“We should change Bitcoin now in a contentious way to fix the security budget” is basically the same tinkering mentality that central bankers have.

It begins with an overconfident assumption that they know fees won’t be sufficient in the future and that a certain “fix” is going to generate more fees. But some “fixes” could even backfire and create less fees, or introduce bugs, or damage the incentive structure.

The Bitcoin fee market a couple decades out will primarily be a function of adoption or lack thereof. In a world of eight billion people, only a couple hundred million can do an on chain transaction per year, or a bit more with maximal batching. The number of people who could do a monthly transaction is 1/12th of that number. In order to be concerned that bitcoin fees will be too low to prevent censorship in the future, we have to start with the assumption that not many people use bitcoin decades out.

Fedwire has about 100x the gross volume that Bitcoin currently does, with a similar number of transactions. What will Bitcoin’s fee market be if volumes go up 5x or 10x, let alone 50x or 100x? Who wants to raise their hand with a confident model of what bitcoin volumes will be in 2040?

What will someone pay to send a ten million dollar equivalent on chain settlement internationally? $100 in fees per million dollar settlement transaction would be .01%. $300 to get it in a quicker block would be 0.03%. That type of environment can generate tens of billions of dollars of fees annually. The fees that people pay to ship millions of dollars of gold long distances, or to perform a real estate transaction worth millions of dollars, are extremely high. Even if bitcoin is a fraction of that, it would be high by today’s standards. And in a world of billions of people, if nobody wants to pay $100 to send a million dollar settlement bearer asset transaction, then that’s a world where not many people use bitcoin period.

In some months the “security budget” concern trends. In other months, the “fees will be so high that only rich people can transact on chain” concern trends. These are so wildly contradictory and the fact that both are common concerns shows how little we know about the long term future.

I don’t think the fee market can be fixed by gimmicks. Either the network is desirable to use in a couple decades or it’s not. If 3 or 4 decades into bitcoin’s life it can’t generate significant settlement volumes, and gets easily censored due to low fees, then it’s just not a very desirable network at that point for one reason or another.

Some soft forks like covenants can be thoughtfully considered for scaling and fee density, and it’s good for smart developers to always be thinking about low risk improvements to the network that the node network and miners might have a high consensus positive view toward over time. But trying to rush VC-backed softforks, and using security budget FUD to push them, is pretty disingenuous imo.

Anyway, good morning.

Thread

Login to reply

Replies (29)

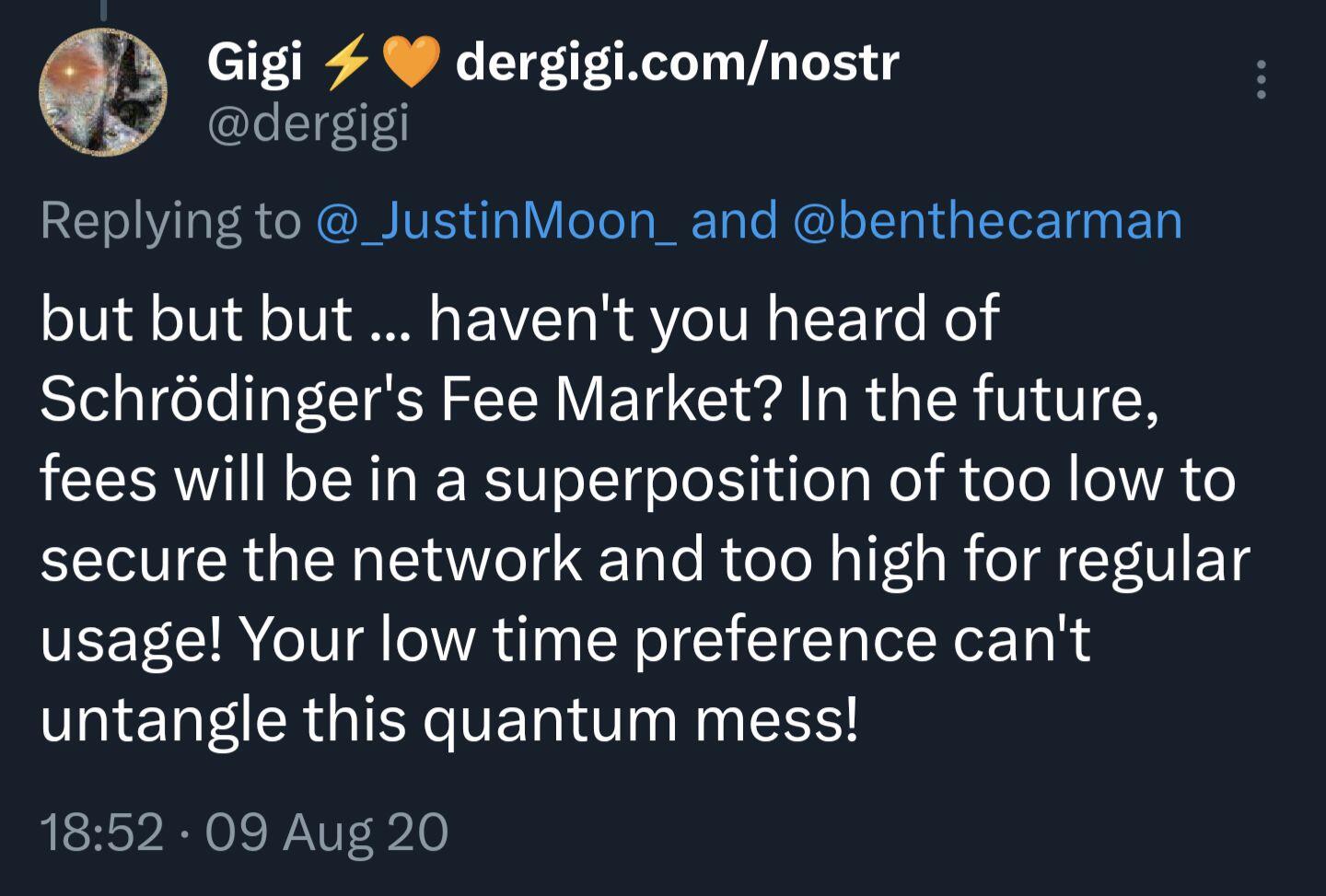

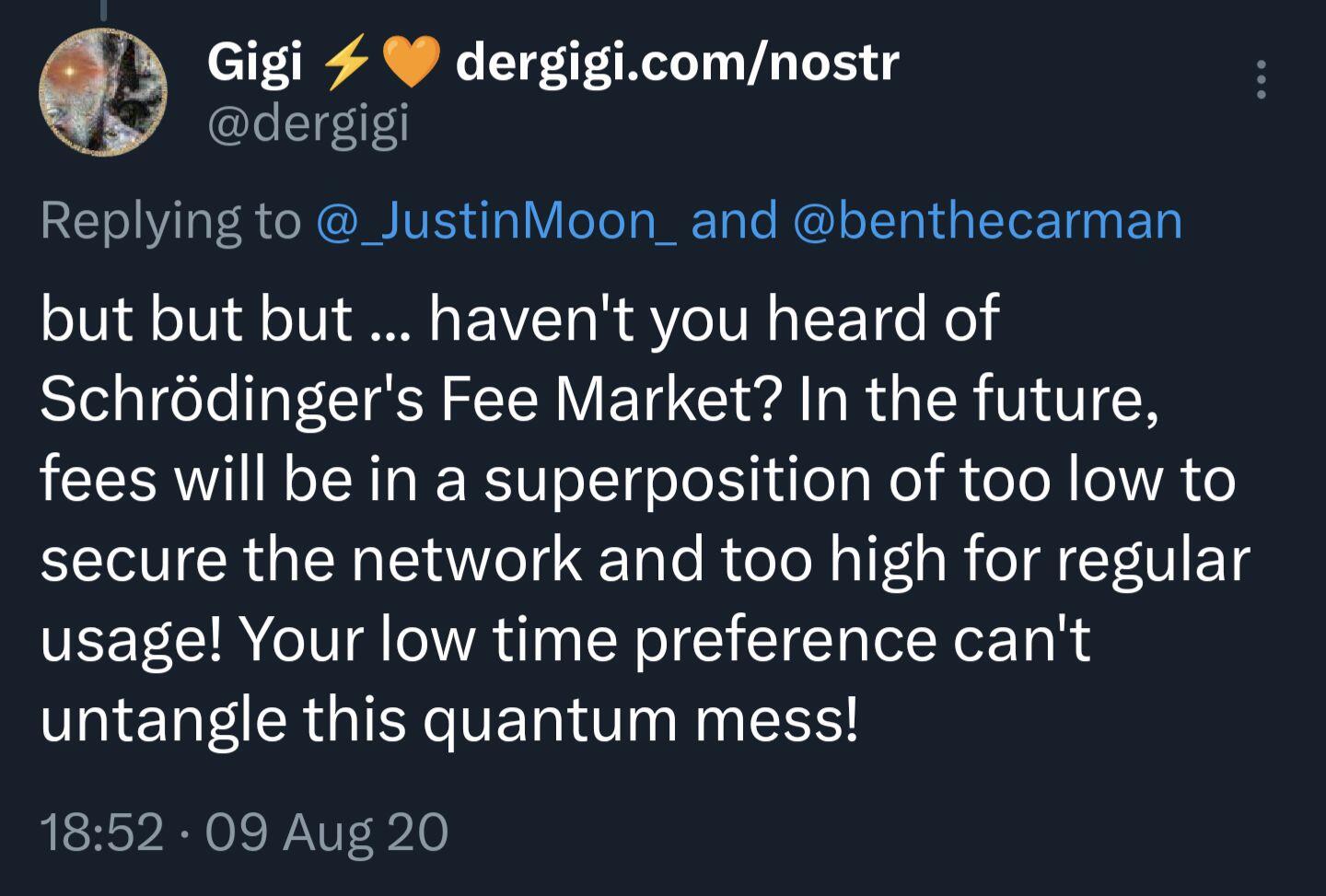

Schrödinger's fee market.

GM. 🔥☕️

Good morning lyn

I guess I just say to myself by 2040 a 100 dollar fee to transfer will be half the price of a coffee. It’s all relative. It’s not really a big deal.

Well articulated answer to some high time preference "Bitcoiners."

They seem to have bamboozled some good folks too.

all want blockspace so fees spikes 😿 so no one want blockspace a this price so budget problem 😿 please buy my shitcoin🙏

yeah exactly, my shitcoin where free blockspace for everyone is supported by military-grade super-quanticresistant-lastgen-computers that takes network up and you can vote by staking your ultra-soud trust-us-we-will-never-inflate money 😄🫡

I think a fair number of people boost every single post by @Lyn Alden but if you read them it is easy to see why.

View quoted note →

> But some “fixes” could even backfire and create less fees, or introduce bugs, or damage the incentive structure

> Some soft forks like covenants can be thoughtfully considered for scaling and fee density

Couldn't this be one of these cases? If covenants allow moving a lot of the transactional volume offchain wouldn't this compromise the incentive of a fee market to form in the first place?

One of the things that makes the future unique, is that nobody knows... Lots of moving parts, better/faster computers, phones, chips, processors...

tick tock

next block

View quoted note →

Can one of these Central Bitcoiners accurately predict what transaction fees will be tomorrow, much less in 2040?

This. The sooner people realize #bitcoin is a better FedWire or international settlement mechanism (as opposed to money), the sooner people will realize the power of Bitcoin's immutability. That should not change.

View quoted note →

Having a few like-minded people is my security budget.

View quoted note →

You are without a doubt by far my favorite mind in bitcoin 👏👏

Reading this, I'm once again silently amazed at the genius of Bitcoin.

Money of the people, by the people, for the people.

Conflicting issues and competing interests are inherent to a diverse and global network. The fact that all of these conflicts must be resolved to a single consensus seems impossibly difficult, and yet Bitcoin forces us all to cooperate.

There can be only one language of value.

Every issue of consequence inescapably finds itself in lively debate in the public square, vying for hearts and minds. If the issue resonates, then it persuades those who have put in the effort to become node runners to cast their vote.

For those who do not run nodes, but have some coins, they cast their vote by selling the hard fork they think will lose.

It is amazing.

View quoted note →

This is the signal i need in the AM

It’s important to remember that there are multi-billion dollar mining companies who have a financial interest in changing the protocol in a way that benefits their economics, not necessarily the system as a whole. Now is a particularly challenging time for bitcoin miners with the hash price near all time lows.

It wouldn’t surprise me that public miners are astroturfing ideas to improve their revenues.

The security budget is a non issue imo. If it’s not profitable to mine, hashrate will drop and difficulty will adjust until it is.

It may make a lot of sense to revisit Satoshi's words on this -

Re: Bitcoin P2P e-cash paper

Good morning.

I'm not concerned about the security budget of bitcoin. I'm certain that the free market will find the right balance of security & usability.

手续费是比特币的货币属性,并非投资部分,一切取决于比特币作为货币应用而非投资品的推广。 View quoted note →

And between 2040 and soon, the fees will be entirely offset by the electricity producer.

The Texas anti-Bitcoin bill was likely the lever pulling of large gas-fired peak power producers, who saw their $9,000 /kw hour peak fees disappear as the grid has become more adaptive.

Proposed changes are an evil Trojan horse.

Run your own user node.

#Bitcoin Freedom.

An excellent heads up

Thank you Lyn!

Fees are SAFU (they really are).

Introducing potential existential risks on the base chain is a no go.

GM!

If you make a bip and Lyn ain't feeling it, I would put forward that...

YOU

ARE

SCREWED

Anti tinkering

Attack surface !!! Every tinker risks widening the attack surface in ways that can be bewildering.