New Generation Of Industries Emerges In Texas As Rare Earths Race Ignites

New Generation Of Industries Emerges In Texas As Rare Earths Race Ignites

Authored by  (emphasis ours),

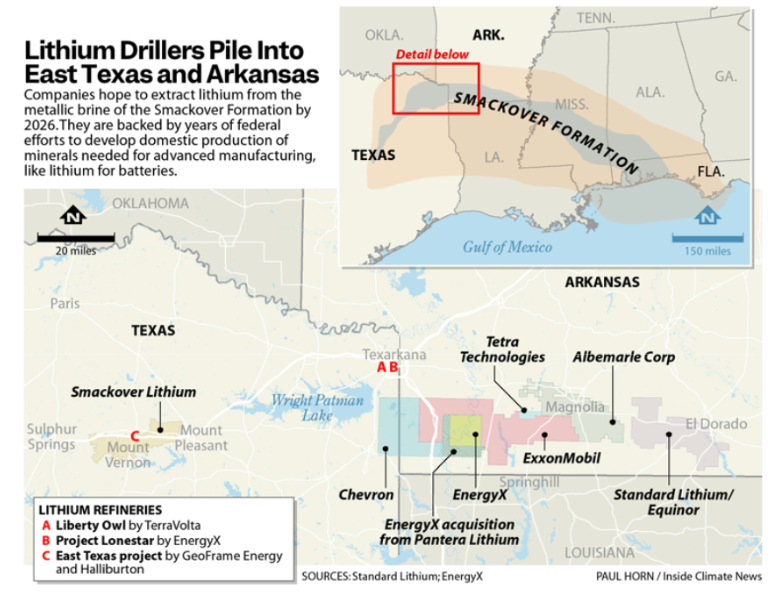

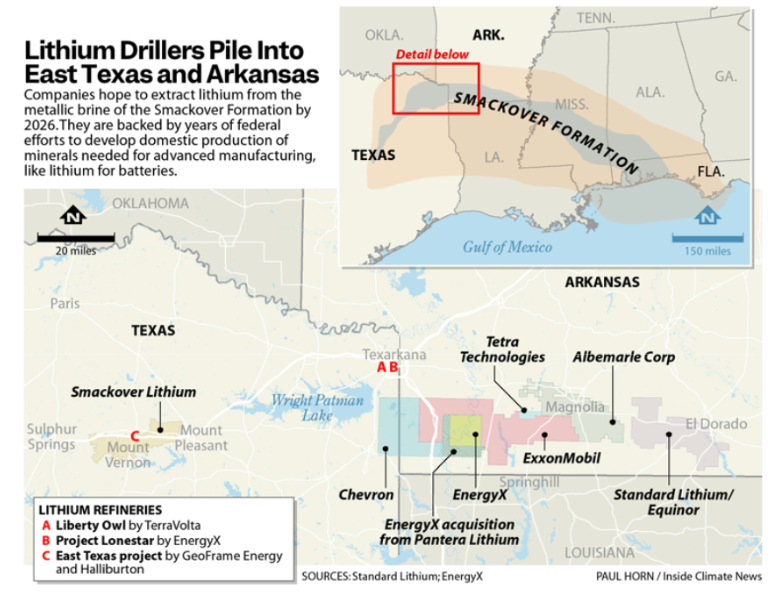

Major oil companies are drilling in East Texas again, but not for oil. This time, they're after lithium for batteries and other rare elements.

Chevron and Halliburton announced East Texas projects this summer. Exxon has acreage across the border in Arkansas. Smackover Lithium, a joint venture of a Norwegian oil giant and a Canadian miner,

(emphasis ours),

Major oil companies are drilling in East Texas again, but not for oil. This time, they're after lithium for batteries and other rare elements.

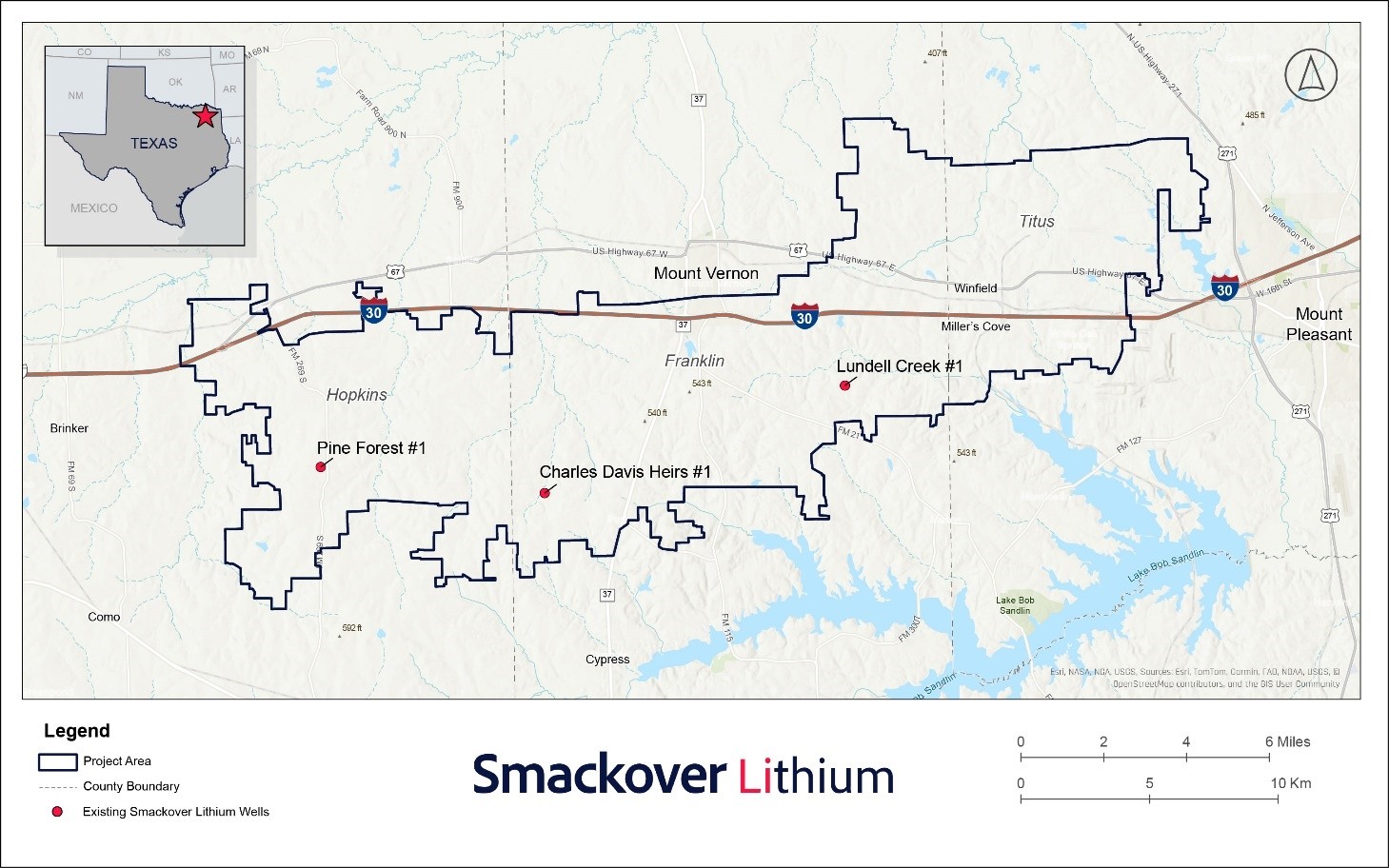

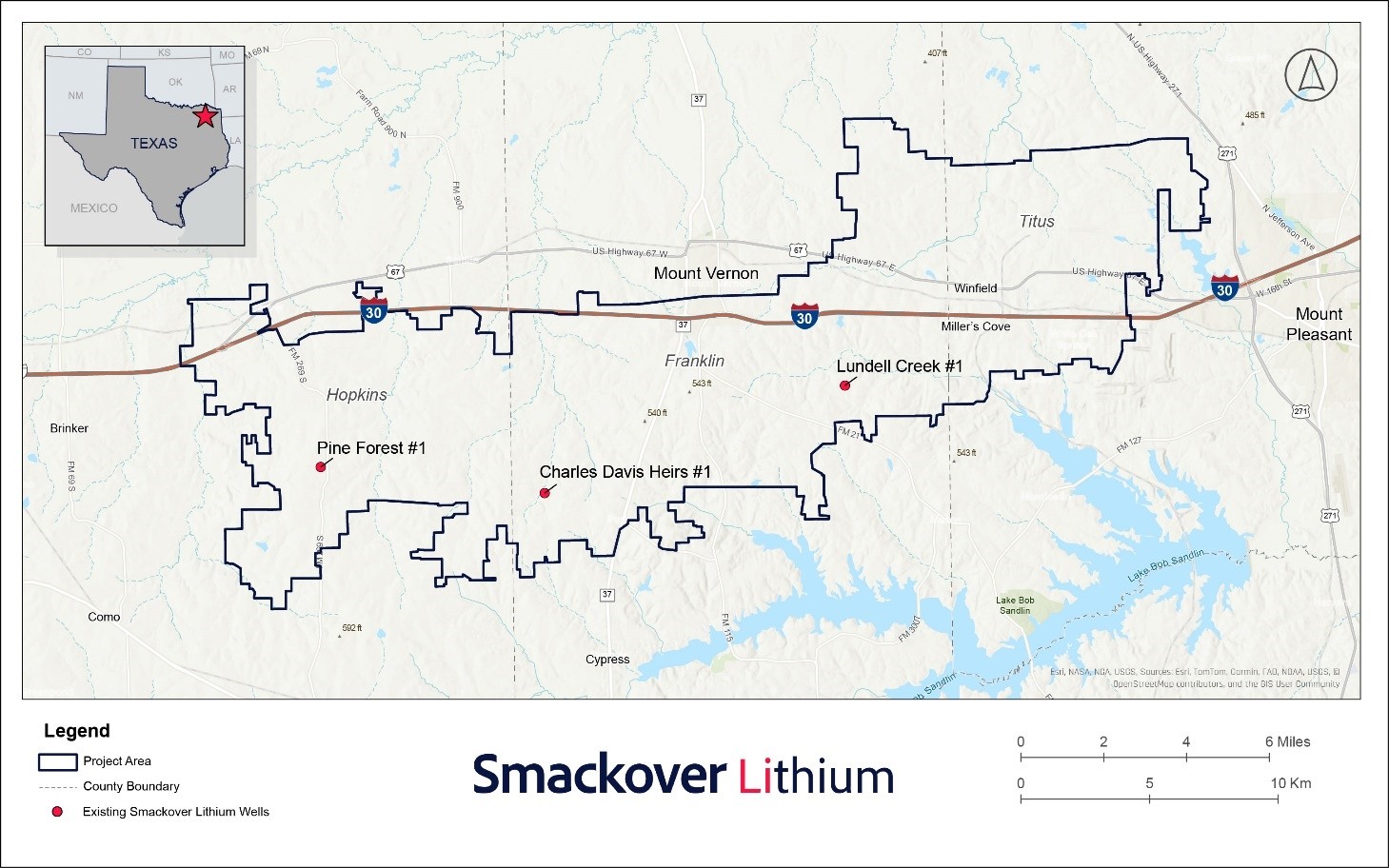

Chevron and Halliburton announced East Texas projects this summer. Exxon has acreage across the border in Arkansas. Smackover Lithium, a joint venture of a Norwegian oil giant and a Canadian miner,  in late September the discovery of the most lithium-rich fluids ever reported in North America, measured deep beneath its Texas claims in a massive brine deposit called the Smackover Formation.

"It's ripe for development," said Jamie Liang, a former Wall Street banker and founder of Houston-based lithium startup TerraVolta, which is developing a lithium refinery on the Smackover with federal support. "There's tremendous growth potential."

Lithium mining is one of several mineral industries emerging in Texas as part of broad federal efforts to urgently establish American production of the materials required for advanced manufacturing, from batteries and solar cells to wind turbines, microchips and cruise missiles.

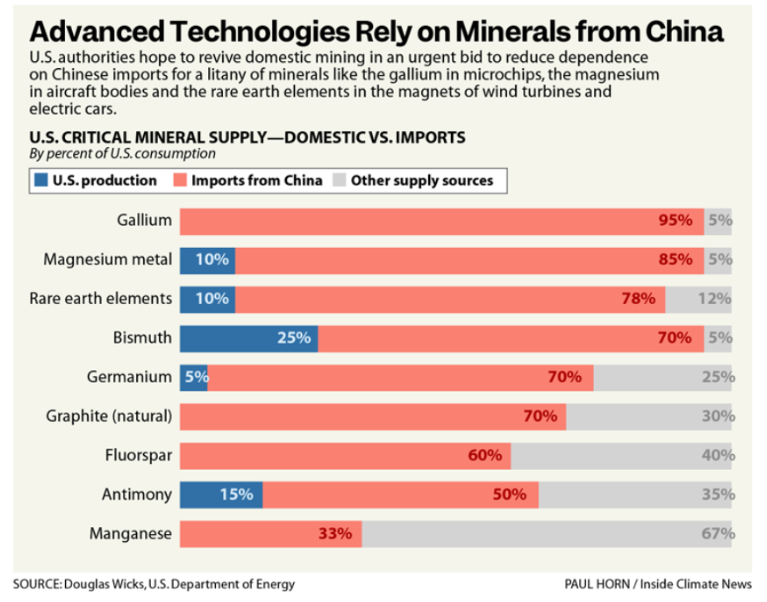

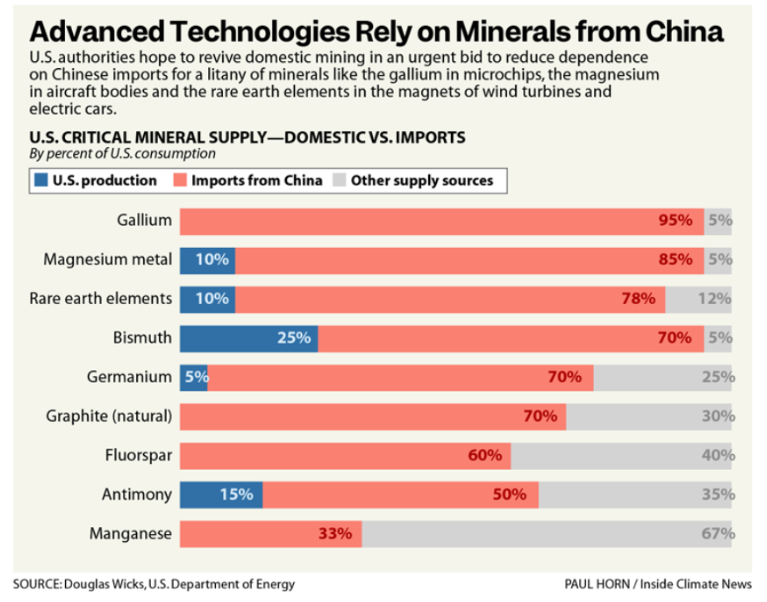

Competition with China looms over this effort. For much of this year, the world's two largest economies have been locked in trade tensions— and much of the ire is linked to minerals used in technology. This month, China announced new export controls on critical mineral products, including lithium battery components. President Trump, in social media posts, described China as "very hostile" and threatened to impose export controls on critical software and add 100 percent tariffs to Chinese imports.

Near Texarkana, the chase for lithium is backed with robust federal support. Liang's TerraVolta received

in late September the discovery of the most lithium-rich fluids ever reported in North America, measured deep beneath its Texas claims in a massive brine deposit called the Smackover Formation.

"It's ripe for development," said Jamie Liang, a former Wall Street banker and founder of Houston-based lithium startup TerraVolta, which is developing a lithium refinery on the Smackover with federal support. "There's tremendous growth potential."

Lithium mining is one of several mineral industries emerging in Texas as part of broad federal efforts to urgently establish American production of the materials required for advanced manufacturing, from batteries and solar cells to wind turbines, microchips and cruise missiles.

Competition with China looms over this effort. For much of this year, the world's two largest economies have been locked in trade tensions— and much of the ire is linked to minerals used in technology. This month, China announced new export controls on critical mineral products, including lithium battery components. President Trump, in social media posts, described China as "very hostile" and threatened to impose export controls on critical software and add 100 percent tariffs to Chinese imports.

Near Texarkana, the chase for lithium is backed with robust federal support. Liang's TerraVolta received  from the U.S. Department of Energy in 2024 for its lithium refinery complex. This year the project was selected for fast-tracked permit review.

It will pump up the naturally metallic super-salty fluids from the Smackover,

and other minerals and then inject the leftover liquids back underground. At least two other lithium refineries are planned in the area and companies have leased tens of thousands of acres for drilling. More will likely follow as long as lithium prices stay strong.

"There's going to be a very large-scale infrastructure buildout," Liang said. "You're going to be drilling wells. You're going to need those service companies. You'll need pipelines."

from the U.S. Department of Energy in 2024 for its lithium refinery complex. This year the project was selected for fast-tracked permit review.

It will pump up the naturally metallic super-salty fluids from the Smackover,

and other minerals and then inject the leftover liquids back underground. At least two other lithium refineries are planned in the area and companies have leased tens of thousands of acres for drilling. More will likely follow as long as lithium prices stay strong.

"There's going to be a very large-scale infrastructure buildout," Liang said. "You're going to be drilling wells. You're going to need those service companies. You'll need pipelines."

Elsewhere in Texas, a mine is planned near El Paso for the rare metals used in magnets for electric motors. On the rural Gulf Coast, the Department of Defense has invested almost $300 million in a project that would process rare metals like samarium, used in jet engines, guided munitions and stealth technology. From Houston's petrochemical complex to the Permian Basin, a flurry of startups, oil majors and mining giants intend to recover minerals from industrial waste like coal ash, discarded electronics, mine tailings and oilfield wastewater in hopes of accelerating U.S. mineral supplies.

Presently, the United States produces a dribble of the raw materials. China broadly owns the global production lines, following decades of investment and securing a dominance that has raised national security concerns as well as financial risk.

The United States has just one operating lithium mine, in Nevada, where a second mine with https://www.reuters.com/business/autos-transportation/us-government-take-5-stake-lithium-americas-joint-venture-with-general-motors-2025-09-30/

expects to begin production in 2027. Only one lithium refinery operates in the country, on the Gulf Coast of Texas.

"Our exposure to China is unacceptable," said Douglas Wicks, a former program director at the Advanced Research Projects Agency of the Energy Department. It raises threats that the outbreak of conflict could leave the United States cut off from essential supply chains.

That's the biggest reason why federal agencies are pushing so hard to play catch-up and boost American mining, Wicks said. As geopolitical tensions squeeze the flow of globalized commerce, Washington hopes to challenge Beijing's monopolies in a battle of extraction.

"I think American industry can outproduce them," said Wicks, who retired this year. The United States has "the deposits to do this."

However, the United States has to contend with China's gargantuan economy where the state owns key industries and provides subsidies, preferential finance schemes and other market support. Still, Wicks said, the United States knows how to move quickly. Just consider the recent evolution of American oil and gas. Technical innovations and loosened environmental standards in the shale revolution turned the United States from the world's largest importers of oil and gas to a major exporter in barely over a decade. Wicks believes the United States can transform again.

In 2023, under the Biden administration, the Pentagon was ordered to establish mineral supply chains independent of China. Since then, billions of dollars have flowed to mining and processing projects across the country, spurring a rush of prospectors and entrepreneurs hoping to cash in on federal grants.

Wisk said, "Now there's a big push in Texas to ask: 'Is there something else under the ground other than oil and gas?"

Elsewhere in Texas, a mine is planned near El Paso for the rare metals used in magnets for electric motors. On the rural Gulf Coast, the Department of Defense has invested almost $300 million in a project that would process rare metals like samarium, used in jet engines, guided munitions and stealth technology. From Houston's petrochemical complex to the Permian Basin, a flurry of startups, oil majors and mining giants intend to recover minerals from industrial waste like coal ash, discarded electronics, mine tailings and oilfield wastewater in hopes of accelerating U.S. mineral supplies.

Presently, the United States produces a dribble of the raw materials. China broadly owns the global production lines, following decades of investment and securing a dominance that has raised national security concerns as well as financial risk.

The United States has just one operating lithium mine, in Nevada, where a second mine with https://www.reuters.com/business/autos-transportation/us-government-take-5-stake-lithium-americas-joint-venture-with-general-motors-2025-09-30/

expects to begin production in 2027. Only one lithium refinery operates in the country, on the Gulf Coast of Texas.

"Our exposure to China is unacceptable," said Douglas Wicks, a former program director at the Advanced Research Projects Agency of the Energy Department. It raises threats that the outbreak of conflict could leave the United States cut off from essential supply chains.

That's the biggest reason why federal agencies are pushing so hard to play catch-up and boost American mining, Wicks said. As geopolitical tensions squeeze the flow of globalized commerce, Washington hopes to challenge Beijing's monopolies in a battle of extraction.

"I think American industry can outproduce them," said Wicks, who retired this year. The United States has "the deposits to do this."

However, the United States has to contend with China's gargantuan economy where the state owns key industries and provides subsidies, preferential finance schemes and other market support. Still, Wicks said, the United States knows how to move quickly. Just consider the recent evolution of American oil and gas. Technical innovations and loosened environmental standards in the shale revolution turned the United States from the world's largest importers of oil and gas to a major exporter in barely over a decade. Wicks believes the United States can transform again.

In 2023, under the Biden administration, the Pentagon was ordered to establish mineral supply chains independent of China. Since then, billions of dollars have flowed to mining and processing projects across the country, spurring a rush of prospectors and entrepreneurs hoping to cash in on federal grants.

Wisk said, "Now there's a big push in Texas to ask: 'Is there something else under the ground other than oil and gas?"

Tiny Concentrations, Big Mines

In the desert of far-west Texas, a company called Texas Mineral Resources Corp. (TMRC) had plans to dig for rare earth elements at a 950-acre Round Top Mountain site. The company won its first Defense Department contract

a "breakthrough," producing a sample of high-purity dysprosium, which is used in semiconductors and electric vehicle motors. .

These rare elements aren't actually hard to find. They're all over the world, but they exist in tiny concentrations that require a tremendous amount of effort to extract in significant volumes. The process also generates large waste streams.

TMRC had said it would crush up 20,000 tons of rock a day. The material then would soak for a month in pools of diluted acid and undergo a series of electromagnetic processes to separate and cull the much-desired minerals. According to TMRC, the rocks hold 15 rare earth elements and other metals including lithium, gallium, hafnium, zirconium and beryllium.

Some processed byproducts "are expected to show hazardous waste characteristics," and "the waste may contain naturally occurring radioactive material," according to a .pdf

by TMRC. It noted "potential impacts to water quality resulting from mine operations and the storage of mine waste." The operations are located in Hudspeth County, home to about 3,400 people, according to the latest census.

However, financial analysts have

Tiny Concentrations, Big Mines

In the desert of far-west Texas, a company called Texas Mineral Resources Corp. (TMRC) had plans to dig for rare earth elements at a 950-acre Round Top Mountain site. The company won its first Defense Department contract

a "breakthrough," producing a sample of high-purity dysprosium, which is used in semiconductors and electric vehicle motors. .

These rare elements aren't actually hard to find. They're all over the world, but they exist in tiny concentrations that require a tremendous amount of effort to extract in significant volumes. The process also generates large waste streams.

TMRC had said it would crush up 20,000 tons of rock a day. The material then would soak for a month in pools of diluted acid and undergo a series of electromagnetic processes to separate and cull the much-desired minerals. According to TMRC, the rocks hold 15 rare earth elements and other metals including lithium, gallium, hafnium, zirconium and beryllium.

Some processed byproducts "are expected to show hazardous waste characteristics," and "the waste may contain naturally occurring radioactive material," according to a .pdf

by TMRC. It noted "potential impacts to water quality resulting from mine operations and the storage of mine waste." The operations are located in Hudspeth County, home to about 3,400 people, according to the latest census.

However, financial analysts have  and lack of revenue. In July, according to analyst reports, TMRC had a "severe liquidity crisis."

The Round Top site is not an anomaly and, as TMRC struggles, other miners could step in, according to Brent Elliot, a geologist with the Bureau of Economic Geology at the University of Texas at Austin, the state's official geological survey. There are "many Round Top-like igneous rocks in west Texas to explore," he said, noting that a recent survey of the area "has shown some hot targets that I'll go out and investigate."

Holiday O'Bryan, a 22-year-old PhD student at the University of Texas, plans a career in mining. At a recent conference in Austin on mineral industries, she pointed out that most mining related to new technologies occurs in faraway countries, which often have lower environmental standards and enforcement. America's surging investment in extraction should be seen in context of the clean innovations it will support. Mining operations will change the landscape—particularly as the Trump administration cuts backs on regulations of federal land—and no one should be surprised by the compromises that the race for rare earths will demand, she said.

"You have to have extraction for these technologies to work," she said. "In the age of the green energy transition that doesn't fly very well for someone who is trying to protect the environment."

U.S. Mining Losses

Before 1990 the United States dominated the world's mineral markets. But domestic production dropped that decade, in part, because of rising environmental protections at home and enticing low-cost foreign production possibilities. New industries and products emerging in the mid-2010s—smartphones and Tesla cars among them—prompted a re-think of the American economy and future needs. Mining had become a lost opportunity.

"People started looking at what you actually need to be able to build things like electric vehicles," said Michelle Michot Foss, fellow in energy, minerals and materials at Rice University's Baker Institute for Public Policy. "We started realizing, oh my gosh, we don't produce any of this stuff."

In recent years, it became clear that China had invested in and developed a strategic market, she said. The first Trump administration, within its first year, assessed mineral production as a national security matter.

A federal mandate was laid out in a 2017 Trump

, 35 minerals were designated "critical" for vulnerable supply chains and essential economic functions.

Federal funding for mineral industries expanded at pace during the Biden administration. The 2021 Bipartisan Infrastructure Bill and the 2022 Inflation Reduction Act injected billions of dollars into projects around the country. Notably, the 2023 National Defense Authorization Act ordered the military to remove and replace Chinese-processed minerals from its processes within four years, sparking a race to rebuild complex supply chains.

Amid escalating trade tensions in 2024, China https://www.reuters.com/markets/commodities/china-bans-exports-gallium-germanium-antimony-us-2024-12-03/

exports of several key minerals to the United States.

The second Trump Administration so far has allocated

and lack of revenue. In July, according to analyst reports, TMRC had a "severe liquidity crisis."

The Round Top site is not an anomaly and, as TMRC struggles, other miners could step in, according to Brent Elliot, a geologist with the Bureau of Economic Geology at the University of Texas at Austin, the state's official geological survey. There are "many Round Top-like igneous rocks in west Texas to explore," he said, noting that a recent survey of the area "has shown some hot targets that I'll go out and investigate."

Holiday O'Bryan, a 22-year-old PhD student at the University of Texas, plans a career in mining. At a recent conference in Austin on mineral industries, she pointed out that most mining related to new technologies occurs in faraway countries, which often have lower environmental standards and enforcement. America's surging investment in extraction should be seen in context of the clean innovations it will support. Mining operations will change the landscape—particularly as the Trump administration cuts backs on regulations of federal land—and no one should be surprised by the compromises that the race for rare earths will demand, she said.

"You have to have extraction for these technologies to work," she said. "In the age of the green energy transition that doesn't fly very well for someone who is trying to protect the environment."

U.S. Mining Losses

Before 1990 the United States dominated the world's mineral markets. But domestic production dropped that decade, in part, because of rising environmental protections at home and enticing low-cost foreign production possibilities. New industries and products emerging in the mid-2010s—smartphones and Tesla cars among them—prompted a re-think of the American economy and future needs. Mining had become a lost opportunity.

"People started looking at what you actually need to be able to build things like electric vehicles," said Michelle Michot Foss, fellow in energy, minerals and materials at Rice University's Baker Institute for Public Policy. "We started realizing, oh my gosh, we don't produce any of this stuff."

In recent years, it became clear that China had invested in and developed a strategic market, she said. The first Trump administration, within its first year, assessed mineral production as a national security matter.

A federal mandate was laid out in a 2017 Trump

, 35 minerals were designated "critical" for vulnerable supply chains and essential economic functions.

Federal funding for mineral industries expanded at pace during the Biden administration. The 2021 Bipartisan Infrastructure Bill and the 2022 Inflation Reduction Act injected billions of dollars into projects around the country. Notably, the 2023 National Defense Authorization Act ordered the military to remove and replace Chinese-processed minerals from its processes within four years, sparking a race to rebuild complex supply chains.

Amid escalating trade tensions in 2024, China https://www.reuters.com/markets/commodities/china-bans-exports-gallium-germanium-antimony-us-2024-12-03/

exports of several key minerals to the United States.

The second Trump Administration so far has allocated  more dollars toward mineral industries, opened federal lands to mining exploration, ordered expedited permitting for certain projects and imposed tariffs on imports from more than 90 countries. China responded with export controls on 17 minerals used in military manufacturing.

The Modern War Institute at West Point military academy has

more dollars toward mineral industries, opened federal lands to mining exploration, ordered expedited permitting for certain projects and imposed tariffs on imports from more than 90 countries. China responded with export controls on 17 minerals used in military manufacturing.

The Modern War Institute at West Point military academy has  that, "a shot across the bow of the U.S. defense industrial base."

Can America fill the gap? It won't be easy, said Foss of Rice University. As the U.S. mining sector faded, so did its talent, expertise and a workforce pipeline.

"Nobody knows anything about this," Foss said. "Not even in the agencies themselves are there good metallurgists anymore… except for down in the bowels of USGS."

The United States will have to develop more than mines to secure a position in global mineral markets. It needs midstream and downstream industries to process extractions—or the raw material will have to be shipped to China, which has a proficient processing capacity.

Rare earth elements are critical components of the advanced magnets used in electrical motors and generators. For every megawatt of generating capacity, a wind turbine requires 180 kilograms of neodymium, 17 kg of dysprosium and 7 kg of terbium, according to a .pdf

from the National Renewable Energy Laboratory at the Energy Department.

Notably, the first large-scale lithium refinery in the United States is owned by Tesla, the electric car manufacturer, and located near Corpus Christi, Texas.

Launched in December, Tesla's plant .pdf

there.

About 70 miles north of Tesla's refinery, another rare earths processing plant, a joint project between an Australian miner, Lynas, and the Defense Department, is also planned.

The Defense Department has invested https://www.war.gov/News/News-Stories/Article/Article/3700059/dod-looks-to-establish-mine-to-magnet-supply-chain-for-rare-earth-materials/#:~:text=Since%202020%2C%20DOD%20has%20awarded,into%20metals%20and%20then%20magnets.

ultra-high-temperature magnets for spacecraft, satellites, missile guidance systems, stealth aircraft and electronic warfare technologies.

But there's a hitch, again, tied to water issues. Lynas aims to discharge wastewater through an existing treatment system at a nearby Dow Chemical plant, according to a

for Dow, which would increase daily discharge limits at one of its outfalls from 17 million to 42 million gallons.

The draft permit amendment did not mention Lynas or the reason for the sudden rise in daily discharges..

Diane Wilson, a 78-year-old environmental activist in Seadrift who has battled Dow for decades, filed a challenge to the permit amendment, questioning Dow's need. Dow's existing permit allows for about 80 harmful chemicals and metals in the wastewater.

To her surprise, Dow

hearing Wilson's request.

"They obviously did not want us going to a hearing," Wilson said about Dow and the mining company. "There is a real secret element here."

Two months later, Lynas announced its project faced rising costs due to "wastewater challenges," according to industry https://www.miningweekly.com/article/lynas-rare-earths-seeks-us-aid-for-texas-refinery-as-costs-surge-2025-04-29

. In August, its annual results statement noted "there is significant uncertainty as to whether the construction of the heavy rare earth processing facility at Seadrift, Texas will proceed and, if so, in what form."

That's when Wilson said she surmised the Lynas mining project was behind the permit request.

Lynas and Dow did not respond to a request for comment.

Minerals from Waste

In the heart of Houston's industrial complex, another Australian company, Metallium, announced in August that it had leased a fully permitted site for a first-of-a-kind facility to recover minerals from industrial and electronic waste.

Many critical minerals mined or refined in China ultimately end up in American landfills as discarded consumer electronics. Metallium aims to use flash heating technology developed at Rice University to haul in the abandoned material and extract an array of elements. The facility plans operations in 2026.

Other companies are exploring extraction of critical minerals from old industrial waste including coal ash, mine tailing and the red mud residues buried over decades at alumina processing sites along the coast. One pilot project in San Antonio

the mineral graphite from methane gas.

A small landscape of startups has also cropped up around the tremendous volumes of mineral-rich–and toxic–wastewater that comes up from oil wells.

"We can basically turn an oil well into a mini-mine," said Jesse Evans, co-founder of a San Antonio-based startup, Maverick Metals.

This year, Maverick began producing a proprietary chemical that is pumped at

into new oil wells during fracking to dissolve metal-bearing rocks that rise to the surface in the brown frothy brine known as "produced water."

Maverick has processes, equipment and chemicals to extract metals from that wastewater. Most startups in this space focus on lithium, Evans said. But oilfield wastewater also contains trace amounts of other metals like platinum, palladium and gold that are profitable business, he said.

"What makes the lithium space really difficult is competing with China," he said.

Some Chinese companies are vertically integrated from mine to factory, including Contemporary Amperex Technology Co., Limited, the world's largest battery manufacturer. Chinese companies also face looser environmental restrictions, lower labor costs and little media scrutiny. Critically, China's state-run economy can swiftly orchestrate production surges to lower prices and crush competition—and its state-backed companies can operate at a loss for months if not years.

"We play by the rules of capitalism but a different set of rules applies to them," said Marek Locmelis, an associate professor at the University of Texas at Austin who organizes an annual conference on critical minerals.

Lithium Hopes

Beyond the need for vast water supplies, the lithium pursuit also faces environmental and technical challenges. In Texas, the methods that companies plan to mine lithium haven't yet been used commercially at scale anywhere in the world.

While traditional hardrock mines require stone crushing and grinding, the Smackover Formation contains a metal-rich brine that allows for quicker extraction.

"If you extract directly from a brine you basically skip the mineral processing step that is energy intensive," Locmelis said.

Existing lithium brine operations—including Silver Peak in Nevada, the country's only operating lithium mine—let fluids evaporate in ponds over 18 months to concentrate the minerals. But projects in Texas plan to use new methods that extract metals in several days.

These methods require much less freshwater than hardrock or evaporation mines but will still draw significant volumes from shallow aquifers. While water in East Texas may seem abundant, the area affected by lithium production lacks groundwater conservation districts to manage or track withdrawals, said Vanessa Puig-Williams, Texas water program director at the nonprofit Environmental Defense Fund.

"There is no entity that is managing the production of the fresh groundwater," she said. "That's worrisome because there is no oversight."

One Austin-based lithium startup, EnergyX, plans to use a process of "proprietary lithium-selective https://www.sciencedirect.com/topics/chemistry/adsorbent

, membranes, and extractants" which "enables faster, cleaner, and cost-efficient lithium extraction," said founder Teague Egan.

The process uses about 6,600 gallons of freshwater per ton of lithium produced, Egan said, just a fraction of traditional evaporation methods.

In September, EnergyX

that, "a shot across the bow of the U.S. defense industrial base."

Can America fill the gap? It won't be easy, said Foss of Rice University. As the U.S. mining sector faded, so did its talent, expertise and a workforce pipeline.

"Nobody knows anything about this," Foss said. "Not even in the agencies themselves are there good metallurgists anymore… except for down in the bowels of USGS."

The United States will have to develop more than mines to secure a position in global mineral markets. It needs midstream and downstream industries to process extractions—or the raw material will have to be shipped to China, which has a proficient processing capacity.

Rare earth elements are critical components of the advanced magnets used in electrical motors and generators. For every megawatt of generating capacity, a wind turbine requires 180 kilograms of neodymium, 17 kg of dysprosium and 7 kg of terbium, according to a .pdf

from the National Renewable Energy Laboratory at the Energy Department.

Notably, the first large-scale lithium refinery in the United States is owned by Tesla, the electric car manufacturer, and located near Corpus Christi, Texas.

Launched in December, Tesla's plant .pdf

there.

About 70 miles north of Tesla's refinery, another rare earths processing plant, a joint project between an Australian miner, Lynas, and the Defense Department, is also planned.

The Defense Department has invested https://www.war.gov/News/News-Stories/Article/Article/3700059/dod-looks-to-establish-mine-to-magnet-supply-chain-for-rare-earth-materials/#:~:text=Since%202020%2C%20DOD%20has%20awarded,into%20metals%20and%20then%20magnets.

ultra-high-temperature magnets for spacecraft, satellites, missile guidance systems, stealth aircraft and electronic warfare technologies.

But there's a hitch, again, tied to water issues. Lynas aims to discharge wastewater through an existing treatment system at a nearby Dow Chemical plant, according to a

for Dow, which would increase daily discharge limits at one of its outfalls from 17 million to 42 million gallons.

The draft permit amendment did not mention Lynas or the reason for the sudden rise in daily discharges..

Diane Wilson, a 78-year-old environmental activist in Seadrift who has battled Dow for decades, filed a challenge to the permit amendment, questioning Dow's need. Dow's existing permit allows for about 80 harmful chemicals and metals in the wastewater.

To her surprise, Dow

hearing Wilson's request.

"They obviously did not want us going to a hearing," Wilson said about Dow and the mining company. "There is a real secret element here."

Two months later, Lynas announced its project faced rising costs due to "wastewater challenges," according to industry https://www.miningweekly.com/article/lynas-rare-earths-seeks-us-aid-for-texas-refinery-as-costs-surge-2025-04-29

. In August, its annual results statement noted "there is significant uncertainty as to whether the construction of the heavy rare earth processing facility at Seadrift, Texas will proceed and, if so, in what form."

That's when Wilson said she surmised the Lynas mining project was behind the permit request.

Lynas and Dow did not respond to a request for comment.

Minerals from Waste

In the heart of Houston's industrial complex, another Australian company, Metallium, announced in August that it had leased a fully permitted site for a first-of-a-kind facility to recover minerals from industrial and electronic waste.

Many critical minerals mined or refined in China ultimately end up in American landfills as discarded consumer electronics. Metallium aims to use flash heating technology developed at Rice University to haul in the abandoned material and extract an array of elements. The facility plans operations in 2026.

Other companies are exploring extraction of critical minerals from old industrial waste including coal ash, mine tailing and the red mud residues buried over decades at alumina processing sites along the coast. One pilot project in San Antonio

the mineral graphite from methane gas.

A small landscape of startups has also cropped up around the tremendous volumes of mineral-rich–and toxic–wastewater that comes up from oil wells.

"We can basically turn an oil well into a mini-mine," said Jesse Evans, co-founder of a San Antonio-based startup, Maverick Metals.

This year, Maverick began producing a proprietary chemical that is pumped at

into new oil wells during fracking to dissolve metal-bearing rocks that rise to the surface in the brown frothy brine known as "produced water."

Maverick has processes, equipment and chemicals to extract metals from that wastewater. Most startups in this space focus on lithium, Evans said. But oilfield wastewater also contains trace amounts of other metals like platinum, palladium and gold that are profitable business, he said.

"What makes the lithium space really difficult is competing with China," he said.

Some Chinese companies are vertically integrated from mine to factory, including Contemporary Amperex Technology Co., Limited, the world's largest battery manufacturer. Chinese companies also face looser environmental restrictions, lower labor costs and little media scrutiny. Critically, China's state-run economy can swiftly orchestrate production surges to lower prices and crush competition—and its state-backed companies can operate at a loss for months if not years.

"We play by the rules of capitalism but a different set of rules applies to them," said Marek Locmelis, an associate professor at the University of Texas at Austin who organizes an annual conference on critical minerals.

Lithium Hopes

Beyond the need for vast water supplies, the lithium pursuit also faces environmental and technical challenges. In Texas, the methods that companies plan to mine lithium haven't yet been used commercially at scale anywhere in the world.

While traditional hardrock mines require stone crushing and grinding, the Smackover Formation contains a metal-rich brine that allows for quicker extraction.

"If you extract directly from a brine you basically skip the mineral processing step that is energy intensive," Locmelis said.

Existing lithium brine operations—including Silver Peak in Nevada, the country's only operating lithium mine—let fluids evaporate in ponds over 18 months to concentrate the minerals. But projects in Texas plan to use new methods that extract metals in several days.

These methods require much less freshwater than hardrock or evaporation mines but will still draw significant volumes from shallow aquifers. While water in East Texas may seem abundant, the area affected by lithium production lacks groundwater conservation districts to manage or track withdrawals, said Vanessa Puig-Williams, Texas water program director at the nonprofit Environmental Defense Fund.

"There is no entity that is managing the production of the fresh groundwater," she said. "That's worrisome because there is no oversight."

One Austin-based lithium startup, EnergyX, plans to use a process of "proprietary lithium-selective https://www.sciencedirect.com/topics/chemistry/adsorbent

, membranes, and extractants" which "enables faster, cleaner, and cost-efficient lithium extraction," said founder Teague Egan.

The process uses about 6,600 gallons of freshwater per ton of lithium produced, Egan said, just a fraction of traditional evaporation methods.

In September, EnergyX  , owns 330 adjacent acres where it plans a commercial-scale refinery. Four units would come online by 2030 to achieve 50,000 tons per year of production.

"Texas—and specifically the Smackover Region—is quickly emerging as one of the central hubs for the U.S. lithium sector," Egan said. "In 10 years, we believe the Smackover Region will be the largest source of domestically produced lithium."

His vision hinges on high hopes for strong lithium prices although there is some uncertainty about that.

A trade war with China could crush the American sector. Technical advancements are making smaller batteries with less lithium and could dampen demand. Rapid evolution of recycling technologies could also reduce the need for lithium production. Scientists are developing new designs for energy storage that could eventually see lithium batteries join CD players and USB sticks in the land of obsolescence.

Egan is not dissuaded. He is betting on Northeast Texas "evolving into a full-fledged lithium hub, with upstream brine production integrated directly into downstream refining."

"The region has the potential to become a global benchmark," he said. "Just as the oil and gas industry shaped the region's past, lithium can help define its future."

Mon, 10/20/2025 - 20:05

, owns 330 adjacent acres where it plans a commercial-scale refinery. Four units would come online by 2030 to achieve 50,000 tons per year of production.

"Texas—and specifically the Smackover Region—is quickly emerging as one of the central hubs for the U.S. lithium sector," Egan said. "In 10 years, we believe the Smackover Region will be the largest source of domestically produced lithium."

His vision hinges on high hopes for strong lithium prices although there is some uncertainty about that.

A trade war with China could crush the American sector. Technical advancements are making smaller batteries with less lithium and could dampen demand. Rapid evolution of recycling technologies could also reduce the need for lithium production. Scientists are developing new designs for energy storage that could eventually see lithium batteries join CD players and USB sticks in the land of obsolescence.

Egan is not dissuaded. He is betting on Northeast Texas "evolving into a full-fledged lithium hub, with upstream brine production integrated directly into downstream refining."

"The region has the potential to become a global benchmark," he said. "Just as the oil and gas industry shaped the region's past, lithium can help define its future."

Mon, 10/20/2025 - 20:05

X (formerly Twitter)

Dylan Baddour (@DylanBaddour) on X

Guy in Texas and sometimes other places

Smackover Lithium Releases Maiden Inferred Resource For Its Franklin Project Comprising A Portion Of Significant Brine Position In East Texas

Highlighted by 2.2M tonnes of Lithium Carbonate Equivalent (“LCE”) at an average lithium grade of 668 mg/L, 15.4M tonnes of potash and 2.6M ton...

TerraVolta Resources Selected by U.S. Department of Energy for $225 Million Award Negotiation for Lithium Production Facility in Texarkana Region

/PRNewswire/ -- TerraVolta Resources, LLC ("TerraVolta" or the "Company"), a leading U.S. critical minerals exploration and production company, was...

Mining Companies Say They Have a Better Way to Get Underground Lithium, but Skepticism Remains - Inside Climate News

Elsewhere in Texas, a mine is planned near El Paso for the rare metals used in magnets for electric motors. On the rural Gulf Coast, the Department of Defense has invested almost $300 million in a project that would process rare metals like samarium, used in jet engines, guided munitions and stealth technology. From Houston's petrochemical complex to the Permian Basin, a flurry of startups, oil majors and mining giants intend to recover minerals from industrial waste like coal ash, discarded electronics, mine tailings and oilfield wastewater in hopes of accelerating U.S. mineral supplies.

Presently, the United States produces a dribble of the raw materials. China broadly owns the global production lines, following decades of investment and securing a dominance that has raised national security concerns as well as financial risk.

The United States has just one operating lithium mine, in Nevada, where a second mine with https://www.reuters.com/business/autos-transportation/us-government-take-5-stake-lithium-americas-joint-venture-with-general-motors-2025-09-30/

expects to begin production in 2027. Only one lithium refinery operates in the country, on the Gulf Coast of Texas.

"Our exposure to China is unacceptable," said Douglas Wicks, a former program director at the Advanced Research Projects Agency of the Energy Department. It raises threats that the outbreak of conflict could leave the United States cut off from essential supply chains.

That's the biggest reason why federal agencies are pushing so hard to play catch-up and boost American mining, Wicks said. As geopolitical tensions squeeze the flow of globalized commerce, Washington hopes to challenge Beijing's monopolies in a battle of extraction.

"I think American industry can outproduce them," said Wicks, who retired this year. The United States has "the deposits to do this."

However, the United States has to contend with China's gargantuan economy where the state owns key industries and provides subsidies, preferential finance schemes and other market support. Still, Wicks said, the United States knows how to move quickly. Just consider the recent evolution of American oil and gas. Technical innovations and loosened environmental standards in the shale revolution turned the United States from the world's largest importers of oil and gas to a major exporter in barely over a decade. Wicks believes the United States can transform again.

In 2023, under the Biden administration, the Pentagon was ordered to establish mineral supply chains independent of China. Since then, billions of dollars have flowed to mining and processing projects across the country, spurring a rush of prospectors and entrepreneurs hoping to cash in on federal grants.

Wisk said, "Now there's a big push in Texas to ask: 'Is there something else under the ground other than oil and gas?"

Elsewhere in Texas, a mine is planned near El Paso for the rare metals used in magnets for electric motors. On the rural Gulf Coast, the Department of Defense has invested almost $300 million in a project that would process rare metals like samarium, used in jet engines, guided munitions and stealth technology. From Houston's petrochemical complex to the Permian Basin, a flurry of startups, oil majors and mining giants intend to recover minerals from industrial waste like coal ash, discarded electronics, mine tailings and oilfield wastewater in hopes of accelerating U.S. mineral supplies.

Presently, the United States produces a dribble of the raw materials. China broadly owns the global production lines, following decades of investment and securing a dominance that has raised national security concerns as well as financial risk.

The United States has just one operating lithium mine, in Nevada, where a second mine with https://www.reuters.com/business/autos-transportation/us-government-take-5-stake-lithium-americas-joint-venture-with-general-motors-2025-09-30/

expects to begin production in 2027. Only one lithium refinery operates in the country, on the Gulf Coast of Texas.

"Our exposure to China is unacceptable," said Douglas Wicks, a former program director at the Advanced Research Projects Agency of the Energy Department. It raises threats that the outbreak of conflict could leave the United States cut off from essential supply chains.

That's the biggest reason why federal agencies are pushing so hard to play catch-up and boost American mining, Wicks said. As geopolitical tensions squeeze the flow of globalized commerce, Washington hopes to challenge Beijing's monopolies in a battle of extraction.

"I think American industry can outproduce them," said Wicks, who retired this year. The United States has "the deposits to do this."

However, the United States has to contend with China's gargantuan economy where the state owns key industries and provides subsidies, preferential finance schemes and other market support. Still, Wicks said, the United States knows how to move quickly. Just consider the recent evolution of American oil and gas. Technical innovations and loosened environmental standards in the shale revolution turned the United States from the world's largest importers of oil and gas to a major exporter in barely over a decade. Wicks believes the United States can transform again.

In 2023, under the Biden administration, the Pentagon was ordered to establish mineral supply chains independent of China. Since then, billions of dollars have flowed to mining and processing projects across the country, spurring a rush of prospectors and entrepreneurs hoping to cash in on federal grants.

Wisk said, "Now there's a big push in Texas to ask: 'Is there something else under the ground other than oil and gas?"

Tiny Concentrations, Big Mines

In the desert of far-west Texas, a company called Texas Mineral Resources Corp. (TMRC) had plans to dig for rare earth elements at a 950-acre Round Top Mountain site. The company won its first Defense Department contract

Tiny Concentrations, Big Mines

In the desert of far-west Texas, a company called Texas Mineral Resources Corp. (TMRC) had plans to dig for rare earth elements at a 950-acre Round Top Mountain site. The company won its first Defense Department contract GlobeNewswire News Room

U.S. Defense Logistics Agency Awards Texas Rare Earth Resources Strategic Materials Research Contract

SIERRA BLANCA, TX--(Marketwired - Sep 25, 2015) - Texas Rare Earth Resources Corp. (OTCQX: TRER)

TRER and...

Panabee

Texas Mineral Resources Earnings Q2 2025 | Texas Mineral Resources News & Analysis

Texas Mineral Resources is grappling with a severe liquidity crisis, evidenced by a 107% surge in its net loss to $1.27 million and insufficient ca...

Federal Register :: Request Access

Energy.gov

Energy Department Announces Actions to Secure American Critical Minerals and Materials Supply Chain

The U.S. Department of Energy today announced its intent to issue notices of funding opportunities totaling nearly $1 billion to advance and scale ...

Modern War Institute -

Minerals, Magnets, and Military Capability: China’s Rare Earth Weaponization Should Be a Wake-Up Call - Modern War Institute

When China imposed export controls on seven of the seventeen rare earth elements in April 2025, it wasn’t just a trade policy tweak—it was a sh...

Google Docs

Lynas-Seadrift-EA-Draft-01NOV23.pdf

Google Docs

Dow_Seadrift TPDES Permit (002).pdf

Startups Make Products From the Carbon in Fossil Fuels - Inside Climate News

bullhead

To forcibly pump fluids into a formation, usually formation fluids that have entered the wellbore during a well control event.

EnergyX | Energy Exploration Technologies, Inc.

EnergyX Secures Landmark Site for Project Lonestar™ Lithium Plant at TexAmericas Center - EnergyX | Energy Exploration Technologies, Inc.

The race to secure America’s lithium supply took a major step forward today as EnergyX announced the official site for its Project Lonestar™ Li...

Tyler Durden | Zero Hedge

Zero Hedge

New Generation Of Industries Emerges In Texas As Rare Earths Race Ignites | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

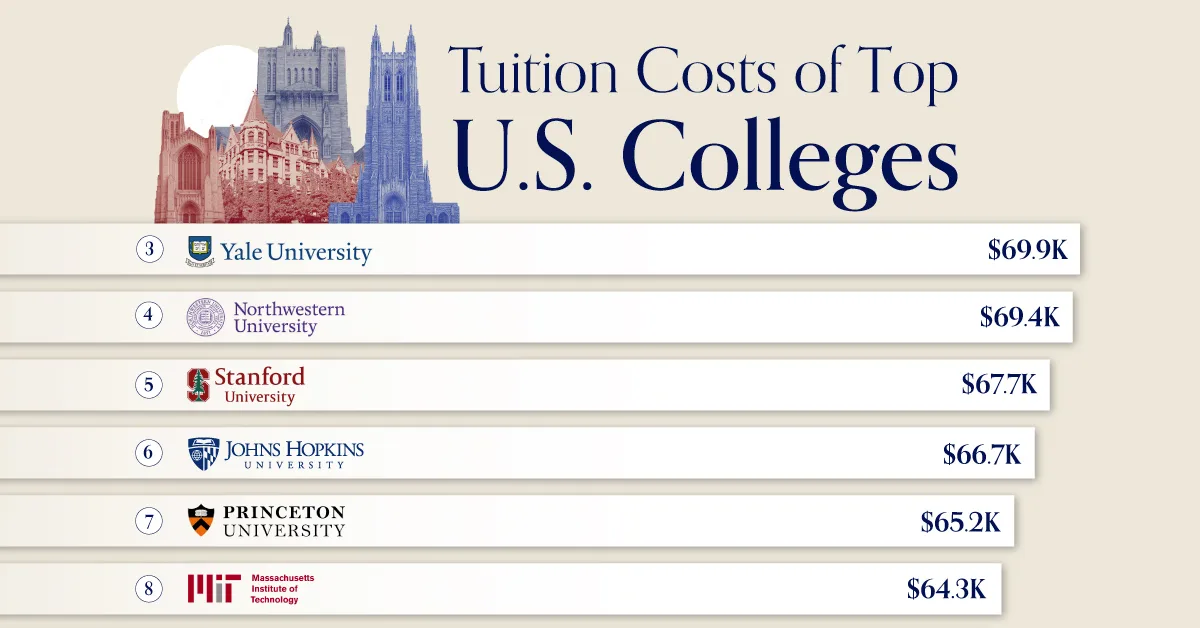

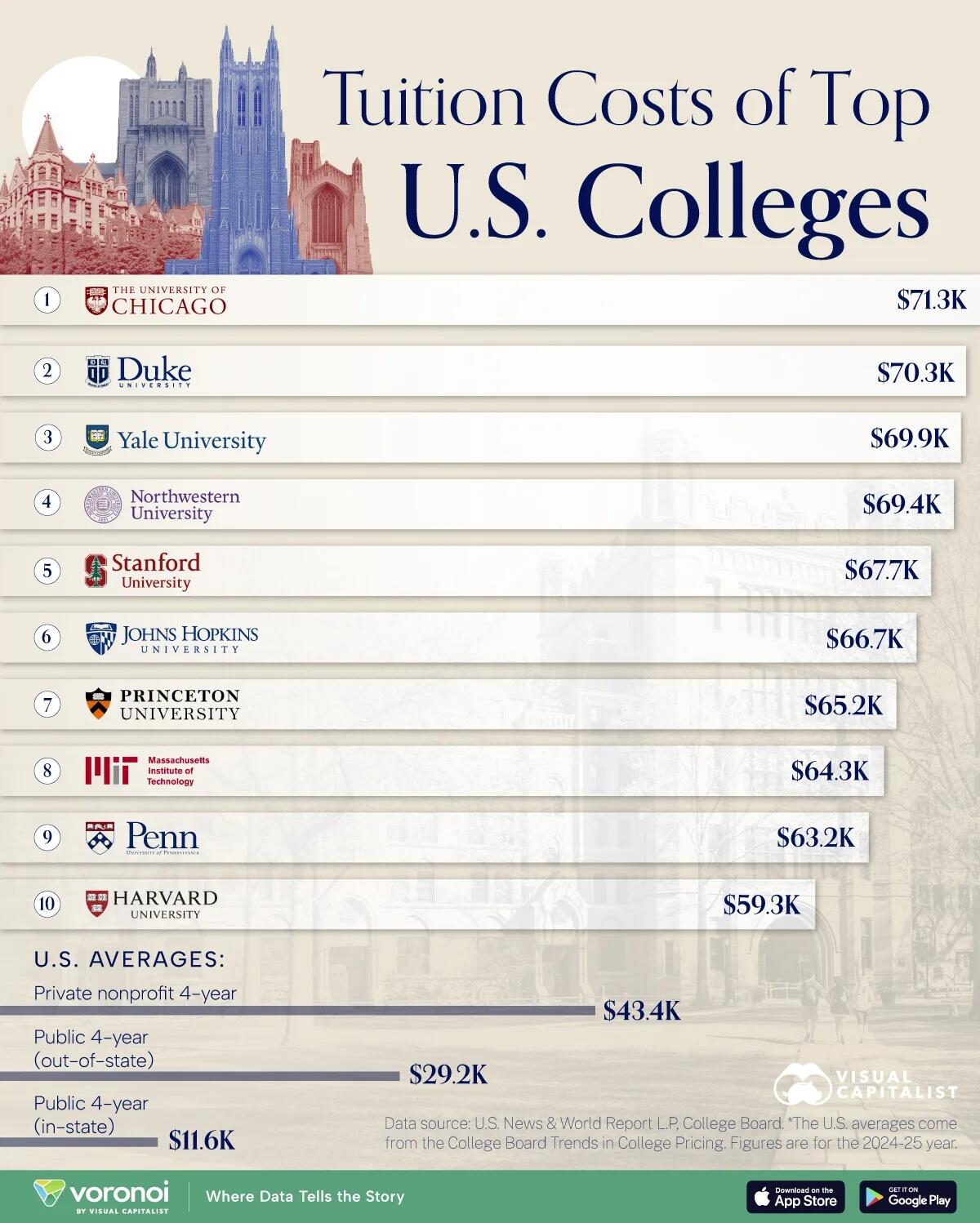

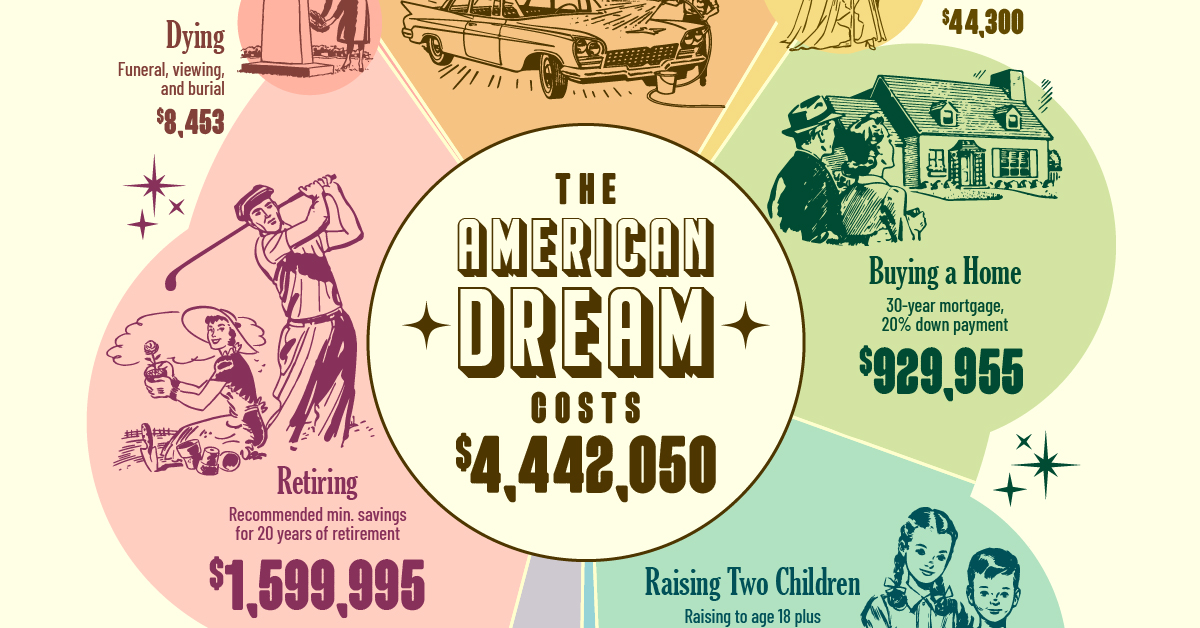

Elite Education Comes at a Premium

The University of Chicago tops the list, with tuition reaching $71,300. Other elite schools like Duke, Yale, and Stanford also hover near the $70,000 mark. Even Harvard, despite having one of the largest endowments in the world, lists tuition at $59,300.

Elite Education Comes at a Premium

The University of Chicago tops the list, with tuition reaching $71,300. Other elite schools like Duke, Yale, and Stanford also hover near the $70,000 mark. Even Harvard, despite having one of the largest endowments in the world, lists tuition at $59,300.

The Gap Between Elite and Average Colleges

Tuition at the top 10 U.S. universities ranges from $59,000 to $71,000 per year, averaging about 50% higher than the $43,400 charged by the typical private nonprofit four-year college. By comparison, public out-of-state universities average around $29,200, while in-state students pay just $11,600.

In fact, the average college tuition costs have

The Gap Between Elite and Average Colleges

Tuition at the top 10 U.S. universities ranges from $59,000 to $71,000 per year, averaging about 50% higher than the $43,400 charged by the typical private nonprofit four-year college. By comparison, public out-of-state universities average around $29,200, while in-state students pay just $11,600.

In fact, the average college tuition costs have

To me, this is all in plain sight, but since nobody else sees it, it's hidden in plain sight. The

To me, this is all in plain sight, but since nobody else sees it, it's hidden in plain sight. The

At the Monday signing ceremony,

At the Monday signing ceremony,

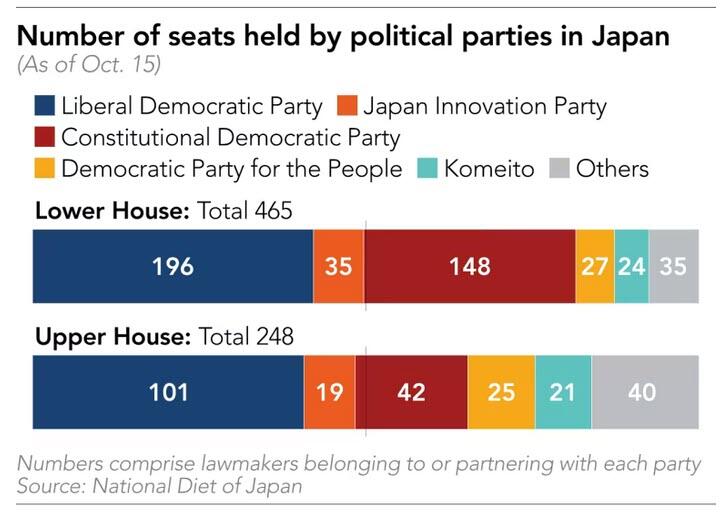

The LDP and Japan Innovation by themselves will not hold a majority of seats in both the upper and lower houses of the Diet, or parliament, but will be only a few short; in the lower house, they will hold a combined 231 seats in the 465-seat chamber, and in the upper house, they will have 120 seats out of 248.

They could, however, reach a majority if they bring in other minor groupings in parliament, allowing for easier passage of bills and budgets. The LDP has already courted Sanseito, a right-wing populist party, as well as other smaller political forces.

Takaichi said the two-party coalition will be the base. "We will thoroughly coordinate policies between the LDP and Japan Innovation, and responsibly submit them to the Diet. After that, since there are opposition parties that share similar views, we will call for broad participation and carefully refine them one by one."

Japan Innovation members will vote for Takaichi in the parliament's prime ministerial election scheduled to take place on Tuesday after incumbent Prime Minister Shigeru Ishiba and his cabinet resign en masse. Takaichi will form her cabinet on the same day.

The election of a new prime minister will be held in separate votes in both houses of parliament. In each chamber, if no nominee wins a majority in the first round, a runoff will be held between the top two vote-getters. The choice in the lower house will prevail in the event of a split decision.

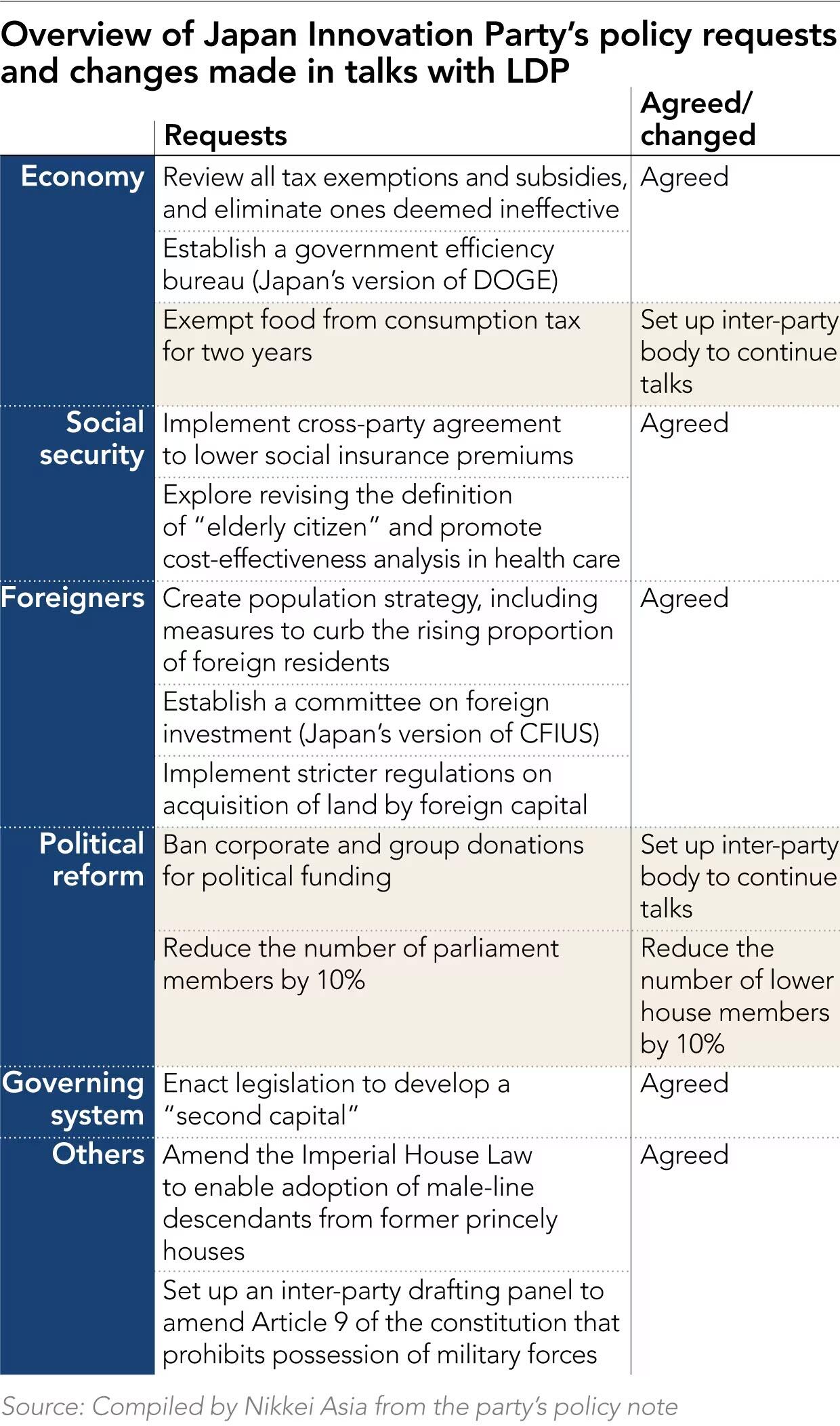

In Monday's deal, Japan Innovation secured "nearly full agreement" on most of the 12 policy areas where it demanded change -- from social security reforms to the establishment of a "second capital" to move certain government and economic functions away from Tokyo -- according to the party's co-leader, Fumitake Fujita.

"Moving forward as a coalition -- although we will be straightforward in expressing our dissatisfaction -- we wish to pledge our commitment to walk together as partners, determined to accomplish what we have mutually agreed upon for Japan's revival," Fujita told reporters after a meeting with fellow lawmakers on Monday.

The agreement states that the new government will create a government efficiency bureau to thoroughly review tax incentives and subsidies, and eliminate those deemed ineffective.

Japan Innovation's demand to reduce the number of Diet members -- something the party says is "the gateway to reforms" -- was also included in the written pact. It says the parties "will aim to reduce the number of the lower house seats by 10%" during the upcoming Diet session. But the proposal has caused political ripples across political parties.

But Fujita said differences remain on exempting food items from the 8% consumption tax for two years and on banning corporate and group political donations. The two parties will establish an inter-party consultative body to continue discussions on these policies.

The LDP and Japan Innovation by themselves will not hold a majority of seats in both the upper and lower houses of the Diet, or parliament, but will be only a few short; in the lower house, they will hold a combined 231 seats in the 465-seat chamber, and in the upper house, they will have 120 seats out of 248.

They could, however, reach a majority if they bring in other minor groupings in parliament, allowing for easier passage of bills and budgets. The LDP has already courted Sanseito, a right-wing populist party, as well as other smaller political forces.

Takaichi said the two-party coalition will be the base. "We will thoroughly coordinate policies between the LDP and Japan Innovation, and responsibly submit them to the Diet. After that, since there are opposition parties that share similar views, we will call for broad participation and carefully refine them one by one."

Japan Innovation members will vote for Takaichi in the parliament's prime ministerial election scheduled to take place on Tuesday after incumbent Prime Minister Shigeru Ishiba and his cabinet resign en masse. Takaichi will form her cabinet on the same day.

The election of a new prime minister will be held in separate votes in both houses of parliament. In each chamber, if no nominee wins a majority in the first round, a runoff will be held between the top two vote-getters. The choice in the lower house will prevail in the event of a split decision.

In Monday's deal, Japan Innovation secured "nearly full agreement" on most of the 12 policy areas where it demanded change -- from social security reforms to the establishment of a "second capital" to move certain government and economic functions away from Tokyo -- according to the party's co-leader, Fumitake Fujita.

"Moving forward as a coalition -- although we will be straightforward in expressing our dissatisfaction -- we wish to pledge our commitment to walk together as partners, determined to accomplish what we have mutually agreed upon for Japan's revival," Fujita told reporters after a meeting with fellow lawmakers on Monday.

The agreement states that the new government will create a government efficiency bureau to thoroughly review tax incentives and subsidies, and eliminate those deemed ineffective.

Japan Innovation's demand to reduce the number of Diet members -- something the party says is "the gateway to reforms" -- was also included in the written pact. It says the parties "will aim to reduce the number of the lower house seats by 10%" during the upcoming Diet session. But the proposal has caused political ripples across political parties.

But Fujita said differences remain on exempting food items from the 8% consumption tax for two years and on banning corporate and group political donations. The two parties will establish an inter-party consultative body to continue discussions on these policies.

The LDP-Japan Innovation cooperation comes after the former's long-term coalition partner Komeito announced it was ending their 26-year partnership, throwing Japanese politics into a state of turmoil. The decision sparked intense jockeying among parties to form a government to succeed the one led by LDP's Ishiba.

Both the LDP and Japan Innovation are conservative, and their policy priorities align in some respects, such as on the need for constitutional reform and stressing the importance of maintaining the Imperial lineage through the male line.

In the short term, the LDP and Japan Innovation will enact a law to cut the surtax on gasoline, and pass a supplementary budget to implement measures to combat rising prices during the Diet session, which starts Tuesday and runs through mid-December.

Both sides also agreed to strengthen Japan's intelligence capabilities by upgrading the existing Cabinet Intelligence Office to give it more authority, as well as by establishing a foreign intelligence agency.

"The agreement incorporates content previously agreed upon by parties, including the LDP and Japan Innovation," said Takaichi. "I believe this coalition government is essential for driving Japan's politics forward with strength."

The market reaction was one of relief: on Monday, the Nikkei surge 337bps to a new ATH led by combination of some positive stories like physical AI-related, including SoftBank Group, recovery of sentiment in banks, raised iPhone17 production forecast. Much of the move was in anticipation of tomorrow's key event, namely Takaichi being nominated as prime minister, which the bank says is now fully priced by investors.

The LDP-Japan Innovation cooperation comes after the former's long-term coalition partner Komeito announced it was ending their 26-year partnership, throwing Japanese politics into a state of turmoil. The decision sparked intense jockeying among parties to form a government to succeed the one led by LDP's Ishiba.

Both the LDP and Japan Innovation are conservative, and their policy priorities align in some respects, such as on the need for constitutional reform and stressing the importance of maintaining the Imperial lineage through the male line.

In the short term, the LDP and Japan Innovation will enact a law to cut the surtax on gasoline, and pass a supplementary budget to implement measures to combat rising prices during the Diet session, which starts Tuesday and runs through mid-December.

Both sides also agreed to strengthen Japan's intelligence capabilities by upgrading the existing Cabinet Intelligence Office to give it more authority, as well as by establishing a foreign intelligence agency.

"The agreement incorporates content previously agreed upon by parties, including the LDP and Japan Innovation," said Takaichi. "I believe this coalition government is essential for driving Japan's politics forward with strength."

The market reaction was one of relief: on Monday, the Nikkei surge 337bps to a new ATH led by combination of some positive stories like physical AI-related, including SoftBank Group, recovery of sentiment in banks, raised iPhone17 production forecast. Much of the move was in anticipation of tomorrow's key event, namely Takaichi being nominated as prime minister, which the bank says is now fully priced by investors.

I won’t address that matter here. I note only that this outrage against executive overreach, or the tyranny of petty autocrats, is quite new. Of course, the opponents of President Trump believe that he is behaving like a king.

“If only!” I might say, thinking of how medieval kings actually governed. We tend to project onto monarchy the most egregious examples of centralized and personal power. “L’État, c’est moi,” said Louis XIV to the French parliament in 1655. His predecessor, Louis IX (r. 1226-1270), not only never said such a thing. He could not have conceived it. France then was a patchwork of duchies and counties, and their relations to the royal will and power were never spelled out in legal terms. Things were similar in England: Magna Carta (1215), the Great Charter, set a limit to the power of the king as opposed to the traditional power of the local lords and squires. Towns too had their charters, as did abbeys and friaries and universities, which were run by the Church. The vogue of claiming a divine right to govern as an absolute ruler was brief; it was a feature of the late Renaissance, and nowhere in Western Europe was it simply accepted. Indeed, by the time of the American Revolution, the engine of power in England was not King George III (r. 1760-1820), but the Parliament. The slogan “No taxation without representation” would make no sense if the king were perceived as the principal villain, though there was little love between him and the Americans.

Medieval kings often made common cause with townsmen and the middle class in a flanking action against their common foes, the landed gentry.

The Mayor of London would likely be more friendly to the king than the House of Lords would be, just as a kid getting beaten up in the schoolyard might make friends with a big bodyguard, a “king,” if you will. In such a situation, if you want “no king,” that is, no big fellow to throw his weight around, you must either be one of the petty lords oppressing the locals, or there is no such oppression to suffer, or you are simply confused, taken in by a word while you miss the reality.

For the fact is that Americans are governed by innumerable unelected bureaucrats, “human resource” meddlers at work, layers of administrative deflectors at school, incomprehensible protocols set by medical insurance companies and connived at by hospitals, the Internal Revenue Service, and now, slouching towards the United Nations to be born, what threatens to be a worldwide public health super-government, grinding to indiscriminate dust every last feature of an independent local human life.

Where have these opponents of arbitrary rule been?

The Supreme Court Royal Over The Undifferentiated Masses—now there’s a passel of archons for you.

Is there a single feature of human culture, let alone local government, that it considers outside of its immense, all-comprehending wisdom?

Redefine marriage, detaching it from common sense and human biology? No problem.

Specify what a football coach may not say to his players in the locker room? No problem.

Manage a city school district for twenty years, busing a certain number of these students to that place and those students to this place? No problem.

Rifling people in their towns and states of almost all their rightful power and responsibility to police obscenity? No problem.

It has become so bad that we all now assume that the main feature we want in our president is that he will agree with us on what kinds of juridical archons to appoint, the super-legislators in the most delicate and yet far-reaching cultural problems, who are no more to be trusted with such power than nine plumbers or nine housewives or nine truck drivers or just the first nine names in the Washington telephone book. Nor should we expect nine lawyers to have the broad human experience we look for in a legislature, where a variety of people consulting on an issue may see many practical consequences quite invisible to those committed to legal abstractions—or rather shaped by the slogans popular at the faculty lounge or the departmental coffee shop.

We are bristling with petty tyrants everywhere. Right now, the Supreme Court—of all things!—is considering a miserable law in Colorado that forbids psychiatrists to help troubled young people become comfortable with their own sex, rather than believing the impossible, that they are “really” boys in girl-flesh or vice versa. The child may desire such assistance; the parents may desire it; but the tyrants of Colorado don’t, so the little people in that state must appeal to the super-tyrants of the Supreme Court just to secure the right to do what anyone with the slightest common sense would consider a matter of course. Where in all this tangled mess—and we may include schoolteachers and guidance counselors who rob parents of their rights, acting not in loco parentis but contra parentem—are the people who now pretend to be affrighted by authoritarianism?

Where were they in 2020? Weren’t they the same people ready to call you a murderer if you dared to question shutting down everything?

Aren’t they ready to do the same the next time there is or there is said to be a public health crisis? And aren’t they the same people who, for the sake of the “planet”—a planet, after all, wins a point or two for sounding scientific—are eager to override national governments, let alone the regional and the local, not to mention individual human choices?

And what about schooling? There are plenty of Americans who hate homeschooling so much, they are eager to forbid by law the kind of thing that made the young Thomas Edison a genius on the run, and of course they would exercise that tyranny with high-toned slogans on their lips. How much will you wager that most of those who would subject all children to the public schools (for there are some who oppose private schooling to boot) are in sympathy with “No Kings”? If Donald Trump did nothing else than to take a sledgehammer to the Department of Education, that pit of uselessness and stupidity in the service of centralized power, he would deserve praise and gratitude from all lovers of liberty.

Meanwhile, the greatest threat to human freedom has spread like poisonous vapor into every facet of life.

Who controls the algorithms that tweak billions of minds at once? Who suppresses people who say the “wrong” things? Who directs the eye toward articles that push the favored positions, while those who search for the opposition must persevere and wade through pages of trash? We don’t know, and we can’t find out. It’s easy to oppose Donald Trump, because he’s visible, all too visible, and he invites the outrage. But let’s be honest. In a healthy society, there would be no superhighways from the national capital directly into your living room or into your child’s brain. Of the 365 days of the year, you might spend two or three of them grouching about the president, not because you belonged or did not belong to his party, but because most of human life would be quite separate from the whole monstrous thing we take for granted as the national government. We don’t want a king, but we’ll take ten million dukes instead?

“Here, peasant, sign this petition against kings, and be quick about it,” says the duke’s flunky. “If you value your freedom, you’d better do it.”

I won’t address that matter here. I note only that this outrage against executive overreach, or the tyranny of petty autocrats, is quite new. Of course, the opponents of President Trump believe that he is behaving like a king.

“If only!” I might say, thinking of how medieval kings actually governed. We tend to project onto monarchy the most egregious examples of centralized and personal power. “L’État, c’est moi,” said Louis XIV to the French parliament in 1655. His predecessor, Louis IX (r. 1226-1270), not only never said such a thing. He could not have conceived it. France then was a patchwork of duchies and counties, and their relations to the royal will and power were never spelled out in legal terms. Things were similar in England: Magna Carta (1215), the Great Charter, set a limit to the power of the king as opposed to the traditional power of the local lords and squires. Towns too had their charters, as did abbeys and friaries and universities, which were run by the Church. The vogue of claiming a divine right to govern as an absolute ruler was brief; it was a feature of the late Renaissance, and nowhere in Western Europe was it simply accepted. Indeed, by the time of the American Revolution, the engine of power in England was not King George III (r. 1760-1820), but the Parliament. The slogan “No taxation without representation” would make no sense if the king were perceived as the principal villain, though there was little love between him and the Americans.

Medieval kings often made common cause with townsmen and the middle class in a flanking action against their common foes, the landed gentry.

The Mayor of London would likely be more friendly to the king than the House of Lords would be, just as a kid getting beaten up in the schoolyard might make friends with a big bodyguard, a “king,” if you will. In such a situation, if you want “no king,” that is, no big fellow to throw his weight around, you must either be one of the petty lords oppressing the locals, or there is no such oppression to suffer, or you are simply confused, taken in by a word while you miss the reality.

For the fact is that Americans are governed by innumerable unelected bureaucrats, “human resource” meddlers at work, layers of administrative deflectors at school, incomprehensible protocols set by medical insurance companies and connived at by hospitals, the Internal Revenue Service, and now, slouching towards the United Nations to be born, what threatens to be a worldwide public health super-government, grinding to indiscriminate dust every last feature of an independent local human life.

Where have these opponents of arbitrary rule been?

The Supreme Court Royal Over The Undifferentiated Masses—now there’s a passel of archons for you.

Is there a single feature of human culture, let alone local government, that it considers outside of its immense, all-comprehending wisdom?

Redefine marriage, detaching it from common sense and human biology? No problem.

Specify what a football coach may not say to his players in the locker room? No problem.

Manage a city school district for twenty years, busing a certain number of these students to that place and those students to this place? No problem.

Rifling people in their towns and states of almost all their rightful power and responsibility to police obscenity? No problem.

It has become so bad that we all now assume that the main feature we want in our president is that he will agree with us on what kinds of juridical archons to appoint, the super-legislators in the most delicate and yet far-reaching cultural problems, who are no more to be trusted with such power than nine plumbers or nine housewives or nine truck drivers or just the first nine names in the Washington telephone book. Nor should we expect nine lawyers to have the broad human experience we look for in a legislature, where a variety of people consulting on an issue may see many practical consequences quite invisible to those committed to legal abstractions—or rather shaped by the slogans popular at the faculty lounge or the departmental coffee shop.

We are bristling with petty tyrants everywhere. Right now, the Supreme Court—of all things!—is considering a miserable law in Colorado that forbids psychiatrists to help troubled young people become comfortable with their own sex, rather than believing the impossible, that they are “really” boys in girl-flesh or vice versa. The child may desire such assistance; the parents may desire it; but the tyrants of Colorado don’t, so the little people in that state must appeal to the super-tyrants of the Supreme Court just to secure the right to do what anyone with the slightest common sense would consider a matter of course. Where in all this tangled mess—and we may include schoolteachers and guidance counselors who rob parents of their rights, acting not in loco parentis but contra parentem—are the people who now pretend to be affrighted by authoritarianism?

Where were they in 2020? Weren’t they the same people ready to call you a murderer if you dared to question shutting down everything?

Aren’t they ready to do the same the next time there is or there is said to be a public health crisis? And aren’t they the same people who, for the sake of the “planet”—a planet, after all, wins a point or two for sounding scientific—are eager to override national governments, let alone the regional and the local, not to mention individual human choices?

And what about schooling? There are plenty of Americans who hate homeschooling so much, they are eager to forbid by law the kind of thing that made the young Thomas Edison a genius on the run, and of course they would exercise that tyranny with high-toned slogans on their lips. How much will you wager that most of those who would subject all children to the public schools (for there are some who oppose private schooling to boot) are in sympathy with “No Kings”? If Donald Trump did nothing else than to take a sledgehammer to the Department of Education, that pit of uselessness and stupidity in the service of centralized power, he would deserve praise and gratitude from all lovers of liberty.

Meanwhile, the greatest threat to human freedom has spread like poisonous vapor into every facet of life.

Who controls the algorithms that tweak billions of minds at once? Who suppresses people who say the “wrong” things? Who directs the eye toward articles that push the favored positions, while those who search for the opposition must persevere and wade through pages of trash? We don’t know, and we can’t find out. It’s easy to oppose Donald Trump, because he’s visible, all too visible, and he invites the outrage. But let’s be honest. In a healthy society, there would be no superhighways from the national capital directly into your living room or into your child’s brain. Of the 365 days of the year, you might spend two or three of them grouching about the president, not because you belonged or did not belong to his party, but because most of human life would be quite separate from the whole monstrous thing we take for granted as the national government. We don’t want a king, but we’ll take ten million dukes instead?

“Here, peasant, sign this petition against kings, and be quick about it,” says the duke’s flunky. “If you value your freedom, you’d better do it.”

In March, Paxton opened a consumer-protection probe and served a Civil Investigative Demand (CID) on CCP, the vehicle formed to develop EPIC City.

In March, Paxton opened a consumer-protection probe and served a Civil Investigative Demand (CID) on CCP, the vehicle formed to develop EPIC City.

President Donald Trump has repeatedly

President Donald Trump has repeatedly

All of this came after

All of this came after

While speaking

with Fox News, Huang said that Nvidia and Taiwan Semiconductor Manufacturing Co. (TSMC) have jointly reached volume production of U.S.-made Blackwell wafers—an achievement he called “a historic moment” in both technology and industrial policy.

“It’s the very first time in recent American history that the single most important chip is being manufactured here in the United States by the most advanced fab, by TSMC, here in the United States,” Huang said at the event.

“This is the vision of President Trump of reindustrialization—to bring back manufacturing to America, to create jobs, of course, but also, this is the single most vital manufacturing industry and the most important technology industry in the world.”

The milestone was marked in a ceremony at the Arizona fab, where Huang joined TSMC executives to sign the first U.S.-produced Blackwell wafer—a symbolic gesture meant to highlight the reemergence of cutting-edge semiconductor production in the United States.

In his Fox News interview, Huang credited Trump’s tariffs and energy policies with speeding up the decision to manufacture advanced chips in the United States rather than keeping production overseas.

“This last week was a historic week,” he

While speaking

with Fox News, Huang said that Nvidia and Taiwan Semiconductor Manufacturing Co. (TSMC) have jointly reached volume production of U.S.-made Blackwell wafers—an achievement he called “a historic moment” in both technology and industrial policy.

“It’s the very first time in recent American history that the single most important chip is being manufactured here in the United States by the most advanced fab, by TSMC, here in the United States,” Huang said at the event.

“This is the vision of President Trump of reindustrialization—to bring back manufacturing to America, to create jobs, of course, but also, this is the single most vital manufacturing industry and the most important technology industry in the world.”

The milestone was marked in a ceremony at the Arizona fab, where Huang joined TSMC executives to sign the first U.S.-produced Blackwell wafer—a symbolic gesture meant to highlight the reemergence of cutting-edge semiconductor production in the United States.

In his Fox News interview, Huang credited Trump’s tariffs and energy policies with speeding up the decision to manufacture advanced chips in the United States rather than keeping production overseas.

“This last week was a historic week,” he

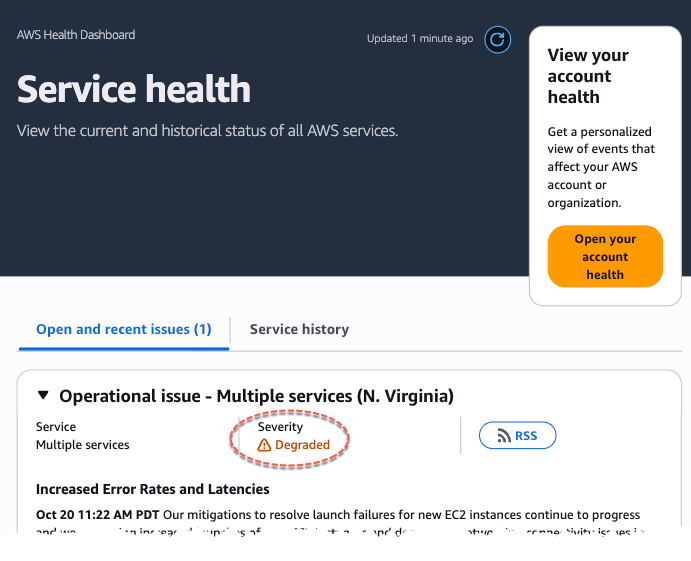

But forget the disruptions seen on Snapchat, Facebook, Fortnite, and many other websites today. We want to focus on the potential for delays in Amazon package deliveries.

For instance, several packages we ordered for the research desk early in the European session were just delayed, as we received this notification from Amazon via email:

"We’re encountering a delay in delivering your order. We'll send a confirmation as soon as it ships and communicate the expected delivery date. We know this delivery is important, and we apologize for the inconvenience."

But forget the disruptions seen on Snapchat, Facebook, Fortnite, and many other websites today. We want to focus on the potential for delays in Amazon package deliveries.

For instance, several packages we ordered for the research desk early in the European session were just delayed, as we received this notification from Amazon via email:

"We’re encountering a delay in delivering your order. We'll send a confirmation as soon as it ships and communicate the expected delivery date. We know this delivery is important, and we apologize for the inconvenience."

Next. We clicked on the "track package" button for each package, but a "Sorry, something went wrong on our end" page appeared.

Next. We clicked on the "track package" button for each package, but a "Sorry, something went wrong on our end" page appeared.

Now packages? Are all those warehouse robots running on AWS fine?

* * *

Update (0615ET):

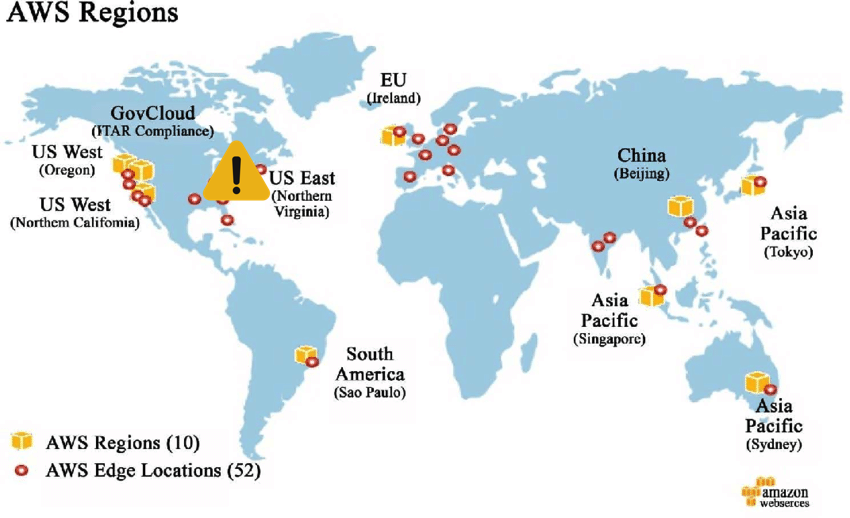

Amazon Web Services (AWS) has largely restored operations after a major disruption in its US-East-1 (Northern Virginia) region earlier this morning that affected numerous apps and websites relying on the service.

Root Cause Identified:

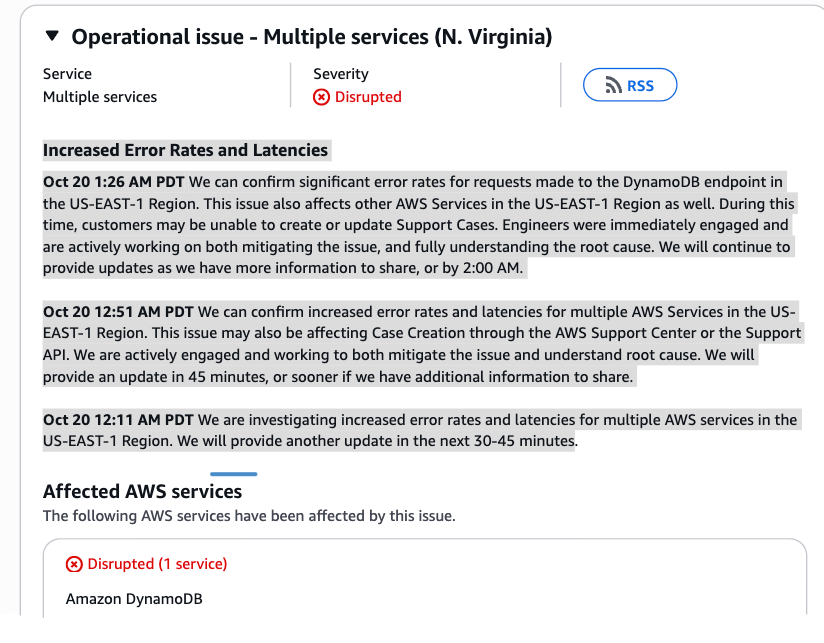

AWS engineers traced the issue to a DNS resolution problem affecting the DynamoDB API endpoint in the US-East-1 region. The failure also disrupted other AWS services and global features dependent on that region, including IAM updates and DynamoDB Global Tables.

Timeline of Recovery:

2:01 AM PDT: Engineers identified the DNS issue and began applying fixes.

2:22 AM PDT: Early signs of recovery appeared after initial mitigations, though many requests were still failing.

2:27 AM PDT: AWS reported significant progress, with most requests beginning to succeed.

3:03 AM PDT: AWS confirmed broad recovery across most affected services, including global systems relying on US-East-1, though teams continue working toward full resolution.

* * *

A massive internet outage is being reported at the start of the new workweek. The problem appears to be originating from Amazon Web Services (AWS), which provides infrastructure that powers much of the modern internet.

Now packages? Are all those warehouse robots running on AWS fine?

* * *

Update (0615ET):