Futures Rise, S&P Set For 8th Gain In 9 Days

Futures Rise, S&P Set For 8th Gain In 9 Days

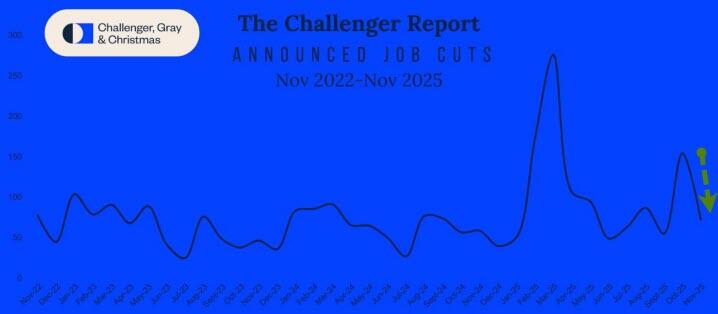

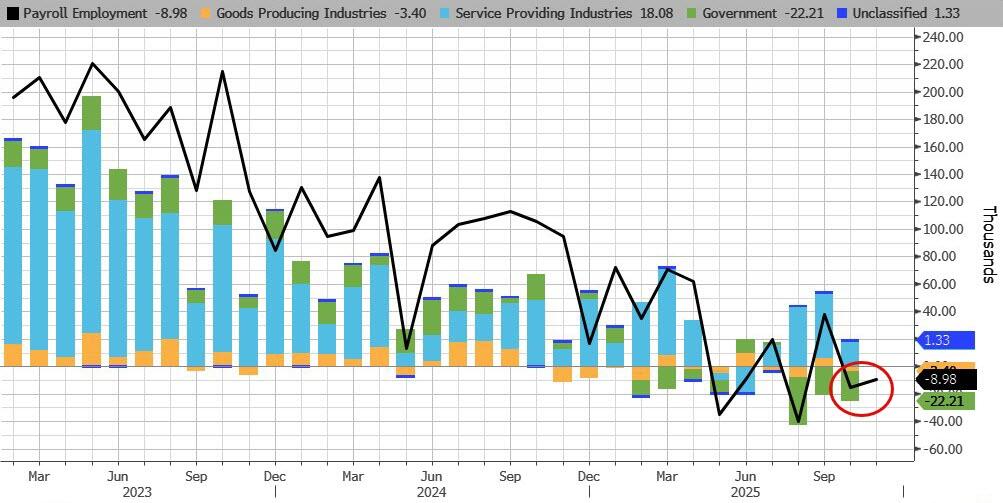

US equity futures rise, trading less than a percent away from a new record high amid signs of a leadership rotation with Big Tech not leading the bounce this time. As of 8:00am ET, S&P and Nasdaq 100 contracts are higher by about 0.1% after climbing in seven of the past eight sessions and extend on Wednesday's gains when bad news was good news as a soft ADP jobs report bolstered expectations for a Fed rate cut next week. Challenger job cuts data for November showed job cuts fell 53% to 71,321 last month from October, but rose 24% from the 57,727 job cuts announced in the same month last year. Pre-market, Mag 7 were up a touch, led by TSLA (+0.9%), META (+0.6%) and NVDA (+0.5%). Salesforce is higher after its forecast beat and it gave a positive view on AI adoption. Bond yields were up modestly, USD unchanged, reversing an earlier drop to a one month low. Commodities are mixed: Oil and base metals are mostly higher; gold/silver are lagging. Bitcoin trades around $93, rebounding almost $10K from its low just days ago. Today's calendar includes November Challenger jobs cuts (7:30am), weekly jobless claims (8:30am) and September factory orders (10am)

In pre-market trading, tech stocks were broadly steady with all Magnificent Seven megacaps apart from Apple posting modest gains, while Salesforce climbed on signs that customers are embracing its artificial intelligence tools.

Mag 7 stocks mostly higher (Tesla +0.6%, Nvidia +0.4%, Meta +0.8%, Alphabet +0.6%, Microsoft +0.4%, Amazon +0.1%, Apple -0.04%)

Axogen (AXGN) rises 5% after the provider of medical and surgical instruments said the FDA approved its biologics license application for its Avance nerve graft to treat peripheral nerve discontinuities.

Bill Holdings Inc. (BILL) gains 3% after activist investor Barington Capital Group has taken a stake in business payments firm.

Costco falls (COST) 1.1% after the retailer reported total comparable sales for November that missed the average analyst estimate.

Dollar General (DG) rises 4% after the company raised its full-year outlook, highlighting value-focused retailers are winning over consumers hunting for deals.

Guidewire (GWRE) jumps 5% after the software company’s first-quarter results and second-quarter revenue forecast topped analysts’ expectations.

Hormel (HRL) rises 6% after the protein producer’s 3Q adj. EPS forecast beat the company’s recently lowered guidance, as well as the Street consensus.

MBX Biosciences (MBX) slips 3% after Goldman Sachs initiated coverage of the drug developer with a sell rating, citing risk to the firm’s data readout in the near term.

Salesforce Inc. (CRM) is up 1.9% after the software company gave an outlook for revenue in the current period that topped analysts’ estimates, suggesting it is persuading customers to buy its AI tools.

Snowflake (SNOW) falls 8% after the software company issued a forecast for operating margin in the current quarter that fell short of the average analyst estimate. Analysts noted a deceleration in product revenue growth.

UiPath (PATH) rises 8% after the software company’s third-quarter results beat expectations. It also gave a forecast.

UniQure (QURE) falls 13% after saying the FDA indicated that data from its Phase I/II studies of an investigational gene therapy for Huntington’s disease are unlikely to provide primary evidence to support a biologics license application submission.

ZIM (ZIM) rises 3% after Globes reports that Hapag-Lloyd submitted a bid to purchase the shipping company, without saying where it got the information.

Fed rate-cut expectations have fueled a broad rebound after November’s slump, with investors turning to defensive and other sectors as worries over stretched tech valuations persist. The small-cap Russell 2000 index is now just shy of a record high, while the Nasdaq 100 remains about 2% below its peak.

“We’re expecting a broadening of the rally for sectors that have so far been lagging,” said Amelie Derambure, senior portfolio manager at Amundi SA in Paris. “The Russell is very sensitive to interest rates, so the figures reinforced the market’s idea that the Fed will be able to lower rates, in a non-recessionary context.”

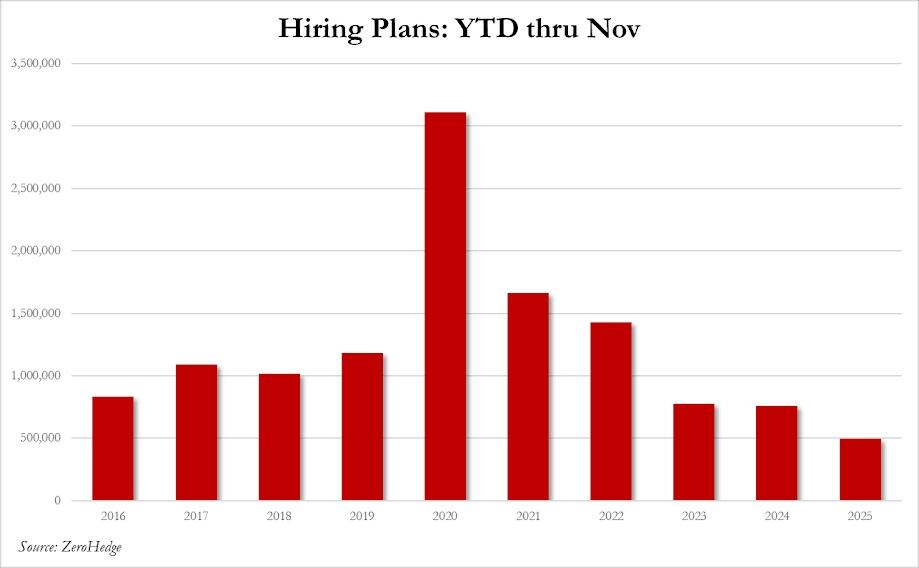

A report on corporate job-cut announcements from Challenger, Gray & Christmas Inc. added to evidence that the US labor market is softening. Announced layoffs fell last month after surging in October, but were still the highest for any November in three years, according to the outplacement firm. Meanwhile, YTD hiring plans are the lowest since 2010.

In pre-market trading, tech stocks were broadly steady with all Magnificent Seven megacaps apart from Apple posting modest gains, while Salesforce climbed on signs that customers are embracing its artificial intelligence tools.

Mag 7 stocks mostly higher (Tesla +0.6%, Nvidia +0.4%, Meta +0.8%, Alphabet +0.6%, Microsoft +0.4%, Amazon +0.1%, Apple -0.04%)

Axogen (AXGN) rises 5% after the provider of medical and surgical instruments said the FDA approved its biologics license application for its Avance nerve graft to treat peripheral nerve discontinuities.

Bill Holdings Inc. (BILL) gains 3% after activist investor Barington Capital Group has taken a stake in business payments firm.

Costco falls (COST) 1.1% after the retailer reported total comparable sales for November that missed the average analyst estimate.

Dollar General (DG) rises 4% after the company raised its full-year outlook, highlighting value-focused retailers are winning over consumers hunting for deals.

Guidewire (GWRE) jumps 5% after the software company’s first-quarter results and second-quarter revenue forecast topped analysts’ expectations.

Hormel (HRL) rises 6% after the protein producer’s 3Q adj. EPS forecast beat the company’s recently lowered guidance, as well as the Street consensus.

MBX Biosciences (MBX) slips 3% after Goldman Sachs initiated coverage of the drug developer with a sell rating, citing risk to the firm’s data readout in the near term.

Salesforce Inc. (CRM) is up 1.9% after the software company gave an outlook for revenue in the current period that topped analysts’ estimates, suggesting it is persuading customers to buy its AI tools.

Snowflake (SNOW) falls 8% after the software company issued a forecast for operating margin in the current quarter that fell short of the average analyst estimate. Analysts noted a deceleration in product revenue growth.

UiPath (PATH) rises 8% after the software company’s third-quarter results beat expectations. It also gave a forecast.

UniQure (QURE) falls 13% after saying the FDA indicated that data from its Phase I/II studies of an investigational gene therapy for Huntington’s disease are unlikely to provide primary evidence to support a biologics license application submission.

ZIM (ZIM) rises 3% after Globes reports that Hapag-Lloyd submitted a bid to purchase the shipping company, without saying where it got the information.

Fed rate-cut expectations have fueled a broad rebound after November’s slump, with investors turning to defensive and other sectors as worries over stretched tech valuations persist. The small-cap Russell 2000 index is now just shy of a record high, while the Nasdaq 100 remains about 2% below its peak.

“We’re expecting a broadening of the rally for sectors that have so far been lagging,” said Amelie Derambure, senior portfolio manager at Amundi SA in Paris. “The Russell is very sensitive to interest rates, so the figures reinforced the market’s idea that the Fed will be able to lower rates, in a non-recessionary context.”

A report on corporate job-cut announcements from Challenger, Gray & Christmas Inc. added to evidence that the US labor market is softening. Announced layoffs fell last month after surging in October, but were still the highest for any November in three years, according to the outplacement firm. Meanwhile, YTD hiring plans are the lowest since 2010.

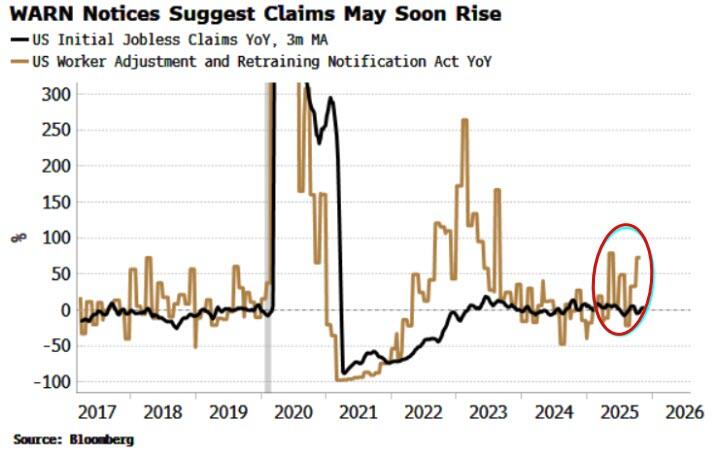

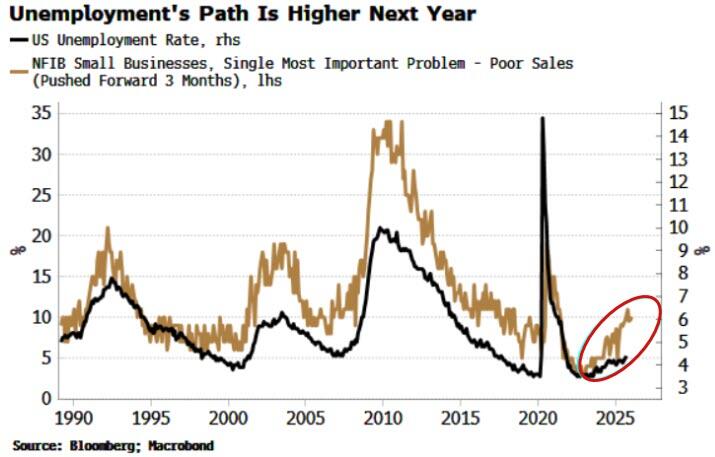

With official data still delayed, private indicators have increasingly pointed to employment coming under pressure from company belt-tightening and weaker spending. Worries about the jobs market and expectations that President Donald Trump will choose a Fed chair who shares his dovish stance have shifted market pricing toward as many as four rate cuts through 2026. Still, with the broader economy resilient, easier policy should continue to support stocks.

“Retail momentum stocks and crypto are still way below the recent peaks, though both have recovered from the recent lows,” wrote Mohit Kumar, chief economist and strategist for Europe at Jefferies. “We see sentiment remaining positive into year-end.”

Meanwhile, Goldman Sachs is looking past this month’s decision to what it calls a “foggy” Fed rate path in 2026. Risks to its terminal-rate range are skewed to the downside amid labor-market weakness, the bank wrote. They still expect two rate cuts next year. JPMorgan strategists expect the market to be boosted by higher equity demand next year. They project a supply-demand “improvement” of around $700 billion in 2026, which would be the strongest year since 2023.

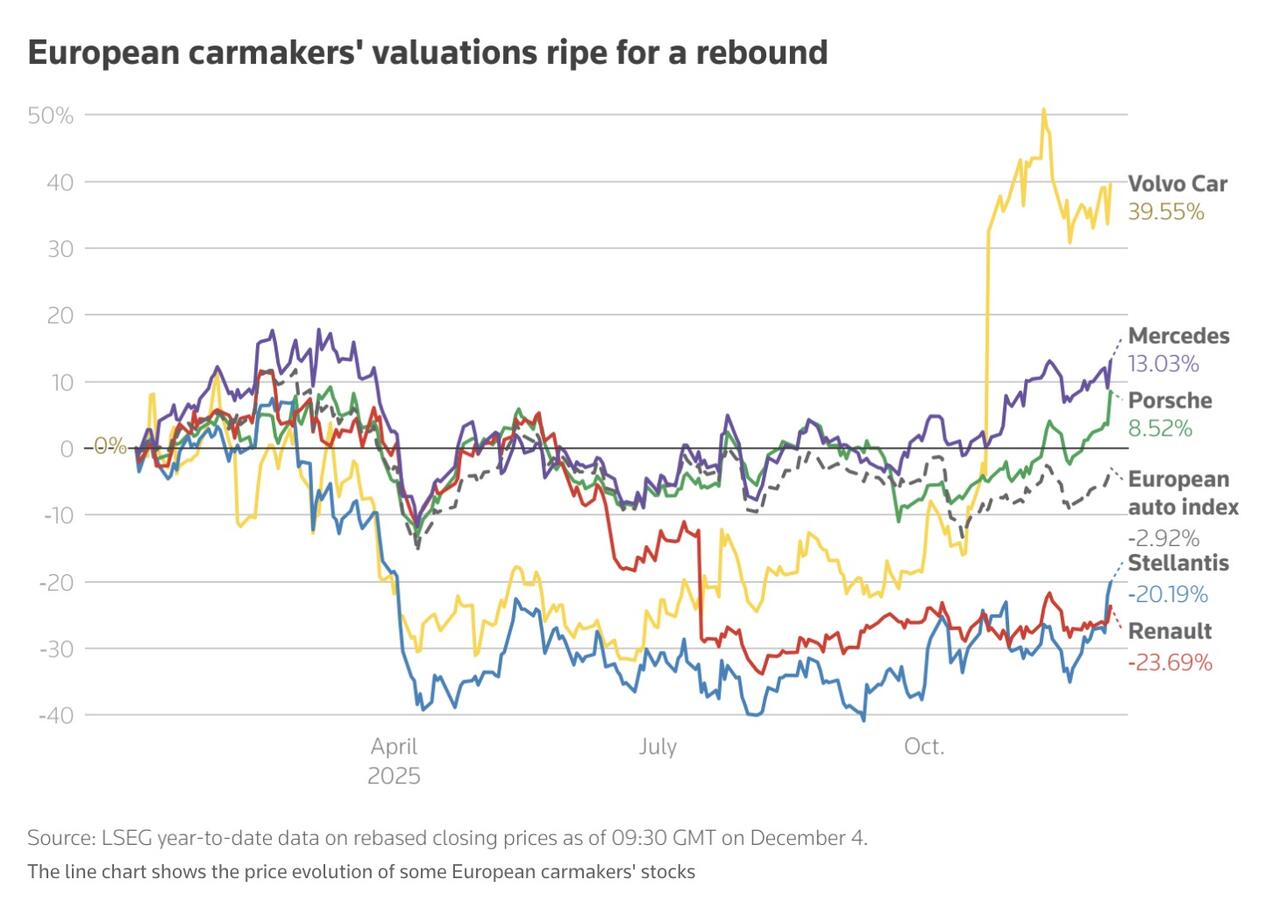

Europe's Stoxx 600 is 0.3% higher with the DAX outperforming. Autos and industrial stocks are leading the way in Europe while utilities and healthcare dip. Automakers gain as Bank of America upgrades some stocks. Here are some of the biggest movers on Thursday:

Mercedes, Renault gain as much as 4.4% and 4.8% respectively while holding company Porsche SE rises 5.7%, as Bank of America upgrades the stocks due to a more positive view on the European autos sector.

Storytel gains as much as 6.5% after SEB initiated coverage of the Swedish audiobook and publishing house with a buy rating, saying the company has improved the quality of its subscriber base and its internal efficiency.

Cosmo shares rise as much as 5.5%, adding to Wednesday’s 20% jump following positive late-stage trial results for the life science company’s experimental treatment for male hair loss.

Balfour Beatty shares rise as much as 2.4% after the engineering and construction group said it expects to grow its order book by 20% in 2025 and confirmed more buybacks are on the way in 2026.

Philips shares drop as much as 8.6% after Citi analysts noted tariff and China challenges for 2026.

Trustpilot shares fall as much as 21% after Grizzly Research published a report on the consumer-review company.

Earlier in the session, Asian stocks rose for a third straight day, led by gains in Japan as regional tech shares tracked their US peers higher. The MSCI Asia Pacific Index advanced as much as 0.9%, with SoftBank Group and Keyence among the biggest contributors. Shares fluctuated in China and Hong Kong, while South Korean stocks slipped. India’s benchmark struggled to hold early gains even as the rupee strengthened against the dollar. Sentiment across the region is improving on rising expectations of a Federal Reserve rate cut this month after the latest US jobs data. Meanwhile, a slightly weaker yen is providing an extra lift to Japanese exporters. Semiconductor shares are showing signs of weakness, with South Korea’s tech-heavy stock index slipping more than 1% as foreign funds take profit. A Microsoft Corp. update is also weighing on sentiment, after a media report that the firm lowered expectations for business customers buying on the cloud unit’s marketplace for artificial intelligence models and agents.

In FX, the dollar gives up earlier gains, Aussie outperforming on bets the central bank may pivot back to rate hikes.

In rates, global bonds weakened, driven by rising yields in Japan. Sentiment shifted as some senior government officials signaled they wouldn’t oppose a Bank of Japan rate hike this month. Treasury yields are rising across the curve. German bonds falling on growing government uncertainty. Gilts are outperforming after very weak construction activity data sparks a small increase in BOE rate-cut bets.

In commodities, oil prices are higher, albeit with some volatility. Brent is trading around $63/barrel. Gold is recovering ground and now trading close to $4,200/oz. Bitcoin, meanwhile, held above $93,000. The dollar was little changed.

US economic calendar includes November Challenger jobs cuts (7:30am), weekly jobless claims (8:30am) and September factory orders (10am)

Market Snapshot

S&P 500 mini and Nasdaq 100 mini little-changed

Russell 2000 mini steady

Stoxx Europe 600 +0.3%

DAX +0.8%

CAC 40 +0.4%

10-year Treasury yield +2 basis points at 4.08%

VIX +0.1 points at 16.17

Bloomberg Dollar Index little changed at 1212.82

euro little changed at $1.1668

WTI crude +0.4% at $59.21/barrel

Top Overnight News

Donald Trump’s aides are considering having Scott Bessent also head the National Economic Council if Kevin Hassett becomes Fed chair, people familiar said. BBG

Trump's administration ordered an enhanced vetting of H-1B visa applicants, with new H-1B visa screening based on any involvement in censorship or free speech, according to the State Department memo.

Trump said he may work out another trade deal with Canada and Mexico. BBG

Vladimir Putin said Russia didn’t agree with some points of the US peace proposal for Ukraine, Tass reported, citing his interview with a local media outlet. Earlier, Trump called the meeting between Steve Witkoff and Putin “reasonably good” but next steps remain unclear. BBG

Emmanuel Macron met Xi Jinping in Beijing and urged China to boost investments in France, as both sides look to rebalance their economic ties. BBG

Cambricon plans to more than triple its production of AI chips to half a million units in 2026, people familiar said. The Beijing-based company aims to rival Huawei in China and fill a void left by Nvidia’s forced exit. BBG

Bank of Japan Governor Kazuo Ueda said on Thursday there was uncertainty on how far the central bank could raise interest rates due to the difficulty of estimating the country's neutral rate of interest. RTRS

The Indian rupee will regain some lost ground against the U.S. dollar over the next three months, but a reversal in the currency's fortunes hinges upon India and the U.S. agreeing to a trade deal. RTRS

Paramount more than doubled its breakup fee to $5 billion in its offer to acquire Warner Bros., signaling confidence it can clear regulatory hurdles. BBG

Meta Platforms Inc. has been hit by a full-scale European Union antitrust investigation over how its AI features in WhatsApp may be harming competition, in the latest probe into Big Tech’s dominance on the continent. The bloc’s digital chief signaled she wants to conclude several ongoing investigations into tech giants this month including Elon Musk’s X. BBG

For all the focus on ADP (historically very noisy), the Indeed Hiring Lab data actually picked back up in the last couple of weeks (need more data). Notable was the a re-acceleration in open jobs in construction (see below). What if AI adoption is slower or less transformative in the near term… the labor market re-accelerates… and inflation proves hotter in 2026? Not at all my base case but inversion an in important part of the process: Goldman

Trade/Tariffs

US President Trump said they will either let the USMCA expire or maybe work out another deal with Mexico and Canada.

US halted plans to sanction the Chinese spy agency to maintain the trade truce, and the Trump administration will also not enact any major new export controls against China, while the Trump admin is preparing to hold a high-level meeting to decide whether to provide licenses to allow NVIDIA (NVDA) to export the H200 to China, according to FT.

Chinese Commerce Ministry, on rare earth export controls, said as long are export license applications are for civilian use, they will be approved.

Chinese President Xi said in a meeting with French President Macron that China and France are far-sighted, responsible and independent major countries, while he added that China and France should uphold multilateralism and that China is willing to eliminate interferences and stick to equal dialogues with France. Xi also commented that both countries should support each other on core interests and agreed to expand practical cooperation, as well as consolidate cooperation on airspace and nuclear energy. Furthermore, he said both countries aim to expand two-way investment and that China will expand domestic demand in the 15th five-year plan and will also expand market access and opening-up.

India's Trade Minister said exports of autos, electronic goods, textiles and machinery to Russia are expected to increase. India also aims to expand and diversify exports to Russia to address the trade imbalances. India has secured a USD 2bln submarine deal, Bloomberg reported during the visit of Russian President Putin.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher following the positive momentum from Wall St, where all major indices rose amid a weaker dollar and softer yield environment, but with some of the gains in the region capped amid a quiet calendar and lack of major fresh macro catalysts. ASX 200 edged higher in rangebound trade with strength in materials and resources offsetting the losses in the real estate and consumer sectors, while the mining industry was among the outperformers aside from the gold-related stocks. Nikkei 225 rallied above the 50k level as the tech-related momentum in Japan continued, despite higher yields and bets for a December BoJ rate hike. Hang Seng and Shanghai Comp were mixed amid weakness in auto names and after another liquidity drain by the PBoC, while PBoC Governor Pan noted in an Op-Ed that China must maintain prudent monetary policy and should avoid excessive policy adjustments.

Top Asian News

PBoC Governor Pan said in a People's Daily op-ed that China must maintain prudent monetary policy and should avoid excessive policy adjustments, while he also suggested preventing overreach from leading to long-term side effects of policies.

BOJ

BoJ is likely to raise interest rates in December, a decision Japan's government will likely tolerate, according to sources cited by Reuters.

Key members of Japanese PM Takaichi's government would not try to prevent a BoJ hike in December, Bloomberg reports, citing sources.

BoJ is carrying out an assessment of the level of neutral interest rate, according to Jiji.

BoJ Governor Ueda reiterated that they can only estimate the neutral rate with a wide range thus far, while he added they cannot specify a terminal rate and are working on narrowing the estimate on the neutral interest rate, with the findings to be disclosed if successful. Furthermore, he said for now, they have to work with the current estimate set in a fairly wide range, and there is uncertainty on how far interest rates can eventually be raised.

European equities opened higher, reflecting positive APAC momentum, though morning news flow has been light. Markets expect Kevin Hassett to be named the next Fed Chair, with some concerns that he could be influenced by President Trump on rates. Meanwhile, Reuters and Bloomberg reported hawkish signals suggesting the BoJ is likely to raise rates in December with government approval. Sectors are mixed with a positive tilt: Autos, Industrial Goods & Services and Technology lead. At the bottom: Utilities, Basic Resources and Health Care.

Top European News

BoE Decision Maker Panel Survey (Nov): Expectations for year-ahead CPI inflation remained unchanged at 3.4%; Expected year-ahead wage growth rose slightly, by 0.1ppt to 3.8% in the three months to November

FX

DXY is trading near the lower end of its 98.798–99.029 intraday range, pressured by JPY strength after Reuters and Bloomberg reported the BoJ is likely to hike rates in December with government approval. Money markets were already pricing a 66% chance of a hike following Governor Ueda’s recent hawkish remarks. USD/JPY slipped from 155.54 to a 154.77 low, with next support at the 1 December trough of 154.66.

AUD is firmer amid continued hawkish repricing of RBA expectations.

G10 FX is otherwise mostly flat and taking its cue from the USD, with few fresh drivers. EUR and GBP were little moved by Construction PMI releases.

PBoC set USD/CNY mid-point at 7.0733 vs exp. 7.0554 (Prev. 7.0754)

Chinese State-owned banks reportedly bought USD on the onshore spot market this week in a bid to rein in CNY strength, according to Reuters sources.

RBI to tolerate a weaker rupee as dollar inflows diminish, according to Reuters sources.

Fixed Income

Fixed income benchmarks are lower following the hawkish BoJ reports, though the associated softening in risk sentiment has provided a modest haven bid as the morning has unfolded.

JGBs underperformed, falling as much as 42 ticks to a new contract low of 134.08. The move pushed the 20yr yield to its highest since June 1999 and the 30yr yield to a record high, with selling driven by reports that boosted December BoJ hike odds to above 65%.

The bearish tone extended into USTs and Bunds (now trading the Mar’25 contract), which hit lows of 112-27 and 128.46, down eight and 16 ticks respectively. European newsflow was limited; French and Spanish supply saw no major reaction, with Spain’s auction strong and France’s slightly softer versus prior.

For USTs, focus beyond the BoJ remains on the Fed Chair narrative. The FT noted bond investors have expressed concern to the Treasury over Hassett’s potential appointment due to his perceived alignment with the President. Kalshi odds for Hassett have slipped to ~75% from above 80% earlier in the week.

Spain sells EUR 2.88bln vs exp. EUR 2.5-3.5bln 2.70% 2030, 0.85% 2037 Bono and EUR 0.481mln vs exp. EUR 0.25-0.75bln 1.15% 2036 I/L.

France sells EUR 5.06bln vs exp. EUR 3.5-5.5bln 4.75% 2035, 0.50% 2040, 4.50% 2041, 3.25% 2055 OAT.

UK sells GBP 1bln 4.25% 2039 Gilt via tender: b/c 3.88x, average yield 4.813%.

Commodities

Crude benchmarks were firmer through the APAC session despite constructive comments from US and Russian officials after their recent Moscow meeting. Both benchmarks climbed to highs of USD 59.42/bbl (WTI) and USD 63.08/bbl (Brent) before easing to USD 59.11/bbl and USD 62.74/bbl as risk sentiment softened following the hawkish BoJ reports.

XAU posts modest gains early in APAC, reaching USD 4,217/oz before sliding to USD 4,176/oz and remaining below USD 4.2k/oz. Despite a recent soft ADP print and mixed services PMI, gold has unwound its data-driven uptick as broader risk sentiment improves.

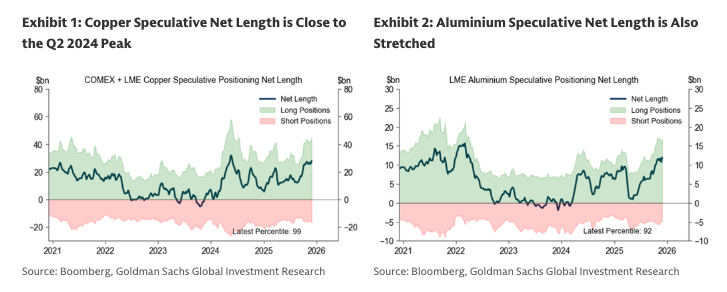

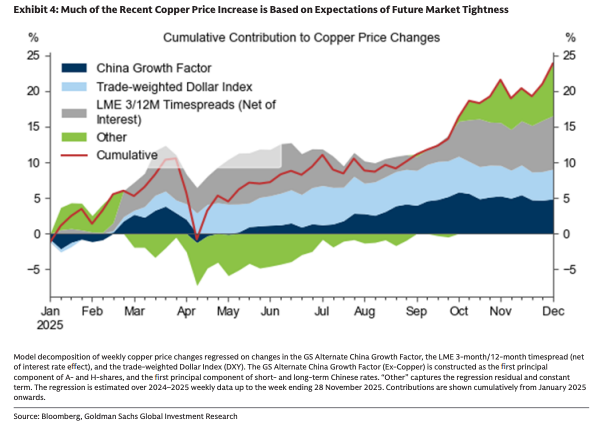

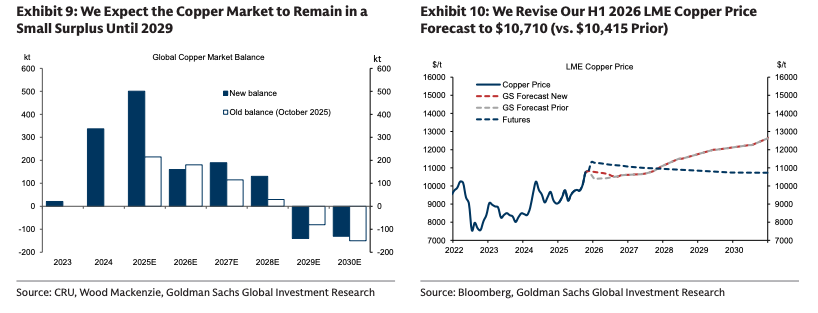

3M LME copper traded within a USD 11.43k–11.53k/t range in APAC before retreating from Wednesday’s all-time high of USD 11.54k/t, now at session lows around USD 11.35k/t. The pullback follows Rio Tinto’s raised 2025 copper production guidance and Goldman Sachs’ scepticism over the recent rally.

Geopolitics: Middle East

Israel identified the body of the hostage received from Gaza as Thai national Sontisek Rintalk and said the body of the last Israeli hostage, Ran Gvili, remains in Gaza.

Iraq has decided to freeze the money of "terrorists", including Hezbollah and the Houthis, via the Official Gazette

Geopolitics: Ukraine

US President Trump said the meeting between Russian President Putin, Special Envoy Witkoff and Kushner was a reasonably good meeting and "we'll see what happens", while he added that Russian President Putin wants to end the war.

White House official said the US and Russia had a thorough and productive meeting, while Witkoff and Kusher briefed Trump after the meeting with Putin on Tuesday and are to meet Ukrainian representatives in Miami on Thursday.

Russian President Putin said the meeting with US' Witkoff and Kushner was necessary and very useful, but it is "too early to say"; said Russia will take control of Donbas and Novorossiya by military means or otherwise.

Russian Foreign Ministry Spokesperson said the attacks on tankers in the Black Sea and CPC are aimed at disrupting the peace talks in Ukraine.

A Ukrainian official has reportedly cautioned that Thursday's meeting between Ukraine's Umerov and US' Witkoff is a "debrief" by the US and not "a negotiating session...", FT reported.

Geopolitics: Other

Venezuela's President Maduro said he had a conversation with US President Trump about 10 days ago, while he added that steps are being taken towards a respectful dialogue between both countries.

China is said to be gathering military ships across East Asia in a show of maritime force, according to Reuters sources

US Event Calendar

7:30 am: Nov Challenger Job Cuts YoY, est. 48%, prior 175.3%

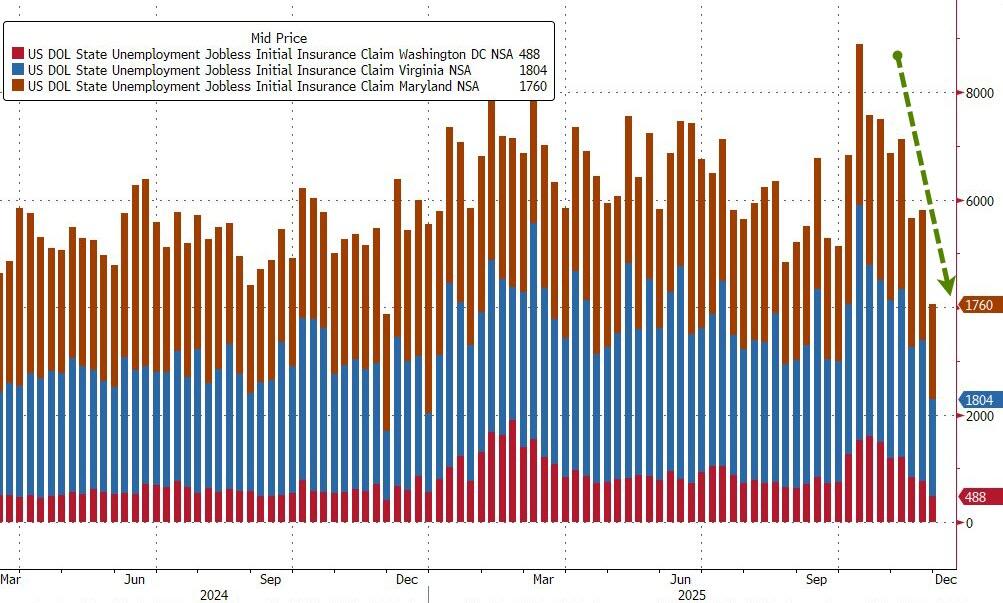

8:30 am: Nov 29 Initial Jobless Claims, est. 220k, prior 216k

8:30 am: Nov 22 Continuing Claims, est. 1962.61k, prior 1960k

10:00 am: Sep Factory Orders, est. 0.3%, prior 1.4%

10:00 am: Sep F Durable Goods Orders, prior 0.5%

10:00 am: Sep F Durables Ex Transportation, prior 0.6%

10:00 am: Sep F Cap Goods Orders Nondef Ex Air, prior 0.9%

10:00 am: Sep F Cap Goods Ship Nondef Ex Air, prior 0.9%

DB's Jim Reid concludes the overnight wrap

Markets continue to be in consolidation mode, with the S&P 500 (+0.30%) and the STOXX 600 (+0.10%) both posting modest gains yesterday. The session had started on the back foot as the ADP’s report of private payrolls showed the biggest monthly drop since March 2023, but most assets recovered by the end of the session, as data cemented the view that the Fed would likely cut rates at next week’s meeting. So lots of assets were up by the close, with the 10yr Treasury yield (-2.3bps) down to 4.06%, whilst Bitcoin (+2.30%) reached a two-week high of $93,722 and the small-cap Russell 2000 rose +1.91%. In Japan this morning a strong 30yr auction has led to a decent long-end rally even as other parts of the curve sell off.

In terms of that ADP report, the headline was that private payrolls fell by -32k in November, undershooting expectations for a +10k rise. The losses were largely concentrated around small businesses (-120k), which saw their largest decline in employment since the pandemic, although payrolls from medium (+51k) and large businesses (+39k) fared better. There were also some questions about regional distortions as the aggregate decline came due to outsized losses in regions along the Atlantic coast. Still, the negative signal from the ADP report received more attention than usual because of the data backlog from the shutdown. So we aren’t getting the usual payrolls this Friday, and the ADP is one of the final pieces of information the Fed will get on the labour market ahead of next week’s decision.

That dovish momentum from the ADP report then got a further boost from the ISM services print. The headline measure was a bit stronger than expected at 52.6 (vs. 52.0 expected), but crucially, the prices paid component fell to a 7-month low of 65.4 (vs. 68.0 expected), which eased concerns about tariff-driven inflation. That component has been strongly correlated to inflation with a lag, so the bigger-than-expected decline helped solidify expectations for a Fed rate cut. Moreover, the employment component remained in contractionary territory at 48.9, so again that echoed the weaker message from the ADP print.

Those prints helped US Treasuries to rally across the curve, with the 2yr yield (-2.4bps) down to 3.49%, whilst the 10yr yield (-2.3bps) fell to 4.06%. And in turn, that saw the dollar index (-0.49%) post its worst day in seven weeks and fall to its weakest level since October 28, the day before Fed Chair Powell said that a December rate cut was “not a foregone conclusion”. This morning, 2 and 10yr US yields are back up +2bps, nearly wiping out yesterday's gains.

Meanwhile for equities, the S&P 500 (+0.30%) continued to move higher, closing less than 1% beneath its record high from late-October. However, there were some fluctuations over the session, and Microsoft (-2.50%) shares fell after tech news outlet The Information reported that Microsoft had lowered their AI software sales quota. That was pushed back on by a spokesperson for Microsoft, and the share price recovered a bit when CNBC reported they hadn’t lowered the quotas. However, Microsoft shares then sold off again into the close, reviving investor fears about AI valuations. Nevertheless, that wasn’t enough to knock the broader market. The Magnificent 7 (+0.12%) still rose on the day thanks to a +4.08% gain for Tesla. And it was a strong day for market breadth with two thirds of the S&P 500 stocks higher on the day and the small cap Russell 2000 rising +1.91%.

Over in Europe, it was also a data heavy day with the final PMI releases. Those were broadly positive, and the final composite PMI for the Euro Area was revised up to 52.8 (vs. flash 52.4), its highest level in two-and-a-half years. So that continues the positive momentum seen in the PMIs over recent months, and helped to bolster sentiment, with upward revisions in Germany, France and the UK for the composite PMI. In turn, that helped the STOXX 600 (+0.10%) to just about post a modest gain, although it was a pretty subdued day across the continent, with the FTSE 100 (-0.10%), the CAC 40 (+0.16%), and the DAX (-0.07%) all seeing little movement.

There was also little movement in European fixed income, with 10yr bund yields (-0.2bps) barely moving. However, we did hear from ECB Chief Economist Lane, who discussed how the ECB should react to medium-sized inflation shocks, and energy price shocks in particular. He argued that inflation risk wasn’t one-way and that the bank had recently seen some upside surprises, so his comments offered support for the view that rates are likely to be kept on hold through the energy-induced inflation undershoot in 2026.

On the geopolitical front, the perception was that the prospect of a breakthrough in the talks on Ukraine continued to ebb yesterday, with the Polymarket chances of a ceasefire by end-March falling back to just 22%, having been at 27% when we went to press yesterday. In turn, there was a reaction among assets more sensitive to the conflict, with the STOXX Aerospace & Defense index up +2.26%, whilst Brent crude oil prices (+0.35%) were up to $62.67/bbl.

In Asia, Japanese stocks are leading the way, with the Nikkei rising by +2.00% and the Topix increasing by +1.86%, both outperforming their regional counterparts. The ASX (+0.27%) is also higher, with the Hang Seng flat and the Shanghai Comp -0.20% lower. The KOSPI is the largest underperformer, down -0.71%. US futures are flat.

Early morning data revealed that Australia’s household spending significantly exceeded expectations in October, marking its largest increase since January 2024, thereby strengthening the argument for an interest rate hike next year. Spending rose by +1.3% from September, surpassing economists’ forecasts of a +0.6% increase. Year-on-year, consumption has increased by +5.6%, compared to the anticipated +4.6% rise. 2yr and 10yr Aussie yields are up +7.5bps and 6bps respectively.

In the bond markets, Japan’s 30-year bonds gained following an auction that attracted the highest demand since 2019, as elevated yields drew in investors. The yield on the 30-year bond decreased by -3bps to 3.39% after the bid-to-cover ratio surged to 4.04, up from 3.125 at the previous auction in November. This strong outcome for the 30-year auction followed a successful sale of 10-year debt earlier in the week, which also saw robust demand. However the rally at the long end today seems to have been funded from elsewhere in the curve with the 10yr yield +3.8bps higher this morning.

To the day ahead now, and we’ll get the US weekly initial jobless claims, the November construction PMIs from the UK and Germany, and Eurozone retail sales for October. Central Bank spearers include the Fed’s Bowman, the ECB’s Kocher, Cipollone and Lane, and the BOE’s Mann. Notable earnings include Kroger, Dollar General and HPE.

Thu, 12/04/2025 - 08:50

With official data still delayed, private indicators have increasingly pointed to employment coming under pressure from company belt-tightening and weaker spending. Worries about the jobs market and expectations that President Donald Trump will choose a Fed chair who shares his dovish stance have shifted market pricing toward as many as four rate cuts through 2026. Still, with the broader economy resilient, easier policy should continue to support stocks.

“Retail momentum stocks and crypto are still way below the recent peaks, though both have recovered from the recent lows,” wrote Mohit Kumar, chief economist and strategist for Europe at Jefferies. “We see sentiment remaining positive into year-end.”

Meanwhile, Goldman Sachs is looking past this month’s decision to what it calls a “foggy” Fed rate path in 2026. Risks to its terminal-rate range are skewed to the downside amid labor-market weakness, the bank wrote. They still expect two rate cuts next year. JPMorgan strategists expect the market to be boosted by higher equity demand next year. They project a supply-demand “improvement” of around $700 billion in 2026, which would be the strongest year since 2023.

Europe's Stoxx 600 is 0.3% higher with the DAX outperforming. Autos and industrial stocks are leading the way in Europe while utilities and healthcare dip. Automakers gain as Bank of America upgrades some stocks. Here are some of the biggest movers on Thursday:

Mercedes, Renault gain as much as 4.4% and 4.8% respectively while holding company Porsche SE rises 5.7%, as Bank of America upgrades the stocks due to a more positive view on the European autos sector.

Storytel gains as much as 6.5% after SEB initiated coverage of the Swedish audiobook and publishing house with a buy rating, saying the company has improved the quality of its subscriber base and its internal efficiency.

Cosmo shares rise as much as 5.5%, adding to Wednesday’s 20% jump following positive late-stage trial results for the life science company’s experimental treatment for male hair loss.

Balfour Beatty shares rise as much as 2.4% after the engineering and construction group said it expects to grow its order book by 20% in 2025 and confirmed more buybacks are on the way in 2026.

Philips shares drop as much as 8.6% after Citi analysts noted tariff and China challenges for 2026.

Trustpilot shares fall as much as 21% after Grizzly Research published a report on the consumer-review company.

Earlier in the session, Asian stocks rose for a third straight day, led by gains in Japan as regional tech shares tracked their US peers higher. The MSCI Asia Pacific Index advanced as much as 0.9%, with SoftBank Group and Keyence among the biggest contributors. Shares fluctuated in China and Hong Kong, while South Korean stocks slipped. India’s benchmark struggled to hold early gains even as the rupee strengthened against the dollar. Sentiment across the region is improving on rising expectations of a Federal Reserve rate cut this month after the latest US jobs data. Meanwhile, a slightly weaker yen is providing an extra lift to Japanese exporters. Semiconductor shares are showing signs of weakness, with South Korea’s tech-heavy stock index slipping more than 1% as foreign funds take profit. A Microsoft Corp. update is also weighing on sentiment, after a media report that the firm lowered expectations for business customers buying on the cloud unit’s marketplace for artificial intelligence models and agents.

In FX, the dollar gives up earlier gains, Aussie outperforming on bets the central bank may pivot back to rate hikes.

In rates, global bonds weakened, driven by rising yields in Japan. Sentiment shifted as some senior government officials signaled they wouldn’t oppose a Bank of Japan rate hike this month. Treasury yields are rising across the curve. German bonds falling on growing government uncertainty. Gilts are outperforming after very weak construction activity data sparks a small increase in BOE rate-cut bets.

In commodities, oil prices are higher, albeit with some volatility. Brent is trading around $63/barrel. Gold is recovering ground and now trading close to $4,200/oz. Bitcoin, meanwhile, held above $93,000. The dollar was little changed.

US economic calendar includes November Challenger jobs cuts (7:30am), weekly jobless claims (8:30am) and September factory orders (10am)

Market Snapshot

S&P 500 mini and Nasdaq 100 mini little-changed

Russell 2000 mini steady

Stoxx Europe 600 +0.3%

DAX +0.8%

CAC 40 +0.4%

10-year Treasury yield +2 basis points at 4.08%

VIX +0.1 points at 16.17

Bloomberg Dollar Index little changed at 1212.82

euro little changed at $1.1668

WTI crude +0.4% at $59.21/barrel

Top Overnight News

Donald Trump’s aides are considering having Scott Bessent also head the National Economic Council if Kevin Hassett becomes Fed chair, people familiar said. BBG

Trump's administration ordered an enhanced vetting of H-1B visa applicants, with new H-1B visa screening based on any involvement in censorship or free speech, according to the State Department memo.

Trump said he may work out another trade deal with Canada and Mexico. BBG

Vladimir Putin said Russia didn’t agree with some points of the US peace proposal for Ukraine, Tass reported, citing his interview with a local media outlet. Earlier, Trump called the meeting between Steve Witkoff and Putin “reasonably good” but next steps remain unclear. BBG

Emmanuel Macron met Xi Jinping in Beijing and urged China to boost investments in France, as both sides look to rebalance their economic ties. BBG

Cambricon plans to more than triple its production of AI chips to half a million units in 2026, people familiar said. The Beijing-based company aims to rival Huawei in China and fill a void left by Nvidia’s forced exit. BBG

Bank of Japan Governor Kazuo Ueda said on Thursday there was uncertainty on how far the central bank could raise interest rates due to the difficulty of estimating the country's neutral rate of interest. RTRS

The Indian rupee will regain some lost ground against the U.S. dollar over the next three months, but a reversal in the currency's fortunes hinges upon India and the U.S. agreeing to a trade deal. RTRS

Paramount more than doubled its breakup fee to $5 billion in its offer to acquire Warner Bros., signaling confidence it can clear regulatory hurdles. BBG

Meta Platforms Inc. has been hit by a full-scale European Union antitrust investigation over how its AI features in WhatsApp may be harming competition, in the latest probe into Big Tech’s dominance on the continent. The bloc’s digital chief signaled she wants to conclude several ongoing investigations into tech giants this month including Elon Musk’s X. BBG

For all the focus on ADP (historically very noisy), the Indeed Hiring Lab data actually picked back up in the last couple of weeks (need more data). Notable was the a re-acceleration in open jobs in construction (see below). What if AI adoption is slower or less transformative in the near term… the labor market re-accelerates… and inflation proves hotter in 2026? Not at all my base case but inversion an in important part of the process: Goldman

Trade/Tariffs

US President Trump said they will either let the USMCA expire or maybe work out another deal with Mexico and Canada.

US halted plans to sanction the Chinese spy agency to maintain the trade truce, and the Trump administration will also not enact any major new export controls against China, while the Trump admin is preparing to hold a high-level meeting to decide whether to provide licenses to allow NVIDIA (NVDA) to export the H200 to China, according to FT.

Chinese Commerce Ministry, on rare earth export controls, said as long are export license applications are for civilian use, they will be approved.

Chinese President Xi said in a meeting with French President Macron that China and France are far-sighted, responsible and independent major countries, while he added that China and France should uphold multilateralism and that China is willing to eliminate interferences and stick to equal dialogues with France. Xi also commented that both countries should support each other on core interests and agreed to expand practical cooperation, as well as consolidate cooperation on airspace and nuclear energy. Furthermore, he said both countries aim to expand two-way investment and that China will expand domestic demand in the 15th five-year plan and will also expand market access and opening-up.

India's Trade Minister said exports of autos, electronic goods, textiles and machinery to Russia are expected to increase. India also aims to expand and diversify exports to Russia to address the trade imbalances. India has secured a USD 2bln submarine deal, Bloomberg reported during the visit of Russian President Putin.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher following the positive momentum from Wall St, where all major indices rose amid a weaker dollar and softer yield environment, but with some of the gains in the region capped amid a quiet calendar and lack of major fresh macro catalysts. ASX 200 edged higher in rangebound trade with strength in materials and resources offsetting the losses in the real estate and consumer sectors, while the mining industry was among the outperformers aside from the gold-related stocks. Nikkei 225 rallied above the 50k level as the tech-related momentum in Japan continued, despite higher yields and bets for a December BoJ rate hike. Hang Seng and Shanghai Comp were mixed amid weakness in auto names and after another liquidity drain by the PBoC, while PBoC Governor Pan noted in an Op-Ed that China must maintain prudent monetary policy and should avoid excessive policy adjustments.

Top Asian News

PBoC Governor Pan said in a People's Daily op-ed that China must maintain prudent monetary policy and should avoid excessive policy adjustments, while he also suggested preventing overreach from leading to long-term side effects of policies.

BOJ

BoJ is likely to raise interest rates in December, a decision Japan's government will likely tolerate, according to sources cited by Reuters.

Key members of Japanese PM Takaichi's government would not try to prevent a BoJ hike in December, Bloomberg reports, citing sources.

BoJ is carrying out an assessment of the level of neutral interest rate, according to Jiji.

BoJ Governor Ueda reiterated that they can only estimate the neutral rate with a wide range thus far, while he added they cannot specify a terminal rate and are working on narrowing the estimate on the neutral interest rate, with the findings to be disclosed if successful. Furthermore, he said for now, they have to work with the current estimate set in a fairly wide range, and there is uncertainty on how far interest rates can eventually be raised.

European equities opened higher, reflecting positive APAC momentum, though morning news flow has been light. Markets expect Kevin Hassett to be named the next Fed Chair, with some concerns that he could be influenced by President Trump on rates. Meanwhile, Reuters and Bloomberg reported hawkish signals suggesting the BoJ is likely to raise rates in December with government approval. Sectors are mixed with a positive tilt: Autos, Industrial Goods & Services and Technology lead. At the bottom: Utilities, Basic Resources and Health Care.

Top European News

BoE Decision Maker Panel Survey (Nov): Expectations for year-ahead CPI inflation remained unchanged at 3.4%; Expected year-ahead wage growth rose slightly, by 0.1ppt to 3.8% in the three months to November

FX

DXY is trading near the lower end of its 98.798–99.029 intraday range, pressured by JPY strength after Reuters and Bloomberg reported the BoJ is likely to hike rates in December with government approval. Money markets were already pricing a 66% chance of a hike following Governor Ueda’s recent hawkish remarks. USD/JPY slipped from 155.54 to a 154.77 low, with next support at the 1 December trough of 154.66.

AUD is firmer amid continued hawkish repricing of RBA expectations.

G10 FX is otherwise mostly flat and taking its cue from the USD, with few fresh drivers. EUR and GBP were little moved by Construction PMI releases.

PBoC set USD/CNY mid-point at 7.0733 vs exp. 7.0554 (Prev. 7.0754)

Chinese State-owned banks reportedly bought USD on the onshore spot market this week in a bid to rein in CNY strength, according to Reuters sources.

RBI to tolerate a weaker rupee as dollar inflows diminish, according to Reuters sources.

Fixed Income

Fixed income benchmarks are lower following the hawkish BoJ reports, though the associated softening in risk sentiment has provided a modest haven bid as the morning has unfolded.

JGBs underperformed, falling as much as 42 ticks to a new contract low of 134.08. The move pushed the 20yr yield to its highest since June 1999 and the 30yr yield to a record high, with selling driven by reports that boosted December BoJ hike odds to above 65%.

The bearish tone extended into USTs and Bunds (now trading the Mar’25 contract), which hit lows of 112-27 and 128.46, down eight and 16 ticks respectively. European newsflow was limited; French and Spanish supply saw no major reaction, with Spain’s auction strong and France’s slightly softer versus prior.

For USTs, focus beyond the BoJ remains on the Fed Chair narrative. The FT noted bond investors have expressed concern to the Treasury over Hassett’s potential appointment due to his perceived alignment with the President. Kalshi odds for Hassett have slipped to ~75% from above 80% earlier in the week.

Spain sells EUR 2.88bln vs exp. EUR 2.5-3.5bln 2.70% 2030, 0.85% 2037 Bono and EUR 0.481mln vs exp. EUR 0.25-0.75bln 1.15% 2036 I/L.

France sells EUR 5.06bln vs exp. EUR 3.5-5.5bln 4.75% 2035, 0.50% 2040, 4.50% 2041, 3.25% 2055 OAT.

UK sells GBP 1bln 4.25% 2039 Gilt via tender: b/c 3.88x, average yield 4.813%.

Commodities

Crude benchmarks were firmer through the APAC session despite constructive comments from US and Russian officials after their recent Moscow meeting. Both benchmarks climbed to highs of USD 59.42/bbl (WTI) and USD 63.08/bbl (Brent) before easing to USD 59.11/bbl and USD 62.74/bbl as risk sentiment softened following the hawkish BoJ reports.

XAU posts modest gains early in APAC, reaching USD 4,217/oz before sliding to USD 4,176/oz and remaining below USD 4.2k/oz. Despite a recent soft ADP print and mixed services PMI, gold has unwound its data-driven uptick as broader risk sentiment improves.

3M LME copper traded within a USD 11.43k–11.53k/t range in APAC before retreating from Wednesday’s all-time high of USD 11.54k/t, now at session lows around USD 11.35k/t. The pullback follows Rio Tinto’s raised 2025 copper production guidance and Goldman Sachs’ scepticism over the recent rally.

Geopolitics: Middle East

Israel identified the body of the hostage received from Gaza as Thai national Sontisek Rintalk and said the body of the last Israeli hostage, Ran Gvili, remains in Gaza.

Iraq has decided to freeze the money of "terrorists", including Hezbollah and the Houthis, via the Official Gazette

Geopolitics: Ukraine

US President Trump said the meeting between Russian President Putin, Special Envoy Witkoff and Kushner was a reasonably good meeting and "we'll see what happens", while he added that Russian President Putin wants to end the war.

White House official said the US and Russia had a thorough and productive meeting, while Witkoff and Kusher briefed Trump after the meeting with Putin on Tuesday and are to meet Ukrainian representatives in Miami on Thursday.

Russian President Putin said the meeting with US' Witkoff and Kushner was necessary and very useful, but it is "too early to say"; said Russia will take control of Donbas and Novorossiya by military means or otherwise.

Russian Foreign Ministry Spokesperson said the attacks on tankers in the Black Sea and CPC are aimed at disrupting the peace talks in Ukraine.

A Ukrainian official has reportedly cautioned that Thursday's meeting between Ukraine's Umerov and US' Witkoff is a "debrief" by the US and not "a negotiating session...", FT reported.

Geopolitics: Other

Venezuela's President Maduro said he had a conversation with US President Trump about 10 days ago, while he added that steps are being taken towards a respectful dialogue between both countries.

China is said to be gathering military ships across East Asia in a show of maritime force, according to Reuters sources

US Event Calendar

7:30 am: Nov Challenger Job Cuts YoY, est. 48%, prior 175.3%

8:30 am: Nov 29 Initial Jobless Claims, est. 220k, prior 216k

8:30 am: Nov 22 Continuing Claims, est. 1962.61k, prior 1960k

10:00 am: Sep Factory Orders, est. 0.3%, prior 1.4%

10:00 am: Sep F Durable Goods Orders, prior 0.5%

10:00 am: Sep F Durables Ex Transportation, prior 0.6%

10:00 am: Sep F Cap Goods Orders Nondef Ex Air, prior 0.9%

10:00 am: Sep F Cap Goods Ship Nondef Ex Air, prior 0.9%

DB's Jim Reid concludes the overnight wrap

Markets continue to be in consolidation mode, with the S&P 500 (+0.30%) and the STOXX 600 (+0.10%) both posting modest gains yesterday. The session had started on the back foot as the ADP’s report of private payrolls showed the biggest monthly drop since March 2023, but most assets recovered by the end of the session, as data cemented the view that the Fed would likely cut rates at next week’s meeting. So lots of assets were up by the close, with the 10yr Treasury yield (-2.3bps) down to 4.06%, whilst Bitcoin (+2.30%) reached a two-week high of $93,722 and the small-cap Russell 2000 rose +1.91%. In Japan this morning a strong 30yr auction has led to a decent long-end rally even as other parts of the curve sell off.

In terms of that ADP report, the headline was that private payrolls fell by -32k in November, undershooting expectations for a +10k rise. The losses were largely concentrated around small businesses (-120k), which saw their largest decline in employment since the pandemic, although payrolls from medium (+51k) and large businesses (+39k) fared better. There were also some questions about regional distortions as the aggregate decline came due to outsized losses in regions along the Atlantic coast. Still, the negative signal from the ADP report received more attention than usual because of the data backlog from the shutdown. So we aren’t getting the usual payrolls this Friday, and the ADP is one of the final pieces of information the Fed will get on the labour market ahead of next week’s decision.

That dovish momentum from the ADP report then got a further boost from the ISM services print. The headline measure was a bit stronger than expected at 52.6 (vs. 52.0 expected), but crucially, the prices paid component fell to a 7-month low of 65.4 (vs. 68.0 expected), which eased concerns about tariff-driven inflation. That component has been strongly correlated to inflation with a lag, so the bigger-than-expected decline helped solidify expectations for a Fed rate cut. Moreover, the employment component remained in contractionary territory at 48.9, so again that echoed the weaker message from the ADP print.

Those prints helped US Treasuries to rally across the curve, with the 2yr yield (-2.4bps) down to 3.49%, whilst the 10yr yield (-2.3bps) fell to 4.06%. And in turn, that saw the dollar index (-0.49%) post its worst day in seven weeks and fall to its weakest level since October 28, the day before Fed Chair Powell said that a December rate cut was “not a foregone conclusion”. This morning, 2 and 10yr US yields are back up +2bps, nearly wiping out yesterday's gains.

Meanwhile for equities, the S&P 500 (+0.30%) continued to move higher, closing less than 1% beneath its record high from late-October. However, there were some fluctuations over the session, and Microsoft (-2.50%) shares fell after tech news outlet The Information reported that Microsoft had lowered their AI software sales quota. That was pushed back on by a spokesperson for Microsoft, and the share price recovered a bit when CNBC reported they hadn’t lowered the quotas. However, Microsoft shares then sold off again into the close, reviving investor fears about AI valuations. Nevertheless, that wasn’t enough to knock the broader market. The Magnificent 7 (+0.12%) still rose on the day thanks to a +4.08% gain for Tesla. And it was a strong day for market breadth with two thirds of the S&P 500 stocks higher on the day and the small cap Russell 2000 rising +1.91%.

Over in Europe, it was also a data heavy day with the final PMI releases. Those were broadly positive, and the final composite PMI for the Euro Area was revised up to 52.8 (vs. flash 52.4), its highest level in two-and-a-half years. So that continues the positive momentum seen in the PMIs over recent months, and helped to bolster sentiment, with upward revisions in Germany, France and the UK for the composite PMI. In turn, that helped the STOXX 600 (+0.10%) to just about post a modest gain, although it was a pretty subdued day across the continent, with the FTSE 100 (-0.10%), the CAC 40 (+0.16%), and the DAX (-0.07%) all seeing little movement.

There was also little movement in European fixed income, with 10yr bund yields (-0.2bps) barely moving. However, we did hear from ECB Chief Economist Lane, who discussed how the ECB should react to medium-sized inflation shocks, and energy price shocks in particular. He argued that inflation risk wasn’t one-way and that the bank had recently seen some upside surprises, so his comments offered support for the view that rates are likely to be kept on hold through the energy-induced inflation undershoot in 2026.

On the geopolitical front, the perception was that the prospect of a breakthrough in the talks on Ukraine continued to ebb yesterday, with the Polymarket chances of a ceasefire by end-March falling back to just 22%, having been at 27% when we went to press yesterday. In turn, there was a reaction among assets more sensitive to the conflict, with the STOXX Aerospace & Defense index up +2.26%, whilst Brent crude oil prices (+0.35%) were up to $62.67/bbl.

In Asia, Japanese stocks are leading the way, with the Nikkei rising by +2.00% and the Topix increasing by +1.86%, both outperforming their regional counterparts. The ASX (+0.27%) is also higher, with the Hang Seng flat and the Shanghai Comp -0.20% lower. The KOSPI is the largest underperformer, down -0.71%. US futures are flat.

Early morning data revealed that Australia’s household spending significantly exceeded expectations in October, marking its largest increase since January 2024, thereby strengthening the argument for an interest rate hike next year. Spending rose by +1.3% from September, surpassing economists’ forecasts of a +0.6% increase. Year-on-year, consumption has increased by +5.6%, compared to the anticipated +4.6% rise. 2yr and 10yr Aussie yields are up +7.5bps and 6bps respectively.

In the bond markets, Japan’s 30-year bonds gained following an auction that attracted the highest demand since 2019, as elevated yields drew in investors. The yield on the 30-year bond decreased by -3bps to 3.39% after the bid-to-cover ratio surged to 4.04, up from 3.125 at the previous auction in November. This strong outcome for the 30-year auction followed a successful sale of 10-year debt earlier in the week, which also saw robust demand. However the rally at the long end today seems to have been funded from elsewhere in the curve with the 10yr yield +3.8bps higher this morning.

To the day ahead now, and we’ll get the US weekly initial jobless claims, the November construction PMIs from the UK and Germany, and Eurozone retail sales for October. Central Bank spearers include the Fed’s Bowman, the ECB’s Kocher, Cipollone and Lane, and the BOE’s Mann. Notable earnings include Kroger, Dollar General and HPE.

Thu, 12/04/2025 - 08:50

In pre-market trading, tech stocks were broadly steady with all Magnificent Seven megacaps apart from Apple posting modest gains, while Salesforce climbed on signs that customers are embracing its artificial intelligence tools.

Mag 7 stocks mostly higher (Tesla +0.6%, Nvidia +0.4%, Meta +0.8%, Alphabet +0.6%, Microsoft +0.4%, Amazon +0.1%, Apple -0.04%)

Axogen (AXGN) rises 5% after the provider of medical and surgical instruments said the FDA approved its biologics license application for its Avance nerve graft to treat peripheral nerve discontinuities.

Bill Holdings Inc. (BILL) gains 3% after activist investor Barington Capital Group has taken a stake in business payments firm.

Costco falls (COST) 1.1% after the retailer reported total comparable sales for November that missed the average analyst estimate.

Dollar General (DG) rises 4% after the company raised its full-year outlook, highlighting value-focused retailers are winning over consumers hunting for deals.

Guidewire (GWRE) jumps 5% after the software company’s first-quarter results and second-quarter revenue forecast topped analysts’ expectations.

Hormel (HRL) rises 6% after the protein producer’s 3Q adj. EPS forecast beat the company’s recently lowered guidance, as well as the Street consensus.

MBX Biosciences (MBX) slips 3% after Goldman Sachs initiated coverage of the drug developer with a sell rating, citing risk to the firm’s data readout in the near term.

Salesforce Inc. (CRM) is up 1.9% after the software company gave an outlook for revenue in the current period that topped analysts’ estimates, suggesting it is persuading customers to buy its AI tools.

Snowflake (SNOW) falls 8% after the software company issued a forecast for operating margin in the current quarter that fell short of the average analyst estimate. Analysts noted a deceleration in product revenue growth.

UiPath (PATH) rises 8% after the software company’s third-quarter results beat expectations. It also gave a forecast.

UniQure (QURE) falls 13% after saying the FDA indicated that data from its Phase I/II studies of an investigational gene therapy for Huntington’s disease are unlikely to provide primary evidence to support a biologics license application submission.

ZIM (ZIM) rises 3% after Globes reports that Hapag-Lloyd submitted a bid to purchase the shipping company, without saying where it got the information.

Fed rate-cut expectations have fueled a broad rebound after November’s slump, with investors turning to defensive and other sectors as worries over stretched tech valuations persist. The small-cap Russell 2000 index is now just shy of a record high, while the Nasdaq 100 remains about 2% below its peak.

“We’re expecting a broadening of the rally for sectors that have so far been lagging,” said Amelie Derambure, senior portfolio manager at Amundi SA in Paris. “The Russell is very sensitive to interest rates, so the figures reinforced the market’s idea that the Fed will be able to lower rates, in a non-recessionary context.”

A report on corporate job-cut announcements from Challenger, Gray & Christmas Inc. added to evidence that the US labor market is softening. Announced layoffs fell last month after surging in October, but were still the highest for any November in three years, according to the outplacement firm. Meanwhile, YTD hiring plans are the lowest since 2010.

In pre-market trading, tech stocks were broadly steady with all Magnificent Seven megacaps apart from Apple posting modest gains, while Salesforce climbed on signs that customers are embracing its artificial intelligence tools.

Mag 7 stocks mostly higher (Tesla +0.6%, Nvidia +0.4%, Meta +0.8%, Alphabet +0.6%, Microsoft +0.4%, Amazon +0.1%, Apple -0.04%)

Axogen (AXGN) rises 5% after the provider of medical and surgical instruments said the FDA approved its biologics license application for its Avance nerve graft to treat peripheral nerve discontinuities.

Bill Holdings Inc. (BILL) gains 3% after activist investor Barington Capital Group has taken a stake in business payments firm.

Costco falls (COST) 1.1% after the retailer reported total comparable sales for November that missed the average analyst estimate.

Dollar General (DG) rises 4% after the company raised its full-year outlook, highlighting value-focused retailers are winning over consumers hunting for deals.

Guidewire (GWRE) jumps 5% after the software company’s first-quarter results and second-quarter revenue forecast topped analysts’ expectations.

Hormel (HRL) rises 6% after the protein producer’s 3Q adj. EPS forecast beat the company’s recently lowered guidance, as well as the Street consensus.

MBX Biosciences (MBX) slips 3% after Goldman Sachs initiated coverage of the drug developer with a sell rating, citing risk to the firm’s data readout in the near term.

Salesforce Inc. (CRM) is up 1.9% after the software company gave an outlook for revenue in the current period that topped analysts’ estimates, suggesting it is persuading customers to buy its AI tools.

Snowflake (SNOW) falls 8% after the software company issued a forecast for operating margin in the current quarter that fell short of the average analyst estimate. Analysts noted a deceleration in product revenue growth.

UiPath (PATH) rises 8% after the software company’s third-quarter results beat expectations. It also gave a forecast.

UniQure (QURE) falls 13% after saying the FDA indicated that data from its Phase I/II studies of an investigational gene therapy for Huntington’s disease are unlikely to provide primary evidence to support a biologics license application submission.

ZIM (ZIM) rises 3% after Globes reports that Hapag-Lloyd submitted a bid to purchase the shipping company, without saying where it got the information.

Fed rate-cut expectations have fueled a broad rebound after November’s slump, with investors turning to defensive and other sectors as worries over stretched tech valuations persist. The small-cap Russell 2000 index is now just shy of a record high, while the Nasdaq 100 remains about 2% below its peak.

“We’re expecting a broadening of the rally for sectors that have so far been lagging,” said Amelie Derambure, senior portfolio manager at Amundi SA in Paris. “The Russell is very sensitive to interest rates, so the figures reinforced the market’s idea that the Fed will be able to lower rates, in a non-recessionary context.”

A report on corporate job-cut announcements from Challenger, Gray & Christmas Inc. added to evidence that the US labor market is softening. Announced layoffs fell last month after surging in October, but were still the highest for any November in three years, according to the outplacement firm. Meanwhile, YTD hiring plans are the lowest since 2010.

With official data still delayed, private indicators have increasingly pointed to employment coming under pressure from company belt-tightening and weaker spending. Worries about the jobs market and expectations that President Donald Trump will choose a Fed chair who shares his dovish stance have shifted market pricing toward as many as four rate cuts through 2026. Still, with the broader economy resilient, easier policy should continue to support stocks.

“Retail momentum stocks and crypto are still way below the recent peaks, though both have recovered from the recent lows,” wrote Mohit Kumar, chief economist and strategist for Europe at Jefferies. “We see sentiment remaining positive into year-end.”

Meanwhile, Goldman Sachs is looking past this month’s decision to what it calls a “foggy” Fed rate path in 2026. Risks to its terminal-rate range are skewed to the downside amid labor-market weakness, the bank wrote. They still expect two rate cuts next year. JPMorgan strategists expect the market to be boosted by higher equity demand next year. They project a supply-demand “improvement” of around $700 billion in 2026, which would be the strongest year since 2023.

Europe's Stoxx 600 is 0.3% higher with the DAX outperforming. Autos and industrial stocks are leading the way in Europe while utilities and healthcare dip. Automakers gain as Bank of America upgrades some stocks. Here are some of the biggest movers on Thursday:

Mercedes, Renault gain as much as 4.4% and 4.8% respectively while holding company Porsche SE rises 5.7%, as Bank of America upgrades the stocks due to a more positive view on the European autos sector.

Storytel gains as much as 6.5% after SEB initiated coverage of the Swedish audiobook and publishing house with a buy rating, saying the company has improved the quality of its subscriber base and its internal efficiency.

Cosmo shares rise as much as 5.5%, adding to Wednesday’s 20% jump following positive late-stage trial results for the life science company’s experimental treatment for male hair loss.

Balfour Beatty shares rise as much as 2.4% after the engineering and construction group said it expects to grow its order book by 20% in 2025 and confirmed more buybacks are on the way in 2026.

Philips shares drop as much as 8.6% after Citi analysts noted tariff and China challenges for 2026.

Trustpilot shares fall as much as 21% after Grizzly Research published a report on the consumer-review company.

Earlier in the session, Asian stocks rose for a third straight day, led by gains in Japan as regional tech shares tracked their US peers higher. The MSCI Asia Pacific Index advanced as much as 0.9%, with SoftBank Group and Keyence among the biggest contributors. Shares fluctuated in China and Hong Kong, while South Korean stocks slipped. India’s benchmark struggled to hold early gains even as the rupee strengthened against the dollar. Sentiment across the region is improving on rising expectations of a Federal Reserve rate cut this month after the latest US jobs data. Meanwhile, a slightly weaker yen is providing an extra lift to Japanese exporters. Semiconductor shares are showing signs of weakness, with South Korea’s tech-heavy stock index slipping more than 1% as foreign funds take profit. A Microsoft Corp. update is also weighing on sentiment, after a media report that the firm lowered expectations for business customers buying on the cloud unit’s marketplace for artificial intelligence models and agents.

In FX, the dollar gives up earlier gains, Aussie outperforming on bets the central bank may pivot back to rate hikes.

In rates, global bonds weakened, driven by rising yields in Japan. Sentiment shifted as some senior government officials signaled they wouldn’t oppose a Bank of Japan rate hike this month. Treasury yields are rising across the curve. German bonds falling on growing government uncertainty. Gilts are outperforming after very weak construction activity data sparks a small increase in BOE rate-cut bets.

In commodities, oil prices are higher, albeit with some volatility. Brent is trading around $63/barrel. Gold is recovering ground and now trading close to $4,200/oz. Bitcoin, meanwhile, held above $93,000. The dollar was little changed.

US economic calendar includes November Challenger jobs cuts (7:30am), weekly jobless claims (8:30am) and September factory orders (10am)

Market Snapshot

S&P 500 mini and Nasdaq 100 mini little-changed

Russell 2000 mini steady

Stoxx Europe 600 +0.3%

DAX +0.8%

CAC 40 +0.4%

10-year Treasury yield +2 basis points at 4.08%

VIX +0.1 points at 16.17

Bloomberg Dollar Index little changed at 1212.82

euro little changed at $1.1668

WTI crude +0.4% at $59.21/barrel

Top Overnight News

Donald Trump’s aides are considering having Scott Bessent also head the National Economic Council if Kevin Hassett becomes Fed chair, people familiar said. BBG

Trump's administration ordered an enhanced vetting of H-1B visa applicants, with new H-1B visa screening based on any involvement in censorship or free speech, according to the State Department memo.

Trump said he may work out another trade deal with Canada and Mexico. BBG

Vladimir Putin said Russia didn’t agree with some points of the US peace proposal for Ukraine, Tass reported, citing his interview with a local media outlet. Earlier, Trump called the meeting between Steve Witkoff and Putin “reasonably good” but next steps remain unclear. BBG

Emmanuel Macron met Xi Jinping in Beijing and urged China to boost investments in France, as both sides look to rebalance their economic ties. BBG

Cambricon plans to more than triple its production of AI chips to half a million units in 2026, people familiar said. The Beijing-based company aims to rival Huawei in China and fill a void left by Nvidia’s forced exit. BBG

Bank of Japan Governor Kazuo Ueda said on Thursday there was uncertainty on how far the central bank could raise interest rates due to the difficulty of estimating the country's neutral rate of interest. RTRS

The Indian rupee will regain some lost ground against the U.S. dollar over the next three months, but a reversal in the currency's fortunes hinges upon India and the U.S. agreeing to a trade deal. RTRS

Paramount more than doubled its breakup fee to $5 billion in its offer to acquire Warner Bros., signaling confidence it can clear regulatory hurdles. BBG

Meta Platforms Inc. has been hit by a full-scale European Union antitrust investigation over how its AI features in WhatsApp may be harming competition, in the latest probe into Big Tech’s dominance on the continent. The bloc’s digital chief signaled she wants to conclude several ongoing investigations into tech giants this month including Elon Musk’s X. BBG

For all the focus on ADP (historically very noisy), the Indeed Hiring Lab data actually picked back up in the last couple of weeks (need more data). Notable was the a re-acceleration in open jobs in construction (see below). What if AI adoption is slower or less transformative in the near term… the labor market re-accelerates… and inflation proves hotter in 2026? Not at all my base case but inversion an in important part of the process: Goldman

Trade/Tariffs

US President Trump said they will either let the USMCA expire or maybe work out another deal with Mexico and Canada.

US halted plans to sanction the Chinese spy agency to maintain the trade truce, and the Trump administration will also not enact any major new export controls against China, while the Trump admin is preparing to hold a high-level meeting to decide whether to provide licenses to allow NVIDIA (NVDA) to export the H200 to China, according to FT.

Chinese Commerce Ministry, on rare earth export controls, said as long are export license applications are for civilian use, they will be approved.

Chinese President Xi said in a meeting with French President Macron that China and France are far-sighted, responsible and independent major countries, while he added that China and France should uphold multilateralism and that China is willing to eliminate interferences and stick to equal dialogues with France. Xi also commented that both countries should support each other on core interests and agreed to expand practical cooperation, as well as consolidate cooperation on airspace and nuclear energy. Furthermore, he said both countries aim to expand two-way investment and that China will expand domestic demand in the 15th five-year plan and will also expand market access and opening-up.

India's Trade Minister said exports of autos, electronic goods, textiles and machinery to Russia are expected to increase. India also aims to expand and diversify exports to Russia to address the trade imbalances. India has secured a USD 2bln submarine deal, Bloomberg reported during the visit of Russian President Putin.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher following the positive momentum from Wall St, where all major indices rose amid a weaker dollar and softer yield environment, but with some of the gains in the region capped amid a quiet calendar and lack of major fresh macro catalysts. ASX 200 edged higher in rangebound trade with strength in materials and resources offsetting the losses in the real estate and consumer sectors, while the mining industry was among the outperformers aside from the gold-related stocks. Nikkei 225 rallied above the 50k level as the tech-related momentum in Japan continued, despite higher yields and bets for a December BoJ rate hike. Hang Seng and Shanghai Comp were mixed amid weakness in auto names and after another liquidity drain by the PBoC, while PBoC Governor Pan noted in an Op-Ed that China must maintain prudent monetary policy and should avoid excessive policy adjustments.

Top Asian News

PBoC Governor Pan said in a People's Daily op-ed that China must maintain prudent monetary policy and should avoid excessive policy adjustments, while he also suggested preventing overreach from leading to long-term side effects of policies.

BOJ

BoJ is likely to raise interest rates in December, a decision Japan's government will likely tolerate, according to sources cited by Reuters.

Key members of Japanese PM Takaichi's government would not try to prevent a BoJ hike in December, Bloomberg reports, citing sources.

BoJ is carrying out an assessment of the level of neutral interest rate, according to Jiji.

BoJ Governor Ueda reiterated that they can only estimate the neutral rate with a wide range thus far, while he added they cannot specify a terminal rate and are working on narrowing the estimate on the neutral interest rate, with the findings to be disclosed if successful. Furthermore, he said for now, they have to work with the current estimate set in a fairly wide range, and there is uncertainty on how far interest rates can eventually be raised.

European equities opened higher, reflecting positive APAC momentum, though morning news flow has been light. Markets expect Kevin Hassett to be named the next Fed Chair, with some concerns that he could be influenced by President Trump on rates. Meanwhile, Reuters and Bloomberg reported hawkish signals suggesting the BoJ is likely to raise rates in December with government approval. Sectors are mixed with a positive tilt: Autos, Industrial Goods & Services and Technology lead. At the bottom: Utilities, Basic Resources and Health Care.

Top European News

BoE Decision Maker Panel Survey (Nov): Expectations for year-ahead CPI inflation remained unchanged at 3.4%; Expected year-ahead wage growth rose slightly, by 0.1ppt to 3.8% in the three months to November

FX

DXY is trading near the lower end of its 98.798–99.029 intraday range, pressured by JPY strength after Reuters and Bloomberg reported the BoJ is likely to hike rates in December with government approval. Money markets were already pricing a 66% chance of a hike following Governor Ueda’s recent hawkish remarks. USD/JPY slipped from 155.54 to a 154.77 low, with next support at the 1 December trough of 154.66.

AUD is firmer amid continued hawkish repricing of RBA expectations.

G10 FX is otherwise mostly flat and taking its cue from the USD, with few fresh drivers. EUR and GBP were little moved by Construction PMI releases.

PBoC set USD/CNY mid-point at 7.0733 vs exp. 7.0554 (Prev. 7.0754)

Chinese State-owned banks reportedly bought USD on the onshore spot market this week in a bid to rein in CNY strength, according to Reuters sources.

RBI to tolerate a weaker rupee as dollar inflows diminish, according to Reuters sources.

Fixed Income

Fixed income benchmarks are lower following the hawkish BoJ reports, though the associated softening in risk sentiment has provided a modest haven bid as the morning has unfolded.

JGBs underperformed, falling as much as 42 ticks to a new contract low of 134.08. The move pushed the 20yr yield to its highest since June 1999 and the 30yr yield to a record high, with selling driven by reports that boosted December BoJ hike odds to above 65%.

The bearish tone extended into USTs and Bunds (now trading the Mar’25 contract), which hit lows of 112-27 and 128.46, down eight and 16 ticks respectively. European newsflow was limited; French and Spanish supply saw no major reaction, with Spain’s auction strong and France’s slightly softer versus prior.

For USTs, focus beyond the BoJ remains on the Fed Chair narrative. The FT noted bond investors have expressed concern to the Treasury over Hassett’s potential appointment due to his perceived alignment with the President. Kalshi odds for Hassett have slipped to ~75% from above 80% earlier in the week.

Spain sells EUR 2.88bln vs exp. EUR 2.5-3.5bln 2.70% 2030, 0.85% 2037 Bono and EUR 0.481mln vs exp. EUR 0.25-0.75bln 1.15% 2036 I/L.

France sells EUR 5.06bln vs exp. EUR 3.5-5.5bln 4.75% 2035, 0.50% 2040, 4.50% 2041, 3.25% 2055 OAT.

UK sells GBP 1bln 4.25% 2039 Gilt via tender: b/c 3.88x, average yield 4.813%.

Commodities

Crude benchmarks were firmer through the APAC session despite constructive comments from US and Russian officials after their recent Moscow meeting. Both benchmarks climbed to highs of USD 59.42/bbl (WTI) and USD 63.08/bbl (Brent) before easing to USD 59.11/bbl and USD 62.74/bbl as risk sentiment softened following the hawkish BoJ reports.

XAU posts modest gains early in APAC, reaching USD 4,217/oz before sliding to USD 4,176/oz and remaining below USD 4.2k/oz. Despite a recent soft ADP print and mixed services PMI, gold has unwound its data-driven uptick as broader risk sentiment improves.

3M LME copper traded within a USD 11.43k–11.53k/t range in APAC before retreating from Wednesday’s all-time high of USD 11.54k/t, now at session lows around USD 11.35k/t. The pullback follows Rio Tinto’s raised 2025 copper production guidance and Goldman Sachs’ scepticism over the recent rally.

Geopolitics: Middle East

Israel identified the body of the hostage received from Gaza as Thai national Sontisek Rintalk and said the body of the last Israeli hostage, Ran Gvili, remains in Gaza.

Iraq has decided to freeze the money of "terrorists", including Hezbollah and the Houthis, via the Official Gazette

Geopolitics: Ukraine