Strategy Sets Up $1.4 Billion Cash Reserve, Lifts Bitcoin Stash To 650,000BTC

Strategy Sets Up $1.4 Billion Cash Reserve, Lifts Bitcoin Stash To 650,000BTC

Michael Saylor’s Strategy, the world’s largest public Bitcoin holder, is creating a $1.44 billion US dollar reserve to support dividend payments on its preferred stock and interest on its outstanding debt.

Michael Saylor’s Strategy, the world’s largest public Bitcoin holder, is creating a $1.44 billion US dollar reserve to support dividend payments on its preferred stock and interest on its outstanding debt.

Strategy on Monday

the establishment of a US dollar reserve funded through proceeds from the sale of Class A common stock under its at-the-market offering program.

“Strategy’s current intention is to maintain a USD Reserve in an amount sufficient to fund at least twelve months of its dividends, and Strategy intends to strengthen the USD Reserve over time, with the goal of ultimately covering 24 months or more of its dividends,” the company said.

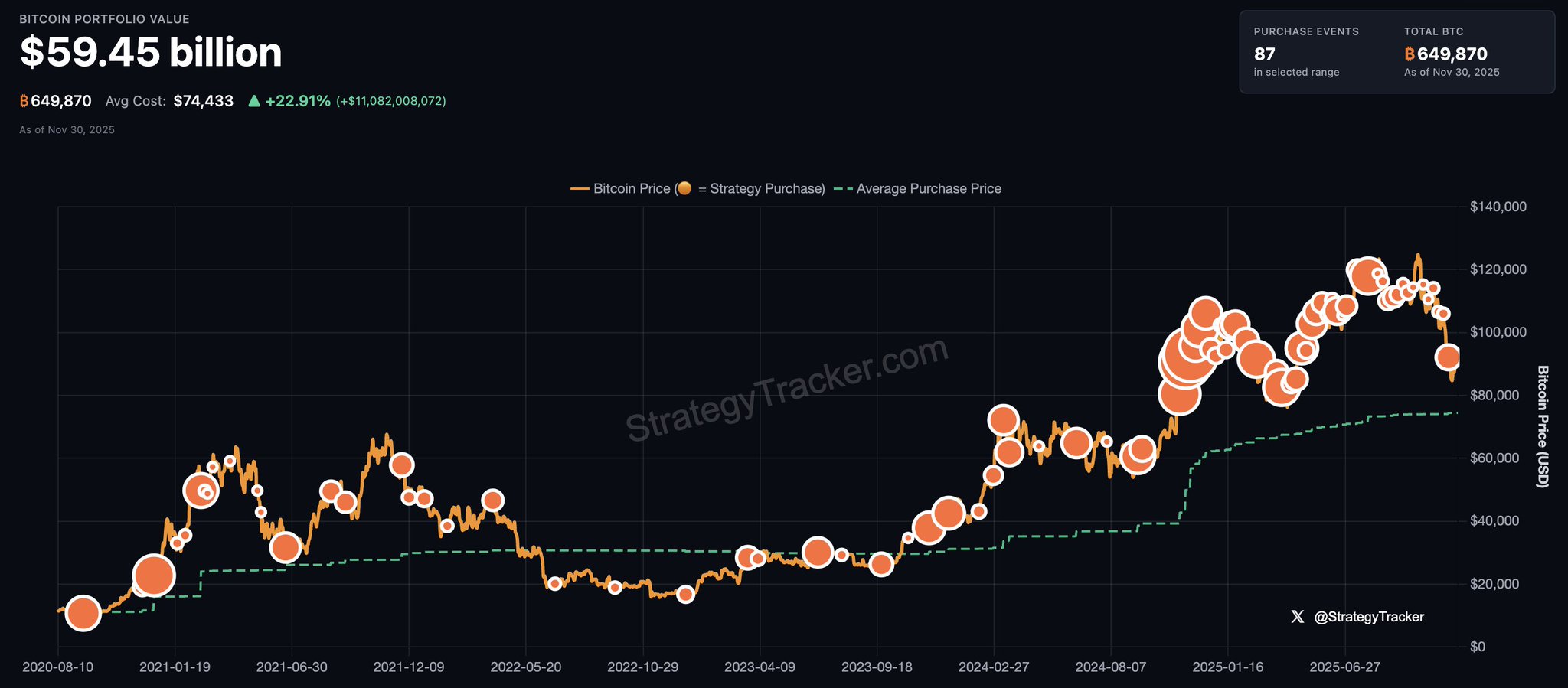

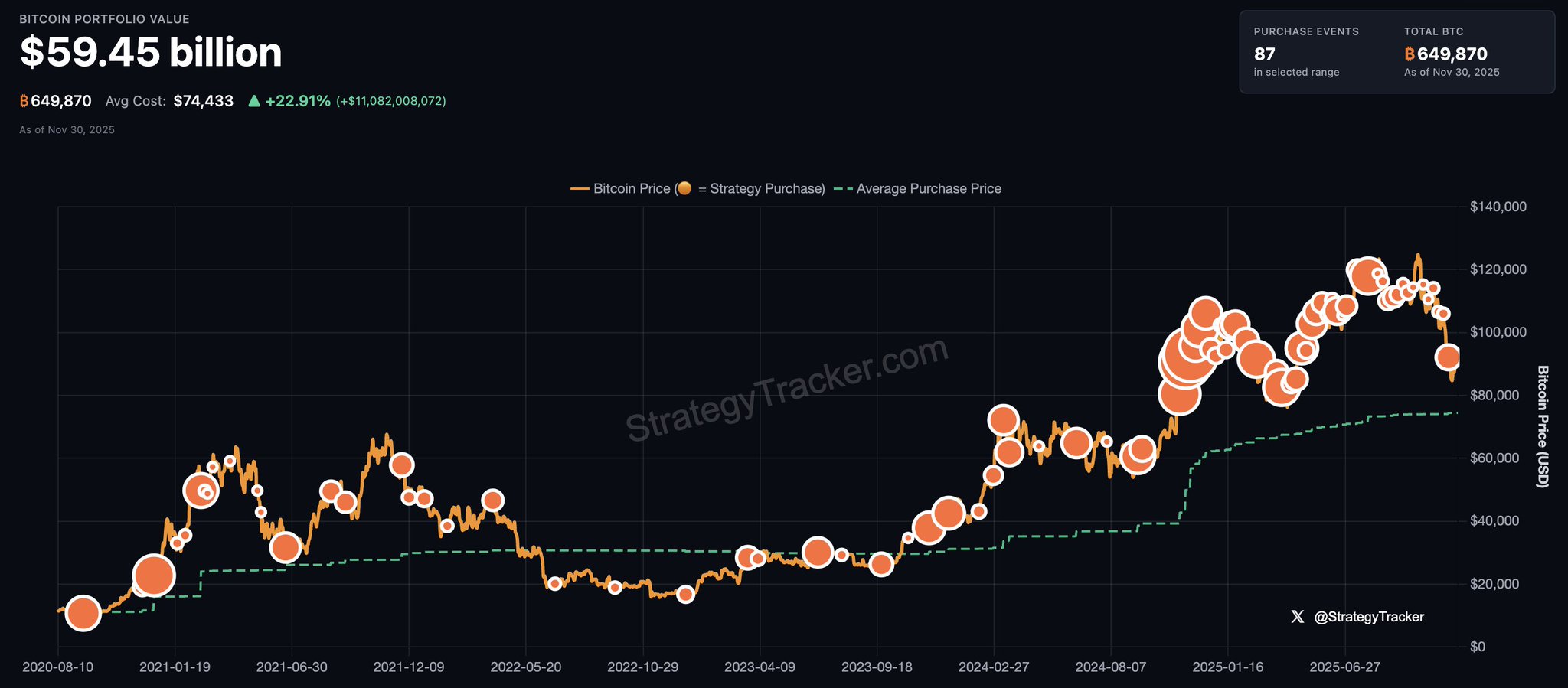

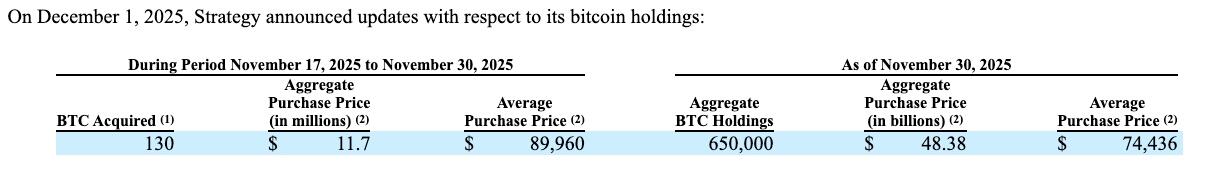

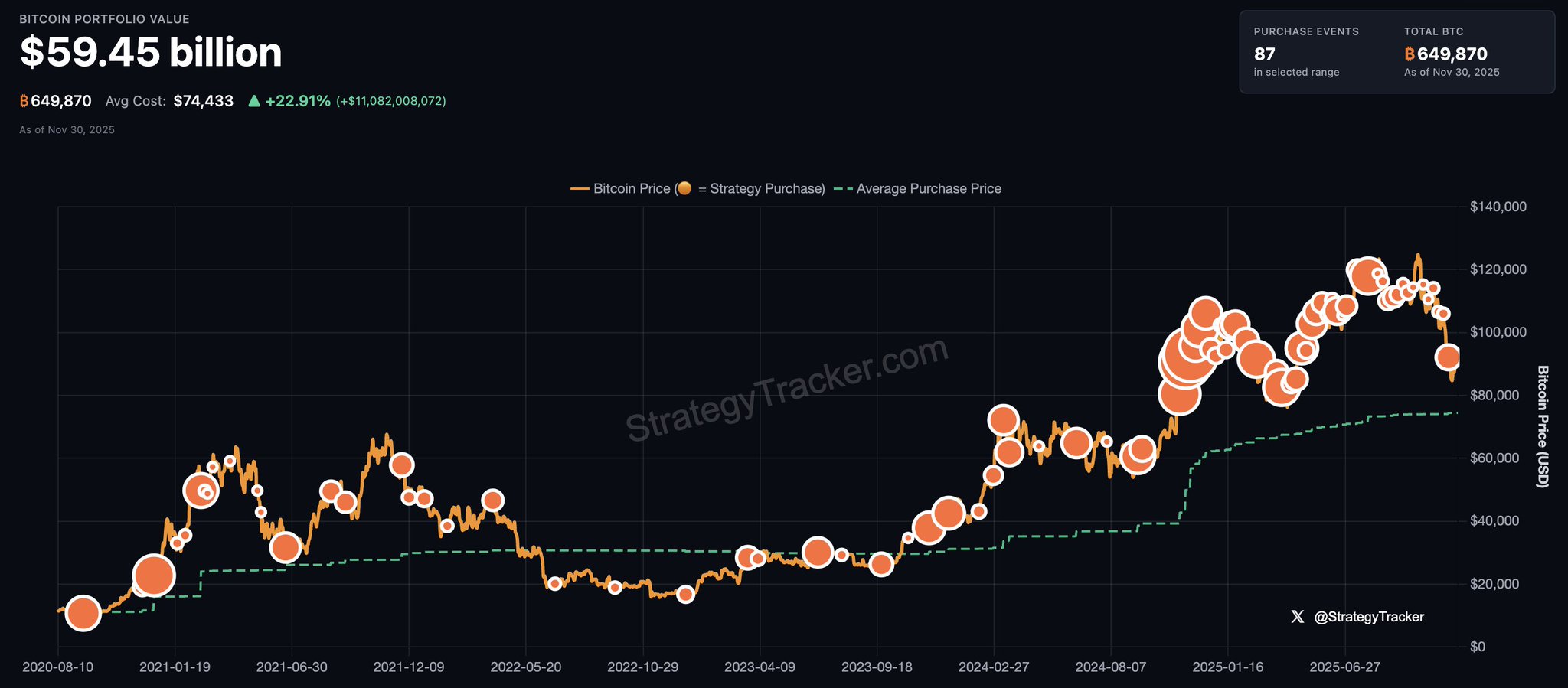

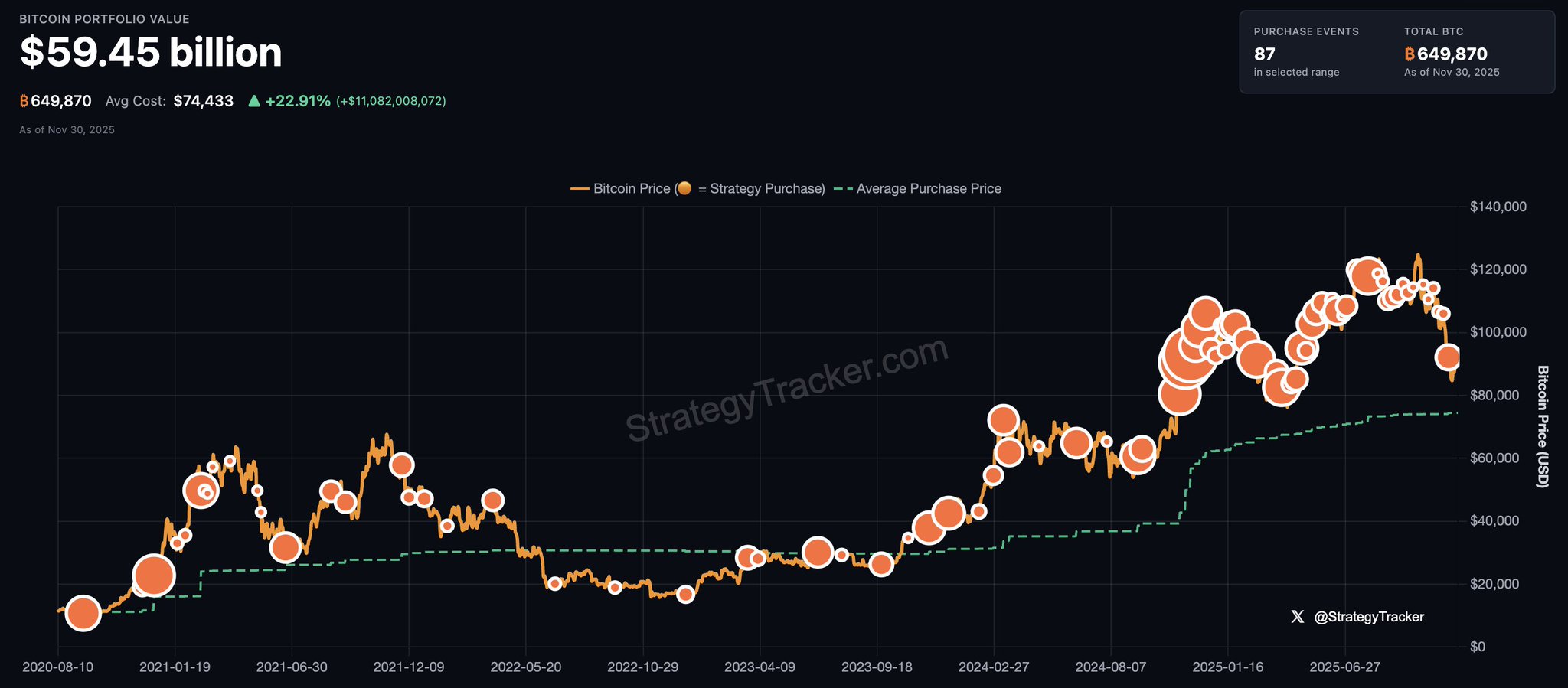

Alongside the launch of the reserve, Strategy disclosed an additional purchase of 130 Bitcoin for $11.7 million, bringing its total holdings to a symbolic value of 650,000 BTC, acquired for $48.38 billion.

https://twitter.com/search?q=%24MSTR&src=ctag&ref_src=twsrc%5Etfw

— Michael Saylor (@saylor)

Strategy on Monday

the establishment of a US dollar reserve funded through proceeds from the sale of Class A common stock under its at-the-market offering program.

“Strategy’s current intention is to maintain a USD Reserve in an amount sufficient to fund at least twelve months of its dividends, and Strategy intends to strengthen the USD Reserve over time, with the goal of ultimately covering 24 months or more of its dividends,” the company said.

Alongside the launch of the reserve, Strategy disclosed an additional purchase of 130 Bitcoin for $11.7 million, bringing its total holdings to a symbolic value of 650,000 BTC, acquired for $48.38 billion.

https://twitter.com/search?q=%24MSTR&src=ctag&ref_src=twsrc%5Etfw

— Michael Saylor (@saylor)  Notably, while MSTR has been in decline, the last few days have seen the preferreds bid...

Notably, while MSTR has been in decline, the last few days have seen the preferreds bid...

The Strategy preferred now yields from 9% to nearly 13%, considerably above the 6% rate on preferred stock from major banks like Bank of America and JPMorgan Chase.

Primary means for funding dividends

According to the Strategy’s company update on Monday, its US dollar reserve will be the primary source of funding dividends paid to holders of its preferred stocks, debt and common equity.

The update details that the $1.44 billion reserve is 2.2% of Strategy’s enterprise value, 2.8% of equity value and 2.4% of Bitcoin value.

The Strategy preferred now yields from 9% to nearly 13%, considerably above the 6% rate on preferred stock from major banks like Bank of America and JPMorgan Chase.

Primary means for funding dividends

According to the Strategy’s company update on Monday, its US dollar reserve will be the primary source of funding dividends paid to holders of its preferred stocks, debt and common equity.

The update details that the $1.44 billion reserve is 2.2% of Strategy’s enterprise value, 2.8% of equity value and 2.4% of Bitcoin value.

Strategy’s funding of the USD Reserve. Source: Strategy

“We believe this improves the quality and attractiveness of our preferreds, debt and common equity,” Strategy said, adding that it raised $1.44 billion in less than nine trading days by selling its common A stock MSTR.

What if we start adding green dots?

Strategy’s funding of the USD Reserve. Source: Strategy

“We believe this improves the quality and attractiveness of our preferreds, debt and common equity,” Strategy said, adding that it raised $1.44 billion in less than nine trading days by selling its common A stock MSTR.

What if we start adding green dots?  — Michael Saylor (@saylor)

— Michael Saylor (@saylor)  USD reserve to complement BTC holdings

“Establishing a USD Reserve to complement our BTC Reserve marks the next step in our evolution,” Strategy founder Saylor said, adding that the new financial tool will better position the company to navigate short-term market volatility.

Strategy CEO and president Phong Le https://www.businesswire.com/news/home/20251201150635/en/Strategy-Announces-Establishment-of-%241.44-Billion-USD-Reserve-and-Updates-FY-2025-Guidance

that the company’s latest BTC purchase — made in the past two weeks — brings its total holdings to 650,000 BTC, or about 3.1% of the 21 million BTC that will ever exist.

USD reserve to complement BTC holdings

“Establishing a USD Reserve to complement our BTC Reserve marks the next step in our evolution,” Strategy founder Saylor said, adding that the new financial tool will better position the company to navigate short-term market volatility.

Strategy CEO and president Phong Le https://www.businesswire.com/news/home/20251201150635/en/Strategy-Announces-Establishment-of-%241.44-Billion-USD-Reserve-and-Updates-FY-2025-Guidance

that the company’s latest BTC purchase — made in the past two weeks — brings its total holdings to 650,000 BTC, or about 3.1% of the 21 million BTC that will ever exist.

An excerpt from Strategy’s Form 8-K. Source: SEC

“In recognition of the important role we play in the broader Bitcoin ecosystem, and to further reinforce our commitment to our credit investors and shareholders, we have established a USD Reserve that currently covers 21 months of dividends,” Le noted.

Strategy lowers 2025 KPI targets

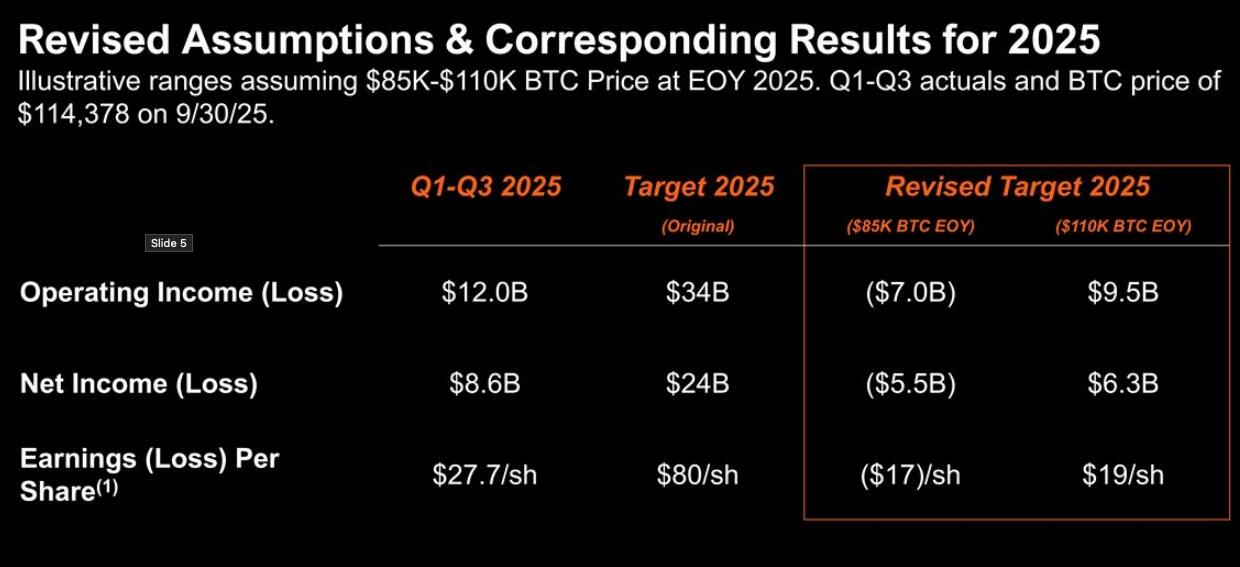

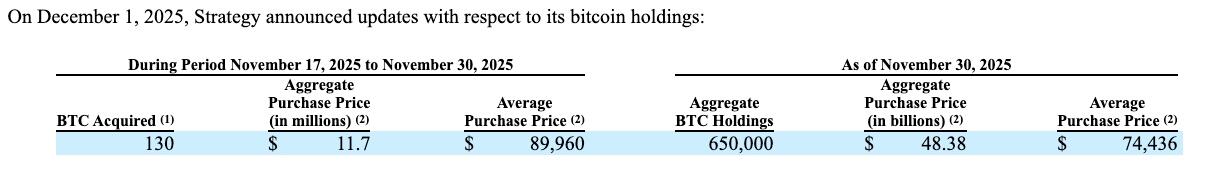

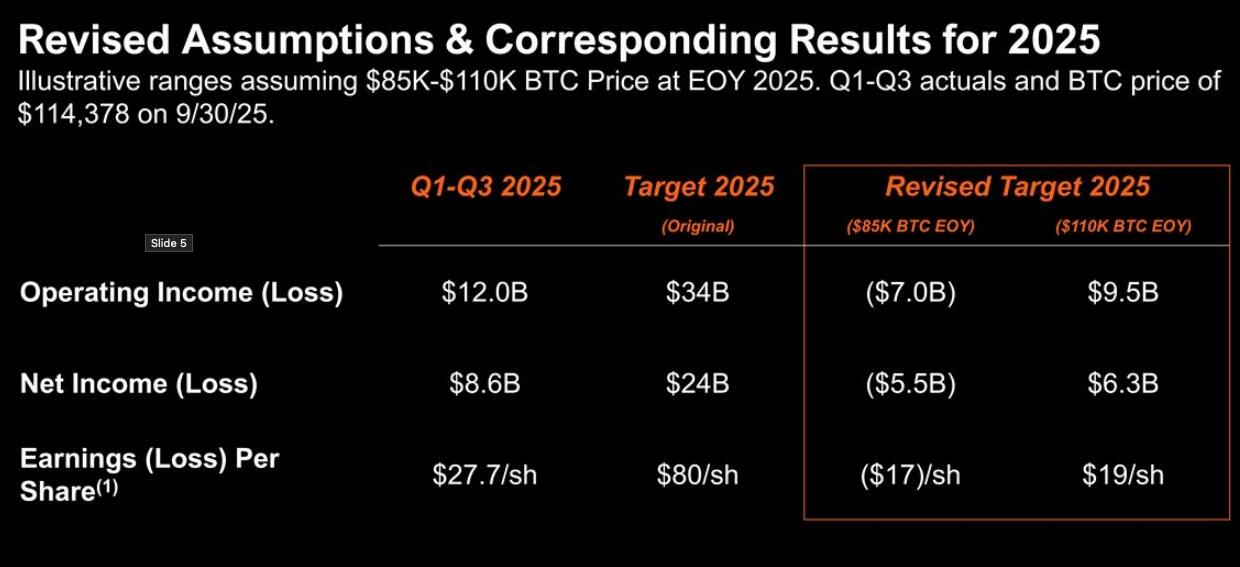

Alongside its reserve and 650,000 BTC holdings, Strategy has significantly lowered its KPI targets and corresponding assumptions for 2025 results.

According to the update, Strategy now expects its BTC yield to end the year between 22% and 26%, with a projected BTC price estimate of $85,000–$110,000 by Dec. 31.

An excerpt from Strategy’s Form 8-K. Source: SEC

“In recognition of the important role we play in the broader Bitcoin ecosystem, and to further reinforce our commitment to our credit investors and shareholders, we have established a USD Reserve that currently covers 21 months of dividends,” Le noted.

Strategy lowers 2025 KPI targets

Alongside its reserve and 650,000 BTC holdings, Strategy has significantly lowered its KPI targets and corresponding assumptions for 2025 results.

According to the update, Strategy now expects its BTC yield to end the year between 22% and 26%, with a projected BTC price estimate of $85,000–$110,000 by Dec. 31.

Revised assumptions and corresponding results for 2025. Source: Strategy

The company has also significantly reduced its targeted BTC gains, cutting its previous expectation of $20 billion to a revised range of between $8.4 billion and $12.8 billion.

The revised target for operating income is between $7 billion and $9.5 billion, down from the originally projected $34 billion.

Mon, 12/01/2025 - 11:40

Revised assumptions and corresponding results for 2025. Source: Strategy

The company has also significantly reduced its targeted BTC gains, cutting its previous expectation of $20 billion to a revised range of between $8.4 billion and $12.8 billion.

The revised target for operating income is between $7 billion and $9.5 billion, down from the originally projected $34 billion.

Mon, 12/01/2025 - 11:40

Cointelegraph

Strategy sets up $1.4B cash reserve, lifts Bitcoin stash to 650,000 BTC

Strategy builds a $1.44B USD reserve for dividend stability to strengthen market resilience alongside its holdings of 650,000 BTC.

Strategy on Monday

Strategy on Monday XBRL Viewer

X (formerly Twitter)

Michael Saylor (@saylor) on X

$MSTR announces the formation of a $1.44 billion USD Reserve and an increase in its BTC Reserve to 650,000 $BTC.

The Strategy preferred now yields from 9% to nearly 13%, considerably above the 6% rate on preferred stock from major banks like Bank of America and JPMorgan Chase.

Primary means for funding dividends

According to the Strategy’s company update on Monday, its US dollar reserve will be the primary source of funding dividends paid to holders of its preferred stocks, debt and common equity.

The update details that the $1.44 billion reserve is 2.2% of Strategy’s enterprise value, 2.8% of equity value and 2.4% of Bitcoin value.

The Strategy preferred now yields from 9% to nearly 13%, considerably above the 6% rate on preferred stock from major banks like Bank of America and JPMorgan Chase.

Primary means for funding dividends

According to the Strategy’s company update on Monday, its US dollar reserve will be the primary source of funding dividends paid to holders of its preferred stocks, debt and common equity.

The update details that the $1.44 billion reserve is 2.2% of Strategy’s enterprise value, 2.8% of equity value and 2.4% of Bitcoin value.

Strategy’s funding of the USD Reserve. Source: Strategy

“We believe this improves the quality and attractiveness of our preferreds, debt and common equity,” Strategy said, adding that it raised $1.44 billion in less than nine trading days by selling its common A stock MSTR.

What if we start adding green dots?

Strategy’s funding of the USD Reserve. Source: Strategy

“We believe this improves the quality and attractiveness of our preferreds, debt and common equity,” Strategy said, adding that it raised $1.44 billion in less than nine trading days by selling its common A stock MSTR.

What if we start adding green dots?

X (formerly Twitter)

Michael Saylor (@saylor) on X

What if we start adding green dots?

X (formerly Twitter)

Michael Saylor (@saylor) on X

What if we start adding green dots?

An excerpt from Strategy’s Form 8-K. Source: SEC

“In recognition of the important role we play in the broader Bitcoin ecosystem, and to further reinforce our commitment to our credit investors and shareholders, we have established a USD Reserve that currently covers 21 months of dividends,” Le noted.

Strategy lowers 2025 KPI targets

Alongside its reserve and 650,000 BTC holdings, Strategy has significantly lowered its KPI targets and corresponding assumptions for 2025 results.

According to the update, Strategy now expects its BTC yield to end the year between 22% and 26%, with a projected BTC price estimate of $85,000–$110,000 by Dec. 31.

An excerpt from Strategy’s Form 8-K. Source: SEC

“In recognition of the important role we play in the broader Bitcoin ecosystem, and to further reinforce our commitment to our credit investors and shareholders, we have established a USD Reserve that currently covers 21 months of dividends,” Le noted.

Strategy lowers 2025 KPI targets

Alongside its reserve and 650,000 BTC holdings, Strategy has significantly lowered its KPI targets and corresponding assumptions for 2025 results.

According to the update, Strategy now expects its BTC yield to end the year between 22% and 26%, with a projected BTC price estimate of $85,000–$110,000 by Dec. 31.

Revised assumptions and corresponding results for 2025. Source: Strategy

The company has also significantly reduced its targeted BTC gains, cutting its previous expectation of $20 billion to a revised range of between $8.4 billion and $12.8 billion.

The revised target for operating income is between $7 billion and $9.5 billion, down from the originally projected $34 billion.

Revised assumptions and corresponding results for 2025. Source: Strategy

The company has also significantly reduced its targeted BTC gains, cutting its previous expectation of $20 billion to a revised range of between $8.4 billion and $12.8 billion.

The revised target for operating income is between $7 billion and $9.5 billion, down from the originally projected $34 billion.

Tyler Durden | Zero Hedge

Zero Hedge

Strategy Sets Up $1.4 Billion Cash Reserve, Lifts Bitcoin Stash To 650,000BTC | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The purpose of US pressure on Venezuela has very likely now expanded from enforcement action against drug trafficking to efforts toward regime change (see

The purpose of US pressure on Venezuela has very likely now expanded from enforcement action against drug trafficking to efforts toward regime change (see  Last week Politico reported that when US Secretary of State Marco Rubio joined a discussion involving the coalition of the willing via phone call, he made clear to all that the White House wants a peace agreement in place before committing to any long-term security guarantees for Kiev.

But UK Prime Minister Kier Starmer tried to push back, arguing that a "multinational force" would be essential for ensuring Ukraine’s future security.

Bloomberg then

Last week Politico reported that when US Secretary of State Marco Rubio joined a discussion involving the coalition of the willing via phone call, he made clear to all that the White House wants a peace agreement in place before committing to any long-term security guarantees for Kiev.

But UK Prime Minister Kier Starmer tried to push back, arguing that a "multinational force" would be essential for ensuring Ukraine’s future security.

Bloomberg then

When the United States withdrew from Afghanistan in 2021, the Biden administration initiated the Operation Allies Welcome program to

When the United States withdrew from Afghanistan in 2021, the Biden administration initiated the Operation Allies Welcome program to

Despite Mr Richelieu-Booth’s offer to demonstrate the photograph's American origin, authorities chose to arrest him on August 24. All charges were ultimately thrown out, but police continued to harass Booth until October, when they arrested him yet again for "bail violations".

Whilst the original firearms and stalking charges were dismissed, prosecutors pursued a public order offense regarding a separate social media post. Mr Richelieu-Booth was scheduled to face Bradford magistrates on November 25th for allegedly displaying material intended to cause distress, but this charge was also eventually withdrawn. He originally faced a potential prison sentence of six months if convicted.

Elon Musk, who has been highly critical of the UK's censorship policies, reposted a

Despite Mr Richelieu-Booth’s offer to demonstrate the photograph's American origin, authorities chose to arrest him on August 24. All charges were ultimately thrown out, but police continued to harass Booth until October, when they arrested him yet again for "bail violations".

Whilst the original firearms and stalking charges were dismissed, prosecutors pursued a public order offense regarding a separate social media post. Mr Richelieu-Booth was scheduled to face Bradford magistrates on November 25th for allegedly displaying material intended to cause distress, but this charge was also eventually withdrawn. He originally faced a potential prison sentence of six months if convicted.

Elon Musk, who has been highly critical of the UK's censorship policies, reposted a

Though the incident has ended with Booth avoiding jail time, there is a cottage industry of Europeans traveling to the US to experience life away from progressive authoritarianism. This includes shooting firearms for recreation. Often these adventures are documented on YouTube and other platforms, and might be considered an embarrassment for some officials overseas.

Booth's arrest could be an attempt to chill the waters on British travelers who make life in America look "too good".

Some firearms are technically "legal" in the UK, but the application process is arduous and subject to arbitrary police examination, which is why only 0.25% of the population has successfully acquired a firearms certificate. The behavior of UK police is reminiscent of a communist regime; no crime has been committed, but the government wants to dissuade from certain behaviors anyway.

A conviction isn't necessarily the goal. Instead, the process is the punishment. The ongoing struggle session for one man sends a warning to the rest of the populace. The goal is to frighten the public into walking on eggshells. It's much easier to control a population that censors itself. The message is clear: No matter where you travel in the world, the government at home owns you.

Though the incident has ended with Booth avoiding jail time, there is a cottage industry of Europeans traveling to the US to experience life away from progressive authoritarianism. This includes shooting firearms for recreation. Often these adventures are documented on YouTube and other platforms, and might be considered an embarrassment for some officials overseas.

Booth's arrest could be an attempt to chill the waters on British travelers who make life in America look "too good".

Some firearms are technically "legal" in the UK, but the application process is arduous and subject to arbitrary police examination, which is why only 0.25% of the population has successfully acquired a firearms certificate. The behavior of UK police is reminiscent of a communist regime; no crime has been committed, but the government wants to dissuade from certain behaviors anyway.

A conviction isn't necessarily the goal. Instead, the process is the punishment. The ongoing struggle session for one man sends a warning to the rest of the populace. The goal is to frighten the public into walking on eggshells. It's much easier to control a population that censors itself. The message is clear: No matter where you travel in the world, the government at home owns you.

But the picture remains mixed:

S&P Global's US Manufacturing PMI BEAT expectations in November but dipped on a MoM basis from 52.5 to 52.2 (still in expansion territory and up from the 51.9 flash print).

ISM's Manufacturing PMI MISSED expectations, dropping from 48.7 to 48.2 (well below the 49.0 expectation) and in contraction for the ninth month in a row.

But the picture remains mixed:

S&P Global's US Manufacturing PMI BEAT expectations in November but dipped on a MoM basis from 52.5 to 52.2 (still in expansion territory and up from the 51.9 flash print).

ISM's Manufacturing PMI MISSED expectations, dropping from 48.7 to 48.2 (well below the 49.0 expectation) and in contraction for the ninth month in a row.

Although the headline PMI signalled a further expansion of factory activity in November, "the health of the US manufacturing sector gets more worrying the more you scratch under the surface," according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"The main impetus came from a strong rise in factory production, but growth in new order inflows slowed sharply, hinting at a marked weakening of demand growth."

Under the hood, ISM shows Price Paid higher, and new orders and employment worsening...

Although the headline PMI signalled a further expansion of factory activity in November, "the health of the US manufacturing sector gets more worrying the more you scratch under the surface," according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"The main impetus came from a strong rise in factory production, but growth in new order inflows slowed sharply, hinting at a marked weakening of demand growth."

Under the hood, ISM shows Price Paid higher, and new orders and employment worsening...

For two successive months now, warehouses have filled with unsold stock to a degree not previously seen since comparable data were available in 2007. This unplanned accumulation of stock is usually a precursor to reduced production in the coming months.

“Profit margins are meanwhile coming under pressure from a combination of disappointing sales, stiff competition and rising input costs, the latter widely linked to tariffs.

In short, Williamson notes that manufacturers are making more goods but often not finding buyers for these products.

"This combination of sustained robust production growth alongside weaker than expected sales led to a worryingly steep rise in unsold inventories."

ISM Respondents were pretty clear with blame for weakness being placed at Trump's feet in Washington:

“New order entries are within the forecast. We have increased requests from customers to get their orders sooner. Transit time on imports seems to be longer.” (Machinery)

“We are starting to institute more permanent changes due to the tariff environment. This includes reduction of staff, new guidance to shareholders, and development of additional offshore manufacturing that would have otherwise been for U.S. export.” (Transportation Equipment)

“Tariffs and economic uncertainty continue to weigh on demand for adhesives and sealants, which are primarily used in building construction.” (Chemical Products)

“No major changes at this time, but going into 2026, we expect to see big changes with cash flow and employee head count. The company has sold off a big part of the business that generated free cash while offering voluntary severance packages to anyone.” (Petroleum & Coal Products)

“Business conditions remain soft as a result of higher costs from tariffs, the government shutdown, and increased global uncertainty.” (Miscellaneous Manufacturing)

“The unstable market has made pricing fluctuate in a very volatile way; I have had to reduce suppliers for raw materials to maintain a better direct cost structure. Reducing my suppliers has reduced the availability of some items and created longer lead times.” (Fabricated Metal Products)

“Business continues to be a struggle regarding long-term sourcing decisions based on tariffs and landing costs. External (or international) sourcing remains the lowest-cost solution compared to U.S. production/manufacturing. The delta is smaller now, reducing margins.” (Computer & Electronic Products)

“The government shutdown has impacted our access to agricultural data, impacting agricultural markets and, as a result, decisions we make. Optimism for a tariff exemption on palm oil percolated but hasn’t come to fruition at this time.” (Food, Beverage & Tobacco Products)

“Trade confusion. At any given point, trade with our international partners is clouded and difficult. Suppliers are finding more and more errors when attempting to export to the U.S. — before I even have the opportunity to import. Freight organizations are also having difficulties overseas, contending with changing regulations and uncertainty. Conditions are more trying than during the coronavirus pandemic in terms of supply chain uncertainty.” (Electrical Equipment, Appliances & Components)

“Domestic and export business have been lackluster. Our customers are taking prompt orders only and still don’t have confidence to build inventory, much less make expansion plans. In fact, most of any kind of ‘planning’ has been undermined by unpredictability due to inconsistent messaging from Washington. Artificial intelligence is in its infancy stages, producing confusing and most often inaccurate information. This also causes apprehensive consumer buying patterns, contributing to the challenge of forecasting demand.” (Wood Products)

However, there is hope, as manufacturers have grown more optimistic about the year ahead, with the ending of the government shutdown helping lift confidence from the sharp drop suffered in October.

"Optimism is being fueled by hopes of improved policy support, including lower interest rates, as well as greater political stability, though it is clear that uncertainty remains elevated and a drag on business growth in many firms, holding confidence well below levels seen at the start of the year.”

For two successive months now, warehouses have filled with unsold stock to a degree not previously seen since comparable data were available in 2007. This unplanned accumulation of stock is usually a precursor to reduced production in the coming months.

“Profit margins are meanwhile coming under pressure from a combination of disappointing sales, stiff competition and rising input costs, the latter widely linked to tariffs.

In short, Williamson notes that manufacturers are making more goods but often not finding buyers for these products.

"This combination of sustained robust production growth alongside weaker than expected sales led to a worryingly steep rise in unsold inventories."

ISM Respondents were pretty clear with blame for weakness being placed at Trump's feet in Washington:

“New order entries are within the forecast. We have increased requests from customers to get their orders sooner. Transit time on imports seems to be longer.” (Machinery)

“We are starting to institute more permanent changes due to the tariff environment. This includes reduction of staff, new guidance to shareholders, and development of additional offshore manufacturing that would have otherwise been for U.S. export.” (Transportation Equipment)

“Tariffs and economic uncertainty continue to weigh on demand for adhesives and sealants, which are primarily used in building construction.” (Chemical Products)

“No major changes at this time, but going into 2026, we expect to see big changes with cash flow and employee head count. The company has sold off a big part of the business that generated free cash while offering voluntary severance packages to anyone.” (Petroleum & Coal Products)

“Business conditions remain soft as a result of higher costs from tariffs, the government shutdown, and increased global uncertainty.” (Miscellaneous Manufacturing)

“The unstable market has made pricing fluctuate in a very volatile way; I have had to reduce suppliers for raw materials to maintain a better direct cost structure. Reducing my suppliers has reduced the availability of some items and created longer lead times.” (Fabricated Metal Products)

“Business continues to be a struggle regarding long-term sourcing decisions based on tariffs and landing costs. External (or international) sourcing remains the lowest-cost solution compared to U.S. production/manufacturing. The delta is smaller now, reducing margins.” (Computer & Electronic Products)

“The government shutdown has impacted our access to agricultural data, impacting agricultural markets and, as a result, decisions we make. Optimism for a tariff exemption on palm oil percolated but hasn’t come to fruition at this time.” (Food, Beverage & Tobacco Products)

“Trade confusion. At any given point, trade with our international partners is clouded and difficult. Suppliers are finding more and more errors when attempting to export to the U.S. — before I even have the opportunity to import. Freight organizations are also having difficulties overseas, contending with changing regulations and uncertainty. Conditions are more trying than during the coronavirus pandemic in terms of supply chain uncertainty.” (Electrical Equipment, Appliances & Components)

“Domestic and export business have been lackluster. Our customers are taking prompt orders only and still don’t have confidence to build inventory, much less make expansion plans. In fact, most of any kind of ‘planning’ has been undermined by unpredictability due to inconsistent messaging from Washington. Artificial intelligence is in its infancy stages, producing confusing and most often inaccurate information. This also causes apprehensive consumer buying patterns, contributing to the challenge of forecasting demand.” (Wood Products)

However, there is hope, as manufacturers have grown more optimistic about the year ahead, with the ending of the government shutdown helping lift confidence from the sharp drop suffered in October.

"Optimism is being fueled by hopes of improved policy support, including lower interest rates, as well as greater political stability, though it is clear that uncertainty remains elevated and a drag on business growth in many firms, holding confidence well below levels seen at the start of the year.”

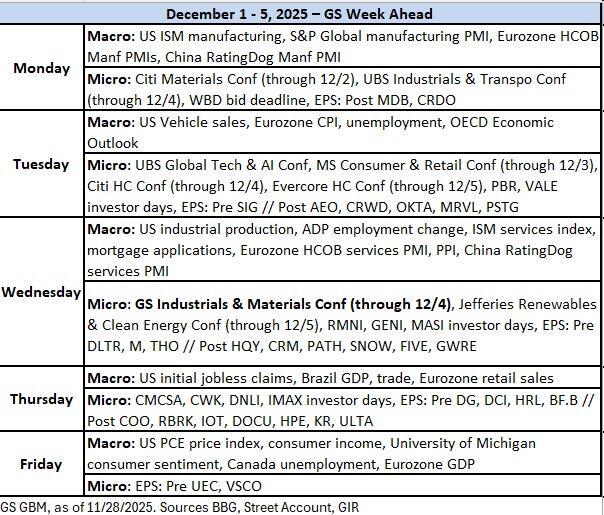

Across Europe, inflation will dominate the agenda. Country-level CPI prints for Germany and France set the tone today, followed by the Eurozone flash CPI for November tomorrow. Switzerland reports inflation figures on Wednesday, and Sweden follows on Thursday. These data points will be closely watched for confirmation that disinflation trends remain intact across the continent.

In Asia, the focus turns to manufacturing and policy signals. Most of China’s PMI data came out yesterday and this morning, but we still have the private-sector services PMI on Wednesday.

Geopolitical developments will also feature prominently. US and Ukrainian delegates met in Florida yesterday without any incremental headlines of note. The US’s main negotiator Witkoff is expected to travel to Moscow today and likely meet Putin tomorrow. EU defence ministers meet today on the same topic, followed by NATO foreign affairs ministers on Wednesday for further strategic discussions. French President Macron undertakes a state visit to China from Wednesday to Friday, underscoring diplomatic engagement in Asia.

Courtesy of DB, here is a day-by-day calendar of events

Monday December 1

Data: US November ISM index, China manufacturing PMI, UK October net consumer credit, M4, Japan November monetary base, Italy November manufacturing PMI, budget balance, new car registrations, Canada November manufacturing PMI

Central banks: BoJ’s Ueda speaks, ECB’s Nagel speaks, BoE's Dhingra speaks

Other: EU foreign affairs council (defence)

Tuesday December 2

Data: US November total vehicle sales, Japan November consumer confidence index, France October budget balance, Italy October unemployment rate, PPI, Eurozone November CPI, October unemployment rate

Central banks: Fed's Powell and Bowman speak, ECB’s Dolenc speaks

Earnings: Crowdstrike, Marvell

Other: OECD economic outlook

Wednesday December 3

Data: US November ISM services, ADP report, September industrial production, import price index, export price index, capacity utilisation, China services PMI, UK November official reserves changes, Italy November services PMI, Eurozone October PPI, Canada Q3 labor productivity, Australia Q3 GDP, Switzerland November CPI

Central banks: ECB's Lagarde and Lane speak, BoE's Mann speaks

Earnings: Salesforce, Snowflake, Inditex, Macy’s, Dollar Tree, Royal Bank of Canada

Other: NATO foreign affairs ministers meeting

Thursday December 4

Data: US initial jobless claims, UK November new car registrations, construction PMI, Japan October household spending, Germany November construction PMI, Eurozone October retail sales, Sweden November CPI

Central banks: Fed's Bowman speaks, ECB's Kocher, Cipollone and Lane speak, BoE's Mann speaks, BoE’s DMP survey

Earnings: Kroger, Dollar General, HPE

Friday December 5

Data: US September PCE, personal income, personal spending, December University of Michigan survey, October consumer credit, Japan October leading index, coincident index, Germany October factory orders, France October trade balance, current account balance, industrial production, Italy October retail sales, Canada November labour force survey

Central banks: ECB's Lane speaks

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing and services indexes on Monday and Wednesday and core PCE inflation and the University of Michigan report on Friday. There are no speaking engagements by Fed officials this week, reflecting the FOMC’s blackout period.

Monday, December 1

09:45 AM S&P Global US manufacturing PMI, November final (consensus 51.9, last 51.9)

10:00 AM ISM manufacturing index, November (GS 49.0, consensus 49.0, last 48.7): We estimate that the ISM manufacturing index rebounded 0.3pt to 49.0 in November, reflecting slight improvement in our manufacturing survey tracker (+0.1pt to 51.6).

Tuesday, December 2

05:00 PM Lightweight motor vehicle sales, November (GS 15.4mn, consensus 15.5mn, last 15.3mn)

Wednesday, December 3

08:15 AM ADP employment change, November (GS -20k, consensus +10k, last +42k)

08:30 AM Import price index, September (consensus +0.1%, last +0.3%)

09:15 AM Industrial production, September (GS flat, consensus +0.1%, last -0.1%): Manufacturing production, September (GS flat, consensus +0.1%, last +0.1%); Capacity utilization, September (GS 75.8%, consensus 77.3%, last 75.8%): We estimate that industrial production was unchanged in September, as declines in auto manufacturing and natural gas production were offset by increases in non-auto manufacturing and electricity, oil and gas production. We estimate capacity utilization was unchanged at 75.8%, following the recent downward adjustment implied by the annual revision to the industrial production index.

09:45 AM S&P Global US services PMI, November final (consensus 55.0, last 55.0)

10:00 AM ISM services index, November (GS 52.5, consensus 52.0, last 52.4): We estimate that the ISM services index increased 0.1pt to 52.5 in November, reflecting sequential improvement in our non-manufacturing survey tracker (+0.6pt to 53.1).

Thursday, December 4

08:30 AM Initial jobless claims, week ended November 29 (GS 215k, consensus 222k, last 216k): Continuing jobless claims, week ended November 22 (consensus 1,956k, last 1,960k)

Friday, December 5

10:00 AM Personal income, September (GS +0.3%, consensus +0.4%, last +0.4%); Personal spending, September (GS +0.2%, consensus +0.3%, last +0.6%); Core PCE price index, September (GS +0.22%, consensus +0.2%, last +0.2%); Core PCE price index (YoY), September (GS +2.85%, consensus +2.8%, last +2.9%); PCE price index, September (GS +0.29%, consensus +0.3%, last +0.3%); PCE price index (YoY), September (GS +2.81%, consensus +2.8%, last +2.7%): We estimate that personal income and personal spending increased by 0.3% and 0.2%, respectively, in September. We estimate that the core PCE price index rose 0.22% in September, corresponding to a year-over-year rate of +2.85%. Additionally, we expect that the headline PCE price index increased 0.29% in September, corresponding to a year-over-year rate of +2.81%. We estimate that market-based core PCE rose 0.23% in September.

10:00 AM University of Michigan consumer sentiment, December preliminary (GS 52.5, consensus 52.0, last 51.0): University of Michigan 5-10-year inflation expectations, December preliminary (GS 3.3%, last 3.4%)

Source: DB, Goldman

Across Europe, inflation will dominate the agenda. Country-level CPI prints for Germany and France set the tone today, followed by the Eurozone flash CPI for November tomorrow. Switzerland reports inflation figures on Wednesday, and Sweden follows on Thursday. These data points will be closely watched for confirmation that disinflation trends remain intact across the continent.

In Asia, the focus turns to manufacturing and policy signals. Most of China’s PMI data came out yesterday and this morning, but we still have the private-sector services PMI on Wednesday.

Geopolitical developments will also feature prominently. US and Ukrainian delegates met in Florida yesterday without any incremental headlines of note. The US’s main negotiator Witkoff is expected to travel to Moscow today and likely meet Putin tomorrow. EU defence ministers meet today on the same topic, followed by NATO foreign affairs ministers on Wednesday for further strategic discussions. French President Macron undertakes a state visit to China from Wednesday to Friday, underscoring diplomatic engagement in Asia.

Courtesy of DB, here is a day-by-day calendar of events

Monday December 1

Data: US November ISM index, China manufacturing PMI, UK October net consumer credit, M4, Japan November monetary base, Italy November manufacturing PMI, budget balance, new car registrations, Canada November manufacturing PMI

Central banks: BoJ’s Ueda speaks, ECB’s Nagel speaks, BoE's Dhingra speaks

Other: EU foreign affairs council (defence)

Tuesday December 2

Data: US November total vehicle sales, Japan November consumer confidence index, France October budget balance, Italy October unemployment rate, PPI, Eurozone November CPI, October unemployment rate

Central banks: Fed's Powell and Bowman speak, ECB’s Dolenc speaks

Earnings: Crowdstrike, Marvell

Other: OECD economic outlook

Wednesday December 3

Data: US November ISM services, ADP report, September industrial production, import price index, export price index, capacity utilisation, China services PMI, UK November official reserves changes, Italy November services PMI, Eurozone October PPI, Canada Q3 labor productivity, Australia Q3 GDP, Switzerland November CPI

Central banks: ECB's Lagarde and Lane speak, BoE's Mann speaks

Earnings: Salesforce, Snowflake, Inditex, Macy’s, Dollar Tree, Royal Bank of Canada

Other: NATO foreign affairs ministers meeting

Thursday December 4

Data: US initial jobless claims, UK November new car registrations, construction PMI, Japan October household spending, Germany November construction PMI, Eurozone October retail sales, Sweden November CPI

Central banks: Fed's Bowman speaks, ECB's Kocher, Cipollone and Lane speak, BoE's Mann speaks, BoE’s DMP survey

Earnings: Kroger, Dollar General, HPE

Friday December 5

Data: US September PCE, personal income, personal spending, December University of Michigan survey, October consumer credit, Japan October leading index, coincident index, Germany October factory orders, France October trade balance, current account balance, industrial production, Italy October retail sales, Canada November labour force survey

Central banks: ECB's Lane speaks

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing and services indexes on Monday and Wednesday and core PCE inflation and the University of Michigan report on Friday. There are no speaking engagements by Fed officials this week, reflecting the FOMC’s blackout period.

Monday, December 1

09:45 AM S&P Global US manufacturing PMI, November final (consensus 51.9, last 51.9)

10:00 AM ISM manufacturing index, November (GS 49.0, consensus 49.0, last 48.7): We estimate that the ISM manufacturing index rebounded 0.3pt to 49.0 in November, reflecting slight improvement in our manufacturing survey tracker (+0.1pt to 51.6).

Tuesday, December 2

05:00 PM Lightweight motor vehicle sales, November (GS 15.4mn, consensus 15.5mn, last 15.3mn)

Wednesday, December 3

08:15 AM ADP employment change, November (GS -20k, consensus +10k, last +42k)

08:30 AM Import price index, September (consensus +0.1%, last +0.3%)

09:15 AM Industrial production, September (GS flat, consensus +0.1%, last -0.1%): Manufacturing production, September (GS flat, consensus +0.1%, last +0.1%); Capacity utilization, September (GS 75.8%, consensus 77.3%, last 75.8%): We estimate that industrial production was unchanged in September, as declines in auto manufacturing and natural gas production were offset by increases in non-auto manufacturing and electricity, oil and gas production. We estimate capacity utilization was unchanged at 75.8%, following the recent downward adjustment implied by the annual revision to the industrial production index.

09:45 AM S&P Global US services PMI, November final (consensus 55.0, last 55.0)

10:00 AM ISM services index, November (GS 52.5, consensus 52.0, last 52.4): We estimate that the ISM services index increased 0.1pt to 52.5 in November, reflecting sequential improvement in our non-manufacturing survey tracker (+0.6pt to 53.1).

Thursday, December 4

08:30 AM Initial jobless claims, week ended November 29 (GS 215k, consensus 222k, last 216k): Continuing jobless claims, week ended November 22 (consensus 1,956k, last 1,960k)

Friday, December 5

10:00 AM Personal income, September (GS +0.3%, consensus +0.4%, last +0.4%); Personal spending, September (GS +0.2%, consensus +0.3%, last +0.6%); Core PCE price index, September (GS +0.22%, consensus +0.2%, last +0.2%); Core PCE price index (YoY), September (GS +2.85%, consensus +2.8%, last +2.9%); PCE price index, September (GS +0.29%, consensus +0.3%, last +0.3%); PCE price index (YoY), September (GS +2.81%, consensus +2.8%, last +2.7%): We estimate that personal income and personal spending increased by 0.3% and 0.2%, respectively, in September. We estimate that the core PCE price index rose 0.22% in September, corresponding to a year-over-year rate of +2.85%. Additionally, we expect that the headline PCE price index increased 0.29% in September, corresponding to a year-over-year rate of +2.81%. We estimate that market-based core PCE rose 0.23% in September.

10:00 AM University of Michigan consumer sentiment, December preliminary (GS 52.5, consensus 52.0, last 51.0): University of Michigan 5-10-year inflation expectations, December preliminary (GS 3.3%, last 3.4%)

Source: DB, Goldman

Rubio

Rubio

Trump dropped several truth bombs as the panicked reporters attempted gotcha questions regarding his

Trump dropped several truth bombs as the panicked reporters attempted gotcha questions regarding his

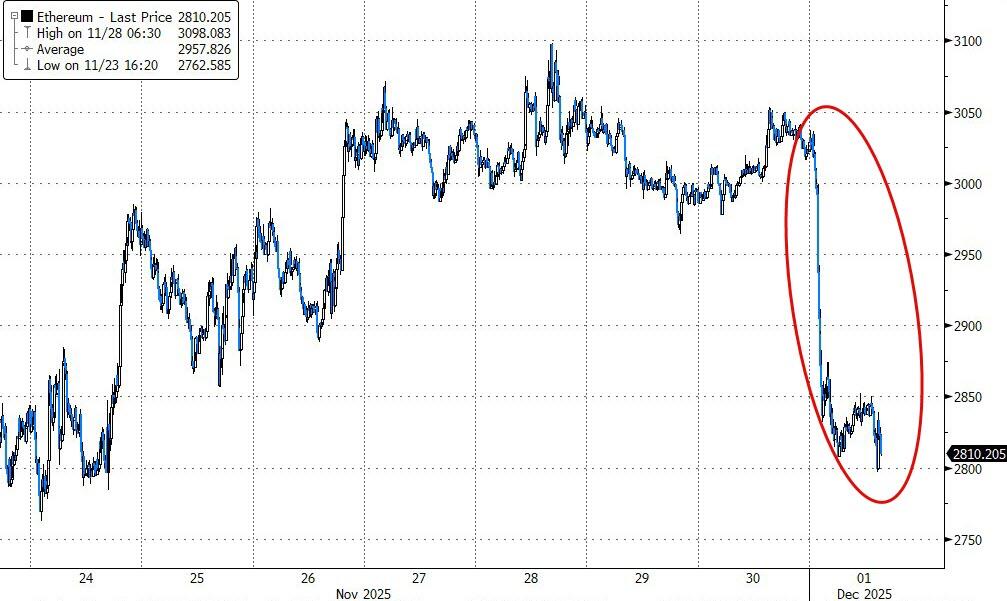

Ethereum also tanked, back below $3,000...

Ethereum also tanked, back below $3,000...

Strategy selling?

Things worsened this morning as Bloomberg reports that concerns are rising that Strategy Inc. soon may be forced to sell some of its roughly $56 billion cryptocurrency haul if token prices continue to fall, leading its shares to wobble in pre-market trading.

Strategy’s mNAV — a key valuation metric comparing the firm’s enterprise value to the value of its Bitcoin holdings — sat at about 1.2 on Monday, according to its website, spurring investor fears it may soon turn negative.

“We can sell Bitcoin and we would sell Bitcoin if we needed to fund our dividend payments below 1x mNAV,” Phong Le, Strategy’s chief executive officer, said on a podcast on Friday, noting that it would only be carried out as a last resort.

“There’s the mathematical side of me that says that would be absolutely the right thing to do, and there’s the emotional side of me, the market side of me, that says we don’t really want to be the company that’s selling Bitcoin,” Le added.

“Generally speaking, for me, the mathematical side wins.”

MSTR is trading down 5% in the pre-market

Strategy selling?

Things worsened this morning as Bloomberg reports that concerns are rising that Strategy Inc. soon may be forced to sell some of its roughly $56 billion cryptocurrency haul if token prices continue to fall, leading its shares to wobble in pre-market trading.

Strategy’s mNAV — a key valuation metric comparing the firm’s enterprise value to the value of its Bitcoin holdings — sat at about 1.2 on Monday, according to its website, spurring investor fears it may soon turn negative.

“We can sell Bitcoin and we would sell Bitcoin if we needed to fund our dividend payments below 1x mNAV,” Phong Le, Strategy’s chief executive officer, said on a podcast on Friday, noting that it would only be carried out as a last resort.

“There’s the mathematical side of me that says that would be absolutely the right thing to do, and there’s the emotional side of me, the market side of me, that says we don’t really want to be the company that’s selling Bitcoin,” Le added.

“Generally speaking, for me, the mathematical side wins.”

MSTR is trading down 5% in the pre-market

However, after a week of not adding to its Bitcoin hoard, Strategy Chairman Michael Saylor appeared to hint in a Sunday post on X that it might soon make further purchases.

What if we start adding green dots?

However, after a week of not adding to its Bitcoin hoard, Strategy Chairman Michael Saylor appeared to hint in a Sunday post on X that it might soon make further purchases.

What if we start adding green dots?