The IRS just finalized its new broker rule, finding that control is not necessary to be considered a broker subject to IRS reporting requirements.

It's a nightmare for every non-custodial exchange and swap provider.

Built a website to let users swap between currencies? You're a broker under IRS reporting requirements.

Built a mobile app to let users swap between currencies? You're a broker under IRS reporting requirements.

Built a browser extension to let people swap between currencies? You're a broker under IRS reporting requirements.

As long as you have the ability to collect fees on a trade, or have the ability to affect the terms under which a trade is provided, or a whole bunch of other nonsense, you're a broker, which makes pretty much any non-custodial exchange or swap provider a broker.

While wallets without swap or exchange features are excluded by the broker rule, it's a taste of what's to come for BSA reporting requirements for non-custodial software.

INB4: "bUt ThEy CaN'T FoRcE mY nOn-CuStOdIaL wAlLeT tO Do aNyThiNg"

That's right they can't. But they can force the people building the software and services. And if they don't, they'll go to jail.

Unless challenged, the rule goes into effect in 2027.

The Rage

Broker Rule: IRS Requires Non-Custodial Services To Report Trading Information

Custody over funds is not necessary to be considered a broker by the IRS.

and use Monero only.

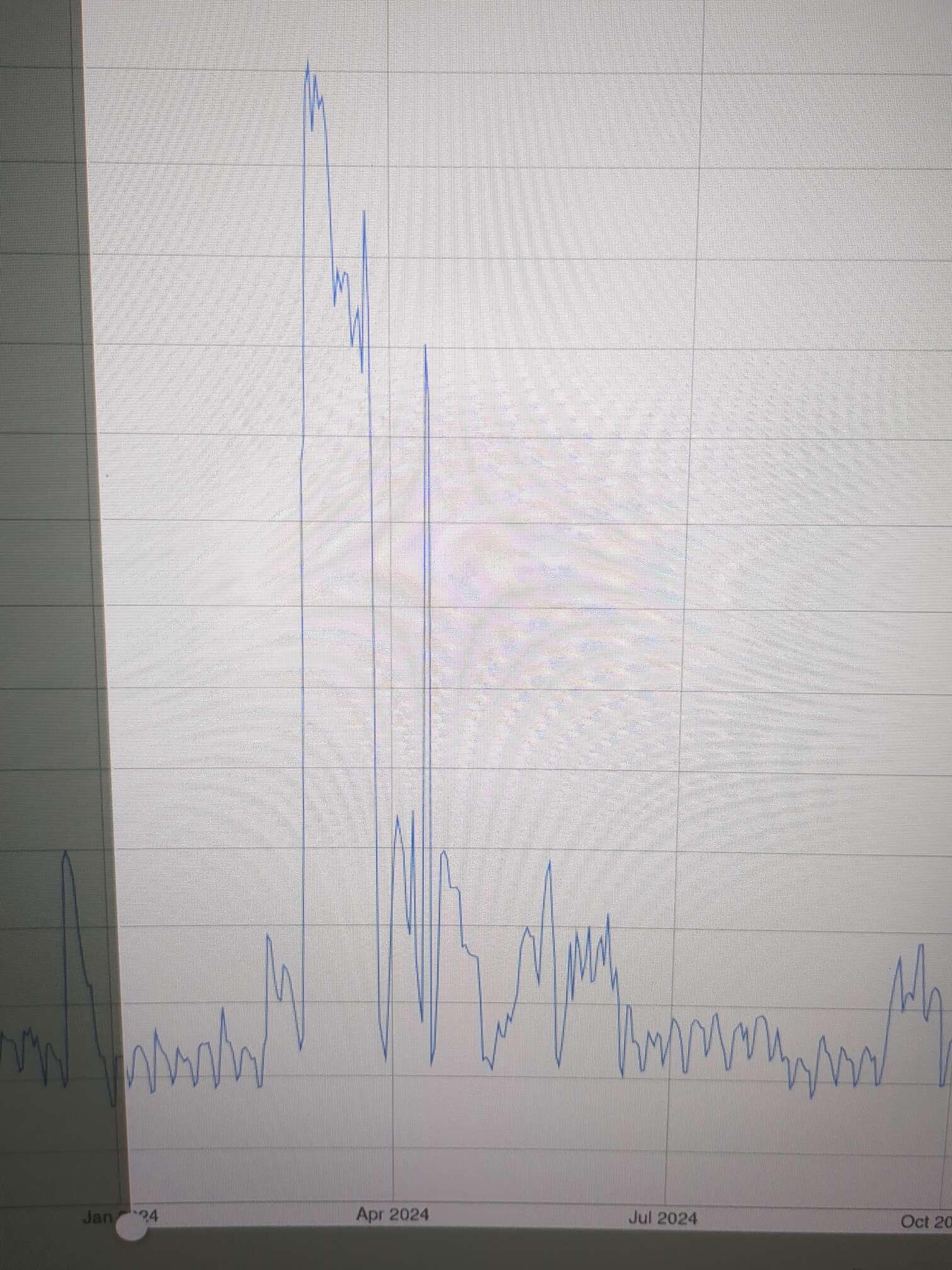

When they arrested the Samourai Wallet devs we saw a spike with Monero transactions. That's why I think we can see that again and with that a steady growing as more people have to think more careful how to route around the financial system.

If you don't re-think your goals with Bitcoin you will be trapped sooner or later.

and use Monero only.

When they arrested the Samourai Wallet devs we saw a spike with Monero transactions. That's why I think we can see that again and with that a steady growing as more people have to think more careful how to route around the financial system.

If you don't re-think your goals with Bitcoin you will be trapped sooner or later.