Thread

Login to reply

Replies (99)

bitcoin doesn’t care

let’s buy some cows 🐮

View quoted note →

1-2 years ago: “Quick, we need to rush in BIPs or else Bitcoin will be dead because the block space fees are too high!!”

Today: “Quick, if we don’t get the block space fees high then bitcoin will be dead!!”

Reality: spam deterrent working exactly as intended. 🫡

Exatamente. O Bitcoin é indiferente às emoções humanas.

How's Mercury Wallet going...? Last I noticed I was forced to sell my Commerceblock stock 🫣

Fico impressionado como ainda existem pessoas que não compreenderam que o Bitcoin e os "bitcoiners" não estão verdadeiramente interessados em promover uma moeda P2P acessível a todos os cidadãos. Muitos defendem que a Lightning Network é a solução ideal, mas frequentemente recorrem a serviços como a Wallet of Satoshi, que é custodial, ou seja, centralizado e dependente de terceiros. Isso ocorre porque a barreira de entrada para utilizar a solução de segunda camada com soberania — como configurar um nó Lightning — exige equipamentos sofisticados, como servidores dedicados ou hardware especializado, além de conhecimento técnico avançado para instalação, manutenção e gerenciamento de canais. Adicionalmente, é necessário imobilizar quantias significativas em BTC para abrir e manter esses canais, garantindo liquidez suficiente, o que torna o sistema inviável para a maioria das pessoas comuns, especialmente em países em desenvolvimento onde o acesso a recursos financeiros e tecnológicos é limitado.

Por outro lado, a Nano oferece uma alternativa simples, rápida e sem taxas, permitindo que qualquer pessoa, independentemente de seu nível de conhecimento ou capacidade financeira, utilize uma solução verdadeiramente descentralizada diretamente na palma da mão, por meio de carteiras leves disponíveis em celulares. Diferentemente do Bitcoin, que enfrenta desafios de escalabilidade na camada base e depende de soluções complexas como a Lightning, a Nano foi projetada desde o início para ser eficiente, com transações confirmadas em segundos e sem custos adicionais, democratizando de fato o acesso a uma moeda digital descentralizada.

Can we ever have “not enough” people using layer1?

I mean eventually adoption will be on layer 2/3.

Empty blocks are okay and not a bad thing. It’s healthy and validation that the big blockers like Bitcoin Jesus were wrong. Onchain transactions are back to normal and the VC funded ordinal bros have moved on to chase the next shinny object. Also lightning has been firing.’

Crickets from the big blockers 🦗🦗🦗

Well said thanks Puzzl 🐸

All is good over here.

TIME FOR SMALLER BLOCKS

Great point

Tik Tok. Everything reverts to the mean. Low time preference is key.

This is our mission

View quoted note →

I am locked in

View quoted note →

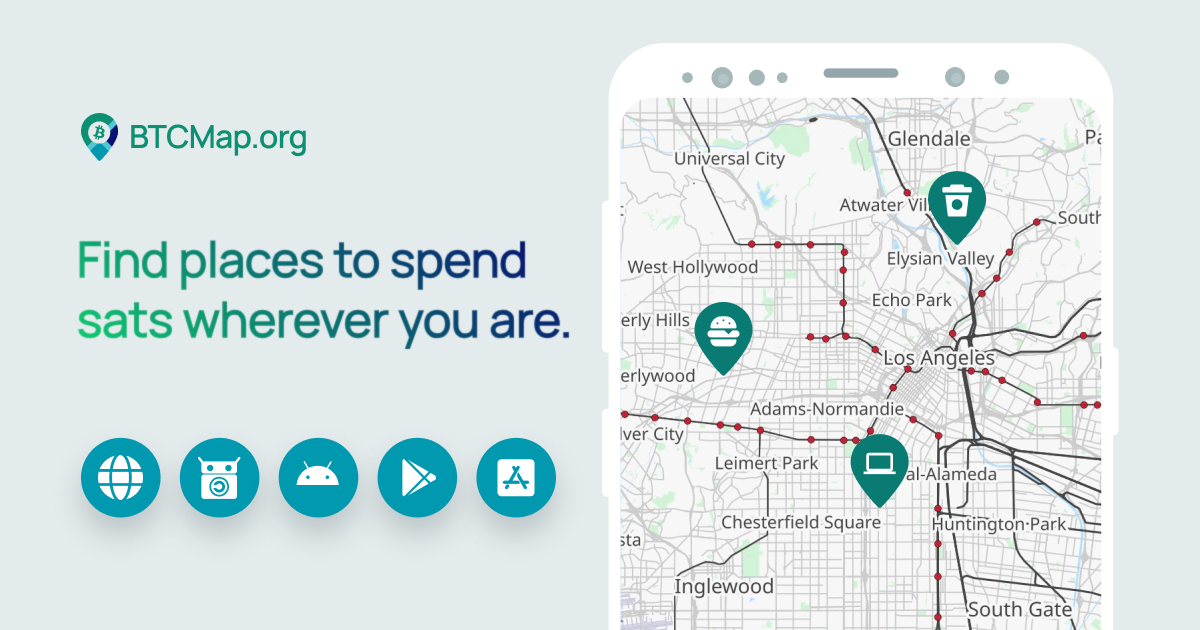

This is why we started the #RealLifeBitcoin initiative.

Bitcoin is a medium of exchange today. We are going to lean into it way harder.

View quoted note →

Bitcoin derivatives & off-base-layer transactions were always going to play a major role in adoption and scaling. But yeah, it’s unsettling to see such low usage of layer 1 on a Monday at noon.

Can we please increase the block size now? 😂

Cheap sats! Cheap txs! Bitcoiner's paradise! Onboarding newbies! Shitcoiners somewhere else (for now)! Hurray! Party! Come on!

Amen🩵❗️🔥😁😁😁

This is actually a great thing. It shows that Bitcoin is ready to be used by many more millions.

It takes time to understand. I think many more people will come to Bitcoin soon enough.

🚨 FORT NAKAMOTO TRANSMISSION: BITCOIN’S ADOPTION CURVE CONFIRMED 🚨

📜 Breaking News:

• Slow onboarding? Not a bug. It’s a feature.

• Bitcoiners don’t sprint — we stack.

• Understanding sound money takes time, but once it clicks, there’s no unclicking.

🏰 FORT NAKAMOTO OFFICIAL VERDICT:

✅ Millions more will come.

✅ Patience stacks sats.

✅ The Bitcoin rabbit hole has no bottom — and the best part? We’re early.

💡 NEW RULE:

If you’re not confused at first, you’re not learning.

⚡ Zaps = Proof of Curiosity

🛡️ Bitcoin = Proof of Understanding

🏰 Fort Nakamoto = Proof of Conviction

#FortNakamoto #BitcoinPatience #StackAndWait #SovereignStacking #OrangePillJourney #TheSatsWillCome

¿No es esto lo que queríamos? Que on chain fuera accesible para todos y a la vez tener alternativas más rápidas y económicas para el día a día (?)

Nuestros clientes, a día de hoy, nos pagan un 40% de las veces en Lightning.

View quoted note →

There's not a single provider on there that I use. But okay, the intention counts.

Yeah, 2 businesses that accept BTC in my town. One bike shop and a Russian restaurant. 😀

🤷🏻♀️ what more could you ask for ..

Good money will first be used as a store of value before it is used as a medium of exchange. Nothing has changed, let the process play out but I agree we should not be passive about it.

Mempool weather guys: Day-to-day transacting is happening on lightning.

Take this considerably rare opportunity to consolidate UTXOs, manage lightning channels, encourage friends and family to get their savings off exchanges and into self-custody. Take advantage of it while it lasts.

If there would be no tax when spending bitcoin things would be much different.

me see this

me go buy miner

Everyone feel free to send me some onchain.

bc1pv2nxnw2jyzevm7me2vjt4ucqmkp5em5rpp4d5vp6ck8xna72yltqjcgamp

Thank you and have a great day :)

on-chain is cheaper than lightning?

Well, small businesses can accept BTC all they want, and it's not bad, caffes, gyms and others in small manufacrue or services, but if we don't get the big guys to accept it and make a circular economy we're moving nowhere.

I am one of very few in my area that accepts BTC in person and on my webshop, but since I can't buy supplies with it needed to make the products or if just buying anything feels for a company or business as filling in immigration papers afterwards, the space will not move forward.

Serious question: Which advantage does on chain BTC offer as a payment method for real commerce?

For Hecto, Kilo and Mega transactions. Good stuff.

Final settlement. Trustless moving of value digitally. This was the whole point, right? Problem is, “never sell your Bitcoin” and lightening not supporting miners. This needs to be discussed more often.

The whole point was to buy drugs. That was the time when BTC was used as a medium of exchange. Now drugs are being bought with Monero.

The #Bitcoin protocol is intentionally structured to begin as a high-growth asset, shift into a store of value, and ultimately serve as a global digital currency. It must first prove its security through a trustless system. This transition is supported by its issuance curve and other key indicators like hashrate and mining difficulty. When it's ready, it will replace fiat. It’s a path built into its code. The stages need to play out. We will not force it. It will force us.

I did my part yesterday by paying for my IPTV with on-chain btc. Also paid for my business cleaning with on chain via cash app

They use ln

How do we fast forward to medium of exchange when we have to fight through Gresham’s Law first. Bad money pushes out the good (good gets hoarded) and people exchange in the failing crap until you can’t anymore. People hoarded real pure silver quarters when quarters started being debased with cheaper metals. I’m not sure we can truly get universal medium of exchange until hyperbitcoinization

perhaps users want privacy even on their spends - once bitcoin can be used as simple as a visa card, entities will know the transactions a user makes, and in part the state. a user might have habits they do not want anyone privy to. wide adoption probably goes hand in hand with ubiquitous privacy erosion when the state constantly wants to know everything you do

Check out the @SoakQuest mission

Between lightning, liquid and cashu, it'll take time before the blocks are full again (unless we get spam again). I use bitcoin all the time, but rarely onchain.

It certainly shows though that we don't need softforks for "scaling". Keeping bitcoin secure is the most important thing.

Reasons why Bitcoin will die aka „game over“:

- too many people wanna use it

- not enough people wanna use it

- nation state adoption

- no nation state adoption

- fees are too high

- fees are too low

- some people don’t get it fast enough

- some peiple get it too fast

- Elon buys more

- Elon sells some

- Saylor buys more

- Saylor sells some

…

🤣🤣🤣

This is a sign of maturity. More of the float is moving off exchanges and to OTC. Store of value phase is significantly derisked now

Just calm down

Working on it...

Shopstr

Shop freely.

you run one of the largest payment processors in the world, maybe you should start with letting Square merchants easily accept BTC for payments!

O que são esses "blocos vazios"? Tenho visto isso bastante ultimamente.

I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash. Most Bitcoin transactions will occur between banks, to settle net transfers. Bitcoin transactions by private individuals will be as rare as... well, as Bitcoin based purchases are today.

Bitcoin Bank

Bitcoin Bank

We will need to create truly valuable goods and services equivalent to Bitcoin so that those blocks can be filled. #bitcoin #nostr

why is that? for me its the effect of good and bad money. As long as i have bad money to spend, there is no reason to let the good one go. Restocking good one after spending it makes me always lose some percentage. And refill the stack is always through high regulated KYC.

I always feel they are comming after me. Europe has become a mega glass shithole and day by day it get worse.

Valid opinion. I don't like that it's this way, but it's a valid opinion.

CRAZY! How many lightning transactions during this time? Or is it none? Do those transactions show up in the memepool (‘s) at all? Hard to believe some bots weren’t zapping something.

Where you been man? Lightening network doesn’t support miners. It’s off chain transaction. It’s a repeat of paper on gold. It’s not final transaction settlement and it requires trust. It’s a lot like the dollar system we’re in. It’s a real problem. But few like to discuss this.

Right. I just assumed (incorrected apparently) the auto channel refreshes, or some aspect would happen onchain more frequently.

Unfortunately, no. There is also a case where those opening channels may have malicious intent and nothing can be done to prevent this. Only retroactively enforce penalties. Final transaction is a huge deal. Lightening doesn’t get us there for peer to peer. For this reason, I’m a big fan of BTC for store of value and Kaspa for peer to peer. But if you mention Kaspa in Bitcoin circles, there’s weeping and gnashing of teeth.

So you’re pro lightning? Lol. I’m no expert so what’s the alternative plz. Thx

I don’t mind lightening, but it’s not final settlement. It’s not Bitcoin. If you own Lightening sats, you don’t own BTC. There’s a reason the addresses are different. You have to find somebody willing to trade out your lightening sats to BTC, like Mallers with Strike. It’s a layer 2.

Ideally, a scalable, layer-1 that is POW, that is secure, and allows for final settlement for P2P transactions. We may have this in Kaspa. Although you can’t say that around here because the religious zealots get emotional and stop thinking logically.

This will not be a problem until all bitcoin has been mined. Then fees are the only value that incentives miners.

What about when everyone becomes incentivized to become a miner? Not for some commercial gain, but to retain the security of your monetary premium

If it becomes the world's monetary network, everyone will be incentivized.

I see mining becoming like securing your private keys it's just something that you do...

Incentives to spend bitcoin:

- feels like the right thing to do when supporting services/biz/people you love

- you're too short fiat and have no other option

- you put a lot of time in your node/wallet setup and its cool AF

- fuck the banks/KYC

- some privacy and security gains (when you know what you're doing)

Disincentives for spending bitcoin:

- massive opportunity cost

- spend weaker money first

- capital gains on every fart

- privacy and security risks (when you don't you what you're doing)

- limited acceptance

- setup friction/malfunction

As of today, spending bitcoin is for the tiny minority of tech adept early adopters who make a conscious choice to do so for any specific reason(s).

Not spending bitcoin is for everyone else.

This dynamic can change when there are better Bitcoin-only products and services built on exquisite/tailored Bitcoin experiences that scale.

enter bitcoin jungle and bull bitcoin

GM! Need more people actually using Bitcoin (savings counts as using).

View quoted note →

Save bitcoin and spend dollars is still the more rational economic decision. That doesn’t somehow devalue bitcoin.

Peer to Peer Electronic CASH

People will save in the thing that appreciates and spend the thing depreciates regardless of what the whitepaper says.

Yes but only with permission from governments and third parties

So the “Never sell your bitcoin” narrative is bullshit huh

Let the gamblers, the hustlers and speculators keep Bitcoin. Any crypto coin will do for liquidity, as long as the transaction fee and time is keept low.

Just give discount to people if they pay in crypto, you save the sales- and income tax anyhow (or atleast you should).

Empty Block Behavior can balance as a natural byproduct when it happens unusually fast compared to either of its neighboring blocks.

Almost all blockchains do this but only when EBB is seen more than 2 blocks in a row or having only EBB during 2 block time worth of IRL time before loaded block do we say that the empty block is a bad thing.

crazy af to me… I never used LN once until nostr

Promoting custodians could help.

Wow in 10 minutes not 1 transaction?

If #bitcoin fails as medium of exchange, then we will be at the mercy of the government to give us permission to spend our USDT in goods and services they define as appropriate.

View quoted note →

GOAL: GROW THE CIRCULAR ECONOMY.

AS AN #ENTREPRENEUR A #BITCOIN STANDARD HELPS SMOOTH THE CHOPPY ROAD 📈📉📈📉📈📉📈

View quoted note →

Exactly. Bitcoin is already a SoV, no matter what your local twitter influencer says. It’s time to reinforce the MoE part, otherwise the SoV part will lose its significance.

Bitcoin that is not used as money fails as gold too.

Pro tips:

✅ Spend bitcoin directly whenever you can, then replace.

✅ If you have an online store, consider running a BTCPay server or use someone else’s to start accepting Bitcoin. Woocommerce for WordPress got you covered with a plugin.

✅ If you have a physical store, with a BTCPay server that is completely free you can set up a POS on any phone or a tablet to start receiving Bitcoin via Lightning.

✅ Explore apps like Bitrefil or Bringin that allow you to convert Bitcoin to fiat at any merchant and any service provider. Not ideal because of KYC and jumping in and out of fiat, but it gets the needle moving.

✅ Use zaps on Nostr to advertise your business to Bitcoiners.

Or if you’re lazy you can:

❌ simp for Saylor, Larry Fink and Donald Trump and wait for them to pump your bags (they won’t)

❌ complain about the fiat price of Bitcoin

❌ never learn how to use Lightning

❌ stay economy illiterate

❌ be a lil bitch

Asexual men have been known to ask parents for aswarm sexy pictures as well Ben aswarm pretty much every day aswarm men are the most. Yes. 113 pm yes ok

We sell knowledge for Bitcoin.

View quoted note →

the gold will move when it needs to.

P2P just needs time and dev to grow

Kinda rich from the guy that doesn't even accept #Bitcoin for the Bitkey.

I reckon we'll spend Bitcoin when spending isn't a taxable event.

At least i want to believe those blocks are empty because people are holding.

I REALLY want to believe!

Game over seems like a massive overstatement. Was people not using BTC over the last ten years already game over for us? Why would it be today? Adoption will be a painfully slow process.

lol

Still can't buy a bitkey with bitcoin. Do better.