These days there are some great self-custodial Bitcoin Lightning wallets to choose from. Some even integrate an LSP so you don't have to manage your own channel liquidity.

Here is a simplified overview of the major players and how their fee arrangements differ.

As Bitcoin on-chain fees rise, you should have a basic understanding of where LSP costs are incurred so you can plan accordingly.

For example, funding your wallet will allow you to send, but if you are receiving lightning payments you will require inbound liquidity.

If you want to receive a payment on a new wallet, an on-chain transaction may be required on behalf of the user by the LSP in order to provide the necessary capacity.

In high Bitcoin fee environments this can sometimes result in unforeseen transaction fees. Be aware.

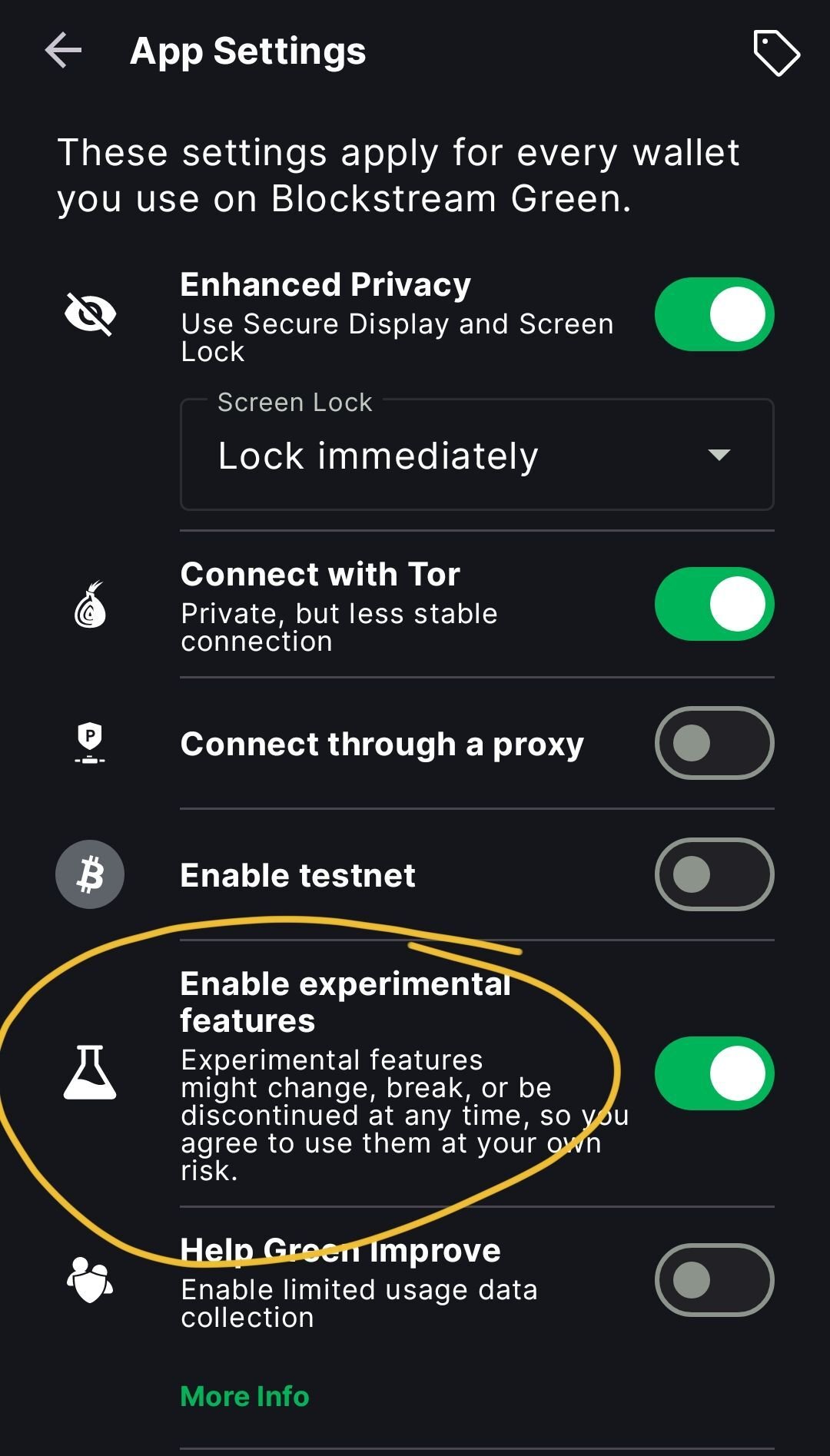

The devs are working hard and shipping improvements and new features all the time.

As these products develop I'll attempt to publish any relevant updates.

⚡️

As Bitcoin on-chain fees rise, you should have a basic understanding of where LSP costs are incurred so you can plan accordingly.

For example, funding your wallet will allow you to send, but if you are receiving lightning payments you will require inbound liquidity.

If you want to receive a payment on a new wallet, an on-chain transaction may be required on behalf of the user by the LSP in order to provide the necessary capacity.

In high Bitcoin fee environments this can sometimes result in unforeseen transaction fees. Be aware.

The devs are working hard and shipping improvements and new features all the time.

As these products develop I'll attempt to publish any relevant updates.

⚡️

As Bitcoin on-chain fees rise, you should have a basic understanding of where LSP costs are incurred so you can plan accordingly.

For example, funding your wallet will allow you to send, but if you are receiving lightning payments you will require inbound liquidity.

If you want to receive a payment on a new wallet, an on-chain transaction may be required on behalf of the user by the LSP in order to provide the necessary capacity.

In high Bitcoin fee environments this can sometimes result in unforeseen transaction fees. Be aware.

The devs are working hard and shipping improvements and new features all the time.

As these products develop I'll attempt to publish any relevant updates.

⚡️

As Bitcoin on-chain fees rise, you should have a basic understanding of where LSP costs are incurred so you can plan accordingly.

For example, funding your wallet will allow you to send, but if you are receiving lightning payments you will require inbound liquidity.

If you want to receive a payment on a new wallet, an on-chain transaction may be required on behalf of the user by the LSP in order to provide the necessary capacity.

In high Bitcoin fee environments this can sometimes result in unforeseen transaction fees. Be aware.

The devs are working hard and shipping improvements and new features all the time.

As these products develop I'll attempt to publish any relevant updates.

⚡️