The US Economy Is Stronger After One Year Of The Trump Administration

The US Economy Is Stronger After One Year Of The Trump Administration

https://www.dlacalle.com/en/the-u-s-economy-is-stronger-after-one-year-of-trump-administration

One year into Donald Trump’s new presidency, the verdict from the data is clear: the apocalyptic consensus forecasts have failed, and the United States stands as the only major developed economy combining strong growth, controlled inflation and fiscal consolidation.

The same analysts and institutions that applauded massive stimulus, monetary excess and regulatory excess under the previous The same analysts and institutions that applauded massive stimulus, monetary excess, and regulatory excess under the previous administration now struggle to explain why the U.S. economy, which they expected to sink into stagflation, is instead outperforming all of its G7 peers. Furthermore, the U.S. peers that followed net-zero, big government and big tax policies are in secular stagnation.

From the “tariff tantrum” to a global surprise

When Trump announced his new wave of tariffs and trade policy, much of the global consensus rushed to predict a disaster. I called it the tariff tantrum. Commentators warned of an inflation surge beyond 2021 levels, 6%–7% Treasury yields, collapsing investment, a recession, and a world turning its back on the United States in favour of supposedly more responsible governments in Europe.

Twelve months later, none of those predictions materialised. Instead, the U.S. 10-year yield has fallen to 4.1%; the U.S. is the only G7 economy growing robustly, while those nations that doubled down on hyperregulation, aggressive climate‑driven restrictions, high taxes and ever‑bigger government spending are stuck in stagnation despite enjoying a very positive tailwind of low oil and gas prices.

The “tariff tantrum” never became the structural shock that critics announced, because tariffs—however debatable on other grounds—do not cause inflation because they do not add currency units to the economy; uncontrolled public spending and monetary excess do.

Growth, investment and a rare fiscal adjustment.

The performance of the U.S. economy in 2025 is extraordinary not just in relative terms, but on its own merits. Real GDP is growing by around 3.8%, with the Atlanta Fed tracking roughly 3.5% annualised in the third quarter, and private investment is expanding at close to double-digit rates. Crucially, this improvement is happening while federal spending is being cut, not expanded as in other peers: public expenditure has fallen by about 3% over the year instead of disguising poor growth with unproductive federal outlays.

All international institutions have had to adjust quickly. The IMF, which initially projected a much weaker performance, now expects U.S. growth of about 2.1% in 2026, and several major research houses have revised their forecasts for 2025 up to around 2.5%, after initially warning of zero or even negative growth. Some economists have publicly acknowledged that the profession misread both the resilience of the U.S. private sector and the real impact of the tariff shock, admitting that from January onwards the consensus The consensus was consistently incorrect about the direction of the economy.

The most important factor is that the American expansion is not due to another wave of debt-fuelled political spending but rather to the recovery of the private sector, investment, trade, and productivity. In a world where most developed nations’ governments responded to every problem with more spending, more debt and more regulation, the new U.S. strategy creates a significant difference, and the results are much better.

Inflation under control

The most significant deviation from the consensus narrative came from inflation. The Keynesian consensus that saw no inflation risk in 2021 when government spending and money supply were soaring unanimously warned in early 2025 that tariffs would push inflation to new annual highs, even above the peaks seen under the previous administration. Instead, by November the consumer price index stands at about 2.7%, below prior expectations of 3.0% and galaxies away from the 6–7% ruin scenario sold to the public.

Core inflation tells the same story. The underlying index, excluding food and energy, is running at around 2.6%, significantly lower than in September and October 2024, when the same commentators enthusiastically defended the Biden‑era mix of giant spending and rapid Fed rate cuts. Over the twelve months to November, the all‑items index has risen 2.7%, after 3.0% in the previous twelve‑month period, and core inflation has increased just 2.6%. There is no sign of a tariff‑induced inflation wave in aggregate prices, only the inertia from the debt and spending binge inherited in 2024.

If anything, the trajectory suggests that as final data come in—particularly for food and energy components—the reported CPI could end up even lower. Independent analysis shows a 2.5% inflation estimate for November.

The lesson is clear: it was never tariffs that drove the global inflation spike, but a combination of uncontrolled fiscal expansion and central banks monetising deficits. The U.S. experience in 2025 proved this point once again.

Deficit, debt, and the politics of discipline.

While many advanced economies continue to drift into deeper deficits and higher debt, the U.S. has managed a rare success: combining growth with early signs of fiscal consolidation. The federal deficit has fallen by roughly 22%, from about 2.07 trillion dollars in November 2024 to approximately 1.6 trillion a year later, thanks to a mix of higher tax and trade revenues and spending cuts. Measured as a share of GDP, the deficit has dropped from a disastrous 7.1% inherited from the previous administration to an estimated 5.9%. Considering that almost 97% of the 2025 budget was already spent when the Trump administration took office, due to prior spending decisions and the continuation bills approved in 2024, the deficit reduction is even more commendable.

The reduction has been accompanied by a major tax reform. Trump has implemented the largest tax cut in decades, bringing the tax wedge on families below 30%, according to estimates from the Tax Foundation. In most OECD economies, policy has been the opposite: higher taxes on work and capital, justified by short‑term revenue needs but negative for investment and productivity.

On the spending side, the numbers are even more remarkable given the starting point. The new administration inherited a budget almost fully pre‑committed. Continuation bills and prior decisions had already locked in around 97% of federal spending. However, federal outlays still fell by 5.6% in the first quarter of 2025 and 5.3% in the second, with total public spending down 3.1% in the first half of the year. Trump has ordered an 8% cut in federal spending for 2026, signalling that fiscal adjustments are a core policy priority.

Debt dynamics are also encouraging. The new administration took office with federal debt around 36.22 trillion dollars and a legacy of 100% of GDP in committed but unfunded liabilities and roughly 1.5 trillion in previously approved obligations. Despite this poisoned inheritance, the debt has stabilised and edged slightly down to about 36.21 trillion, while the debt‑to‑GDP ratio has declined from roughly 122% to 120%, according to the Federal Reserve and independent analysis figures. Even a modest reversal sends a powerful message.

Labour market: native workers improve, and government and immigration shrink.

The labour market picture may be the least understood aspect of the U.S. turnaround. November’s employment report shows the best month for native private‑sector employment in absolute, seasonally adjusted terms since 2015, with real wages rising and a clear shift away from public employment and low‑productivity jobs fuelled by uncontrolled immigration. Weekly real wages are up about 0.8% over the year, and workers in middle- and lower-income categories see real gains of roughly 1.4%. Net real wages after taxes are rising at the fastest pace in years.

The unemployment rate stands at 4.6%, higher than in Canada, the UK, France, Italy and the Eurozone average.

According to household survey data, native employment has increased from around 130.6 million in November 2024 to 133.3 million a year later—an addition of roughly 2.63 million jobs. Over the same period, foreign employment has fallen modestly, by about 21,000, and total public‑sector employment has dropped by 188,000.

This change—more native private-sector jobs and fewer government- and immigration-dependent jobs—is a huge difference compared with Canada, the UK, or most European economies, where employment gains include large public-sector and heavily subsidised job increases. The U.S. experience shows that a combination of deregulation, tax cuts and stricter control of public payrolls can still deliver better jobs and higher real wages for domestic workers.

Trade deals have been a success.

The evidence contradicts the notion that tariffs would destroy America’s position in global trade. The previous administration left behind a massive trade deficit—around 79.8 billion dollars in November 2024, seasonally adjusted, according to the Bureau of Economic Analysis. By September 2025, that deficit had fallen to roughly 52.8 billion, a reduction of about one-third compared with a year earlier.

The combination of targeted tariffs, renegotiated trade agreements, and a clearer defence of domestic industry has improved trade flows without triggering the inflation explosion that many had predicted.

Other improvements that matter.

The Trump administration has moved strongly on several fronts: banning central bank digital currencies, rolling back “woke” regulatory and freedom-of-speech limits, healthcare reform, and committing to scrap ten regulations for every new one approved. In foreign policy, Washington has pushed for a peace agreement in Gaza, a more realistic path to a solution in Ukraine based on pressure and sanctions on Russia, and stronger support for the return to democracy in countries like Venezuela.

The message for conservatives and centrists in Europe and Latin America is strong: If you want growth, jobs, and lower inflation, you cannot simply replicate the bureaucratic, high-tax, high-regulation model that has left much of the developed world stuck in secular stagnation. Trump may not fit the traditional label of a “classical liberal”, but the results of his first year in office show what a truly reformist conservative government can achieve.

For many in the international policy establishment, the uncomfortable reality is that the United States has delivered what others merely promised: stronger growth, controlled inflation, a narrower deficit, a better labour market for domestic workers, and initial stabilisation of debt. This has been achieved not by expanding the state and suppressing price signals, but by cutting taxes, reducing public spending, deregulating and trusting the private sector to respond.

Other advanced economies chose a different strategy: more bureaucracy, higher spending, and aggressive climate and social agendas financed with debt and taxes, and now find themselves in stagnation and a private sector recession despite favourable international energy prices reducing import expenses.

One year of Trump’s new term does not guarantee future success, and risks remain—from global shocks to central bank missteps—but it already offers an empirical challenge to the Keynesian consensus recommendations. If the U.S. had followed the net zero, big government and high tax policy suggestions of the mainstream consensus, it would now be in a disastrous fiscal and growth position, and inflation would be much higher, as the UK proves.

Mon, 12/22/2025 - 10:45

The same analysts and institutions that applauded massive stimulus, monetary excess and regulatory excess under the previous The same analysts and institutions that applauded massive stimulus, monetary excess, and regulatory excess under the previous administration now struggle to explain why the U.S. economy, which they expected to sink into stagflation, is instead outperforming all of its G7 peers. Furthermore, the U.S. peers that followed net-zero, big government and big tax policies are in secular stagnation.

From the “tariff tantrum” to a global surprise

When Trump announced his new wave of tariffs and trade policy, much of the global consensus rushed to predict a disaster. I called it the tariff tantrum. Commentators warned of an inflation surge beyond 2021 levels, 6%–7% Treasury yields, collapsing investment, a recession, and a world turning its back on the United States in favour of supposedly more responsible governments in Europe.

Twelve months later, none of those predictions materialised. Instead, the U.S. 10-year yield has fallen to 4.1%; the U.S. is the only G7 economy growing robustly, while those nations that doubled down on hyperregulation, aggressive climate‑driven restrictions, high taxes and ever‑bigger government spending are stuck in stagnation despite enjoying a very positive tailwind of low oil and gas prices.

The “tariff tantrum” never became the structural shock that critics announced, because tariffs—however debatable on other grounds—do not cause inflation because they do not add currency units to the economy; uncontrolled public spending and monetary excess do.

Growth, investment and a rare fiscal adjustment.

The performance of the U.S. economy in 2025 is extraordinary not just in relative terms, but on its own merits. Real GDP is growing by around 3.8%, with the Atlanta Fed tracking roughly 3.5% annualised in the third quarter, and private investment is expanding at close to double-digit rates. Crucially, this improvement is happening while federal spending is being cut, not expanded as in other peers: public expenditure has fallen by about 3% over the year instead of disguising poor growth with unproductive federal outlays.

All international institutions have had to adjust quickly. The IMF, which initially projected a much weaker performance, now expects U.S. growth of about 2.1% in 2026, and several major research houses have revised their forecasts for 2025 up to around 2.5%, after initially warning of zero or even negative growth. Some economists have publicly acknowledged that the profession misread both the resilience of the U.S. private sector and the real impact of the tariff shock, admitting that from January onwards the consensus The consensus was consistently incorrect about the direction of the economy.

The most important factor is that the American expansion is not due to another wave of debt-fuelled political spending but rather to the recovery of the private sector, investment, trade, and productivity. In a world where most developed nations’ governments responded to every problem with more spending, more debt and more regulation, the new U.S. strategy creates a significant difference, and the results are much better.

Inflation under control

The most significant deviation from the consensus narrative came from inflation. The Keynesian consensus that saw no inflation risk in 2021 when government spending and money supply were soaring unanimously warned in early 2025 that tariffs would push inflation to new annual highs, even above the peaks seen under the previous administration. Instead, by November the consumer price index stands at about 2.7%, below prior expectations of 3.0% and galaxies away from the 6–7% ruin scenario sold to the public.

Core inflation tells the same story. The underlying index, excluding food and energy, is running at around 2.6%, significantly lower than in September and October 2024, when the same commentators enthusiastically defended the Biden‑era mix of giant spending and rapid Fed rate cuts. Over the twelve months to November, the all‑items index has risen 2.7%, after 3.0% in the previous twelve‑month period, and core inflation has increased just 2.6%. There is no sign of a tariff‑induced inflation wave in aggregate prices, only the inertia from the debt and spending binge inherited in 2024.

If anything, the trajectory suggests that as final data come in—particularly for food and energy components—the reported CPI could end up even lower. Independent analysis shows a 2.5% inflation estimate for November.

The lesson is clear: it was never tariffs that drove the global inflation spike, but a combination of uncontrolled fiscal expansion and central banks monetising deficits. The U.S. experience in 2025 proved this point once again.

Deficit, debt, and the politics of discipline.

While many advanced economies continue to drift into deeper deficits and higher debt, the U.S. has managed a rare success: combining growth with early signs of fiscal consolidation. The federal deficit has fallen by roughly 22%, from about 2.07 trillion dollars in November 2024 to approximately 1.6 trillion a year later, thanks to a mix of higher tax and trade revenues and spending cuts. Measured as a share of GDP, the deficit has dropped from a disastrous 7.1% inherited from the previous administration to an estimated 5.9%. Considering that almost 97% of the 2025 budget was already spent when the Trump administration took office, due to prior spending decisions and the continuation bills approved in 2024, the deficit reduction is even more commendable.

The reduction has been accompanied by a major tax reform. Trump has implemented the largest tax cut in decades, bringing the tax wedge on families below 30%, according to estimates from the Tax Foundation. In most OECD economies, policy has been the opposite: higher taxes on work and capital, justified by short‑term revenue needs but negative for investment and productivity.

On the spending side, the numbers are even more remarkable given the starting point. The new administration inherited a budget almost fully pre‑committed. Continuation bills and prior decisions had already locked in around 97% of federal spending. However, federal outlays still fell by 5.6% in the first quarter of 2025 and 5.3% in the second, with total public spending down 3.1% in the first half of the year. Trump has ordered an 8% cut in federal spending for 2026, signalling that fiscal adjustments are a core policy priority.

Debt dynamics are also encouraging. The new administration took office with federal debt around 36.22 trillion dollars and a legacy of 100% of GDP in committed but unfunded liabilities and roughly 1.5 trillion in previously approved obligations. Despite this poisoned inheritance, the debt has stabilised and edged slightly down to about 36.21 trillion, while the debt‑to‑GDP ratio has declined from roughly 122% to 120%, according to the Federal Reserve and independent analysis figures. Even a modest reversal sends a powerful message.

Labour market: native workers improve, and government and immigration shrink.

The labour market picture may be the least understood aspect of the U.S. turnaround. November’s employment report shows the best month for native private‑sector employment in absolute, seasonally adjusted terms since 2015, with real wages rising and a clear shift away from public employment and low‑productivity jobs fuelled by uncontrolled immigration. Weekly real wages are up about 0.8% over the year, and workers in middle- and lower-income categories see real gains of roughly 1.4%. Net real wages after taxes are rising at the fastest pace in years.

The unemployment rate stands at 4.6%, higher than in Canada, the UK, France, Italy and the Eurozone average.

According to household survey data, native employment has increased from around 130.6 million in November 2024 to 133.3 million a year later—an addition of roughly 2.63 million jobs. Over the same period, foreign employment has fallen modestly, by about 21,000, and total public‑sector employment has dropped by 188,000.

This change—more native private-sector jobs and fewer government- and immigration-dependent jobs—is a huge difference compared with Canada, the UK, or most European economies, where employment gains include large public-sector and heavily subsidised job increases. The U.S. experience shows that a combination of deregulation, tax cuts and stricter control of public payrolls can still deliver better jobs and higher real wages for domestic workers.

Trade deals have been a success.

The evidence contradicts the notion that tariffs would destroy America’s position in global trade. The previous administration left behind a massive trade deficit—around 79.8 billion dollars in November 2024, seasonally adjusted, according to the Bureau of Economic Analysis. By September 2025, that deficit had fallen to roughly 52.8 billion, a reduction of about one-third compared with a year earlier.

The combination of targeted tariffs, renegotiated trade agreements, and a clearer defence of domestic industry has improved trade flows without triggering the inflation explosion that many had predicted.

Other improvements that matter.

The Trump administration has moved strongly on several fronts: banning central bank digital currencies, rolling back “woke” regulatory and freedom-of-speech limits, healthcare reform, and committing to scrap ten regulations for every new one approved. In foreign policy, Washington has pushed for a peace agreement in Gaza, a more realistic path to a solution in Ukraine based on pressure and sanctions on Russia, and stronger support for the return to democracy in countries like Venezuela.

The message for conservatives and centrists in Europe and Latin America is strong: If you want growth, jobs, and lower inflation, you cannot simply replicate the bureaucratic, high-tax, high-regulation model that has left much of the developed world stuck in secular stagnation. Trump may not fit the traditional label of a “classical liberal”, but the results of his first year in office show what a truly reformist conservative government can achieve.

For many in the international policy establishment, the uncomfortable reality is that the United States has delivered what others merely promised: stronger growth, controlled inflation, a narrower deficit, a better labour market for domestic workers, and initial stabilisation of debt. This has been achieved not by expanding the state and suppressing price signals, but by cutting taxes, reducing public spending, deregulating and trusting the private sector to respond.

Other advanced economies chose a different strategy: more bureaucracy, higher spending, and aggressive climate and social agendas financed with debt and taxes, and now find themselves in stagnation and a private sector recession despite favourable international energy prices reducing import expenses.

One year of Trump’s new term does not guarantee future success, and risks remain—from global shocks to central bank missteps—but it already offers an empirical challenge to the Keynesian consensus recommendations. If the U.S. had followed the net zero, big government and high tax policy suggestions of the mainstream consensus, it would now be in a disastrous fiscal and growth position, and inflation would be much higher, as the UK proves.

Mon, 12/22/2025 - 10:45

The same analysts and institutions that applauded massive stimulus, monetary excess and regulatory excess under the previous The same analysts and institutions that applauded massive stimulus, monetary excess, and regulatory excess under the previous administration now struggle to explain why the U.S. economy, which they expected to sink into stagflation, is instead outperforming all of its G7 peers. Furthermore, the U.S. peers that followed net-zero, big government and big tax policies are in secular stagnation.

From the “tariff tantrum” to a global surprise

When Trump announced his new wave of tariffs and trade policy, much of the global consensus rushed to predict a disaster. I called it the tariff tantrum. Commentators warned of an inflation surge beyond 2021 levels, 6%–7% Treasury yields, collapsing investment, a recession, and a world turning its back on the United States in favour of supposedly more responsible governments in Europe.

Twelve months later, none of those predictions materialised. Instead, the U.S. 10-year yield has fallen to 4.1%; the U.S. is the only G7 economy growing robustly, while those nations that doubled down on hyperregulation, aggressive climate‑driven restrictions, high taxes and ever‑bigger government spending are stuck in stagnation despite enjoying a very positive tailwind of low oil and gas prices.

The “tariff tantrum” never became the structural shock that critics announced, because tariffs—however debatable on other grounds—do not cause inflation because they do not add currency units to the economy; uncontrolled public spending and monetary excess do.

Growth, investment and a rare fiscal adjustment.

The performance of the U.S. economy in 2025 is extraordinary not just in relative terms, but on its own merits. Real GDP is growing by around 3.8%, with the Atlanta Fed tracking roughly 3.5% annualised in the third quarter, and private investment is expanding at close to double-digit rates. Crucially, this improvement is happening while federal spending is being cut, not expanded as in other peers: public expenditure has fallen by about 3% over the year instead of disguising poor growth with unproductive federal outlays.

All international institutions have had to adjust quickly. The IMF, which initially projected a much weaker performance, now expects U.S. growth of about 2.1% in 2026, and several major research houses have revised their forecasts for 2025 up to around 2.5%, after initially warning of zero or even negative growth. Some economists have publicly acknowledged that the profession misread both the resilience of the U.S. private sector and the real impact of the tariff shock, admitting that from January onwards the consensus The consensus was consistently incorrect about the direction of the economy.

The most important factor is that the American expansion is not due to another wave of debt-fuelled political spending but rather to the recovery of the private sector, investment, trade, and productivity. In a world where most developed nations’ governments responded to every problem with more spending, more debt and more regulation, the new U.S. strategy creates a significant difference, and the results are much better.

Inflation under control

The most significant deviation from the consensus narrative came from inflation. The Keynesian consensus that saw no inflation risk in 2021 when government spending and money supply were soaring unanimously warned in early 2025 that tariffs would push inflation to new annual highs, even above the peaks seen under the previous administration. Instead, by November the consumer price index stands at about 2.7%, below prior expectations of 3.0% and galaxies away from the 6–7% ruin scenario sold to the public.

Core inflation tells the same story. The underlying index, excluding food and energy, is running at around 2.6%, significantly lower than in September and October 2024, when the same commentators enthusiastically defended the Biden‑era mix of giant spending and rapid Fed rate cuts. Over the twelve months to November, the all‑items index has risen 2.7%, after 3.0% in the previous twelve‑month period, and core inflation has increased just 2.6%. There is no sign of a tariff‑induced inflation wave in aggregate prices, only the inertia from the debt and spending binge inherited in 2024.

If anything, the trajectory suggests that as final data come in—particularly for food and energy components—the reported CPI could end up even lower. Independent analysis shows a 2.5% inflation estimate for November.

The lesson is clear: it was never tariffs that drove the global inflation spike, but a combination of uncontrolled fiscal expansion and central banks monetising deficits. The U.S. experience in 2025 proved this point once again.

Deficit, debt, and the politics of discipline.

While many advanced economies continue to drift into deeper deficits and higher debt, the U.S. has managed a rare success: combining growth with early signs of fiscal consolidation. The federal deficit has fallen by roughly 22%, from about 2.07 trillion dollars in November 2024 to approximately 1.6 trillion a year later, thanks to a mix of higher tax and trade revenues and spending cuts. Measured as a share of GDP, the deficit has dropped from a disastrous 7.1% inherited from the previous administration to an estimated 5.9%. Considering that almost 97% of the 2025 budget was already spent when the Trump administration took office, due to prior spending decisions and the continuation bills approved in 2024, the deficit reduction is even more commendable.

The reduction has been accompanied by a major tax reform. Trump has implemented the largest tax cut in decades, bringing the tax wedge on families below 30%, according to estimates from the Tax Foundation. In most OECD economies, policy has been the opposite: higher taxes on work and capital, justified by short‑term revenue needs but negative for investment and productivity.

On the spending side, the numbers are even more remarkable given the starting point. The new administration inherited a budget almost fully pre‑committed. Continuation bills and prior decisions had already locked in around 97% of federal spending. However, federal outlays still fell by 5.6% in the first quarter of 2025 and 5.3% in the second, with total public spending down 3.1% in the first half of the year. Trump has ordered an 8% cut in federal spending for 2026, signalling that fiscal adjustments are a core policy priority.

Debt dynamics are also encouraging. The new administration took office with federal debt around 36.22 trillion dollars and a legacy of 100% of GDP in committed but unfunded liabilities and roughly 1.5 trillion in previously approved obligations. Despite this poisoned inheritance, the debt has stabilised and edged slightly down to about 36.21 trillion, while the debt‑to‑GDP ratio has declined from roughly 122% to 120%, according to the Federal Reserve and independent analysis figures. Even a modest reversal sends a powerful message.

Labour market: native workers improve, and government and immigration shrink.

The labour market picture may be the least understood aspect of the U.S. turnaround. November’s employment report shows the best month for native private‑sector employment in absolute, seasonally adjusted terms since 2015, with real wages rising and a clear shift away from public employment and low‑productivity jobs fuelled by uncontrolled immigration. Weekly real wages are up about 0.8% over the year, and workers in middle- and lower-income categories see real gains of roughly 1.4%. Net real wages after taxes are rising at the fastest pace in years.

The unemployment rate stands at 4.6%, higher than in Canada, the UK, France, Italy and the Eurozone average.

According to household survey data, native employment has increased from around 130.6 million in November 2024 to 133.3 million a year later—an addition of roughly 2.63 million jobs. Over the same period, foreign employment has fallen modestly, by about 21,000, and total public‑sector employment has dropped by 188,000.

This change—more native private-sector jobs and fewer government- and immigration-dependent jobs—is a huge difference compared with Canada, the UK, or most European economies, where employment gains include large public-sector and heavily subsidised job increases. The U.S. experience shows that a combination of deregulation, tax cuts and stricter control of public payrolls can still deliver better jobs and higher real wages for domestic workers.

Trade deals have been a success.

The evidence contradicts the notion that tariffs would destroy America’s position in global trade. The previous administration left behind a massive trade deficit—around 79.8 billion dollars in November 2024, seasonally adjusted, according to the Bureau of Economic Analysis. By September 2025, that deficit had fallen to roughly 52.8 billion, a reduction of about one-third compared with a year earlier.

The combination of targeted tariffs, renegotiated trade agreements, and a clearer defence of domestic industry has improved trade flows without triggering the inflation explosion that many had predicted.

Other improvements that matter.

The Trump administration has moved strongly on several fronts: banning central bank digital currencies, rolling back “woke” regulatory and freedom-of-speech limits, healthcare reform, and committing to scrap ten regulations for every new one approved. In foreign policy, Washington has pushed for a peace agreement in Gaza, a more realistic path to a solution in Ukraine based on pressure and sanctions on Russia, and stronger support for the return to democracy in countries like Venezuela.

The message for conservatives and centrists in Europe and Latin America is strong: If you want growth, jobs, and lower inflation, you cannot simply replicate the bureaucratic, high-tax, high-regulation model that has left much of the developed world stuck in secular stagnation. Trump may not fit the traditional label of a “classical liberal”, but the results of his first year in office show what a truly reformist conservative government can achieve.

For many in the international policy establishment, the uncomfortable reality is that the United States has delivered what others merely promised: stronger growth, controlled inflation, a narrower deficit, a better labour market for domestic workers, and initial stabilisation of debt. This has been achieved not by expanding the state and suppressing price signals, but by cutting taxes, reducing public spending, deregulating and trusting the private sector to respond.

Other advanced economies chose a different strategy: more bureaucracy, higher spending, and aggressive climate and social agendas financed with debt and taxes, and now find themselves in stagnation and a private sector recession despite favourable international energy prices reducing import expenses.

One year of Trump’s new term does not guarantee future success, and risks remain—from global shocks to central bank missteps—but it already offers an empirical challenge to the Keynesian consensus recommendations. If the U.S. had followed the net zero, big government and high tax policy suggestions of the mainstream consensus, it would now be in a disastrous fiscal and growth position, and inflation would be much higher, as the UK proves.

The same analysts and institutions that applauded massive stimulus, monetary excess and regulatory excess under the previous The same analysts and institutions that applauded massive stimulus, monetary excess, and regulatory excess under the previous administration now struggle to explain why the U.S. economy, which they expected to sink into stagflation, is instead outperforming all of its G7 peers. Furthermore, the U.S. peers that followed net-zero, big government and big tax policies are in secular stagnation.

From the “tariff tantrum” to a global surprise

When Trump announced his new wave of tariffs and trade policy, much of the global consensus rushed to predict a disaster. I called it the tariff tantrum. Commentators warned of an inflation surge beyond 2021 levels, 6%–7% Treasury yields, collapsing investment, a recession, and a world turning its back on the United States in favour of supposedly more responsible governments in Europe.

Twelve months later, none of those predictions materialised. Instead, the U.S. 10-year yield has fallen to 4.1%; the U.S. is the only G7 economy growing robustly, while those nations that doubled down on hyperregulation, aggressive climate‑driven restrictions, high taxes and ever‑bigger government spending are stuck in stagnation despite enjoying a very positive tailwind of low oil and gas prices.

The “tariff tantrum” never became the structural shock that critics announced, because tariffs—however debatable on other grounds—do not cause inflation because they do not add currency units to the economy; uncontrolled public spending and monetary excess do.

Growth, investment and a rare fiscal adjustment.

The performance of the U.S. economy in 2025 is extraordinary not just in relative terms, but on its own merits. Real GDP is growing by around 3.8%, with the Atlanta Fed tracking roughly 3.5% annualised in the third quarter, and private investment is expanding at close to double-digit rates. Crucially, this improvement is happening while federal spending is being cut, not expanded as in other peers: public expenditure has fallen by about 3% over the year instead of disguising poor growth with unproductive federal outlays.

All international institutions have had to adjust quickly. The IMF, which initially projected a much weaker performance, now expects U.S. growth of about 2.1% in 2026, and several major research houses have revised their forecasts for 2025 up to around 2.5%, after initially warning of zero or even negative growth. Some economists have publicly acknowledged that the profession misread both the resilience of the U.S. private sector and the real impact of the tariff shock, admitting that from January onwards the consensus The consensus was consistently incorrect about the direction of the economy.

The most important factor is that the American expansion is not due to another wave of debt-fuelled political spending but rather to the recovery of the private sector, investment, trade, and productivity. In a world where most developed nations’ governments responded to every problem with more spending, more debt and more regulation, the new U.S. strategy creates a significant difference, and the results are much better.

Inflation under control

The most significant deviation from the consensus narrative came from inflation. The Keynesian consensus that saw no inflation risk in 2021 when government spending and money supply were soaring unanimously warned in early 2025 that tariffs would push inflation to new annual highs, even above the peaks seen under the previous administration. Instead, by November the consumer price index stands at about 2.7%, below prior expectations of 3.0% and galaxies away from the 6–7% ruin scenario sold to the public.

Core inflation tells the same story. The underlying index, excluding food and energy, is running at around 2.6%, significantly lower than in September and October 2024, when the same commentators enthusiastically defended the Biden‑era mix of giant spending and rapid Fed rate cuts. Over the twelve months to November, the all‑items index has risen 2.7%, after 3.0% in the previous twelve‑month period, and core inflation has increased just 2.6%. There is no sign of a tariff‑induced inflation wave in aggregate prices, only the inertia from the debt and spending binge inherited in 2024.

If anything, the trajectory suggests that as final data come in—particularly for food and energy components—the reported CPI could end up even lower. Independent analysis shows a 2.5% inflation estimate for November.

The lesson is clear: it was never tariffs that drove the global inflation spike, but a combination of uncontrolled fiscal expansion and central banks monetising deficits. The U.S. experience in 2025 proved this point once again.

Deficit, debt, and the politics of discipline.

While many advanced economies continue to drift into deeper deficits and higher debt, the U.S. has managed a rare success: combining growth with early signs of fiscal consolidation. The federal deficit has fallen by roughly 22%, from about 2.07 trillion dollars in November 2024 to approximately 1.6 trillion a year later, thanks to a mix of higher tax and trade revenues and spending cuts. Measured as a share of GDP, the deficit has dropped from a disastrous 7.1% inherited from the previous administration to an estimated 5.9%. Considering that almost 97% of the 2025 budget was already spent when the Trump administration took office, due to prior spending decisions and the continuation bills approved in 2024, the deficit reduction is even more commendable.

The reduction has been accompanied by a major tax reform. Trump has implemented the largest tax cut in decades, bringing the tax wedge on families below 30%, according to estimates from the Tax Foundation. In most OECD economies, policy has been the opposite: higher taxes on work and capital, justified by short‑term revenue needs but negative for investment and productivity.

On the spending side, the numbers are even more remarkable given the starting point. The new administration inherited a budget almost fully pre‑committed. Continuation bills and prior decisions had already locked in around 97% of federal spending. However, federal outlays still fell by 5.6% in the first quarter of 2025 and 5.3% in the second, with total public spending down 3.1% in the first half of the year. Trump has ordered an 8% cut in federal spending for 2026, signalling that fiscal adjustments are a core policy priority.

Debt dynamics are also encouraging. The new administration took office with federal debt around 36.22 trillion dollars and a legacy of 100% of GDP in committed but unfunded liabilities and roughly 1.5 trillion in previously approved obligations. Despite this poisoned inheritance, the debt has stabilised and edged slightly down to about 36.21 trillion, while the debt‑to‑GDP ratio has declined from roughly 122% to 120%, according to the Federal Reserve and independent analysis figures. Even a modest reversal sends a powerful message.

Labour market: native workers improve, and government and immigration shrink.

The labour market picture may be the least understood aspect of the U.S. turnaround. November’s employment report shows the best month for native private‑sector employment in absolute, seasonally adjusted terms since 2015, with real wages rising and a clear shift away from public employment and low‑productivity jobs fuelled by uncontrolled immigration. Weekly real wages are up about 0.8% over the year, and workers in middle- and lower-income categories see real gains of roughly 1.4%. Net real wages after taxes are rising at the fastest pace in years.

The unemployment rate stands at 4.6%, higher than in Canada, the UK, France, Italy and the Eurozone average.

According to household survey data, native employment has increased from around 130.6 million in November 2024 to 133.3 million a year later—an addition of roughly 2.63 million jobs. Over the same period, foreign employment has fallen modestly, by about 21,000, and total public‑sector employment has dropped by 188,000.

This change—more native private-sector jobs and fewer government- and immigration-dependent jobs—is a huge difference compared with Canada, the UK, or most European economies, where employment gains include large public-sector and heavily subsidised job increases. The U.S. experience shows that a combination of deregulation, tax cuts and stricter control of public payrolls can still deliver better jobs and higher real wages for domestic workers.

Trade deals have been a success.

The evidence contradicts the notion that tariffs would destroy America’s position in global trade. The previous administration left behind a massive trade deficit—around 79.8 billion dollars in November 2024, seasonally adjusted, according to the Bureau of Economic Analysis. By September 2025, that deficit had fallen to roughly 52.8 billion, a reduction of about one-third compared with a year earlier.

The combination of targeted tariffs, renegotiated trade agreements, and a clearer defence of domestic industry has improved trade flows without triggering the inflation explosion that many had predicted.

Other improvements that matter.

The Trump administration has moved strongly on several fronts: banning central bank digital currencies, rolling back “woke” regulatory and freedom-of-speech limits, healthcare reform, and committing to scrap ten regulations for every new one approved. In foreign policy, Washington has pushed for a peace agreement in Gaza, a more realistic path to a solution in Ukraine based on pressure and sanctions on Russia, and stronger support for the return to democracy in countries like Venezuela.

The message for conservatives and centrists in Europe and Latin America is strong: If you want growth, jobs, and lower inflation, you cannot simply replicate the bureaucratic, high-tax, high-regulation model that has left much of the developed world stuck in secular stagnation. Trump may not fit the traditional label of a “classical liberal”, but the results of his first year in office show what a truly reformist conservative government can achieve.

For many in the international policy establishment, the uncomfortable reality is that the United States has delivered what others merely promised: stronger growth, controlled inflation, a narrower deficit, a better labour market for domestic workers, and initial stabilisation of debt. This has been achieved not by expanding the state and suppressing price signals, but by cutting taxes, reducing public spending, deregulating and trusting the private sector to respond.

Other advanced economies chose a different strategy: more bureaucracy, higher spending, and aggressive climate and social agendas financed with debt and taxes, and now find themselves in stagnation and a private sector recession despite favourable international energy prices reducing import expenses.

One year of Trump’s new term does not guarantee future success, and risks remain—from global shocks to central bank missteps—but it already offers an empirical challenge to the Keynesian consensus recommendations. If the U.S. had followed the net zero, big government and high tax policy suggestions of the mainstream consensus, it would now be in a disastrous fiscal and growth position, and inflation would be much higher, as the UK proves.

Tyler Durden | Zero Hedge

Zero Hedge

The US Economy Is Stronger After One Year Of The Trump Administration | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The five-member commission on Dec. 19 unanimously approved a

The five-member commission on Dec. 19 unanimously approved a

‘Trade Secrets’

Under its “stipulated agreement” with the commission’s Public Interest Advocacy staff, Georgia Power

‘Trade Secrets’

Under its “stipulated agreement” with the commission’s Public Interest Advocacy staff, Georgia Power

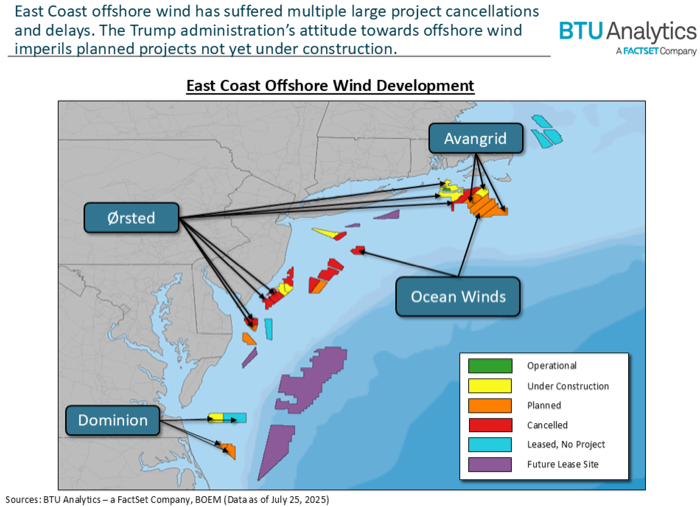

Orested shares in Eruope puke after Burgum's comments:

Orested shares in Eruope puke after Burgum's comments:

The move is the latest in a series of efforts by the Trump administration to hinder uneconomical offshore wind power, which is currently locked in a legal battle.

"ONE natural gas pipeline supplies as much energy as these 5 projects COMBINED. POTUS is bringing common sense back to energy policy & putting security FIRST,"

The move is the latest in a series of efforts by the Trump administration to hinder uneconomical offshore wind power, which is currently locked in a legal battle.

"ONE natural gas pipeline supplies as much energy as these 5 projects COMBINED. POTUS is bringing common sense back to energy policy & putting security FIRST,"

The move signals a broader culture shift in Big Tech, where woke agendas are crumbling under pressure from free speech advocates. It’s no coincidence this comes after Elon Musk turned Twitter into X, a platform where ideas flow without the heavy hand of ideological gatekeepers.

Google, which has demonetized, shadow-banned, and outright censored content that doesn’t align with leftist narratives, now positions itself as a defender of open discourse, accusing Britain of threatening to stifle free speech in an escalation of US opposition to online safety rules.

🔴 Google has accused Britain of threatening to stifle free speech in an escalation of US opposition to online safety rules

The move signals a broader culture shift in Big Tech, where woke agendas are crumbling under pressure from free speech advocates. It’s no coincidence this comes after Elon Musk turned Twitter into X, a platform where ideas flow without the heavy hand of ideological gatekeepers.

Google, which has demonetized, shadow-banned, and outright censored content that doesn’t align with leftist narratives, now positions itself as a defender of open discourse, accusing Britain of threatening to stifle free speech in an escalation of US opposition to online safety rules.

🔴 Google has accused Britain of threatening to stifle free speech in an escalation of US opposition to online safety rules

In premarket trading, Nvidia and Tesla lead gains among the Mag 7 tech stocks as sentiment toward AI-exposed companies improves following Micron Technology’s results last week. Nvidia has told Chinese clients it aims to ship its second-most powerful AI chips to China by mid-February, Reuters reports, citing people familiar with the matter. (NVDA +1.7%, TSLA +1.2%, GOOGL +0.5%, AMZN +0.4%, META +0.4%, MSFT +0.3%, AAPL is little changed).

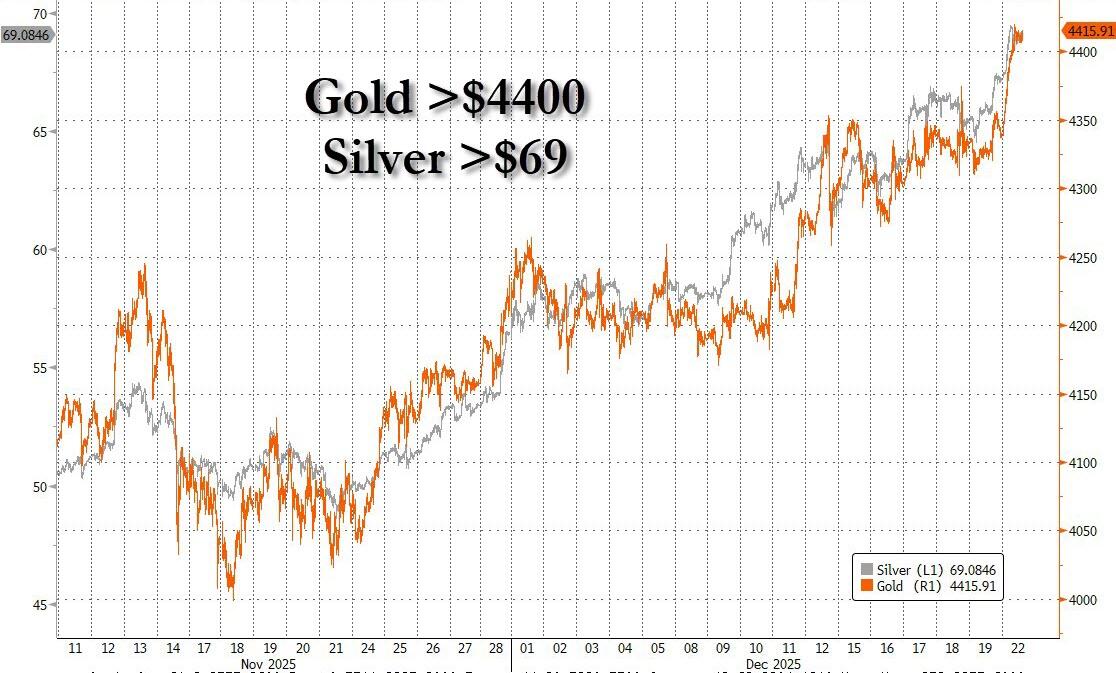

Gold and silver miners advance after prices of both precious metals hit record highs. Newmont (NEM) climbs 2% and Coeur Mining (CDE) rises 4%.

Clearwater Analytics Holdings Inc. (CWAN) is up 8% as a group of private equity firms led by Permira and Warburg Pincus has agreed to acquire the investment and accounting software maker in a deal valuing it at $8.4 billion including debt.

Honeywell (HON) slips 1% after the industrial conglomerate adjusted its full-year and fourth quarter 2025 guidance to reflect the reclassification of its Advanced Materials business — now Solstice Advanced Materials Inc. — as it discontinued operations following its spinoff on October 30.

Marvell Technology (MRVL) rises 2% after Citi opened a positive catalyst watch on the chipmaker ahead of next month’s CES conference.

Rocket Lab (RKLB) gains 4% after saying late Friday that it won a contract to design and build 18 satellites, the company’s largest single contract to date.

T1 Energy (TE) climbs 7% after it signed a three-year contract to supply Treaty Oak Clean Energy with a minimum of 900MW of solar modules built with domestic solar cells from T1’s planned G2_Austin solar cell fab.

A year-end rally in stocks is taking hold, with investors positive about further gains in 2026, although volumes are set to be thinner in this holiday-shortened trading week. Sentiment has been bullish for three weeks in a row, according to Deutsche Bank strategists. Meanwhile, in commodities, oil rose as Trump intensified a blockade on Venezuela. Gold and silver soared to all-time highs on the escalating geopolitical tensions and bets on Fed rate cuts.

In premarket trading, Nvidia and Tesla lead gains among the Mag 7 tech stocks as sentiment toward AI-exposed companies improves following Micron Technology’s results last week. Nvidia has told Chinese clients it aims to ship its second-most powerful AI chips to China by mid-February, Reuters reports, citing people familiar with the matter. (NVDA +1.7%, TSLA +1.2%, GOOGL +0.5%, AMZN +0.4%, META +0.4%, MSFT +0.3%, AAPL is little changed).

Gold and silver miners advance after prices of both precious metals hit record highs. Newmont (NEM) climbs 2% and Coeur Mining (CDE) rises 4%.

Clearwater Analytics Holdings Inc. (CWAN) is up 8% as a group of private equity firms led by Permira and Warburg Pincus has agreed to acquire the investment and accounting software maker in a deal valuing it at $8.4 billion including debt.

Honeywell (HON) slips 1% after the industrial conglomerate adjusted its full-year and fourth quarter 2025 guidance to reflect the reclassification of its Advanced Materials business — now Solstice Advanced Materials Inc. — as it discontinued operations following its spinoff on October 30.

Marvell Technology (MRVL) rises 2% after Citi opened a positive catalyst watch on the chipmaker ahead of next month’s CES conference.

Rocket Lab (RKLB) gains 4% after saying late Friday that it won a contract to design and build 18 satellites, the company’s largest single contract to date.

T1 Energy (TE) climbs 7% after it signed a three-year contract to supply Treaty Oak Clean Energy with a minimum of 900MW of solar modules built with domestic solar cells from T1’s planned G2_Austin solar cell fab.

A year-end rally in stocks is taking hold, with investors positive about further gains in 2026, although volumes are set to be thinner in this holiday-shortened trading week. Sentiment has been bullish for three weeks in a row, according to Deutsche Bank strategists. Meanwhile, in commodities, oil rose as Trump intensified a blockade on Venezuela. Gold and silver soared to all-time highs on the escalating geopolitical tensions and bets on Fed rate cuts.

“It has been very remarkable how precious metals’ prices have decorrelated from other assets in recent months,” said Roberto Scholtes, head of strategy at Singular Bank. “Earlier this year, gold prices were materially correlated to the dollar and to high-beta risk assets such as tech stocks and cryptos. But this has been waning gradually, and nowadays they’re running freely.”

The focus on price moves in commodities went beyond record-setting metals, with oil climbing amid heightened geopolitical tensions after the US stepped up a blockade on Venezuela.

Bullishness toward stocks has pushed positioning higher, while fund managers are maintaining record low levels of cash, according to the latest BofA Fund Manager Survey. They are betting on a further rally next year, despite concerns in some quarters over rich valuations, heavy artificial intelligence capex and potentially over-optimistic earnings expectations. Separately, Goldman strategists say the economic outlook is supportive for small-cap stocks, a factor that’s underpriced by the market. The Russell 2000 is likely to advance 10% in 2026, close to the 12% return expected in the S&P 500, they say.

Optimism for a year-end rally in equities are growing after dip buyers late last week supported a rebound in US stocks. While some doubts about the AI trade and elevated valuations persist, optimism over the economy and corporate earnings is helping lift sentiment.

“Markets are riding a risk-on liquidity wave into year-end as resilient US growth underpins earnings next year, while a lower Fed fund rate eases financial conditions,” said Desmond Tjiang, chief investment officer for equities and multi-asset investment at BEA Union Investment. “Fears of AI capex and returns also recede on improving compute economics.”

Unlike the US, enthusiasm for European equities is missing on Monday as the Stoxx 600 slips 0.2% with utilities as well as food and beverage shares among the biggest laggards. Meanwhile, miners outperform as traders monitor the geopolitical outlook in Venezuela. Here are some of the biggest movers on Monday:

Saipem shares rise as much as 4.3%, the most since July, after the Italian energy services and drilling specialist wins an offshore EPCI Contract Worth $3.1 Billion by QatarEnergy LNG.

Fresnillo shares climb as much as 3% to a record high, leading a rally in mining stocks as gold, silver and copper prices hit record highs.

Gruvaktiebolaget Viscaria shares rise as much as 17%, the most in more than a year, after Handelsbanken initiated coverage of the Swedish mining company’s stock with a buy rating, calling its growth potential attractive.

Rank Group shares decline as much as 9.1%, hitting the lowest level since mid-May, after the gambling firm said its Spanish businesses, Enracha and Yo, were targeted by payment fraud totaling about €7.1 million.

ASP Isotopes shares plunge as much as 50% in Johannesburg after Bronstein, Gewirtz & Grossman said it is investigating potential claims on behalf of purchasers.

Fenerbahce shares fall as much as 3.5% in Istanbul to the lowest level since May after state-run Anadolu Agency reported the sports club’s chairman was questioned as part of an investigation into illegal drug use.

Pantheon Resources shares drop as much as 58%, the most since April 2018, after pausing testing of the Dubhe-1 well, citing cost profile of winter operations and focus on “disciplined” capital allocation.

In rates, Japanese yields remain center stage, with the 10-year segment hitting its highest level since 1999. The yield is 6bps higher today, amid speculation the Bank of Japan may need to raise interest rates more aggressively. This has spilled into other global benchmarks, lifting US, UK and German yields by 1-2bps. US yields cheaper by 1bp to 2bp across the curve with 2s10s, 5s30s spreads steeper by 1.2bp and 1bp on the day. US 10-year yields trade around 4.165%, cheaper by 1.5bp vs.

“It has been very remarkable how precious metals’ prices have decorrelated from other assets in recent months,” said Roberto Scholtes, head of strategy at Singular Bank. “Earlier this year, gold prices were materially correlated to the dollar and to high-beta risk assets such as tech stocks and cryptos. But this has been waning gradually, and nowadays they’re running freely.”

The focus on price moves in commodities went beyond record-setting metals, with oil climbing amid heightened geopolitical tensions after the US stepped up a blockade on Venezuela.

Bullishness toward stocks has pushed positioning higher, while fund managers are maintaining record low levels of cash, according to the latest BofA Fund Manager Survey. They are betting on a further rally next year, despite concerns in some quarters over rich valuations, heavy artificial intelligence capex and potentially over-optimistic earnings expectations. Separately, Goldman strategists say the economic outlook is supportive for small-cap stocks, a factor that’s underpriced by the market. The Russell 2000 is likely to advance 10% in 2026, close to the 12% return expected in the S&P 500, they say.

Optimism for a year-end rally in equities are growing after dip buyers late last week supported a rebound in US stocks. While some doubts about the AI trade and elevated valuations persist, optimism over the economy and corporate earnings is helping lift sentiment.

“Markets are riding a risk-on liquidity wave into year-end as resilient US growth underpins earnings next year, while a lower Fed fund rate eases financial conditions,” said Desmond Tjiang, chief investment officer for equities and multi-asset investment at BEA Union Investment. “Fears of AI capex and returns also recede on improving compute economics.”

Unlike the US, enthusiasm for European equities is missing on Monday as the Stoxx 600 slips 0.2% with utilities as well as food and beverage shares among the biggest laggards. Meanwhile, miners outperform as traders monitor the geopolitical outlook in Venezuela. Here are some of the biggest movers on Monday:

Saipem shares rise as much as 4.3%, the most since July, after the Italian energy services and drilling specialist wins an offshore EPCI Contract Worth $3.1 Billion by QatarEnergy LNG.

Fresnillo shares climb as much as 3% to a record high, leading a rally in mining stocks as gold, silver and copper prices hit record highs.

Gruvaktiebolaget Viscaria shares rise as much as 17%, the most in more than a year, after Handelsbanken initiated coverage of the Swedish mining company’s stock with a buy rating, calling its growth potential attractive.

Rank Group shares decline as much as 9.1%, hitting the lowest level since mid-May, after the gambling firm said its Spanish businesses, Enracha and Yo, were targeted by payment fraud totaling about €7.1 million.

ASP Isotopes shares plunge as much as 50% in Johannesburg after Bronstein, Gewirtz & Grossman said it is investigating potential claims on behalf of purchasers.

Fenerbahce shares fall as much as 3.5% in Istanbul to the lowest level since May after state-run Anadolu Agency reported the sports club’s chairman was questioned as part of an investigation into illegal drug use.

Pantheon Resources shares drop as much as 58%, the most since April 2018, after pausing testing of the Dubhe-1 well, citing cost profile of winter operations and focus on “disciplined” capital allocation.

In rates, Japanese yields remain center stage, with the 10-year segment hitting its highest level since 1999. The yield is 6bps higher today, amid speculation the Bank of Japan may need to raise interest rates more aggressively. This has spilled into other global benchmarks, lifting US, UK and German yields by 1-2bps. US yields cheaper by 1bp to 2bp across the curve with 2s10s, 5s30s spreads steeper by 1.2bp and 1bp on the day. US 10-year yields trade around 4.165%, cheaper by 1.5bp vs.

In Asia, stocks extended gains, as tech firms tracked their US peers higher in a holiday-shortened week. The MSCI Asia Pacific Index climbed as much as 1.1%, with TSMC and Samsung Electronics supporting the gauge higher. Tech-heavy benchmarks in Taiwan and South Korea led gains in the region with a more than 1.5% increase each. Japan and Hong Kong shares also advanced. Here Are the Most Notable Asian Movers

Kokusai Electric and Tokyo Electron shares climbed after Morgan Stanley MUFG analysts raised ratings and price targets for the stocks on signs of a recovery in demand for front-end semiconductor equipment. Meanwhile, Nidec shares rose after news the Japanese electronic component company’s founder Shigenobu Nagamori is stepping down from his position as chairman of the board.

Shriram Finance shares surge to a record after analysts saw Mitsubishi UFJ Financial Group’s $4.4 billion investment improving prospects of a credit rating upgrade.

Mixue Group shares surge as much as 13% in Hong Kong, the most since March 7, after the Chinese fresh tea maker opened its first store in the US.

Moore Threads shares rise as much as 4.2% after the company unveiled a new generation of chips aimed at reducing dependence on Nvidia Corp.’s hardware.

WiseTech shares drop as much as 4.7%, the most since Nov. 18, after Executive Chair Richard White’s investment vehicle RealWise entered into a collar derivative transaction.

Seatrium shares gain after the offshore engineering company reached an agreement with Maersk Offshore Wind’s affiliate Phoenix II A/S to deliver a wind turbine installation vessel by Feb. 28.

Kokusai Electric and Tokyo Electron shares climbed Monday after Morgan Stanley MUFG analysts raised ratings and price targets for the stocks on signs of a recovery in demand for front-end semiconductor equipment.

Daikin shares rose as much as 2.7%, the most since Nov. 20, after SMBC Nikko Securities raised the Japanese air conditioner maker to outperform from neutral on expectations for demand recovery and capital efficiency improvement.

Nidec shares climb as much as 7.3%, the most since Nov. 11, after news the Japanese electronic component company’s founder Shigenobu Nagamori is stepping down from his position as chairman of the board.

This week’s Treasury auctions kick-off at 1pm New York with $69 billion 2-year notes, followed by $70 billion 5-year notes and $44 billion 7-year notes Tuesday and Wednesday. Before today’s auction, the WI 2-year currently trades around 3.482% which is ~0.7bp richer than November’s sale

In FX, the upside in Japanese yields and officials’ jawboning has supported the yen versus the dollar. Bloomberg’s Dollar Index is down 0.2%, pressured also by the outperformance in AUD, NZD and GBP.

In commodities, as noted above, gold and silver sit at record highs, up 1.6% and 2.8% respectively. WTI crude oil futures are up 1.9% as the US pursues a third tanker in Venezuela. Bitcoin continues to rise, up 1.8%.

The US economic calendar includes September Chicago Fed national activity index (8:30am). No Fed members scheduled to speak for the session

Market Snapshot

S&P 500 mini +0.4%

Nasdaq 100 mini +0.6%

Russell 2000 mini +0.4%

Stoxx Europe 600 -0.2%

DAX little changed

CAC 40 -0.4%

10-year Treasury yield +2 basis points at 4.16%

VIX +0.1 points at 15.05

Bloomberg Dollar Index -0.2% at 1207.51

euro +0.2% at $1.1737

WTI crude +1.2% at $57.17/barrel

Top Overnight News

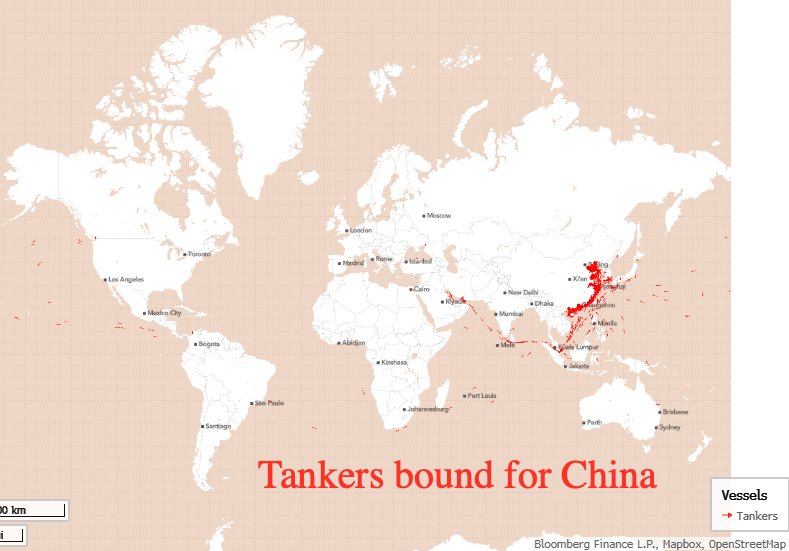

U.S. Coast Guard Chasing Another Tanker Involved in Shipping Venezuela Oil: WSJ

Russian General Is Killed After Car Bomb Explodes in Moscow: BBG

Paramount Amends Bid for Warner Discovery With New Ellison Guarantee: WSJ

Trump on Friday said he would call a meeting of insurance companies in the coming weeks to push them to cut prices and stay in the system.

Trump on Friday announced deals with nine pharmaceutical companies to cut prices on most drugs sold through Medicaid and lower cash-pay prices, while committing to most-favoured-nation pricing for future drugs, according to Reuters. The companies also pledged more than USD 150bln in US manufacturing and R&D investment, agreed to remit some foreign revenues to offset US costs, and received relief from US tariffs in return.

Charlie Kirk’s Empire Is Lining Up Behind a JD Vance Presidential Bid: WSJ

Vanke Averts Default as Bondholders Approve Longer Grace Period: BBG

Japan prepares to restart world's biggest nuclear plant, 15 years after Fukushima: RTRS

CBS News Pulls ‘60 Minutes’ Segment; Correspondent Calls Decision Political: WSJ

One of Elon Musk’s Old Enemies Joins the Race to Run GM: WSJ

Syrians emptied Assad’s prisons. They’re filling up again, and abuse is rife: RTRS

Toxic Fumes on Planes Blamed for Deaths of Pilots and Crew: WSJ

The Warner Deal: Cinema owners fear that Netflix or Paramount acquiring Warner could reduce number of theatrical releases or speed time to streaming platforms: WSJ

Trump names Louisiana governor as Greenland special envoy, prompting Danish alarm: RTRS

Central Banks

ECB's Kazmir said that the ECB remains flexible and will be ready to step in if needed. He is concerned about the long term growth prospect of the Eurozone.

Fed’s Hammack (2026 voter) said rates should be held steady into the spring after recent cuts, warning she was inflation-wary, noting November’s 2.7% CPI likely understated 12-month price growth due to data distortions, and suggesting the neutral interest rate was higher than commonly believed, the WSJ reported.

Former BoJ member Sakurai said the first hike to 1.0% could come around June or July and that the BoJ likely sees the neutral rate sitting somewhere around 1.75%.

Chinese Loan Prime Rate 5Y (Dec) 3.50% vs. Exp. 3.50% (Prev. 3.50%).

Chinese Loan Prime Rate 1Y (Dec) 3.00% vs. Exp. 3.00% (Prev. 3.00%).

Trade/Tariffs

China's Commerce Ministry is to impose levies of up to 42.2% on EU dairy products, effective 23rd December, following its anti-subsidy probe.

New Zealand concludes free trade agreement with India; deal set to be signed in H1 2026. India and New Zealand are confident of doubling bilateral trade over the next five years.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks kicked off the week with gains across the board as the region coat-tailed on the strength seen stateside. Tech outperformance continued across the region. ASX 200 edged higher as miners tracked gains in gold prices, with the yellow metal buoyed by a weekend packed with geopolitics Nikkei 225 was the clear outperformer as it topped 50.5k as the index cheered the post-BoJ JPY weakness on Friday alongside the global tech rally, whilst simultaneously overlooking the continuing rise in JGB yields. KOSPI was underpinned by its tech sector and following a month-to-date rise in exports. Hang Seng and Shanghai Comp conformed to the risk tone but with upside shallower than the above peers, with the PBoC LPR left unchanged as expected, whilst reports on Friday suggested US lawmakers urged the Pentagon to add DeepSeek and Xiaomi to the list of firms allegedly aiding the Chinese military.

Top Asian News

Japanese Chief Cabinet Secretary Kihara said will not comment on the forex market; recently seeing one-sided, rapid moves; important for currencies to move in a stable manner reflecting fundamentals; will take appropriate action against excessive moves. Closely watching the impact of higher interest rates while cooperating with the BoJ.

Japanese Top Currency Diplomat Mimura said he is recently seeing one-sided, rapid moves; will take appropriate action against excessive moves; concerned about forex moves.

China Vanke (2202 HK) bondholders approve the decision on a vote for 30-day extension of CNY 2bln bond, however rejecting one-year extension for 15th Dec CNY 2bln bond, via Reuters sources.

Goldman Sachs expect Chinese stocks to continue advancing in 2026, citing easing geopolitical tensions and as investors household savings begin flowing to equities as interest rates fall. Analyst Kinger Lau writes that "we expect the bull run to continue, but at a slower pace". Though the firm highlights some main risks to the upside, including; global recession, AI exuberance, US-China tensions and disinflation. Finally, analysts suggest that the macro / equity-market policies remain in effect which should shift the expected fair value of Chinese stocks upward.

European equities (STOXX 600 -0.2%) are trading lower/flat this morning, with price action fairly rangebound in light newsflow. European sectors are trading with a mostly negative bias. Basic Resources (+1.1%) leads on firmer metal prices, followed by Tech (+0.4%) on positive spillover from the strong Nasdaq close, and Energy (+0.3%) on higher crude amid ongoing geopolitical tensions between Russia-Ukraine and US-Venezuela. On the downside, Utilities (-0.9%), Optimised Personal Care (-0.9%) and Food Beverage and Tobacco (-0.9%) lag.

Top European News

German Ifo survey finds that 26% of firms expect business to deteriorate in 2026, 59% expect no change, 15% forecast an improvement.

Geopolitics: Venezuela

US Coast Guard officials over the weekend tracked two oil tankers in international waters close to Venezuela, marking three tankers within the past week. An official suggested that the tanker is subject to sanctions, according to several media reports.

The Venezuelan government rejected the seizure of a new vessel transporting oil, it said in a statement.

Geopolitics: Ukraine

US Special Envoy Witkoff said the Ukrainian delegation held productive meetings over three days in Florida with US and European partners, including a separate US–Ukraine meeting, with discussions focused on timelines and sequencing of next steps.

Ukrainian President Zelensky said broader consultations with European partners should follow recent talks in the US.

Ukrainian President Zelensky said allies had started to slow supplies of air defence missiles and said Kyiv should stand by the US as mediator on talks with Russia, commenting on French President Macron’s proposal.

Ukrainian President Zelensky said the situation in the Odesa region was harsh after Russian strikes and said Russia was trying to restrict Ukraine’s access to the sea.

The Kremlin said changes made by Ukrainians and Europeans to peace proposals did not bring agreements closer or add anything positive, IFAX reported. It said Dmitriev was still in Miami meeting with Americans and would report on the results upon his return to Moscow. Kremlin aide said a trilateral Russia–US–Ukraine meeting was not being discussed.

Ukrainian President Zelensky said elections could not be held in Russian-occupied parts of Ukraine, could only take place once security was guaranteed, and said Kyiv was working with the US on a stable peace while preparing voting infrastructure for Ukrainians abroad, Reuters reported.

Ukraine’s deputy prime minister said Russia attacked the Pivdennyi port and was deliberately targeting civilian logistics in the Odesa region.

Russia’s Defence Ministry said Russian troops had captured Vysoke in Ukraine’s Sumy region and Svitlie in the Donetsk region, according to IFAX and TASS.

Russia's Kremlin said Envoy Dmitriev will report to President Putin on the US proposals for a possible Ukraine settlement. Adds the US intelligence perception of Putin's aims are mistaken following the Reuters report.

Russian General Sarvarov was injured in a car explosion in Moscow, via Unn; subsequently, the Russian Investigative Committee said the general was killed in the explosion.

"TASS: [Russian President] Putin's envoy is likely to hold the next meeting with the US delegation in Moscow", via Al Arabiya.

Two vessels and two piers were damaged in Russia’s Krasnodar after a Ukrainian drone attack, regional authorities said; damage to piers led to a large fire in the area.

US Special Envoy Witkoff said weekend meetings between US and Russian delegation were productive and constructive; Russia remains fully committed to achieving peace in Ukraine.

Geopolitics: Middle East

Israeli PM Netanyahu reportedly plans to brief US President Trump on possible new Iran strikes, according to NBC News. Israeli officials believe Iran is expanding its ballistic missile program. They are preparing to make the case during an upcoming meeting with Trump that it poses a new threat. Israeli officials have announced a Dec. 29 meeting.

Sources said the biggest risk is a war between Israel and Iran will break as a result of a miscalculation with each side thinking the other plans to attack and try to preempt it, according to Axios.

Israeli officials warned the Trump administration over the weekend that an Iranian IRGC missile exercise could be preparations for a strike on Israel, according to Axios sources.

US Event Calendar

8:30 a.m. ET: Chicago Fed Nat Activity Index

DB's Jim Reid concludes the overnight wrap

For anyone still out there, we’re now entering a very quiet spell for markets before Christmas, with data releases and other headline announcements almost completely drying up. Indeed, there’s only two-and-a-half days left to go for many places, as the US and several European markets are closing early on Christmas Eve, and this week usually sees some of the lowest volumes of the year.

This morning, the main news has been further sharp losses for Japan’s government bonds, which follows the Bank of Japan’s Friday decision to hike rates by 25bps to 0.75%, the highest since 1995. The hike already meant that Japan’s 10yr yield was up +6.9bps last week to close above 2%, and this morning they’re up another +6.9bps to 2.08%, their highest since 1999. One factor behind that has been the weakness in the Japanese yen, which fell -1.40% against the US dollar on Friday, despite the hike. And this morning, the country’s chief currency official Atsushi Mimura said to reporters that “We’re seeing one-directional, sudden moves especially after last week’s monetary policy meeting, so I’m deeply concerned”. So in turn, that weakness for the yen is seen as raising the chance of another BoJ rate hike and has prompted the latest selloff for JGBs. We’ve seen that echoed across other countries too this morning, with 10yr Australian yields up +5.1bps this morning, whilst the 10yr Treasury yield is up +2.0bps to 4.17%.

For equities however, there’s been a much stronger picture across the board overnight, with gains for Japan’s Nikkei (+1.90%), along with the KOSPI (+1.82%), the CSI 300 (+0.79%), the Shanghai Comp (+0.64%) and the Hang Seng (+0.20%). Looking forward, US equity futures are also pointing higher, with those on the S&P 500 up +0.26%. Moreover, there’s been a fresh rally for precious metals this morning, with gold prices up +1.40% to $4400/oz, which would be an all-time closing high if sustained, and is the first time they’ve reached that level on an intraday basis as well. Similarly, silver prices (+3.25%) are up to a fresh record of $69.34/oz. So that now leaves their YTD gains at +68% for gold and +140% for silver, which would be the biggest for both since 1979, back when oil prices surged after the Iranian Revolution that year led to major supply disruption.

The latest rise in bond yields this morning follows several central bank decisions last week, where hawkish-leaning elements pushed yields higher around the world. So for example, the Bank of Japan did their 25bp rate hike as expected but also signalled more were still ahead and said real interest rates were “at significantly low levels”. Meanwhile in Europe, there was ongoing speculation about a potential ECB hike next year, particularly after they upgraded their forecasts for growth and core inflation. So that helped to push 10yr bund yields up +3.8bps last week to 2.89%, their highest level since the German fiscal stimulus announcements back in March.

However, the main exception to that pattern were US Treasuries, whose yields fell after the soft CPI print led investors to price in more rate cuts, with the 10yr yield down -3.7bps last week to 4.15%. That comes as speculation around the next Fed Chair has continued to swirl, and Trump said last week that it would be “someone who believes in lower interest rates”. We got some more headlines on the next Fed Chair last Friday as well, as CNBC reported that Fed Governor Waller had a “strong interview” with Trump, and that BlackRock’s Rick Rieder would be interviewed in the last week of the year. So as it stands the current odds on Polymarket are 56% for NEC Director Hassett, 22% for former Fed Governor Warsh, 12% for Governor Waller, and 6% for Rieder.

In terms of the week ahead, it’s a pretty quiet one on the events calendar. One thing to note will be a few US data releases, including the delayed Q3 GDP print today, but that’s very backward-looking and covers the period before the shutdown. Otherwise today, the more recent data will be the December consumer confidence reading from the Conference Board, which will be in the spotlight given the recent downtick in sentiment. In fact, the previous reading for November was the lowest since the Liberation Day turmoil in April. But apart from that, there really isn’t much scheduled.