Paradox

Bitcoin exists. The network works. Transactions settle without middlemen or state approval.

Yet most people refuse it.

Not from ignorance. From something worse: accepting Bitcoin means questioning money, government, and power itself.

When Nicholas Fuentes said “I believe in fiat,” he wasn’t doing economics. He was confessing theology. He was saying: the state should control my money. The state should control me.

He believes in the state.

This isn’t reason. It’s faith.

Everyone knows this implicitly. But voicing it demands confronting what fiat actually is.

The question is simple:

If Bitcoin proves money can work without masters, what does loyalty to fiat reveal?

Not prosperity. Something human: we defend systems we’ve always known, even when numbers no longer add up.

Plato’s Currency

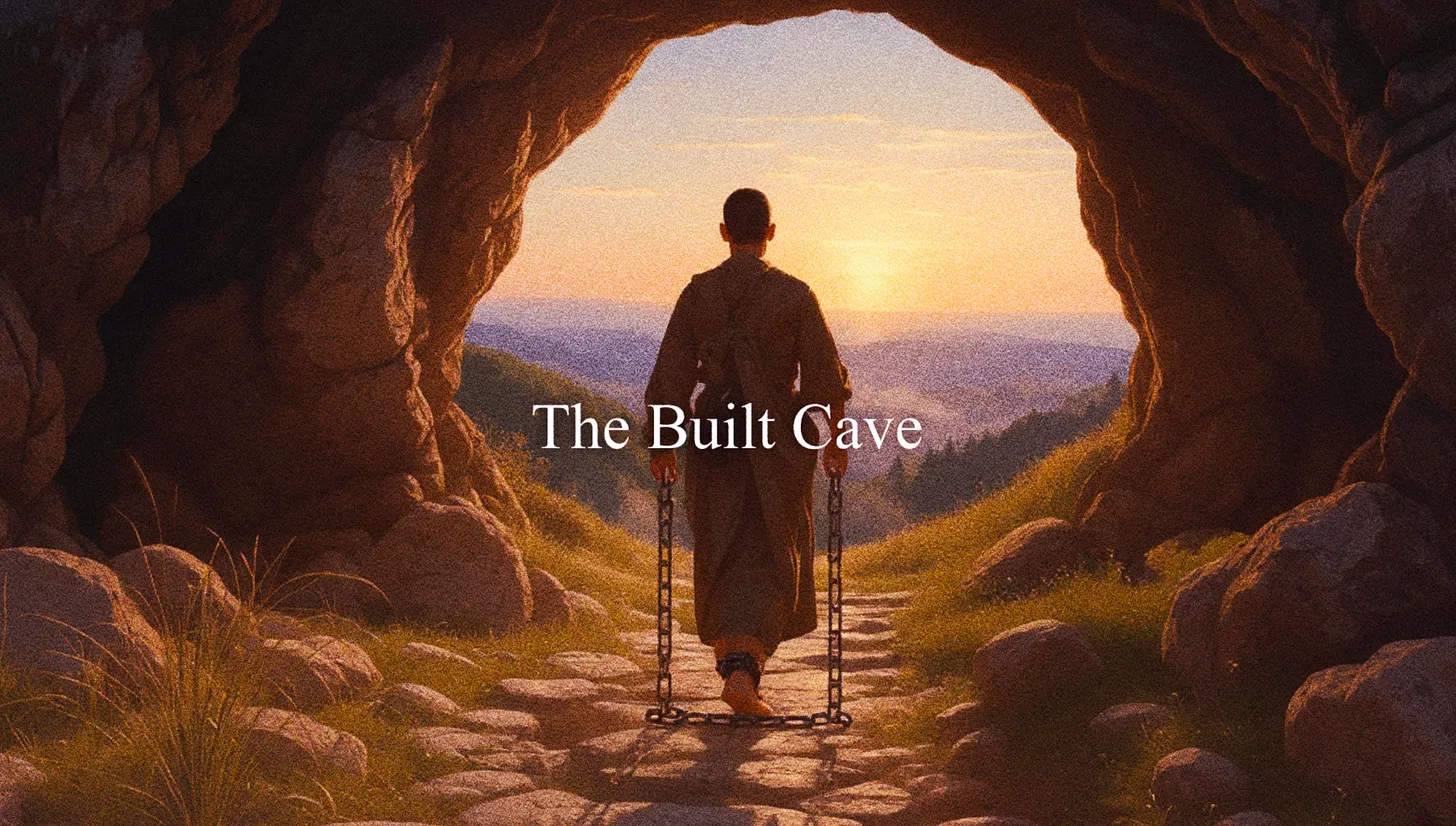

Imagine prisoners chained since childhood, facing a wall.

Fire burns behind them. Shadows flicker across stone. The prisoners watch the shadows. Believe them to be reality.

The wall is all they know.

One prisoner breaks free. He turns. Sees the fire. Climbs toward light. The sun blinds him. Pain. Confusion. Then clarity.

Everything below was illusion.

Most of us are still looking at the wall. We don’t even realize it.

The cave is fiat currency. The shadows are “economic stability,” “monetary policy,” “financial security.” Abstract concepts that feel real until you examine them directly.

The fire is the central bank. The mechanism casting shadows across our collective consciousness.

The sunlight is Bitcoin. Proof that another arrangement exists. It works. It requires no central authority.

Imagine staring at shadows on a wall your whole life. Believing they’re the whole world. That wall is fiat. Bitcoin is the first moment you can turn around and see the fire.

Most people will never make that turn. The chains feel like comfort. The wall feels like truth.

Anyone who mentions the outside world gets mocked. Delusional. Dangerous. Crazy.

The other prisoners don’t want liberation. They want reassurance that the cave is real. That their imprisonment is natural. That nothing exists beyond the wall.

Fiat’s genius: it doesn’t require your love. Only your compliance. Only the willingness to mistake chains for safety.

Most of us were born in this cave. Our parents believed the shadows cast by central banking. So we inherited the belief without question. The government told us that controlling money made us safe. We believed it because questioning it meant standing alone against civilization itself.

It feels safer to trust the system we’ve always known. Questioning it feels like standing alone.

But the numbers are public. And they’re getting harder to ignore.

Mechanisms

Strip away the language. What remains is observable structure.

Fiat currency doesn’t emerge from markets. Markets rejected it for thousands of years.

Fiat requires force. The application of state power.

Legal tender laws compel acceptance. Tax collection in fiat compels labor toward fiat. Capital controls prevent exit. Financial surveillance monitors compliance.

The system requires constant enforcement.

Call it “monetary policy.” Call it “central banking.”

The translation is simpler: Governments and banks profit from printing more currency. Every new dollar they print is a silent tax on every dollar you already own.

Here’s the mechanism: You earn $100,000 in a year. The central bank prints trillions. The money supply increases. Your $100,000 doesn’t change numerically.

But its purchasing power decreases. You can now buy less with it.

No one asked permission. No vote was held. Your labor was taxed without representation. The taking happened through currency debasement instead of direct confiscation.

This happens annually. It compounds across decades.

After forty years of saving, your money is worth pennies on the original dollar.

Since 1971, the dollar lost roughly 88–90% of its purchasing power. That’s not a conspiracy. It’s on the Bureau of Labor Statistics website.

An entire generation’s savings have quietly vanished. The next one is on the same path.

This isn’t inflation. It’s a quiet tax on savers, workers, and anyone holding currency.

In 1971, President Nixon ended the gold standard. He severed the last constraint on fiat creation. The system was unleashed.

Fifty years later, a dollar is worth what a nickel was then.

Your parents felt it. You’re feeling it. Your kids will feel it even harder.

Commodity money imposed constraint. Gold didn’t print itself. Governments faced limits on spending. They couldn’t infinitely create currency.

Fiat removed these constraints entirely. Now there are no limits. Except one: whether people believe the currency has value.

The system survives only because most people don’t question it.

The moment questioning becomes widespread, fiat’s foundation becomes unstable.

Everything depends on collective faith in a system that doesn’t deserve faith.

Stockholm

Wall St knows the actual condition of fiat. They read the same data available to everyone:

Central bank balance sheets have exploded beyond historical precedent. Government debt has become mathematically unsustainable. Interest payments on existing debt consume ever-larger portions of government revenue. Currency debasement accelerates. The terminal condition is visible to anyone examining the data.

But Wall St doesn’t warn the public.

Instead, they accumulate Bitcoin quietly. In private. Through personal holdings and vehicles designed to resist regulatory seizure.

In public, they say fiat is fine. They promote Bitcoin as speculation. They create Bitcoin ETFs. Products that keep your Bitcoin trackable. Seizeable. Controllable by the state.

This isn’t accidental. This is strategy.

Wall St is hedging systematically. If fiat survives, they profit from Bitcoin holdings and maintain public legitimacy. If fiat becomes unstable, they have Bitcoin. Held in self-custody, beyond state reach, to preserve wealth.

Either way, they escape the consequences. Anyone holding Bitcoin through an institutional intermediary does not.

Their action speaks: If fiat collapses, the only Bitcoin that matters is the Bitcoin no one can take from you. Everything else is someone else’s liability.

When systemic instability arrives—and history suggests it will—the distinction becomes catastrophic.

The wealthy will have Bitcoin beyond state reach. Genuinely free. Transferable across borders. Usable in any circumstance.

Anyone holding an IOU from an institution will hold a paper claim on nothing. Worthless when the institution collapses.

The state doesn’t fear Bitcoin in principle. It fears Bitcoin held outside its jurisdiction. Bitcoin in self-custody that cannot be seized, frozen, or confiscated.

Bitcoin in an ETF is tolerated. It remains captured within the state financial system.

Bitcoin in self-custody is attacked, regulated, and discouraged. It’s genuinely free from control.

Follow the behavior of those with actual resources and knowledge. They’re preparing to survive what’s coming. The rest of the system is being prepared to endure it.

Sorting

Bitcoin adoption creates a hierarchy. Understanding which category matters.

The Sovereign Adopter

Holds Bitcoin in genuine self-custody. Private keys memorized or secured beyond institutional access. This adopter seeks authentic exit from state monetary control. They understand freedom requires individual responsibility. They accept the burden.

They hold Bitcoin as an alternative to fiat, not as an asset within fiat. This represents authentic adoption of Bitcoin’s revolutionary potential. It’s also the most difficult adoption psychologically and technically.

The Institutional Adopter

Holds Bitcoin through regulated intermediaries. Wall St firms. Banks. ETFs. Custodial services. They seek profit within existing power structures. They view Bitcoin as a speculative asset, not as an alternative monetary system.

They’re comfortable with regulatory frameworks governing their holdings. This category represents Bitcoin integrated into the control system itself. Bitcoin held institutionally is no longer Bitcoin in the sense that matters most.

The Crisis Adopter

Doesn’t choose Bitcoin from ideology or forward planning. They adopt because their currency already imploded. Argentines watching peso collapse. Venezuelans unable to feed families. Zimbabweans with worthless currency.

The crisis adopter moves unprepared. Without knowledge. Without hardware. Without technical skills. They move when they have no choice. At maximum disadvantage. When prices are highest and knowledge is scarcest.

The Statist Believer

Rejects Bitcoin entirely. Not from economic analysis. From political commitment. They believe fiat serves legitimate authority correctly. They use Wall St’s adoption as proof that Bitcoin poses no genuine threat to the system.

The people who move first get the cleanest exit. The people who wait until the crowd panics pay the highest price.

History is brutally consistent on that point.

Red Pill

Here’s what Bitcoin actually is. Stripped of mythology.

Math that cannot be debased. Numbers that don’t respond to government decree. A network requiring no permission from authority. Software that works whether governments approve or not.

The first technology making state monetary control optional instead of mandatory.

This isn’t theoretical. It’s observable. Running. Functional. Right now.

When you understand what Bitcoin actually does—not what media says—everything clarifies. Immediately.

Governments fear Bitcoin. Monetary control is the foundation of state power. If citizens can store value beyond government reach, government’s ability to coerce diminishes.

Banks fear Bitcoin. If depositors can hold value without intermediaries, the banking system’s function becomes optional.

Employers fear Bitcoin. If workers can save beyond employer control, the employer’s leverage weakens.

Everyone with power fears Bitcoin. It removes their exclusive privilege: controlling your money without your consent.

This is existentially threatening to every institution built on monetary control.

Bitcoin is the first tool that lets you own your wealth without asking permission.

The Confession

Wall St’s institutional adoption of Bitcoin is an admission disguised as innovation.

It admits, implicitly but unmistakably: Fiat’s trajectory is becoming unsustainable. The math no longer works. The system faces increasing pressure.

But instead of warning the public, Wall St’s positioning itself to profit. You remain exposed.

The strategy is elegant.

They promote Bitcoin ETFs as “accessibility.” This is technically true. But what you access isn’t Bitcoin. You access a paper promise. Regulated by the state. Subject to confiscation at government decree.

They accumulate self-custodied Bitcoin as “insurance.” Also technically true. But the insurance is only for them. The wealthy. The connected.

The outcome is systematic.

When instability arrives, Wall St will have genuine Bitcoin held beyond state reach. Anyone holding ETF shares will hold denominations in a system under stress.

The wealthy will own Bitcoin beyond government jurisdiction. Anyone without self-custody will own an IOU from an institution under pressure.

This outcome isn’t accidental. This is strategy executed deliberately.

Refusal

Your salary arrives as fiat. Created by keystroke at the central bank.

Your taxes fund a government controlled entirely by the central bank’s monetary decisions.

Your savings experience loss through currency debasement. A loss you never consented to.

Your bank account can be frozen by government decree. Without trial. Without legal recourse.

Your purchasing power decreases continuously. Officials tell you there’s no inflation. That debasement is temporary or necessary.

These aren’t accidental system features. They’re core design elements.

The system has a built-in structure rewarding currency creation. It benefits those closest to the printing press.

Most of us defend this system anyway.

Not because we believe fiat works. Deep down we know it doesn’t.

We’ve watched it fail to protect savings. Fail to preserve value. Fail to provide stability.

It’s human nature to defend the system we grew up in. Even when the numbers no longer add up.

Questioning it feels uncomfortable. Whether authority is actually legitimate. Whether we deserve freedom. Whether our entire lives need rethinking.

That interrogation is uncomfortable. So most people stay. Watch the shadows. Call them reality.

But the math is getting harder to ignore.

The Clock

Fiat currency systems collapse. This isn’t prediction. It’s historical fact.

Rome. Weimar Republic. Venezuela. Zimbabwe. Argentina. Turkey.

The list is extensive. The pattern is identical.

Governments create currency rapidly. Currencies lose value. Citizens discover they have no choice but to find alternatives.

Every major economy is following this trajectory. Not as speculation. As observable pattern.

El Salvador collapsed visibly and suddenly. Seventy percent of the population became unbanked. Not by choice. By exclusion.

Bitcoin adoption was desperation. Not success story. They had no alternative.

The question isn’t whether this trajectory is happening. It’s timing.

When does currency instability arrive where you live? How many years until the money you depend on becomes volatile like the peso, bolivar, or lira?

One year? Five years? Twenty?

The Federal Reserve prints trillions. Purchasing power decreases. Anyone depending on fiat is being slowly backed into a corner.

Not by malice. By the system’s built-in logic.

When instability finally arrives, Bitcoin will be the only functional alternative.

But the easier transition happens before the crowd panics. The harder one happens after.

Wall St already knows the answer for themselves.

The earlier someone figures this out, the cheaper the transition is.

Choice

You can continue believing in fiat. Continue working for currency being systematically debased. Continue trusting a system with mathematical incentives toward debasement.

This is the path of least resistance. Most people choose it. Your friends choose it. Your family chose it. Authority figures recommend it.

Or you can study what Bitcoin actually is. Move some savings to Bitcoin. Learn what self-custody means. Reclaim control of your wealth.

Stop letting an institution’s decisions determine your financial future. Understand the difference between permission and ownership.

The obstacles are real.

The state will call Bitcoin dangerous and unregulated. Wall St will try to trap you in institutional custody. Your friends will think you’re insane. Your family will worry. Authority figures will mock you.

The psychological pressure to conform is enormous.

But the pressure exists precisely because this matters.

The earlier someone figures this out, the cheaper the transition is.

Truth

When someone says “I believe in fiat,” they’re not making an economic statement based on data.

They’re stating their comfort with delegation: “I’m okay letting institutions manage my currency.”

This is understandable. It’s also risky.

Every government given power over money has used that power to debase the currency.

Not sometimes. Always.

The pattern is historical and consistent.

Yet most people believe their government will be different. Their central bank will exercise restraint.

This isn’t optimism. This is faith without evidence.

Wall St knows better.

That’s why they’re buying self-custodied Bitcoin while publicly supporting fiat.

They see what the trajectory suggests.

They’re not preparing to stay in the system. They’re preparing to survive it with their wealth intact.

While most people defend fiat, they accumulate Bitcoin.

While most people watch their purchasing power dissolve, they secure genuine alternatives.

While most people believe the system will be reformed, they’re already gone.

Tools

For understanding

Read “The Bitcoin Standard” by Saifedean Ammous. It traces fiat’s complete history and exposes the mythology surrounding it.

The narrative of fiat falls apart under scrutiny. The incentive structure becomes clear.

Read “Anatomy of the State” and “What Has Government Done to Our Money?” both by Murray Rothbard. The first shows how governments function as organized coercion. The second traces exactly what happened to currency after 1971. Understanding the mechanism matters before understanding the money. The theft becomes undeniable once you see the timeline.

For action

Sovereign self-custody. Hold Bitcoin beyond state and institutional reach.

This is the difference between ownership and exposure. Not Bitcoin in an app. Not Bitcoin with a company holding your keys.

Bitcoin you control yourself. Accessible only through knowledge you possess.

For clarity

Track M2 money supply data through the Federal Reserve’s own website.

Watch it in real time. Watch what your purchasing power actually does year after year.

Once you see the pattern measured precisely, the system’s design becomes undeniable.

Running

Your transition window is open right now. Not forever.

The earlier someone moves, the calmer and cleaner the transition is.

Regulations tighten. Self-custody becomes increasingly difficult. The state moves toward digital currencies they control entirely. Sovereignty becomes harder to achieve.

Wall St is already moving. The question is whether you will.

When pressure arrives—and history suggests it will—the moment for preparation passes.

The people who saw clearly will have already positioned themselves.

Those who waited will discover what Wall St already knows:

When the music stops, the only Bitcoin that’s still yours is the Bitcoin you actually control.

Everything else is someone else’s liability.

The earlier someone figures this out, the less stressful the transition is.

The people who move first get the cleanest exit.

The people who wait until the crowd panics pay the highest price.

Thank You

I’ve been writing these essays for a year now.

You read them. You shared them. Some of you sent tips.

That signal means everything.

When you share an essay, you tell someone else to look. To think. To question. That’s how ideas spread. Through people who saw something true and decided it mattered.

To everyone who amplified this work: you kept a voice alive that would have disappeared. To those who sent tips: you signaled it meant something.

Whatever comes next comes because you decided these ideas were worth your time.

Thank you for seeing what I was trying to say. Thank you for passing it along.

The cave is still here. But you’re helping people see the fire.

That matters.

- Rare