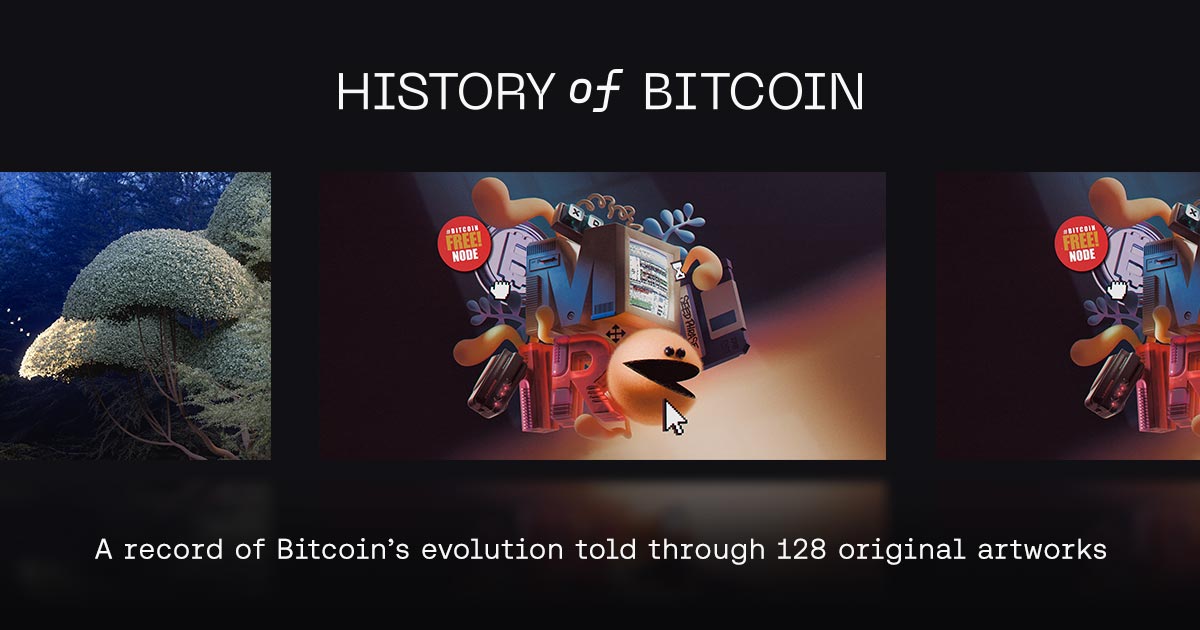

Before #hashtags, podcasts and meetups, early #Bitcoin believers connected in a simple chat room. IRC was where the first Bitcoin community met, collaborated and kept the network alive. Artwork by Zigor (@zigor).

IRC was a real time communication protocol created in 1988. Its decentralised server structure resonated with open source communities and later with Bitcoin itself. It was the natural place for early users to gather, troubleshoot software and support each other as they figured out how to run the network.

Within 24 hours of Bitcoin’s launch, the #bitcoin channel appeared. Logs show #HalFinney joining on January 10 2009 and receiving a message with two peers’ IP addresses, one believed to be Satoshi’s node. These early channels were not just for conversation. They were essential for peer discovery. Without IRC, users had no way to know which nodes they could connect to.

By mid 2010, the #bitcoindev channel became the informal headquarters of early development. It supported node bootstrapping and helped developers find and fix bugs. Satoshi often lurked quietly, preferring Bitcointalk for public posts, but he monitored IRC closely. When an early miner bragged in #bitcoin-dev about high hashpower, Satoshi appeared on the forum to ask what hardware he was using, a clue that he learned about GPU mining through IRC.

IRC also documented the rise of early mining giants. ArtForz regularly shared updates about his hashpower, noting 2 Ghash per second in September 2010 and over 15 Ghash per second by December, at one point mining more than 1,200 BTC per day. IRC became a place to share ideas as well as hashrates. It was here that Namecoin, the first Bitcoin spin off, was announced in November 2010.

In Bitcoin’s early months, IRC was vital. The Bitcoin client relied on IRC bootstrapping to help users find peers. Once the network grew, this was no longer necessary. Version 0.6.x disabled IRC bootstrapping by default, and by version 0.8.2 it was removed. But for a brief moment, IRC was Bitcoin’s first social hub and the technical bridge that helped the network come alive.

Read the full article:

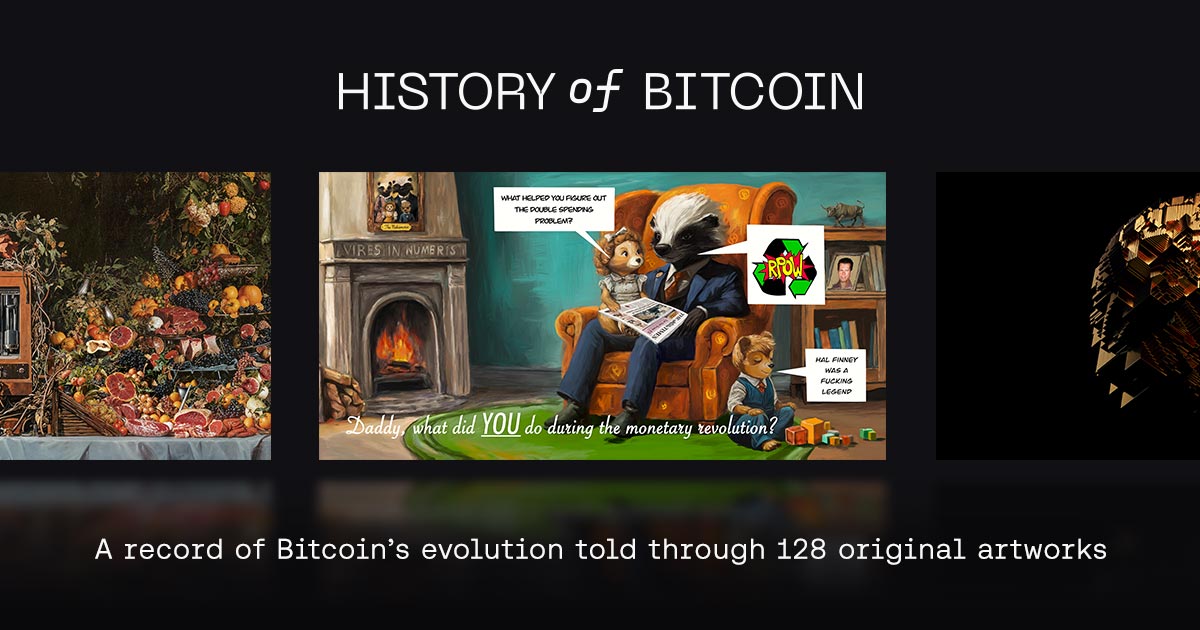

Artwork: Bitcoiners Meet Bitcoiners by Zigor (@zigor).

Appears in the History of Bitcoin Collector’s Book and on our interactive timeline.

Artwork: Bitcoiners Meet Bitcoiners by Zigor (@zigor).

Appears in the History of Bitcoin Collector’s Book and on our interactive timeline.

History of Bitcoin

Bitcoiners Meet Bitcoiners

In Bitcoin’s early days, the #bitcoin IRC channel on Freenode connected miners in real time, becoming the first hub for peer discovery and networ...