Tesla Earnings Preview: Record Deliveries, Margin Pressure And AI In Focus

Tesla Earnings Preview: Record Deliveries, Margin Pressure And AI In Focus

Tesla is set to report its third-quarter 2025 earnings results after the market closes today. Wall Street’s focus this quarter is squarely on whether record deliveries and energy deployments will translate into meaningful profit growth amid persistent price pressures and an increasingly competitive EV landscape. Additionally, Robotaxi, AI and robotics will be in focus for investors looking to model the company's future.

Revenue and EPS Expectations

Analysts expect Tesla to post earnings of $0.52 per share on revenue of $26.27 billion, while the so-called whisper number stands slightly higher at $0.61 per share. According to Bloomberg’s consensus, adjusted EPS is estimated at $0.54, with total revenue of $26.36 billion, gross margins near 17.2%, operating income of $1.65 billion, free cash flow of $1.25 billion, and capital expenditures around $2.84 billion.

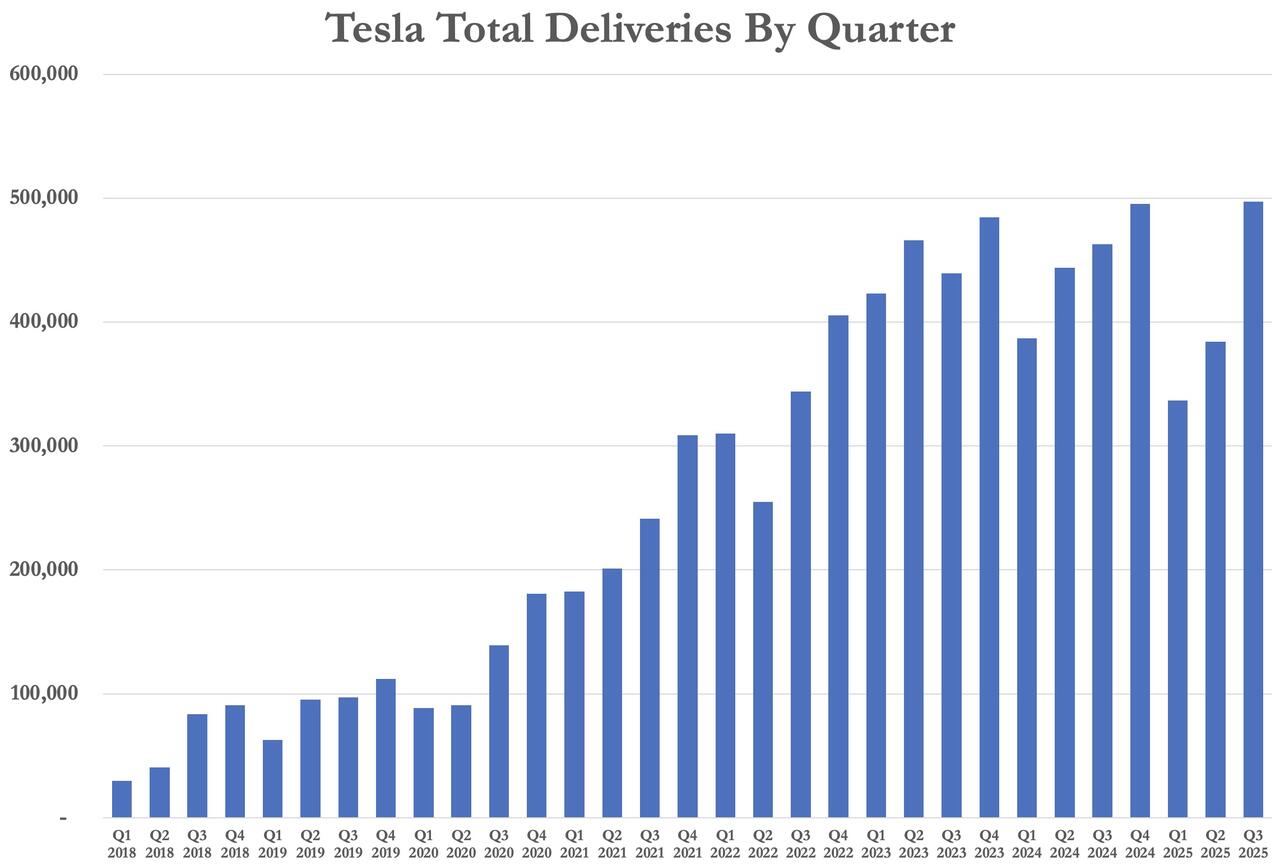

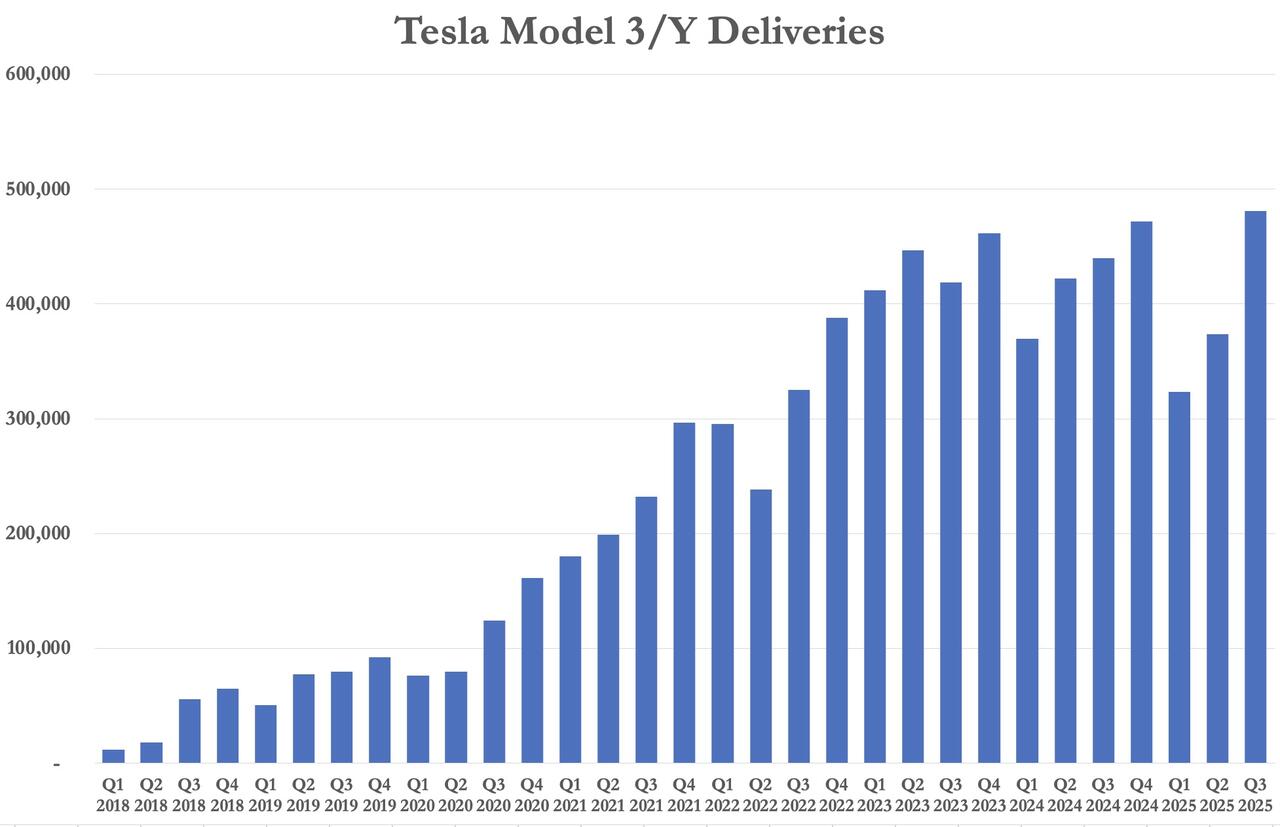

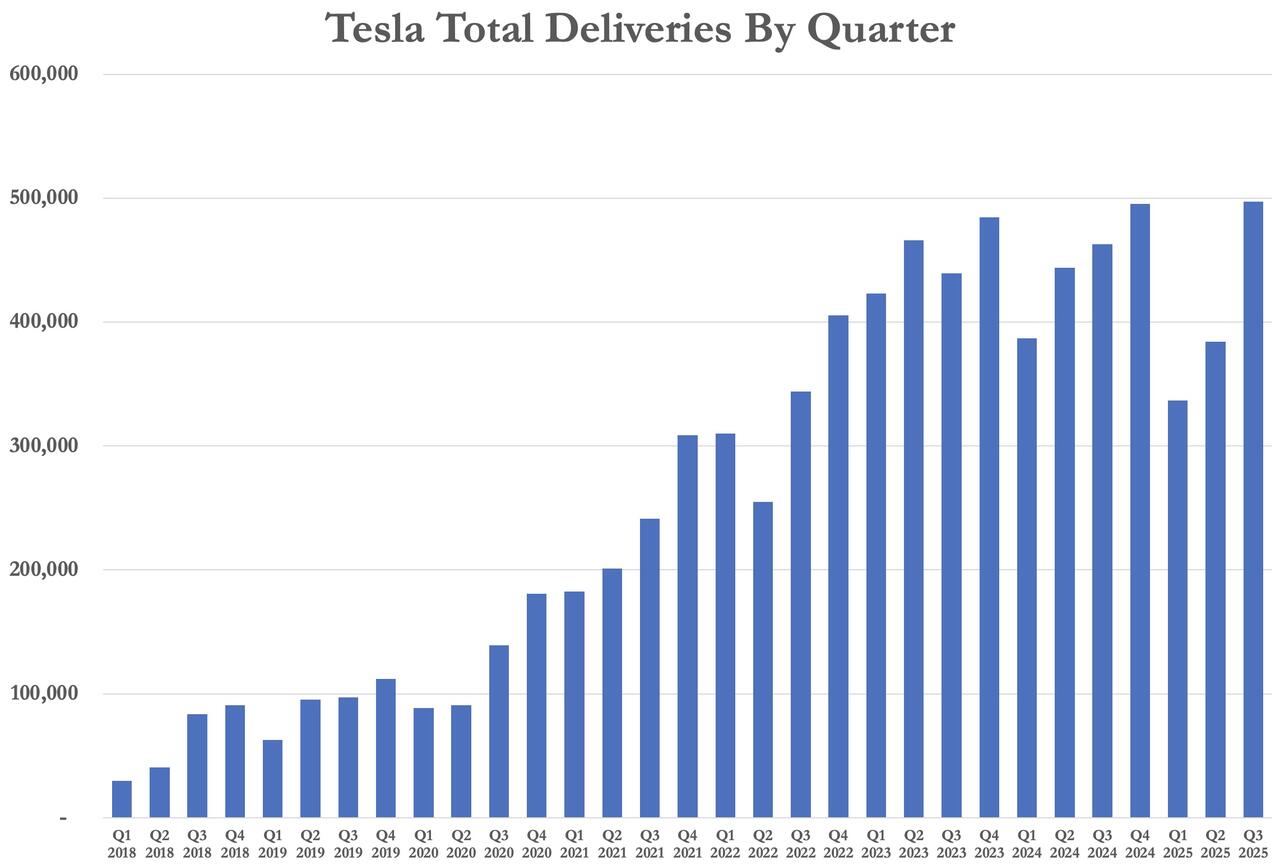

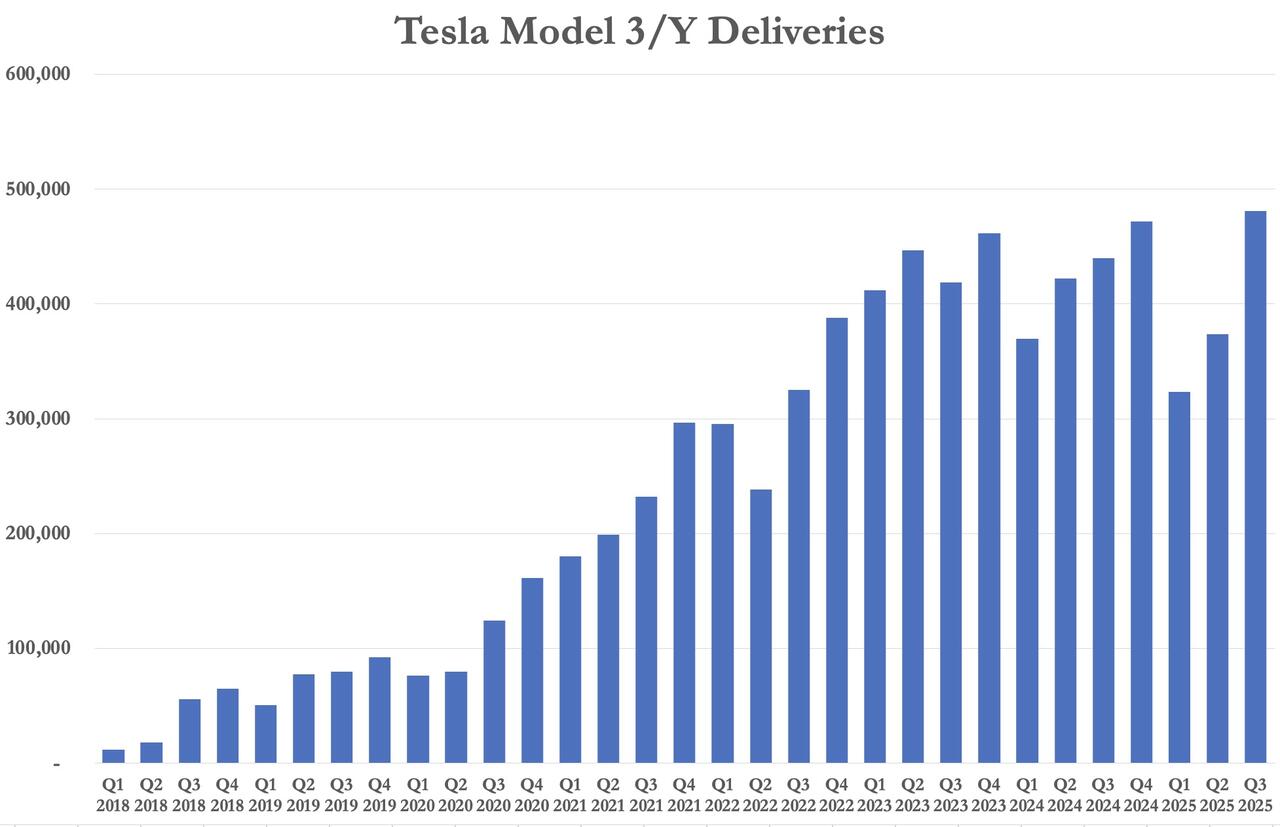

If Tesla meets expectations, the company will post its highest quarterly revenue ever—powered primarily by its record vehicle deliveries. Earlier this month, Tesla disclosed it produced 447,450 vehicles and delivered 497,099 during the quarter, the highest in its history. That total included 481,166 deliveries of the Model 3 and Model Y and 15,933 deliveries of other models. Tesla also confirmed deployment of 12.5 GWh of energy storage capacity during the period, another record for the company. These figures have solidified expectations for top-line growth, even as margins continue to compress.

On the production side, Tesla built 447,450 vehicles, down 4.8% from a year earlier and just under the consensus of 450,313. Model 3/Y production totaled 435,826, a 1.8% decline but still ahead of forecasts. Production of other models slipped to 11,624, down 13% from the prior quarter.

Despite those records, Wall Street does not expect record profits. Tesla earned $0.72 per share during the same period last year, and consensus estimates now suggest an earnings downtrend driven by ongoing price cuts and cost competition across the global EV market. The company’s earnings per share have fallen steadily since peaking in 2022, and analysts expect full-year 2025 EPS of around $1.75, down from $2.28 in 2024 and $3.12 in 2023.

Auto Focus: EV Credit Pull Forward and Cheaper Model Y

Tesla’s automotive business still dominates its results, accounting for the majority of revenue despite Elon Musk’s frequent characterization of the company as an AI and robotics leader. For now, the automaker’s financial health remains tightly linked to the number of vehicles it delivers, not autonomous driving or humanoid robots.

Recall, Tesla unveiled a cheaper Model Y today weeks ago with prices starting at $37,990–$39,990, about 15% below the previous base model, as the company works to reverse slowing sales and lost U.S. tax incentives. Elon Musk has long promised a mass-market EV, though he scrapped a $25,000 car plan last year. Still,

https://www.reuters.com/business/autos-transportation/tesla-expected-unveil-lower-cost-model-y-push-reignite-sales-2025-10-07/?utm_source=chatgpt.com

: "The desire to buy the car is very high. (It's) just (that) people don't have enough money in the bank account to buy it. So the more affordable we can make the car, the better."

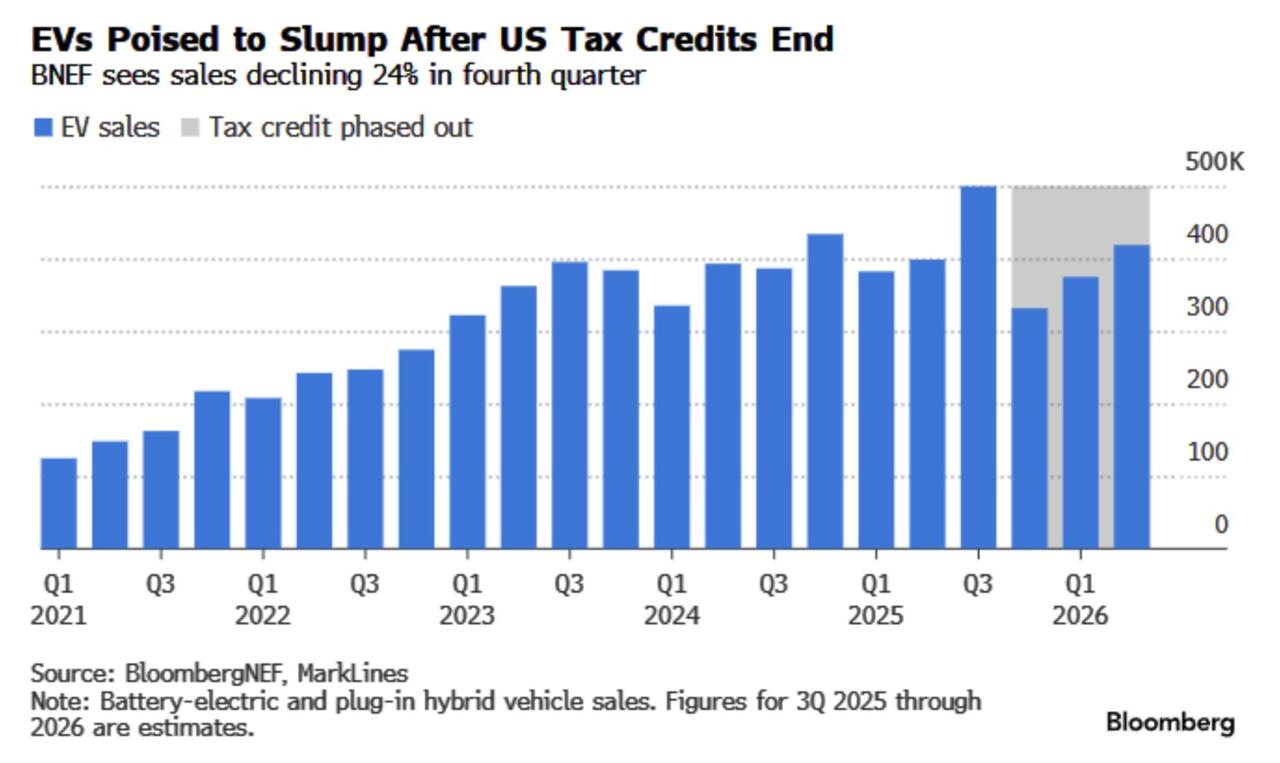

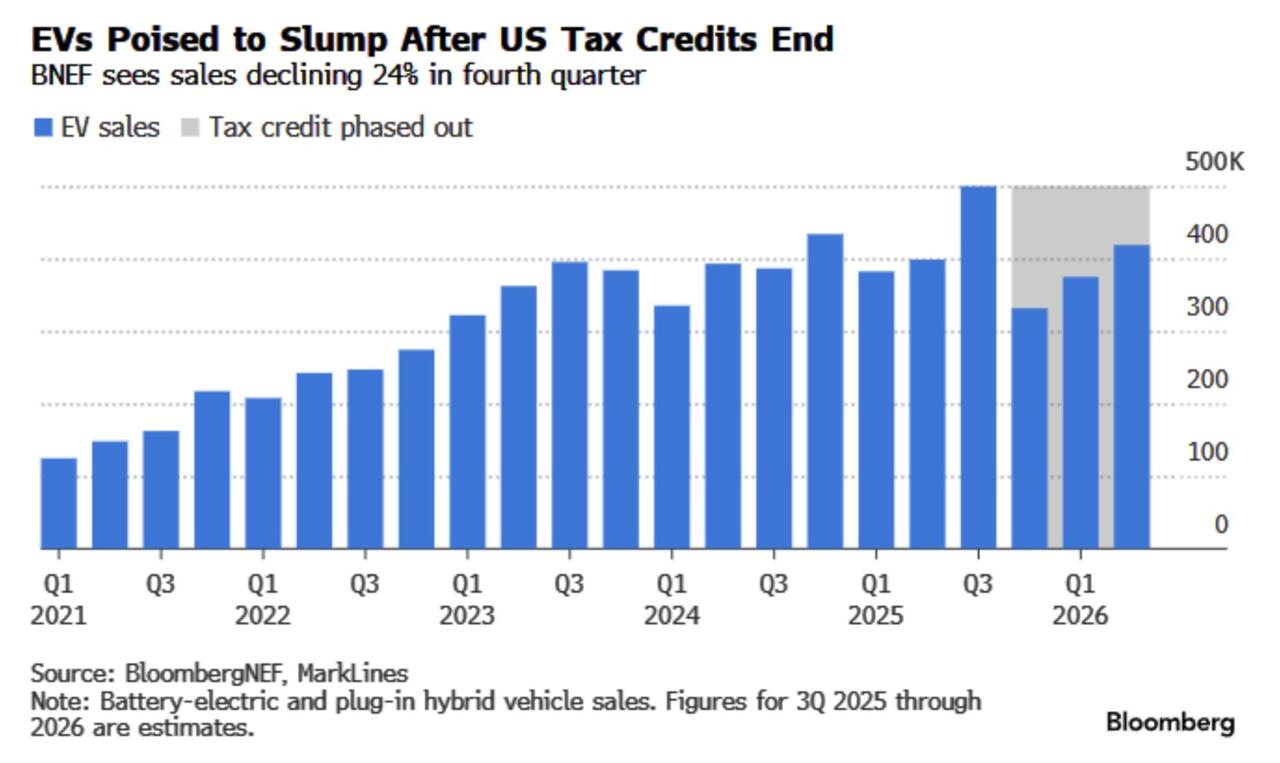

While Tesla just had a record quarter, global sales are down about 6% this year, and analysts expect U.S. EV sales to fall sharply after the credit’s removal.

What Analysts Are Expecting

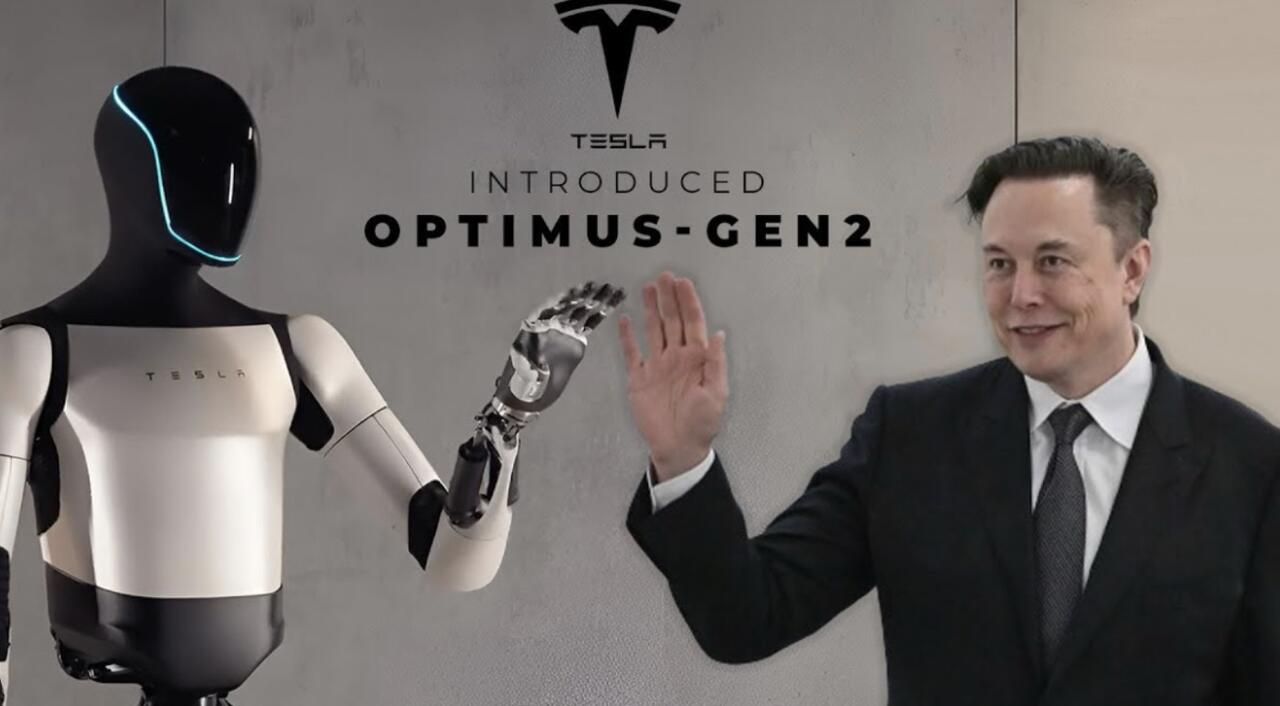

Analyst opinions ahead of tonight's report are mixed but focused on several key themes. Cantor Fitzgerald’s Andres Sheppard said investors will be watching for “several upcoming key material potential near-term catalysts,” including the rollout of Robotaxi programs in Texas and California, ramp-up of lower-cost Model 3/Y variants, FSD adoption in China and Europe, and updates on the Optimus humanoid robot and future Cybercab launch. Cantor maintains a $355 price target, implying roughly 20% downside from current levels.

Goldman Sachs analysts are watching five key areas in tonight’s call: vehicle delivery guidance, automotive profit margins, progress on robotaxis and FSD, growth in the energy business, and fresh details on the Optimus robot. Goldman’s price target is $425 per share with a Neutral rating, expecting Tesla to have delivered about 475,000 vehicles in Q3, slightly below the reported total.

RBC is more bullish, setting a $500 price target based on a “sum-of-the-parts” valuation that assigns increasing weight to Tesla’s AI and robotics divisions. RBC analyst Tom Narayan recently raised his target after management discussions around Optimus production, which the bank believes could represent a $9 trillion total addressable market over time. Morningstar’s Dave Sekera, meanwhile, is looking for updates on Robotaxi timelines and Tesla’s recently launched lower-cost Model 3 and Model Y variants, suggesting that affordability could be critical for reigniting demand.

Wedbush’s Dan Ives continues to frame Tesla’s next chapter as the “AI era,” emphasizing that “the most important chapter in Tesla's growth story is now beginning with the AI era now here.” Ives believes autonomous driving and robotics could add $1 trillion in value to Tesla’s story in the coming years, positioning the company at the intersection of mobility and intelligence.

Despite the futuristic focus, some are also wary about Tesla’s fundamentals. The company recently recalled nearly 13,000 Model 3 and Model Y vehicles due to a defect that could cause sudden battery power loss, forcing in-person repairs rather than software fixes. The recall underscores the tension between Tesla’s cutting-edge ambitions and its ongoing manufacturing and reliability challenges.

Musk's $1 Trillion Pay Plan Would Be Helped By A Bullish Report

Also in focus will be Elon Musk’s proposed new pay package, valued at nearly $1 trillion in Tesla stock, and which has ignited opposition from unions, pension funds, and governance watchdogs ahead of a shareholder vote next month. The plan would boost Musk’s voting control to about 25% and extend his leadership for another decade.

Proxy firms ISS and Glass Lewis have urged investors to vote against it, while supporters on Tesla’s board say it’s needed to retain Musk’s focus and vision. The vote will test shareholder confidence in Musk’s leadership as Tesla’s growth slows and scrutiny over governance intensifies.

In the short term, analysts and investors alike expect a bullish tone from management on the call. Tesla strategically delayed its annual shareholders meeting to early November, likely to coincide with this strong quarter ahead of key votes on Musk’s compensation and board seats. With tax credit expirations pulling demand into Q3, Tesla has good reason to spotlight its record quarter before potentially facing a tougher demand environment in coming periods.

Tyler Durden | Zero Hedge

Zero Hedge

Wed, 10/22/2025 - 14:40

Tesla Earnings Preview: Record Deliveries, Margin Pressure And AI In Focus | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

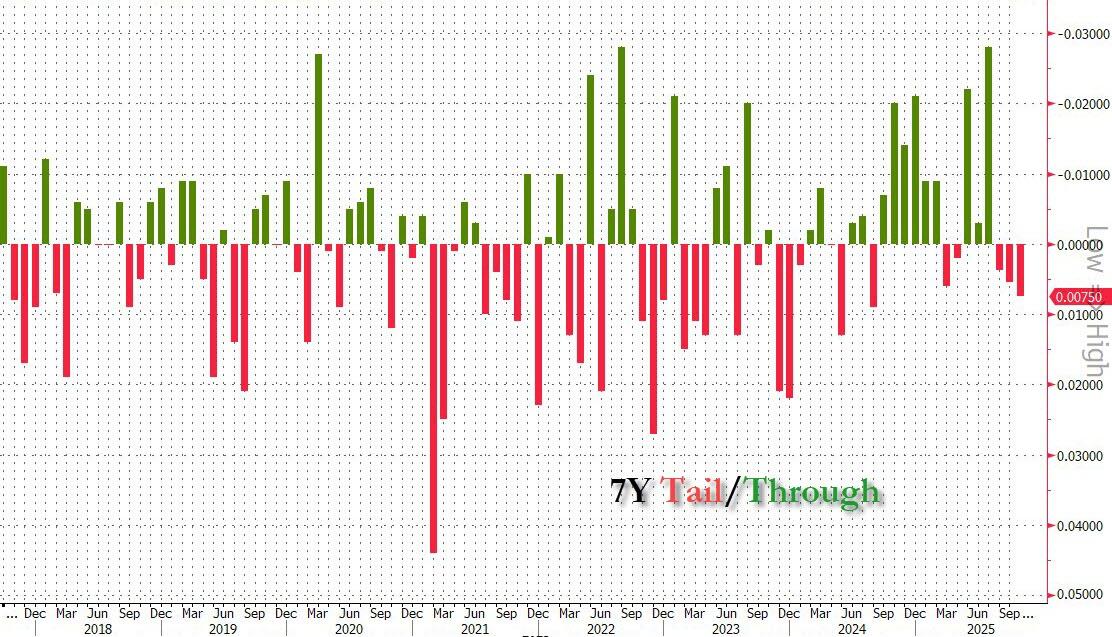

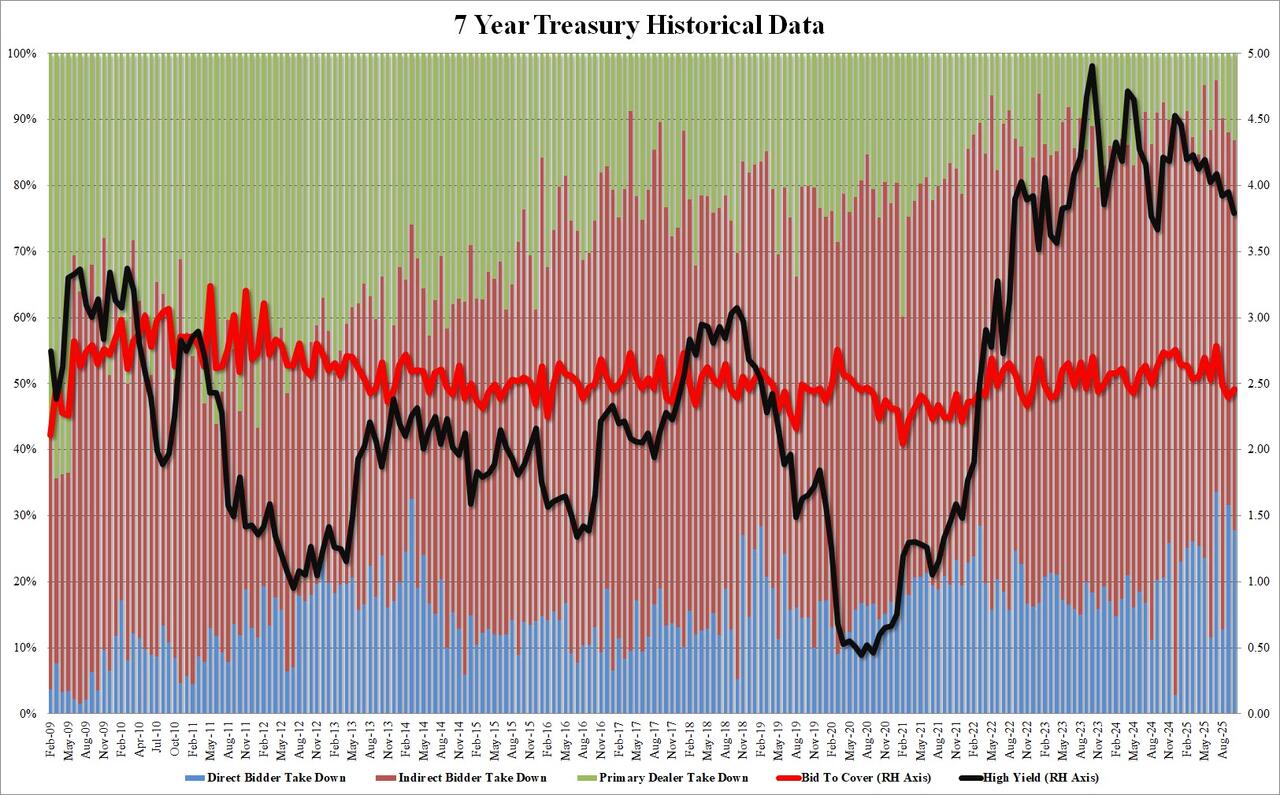

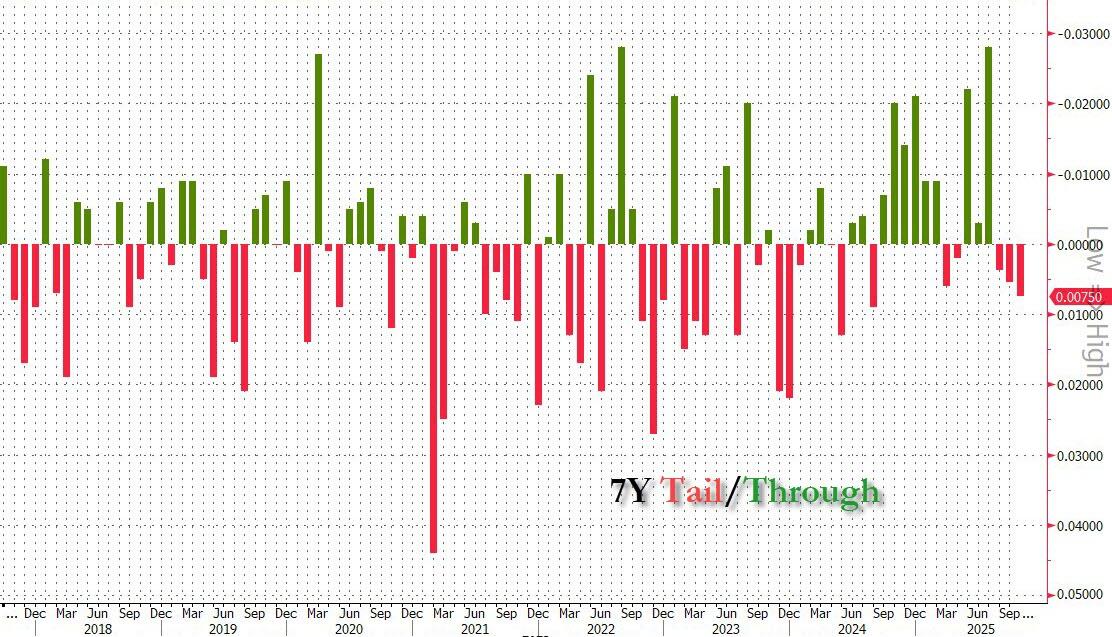

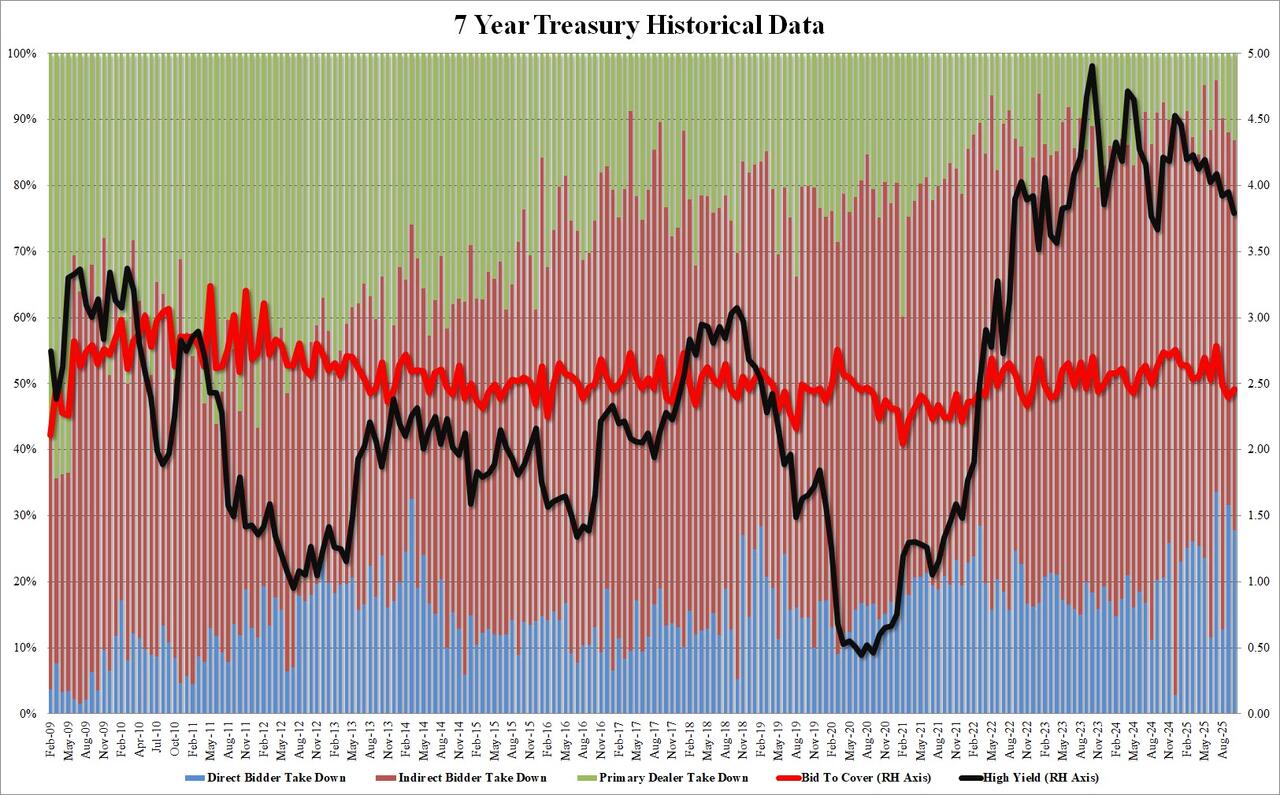

The bid to cover was 2.457, up from 2.395 which however was a multi-year low; in the context of recent auctions today's btc was subpar, printing below the six auction average at 2.575.

Internals were also mediocre, if better than the dismal September auction: Indirects were awarded 59.0%, up from 56.4%, but below the six-auction average 67.3%. And with Directs dipping to 27.9%, Dealers were left with 13.14%, the highest since April.

The bid to cover was 2.457, up from 2.395 which however was a multi-year low; in the context of recent auctions today's btc was subpar, printing below the six auction average at 2.575.

Internals were also mediocre, if better than the dismal September auction: Indirects were awarded 59.0%, up from 56.4%, but below the six-auction average 67.3%. And with Directs dipping to 27.9%, Dealers were left with 13.14%, the highest since April.

Overall, this was a mediocre, forgettable, and very tailing "belly-busting" 7Y auction which is somewhat surprising ahead of tomorrow's Fed decision which is expected to see not only a rate cut but put an end to QT as

.

Tue, 10/28/2025 - 13:27

Overall, this was a mediocre, forgettable, and very tailing "belly-busting" 7Y auction which is somewhat surprising ahead of tomorrow's Fed decision which is expected to see not only a rate cut but put an end to QT as

.

Tue, 10/28/2025 - 13:27

The bid to cover was 2.457, up from 2.395 which however was a multi-year low; in the context of recent auctions today's btc was subpar, printing below the six auction average at 2.575.

Internals were also mediocre, if better than the dismal September auction: Indirects were awarded 59.0%, up from 56.4%, but below the six-auction average 67.3%. And with Directs dipping to 27.9%, Dealers were left with 13.14%, the highest since April.

The bid to cover was 2.457, up from 2.395 which however was a multi-year low; in the context of recent auctions today's btc was subpar, printing below the six auction average at 2.575.

Internals were also mediocre, if better than the dismal September auction: Indirects were awarded 59.0%, up from 56.4%, but below the six-auction average 67.3%. And with Directs dipping to 27.9%, Dealers were left with 13.14%, the highest since April.

Overall, this was a mediocre, forgettable, and very tailing "belly-busting" 7Y auction which is somewhat surprising ahead of tomorrow's Fed decision which is expected to see not only a rate cut but put an end to QT as

Overall, this was a mediocre, forgettable, and very tailing "belly-busting" 7Y auction which is somewhat surprising ahead of tomorrow's Fed decision which is expected to see not only a rate cut but put an end to QT as  On the production side, Tesla built 447,450 vehicles, down 4.8% from a year earlier and just under the consensus of 450,313. Model 3/Y production totaled 435,826, a 1.8% decline but still ahead of forecasts. Production of other models slipped to 11,624, down 13% from the prior quarter.

On the production side, Tesla built 447,450 vehicles, down 4.8% from a year earlier and just under the consensus of 450,313. Model 3/Y production totaled 435,826, a 1.8% decline but still ahead of forecasts. Production of other models slipped to 11,624, down 13% from the prior quarter.

Despite those records, Wall Street does not expect record profits. Tesla earned $0.72 per share during the same period last year, and consensus estimates now suggest an earnings downtrend driven by ongoing price cuts and cost competition across the global EV market. The company’s earnings per share have fallen steadily since peaking in 2022, and analysts expect full-year 2025 EPS of around $1.75, down from $2.28 in 2024 and $3.12 in 2023.

Auto Focus: EV Credit Pull Forward and Cheaper Model Y

Tesla’s automotive business still dominates its results, accounting for the majority of revenue despite Elon Musk’s frequent characterization of the company as an AI and robotics leader. For now, the automaker’s financial health remains tightly linked to the number of vehicles it delivers, not autonomous driving or humanoid robots.

Recall, Tesla unveiled a cheaper Model Y today weeks ago with prices starting at $37,990–$39,990, about 15% below the previous base model, as the company works to reverse slowing sales and lost U.S. tax incentives. Elon Musk has long promised a mass-market EV, though he scrapped a $25,000 car plan last year. Still,

Despite those records, Wall Street does not expect record profits. Tesla earned $0.72 per share during the same period last year, and consensus estimates now suggest an earnings downtrend driven by ongoing price cuts and cost competition across the global EV market. The company’s earnings per share have fallen steadily since peaking in 2022, and analysts expect full-year 2025 EPS of around $1.75, down from $2.28 in 2024 and $3.12 in 2023.

Auto Focus: EV Credit Pull Forward and Cheaper Model Y

Tesla’s automotive business still dominates its results, accounting for the majority of revenue despite Elon Musk’s frequent characterization of the company as an AI and robotics leader. For now, the automaker’s financial health remains tightly linked to the number of vehicles it delivers, not autonomous driving or humanoid robots.

Recall, Tesla unveiled a cheaper Model Y today weeks ago with prices starting at $37,990–$39,990, about 15% below the previous base model, as the company works to reverse slowing sales and lost U.S. tax incentives. Elon Musk has long promised a mass-market EV, though he scrapped a $25,000 car plan last year. Still,  While Tesla just had a record quarter, global sales are down about 6% this year, and analysts expect U.S. EV sales to fall sharply after the credit’s removal.

What Analysts Are Expecting

Analyst opinions ahead of tonight's report are mixed but focused on several key themes. Cantor Fitzgerald’s Andres Sheppard said investors will be watching for “several upcoming key material potential near-term catalysts,” including the rollout of Robotaxi programs in Texas and California, ramp-up of lower-cost Model 3/Y variants, FSD adoption in China and Europe, and updates on the Optimus humanoid robot and future Cybercab launch. Cantor maintains a $355 price target, implying roughly 20% downside from current levels.

Goldman Sachs analysts are watching five key areas in tonight’s call: vehicle delivery guidance, automotive profit margins, progress on robotaxis and FSD, growth in the energy business, and fresh details on the Optimus robot. Goldman’s price target is $425 per share with a Neutral rating, expecting Tesla to have delivered about 475,000 vehicles in Q3, slightly below the reported total.

RBC is more bullish, setting a $500 price target based on a “sum-of-the-parts” valuation that assigns increasing weight to Tesla’s AI and robotics divisions. RBC analyst Tom Narayan recently raised his target after management discussions around Optimus production, which the bank believes could represent a $9 trillion total addressable market over time. Morningstar’s Dave Sekera, meanwhile, is looking for updates on Robotaxi timelines and Tesla’s recently launched lower-cost Model 3 and Model Y variants, suggesting that affordability could be critical for reigniting demand.

Wedbush’s Dan Ives continues to frame Tesla’s next chapter as the “AI era,” emphasizing that “the most important chapter in Tesla's growth story is now beginning with the AI era now here.” Ives believes autonomous driving and robotics could add $1 trillion in value to Tesla’s story in the coming years, positioning the company at the intersection of mobility and intelligence.

While Tesla just had a record quarter, global sales are down about 6% this year, and analysts expect U.S. EV sales to fall sharply after the credit’s removal.

What Analysts Are Expecting

Analyst opinions ahead of tonight's report are mixed but focused on several key themes. Cantor Fitzgerald’s Andres Sheppard said investors will be watching for “several upcoming key material potential near-term catalysts,” including the rollout of Robotaxi programs in Texas and California, ramp-up of lower-cost Model 3/Y variants, FSD adoption in China and Europe, and updates on the Optimus humanoid robot and future Cybercab launch. Cantor maintains a $355 price target, implying roughly 20% downside from current levels.

Goldman Sachs analysts are watching five key areas in tonight’s call: vehicle delivery guidance, automotive profit margins, progress on robotaxis and FSD, growth in the energy business, and fresh details on the Optimus robot. Goldman’s price target is $425 per share with a Neutral rating, expecting Tesla to have delivered about 475,000 vehicles in Q3, slightly below the reported total.

RBC is more bullish, setting a $500 price target based on a “sum-of-the-parts” valuation that assigns increasing weight to Tesla’s AI and robotics divisions. RBC analyst Tom Narayan recently raised his target after management discussions around Optimus production, which the bank believes could represent a $9 trillion total addressable market over time. Morningstar’s Dave Sekera, meanwhile, is looking for updates on Robotaxi timelines and Tesla’s recently launched lower-cost Model 3 and Model Y variants, suggesting that affordability could be critical for reigniting demand.

Wedbush’s Dan Ives continues to frame Tesla’s next chapter as the “AI era,” emphasizing that “the most important chapter in Tesla's growth story is now beginning with the AI era now here.” Ives believes autonomous driving and robotics could add $1 trillion in value to Tesla’s story in the coming years, positioning the company at the intersection of mobility and intelligence.

Despite the futuristic focus, some are also wary about Tesla’s fundamentals. The company recently recalled nearly 13,000 Model 3 and Model Y vehicles due to a defect that could cause sudden battery power loss, forcing in-person repairs rather than software fixes. The recall underscores the tension between Tesla’s cutting-edge ambitions and its ongoing manufacturing and reliability challenges.

Musk's $1 Trillion Pay Plan Would Be Helped By A Bullish Report

Also in focus will be Elon Musk’s proposed new pay package, valued at nearly $1 trillion in Tesla stock, and which has ignited opposition from unions, pension funds, and governance watchdogs ahead of a shareholder vote next month. The plan would boost Musk’s voting control to about 25% and extend his leadership for another decade.

Proxy firms ISS and Glass Lewis have urged investors to vote against it, while supporters on Tesla’s board say it’s needed to retain Musk’s focus and vision. The vote will test shareholder confidence in Musk’s leadership as Tesla’s growth slows and scrutiny over governance intensifies.

In the short term, analysts and investors alike expect a bullish tone from management on the call. Tesla strategically delayed its annual shareholders meeting to early November, likely to coincide with this strong quarter ahead of key votes on Musk’s compensation and board seats. With tax credit expirations pulling demand into Q3, Tesla has good reason to spotlight its record quarter before potentially facing a tougher demand environment in coming periods.

Despite the futuristic focus, some are also wary about Tesla’s fundamentals. The company recently recalled nearly 13,000 Model 3 and Model Y vehicles due to a defect that could cause sudden battery power loss, forcing in-person repairs rather than software fixes. The recall underscores the tension between Tesla’s cutting-edge ambitions and its ongoing manufacturing and reliability challenges.

Musk's $1 Trillion Pay Plan Would Be Helped By A Bullish Report

Also in focus will be Elon Musk’s proposed new pay package, valued at nearly $1 trillion in Tesla stock, and which has ignited opposition from unions, pension funds, and governance watchdogs ahead of a shareholder vote next month. The plan would boost Musk’s voting control to about 25% and extend his leadership for another decade.

Proxy firms ISS and Glass Lewis have urged investors to vote against it, while supporters on Tesla’s board say it’s needed to retain Musk’s focus and vision. The vote will test shareholder confidence in Musk’s leadership as Tesla’s growth slows and scrutiny over governance intensifies.

In the short term, analysts and investors alike expect a bullish tone from management on the call. Tesla strategically delayed its annual shareholders meeting to early November, likely to coincide with this strong quarter ahead of key votes on Musk’s compensation and board seats. With tax credit expirations pulling demand into Q3, Tesla has good reason to spotlight its record quarter before potentially facing a tougher demand environment in coming periods.