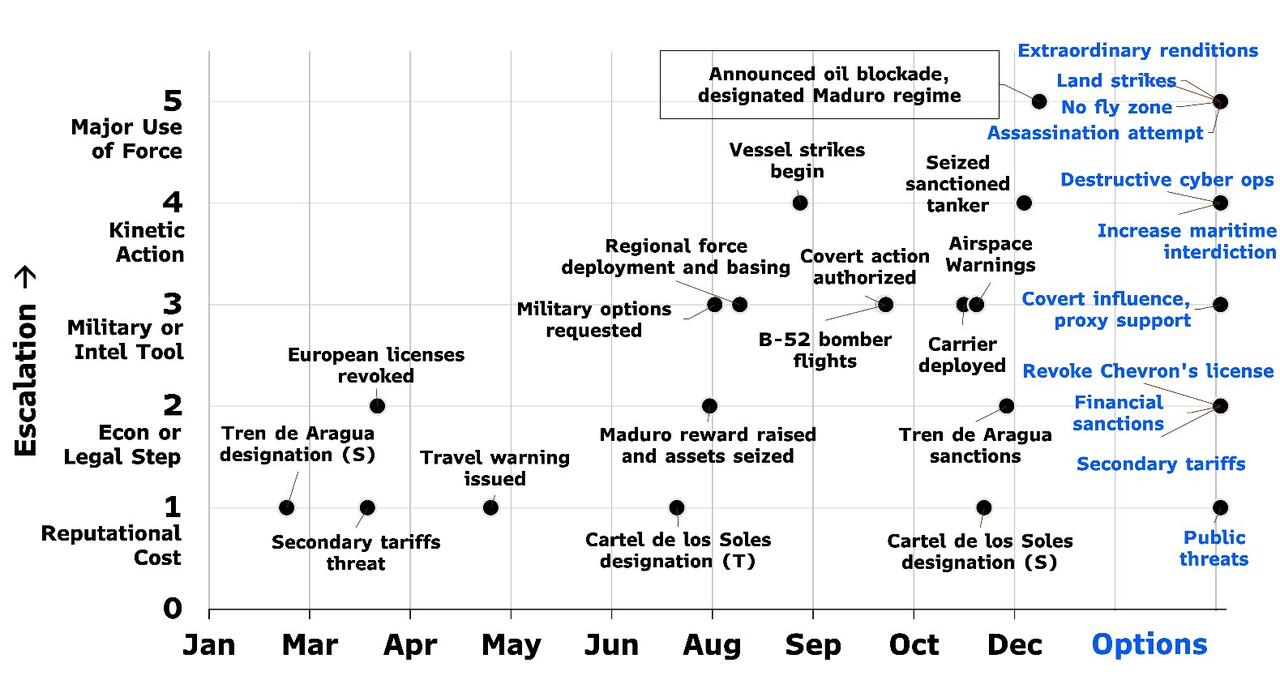

He claims to have ended eight wars around the world: Cambodia and Thailand, Kosovo and Serbia, the DRC and Rwanda, Pakistan and India, Israel and Iran, Egypt and Ethiopia, Armenia and Azerbaijan, Israel and Gaza. In each and every case, there’s been zero change in the fundamentals. Any ceasefires were the result of threats and bribery. By intervening, the US is likely to involve itself militarily in these places. Not to mention that he’s at the point of starting a war with Venezuela. Trump loves hyperbole, prevarication, and half-truths. His word is approaching zero value, both inside and outside the US.

There’s so much more. Will ICE ever be disbanded? Will it deport 30 million illegal aliens? Will tourism from advanced countries, worth about $250 billion a year, collapse with Trump’s new demands for vast amounts of personal data? Even though Zelensky can be shown to have personally looted several billion dollars, will he be reinstated as Ukraine’s president? What will the consequences be of Trump’s promiscuously granting pardons to friendly billionaires? Will he get away with the billion-dollar rug pull on his and Melania’s worthless cryptocoins?

We’re in a state of political chaos.

Financially, the destruction of the currency can only accelerate when Trump gets his new Fed chairman.

Technologically, we’re in an AI bubble. I don’t doubt that AI will enable huge scientific advances, but I wonder if the hundreds of billions going into AI will ever show an economic return. If not, the losses could result in real upset. The amounts are so large that—apart from the deleterious ways it can be used—they might cause a real drop in the general standard of living. Or at least catalyze a stock market collapse. The old saying “high-tech, big wreck” will likely once again prove true, even if AI changes the world for the better—which is not a certainty.

On the bright side, SpaceX can build giant rockets with large payloads and reuse them multiple times, cutting costs by a factor of 10 or 100. Bezos’ Blue Origin is doing the same. As are the Chinese. Technologically, 2025 was a great year, and in the long run, technology is what drives civilization. Loads of civilizations, governments, religions, and ideologies have risen and fallen in the 12,000 years since the end of the last Ice Age. The one thing that’s progressed on an accelerating curve, bringing mankind out of the mud, is technology.

There’s cause for long-term optimism, even if some bad things happen. However, technology needs more capital than ever. And if the economic, financial, political, and cultural problems—including Wokism and the resurgence of Islam—make it impossible to accumulate adequate capital, even the great flywheel of technology could slow down.

The biggest problem is cultural Wokeism.

Maybe the election of Trump signals peak Wokeism; many sensible people are reacting against it. But its underlying causes in the educational system, and the hive mind of Boobus americanus, are still there.

The optimist in me says that 2025 probably signals a turning point.

International Man: 2025 seemed to accelerate the delegitimization of major institutions—the media, academia, government, and even central banks.

Has the loss of trust reached the point of no return? What does that imply for the stability of the US and other countries going forward?

Doug Casey: Not so long ago, the electronic media meant CBS, NBC, and ABC. I’m not saying they were particularly truthful, but newsmen like Huntley and Brinkley, Edward R Murrow, and Walter Cronkite were thoughtful and independent. Their spoken words had more credibility than the writing in manipulative newspaper behemoths like those of Pulitzer and Hearst. Print publishers were replaced by electronic networks. Now, blow-dried lookalike corporate newscasters have lost credibility. They’ve been replaced by independent media, podcasts, and blogs. It’s true that the old institutions have been delegitimized. It’s much as Buckminster Fuller said: “You don’t change things by destroying the old order; you change the old order by making it irrelevant.”

The same thing is happening with academia. It’s become obvious to almost everybody that college is a negative value. Parents are aware that, starting in grade school, their kids are subjected to standardized indoctrination. Schools have become corrupt babysitters that enrich administrators while impoverishing their customers.

Let me draw your attention to a current series called The Chair about a totally woke mid-level Ivy League university on the edge of chaos. I mention it because I had trouble figuring out whether it was a spoof of the educational system or a semi-documentary description of it.

As for government, I suppose people are genetically programmed to want leaders. Just in my lifetime, governments have become vastly more powerful and coercive. On the other hand, the concepts of libertarianism and anarcho-capitalism have gone from things that nobody had even heard of to being widely discussed. And people are even starting to understand how central banks create fiat money, and that an increase in the money supply is what causes inflation. Even that meme is getting traction.

So there’s some cause for optimism regarding the delegitimization of corrupt old institutions. But if trust collapses too far, and everywhere, that implies bad things for the stability of society.

The U.S. used to be a high-trust culture with shared values and long-term time preferences. But now, with the mass immigration of vastly different cultures with conflicting values and very short-term time preferences, that’s changing—and not for the better. The new migrants sense that traditional American institutions in the U.S. are washing away, and they’re taking advantage of it.

International Man: Economically, 2025 was a paradox: financial markets hit new highs while the average household struggled under rising debt and falling real wages.

What does this divergence tell you about the underlying state of the economy—and where does it lead from here?

Doug Casey: The health and direction of the stock market and the economy are two different things. The massive money creation that’s gone on in the U.S. for decades, but especially over the last 10 years, has found its way into the stock market as a place to hide, out of self-preservation. I think both the stock market and the economy are riding for a fall.

International Man: It seems to many that the US is approaching a period of major political, social, and institutional upheaval. Do you think the country is at the beginning of a broader historical shift?

Doug Casey: Strauss and Howe’s book, The Fourth Turning, predicted a major upset would occur about now. But they didn’t predict who would win. I agree. My only prediction is that the US will be a different place in 10 years. Whether it will be “better” or “worse” is an open question.

* * *

Doug Casey’s candid assessment of 2025 makes one thing clear: we’re living through a historic inflection point—politically, economically, and culturally. But this conversation only scratches the surface. In a new free special report,

Doug Casey: Politically, and in every other way, it’s all about Trump. As Shakespeare said of Julius Caesar, “he doth bestride the narrow world. Like a Colossus, and we petty men. Walk under his huge legs and peep about. To find ourselves dishonorable graves.”

Trump has his finger in everything, in all countries, all spheres of enterprise, everywhere. He’s a political phenomenon with authoritarian tendencies. Which is a natural consequence of an unstable “democracy.” In fact, Caesar rose to power because of the late Roman Republic’s chronic political instability—much of which he caused. Trump could be America’s answer to Caesar.

I made that observation to a friend who, like me, is prone to classical references. He countered that perhaps Trump sees himself as a Cincinnatus lookalike. Cincinnatus, you’ll recall, was a patrician citizen appointed dictator in about 458 BC to deal with a military emergency. He quickly did so. Instead of serving out the rest of his six-month term, he handed back his power and returned to his farm.

Trump sees that the US is on the cusp of a cultural crisis, and wants to avert it. He’s certainly a cultural conservative who wants to return the country to the halcyon days of yesteryear, the way it was in “Leave it to Beaver” and “Father Knows Best.” But he’s also a narcissist and a megalomaniac, trying to reorder the world by signing hundreds of Executive Orders, creating chaos with his tariffs, subsidies, threats, attacks, and arbitrary blustering. At heart, Trump is a Caesar, not a Cincinnatus,

Economically, the U.S. is imitating Argentina. His actions are pretty much those of Perón, who was responsible for the destruction of the Argentine economy: tariffs to protect domestic industries, lots of arbitrary regulations, and government “partnerships” with corporations. Both Peron and Trump are reminiscent of Mussolini. It’s a slippery slope.

He’s surrounded himself with sycophants and lickspittles. His tariffs have an excellent chance of upending both the domestic and world economies. He claims that he will replace the income tax with tariffs, which sounds great. It’s true that tariffs paid for over 75% of government expenditures up to 1916. But that was when Federal spending was tiny, about 1.5% of GDP. Today, the only way to reduce taxes is to reduce spending—but Trump loves spending. DOGE is long forgotten. I predict he’ll outdo FDR by every measure in spending.

He claims to have ended eight wars around the world: Cambodia and Thailand, Kosovo and Serbia, the DRC and Rwanda, Pakistan and India, Israel and Iran, Egypt and Ethiopia, Armenia and Azerbaijan, Israel and Gaza. In each and every case, there’s been zero change in the fundamentals. Any ceasefires were the result of threats and bribery. By intervening, the US is likely to involve itself militarily in these places. Not to mention that he’s at the point of starting a war with Venezuela. Trump loves hyperbole, prevarication, and half-truths. His word is approaching zero value, both inside and outside the US.

There’s so much more. Will ICE ever be disbanded? Will it deport 30 million illegal aliens? Will tourism from advanced countries, worth about $250 billion a year, collapse with Trump’s new demands for vast amounts of personal data? Even though Zelensky can be shown to have personally looted several billion dollars, will he be reinstated as Ukraine’s president? What will the consequences be of Trump’s promiscuously granting pardons to friendly billionaires? Will he get away with the billion-dollar rug pull on his and Melania’s worthless cryptocoins?

We’re in a state of political chaos.

Financially, the destruction of the currency can only accelerate when Trump gets his new Fed chairman.

Technologically, we’re in an AI bubble. I don’t doubt that AI will enable huge scientific advances, but I wonder if the hundreds of billions going into AI will ever show an economic return. If not, the losses could result in real upset. The amounts are so large that—apart from the deleterious ways it can be used—they might cause a real drop in the general standard of living. Or at least catalyze a stock market collapse. The old saying “high-tech, big wreck” will likely once again prove true, even if AI changes the world for the better—which is not a certainty.

On the bright side, SpaceX can build giant rockets with large payloads and reuse them multiple times, cutting costs by a factor of 10 or 100. Bezos’ Blue Origin is doing the same. As are the Chinese. Technologically, 2025 was a great year, and in the long run, technology is what drives civilization. Loads of civilizations, governments, religions, and ideologies have risen and fallen in the 12,000 years since the end of the last Ice Age. The one thing that’s progressed on an accelerating curve, bringing mankind out of the mud, is technology.