On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 10.11.2025

## 🧠Quote(s) of the week:

> If we don't diagnose and treat the core of the problem, people are only going to continue moving closer to the polar ends of the political spectrum. Broken money is at the core of today's issues. Until that is widely acknowledged, nothing will get fixed. - Marty Bend

## 🧡Bitcoin news🧡

Before we start. Over the past few weeks, I stepped away for a moment — no weekly recaps, no updates. Life had its way of asking me to slow down, reset, and catch my breath. It was necessary, and honestly, it felt good to disconnect for a bit.

But I’m back now, fully recharged and ready to dive in again. Thanks for sticking around — let’s pick up where we left off.

Photos hosted by Azzamo (

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 10.11.2025

## 🧠Quote(s) of the week:

> If we don't diagnose and treat the core of the problem, people are only going to continue moving closer to the polar ends of the political spectrum. Broken money is at the core of today's issues. Until that is widely acknowledged, nothing will get fixed. - Marty Bend

## 🧡Bitcoin news🧡

Before we start. Over the past few weeks, I stepped away for a moment — no weekly recaps, no updates. Life had its way of asking me to slow down, reset, and catch my breath. It was necessary, and honestly, it felt good to disconnect for a bit.

But I’m back now, fully recharged and ready to dive in again. Thanks for sticking around — let’s pick up where we left off.

Photos hosted by Azzamo (

Azzamo

Azzamo | Web Hosting, Bitcoin Payment & Nostr Relay Services

Azzamo offers fast web hosting, BTCpay & LNbits hosting, and Nostr relays. Build your online presence with secure, reliable solutions.

)

➡️Norway reports a 30% rise in taxpayers declaring digital assets in 2024, with holdings exceeding US$4B.

**On the 4th of November:**

➡️Wicked: 'Everyone who first started daily DCA'ing bitcoin anytime over the past year is now at a loss on their investment, price lower than cost basis. If bitcoin were to drop down to $83k, then everyone who started as early as the last halving, on April 20, 2024, would also be at a loss.'

➡️'Bitcoin officially enters bear market territory, now down -20% since its record high seen on October 6th. We are living in the most exciting market in history.' -TKL

➡️Joe Consorti: 'Bitcoin is now down 20% from its all-time high—in equity terms, this would be considered the start of a bear market. We've already seen two 30%+ drawdowns this cycle. Nothing new under the sun. This is just capitulation from spot Bitcoin holders.' -Joe Consorti

➡️Largest re-accumulation event in the history of the asset class 300-500k.

➡️Pierre Rochard: We need more Bitcoin education. The mispricing is a result of growing information asymmetry. Check out and share:

)

➡️Norway reports a 30% rise in taxpayers declaring digital assets in 2024, with holdings exceeding US$4B.

**On the 4th of November:**

➡️Wicked: 'Everyone who first started daily DCA'ing bitcoin anytime over the past year is now at a loss on their investment, price lower than cost basis. If bitcoin were to drop down to $83k, then everyone who started as early as the last halving, on April 20, 2024, would also be at a loss.'

➡️'Bitcoin officially enters bear market territory, now down -20% since its record high seen on October 6th. We are living in the most exciting market in history.' -TKL

➡️Joe Consorti: 'Bitcoin is now down 20% from its all-time high—in equity terms, this would be considered the start of a bear market. We've already seen two 30%+ drawdowns this cycle. Nothing new under the sun. This is just capitulation from spot Bitcoin holders.' -Joe Consorti

➡️Largest re-accumulation event in the history of the asset class 300-500k.

➡️Pierre Rochard: We need more Bitcoin education. The mispricing is a result of growing information asymmetry. Check out and share:

Satoshi Nakamoto Institute

Advancing and preserving bitcoin knowledge

)

When people say “Capitalism doesn’t work.”

What they really mean is, “The limitless + costless creation of money doesn’t work.”

Your money is broke. Opt out."

Study Bitcoin

➡️Pullbacks in Bitcoin price are a feature of bull runs, not a bug. The recent drawdown of -21% from the all-time high doesn’t even make this list.

When people say “Capitalism doesn’t work.”

What they really mean is, “The limitless + costless creation of money doesn’t work.”

Your money is broke. Opt out."

Study Bitcoin

➡️Pullbacks in Bitcoin price are a feature of bull runs, not a bug. The recent drawdown of -21% from the all-time high doesn’t even make this list.

)

**On the 6th of November:**

➡️BITCOIN MIMICS APRIL CRASH

Bitcoin Archive:

In April, Bitcoin fell 30% to $74K before rallying 70% to $126K Several indicators marked the low in hindsight, including MVRV, Supply in Loss %, 365DMA, and RSI. Today, those same indicators are signaling a potential reversal.

Structurally, it all looks the same. My theory is that people are just down and tired of being chopped up throughout the year.

➡️Wicked: "In dollars, prices of houses have more than doubled. In Bitcoin, they continue to collapse, trending toward zero. Wake me up when the average new house costs less than 1 BTC."

**On the 6th of November:**

➡️BITCOIN MIMICS APRIL CRASH

Bitcoin Archive:

In April, Bitcoin fell 30% to $74K before rallying 70% to $126K Several indicators marked the low in hindsight, including MVRV, Supply in Loss %, 365DMA, and RSI. Today, those same indicators are signaling a potential reversal.

Structurally, it all looks the same. My theory is that people are just down and tired of being chopped up throughout the year.

➡️Wicked: "In dollars, prices of houses have more than doubled. In Bitcoin, they continue to collapse, trending toward zero. Wake me up when the average new house costs less than 1 BTC."

)

➡️Institute of Technology and Renewable Energies to sell 97 Bitcoin ($10M), originally bought for $10,000 in 2012 during a blockchain research project.

➡️Normally, the following I would place the following in the segment Macro/geopolitics.

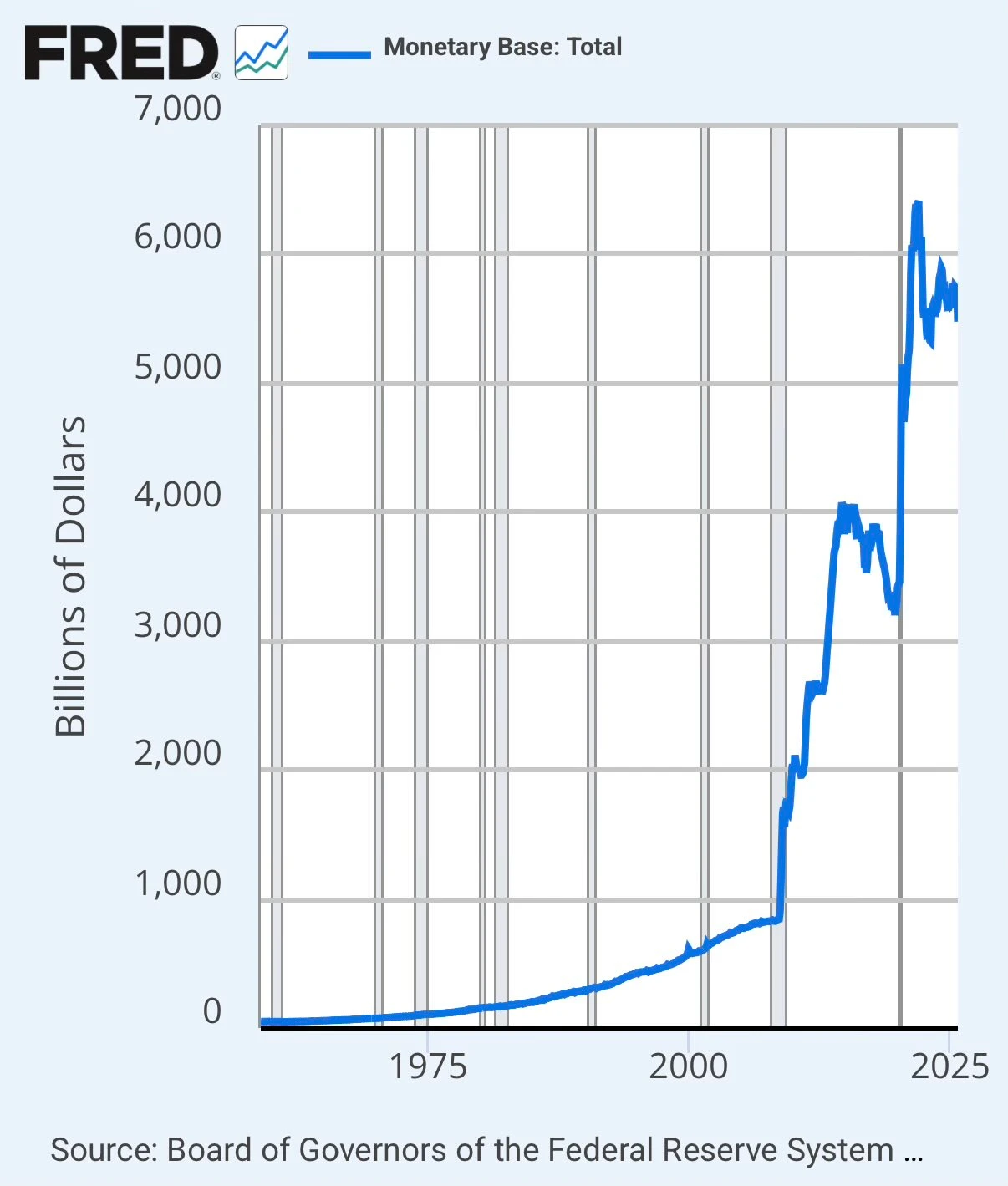

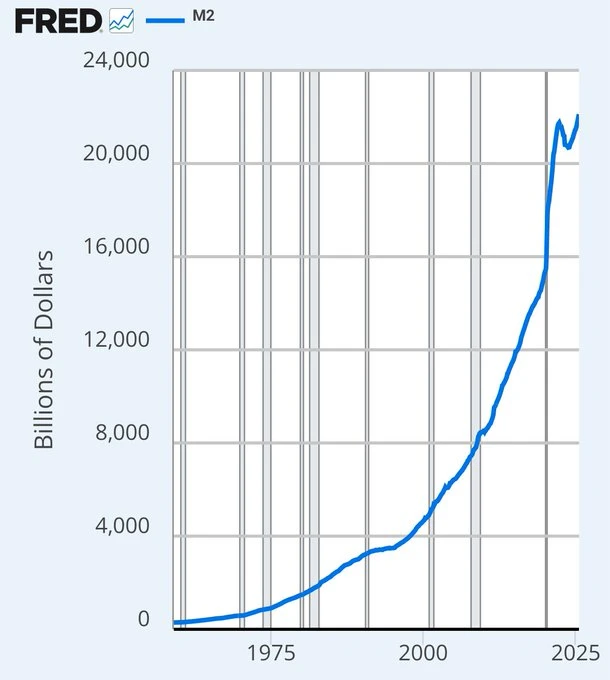

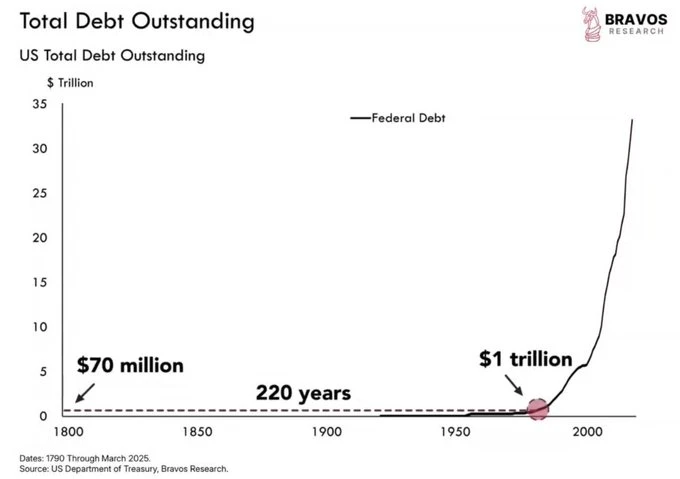

Mark Mitchell: 'This chart is damning. The death of true capitalism.'

➡️Institute of Technology and Renewable Energies to sell 97 Bitcoin ($10M), originally bought for $10,000 in 2012 during a blockchain research project.

➡️Normally, the following I would place the following in the segment Macro/geopolitics.

Mark Mitchell: 'This chart is damning. The death of true capitalism.'

)

The chart is real. The conclusion is not.

Great response by Rock Chartrand: 'What you’re calling “the death of true capitalism” is actually the triumph of government-managed markets. When the state rigs the rules, prices signal politics instead of value. Capitalism didn’t fail. It was replaced. If productivity rises but your paycheck doesn’t, the first question is: Who inserted themselves between you and the value you produce? The answer is never “capitalism.” It’s always “the people who claim to be protecting you.”

Opt out, study Bitcoin.

)

The chart is real. The conclusion is not.

Great response by Rock Chartrand: 'What you’re calling “the death of true capitalism” is actually the triumph of government-managed markets. When the state rigs the rules, prices signal politics instead of value. Capitalism didn’t fail. It was replaced. If productivity rises but your paycheck doesn’t, the first question is: Who inserted themselves between you and the value you produce? The answer is never “capitalism.” It’s always “the people who claim to be protecting you.”

Opt out, study Bitcoin.

WTF Happened In 1971?

WTF Happened In 1971?

https://inflationdata.com/articles/2022/08/10/u-s-cumulative-inflation-since-1913/ "I don't believe we shall ever have a good money again befo...

)

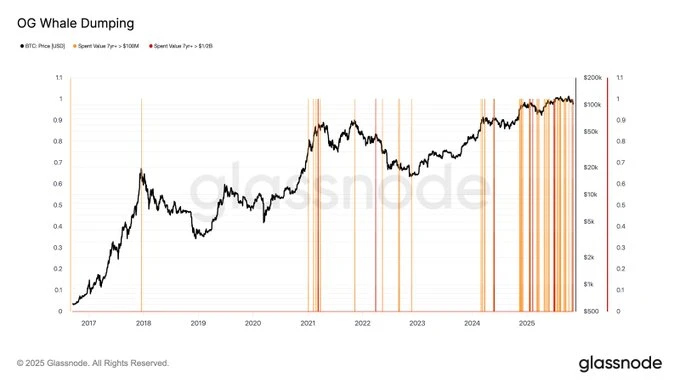

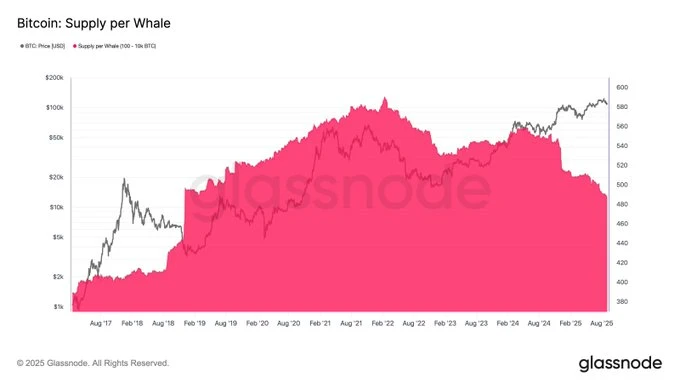

'This chart gives a good visual of how many super whales are cashing out of Bitcoin. All lines here are 7+ year on-chain spends from pre-2018 era OG Bitcoin Hodlers.

Orange = $100M OG dumps.

Red = $500M OG dumps.

The chart is VERY colorful in 2025. OGs are cashing out.'

➡️'Largest business cycle bull div yet. Reversal = Parabolic market' - TechDev

'This chart gives a good visual of how many super whales are cashing out of Bitcoin. All lines here are 7+ year on-chain spends from pre-2018 era OG Bitcoin Hodlers.

Orange = $100M OG dumps.

Red = $500M OG dumps.

The chart is VERY colorful in 2025. OGs are cashing out.'

➡️'Largest business cycle bull div yet. Reversal = Parabolic market' - TechDev

)

'The US Government seeks a maximum 5-year sentence for Samourai Wallet developers. In its sentencing memo, prosecutors barely mention the actual charge of operating an unlicensed money transmitter. Instead, they focus on dropped allegations of money laundering and sanctions evasion.' - Bitcoin News

➡️Blackrock bought 921 BTC today. Has sold 5,300 this week. Still holds 798,000 BTC.

➡️Japan's Financial Services Agency to support the country's three largest banks in developing a stablecoin. More liquidity for Bitcoin.

➡️Smart money isn’t selling 99.5% of spot bitcoin ETF investors held through the 20% drawdown.

➡️'What's different this time about Bitcoin Long-term holder (LTH) selling? Bitcoin Long-term holders selling is a normal occurrence in bull markets. LTH takes profits as prices reach new highs.

What's important to analyze each time is whether there's growing Bitcoin demand that can absorb the LTH selling at higher prices. For example, in Jan-March and Nov-Dec 2024, increasing LTH sales occurred as demand was growing (green areas), so the price reached new ATHs.

However, since October, LTH sales have increased (nothing new here), but demand is contracting (red areas), unable to absorb LTH supply at higher prices.' -Julio Moreno

➡️U.S. Bitcoin ETFs bought $240 MILLION BTC yesterday, ending six days of outflows.

➡️Joe Consorti: 'Bitcoin is now in "extreme fear" with its price now 20% off the all-time high and falling. The market has been more fearful twice this cycle:

1. After 8 months of consolidation in 2024,

2. This April, near the bottom of a 32% drawdown

If we're still in a bull, this means we're nearing the local bottom.

If we're moving into a bear (I don't think so), then look out down below.'

➡️'Since 1987, every major bottom in the University of Michigan Consumer Sentiment Index has aligned with a bottom in the Russell 2000. And over the past 15 years, every parabolic bitcoin bull market has coincided with a Russell 2000 breakout, which may be forming again now.'- Joe Burnett

'The US Government seeks a maximum 5-year sentence for Samourai Wallet developers. In its sentencing memo, prosecutors barely mention the actual charge of operating an unlicensed money transmitter. Instead, they focus on dropped allegations of money laundering and sanctions evasion.' - Bitcoin News

➡️Blackrock bought 921 BTC today. Has sold 5,300 this week. Still holds 798,000 BTC.

➡️Japan's Financial Services Agency to support the country's three largest banks in developing a stablecoin. More liquidity for Bitcoin.

➡️Smart money isn’t selling 99.5% of spot bitcoin ETF investors held through the 20% drawdown.

➡️'What's different this time about Bitcoin Long-term holder (LTH) selling? Bitcoin Long-term holders selling is a normal occurrence in bull markets. LTH takes profits as prices reach new highs.

What's important to analyze each time is whether there's growing Bitcoin demand that can absorb the LTH selling at higher prices. For example, in Jan-March and Nov-Dec 2024, increasing LTH sales occurred as demand was growing (green areas), so the price reached new ATHs.

However, since October, LTH sales have increased (nothing new here), but demand is contracting (red areas), unable to absorb LTH supply at higher prices.' -Julio Moreno

➡️U.S. Bitcoin ETFs bought $240 MILLION BTC yesterday, ending six days of outflows.

➡️Joe Consorti: 'Bitcoin is now in "extreme fear" with its price now 20% off the all-time high and falling. The market has been more fearful twice this cycle:

1. After 8 months of consolidation in 2024,

2. This April, near the bottom of a 32% drawdown

If we're still in a bull, this means we're nearing the local bottom.

If we're moving into a bear (I don't think so), then look out down below.'

➡️'Since 1987, every major bottom in the University of Michigan Consumer Sentiment Index has aligned with a bottom in the Russell 2000. And over the past 15 years, every parabolic bitcoin bull market has coincided with a Russell 2000 breakout, which may be forming again now.'- Joe Burnett

)

➡️'They print the money, fund the crimes, and walk free, but the dev who built a privacy wallet gets 5 years.' - TFTC

➡️71% of traditional hedge funds plan to increase Bitcoin and crypto exposure over the next year - AIMA

➡️The Trump family’s American Bitcoin continues stacking, adding ~₿139 since the October 24, 2025 announcement. Total holdings now stand at ₿4,004, with Satoshis per Share (SPS) rising to 432.

➡️'They print the money, fund the crimes, and walk free, but the dev who built a privacy wallet gets 5 years.' - TFTC

➡️71% of traditional hedge funds plan to increase Bitcoin and crypto exposure over the next year - AIMA

➡️The Trump family’s American Bitcoin continues stacking, adding ~₿139 since the October 24, 2025 announcement. Total holdings now stand at ₿4,004, with Satoshis per Share (SPS) rising to 432.

)

**On the 8th of November:**

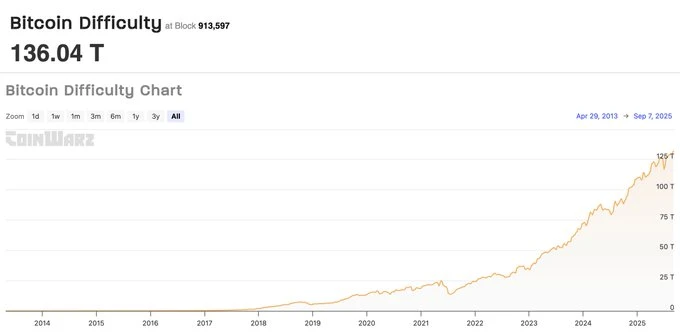

➡️Satoshi Nakamoto Explains ‘Difficulty Adjustment’ “As computers get faster and the total computing power applied to creating bitcoins increases, the difficulty increases proportionally to keep the total new production constant. Thus, it is known in advance how many new Bitcoins.”

**On the 8th of November:**

➡️Satoshi Nakamoto Explains ‘Difficulty Adjustment’ “As computers get faster and the total computing power applied to creating bitcoins increases, the difficulty increases proportionally to keep the total new production constant. Thus, it is known in advance how many new Bitcoins.”

)

➡️Wicked: The NASDAQ 100 just edged out Bitcoin, comparing their 4-year CAGR.

➡️Wicked: The NASDAQ 100 just edged out Bitcoin, comparing their 4-year CAGR.

)

➡️A Ledger blog article explaining multi-sig is restricted to citizens in the UK “due to new rules.”

➡️Bitcoin News: 'On Friday, Nov. 7, with the price of Bitcoin hovering just above $100,000, a 2016-era whale moved 216.95 BTC worth $22.47 million after 9 years and 4 months of dormancy.'

➡️Bitcoin miners are under renewed pressure as the hash price, a key profitability metric measuring daily revenue per petahash per second, falls to around $42, nearing the $40 “survival” threshold that could push smaller operators offline.

**On the 9th of November:**

➡️The S&P 500 is up in nominal terms, flat in gold terms, and down in Bitcoin terms.

➡️A Ledger blog article explaining multi-sig is restricted to citizens in the UK “due to new rules.”

➡️Bitcoin News: 'On Friday, Nov. 7, with the price of Bitcoin hovering just above $100,000, a 2016-era whale moved 216.95 BTC worth $22.47 million after 9 years and 4 months of dormancy.'

➡️Bitcoin miners are under renewed pressure as the hash price, a key profitability metric measuring daily revenue per petahash per second, falls to around $42, nearing the $40 “survival” threshold that could push smaller operators offline.

**On the 9th of November:**

➡️The S&P 500 is up in nominal terms, flat in gold terms, and down in Bitcoin terms.

)

➡️Josh Mandell reports losing over $1.2 million on IBIT call options, which he bought after predicting Bitcoin would reach $444,000 by November 8.

➡️The Winklevoss twins send 250 BTC to Gemini hot wallets.

➡️Wicked: 'Block by block, sat by sat...save and HODL bitcoin for a better future.'

➡️Josh Mandell reports losing over $1.2 million on IBIT call options, which he bought after predicting Bitcoin would reach $444,000 by November 8.

➡️The Winklevoss twins send 250 BTC to Gemini hot wallets.

➡️Wicked: 'Block by block, sat by sat...save and HODL bitcoin for a better future.'

)

➡️$1,200 Covid stimulus check is now worth $21,270 if you bought bitcoin with it, 1,672% return.

**On the 10th of November:**

➡️Retail is selling Bitcoin while large investors are buying.

➡️$1,200 Covid stimulus check is now worth $21,270 if you bought bitcoin with it, 1,672% return.

**On the 10th of November:**

➡️Retail is selling Bitcoin while large investors are buying.

)

➡️"On October 15, as gold was hitting a blow-off top, people in Australia were lining up for hours to buy it. Today, after an 11% correction over the past couple of weeks, those lines have vanished, even though gold has already bounced 5% off the lows." -Bitcoin News

Fascinating how market psychology works; you can apply that to Bitcoin as well.

➡️APPLE CO-FOUNDER STEVE WOZNIAK: "Bitcoin is mathematical purity"

➡️"On October 15, as gold was hitting a blow-off top, people in Australia were lining up for hours to buy it. Today, after an 11% correction over the past couple of weeks, those lines have vanished, even though gold has already bounced 5% off the lows." -Bitcoin News

Fascinating how market psychology works; you can apply that to Bitcoin as well.

➡️APPLE CO-FOUNDER STEVE WOZNIAK: "Bitcoin is mathematical purity"

)

➡️4 million Square merchants can now accept Bitcoin with no fees starting today. Square just announced Bitcoin payments live via Lightning. Instant settlement. No banks. The rails of fiat are breaking. The rails of Bitcoin are being built. Their sellers can now receive Bitcoin to Bitcoin, Bitcoin to fiat, fiat to Bitcoin, or fiat to fiat.

Allen Farrington: But why would Square want merchants to accept bitcoin?

➡️4 million Square merchants can now accept Bitcoin with no fees starting today. Square just announced Bitcoin payments live via Lightning. Instant settlement. No banks. The rails of fiat are breaking. The rails of Bitcoin are being built. Their sellers can now receive Bitcoin to Bitcoin, Bitcoin to fiat, fiat to Bitcoin, or fiat to fiat.

Allen Farrington: But why would Square want merchants to accept bitcoin?

)

➡️Ethiopia's Bitcoin mining operation has made $82 MILLION in just 3 months.

➡️Strategy has acquired 487 BTC for ~$49.9 million at ~$102,557 per bitcoin and has achieved BTC Yield of 26.1% YTD 2025. As of 11/9/2025, they hodl 641,692 Bitcoin acquired for ~$47.54 billion at ~$74,079 per Bitcoin.

➡️'Bank of England proposes £20k cap on retail stablecoin holdings. They can only control you because you are using their money. Opt out, study Bitcoin. HODL it in self-custody. F*CK THEM!' - CarlBMenger

➡️'HIVE just reached 24 EH/s, up 147% YoY, and completed its 300 MW Paraguay site. Now it’s turning Bitcoin mining profits into AI data centers across Canada!' - Simply Bitcoin

➡️No, the EU will not require ID for every Bitcoin transaction.

But the AMLR is still a massive pile of trash.

Now let's break it down...

"Lots of fake news about the EU’s Anti-Money Laundering Package flooded the timeline last weekend, so here’s a quick breakdown of what these new regulations actually mean.

First, the EU *is not* requiring an ID for every bitcoin transaction, as widely misreported. The EU’s AMLR only applies to so-called CASPs, or Crypto Asset Service Providers, which are defined custodians under the Markets in Crypto Assets Regulation (MiCAR) and was adopted 1.5 years ago.

This is bad because it effectively requires most custodians to KYC their users, which is a major blow to small software firms trying to innovate.

Second, the AMLR requires CASPs to conduct due diligence on any funds that are sent to and from non-custodial wallets below 1000 EUR, and requires proof of proof-of-ownership of the non-custodial addresses when payments exceed 1000 EUR.

This also isn’t great because it effectively hinders the use of bitcoin as money, but it also isn’t KYC – due diligence is defined as a risk-based approach, which CASPs have some room to define, e.g., via the use of chain analysis firms. For transactions above 1000 EUR, most CASPs require something called the Satoshi Test, where you make a small transaction to the CASP to prove that the address belongs to you.

Again, this isn’t news and was implemented at the beginning of this year via the Travel Rule.

Third, the EU bans cash transactions over 10k EUR for business transactions, but this too is already in effect in most countries, which have bans on cash transactions as low as 1000 EUR, e.g., France or Spain. What *is* new is that the AMLR bans CASPs from offering privacy coins – but some exchanges, such as Kraken EU, have already delisted coins like Monero as the EU considers them to be risk-carrying assets.

I hope this helps clear up some of the misconceptions and reminds you to read primary news sources yourself instead of relying on AI-fueled news aggregators feeding a frenzy for monetized clicks.

The AMLR is an absolute disaster, and there’s no need to make it worse than it sounds, because things are already pretty bad in the EU for Bitcoin.' -Independent Journalist L0laL33tz

Here's what the new regulations mean. Full story:

)

➡️Ethiopia's Bitcoin mining operation has made $82 MILLION in just 3 months.

➡️Strategy has acquired 487 BTC for ~$49.9 million at ~$102,557 per bitcoin and has achieved BTC Yield of 26.1% YTD 2025. As of 11/9/2025, they hodl 641,692 Bitcoin acquired for ~$47.54 billion at ~$74,079 per Bitcoin.

➡️'Bank of England proposes £20k cap on retail stablecoin holdings. They can only control you because you are using their money. Opt out, study Bitcoin. HODL it in self-custody. F*CK THEM!' - CarlBMenger

➡️'HIVE just reached 24 EH/s, up 147% YoY, and completed its 300 MW Paraguay site. Now it’s turning Bitcoin mining profits into AI data centers across Canada!' - Simply Bitcoin

➡️No, the EU will not require ID for every Bitcoin transaction.

But the AMLR is still a massive pile of trash.

Now let's break it down...

"Lots of fake news about the EU’s Anti-Money Laundering Package flooded the timeline last weekend, so here’s a quick breakdown of what these new regulations actually mean.

First, the EU *is not* requiring an ID for every bitcoin transaction, as widely misreported. The EU’s AMLR only applies to so-called CASPs, or Crypto Asset Service Providers, which are defined custodians under the Markets in Crypto Assets Regulation (MiCAR) and was adopted 1.5 years ago.

This is bad because it effectively requires most custodians to KYC their users, which is a major blow to small software firms trying to innovate.

Second, the AMLR requires CASPs to conduct due diligence on any funds that are sent to and from non-custodial wallets below 1000 EUR, and requires proof of proof-of-ownership of the non-custodial addresses when payments exceed 1000 EUR.

This also isn’t great because it effectively hinders the use of bitcoin as money, but it also isn’t KYC – due diligence is defined as a risk-based approach, which CASPs have some room to define, e.g., via the use of chain analysis firms. For transactions above 1000 EUR, most CASPs require something called the Satoshi Test, where you make a small transaction to the CASP to prove that the address belongs to you.

Again, this isn’t news and was implemented at the beginning of this year via the Travel Rule.

Third, the EU bans cash transactions over 10k EUR for business transactions, but this too is already in effect in most countries, which have bans on cash transactions as low as 1000 EUR, e.g., France or Spain. What *is* new is that the AMLR bans CASPs from offering privacy coins – but some exchanges, such as Kraken EU, have already delisted coins like Monero as the EU considers them to be risk-carrying assets.

I hope this helps clear up some of the misconceptions and reminds you to read primary news sources yourself instead of relying on AI-fueled news aggregators feeding a frenzy for monetized clicks.

The AMLR is an absolute disaster, and there’s no need to make it worse than it sounds, because things are already pretty bad in the EU for Bitcoin.' -Independent Journalist L0laL33tz

Here's what the new regulations mean. Full story:

The Rage

No, The EU Will Not Require ID For Every Bitcoin Transaction

But the AMLR is still a massive pile of trash.

SAIFEDEAN AMMOUS: "The biggest problem with Bitcoin is that it didn't exist before 2009."

🧡Bitcoin news🧡

On the 1st of September:

➡️'Bitcoin supply shock is imminent!' - Trending Bitcoin

SAIFEDEAN AMMOUS: "The biggest problem with Bitcoin is that it didn't exist before 2009."

🧡Bitcoin news🧡

On the 1st of September:

➡️'Bitcoin supply shock is imminent!' - Trending Bitcoin

On the 2nd of September:

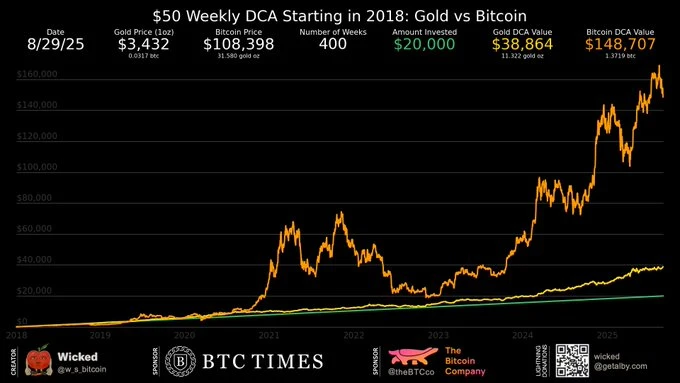

➡️Wicked: 'Saving in dollars vs gold vs bitcoin: After 400 weeks of $50 DCA, you’d have $20,000 had you saved in dollars, 11.322 ounces of gold (worth $38,864) had you saved in gold, or 1.3719 BTC (worth $148,707) had you saved in bitcoin.'

On the 2nd of September:

➡️Wicked: 'Saving in dollars vs gold vs bitcoin: After 400 weeks of $50 DCA, you’d have $20,000 had you saved in dollars, 11.322 ounces of gold (worth $38,864) had you saved in gold, or 1.3719 BTC (worth $148,707) had you saved in bitcoin.'

Quick reminder: Gold officially hits $3,600/oz for the first time in history. Gold is now up +33% YTD, more than 3.5 TIMES the S&P 500’s return. Meanwhile, the US Dollar to Gold ratio is falling off a cliff.

Quick reminder: Gold officially hits $3,600/oz for the first time in history. Gold is now up +33% YTD, more than 3.5 TIMES the S&P 500’s return. Meanwhile, the US Dollar to Gold ratio is falling off a cliff.

What does that tell us?

Oh wait.... 'US M2 Money Supply is now growing at a +5.1% annualized rate of change. It should be no surprise that Core CPI inflation is back above 3.0%, AND rate cuts are on the way. After 10 years of 3% inflation, the US Dollar loses 25%+ of its purchasing power. This is on top of the ~20% in value that the US Dollar has lost since 2020. Own assets or you will be left behind.' - TKL

Anyway, got Bitcoin?

What does that tell us?

Oh wait.... 'US M2 Money Supply is now growing at a +5.1% annualized rate of change. It should be no surprise that Core CPI inflation is back above 3.0%, AND rate cuts are on the way. After 10 years of 3% inflation, the US Dollar loses 25%+ of its purchasing power. This is on top of the ~20% in value that the US Dollar has lost since 2020. Own assets or you will be left behind.' - TKL

Anyway, got Bitcoin?

➡️Strategy has acquired 4,048 BTC for ~$449.3 million at ~$110,981 per bitcoin and has achieved BTC Yield of 25.7% YTD 2025. As of 9/1/2025, we hodl 636,505 Bitcoin acquired for ~$46.95 billion at ~$73,765 per Bitcoin.

➡️

➡️Strategy has acquired 4,048 BTC for ~$449.3 million at ~$110,981 per bitcoin and has achieved BTC Yield of 25.7% YTD 2025. As of 9/1/2025, we hodl 636,505 Bitcoin acquired for ~$46.95 billion at ~$73,765 per Bitcoin.

➡️ Robin Seyr: 'They know it's a race between private sound money and state surveillance money. ⇒ Bitcoin vs. CBDC!"

➡️Parker Lewis: "Not changing your software or running new code is being framed as the heretical position, which feels like gaslighting. 2009-2024: run full nodes, verify, don't trust, default position is no. 2025: run light clients, trust the experts, if you don't change code, you're a retard."

➡️'Cango Inc. reports 663.7 Bitcoin produced in August, up from 650.5 in July, with 5,193.4 BTC held by month-end. Deployed hashrate stayed at 50 EH/s, while average operating hashrate rose to 43.74 EH/s from 40.91 EH/s.' - Bitcoin News

➡️Billionaire Ray Dalio warns of a "debt-induced heart attack in the near future." "I'd say three years, give or take a year or two." Dalio has warned Donald Trump’s America is drifting into 1930s-style autocratic politics — and said other investors are too scared of the president to speak up.

Robin Seyr: 'They know it's a race between private sound money and state surveillance money. ⇒ Bitcoin vs. CBDC!"

➡️Parker Lewis: "Not changing your software or running new code is being framed as the heretical position, which feels like gaslighting. 2009-2024: run full nodes, verify, don't trust, default position is no. 2025: run light clients, trust the experts, if you don't change code, you're a retard."

➡️'Cango Inc. reports 663.7 Bitcoin produced in August, up from 650.5 in July, with 5,193.4 BTC held by month-end. Deployed hashrate stayed at 50 EH/s, while average operating hashrate rose to 43.74 EH/s from 40.91 EH/s.' - Bitcoin News

➡️Billionaire Ray Dalio warns of a "debt-induced heart attack in the near future." "I'd say three years, give or take a year or two." Dalio has warned Donald Trump’s America is drifting into 1930s-style autocratic politics — and said other investors are too scared of the president to speak up.  In this report:

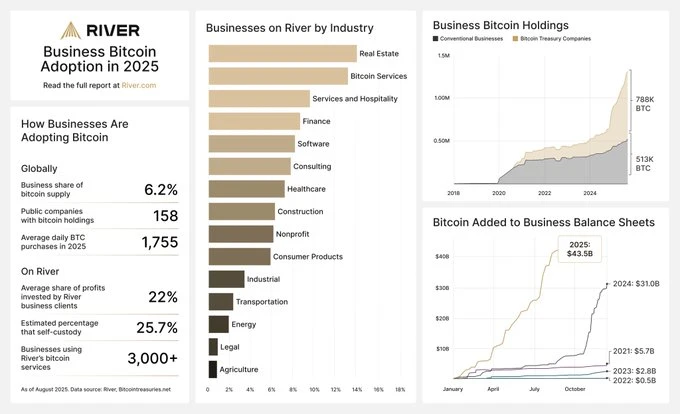

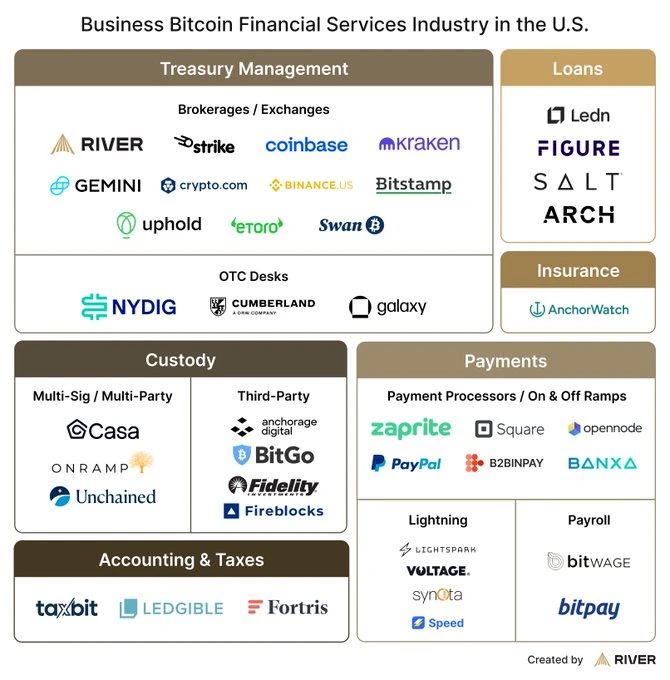

Why 2025 is a breakout year for business adoption

Bitcoin adoption across every industry

The Bitcoin Treasury Company Megatrend

How bitcoin goes mainstream for businesses

In this report:

Why 2025 is a breakout year for business adoption

Bitcoin adoption across every industry

The Bitcoin Treasury Company Megatrend

How bitcoin goes mainstream for businesses  ➡️'Bitcoin smashes through $112K as Fed Governor Waller signals support for "multiple rate cuts" in the coming months.' - Bitcoin News

➡️River: 'You should be able to verify that your exchange is not selling paper bitcoin. It's a requirement to build a better financial system. All Bitcoin held on River is in proven full-reserve custody.'

➡️'Bitcoin smashes through $112K as Fed Governor Waller signals support for "multiple rate cuts" in the coming months.' - Bitcoin News

➡️River: 'You should be able to verify that your exchange is not selling paper bitcoin. It's a requirement to build a better financial system. All Bitcoin held on River is in proven full-reserve custody.'

We need that all over the space, and worldwide in each country.

➡️One month later, and MSTY's down another 10% in terms of Bitcoin.

We need that all over the space, and worldwide in each country.

➡️One month later, and MSTY's down another 10% in terms of Bitcoin.  Even if a 'product' comes out of the Saylor fabric, paper Bitcoin is not Bitcoin... and it will go to 0, given enough time.

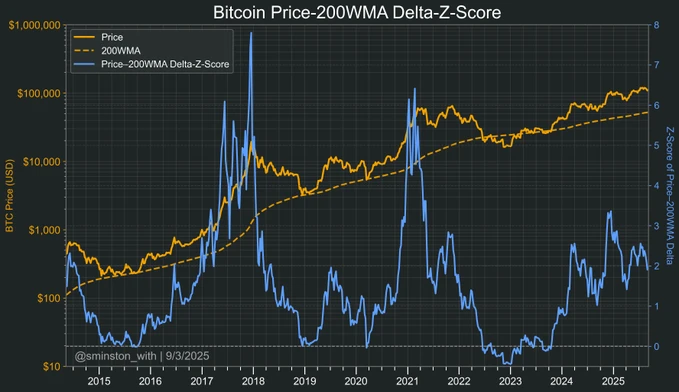

➡️'Simple way to see if we have juice left in this cycle: Track the Z-score of Bitcoin's (daily price - 200WMA), and we see that the resulting standard deviation has a history of creeping up to ~2-3σ, and somewhere around that 2-3σ crest there tends to be a BLOW-OFF to the 6-8σ range. We haven't seen that blow-off yet this cycle. Get your popcorn ready for Q4 - Sminston With

Even if a 'product' comes out of the Saylor fabric, paper Bitcoin is not Bitcoin... and it will go to 0, given enough time.

➡️'Simple way to see if we have juice left in this cycle: Track the Z-score of Bitcoin's (daily price - 200WMA), and we see that the resulting standard deviation has a history of creeping up to ~2-3σ, and somewhere around that 2-3σ crest there tends to be a BLOW-OFF to the 6-8σ range. We haven't seen that blow-off yet this cycle. Get your popcorn ready for Q4 - Sminston With

➡️West Main Self Storage buys an additional 0.089 Bitcoin and now holds a total of 0.52 BTC.

➡️Bloomberg reports Michael Saylor's Strategy "has met all the criteria — and more" to be added into the S&P 500

On the 5th of September:

➡️

➡️West Main Self Storage buys an additional 0.089 Bitcoin and now holds a total of 0.52 BTC.

➡️Bloomberg reports Michael Saylor's Strategy "has met all the criteria — and more" to be added into the S&P 500

On the 5th of September:

➡️  ➡️Bitcoin Archive: "$120 million Bitcoin and crypto longs liquidated in the past hour. Bitcoin fell -$2,500 in a few minutes."

➡️A solo Bitcoin miner has mined on this day a block worth $353,000.

➡️MARA mined 705 Bitcoin worth $77.7 MILLION in August. MARA now holds 52,477 BTC worth $5.9 BILLION. Second-largest public holder behind Strategy.

➡️El Salvador buys $50,000,000 worth of Gold.

➡️Bitcoin Archive: "$120 million Bitcoin and crypto longs liquidated in the past hour. Bitcoin fell -$2,500 in a few minutes."

➡️A solo Bitcoin miner has mined on this day a block worth $353,000.

➡️MARA mined 705 Bitcoin worth $77.7 MILLION in August. MARA now holds 52,477 BTC worth $5.9 BILLION. Second-largest public holder behind Strategy.

➡️El Salvador buys $50,000,000 worth of Gold.

Anyway, got Bitcoin?

On the 7th of September:

➡️Companies are buying 1,755 BTC per day. That’s 4x the daily mining issuance of just 450 BTC.

➡️Next ₿itcoin Halving Progress ▓▓▓▓▓░░░░░░░░░░░░░░░░ 35% Current Block: 913,519 Halving Block: 1,050,000 Blocks Remaining: 136,481 Days Remaining: ~948 days It is projected to occur in 2 years and 217 days on 4/11/2028.

➡️Bitcoin mining difficulty sets a new all-time high above $136 TRILLION. Network is stronger than ever.

Anyway, got Bitcoin?

On the 7th of September:

➡️Companies are buying 1,755 BTC per day. That’s 4x the daily mining issuance of just 450 BTC.

➡️Next ₿itcoin Halving Progress ▓▓▓▓▓░░░░░░░░░░░░░░░░ 35% Current Block: 913,519 Halving Block: 1,050,000 Blocks Remaining: 136,481 Days Remaining: ~948 days It is projected to occur in 2 years and 217 days on 4/11/2028.

➡️Bitcoin mining difficulty sets a new all-time high above $136 TRILLION. Network is stronger than ever.

➡️Bitcoin illiquid supply hits a record 14.3M BTC. 72% of the total supply is locked up by long-term holders.

On the 8th of September:

➡️Bitcoin Archive: Massive crypto supply chain attack. Ledger CTO warns: Hardware wallet users must verify every transaction. Others should avoid on-chain activity until patched.

➡️Bitcoin illiquid supply hits a record 14.3M BTC. 72% of the total supply is locked up by long-term holders.

On the 8th of September:

➡️Bitcoin Archive: Massive crypto supply chain attack. Ledger CTO warns: Hardware wallet users must verify every transaction. Others should avoid on-chain activity until patched.

The drama here isn’t that a vulnerability exists — every system eventually reveals cracks. The drama is that 'crypto' has lulled people into forgetting the first principle of sovereignty: trust nothing blindly, not even your tools. And because no one bothers to listen, the majority of the people will continue to suffer. Do you know why Satoshi designed Bitcoin to be used "p2p"? It's because "3RD PARTIES ARE SECURITY HOLES...ALL OF THEM!". And for the love of god! When are people going to learn that Ledger is just crap and not air gapped? Just don't do shitcoins!

🎁If you have made it this far, I would like to give you a little gift:

'Lyn Alden just dropped a 2-hour masterclass with Tom Bilyeu to his 4.5M+ subscribers. If you don’t understand what’s happening to money right now, you’ll wake up on the wrong side of history. A 2-hour macro deep dive, compressed for signal. Which insight hit hardest for you? Watch the full conversation here:' - Swan

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

The drama here isn’t that a vulnerability exists — every system eventually reveals cracks. The drama is that 'crypto' has lulled people into forgetting the first principle of sovereignty: trust nothing blindly, not even your tools. And because no one bothers to listen, the majority of the people will continue to suffer. Do you know why Satoshi designed Bitcoin to be used "p2p"? It's because "3RD PARTIES ARE SECURITY HOLES...ALL OF THEM!". And for the love of god! When are people going to learn that Ledger is just crap and not air gapped? Just don't do shitcoins!

🎁If you have made it this far, I would like to give you a little gift:

'Lyn Alden just dropped a 2-hour masterclass with Tom Bilyeu to his 4.5M+ subscribers. If you don’t understand what’s happening to money right now, you’ll wake up on the wrong side of history. A 2-hour macro deep dive, compressed for signal. Which insight hit hardest for you? Watch the full conversation here:' - Swan

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃