Bubble In AI? Echoes Of The Past, Lessons For The Present

Bubble In AI? Echoes Of The Past, Lessons For The Present

Bubble In AI: Echoes Of The Past, Lessons For The Present - RIA

If you want to understand the engine under this market’s hood, follow the capital. A recent article by

📄.pdf

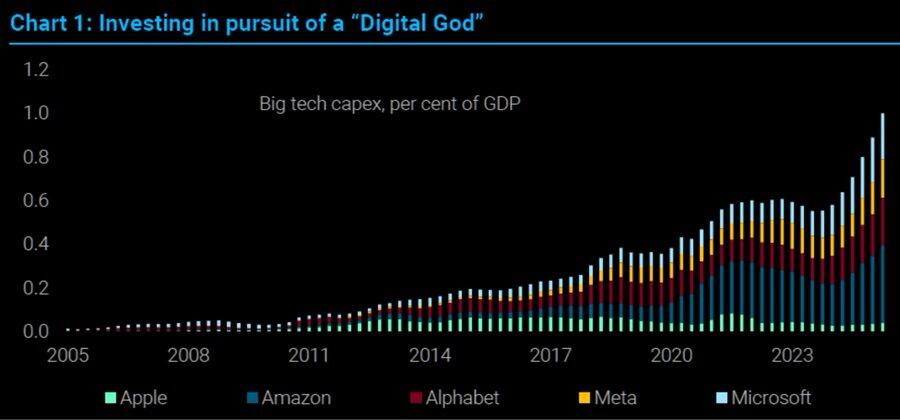

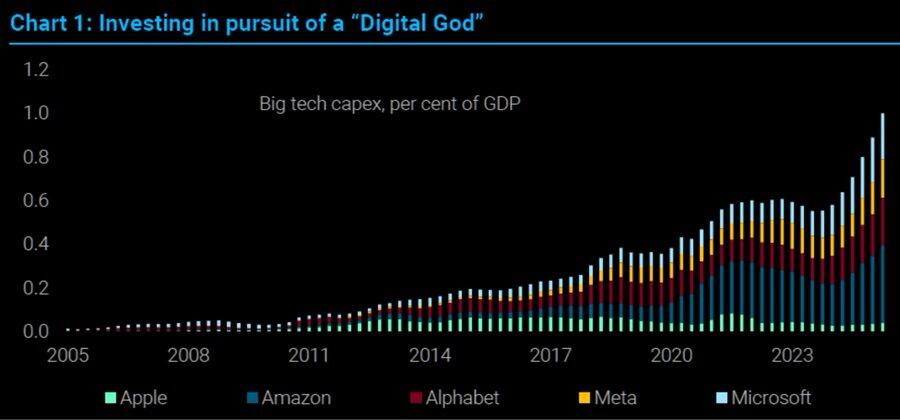

frames today’s AI boom as a “vendor-financing circle.” This circle occurs when capital raised by one set of companies (via stock, convertibles, or bonds) is recycled into other companies, and so on. In today’s market, that is where AI-related companies are raising capital to make massive AI capex investments, which become revenue for a handful of infrastructure suppliers (GPUs, networking, power, and data centers). Those reported revenues, in turn, help justify still more capital raises, higher valuations, and even bigger build-outs. It looks and feels like reflexivity in real time.

You can see the loop in the tape. With sequential growth powered by AI demand, Nvidia’s data-center cycle has produced staggering top-line figures: $30B for Q2 FY2025 and $46.7B for Q2 FY2026. Those dollars don’t appear out of thin air; they are funded by hyperscalers and “neoclouds” expanding footprints at breakneck speed.

Meanwhile, capital formation downstream has accelerated. Citigroup projects AI infrastructure outlays to reach roughly $490B by 2026 and $2.8T by 2029.

Oracle’s $18B bond sale, a jumbo deal, was explicitly tied to building AI cloud capacity for large customers. And OpenAI’s “Stargate” initiative targets a stunning $500B to deploy ~10 GW of compute across sites, with partners and suppliers intertwined through equity stakes, long-dated supply agreements, and chip-leasing constructs. When suppliers invest in customers who then pre-order supplier hardware, you’re not just seeing demand but circular demand.

For example, Oracle doesn’t have the money to pay for this spending surge, which is projected to last well into the 2030s (This also assumes that there is NO RECESSION between now and then). While vendor financing with cash from operations is one thing, vendor financing with cash from debt is something totally different. As Cembalest noted, we have now evolved into a “circular economy” of AI, where growth depends on a narrow group of companies. As he noted:

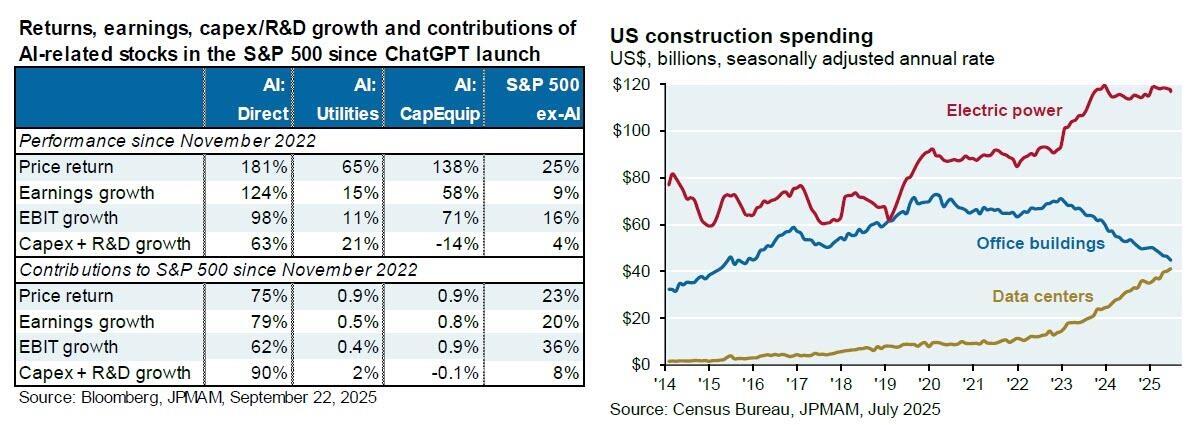

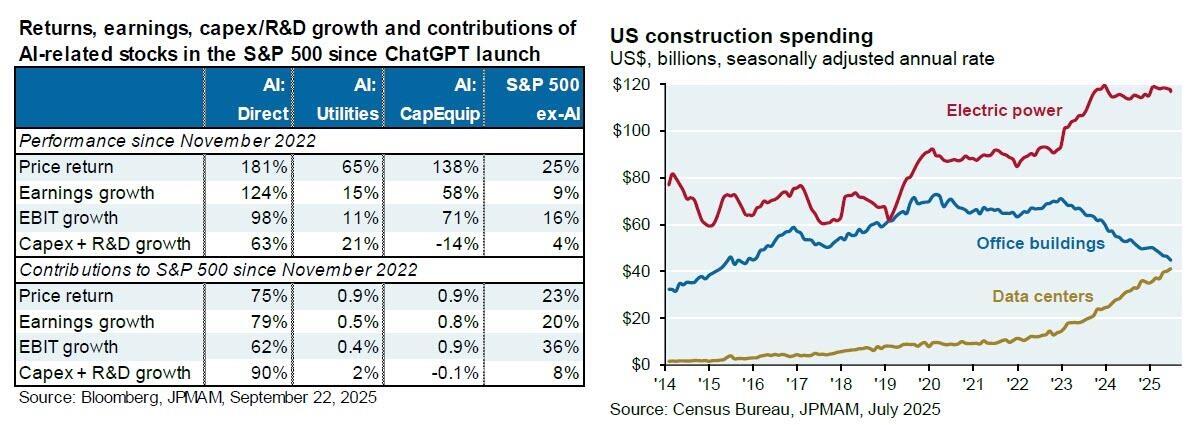

“I think this is well understood, but just to reinforce the point: AI related stocks (1) have accounted for 75% of S&P 500 returns, 80% of earnings growth and 90% of capital spending growth since ChatGPT launched in November 2022. AI is showing up other places as well. Data centers are eclipsing office construction spending and are coming under increased scrutiny for their impact on power grids and rising electricity prices.”

But here is his real eye-opening statement:

“Other recent AI news: Oracle’s stock jumped by 25% after being promised $60 billion a year from OpenAI, an amount of money OpenAI doesn’t earn yet, to provide cloud computing facilities that Oracle hasn’t built yet, and which will require 4.5 GW of power (the equivalent of 2.25 Hoover Dams or four nuclear plants), as well as increased borrowing by Oracle whose debt to equity ratio is already 500% compared to 50% for Amazon, 30% for Microsoft and even less at Meta and Google. In other words, the tech capital cycle may be about to change.”

This pattern has historical rhyme. During the late-1990s telecom boom, equipment makers extended aggressive credit (“vendor financing”) to carriers, effectively funding the purchase orders that produced the vendors’ reported revenues. By mid-2001, the Wall Street Journal tallied at least $25.6B of such loans across major vendors; for one cohort, that financing equaled 123% of combined pretax earnings in 1999. Vendors wrote down receivables when customers defaulted, and the virtuous loop snapped.

The takeaway isn’t that today’s AI spend is fake; the ecosystem itself reflexively finances some portion of revenue. While that completely supports the market while the “music plays,” it becomes problematic if cash returns lag capex for too long, power and supply constraints slow utilization, or financing windows narrow.

Is AI a bubble? Maybe.

The AI Bubble Today: Similarities and Differences from the Late ’90s

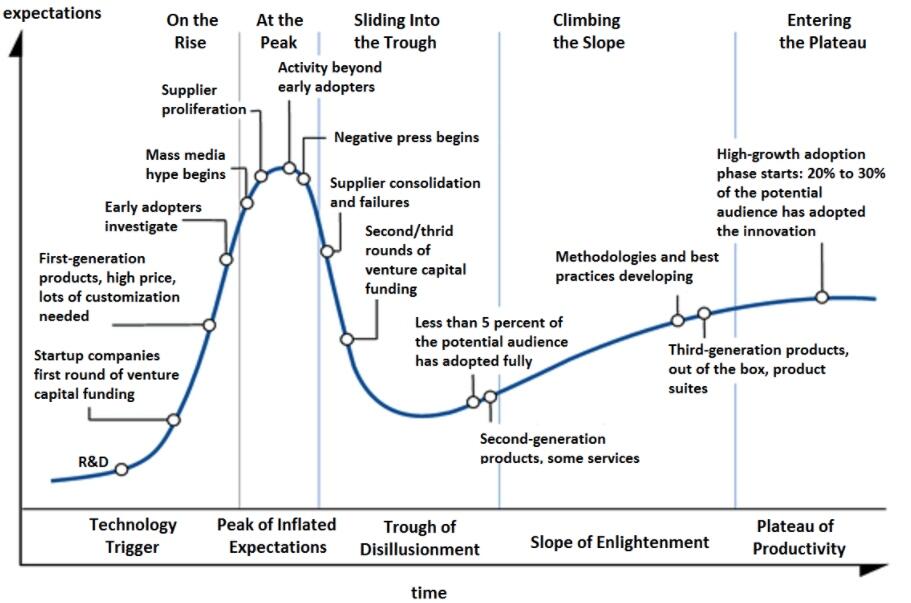

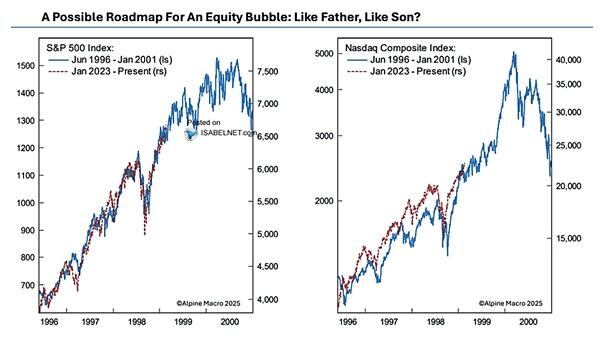

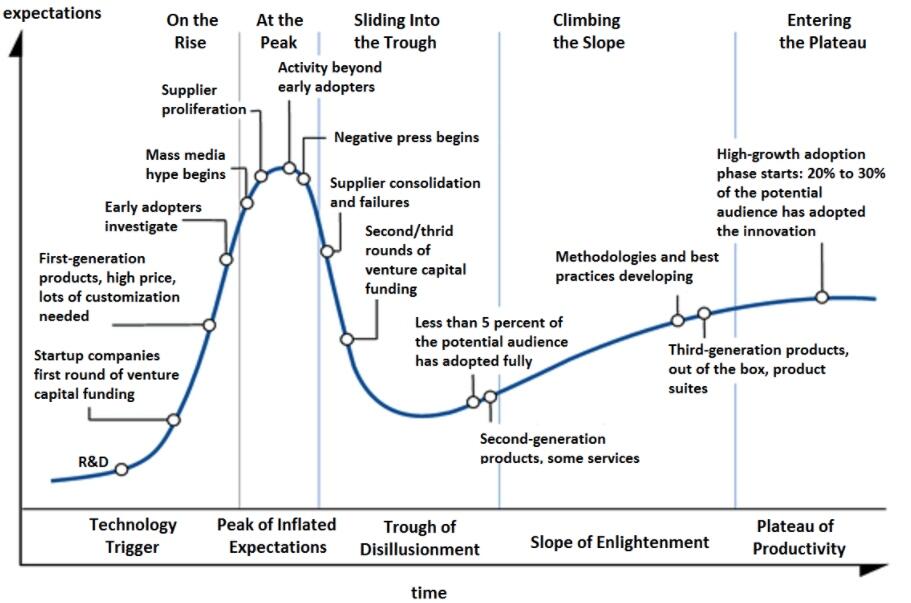

Every bubble has a story at its core. In 1999, that story was the internet: a transformational technology that would reshape commerce, communications, and culture. Investors saw the future, bid prices into the stratosphere, and assumed profits would inevitably follow. In 2025, the story is artificial intelligence, which carries the same irresistible promise of reshaping industries, creating productivity booms, and unlocking new frontiers. The parallels are hard to miss, along with the current price action.

Like the dot-com era, today’s market is being driven by breathtaking growth assumptions. Back then, Cisco traded north of 100x earnings on the belief it was selling the “backbone of the internet.” Pets.com and Webvan raised hundreds of millions, only to collapse when business models proved unsustainable. The psychology, then and now, is driven by the “fear of missing out.” Investors rush in because the narrative is too powerful to ignore: However, “if AI changes everything, you can’t afford not to own it.“

But while the similarities are striking, the differences are equally significant. Unlike the dot-com darlings of the 1990s, today’s AI leaders are not pre-revenue companies burning cash with no path to profitability. Nvidia generates tens of billions in quarterly revenue from its GPU dominance. Microsoft, Amazon, and Alphabet have deep operating businesses producing free cash flow to fund their AI bets. These are not speculative shell companies; they are some of history’s largest, most profitable corporations.

That distinction matters. In the late ’90s, investors piled capital into companies with no earnings or customers. Today, investors are bidding up firms with massive revenues, entrenched customer bases, and operating leverage. The risk, however, is that investors are again extrapolating linear revenue growth into the future without considering bottlenecks, power constraints, monetization limits, and slowing marginal returns on AI spend.

So while today’s AI ecosystem is more grounded than the dot-com startups of 1999, the underlying behavior is the same: valuations are being stretched on the assumption that a revolutionary technology will deliver exponential profits.

History reminds us that transformative technologies often succeed over decades, but the first wave of companies and their investors rarely capture the full promise implied in their stock prices.

Bubble Length and Eventual Endings

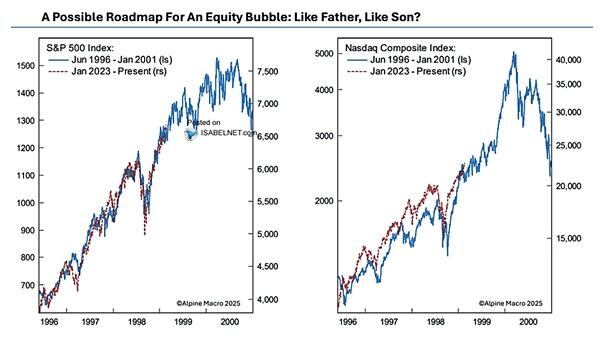

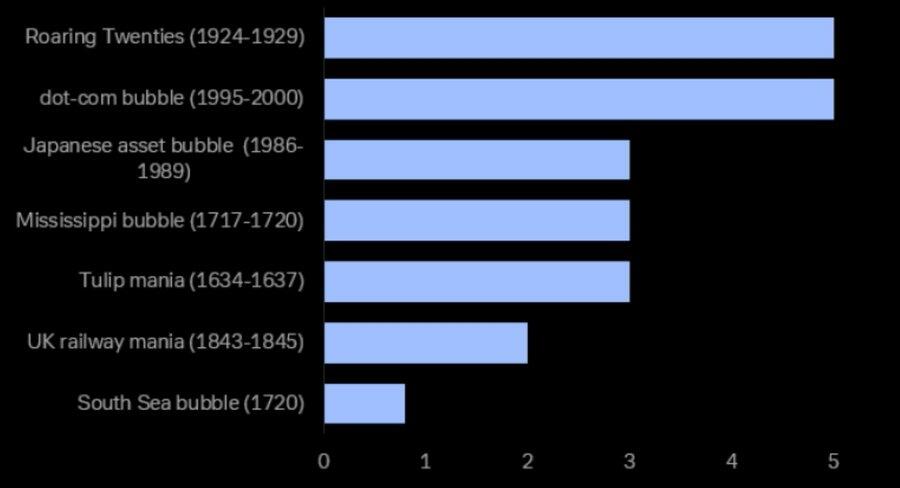

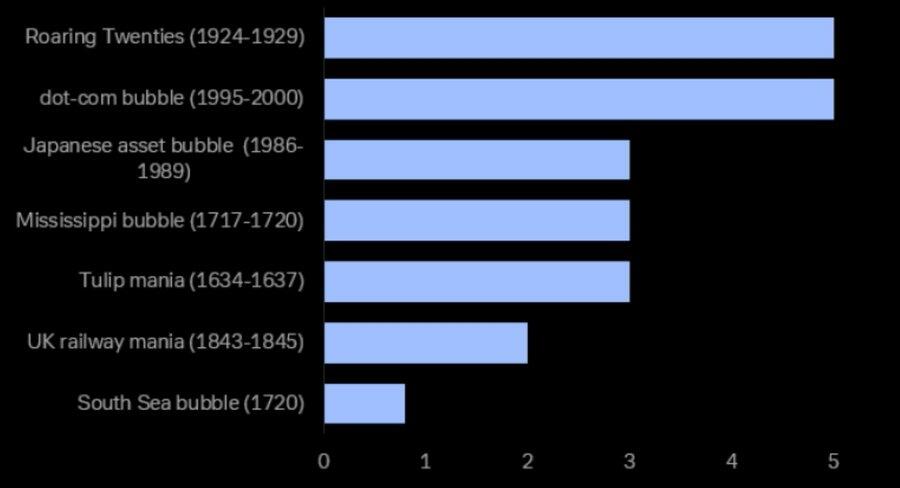

Timing is the cruel part. As shown above, is this Alan Greenspan’s “irrational exuberance” moment in December 1996? Or, are we much later in the cycle? Honestly, I have no idea. But in 1996, the Nasdaq peaked more than three years later, suggesting that amid the “inflation of a bubble,” inflation can last longer than seems logical. We see that through all previous bubbles in history.

The critical issue for investors, both then and now, was that many were “right” about the Dot.com bubble. However, they were so early in their warnings that they were wrong in their portfolios. The same warning applies currently. Is there a bubble in AI? Maybe. But, I would even suggest that it is pretty likely. As investors, we must realize that during the “inflation” phase of the bubble, there is a lot of money to be made, but the cycle will eventually end.

That’s why fighting parabolic moves can be so problematic. As Peter Lynch once stated:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in the corrections themselves.”

Read that again.

We are likely closer to a top than not, but that top could be months, quarters, or even one or two years away. That is why the better frame for investors to consider is “cycle math.” Focus on liquidity, policy, indexation, and corporate incentives, as they can extend manias far beyond fundamental comfort. However, eventually, those cycles begin to reverse, and what previously ended speculative bubbles begin to “rhyme.”

Financing tightens;

ROI disappoints;

Accounting adjustments reveal how much growth was pulled forward, not run-rate, and

Leadership concentration flips from strength to fragility as forced sellers meet illiquidity.

From 2000 to 2002, the telecom sector unwind delivered all of the above from defaults, receivable write-offs, and serial guidance cuts. Replace “fiber overbuild” with “compute and power overbuild,” and you have a credible left-tail scenario if demand monetization trails supply for too long. Ratings agencies and sell-side shops have noticed, flagging the leverage and power constraints embedded in the current build cycle, even as they acknowledge substantial real use cases.

Today, it is the same, but in a different form. As Roger McNamee recently wrote for The Guardian:

“Investors have assumed that every major US player in [large language models (“LLMs”)] will be a winner. This assumption is essential, as the monopolies that power big tech – such as Microsoft’s Office suite, Google Search, Gmail, and Docs, and Meta’s Facebook – are, without exception, approaching the end of their useful lives. The vast majority of customers believe that these products have gotten worse – and made users less productive – over the past decade or more. Each big tech company needs a global monopoly in AI to sustain their success and market value. They are not all going to get one.

The former General Electric CEO Jack Welch made famous the notion that only two players can be profitable in a competitive industry. Below the top two, it is a struggle to survive. That means that at least three, and perhaps more, of the current players will be forced to write off their investments in LLMs. Each of the big tech companies has invested in the range of $100bn through this year, and by next year that number could easily double. If LLM technology does not improve rapidly, their corporate customers will also face write-offs.

The day may come sooner than many expect when shareholders, directors and executives will demand evidence that the massive investment in LLM technology will generate an adequate return for them. The answer will be no for many, if not most, players, and the reckoning will [be] ugly for everyone.“

Such reminds me of Charles Kindleberger’s old line:

“If something cannot go on forever, it will stop.”

Critically, I am not suggesting that the AI bubble is about to burst tomorrow. We have many of those particular stocks in our portfolios, from Google to Meta to Nvidia and others. Furthermore, my discussion here is not intended to be a timing tool but rather a budgeting tool. Don’t expect the current market to underwrite infinite carry from a finite financing window. That mindset kept investors alive in 1999–2002 and again in 2007–2009. It applies again in 2025.

📒 Portfolio Tactics – Navigating A Market Bubble

Let me conclude by stating that my intention is not to dunk on innovation; it’s to manage risk amid it. The practical playbook in bubbles is more carpentry than heroics.

First, separate plumbing from promises. Infrastructure winners can post extraordinary revenue growth if the financing loop remains open. That’s tradable momentum but not the same as durable, end-customer ROI. In your underwriting, prioritize evidence of cash demand (contracted workloads with measurable payback) over capital demand (pre-buys and option-like contracts funded by equity or fresh debt). Until the monetization bridge is built, capex dependence is a risk factor, not a moat.

Second, let prices do the heavy lifting. When leadership is this extended, mean-reversion is a feature, not a bug. Use predefined rebalancing bands to trim exposure into vertical rallies and add on resets to rising 50/100-DMAs instead of chasing exhaustion gaps. That keeps you involved (because bubbles can run) while turning volatility into a source of discipline rather than damage.

Third, demand balance-sheet realism. In the late ’90s, vendor financing and receivables quality were the tell. Watch interest coverage after new bond deals, capex as a share of operating cash flow, and disclosure around take-or-pay or utilization guarantees. If the ecosystem is cross-subsidizing itself (supplier invests in the customer who pre-orders the supplier’s gear), discount the apparent “visibility.” The more circular the revenue, the more fragile the flywheel when financing costs rise. Recent deals around Stargate and supplier co-investments are a case in point.

Fourth, think in barbells and play defense in the middle. On one end, maintain a measured exposure to proven cash generators that genuinely benefit from AI (unit-level margins, network effects, or distribution that converts AI into pricing power). On the other hand, hold high-quality ballast, short-duration Treasuries, or cash equivalents, to fund drawdowns and keep optionality. In between, be choosy with capital-intensive stories where the cash-in date sits far beyond the cash-out date. As the Dallas Fed and Goldman work suggests, productivity gains likely build over years—not quarters—so leave yourself time.

Finally, accept that you won’t nail the top. That’s okay. Successful navigation is less about calling a date and more about insisting on process: valuation awareness, position sizing, staged entries/exits, and the humility to let price action confirm your thesis. Bubbles end the same way, financing tightens, a few high-profile misses flip psychology, and cash becomes king. Have some.

Trade accordingly.

Tyler Durden | Zero Hedge

Zero Hedge

Tue, 10/07/2025 - 07:20

Bubble In AI? Echoes Of The Past, Lessons For The Present | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

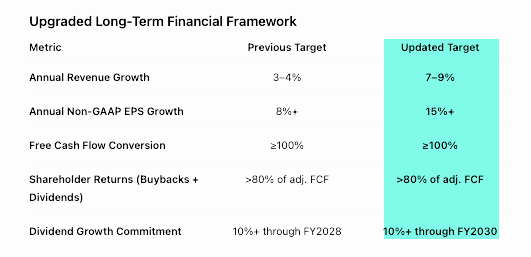

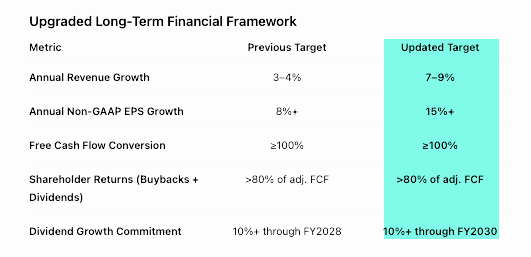

Ahead of the Securities Analyst Meeting that begins around 0930 ET, COO Jeff Clarke told

Ahead of the Securities Analyst Meeting that begins around 0930 ET, COO Jeff Clarke told  , "We were all wrong how big we thought the AI market was two years ago, and it's nothing but bigger." This growth is fueled by orders from CoreWeave, Elon Musk's xAI, the U.S. Energy Department, and Abu Dhabi's G42.

Here's more commentary from Dell leadership ahead of the analyst meeting:

CEO Michael Dell: "Customers are hungry for AI and the compute, storage, and networking we provide to deploy intelligence at scale. The opportunity ahead is massive."

COO Jeff Clarke: "We're actively shaping the future of AI infrastructure — growing AI into a $20 billion business in two years."

CFO David Kennedy: "With our increased EPS target, we expect to double EPS again."

Shares of Dell in New York in premarket trading jumped 6% on the press release from the company detailing what executives were planning to unveil at the upcoming analyst meeting. Shares are up 26.5% on the year (as of Monday's close).

, "We were all wrong how big we thought the AI market was two years ago, and it's nothing but bigger." This growth is fueled by orders from CoreWeave, Elon Musk's xAI, the U.S. Energy Department, and Abu Dhabi's G42.

Here's more commentary from Dell leadership ahead of the analyst meeting:

CEO Michael Dell: "Customers are hungry for AI and the compute, storage, and networking we provide to deploy intelligence at scale. The opportunity ahead is massive."

COO Jeff Clarke: "We're actively shaping the future of AI infrastructure — growing AI into a $20 billion business in two years."

CFO David Kennedy: "With our increased EPS target, we expect to double EPS again."

Shares of Dell in New York in premarket trading jumped 6% on the press release from the company detailing what executives were planning to unveil at the upcoming analyst meeting. Shares are up 26.5% on the year (as of Monday's close).

News from Dell adds to the positive news flow that has sent the Philadelphia Stock Exchange Semiconductor to record highs.

News from Dell adds to the positive news flow that has sent the Philadelphia Stock Exchange Semiconductor to record highs.

Yesterday's news:

Endless positive news flow generated by:

. . .

Tue, 10/07/2025 - 09:40

Yesterday's news:

Endless positive news flow generated by:

. . .

Tue, 10/07/2025 - 09:40

Ahead of the Securities Analyst Meeting that begins around 0930 ET, COO Jeff Clarke told

Ahead of the Securities Analyst Meeting that begins around 0930 ET, COO Jeff Clarke told

News from Dell adds to the positive news flow that has sent the Philadelphia Stock Exchange Semiconductor to record highs.

News from Dell adds to the positive news flow that has sent the Philadelphia Stock Exchange Semiconductor to record highs.

Yesterday's news:

Yesterday's news:

Transportation Secretary Sean Duffy said air-traffic control towers were contending with mounting absenteeism since the shutdown began Oct. 1, forcing the Federal Aviation Administration to slow operations at times to maintain safety. While roughly 13,000 controllers are classified as essential and continue working, there is no assurance they will be paid on time, he said. About 50,000 Transportation Security Administration officers are also required to report to work; their next paycheck is due Oct. 14.

Transportation Secretary Sean Duffy said air-traffic control towers were contending with mounting absenteeism since the shutdown began Oct. 1, forcing the Federal Aviation Administration to slow operations at times to maintain safety. While roughly 13,000 controllers are classified as essential and continue working, there is no assurance they will be paid on time, he said. About 50,000 Transportation Security Administration officers are also required to report to work; their next paycheck is due Oct. 14.

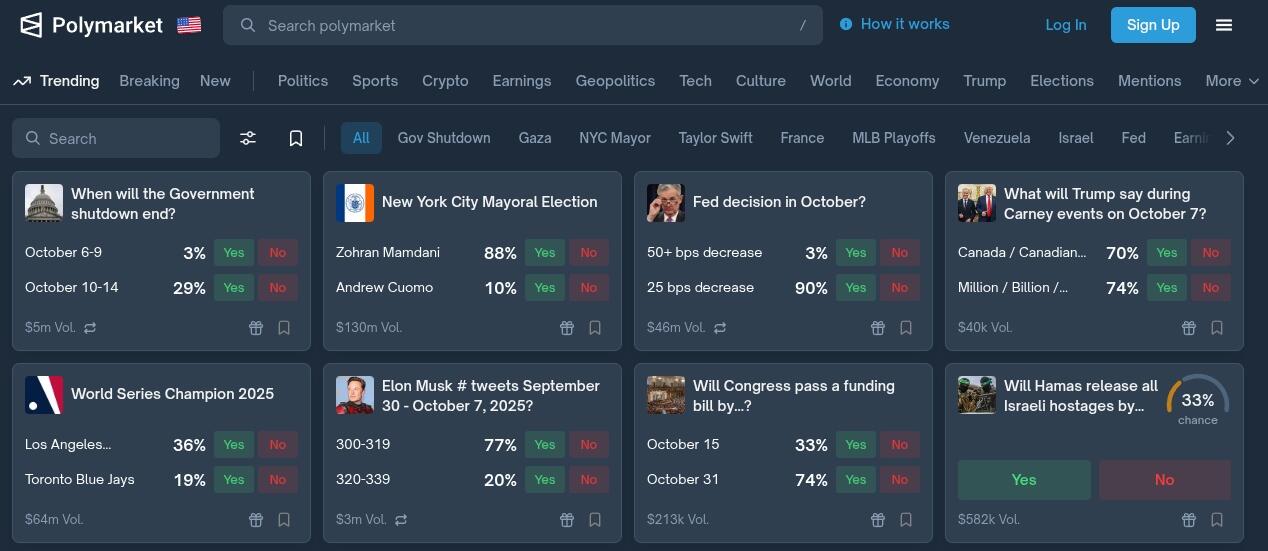

According to a Tuesday Polymarket X

According to a Tuesday Polymarket X

Polymarket’s homepage. Source: Polymarket

Polymarket’s homepage. Source: Polymarket

On Monday, as the political turmoil unfolded, UBS analyst Matthew Cowley provided clients with three possible pathways for Macron:

"President Macron faces three scenarios: appointing a new PM, dissolving parliament for legislative elections, or even calling an early presidential election—though the latter remains unlikely."

Bloomberg Economics analysts Antonio Barroso and Jean Dalbard wrote that if Lecornu fails to broker a deal, Macron will be forced to either appoint a new prime minister or call elections. This scenario could result in Marine Le Pen's National Rally:

"If Lecornu fails, Macron will have to appoint a new premier or call early elections — potentially giving the far- right National Rally its best shot at power."

Cowley told clients early about the urgency for Lecornu to reach a budget deal amid Macron's mounting negative sentiment nationwide:

France's President Macron has given Sebastién Lecornu, the future ex-prime-minister, until Wednesday to try to forge a budget agreement with parties in parliament. That seems extremely unlikely to succeed. Macron, who had appointed Lecornu at least in part to deflect public ire over the political impasse away from him, is now back in the eye of the storm. His own party seems increasingly to be distancing itself from the party's founder as Macron's popularity plunges. To be sure, not everything in France is Macron's fault, and yet as president, he's the lightning rod. That doesn't mean he will resign – very unpopular presidents have remained in office and seen out their term. It does raise the likelihood of fresh parliamentary elections, but those are unlikely to solve anything. It's going to be a slow grind for French politics to get out of this rut. On a practical level, there will be no shutdown as, for the most part, the 2025 budget will roll over into 2026.

Cowley continued:

A new poll shows French people blame the entire political system for the country's political crisis, and that in turn suggests fresh elections are unlikely to solve very much as the parliament would probably be just as divided as it is now. According to a poll by Elabe for BMFTV, three out of four people queried said Sébastien Lecornu, was right to have resigned as prime minister given the deadlock, and the same number blamed all political parties for not seeking compromise. Almost half of French people (47%) blame France's President Macron for the political crisis, and 51% believe his resignation would help solve the political impasse. Slightly fewer – 42%– believe general elections for parliament would be the way out. The poll asked which coalition they would support in the event of elections : 28% said they would support the right/far right, 22% the left or far left and 12% would support the centrists. In a boost for the far right, 53% of French people said they would oppose the « replublican front » strategy where centrsits and leftists united to keep them out of power in previous elections.

National Assembly turmoil has already toppled two previous premiers, including Michel Barnier and François Bayrou, over budget disputes. It now threatens to derail a budget agreement ahead of next Monday's deadline. This means the government risks needing emergency measures to avoid a January shutdown. Bond markets are reacting: France's 10-year yield premium over Germany widened to 85 basis points, the highest since the start of the year.

Here is EU equity market commentary via UBS analyst Joe Dickinson:

EuroStoxx is unchanged to start Tuesday. Developments in Europe overnight saw President Macron giving outgoing PM Lecornu 48 hours to negotiate with France's parties in a last-ditch effort to stem the country's political crisis - market expectations for progress remain low.

Lecornu wrote on X, "At the request of the President of the Republic, I have agreed to hold final discussions with the political forces for the sake of the country's stability," adding, "I will tell the Head of State on Wednesday evening whether this is possible or not, so that he can draw all the necessary conclusions."

J’ai accepté à la demande du Président de la République de mener d’ultimes discussions avec les forces politiques pour la stabilité du pays.

Je dirai au chef de l’Etat mercredi soir si cela est possible ou non, pour qu’il puisse en tirer toutes les conclusions qui s’imposent.

— Sébastien Lecornu (@SebLecornu)

On Monday, as the political turmoil unfolded, UBS analyst Matthew Cowley provided clients with three possible pathways for Macron:

"President Macron faces three scenarios: appointing a new PM, dissolving parliament for legislative elections, or even calling an early presidential election—though the latter remains unlikely."

Bloomberg Economics analysts Antonio Barroso and Jean Dalbard wrote that if Lecornu fails to broker a deal, Macron will be forced to either appoint a new prime minister or call elections. This scenario could result in Marine Le Pen's National Rally:

"If Lecornu fails, Macron will have to appoint a new premier or call early elections — potentially giving the far- right National Rally its best shot at power."

Cowley told clients early about the urgency for Lecornu to reach a budget deal amid Macron's mounting negative sentiment nationwide:

France's President Macron has given Sebastién Lecornu, the future ex-prime-minister, until Wednesday to try to forge a budget agreement with parties in parliament. That seems extremely unlikely to succeed. Macron, who had appointed Lecornu at least in part to deflect public ire over the political impasse away from him, is now back in the eye of the storm. His own party seems increasingly to be distancing itself from the party's founder as Macron's popularity plunges. To be sure, not everything in France is Macron's fault, and yet as president, he's the lightning rod. That doesn't mean he will resign – very unpopular presidents have remained in office and seen out their term. It does raise the likelihood of fresh parliamentary elections, but those are unlikely to solve anything. It's going to be a slow grind for French politics to get out of this rut. On a practical level, there will be no shutdown as, for the most part, the 2025 budget will roll over into 2026.

Cowley continued:

A new poll shows French people blame the entire political system for the country's political crisis, and that in turn suggests fresh elections are unlikely to solve very much as the parliament would probably be just as divided as it is now. According to a poll by Elabe for BMFTV, three out of four people queried said Sébastien Lecornu, was right to have resigned as prime minister given the deadlock, and the same number blamed all political parties for not seeking compromise. Almost half of French people (47%) blame France's President Macron for the political crisis, and 51% believe his resignation would help solve the political impasse. Slightly fewer – 42%– believe general elections for parliament would be the way out. The poll asked which coalition they would support in the event of elections : 28% said they would support the right/far right, 22% the left or far left and 12% would support the centrists. In a boost for the far right, 53% of French people said they would oppose the « replublican front » strategy where centrsits and leftists united to keep them out of power in previous elections.

National Assembly turmoil has already toppled two previous premiers, including Michel Barnier and François Bayrou, over budget disputes. It now threatens to derail a budget agreement ahead of next Monday's deadline. This means the government risks needing emergency measures to avoid a January shutdown. Bond markets are reacting: France's 10-year yield premium over Germany widened to 85 basis points, the highest since the start of the year.

Here is EU equity market commentary via UBS analyst Joe Dickinson:

EuroStoxx is unchanged to start Tuesday. Developments in Europe overnight saw President Macron giving outgoing PM Lecornu 48 hours to negotiate with France's parties in a last-ditch effort to stem the country's political crisis - market expectations for progress remain low.

Lecornu wrote on X, "At the request of the President of the Republic, I have agreed to hold final discussions with the political forces for the sake of the country's stability," adding, "I will tell the Head of State on Wednesday evening whether this is possible or not, so that he can draw all the necessary conclusions."

J’ai accepté à la demande du Président de la République de mener d’ultimes discussions avec les forces politiques pour la stabilité du pays.

Je dirai au chef de l’Etat mercredi soir si cela est possible ou non, pour qu’il puisse en tirer toutes les conclusions qui s’imposent.

— Sébastien Lecornu (@SebLecornu)

Oracle’s $18B bond sale, a jumbo deal, was explicitly tied to building AI cloud capacity for large customers. And OpenAI’s “Stargate” initiative targets a stunning $500B to deploy ~10 GW of compute across sites, with partners and suppliers intertwined through equity stakes, long-dated supply agreements, and chip-leasing constructs. When suppliers invest in customers who then pre-order supplier hardware, you’re not just seeing demand but circular demand.

For example, Oracle doesn’t have the money to pay for this spending surge, which is projected to last well into the 2030s (This also assumes that there is NO RECESSION between now and then). While vendor financing with cash from operations is one thing, vendor financing with cash from debt is something totally different. As Cembalest noted, we have now evolved into a “circular economy” of AI, where growth depends on a narrow group of companies. As he noted:

“I think this is well understood, but just to reinforce the point: AI related stocks (1) have accounted for 75% of S&P 500 returns, 80% of earnings growth and 90% of capital spending growth since ChatGPT launched in November 2022. AI is showing up other places as well. Data centers are eclipsing office construction spending and are coming under increased scrutiny for their impact on power grids and rising electricity prices.”

Oracle’s $18B bond sale, a jumbo deal, was explicitly tied to building AI cloud capacity for large customers. And OpenAI’s “Stargate” initiative targets a stunning $500B to deploy ~10 GW of compute across sites, with partners and suppliers intertwined through equity stakes, long-dated supply agreements, and chip-leasing constructs. When suppliers invest in customers who then pre-order supplier hardware, you’re not just seeing demand but circular demand.

For example, Oracle doesn’t have the money to pay for this spending surge, which is projected to last well into the 2030s (This also assumes that there is NO RECESSION between now and then). While vendor financing with cash from operations is one thing, vendor financing with cash from debt is something totally different. As Cembalest noted, we have now evolved into a “circular economy” of AI, where growth depends on a narrow group of companies. As he noted:

“I think this is well understood, but just to reinforce the point: AI related stocks (1) have accounted for 75% of S&P 500 returns, 80% of earnings growth and 90% of capital spending growth since ChatGPT launched in November 2022. AI is showing up other places as well. Data centers are eclipsing office construction spending and are coming under increased scrutiny for their impact on power grids and rising electricity prices.”

But here is his real eye-opening statement:

“Other recent AI news: Oracle’s stock jumped by 25% after being promised $60 billion a year from OpenAI, an amount of money OpenAI doesn’t earn yet, to provide cloud computing facilities that Oracle hasn’t built yet, and which will require 4.5 GW of power (the equivalent of 2.25 Hoover Dams or four nuclear plants), as well as increased borrowing by Oracle whose debt to equity ratio is already 500% compared to 50% for Amazon, 30% for Microsoft and even less at Meta and Google. In other words, the tech capital cycle may be about to change.”

This pattern has historical rhyme. During the late-1990s telecom boom, equipment makers extended aggressive credit (“vendor financing”) to carriers, effectively funding the purchase orders that produced the vendors’ reported revenues. By mid-2001, the Wall Street Journal tallied at least $25.6B of such loans across major vendors; for one cohort, that financing equaled 123% of combined pretax earnings in 1999. Vendors wrote down receivables when customers defaulted, and the virtuous loop snapped.

The takeaway isn’t that today’s AI spend is fake; the ecosystem itself reflexively finances some portion of revenue. While that completely supports the market while the “music plays,” it becomes problematic if cash returns lag capex for too long, power and supply constraints slow utilization, or financing windows narrow.

Is AI a bubble? Maybe.

The AI Bubble Today: Similarities and Differences from the Late ’90s

Every bubble has a story at its core. In 1999, that story was the internet: a transformational technology that would reshape commerce, communications, and culture. Investors saw the future, bid prices into the stratosphere, and assumed profits would inevitably follow. In 2025, the story is artificial intelligence, which carries the same irresistible promise of reshaping industries, creating productivity booms, and unlocking new frontiers. The parallels are hard to miss, along with the current price action.

But here is his real eye-opening statement:

“Other recent AI news: Oracle’s stock jumped by 25% after being promised $60 billion a year from OpenAI, an amount of money OpenAI doesn’t earn yet, to provide cloud computing facilities that Oracle hasn’t built yet, and which will require 4.5 GW of power (the equivalent of 2.25 Hoover Dams or four nuclear plants), as well as increased borrowing by Oracle whose debt to equity ratio is already 500% compared to 50% for Amazon, 30% for Microsoft and even less at Meta and Google. In other words, the tech capital cycle may be about to change.”

This pattern has historical rhyme. During the late-1990s telecom boom, equipment makers extended aggressive credit (“vendor financing”) to carriers, effectively funding the purchase orders that produced the vendors’ reported revenues. By mid-2001, the Wall Street Journal tallied at least $25.6B of such loans across major vendors; for one cohort, that financing equaled 123% of combined pretax earnings in 1999. Vendors wrote down receivables when customers defaulted, and the virtuous loop snapped.

The takeaway isn’t that today’s AI spend is fake; the ecosystem itself reflexively finances some portion of revenue. While that completely supports the market while the “music plays,” it becomes problematic if cash returns lag capex for too long, power and supply constraints slow utilization, or financing windows narrow.

Is AI a bubble? Maybe.

The AI Bubble Today: Similarities and Differences from the Late ’90s

Every bubble has a story at its core. In 1999, that story was the internet: a transformational technology that would reshape commerce, communications, and culture. Investors saw the future, bid prices into the stratosphere, and assumed profits would inevitably follow. In 2025, the story is artificial intelligence, which carries the same irresistible promise of reshaping industries, creating productivity booms, and unlocking new frontiers. The parallels are hard to miss, along with the current price action.

Like the dot-com era, today’s market is being driven by breathtaking growth assumptions. Back then, Cisco traded north of 100x earnings on the belief it was selling the “backbone of the internet.” Pets.com and Webvan raised hundreds of millions, only to collapse when business models proved unsustainable. The psychology, then and now, is driven by the “fear of missing out.” Investors rush in because the narrative is too powerful to ignore: However, “if AI changes everything, you can’t afford not to own it.“

But while the similarities are striking, the differences are equally significant. Unlike the dot-com darlings of the 1990s, today’s AI leaders are not pre-revenue companies burning cash with no path to profitability. Nvidia generates tens of billions in quarterly revenue from its GPU dominance. Microsoft, Amazon, and Alphabet have deep operating businesses producing free cash flow to fund their AI bets. These are not speculative shell companies; they are some of history’s largest, most profitable corporations.

That distinction matters. In the late ’90s, investors piled capital into companies with no earnings or customers. Today, investors are bidding up firms with massive revenues, entrenched customer bases, and operating leverage. The risk, however, is that investors are again extrapolating linear revenue growth into the future without considering bottlenecks, power constraints, monetization limits, and slowing marginal returns on AI spend.

So while today’s AI ecosystem is more grounded than the dot-com startups of 1999, the underlying behavior is the same: valuations are being stretched on the assumption that a revolutionary technology will deliver exponential profits.

Like the dot-com era, today’s market is being driven by breathtaking growth assumptions. Back then, Cisco traded north of 100x earnings on the belief it was selling the “backbone of the internet.” Pets.com and Webvan raised hundreds of millions, only to collapse when business models proved unsustainable. The psychology, then and now, is driven by the “fear of missing out.” Investors rush in because the narrative is too powerful to ignore: However, “if AI changes everything, you can’t afford not to own it.“

But while the similarities are striking, the differences are equally significant. Unlike the dot-com darlings of the 1990s, today’s AI leaders are not pre-revenue companies burning cash with no path to profitability. Nvidia generates tens of billions in quarterly revenue from its GPU dominance. Microsoft, Amazon, and Alphabet have deep operating businesses producing free cash flow to fund their AI bets. These are not speculative shell companies; they are some of history’s largest, most profitable corporations.

That distinction matters. In the late ’90s, investors piled capital into companies with no earnings or customers. Today, investors are bidding up firms with massive revenues, entrenched customer bases, and operating leverage. The risk, however, is that investors are again extrapolating linear revenue growth into the future without considering bottlenecks, power constraints, monetization limits, and slowing marginal returns on AI spend.

So while today’s AI ecosystem is more grounded than the dot-com startups of 1999, the underlying behavior is the same: valuations are being stretched on the assumption that a revolutionary technology will deliver exponential profits.

History reminds us that transformative technologies often succeed over decades, but the first wave of companies and their investors rarely capture the full promise implied in their stock prices.

Bubble Length and Eventual Endings

Timing is the cruel part. As shown above, is this Alan Greenspan’s “irrational exuberance” moment in December 1996? Or, are we much later in the cycle? Honestly, I have no idea. But in 1996, the Nasdaq peaked more than three years later, suggesting that amid the “inflation of a bubble,” inflation can last longer than seems logical. We see that through all previous bubbles in history.

History reminds us that transformative technologies often succeed over decades, but the first wave of companies and their investors rarely capture the full promise implied in their stock prices.

Bubble Length and Eventual Endings

Timing is the cruel part. As shown above, is this Alan Greenspan’s “irrational exuberance” moment in December 1996? Or, are we much later in the cycle? Honestly, I have no idea. But in 1996, the Nasdaq peaked more than three years later, suggesting that amid the “inflation of a bubble,” inflation can last longer than seems logical. We see that through all previous bubbles in history.

The critical issue for investors, both then and now, was that many were “right” about the Dot.com bubble. However, they were so early in their warnings that they were wrong in their portfolios. The same warning applies currently. Is there a bubble in AI? Maybe. But, I would even suggest that it is pretty likely. As investors, we must realize that during the “inflation” phase of the bubble, there is a lot of money to be made, but the cycle will eventually end.

The critical issue for investors, both then and now, was that many were “right” about the Dot.com bubble. However, they were so early in their warnings that they were wrong in their portfolios. The same warning applies currently. Is there a bubble in AI? Maybe. But, I would even suggest that it is pretty likely. As investors, we must realize that during the “inflation” phase of the bubble, there is a lot of money to be made, but the cycle will eventually end.

That’s why fighting parabolic moves can be so problematic. As Peter Lynch once stated:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in the corrections themselves.”

Read that again.

We are likely closer to a top than not, but that top could be months, quarters, or even one or two years away. That is why the better frame for investors to consider is “cycle math.” Focus on liquidity, policy, indexation, and corporate incentives, as they can extend manias far beyond fundamental comfort. However, eventually, those cycles begin to reverse, and what previously ended speculative bubbles begin to “rhyme.”

Financing tightens;

ROI disappoints;

Accounting adjustments reveal how much growth was pulled forward, not run-rate, and

Leadership concentration flips from strength to fragility as forced sellers meet illiquidity.

From 2000 to 2002, the telecom sector unwind delivered all of the above from defaults, receivable write-offs, and serial guidance cuts. Replace “fiber overbuild” with “compute and power overbuild,” and you have a credible left-tail scenario if demand monetization trails supply for too long. Ratings agencies and sell-side shops have noticed, flagging the leverage and power constraints embedded in the current build cycle, even as they acknowledge substantial real use cases.

Today, it is the same, but in a different form. As Roger McNamee recently wrote for The Guardian:

“Investors have assumed that every major US player in [large language models (“LLMs”)] will be a winner. This assumption is essential, as the monopolies that power big tech – such as Microsoft’s Office suite, Google Search, Gmail, and Docs, and Meta’s Facebook – are, without exception, approaching the end of their useful lives. The vast majority of customers believe that these products have gotten worse – and made users less productive – over the past decade or more. Each big tech company needs a global monopoly in AI to sustain their success and market value. They are not all going to get one.

The former General Electric CEO Jack Welch made famous the notion that only two players can be profitable in a competitive industry. Below the top two, it is a struggle to survive. That means that at least three, and perhaps more, of the current players will be forced to write off their investments in LLMs. Each of the big tech companies has invested in the range of $100bn through this year, and by next year that number could easily double. If LLM technology does not improve rapidly, their corporate customers will also face write-offs.

The day may come sooner than many expect when shareholders, directors and executives will demand evidence that the massive investment in LLM technology will generate an adequate return for them. The answer will be no for many, if not most, players, and the reckoning will [be] ugly for everyone.“

Such reminds me of Charles Kindleberger’s old line:

“If something cannot go on forever, it will stop.”

Critically, I am not suggesting that the AI bubble is about to burst tomorrow. We have many of those particular stocks in our portfolios, from Google to Meta to Nvidia and others. Furthermore, my discussion here is not intended to be a timing tool but rather a budgeting tool. Don’t expect the current market to underwrite infinite carry from a finite financing window. That mindset kept investors alive in 1999–2002 and again in 2007–2009. It applies again in 2025.

📒 Portfolio Tactics – Navigating A Market Bubble

Let me conclude by stating that my intention is not to dunk on innovation; it’s to manage risk amid it. The practical playbook in bubbles is more carpentry than heroics.

First, separate plumbing from promises. Infrastructure winners can post extraordinary revenue growth if the financing loop remains open. That’s tradable momentum but not the same as durable, end-customer ROI. In your underwriting, prioritize evidence of cash demand (contracted workloads with measurable payback) over capital demand (pre-buys and option-like contracts funded by equity or fresh debt). Until the monetization bridge is built, capex dependence is a risk factor, not a moat.

Second, let prices do the heavy lifting. When leadership is this extended, mean-reversion is a feature, not a bug. Use predefined rebalancing bands to trim exposure into vertical rallies and add on resets to rising 50/100-DMAs instead of chasing exhaustion gaps. That keeps you involved (because bubbles can run) while turning volatility into a source of discipline rather than damage.

Third, demand balance-sheet realism. In the late ’90s, vendor financing and receivables quality were the tell. Watch interest coverage after new bond deals, capex as a share of operating cash flow, and disclosure around take-or-pay or utilization guarantees. If the ecosystem is cross-subsidizing itself (supplier invests in the customer who pre-orders the supplier’s gear), discount the apparent “visibility.” The more circular the revenue, the more fragile the flywheel when financing costs rise. Recent deals around Stargate and supplier co-investments are a case in point.

Fourth, think in barbells and play defense in the middle. On one end, maintain a measured exposure to proven cash generators that genuinely benefit from AI (unit-level margins, network effects, or distribution that converts AI into pricing power). On the other hand, hold high-quality ballast, short-duration Treasuries, or cash equivalents, to fund drawdowns and keep optionality. In between, be choosy with capital-intensive stories where the cash-in date sits far beyond the cash-out date. As the Dallas Fed and Goldman work suggests, productivity gains likely build over years—not quarters—so leave yourself time.

Finally, accept that you won’t nail the top. That’s okay. Successful navigation is less about calling a date and more about insisting on process: valuation awareness, position sizing, staged entries/exits, and the humility to let price action confirm your thesis. Bubbles end the same way, financing tightens, a few high-profile misses flip psychology, and cash becomes king. Have some.

Trade accordingly.

That’s why fighting parabolic moves can be so problematic. As Peter Lynch once stated:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in the corrections themselves.”

Read that again.

We are likely closer to a top than not, but that top could be months, quarters, or even one or two years away. That is why the better frame for investors to consider is “cycle math.” Focus on liquidity, policy, indexation, and corporate incentives, as they can extend manias far beyond fundamental comfort. However, eventually, those cycles begin to reverse, and what previously ended speculative bubbles begin to “rhyme.”

Financing tightens;

ROI disappoints;

Accounting adjustments reveal how much growth was pulled forward, not run-rate, and

Leadership concentration flips from strength to fragility as forced sellers meet illiquidity.

From 2000 to 2002, the telecom sector unwind delivered all of the above from defaults, receivable write-offs, and serial guidance cuts. Replace “fiber overbuild” with “compute and power overbuild,” and you have a credible left-tail scenario if demand monetization trails supply for too long. Ratings agencies and sell-side shops have noticed, flagging the leverage and power constraints embedded in the current build cycle, even as they acknowledge substantial real use cases.

Today, it is the same, but in a different form. As Roger McNamee recently wrote for The Guardian:

“Investors have assumed that every major US player in [large language models (“LLMs”)] will be a winner. This assumption is essential, as the monopolies that power big tech – such as Microsoft’s Office suite, Google Search, Gmail, and Docs, and Meta’s Facebook – are, without exception, approaching the end of their useful lives. The vast majority of customers believe that these products have gotten worse – and made users less productive – over the past decade or more. Each big tech company needs a global monopoly in AI to sustain their success and market value. They are not all going to get one.

The former General Electric CEO Jack Welch made famous the notion that only two players can be profitable in a competitive industry. Below the top two, it is a struggle to survive. That means that at least three, and perhaps more, of the current players will be forced to write off their investments in LLMs. Each of the big tech companies has invested in the range of $100bn through this year, and by next year that number could easily double. If LLM technology does not improve rapidly, their corporate customers will also face write-offs.

The day may come sooner than many expect when shareholders, directors and executives will demand evidence that the massive investment in LLM technology will generate an adequate return for them. The answer will be no for many, if not most, players, and the reckoning will [be] ugly for everyone.“

Such reminds me of Charles Kindleberger’s old line:

“If something cannot go on forever, it will stop.”

Critically, I am not suggesting that the AI bubble is about to burst tomorrow. We have many of those particular stocks in our portfolios, from Google to Meta to Nvidia and others. Furthermore, my discussion here is not intended to be a timing tool but rather a budgeting tool. Don’t expect the current market to underwrite infinite carry from a finite financing window. That mindset kept investors alive in 1999–2002 and again in 2007–2009. It applies again in 2025.

📒 Portfolio Tactics – Navigating A Market Bubble

Let me conclude by stating that my intention is not to dunk on innovation; it’s to manage risk amid it. The practical playbook in bubbles is more carpentry than heroics.

First, separate plumbing from promises. Infrastructure winners can post extraordinary revenue growth if the financing loop remains open. That’s tradable momentum but not the same as durable, end-customer ROI. In your underwriting, prioritize evidence of cash demand (contracted workloads with measurable payback) over capital demand (pre-buys and option-like contracts funded by equity or fresh debt). Until the monetization bridge is built, capex dependence is a risk factor, not a moat.

Second, let prices do the heavy lifting. When leadership is this extended, mean-reversion is a feature, not a bug. Use predefined rebalancing bands to trim exposure into vertical rallies and add on resets to rising 50/100-DMAs instead of chasing exhaustion gaps. That keeps you involved (because bubbles can run) while turning volatility into a source of discipline rather than damage.

Third, demand balance-sheet realism. In the late ’90s, vendor financing and receivables quality were the tell. Watch interest coverage after new bond deals, capex as a share of operating cash flow, and disclosure around take-or-pay or utilization guarantees. If the ecosystem is cross-subsidizing itself (supplier invests in the customer who pre-orders the supplier’s gear), discount the apparent “visibility.” The more circular the revenue, the more fragile the flywheel when financing costs rise. Recent deals around Stargate and supplier co-investments are a case in point.

Fourth, think in barbells and play defense in the middle. On one end, maintain a measured exposure to proven cash generators that genuinely benefit from AI (unit-level margins, network effects, or distribution that converts AI into pricing power). On the other hand, hold high-quality ballast, short-duration Treasuries, or cash equivalents, to fund drawdowns and keep optionality. In between, be choosy with capital-intensive stories where the cash-in date sits far beyond the cash-out date. As the Dallas Fed and Goldman work suggests, productivity gains likely build over years—not quarters—so leave yourself time.

Finally, accept that you won’t nail the top. That’s okay. Successful navigation is less about calling a date and more about insisting on process: valuation awareness, position sizing, staged entries/exits, and the humility to let price action confirm your thesis. Bubbles end the same way, financing tightens, a few high-profile misses flip psychology, and cash becomes king. Have some.

Trade accordingly.

According to the Department of Homeland Security, U.S. Immigration and Customs has seen

According to the Department of Homeland Security, U.S. Immigration and Customs has seen

. . .

. . .

Since early 2025, European drugmakers have stepped up their U.S. presence. In the most recent move, the United Kingdom’s giant AstraZeneca

Since early 2025, European drugmakers have stepped up their U.S. presence. In the most recent move, the United Kingdom’s giant AstraZeneca