EU "Russia Confiscation" Summit Ends In Failure As Brussels Quietly Paves Way For Eurobonds

EU "Russia Confiscation" Summit Ends In Failure As Brussels Quietly Paves Way For Eurobonds

Submitted By Thomas Kolbe

The EU summit held in Brussels on December 18–19 was supposed to deliver two fundamental decisions. First, it was meant to address the expropriation of frozen Russian assets held at Euroclear. Second, it was expected to ratify the Mercosur trade agreement. In both cases, the EU’s bureaucratic elite around Ursula von der Leyen failed—paralyzed by its own dysfunction and ultimately by a lack of real power.

What had been grandly announced as a “summit of decisions” ended in a fiasco for Brussels. Neither was the Mercosur agreement approved, nor did the EU manage to convert the Russian central bank assets held at Euroclear into a substantial loan to extend Ukraine financing.

Let us first examine the Euroclear affair. That the EU bowed to growing pressure from several member states such as Belgium, Hungary, and Slovakia—as well as from the U.S. government—is telling. Despite all its ambitions, the EU remains a paper tiger in the global power struggle.

A Typical EU Solution

The solution to Ukraine’s massive financing gap looks as follows: the https://www.reuters.com/world/europe/eu-leaders-agree-ukraine-financing-2026-27-belgiums-approval-key-2025-12-18/

Kyiv with an interest-free loan of €90 billion for the next two years. Repayment will only be required if Russia pays reparations—which it will not. In that case, the EU plans to fall back on frozen Russian assets to cover the deficit.

That immediate expropriation did not occur is largely due to Belgium’s insistence—given that Euroclear is legally domiciled there—on a collective assumption of liability risks. As so often when consequences might arise from its own actions, Brussels opted for a diluted compromise.

Through the back door, this effectively introduces Eurobonds—a joint debt issuance—without explicitly saying so.

German Chancellor Friedrich Merz hailed the construct as a major success. National budgets would not be burdened, he argued, since the financing would be handled entirely at the EU level. Moreover, the loan would be secured by Russian assets. What Merz conveniently omitted is that EU member states ultimately remain liable for Brussels’ maneuvers.

In reality, Brussels achieved one thing above all: the politically and legally explosive issue of expropriating the Russian central bank was postponed. At the same time, the EU once again used the opportunity to cleverly circumvent its own rules—specifically the prohibition of joint debt issuance.

Enormous Financial Needs

Ukraine’s financial requirements are immense. In view of the war of attrition in the Donbas, the European Commission expects roughly €81 billion to be needed next year alone to close Ukraine’s budget gap, which currently stands at 18.5 percent of GDP. The newly approved EU loan will be supplemented by national contributions.

Germany alone will finance €11.5 billion for Ukraine’s military equipment from its federal budget—funded through new debt and charged to the taxpayer, who, needless to say, has no say in the matter.

Within EU budget planning, grants of up to €50 billion are earmarked for next year. According to plans by Commission President Ursula von der Leyen, this amount is to be  over the following two years. This bottomless pit threatens to plunge economically weakening EU states—with already ballooning deficits—into severe turbulence unless the course is changed swiftly.

Restoring Military Striking Power

So what is the concrete alternative now that the raid on Euroclear’s balance sheet is temporarily blocked? EU and UK officials have repeatedly made clear in recent months that they intend to restore their military capabilities by 2028.

The signal to Russia is unmistakable: this is neither about lasting peace nor a genuine resolution of the conflict. A ceasefire—something Russia learned during the Minsk Agreement episode—would merely serve military consolidation.

When Friedrich Merz claims that Ukraine financing over the next two years serves exclusively to equip the Ukrainian army and not to prolong the war, this statement reveals one thing above all: a deliberate semantic separation of what is politically and militarily inseparable. Anyone who rhetorically decouples arms deliveries from war prolongation is not informing the public—but pacifying it.

Eurobonds or War Bonds

Brussels will now seize the moment to push ahead with a rapid expansion of Eurobonds. During the COVID lockdowns, the European Commission already ventured into this forbidden territory by issuing several hundred billion euros under the “NextGenerationEU” bond program.

The procedure is now being repeated. The Commission will issue bonds officially secured by Russian assets, but for which all member states ultimately bear proportional liability. Put differently: the EU is concealing yet another gigantic debt program, for which taxpayers will be on the hook in the end.

A large portion of this money will flow back into the European and American military-industrial sectors.

We are witnessing a classic EU solution: the existing rulebook is systematically undermined, while the representatives of the so-called “rules-based order” continue their erosion campaign—until even the last residue of trust in the integrity of EU institutions is ground down.

From Ukraine Conflict to Credit Accelerator

Regardless of one’s view of the historical background of the Ukraine conflict—of the 2014 Maidan coup or the years-long Donbas conflict—the principle of neutrality beyond humanitarian aid has been systematically abandoned.

Once it became clear that the Ukraine conflict could be turned into a credit accelerator, state-backed banks such as the European Investment Bank were heavily integrated into the process.

What has long been evident about Brussels hardliners is now plain to see: megalomania combined with personal career ambition. In the cases of Ursula von der Leyen and Friedrich Merz, this toxic mix produces political strategies and outcomes that drag the EU and its member states ever deeper into a spiral of fiscal obligations and looming military escalation.

Mercosur Postponed

The European Union’s historic task was to create and legally safeguard a competitive internal market. This attempt at limited competence transfer has now definitively failed.

On Thursday, the EU summit also failed to ratify the Mercosur agreement with South America. At the insistence of France and Italy, the decision was postponed by one month.

Negotiations have stalled for a quarter century. A finalized draft is on the table, providing for a phased tariff reduction over 15 years and covering Brazil, Argentina, Paraguay, and Uruguay. With 780 million people, a significant integrated market could emerge.

The agreement aims to boost European exports in automobiles and mechanical engineering while reducing tariffs on agricultural imports from South America—blocked primarily by the French farm lobby. Once again, the EU refuses to ease regulatory burdens on domestic farmers in order to balance competing interests.

What Remains?

In sum, the European Union keeps its debt machinery alive for another two years—while remaining incapable of making substantive moves on the international stage. The politics of postponement, and the costs of delayed decision-making, will ultimately be passed on to European taxpayers.

Sat, 12/20/2025 - 07:00

over the following two years. This bottomless pit threatens to plunge economically weakening EU states—with already ballooning deficits—into severe turbulence unless the course is changed swiftly.

Restoring Military Striking Power

So what is the concrete alternative now that the raid on Euroclear’s balance sheet is temporarily blocked? EU and UK officials have repeatedly made clear in recent months that they intend to restore their military capabilities by 2028.

The signal to Russia is unmistakable: this is neither about lasting peace nor a genuine resolution of the conflict. A ceasefire—something Russia learned during the Minsk Agreement episode—would merely serve military consolidation.

When Friedrich Merz claims that Ukraine financing over the next two years serves exclusively to equip the Ukrainian army and not to prolong the war, this statement reveals one thing above all: a deliberate semantic separation of what is politically and militarily inseparable. Anyone who rhetorically decouples arms deliveries from war prolongation is not informing the public—but pacifying it.

Eurobonds or War Bonds

Brussels will now seize the moment to push ahead with a rapid expansion of Eurobonds. During the COVID lockdowns, the European Commission already ventured into this forbidden territory by issuing several hundred billion euros under the “NextGenerationEU” bond program.

The procedure is now being repeated. The Commission will issue bonds officially secured by Russian assets, but for which all member states ultimately bear proportional liability. Put differently: the EU is concealing yet another gigantic debt program, for which taxpayers will be on the hook in the end.

A large portion of this money will flow back into the European and American military-industrial sectors.

We are witnessing a classic EU solution: the existing rulebook is systematically undermined, while the representatives of the so-called “rules-based order” continue their erosion campaign—until even the last residue of trust in the integrity of EU institutions is ground down.

From Ukraine Conflict to Credit Accelerator

Regardless of one’s view of the historical background of the Ukraine conflict—of the 2014 Maidan coup or the years-long Donbas conflict—the principle of neutrality beyond humanitarian aid has been systematically abandoned.

Once it became clear that the Ukraine conflict could be turned into a credit accelerator, state-backed banks such as the European Investment Bank were heavily integrated into the process.

What has long been evident about Brussels hardliners is now plain to see: megalomania combined with personal career ambition. In the cases of Ursula von der Leyen and Friedrich Merz, this toxic mix produces political strategies and outcomes that drag the EU and its member states ever deeper into a spiral of fiscal obligations and looming military escalation.

Mercosur Postponed

The European Union’s historic task was to create and legally safeguard a competitive internal market. This attempt at limited competence transfer has now definitively failed.

On Thursday, the EU summit also failed to ratify the Mercosur agreement with South America. At the insistence of France and Italy, the decision was postponed by one month.

Negotiations have stalled for a quarter century. A finalized draft is on the table, providing for a phased tariff reduction over 15 years and covering Brazil, Argentina, Paraguay, and Uruguay. With 780 million people, a significant integrated market could emerge.

The agreement aims to boost European exports in automobiles and mechanical engineering while reducing tariffs on agricultural imports from South America—blocked primarily by the French farm lobby. Once again, the EU refuses to ease regulatory burdens on domestic farmers in order to balance competing interests.

What Remains?

In sum, the European Union keeps its debt machinery alive for another two years—while remaining incapable of making substantive moves on the international stage. The politics of postponement, and the costs of delayed decision-making, will ultimately be passed on to European taxpayers.

Sat, 12/20/2025 - 07:00

euronews

135 Milliarden €: Von der Leyen will Haushaltsloch der Ukraine stopfen

Von der Leyen fordert eine rasche Einigung über die Finanzierung des enormen Haushaltslochs der Ukraine in Höhe von 135 Milliarden Euro bis 2027....

Tyler Durden | Zero Hedge

Zero Hedge

EU "Russia Confiscation" Summit Ends In Failure As Brussels Quietly Paves Way For Eurobonds | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

This vision aligns with the new

This vision aligns with the new

The test of the Low-cost Unmanned Combat Attack System (LUCAS) was completed in the Arabian Gulf region and marks a "significant milestone in rapidly delivering affordable and effective unmanned capabilities to the warfighter," Vice Adm. Curt Renshaw, commander of NAVCENT/C5F, wrote in a

The test of the Low-cost Unmanned Combat Attack System (LUCAS) was completed in the Arabian Gulf region and marks a "significant milestone in rapidly delivering affordable and effective unmanned capabilities to the warfighter," Vice Adm. Curt Renshaw, commander of NAVCENT/C5F, wrote in a

Cheap kamikaze drones are reshaping the modern battlefield by dramatically reducing the cost of precision strikes. Equipped with low-cost warheads, these drones cost a fraction of cruise missiles while being capable of swarming overwhelming missile defense shields. Their effectiveness has been demonstrated repeatedly in Ukraine, where cheap, disposable drones have crippled air defenses, struck critical power grid infrastructure, and oil/gas tankers.

Cheap kamikaze drones are reshaping the modern battlefield by dramatically reducing the cost of precision strikes. Equipped with low-cost warheads, these drones cost a fraction of cruise missiles while being capable of swarming overwhelming missile defense shields. Their effectiveness has been demonstrated repeatedly in Ukraine, where cheap, disposable drones have crippled air defenses, struck critical power grid infrastructure, and oil/gas tankers.

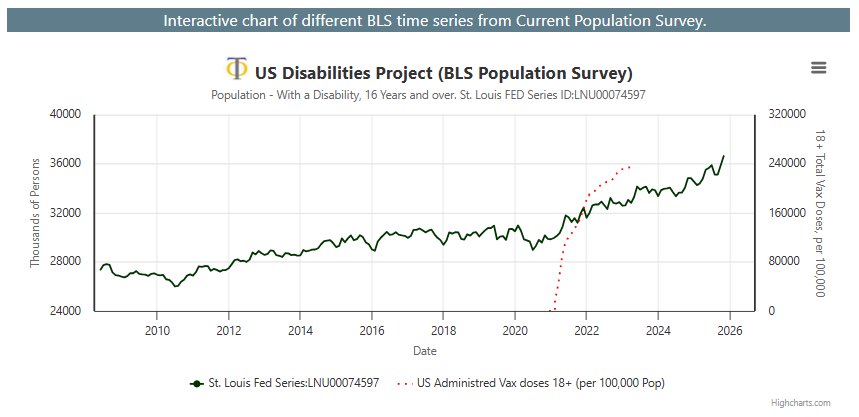

The disabilities began to soar only after the inoculation was pushed and sometimes forced on the public.

The upward trend began in February 2021 and has not stopped.

Edward Dowd, investment analyst and author of “Cause Unknown: The Epidemic of Sudden Deaths in 2021 & 2022,”

The disabilities began to soar only after the inoculation was pushed and sometimes forced on the public.

The upward trend began in February 2021 and has not stopped.

Edward Dowd, investment analyst and author of “Cause Unknown: The Epidemic of Sudden Deaths in 2021 & 2022,”

Nikkei

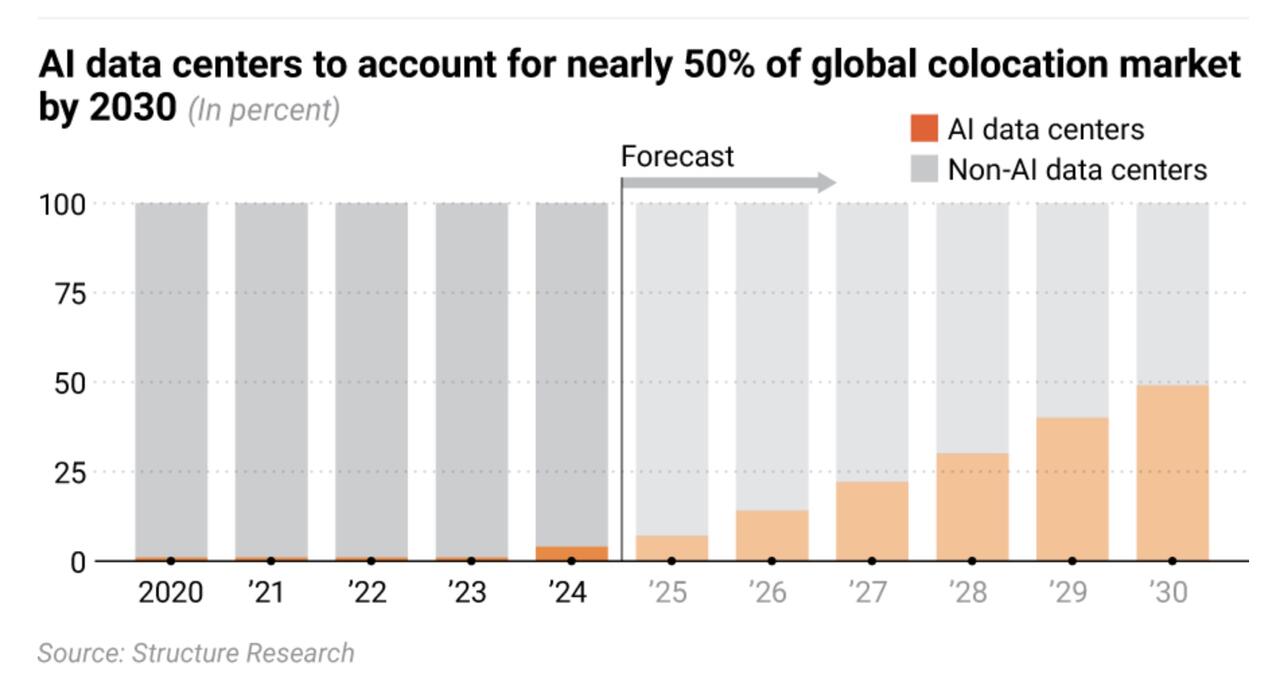

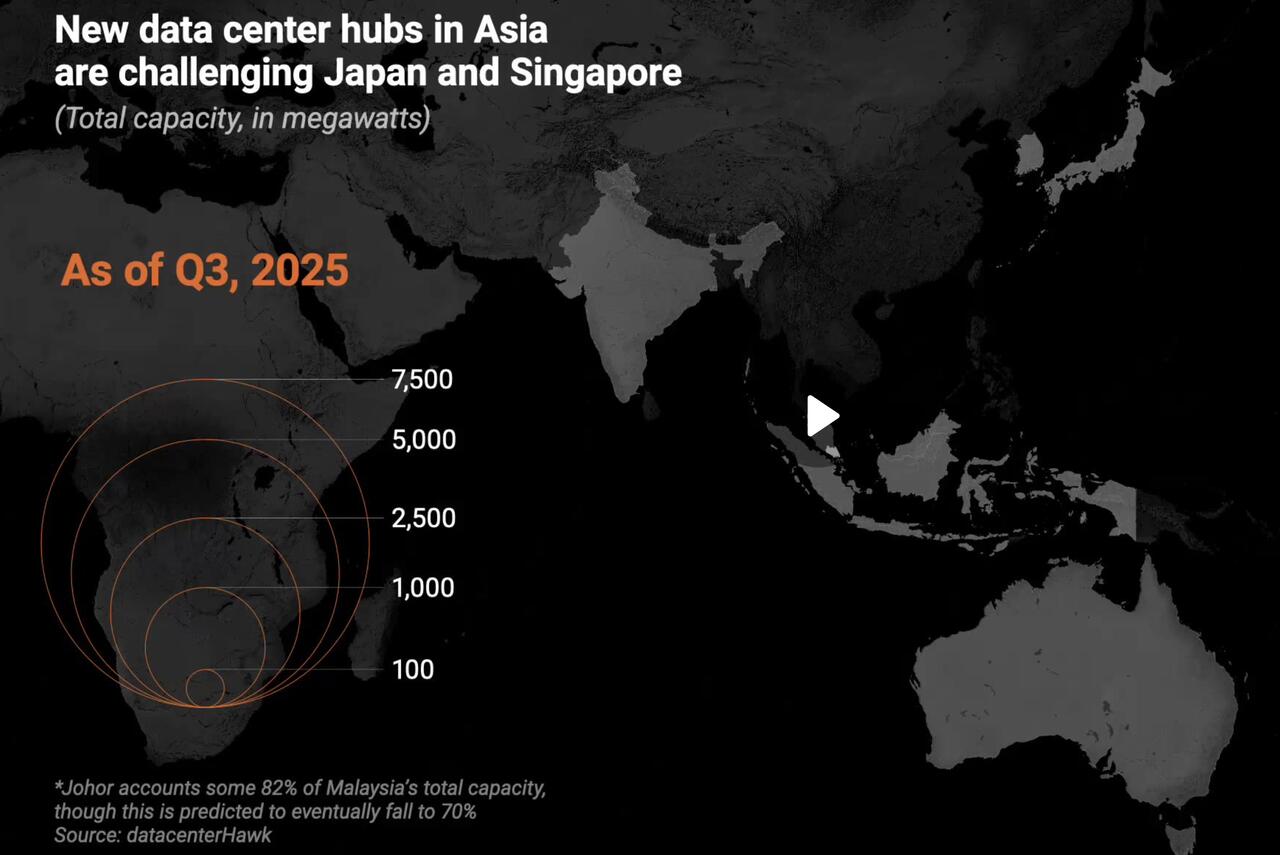

Nikkei  The boom is also reshaping local labor markets. While data centers generate fewer jobs than manufacturing, the roles they do create—ranging from electrical engineering and telecommunications to network and cloud architecture—pay well above the national median. Central bank estimates cited by Nikkei suggest entry-level positions typically earn more than average Malaysian wages, with experienced specialists commanding significantly higher salaries.

At the same time, constraints are becoming more visible. Electricity and water are critical bottlenecks, particularly for AI facilities that rely on liquid cooling. Johor has begun rejecting new projects that depend on water-intensive cooling systems while it builds additional supply infrastructure, which officials say will take several years to come online. Analysts also point to geopolitical risk, especially uncertainty around access to advanced AI chips amid tightening export controls.

The boom is also reshaping local labor markets. While data centers generate fewer jobs than manufacturing, the roles they do create—ranging from electrical engineering and telecommunications to network and cloud architecture—pay well above the national median. Central bank estimates cited by Nikkei suggest entry-level positions typically earn more than average Malaysian wages, with experienced specialists commanding significantly higher salaries.

At the same time, constraints are becoming more visible. Electricity and water are critical bottlenecks, particularly for AI facilities that rely on liquid cooling. Johor has begun rejecting new projects that depend on water-intensive cooling systems while it builds additional supply infrastructure, which officials say will take several years to come online. Analysts also point to geopolitical risk, especially uncertainty around access to advanced AI chips amid tightening export controls.

Finally, questions are emerging about oversupply. Unlike hyperscalers that build data centers to serve their own platforms, many carrier-neutral operators are betting on future tenant demand. Some projects have already been shelved, and analysts warn that Johor’s growth remains heavily dependent on foreign customers rather than domestic demand. Whether the state can sustain its rapid rise as an AI data center hub will depend on how effectively it balances infrastructure, regulation, geopolitics and long-term market demand.

Finally, questions are emerging about oversupply. Unlike hyperscalers that build data centers to serve their own platforms, many carrier-neutral operators are betting on future tenant demand. Some projects have already been shelved, and analysts warn that Johor’s growth remains heavily dependent on foreign customers rather than domestic demand. Whether the state can sustain its rapid rise as an AI data center hub will depend on how effectively it balances infrastructure, regulation, geopolitics and long-term market demand.

The Wall Street Journal reports that a U.S. military official said Friday that dozens of targets were being struck by U.S. F-15 and A-10 warplanes, Apache attack helicopters and Himars rockets.

The operation is being dubbed “Hawkeye Strike” in honor of the Iowa National Guard soldiers who were killed and wounded in an ambush the Trump administration has blamed on ISIS.

The gunman that ambushed the Americans was killed in the attack.

But President Trump on Sunday vowed to take military action against the group.

“There will be a lot of damage done to the people that did it. They got the person, the individual person, but there will be big damage done,” Trump said at the time.

Syrian authorities last week blamed the ambush on a member of Syria’s security forces who they said was set to be fired for holding extremist views.

* * *

Syria is celebrating after President Trump

The Wall Street Journal reports that a U.S. military official said Friday that dozens of targets were being struck by U.S. F-15 and A-10 warplanes, Apache attack helicopters and Himars rockets.

The operation is being dubbed “Hawkeye Strike” in honor of the Iowa National Guard soldiers who were killed and wounded in an ambush the Trump administration has blamed on ISIS.

The gunman that ambushed the Americans was killed in the attack.

But President Trump on Sunday vowed to take military action against the group.

“There will be a lot of damage done to the people that did it. They got the person, the individual person, but there will be big damage done,” Trump said at the time.

Syrian authorities last week blamed the ambush on a member of Syria’s security forces who they said was set to be fired for holding extremist views.

* * *

Syria is celebrating after President Trump

Sanctions have been on Syria going all the way back to the 1970s, with more piled on over the decades, especially after 2011, and then the most far-reaching, the Caesar sanctions, took effect in 2019 at a time that Assad was winning the war.

Coupled with the sanctions was a long-running CIA and Gulf-spearheaded proxy war, which flooded jihadist groups with weapons and cash - all for the sake of eventually installing a more pliant client ruler.

Now, one year after Washington accomplished its regime change, and with Bashar al-Assad in Moscow, has Washington chosen to remove the sanctions.

As Beirut-based

Sanctions have been on Syria going all the way back to the 1970s, with more piled on over the decades, especially after 2011, and then the most far-reaching, the Caesar sanctions, took effect in 2019 at a time that Assad was winning the war.

Coupled with the sanctions was a long-running CIA and Gulf-spearheaded proxy war, which flooded jihadist groups with weapons and cash - all for the sake of eventually installing a more pliant client ruler.

Now, one year after Washington accomplished its regime change, and with Bashar al-Assad in Moscow, has Washington chosen to remove the sanctions.

As Beirut-based

Shellenberger pointed out that Musk’s fine came while European governments are demanding backdoor access to all private text messages (under the pretense of combatting the transmission of child pornography) and creating a so-called “Democracy Shield” of government-funded “fact-checkers” that enables “censorship by proxy.” He also noted that the European Commission announced the fine to coincide with the rollout of the Trump administration’s new

Shellenberger pointed out that Musk’s fine came while European governments are demanding backdoor access to all private text messages (under the pretense of combatting the transmission of child pornography) and creating a so-called “Democracy Shield” of government-funded “fact-checkers” that enables “censorship by proxy.” He also noted that the European Commission announced the fine to coincide with the rollout of the Trump administration’s new

Everywhere we look in Western countries, from the United Kingdom, through Europe to America (and even

Everywhere we look in Western countries, from the United Kingdom, through Europe to America (and even

That principle underwrites reserve currencies, correspondent banking, sovereign debt markets, and cross-border investment. It is why central banks like Russia’s (once) accepted euros instead of bullion shipped under armed guard. It is why settlement systems like Euroclear exist at all. Once that rule is broken, capital does not debate. It reprices risk instantly and it leaves.

Confiscation sends a message to every country outside the Western political orbit: your savings are safe only as long as you remain politically compliant.

That is not a rules-based order. It is a selectively enforced order whose rules change the moment compliance ends. What we have is a compliance cartel, enforcing law upward and punishment downward, depending on who obeys and who resists.

Belgium’s fear is not legalistic. It is actuarial. Hosting Euroclear means hosting systemic risk. If Russia or any future target successfully challenges the seizure, Belgium could be exposed to claims that dwarf the sums being discussed. Belgium is therefore right to be skeptical of Europe’s promise to underwrite such colossal risk, given the bloc’s now shattered credibility. No serious financial actor would treat such guarantees as reliable.

Italy’s hesitation is not ideological. It is mathematical. With one of Europe’s heaviest debt burdens, Rome understands what happens when markets begin questioning the neutrality of reserve currencies and custodians.

Neither country suddenly developed sympathy for Moscow. They simply did the arithmetic before the slogans.

Paris and London, meanwhile, thunder publicly while quietly insulating their own commercial banks’ exposure to Russian sovereign assets, exposure measured not in rhetoric, but in tens of billions. French financial institutions alone hold an estimated €15–20 billion, while UK-linked banks and custodial structures account for roughly £20–25 billion, much of it routed through London’s clearing and custody ecosystem rather than sitting on government balance sheets.

This hypocrisy and cowardice are not accidental. Paris and London sit at the heart of global custodial banking, derivatives clearing, and FX settlement, nodes embedded deep within the plumbing of global finance. Retaliatory seizures or accelerated capital flight would not be symbolic for them; they would be catastrophic.

So the burden is shifted outward. Smaller states are expected to absorb systemic risk while core financial centers preserve deniability, play a double game, and posture as virtuous.

This is anything but European solidarity. It is class defense at the international level.

The increasingly shrill insistence from the Eurocrats that the assets must be seized betrays something far more revealing than hysteria or resolve: the unmasking of a project sustained by delusion and Russophobic dogma, in which moral certainty did not arise from conviction, but functioned as a mechanism for managing cognitive dissonance, a means of avoiding realities that any serious strategy would already have been forced to confront.

Not confidence, but exposure. Exposure of a war Europe never possessed the power to decide, only the capacity to prolong. Exposure of a financial system discovering that money, once stripped of neutrality and weaponized, forfeits its credibility as capital. And exposure of a ruling class confronting the reality that performance, however theatrical, cannot substitute for power that has long since been exhausted – power Europe relinquished decades ago when it outsourced real sovereignty to Washington.

Looting Russian reserves will not shorten the conflict. It will not pressure Moscow into capitulation. It will not meaningfully finance Ukraine’s future. And this is not because Europe has miscalculated, it is because Europe has knowingly abandoned reality.

There is no serious actor in Europe who does not understand how wars are won. They know that Russia’s war effort is driven by industrial throughput, manpower depth, logistics resilience, and continental scale and that on every one of these axes Russia has expanded its advantage while Europe has accelerated its collapse. Russia has retooled its defense-industrial base for sustained output, secured energy and raw materials at scale, reoriented trade beyond Western choke points, and absorbed sanctions as a catalyst for growth. This is not conjecture. It is observable fact.

This move will permanently accelerate reserve diversification away from the euro, expand bilateral settlement, hasten gold repatriation, and entrench non-Western clearing systems, and it will do so immediately.

What is being exposed here is not Russian vulnerability, but Western exhaustion. When economies can no longer compete through production, innovation, or growth, they turn to banditry. Asset seizure is not a sign of strength, but he terminal behavior of a rentier system that has exhausted surplus and begun consuming its own foundations.

This decision does not defend any lingering illusion of Western dominance. It advertises its expiry. The turn toward policing speech in Europe did not happen in a vacuum.

The Digital Services Act, platform intimidation, and the policing of dissent is all about pre-emptive damage control. European elites understand that the consequences of this policy will land squarely on households.

The people who will pay for this are not sitting in Commission buildings, they are the ones whose pensions, currencies, and living standards are being quietly offered up to preserve a collapsing illusion of power.

That is why dissent had to be neutralized before confiscation could be attempted. Not after. Criticism was pre-emptively reclassified as disinformation. Debate was recoded as existential danger. Speech itself was reframed as a security threat.

In their desperation to punish Russia, Europe’s leadership is handing Moscow something far more valuable than €210 billion. They are validating every argument held by the Global Majority about Western hypocrisy, legal nihilism, and financial coercion. They are demonstrating that sovereignty within the Western system is provisional, granted conditionally, revoked politically.

Empires do not collapse because they are challenged. They collapse because they cannibalize the systems that once made them legitimate.

This seizure will not be remembered as a blow against Moscow. It will be remembered as the moment Europe told the world that property rights end where obedience begins.

Once that message is received, there is no reset.

That principle underwrites reserve currencies, correspondent banking, sovereign debt markets, and cross-border investment. It is why central banks like Russia’s (once) accepted euros instead of bullion shipped under armed guard. It is why settlement systems like Euroclear exist at all. Once that rule is broken, capital does not debate. It reprices risk instantly and it leaves.

Confiscation sends a message to every country outside the Western political orbit: your savings are safe only as long as you remain politically compliant.

That is not a rules-based order. It is a selectively enforced order whose rules change the moment compliance ends. What we have is a compliance cartel, enforcing law upward and punishment downward, depending on who obeys and who resists.

Belgium’s fear is not legalistic. It is actuarial. Hosting Euroclear means hosting systemic risk. If Russia or any future target successfully challenges the seizure, Belgium could be exposed to claims that dwarf the sums being discussed. Belgium is therefore right to be skeptical of Europe’s promise to underwrite such colossal risk, given the bloc’s now shattered credibility. No serious financial actor would treat such guarantees as reliable.

Italy’s hesitation is not ideological. It is mathematical. With one of Europe’s heaviest debt burdens, Rome understands what happens when markets begin questioning the neutrality of reserve currencies and custodians.

Neither country suddenly developed sympathy for Moscow. They simply did the arithmetic before the slogans.

Paris and London, meanwhile, thunder publicly while quietly insulating their own commercial banks’ exposure to Russian sovereign assets, exposure measured not in rhetoric, but in tens of billions. French financial institutions alone hold an estimated €15–20 billion, while UK-linked banks and custodial structures account for roughly £20–25 billion, much of it routed through London’s clearing and custody ecosystem rather than sitting on government balance sheets.

This hypocrisy and cowardice are not accidental. Paris and London sit at the heart of global custodial banking, derivatives clearing, and FX settlement, nodes embedded deep within the plumbing of global finance. Retaliatory seizures or accelerated capital flight would not be symbolic for them; they would be catastrophic.

So the burden is shifted outward. Smaller states are expected to absorb systemic risk while core financial centers preserve deniability, play a double game, and posture as virtuous.

This is anything but European solidarity. It is class defense at the international level.

The increasingly shrill insistence from the Eurocrats that the assets must be seized betrays something far more revealing than hysteria or resolve: the unmasking of a project sustained by delusion and Russophobic dogma, in which moral certainty did not arise from conviction, but functioned as a mechanism for managing cognitive dissonance, a means of avoiding realities that any serious strategy would already have been forced to confront.

Not confidence, but exposure. Exposure of a war Europe never possessed the power to decide, only the capacity to prolong. Exposure of a financial system discovering that money, once stripped of neutrality and weaponized, forfeits its credibility as capital. And exposure of a ruling class confronting the reality that performance, however theatrical, cannot substitute for power that has long since been exhausted – power Europe relinquished decades ago when it outsourced real sovereignty to Washington.

Looting Russian reserves will not shorten the conflict. It will not pressure Moscow into capitulation. It will not meaningfully finance Ukraine’s future. And this is not because Europe has miscalculated, it is because Europe has knowingly abandoned reality.

There is no serious actor in Europe who does not understand how wars are won. They know that Russia’s war effort is driven by industrial throughput, manpower depth, logistics resilience, and continental scale and that on every one of these axes Russia has expanded its advantage while Europe has accelerated its collapse. Russia has retooled its defense-industrial base for sustained output, secured energy and raw materials at scale, reoriented trade beyond Western choke points, and absorbed sanctions as a catalyst for growth. This is not conjecture. It is observable fact.

This move will permanently accelerate reserve diversification away from the euro, expand bilateral settlement, hasten gold repatriation, and entrench non-Western clearing systems, and it will do so immediately.

What is being exposed here is not Russian vulnerability, but Western exhaustion. When economies can no longer compete through production, innovation, or growth, they turn to banditry. Asset seizure is not a sign of strength, but he terminal behavior of a rentier system that has exhausted surplus and begun consuming its own foundations.

This decision does not defend any lingering illusion of Western dominance. It advertises its expiry. The turn toward policing speech in Europe did not happen in a vacuum.

The Digital Services Act, platform intimidation, and the policing of dissent is all about pre-emptive damage control. European elites understand that the consequences of this policy will land squarely on households.

The people who will pay for this are not sitting in Commission buildings, they are the ones whose pensions, currencies, and living standards are being quietly offered up to preserve a collapsing illusion of power.

That is why dissent had to be neutralized before confiscation could be attempted. Not after. Criticism was pre-emptively reclassified as disinformation. Debate was recoded as existential danger. Speech itself was reframed as a security threat.

In their desperation to punish Russia, Europe’s leadership is handing Moscow something far more valuable than €210 billion. They are validating every argument held by the Global Majority about Western hypocrisy, legal nihilism, and financial coercion. They are demonstrating that sovereignty within the Western system is provisional, granted conditionally, revoked politically.

Empires do not collapse because they are challenged. They collapse because they cannibalize the systems that once made them legitimate.

This seizure will not be remembered as a blow against Moscow. It will be remembered as the moment Europe told the world that property rights end where obedience begins.

Once that message is received, there is no reset.

Blaise Metreweli, who recently became head of the Secret Intelligence Service—commonly known as MI6—said that Russia’s campaign against Ukraine and its wider hybrid operations pose an acute and enduring danger to Britain and its allies, according to a

Blaise Metreweli, who recently became head of the Secret Intelligence Service—commonly known as MI6—said that Russia’s campaign against Ukraine and its wider hybrid operations pose an acute and enduring danger to Britain and its allies, according to a