On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 04.08.2025

🧠Quote(s) of the week:

Jeroen Blokland:

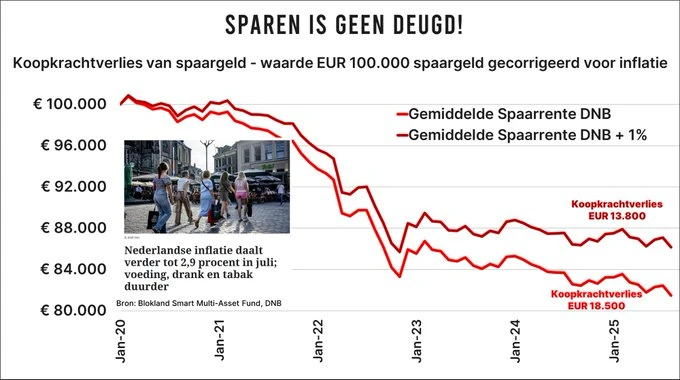

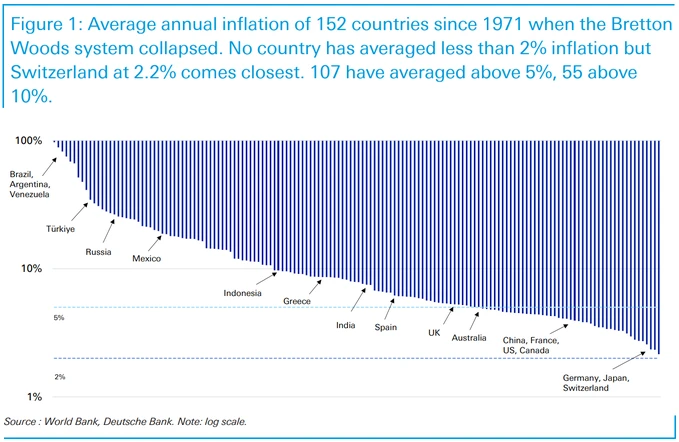

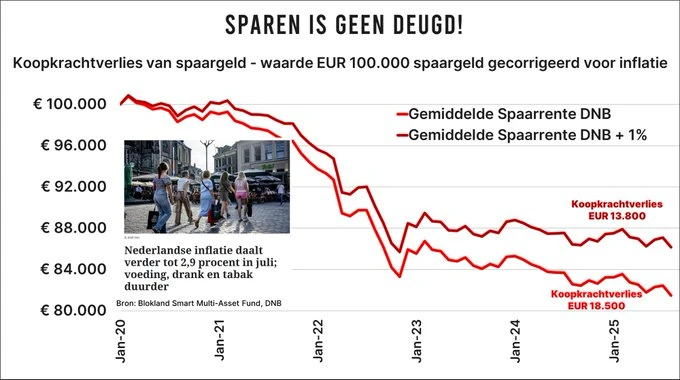

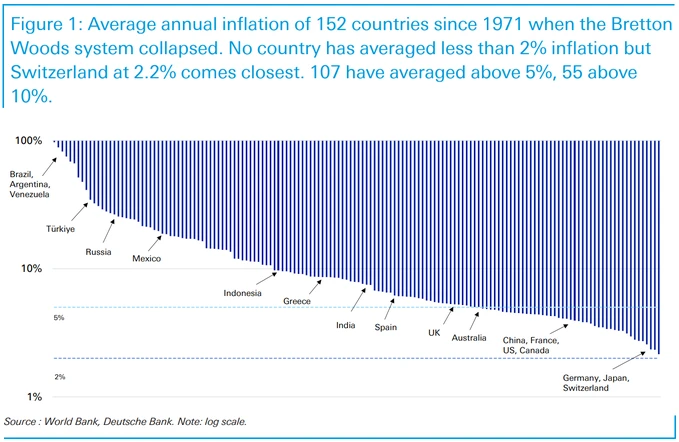

"Although I appreciate De Telegraaf’s headline, 'Dutch inflation continues to fall', I see inflation a little differently. Here are the facts: At 2.9%, inflation was still too high in July. In the last four years (48 months), Dutch inflation has been above 2% a total of 44 times (!). The average inflation rate over the past four years—brace yourself—was 5.2%. Every €100,000 in savings (we have a total of €600 billion in savings) has lost €18,000 in purchasing power since 2020 at a ‘normal’ interest rate. With that money, and the (low) interest you’ve received, you can now buy 18% fewer groceries and other goods. Current savings rates at the major banks range roughly from 1.0% to 1.5%. Every single day that prices rise faster than your interest rate, the purchasing power of your savings decreases. These are facts, hard numbers, reality. Of course, you can argue whether the reported inflation figures are accurate (chances are they’re not) or point out that you can get an extra percent of interest at underperforming Klarna (the chart shows you’d still lose 14% of your purchasing power), but I think this post speaks for itself. In a world full of debt, artificially low interest rates, high inflation, and infinite money creation, look for investments that do yield returns in today’s financial system. Have a great day!"

Got Bitcoin?

🧡Bitcoin news🧡

Study Bitcoin:

On the 28th of July:

➡️80,000 BTC is roughly the number of BTC dumped by the LFG during the $LUNA ponzi collapse in 2022 that sent us plunging into a bear market. Now it gets absorbed like (Snyder/Cavill) Superman taking a bullet. It should tell you where we are now vs where we were then.

➡️Grok 4 Heavy, the most advanced AI model in the world, predicts Bitcoin to hit $400,000 in 97 days.

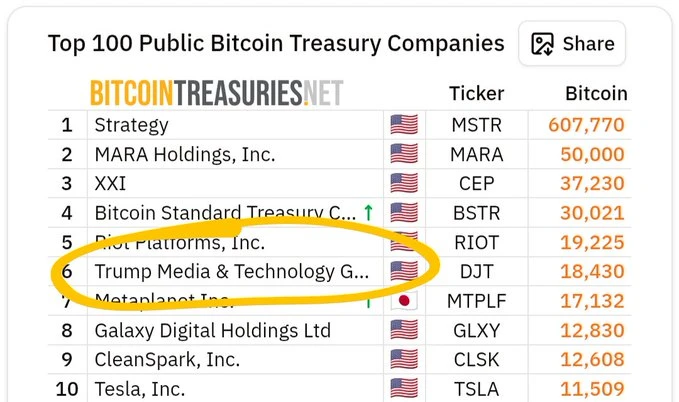

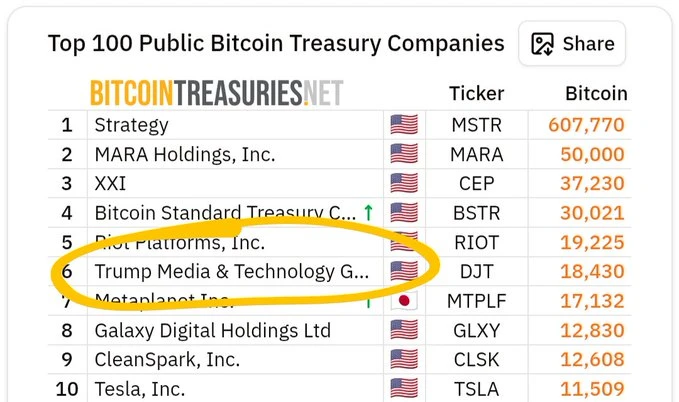

➡️Vijah Boyapati: "We went from the entire state apparatus being adversarial to Bitcoin to the 6th largest Treasury company being owned by the President's family. Not priced in."

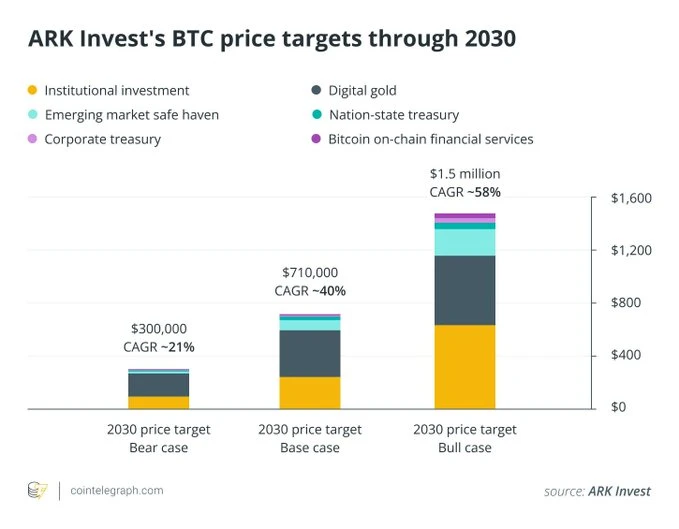

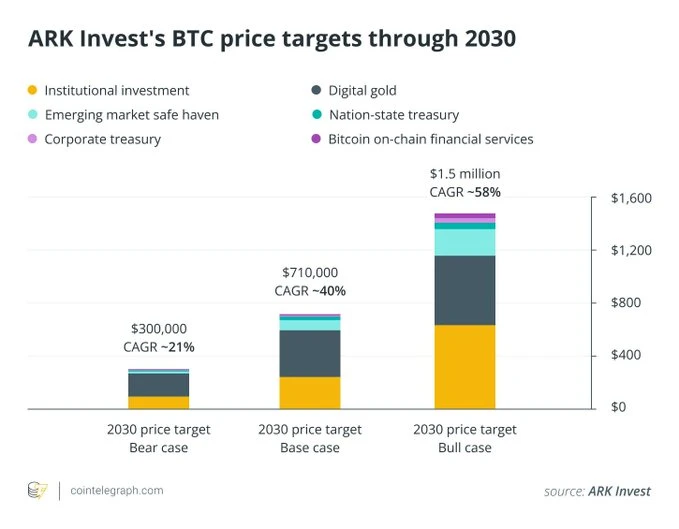

➡️Cathie Wood's Ark Invest predicts $1.5 million Bitcoin by 2030.

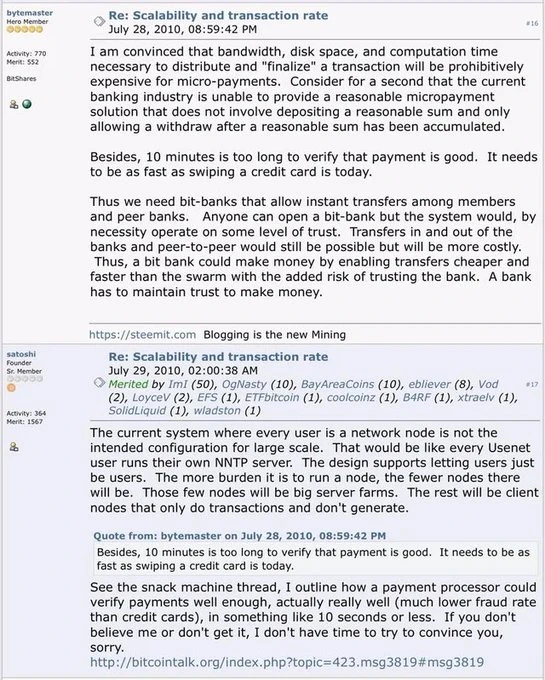

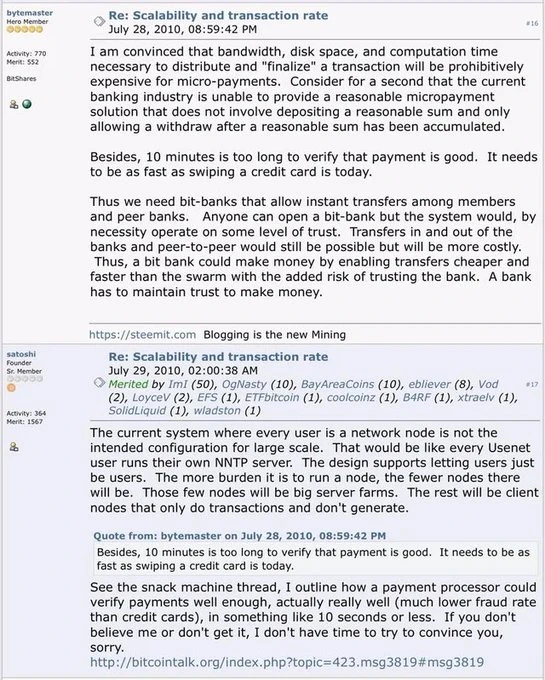

➡️Documenting Bitcoin: "Fifteen years ago today, the mysterious creator of Bitcoin, Satoshi Nakamoto, posted their most famous quote: ‘If you don't believe me or don't get it, I don't have time to try to convince you, sorry.’ At the time, you could buy a bitcoin for 6 cents."

On the 29th of July:

➡️Strategy has acquired 21,021 BTC for ~$2.46 billion at ~$117,256 per bitcoin and has achieved BTC Yield of 25.0% YTD 2025. As of 7/29/2025, we hold 628,791 Bitcoin acquired for ~$46.08 billion at ~$73,277 per Bitcoin.

On the 30th of July:

➡️America’s largest public bitcoin mining company, MARA, reports record-breaking quarter with revenue increasing 64% year-over-year to $238 million.

➡️In 2023, JPMorgan Chase CEO Jamie Dimon said he's "deeply opposed" to Bitcoin and it's for criminals. Today, JPMorgan partnered with Coinbase "to accelerate crypto adoption."

On the 31st of July:

➡️Trump’s Digital Asset Director says, "We understand the importance of this Strategic Bitcoin Reserve." "We do believe in accumulation."

➡️Here we go again, the IMF Bitcoin fud: Bitcoin consumes as much electricity as Argentina, but isn't counted in GDP because it doesn't create traditional goods or services. The updated System of National Accounts classifies crypto assets as national wealth for better economic measurement. Source:

IMF

New Standards for Economic Data Aim to Sharpen View of Global Economy

The updated System of National Accounts better captures digitalization, intangible assets, and global production—helping governments support grow...

Let's break that statement down, shall we?

'That's 0.07% of global energy use (comparable to many other random industries, and often using otherwise wasted/stranded energy). Its service is that it gives people an alternative for when the IMF comes and makes a deal with your country's government to devalue your currency.' - Lyn Alden

Great reply by Daniel Batten with sources + context:

"Misleading statistic because much of Bitcoin's energy usage is often from stranded, wasted sources that others cannot utilize. It has also been shown in 20 peer reviewed papers and 7 independent studies to stabilize and decarbonize grids, mitigate methane and lower electricity prices and is 52.4% sustainably powered (unlike the much lower sustainable power mix of the banking industry, and gold mining - which Bitcoin provides viable and technologically superior alternatives to) source:

X (formerly Twitter)

Daniel Batten (@DSBatten) on X

The list keeps growing!

There are now 20 peer reviewed articles showing Bitcoin has significant environmental benefits.

1. How Bitcoin Can Supp...

Contrary to the implications of this tweet, Bitcoin has 19 well documented usecases that create value to society.

Source:

X (formerly Twitter)

Daniel Batten (@DSBatten) on X

19 benefits of Bitcoin that most people have never heard about...

Note: these are not hypothetical, or isolated benefits - but existing uses that ...

Important context: Bitcoin threatens the IMF with disintermediation in 5 ways, which I have categorized previously here -->

X (formerly Twitter)

Daniel Batten (@DSBatten) on X

Why is the IMF so critical of Bitcoin? Why was the IMF so intent on imposing strict anti-Bitcoin conditions over El Salvador?

Simple. Bitcoin rep...

and the IMF has a reputation for openly opposing Bitcoin, repeatedly citing "concerns" that have consistently failed to materialize. (source:

Bitcoin Magazine

How The IMF Prevents Global Bitcoin Adoption (And Why They Do It)

IMF loans halt nation-state Bitcoin plans—only debt-free countries like Bhutan push forward. Grassroots use still thrives.

) Its perspective on Bitcoin is neither neutral nor objective."

Bitcoin is a highly circular economy asset since it can be used over and over again indefinitely, with very low friction of order 1% in transaction fees. It's a superior monetary technology and asset, superior to SDRs since it is not losing, but gaining in purchasing power, is available to all, and has a highly decentralized triple-entry ledger fully replicated to tens of thousands of nodes. And it is the most efficient tool available in turning energy into a lifeline for those suffering under policies imposed by the IMF. Nothing beats Bitcoin's energy-to-lifeboat ratio.

Anyway, got Bitcoin?

➡️Congress green-lit a $3.4 trillion spending package through the Big Beautiful Bill. What does that mean for Americans? Your dollars are on the path to devaluation. Excellent post (

X (formerly Twitter)

River (@River) on X

Congress green-lit a $3.4 trillion spending package through the Big Beautiful Bill.

What does that mean for Americans?

Your dollars are on the pa...

) , and article on where the US dollar is going and why BTC is the most secure long play we have.

River

How Does Money Printing Work? | River Learn - Bitcoin Markets

Learn the basics of money creation and discover the key players involved, including the Federal Reserve and the U.S. Treasury. Understand how digit...

➡️El Salvador and Bolivia sign a deal to integrate Bitcoin and crypto into Bolivia’s financial system. Crypto activity in Bolivia surged 6x after lifting its 2024 ban. Now the nation is working with Bukele’s team to build an economy.' - Bitcoin Archive

➡️Bitcoin-based Bitcoin’s Acceleration Phase continues with five new ATH closes in July. Momentum from Q2—where 54 of 91 days saw high profit and high volatility—appears intact. We’ll continue to watch closely for signs of a potential blow-off top.'- Fidelity

➡️Algeria bans all Bitcoin and cryptocurrency activities, including trading, ownership, and mining. Violations face 2-12 months in prison and/or fines of 200,000-1,000,000 dinars ($1,500-$7,700).' -Bitcoin News

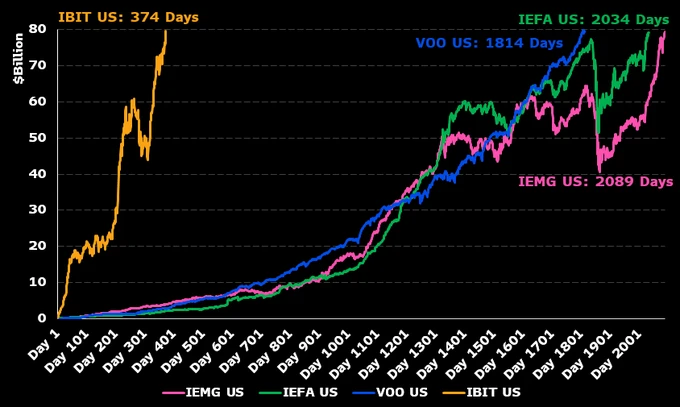

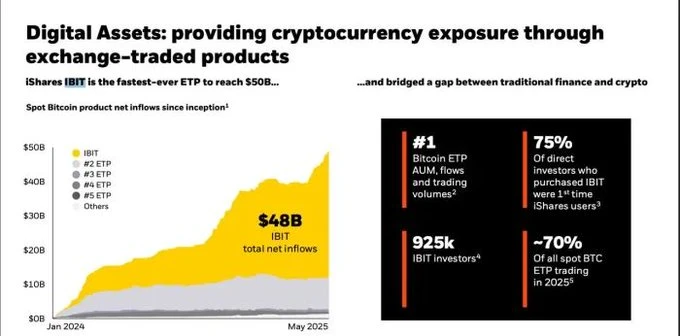

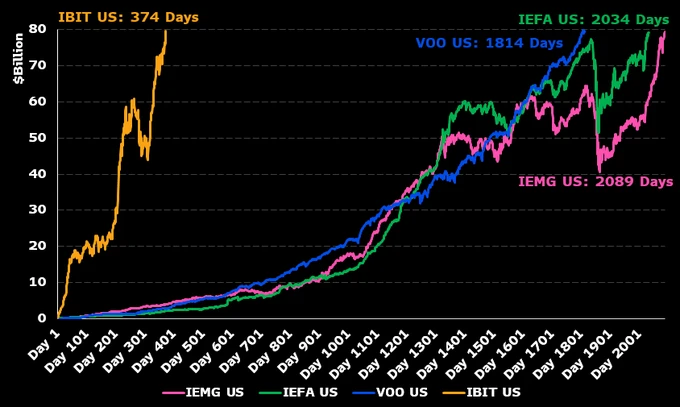

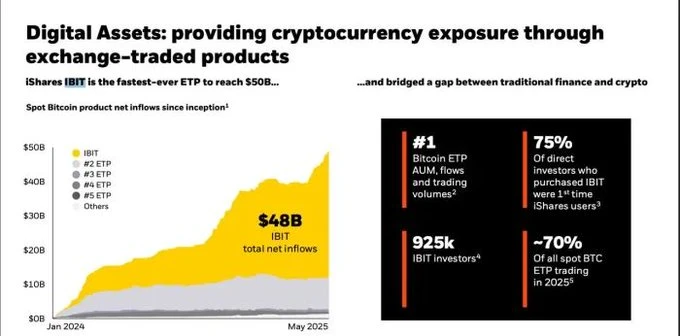

➡️ BlackRock's Bitcoin ETF is the fastest-growing ETF ever. 80B AUM in just over a year. Unheard of. Meanwhile, Vanguard refuses to offer a Bitcoin ETF to its clients. Are they even a real business?

One disclaimer, though. One of the biggest MSTR shareholders -> Vanguard.

➡️Charles Edwards: 'Institutional net buying just breached 97% of all transactions. The last time net buying by the pros was this high was August 2020. Those who know, know.'

Unique alpha indicators are only available at

Capriole Investments

Capriole Investments | Charts

Leading systematic Bitcoin + Macro hedge fund deploying a quantitative strategy.

.

➡️The United States SEC Chairman Paul Atkins today says, “The right to have self-custody of one's private property is a core American value. I believe deeply in the right to use a self-custodial digital wallet to maintain personal crypto assets.”

➡️Bitcoin whales bought 1% of the total supply in the last 4 months. Big money is stacking.

➡️Balaji: By 2035, you will have the Democrats side with the Chinese Communists, and Republicans will become Bitcoin Maximalists after MAGA maximalism. After Orange Man, Orange Coin. Statement is from a great podcast:

➡️The White House Releases New Report Comparing Bitcoin and Crypto to the Railroads and the Internet.

➡️Clean energy provider PowerBank to establish a Bitcoin treasury, partnering with Intellistake for security, custody, and Bitcoin operations.

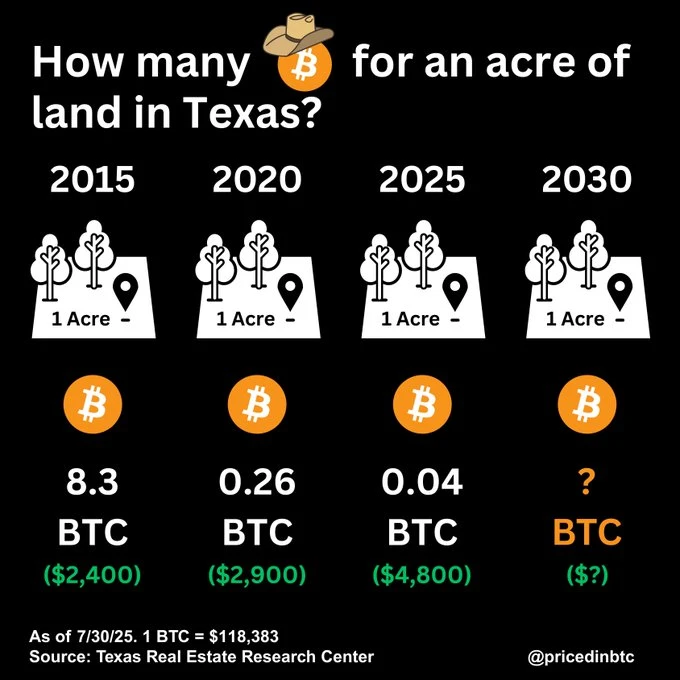

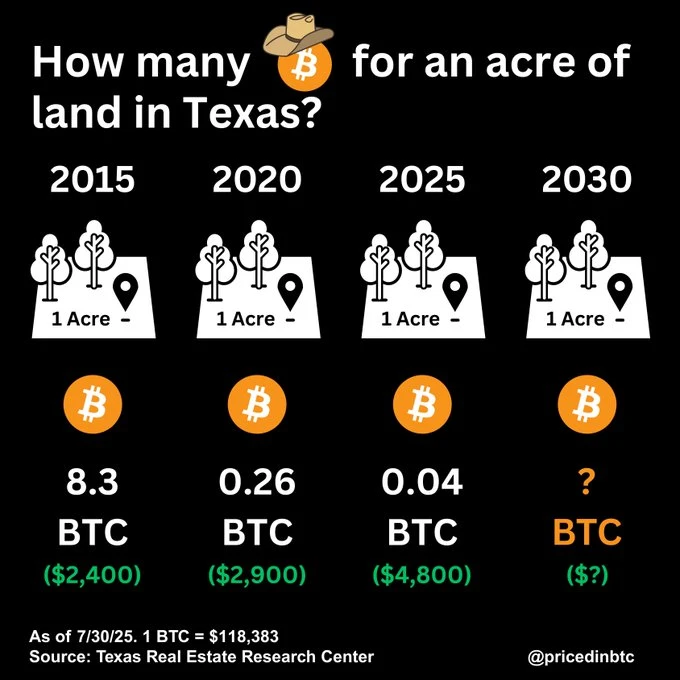

➡️Priced in Bitcoin:

"How many Bitcoins for an acre of Texas land?

2015 → 8.3 BTC ($2,400)

2020 → 0.26 BTC ($2,900)

2025 → 0.04 BTC ($4,800)

Land in fiat: +100%

Land in BTC: –99%

At this rate, by 2030, you’ll get a ranch for a fraction of a coin."

➡️Crypto bank Anchorage Digital just bought $1.2 BILLION Bitcoin.

➡️Michael Saylor's STRATEGY files $4.2B STRC offering, plans to buy more Bitcoin with proceeds.

Proposed IPO of $500 million Upsized to $2.52 billion due to demand Largest perpetual preferred IPO since 2009 Files to sell another $4.2 billion All of this in 11 days, by the way. $30T in short-duration credit has been starving for yield. Bitcoin is fixing it.

On the 1st of August:

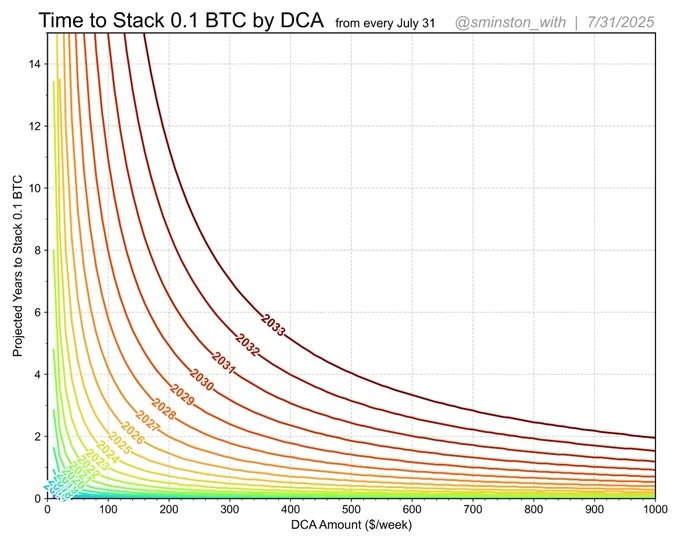

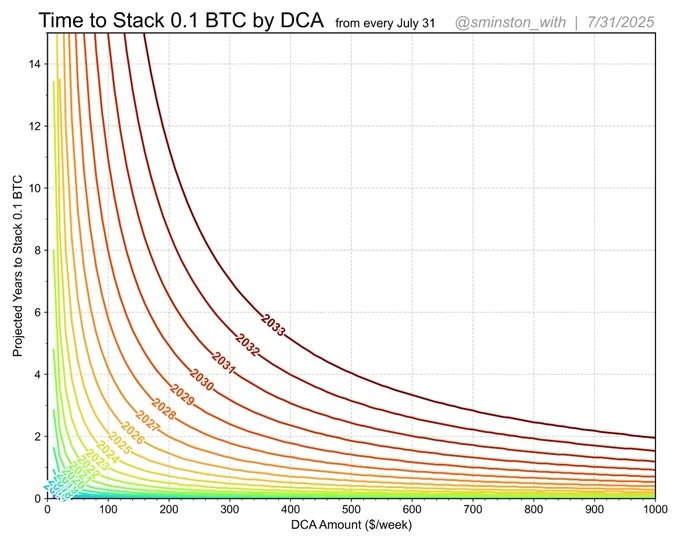

➡️Sminston With: How long will it take you to stack 0.1 BTC if you start with $100/ week now? 2 years.

If you start on July 31, 2030, it will be 11 years.

If you start in 2033, when Bitcoin is $1M, even stacking $1000/ week will take 2 years to stack 0.1.

Something to ponder on. There is no timing the market with ₿, it’s all about time in the market. Buy what you can, when you can, and save in Bitcoin. Simple. Not always easy. Start today, when time is on your side.

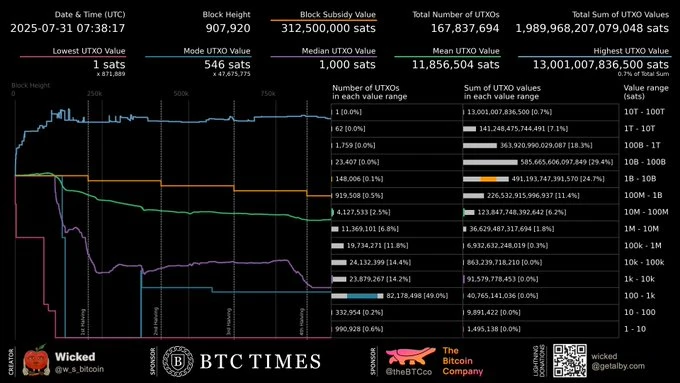

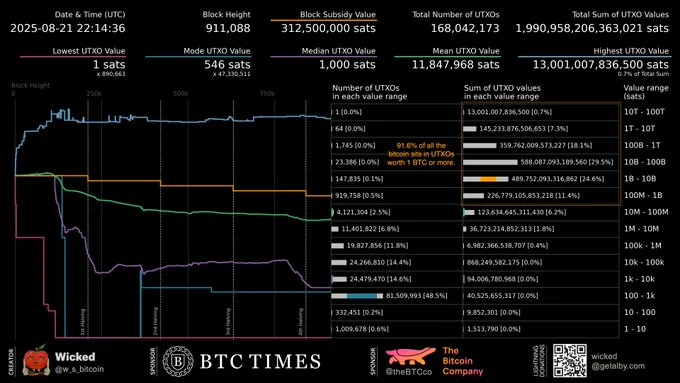

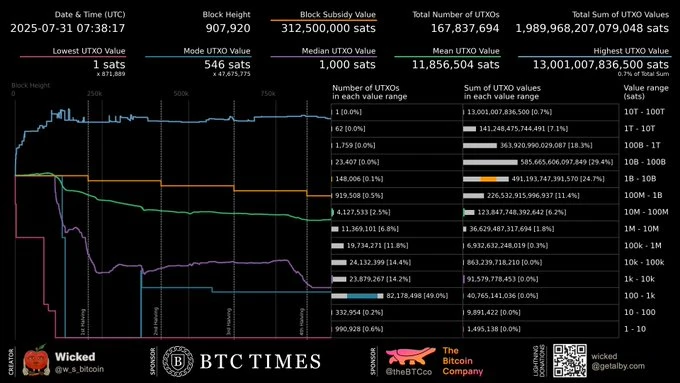

➡️Wicked: The largest Bitcoin UTXO holds over 13 trillion sats (130k+ BTC) and is locked in a P2WSH 3-of-5 multisig with all 5 of its public keys exposed. If you had a quantum computer and wanted to cause the most chaos, this would likely be one of your primary targets.

➡️Charles Edwards: Bitcoin Energy Value just hit a new record of $135K. Never before has price moved so gradually along the undervalued bound as the fair value of Bitcoin grows consistently with time. Two key findings:

The market is growing conservatively (no hype)

Bitcoin is unbelievably still undervalued today

➡️Bitcoin achieves its highest monthly close ever at $115K.

➡️'BlackRock Bitcoin ETF hits 1 million investors 75% are new clients. IBIT holds $87B 70% of all spot Bitcoin ETF trading. It seems like Bitcoin is taking over TradFi.' - Bitcoin Archive

➡️Garrit Goggin: 'The last time the Buffett Indicator was this far above trend, the HUI rose 222%, Gold 24%, and the Nasdaq 100 fell 64% over the following 3 years.'

When valuations get this stretched, history doesn’t whisper, it yells. Oh, and this time we have Bitcoin.

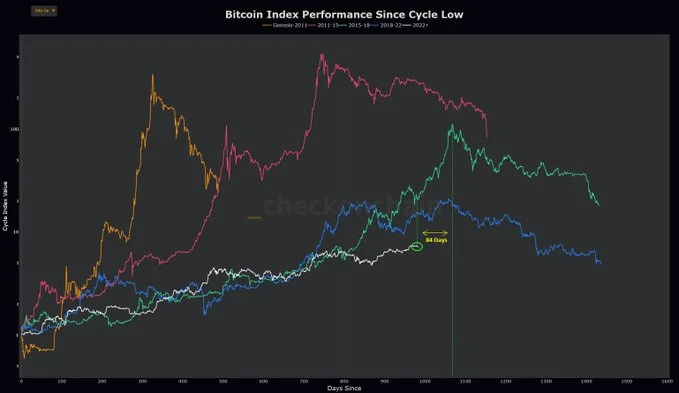

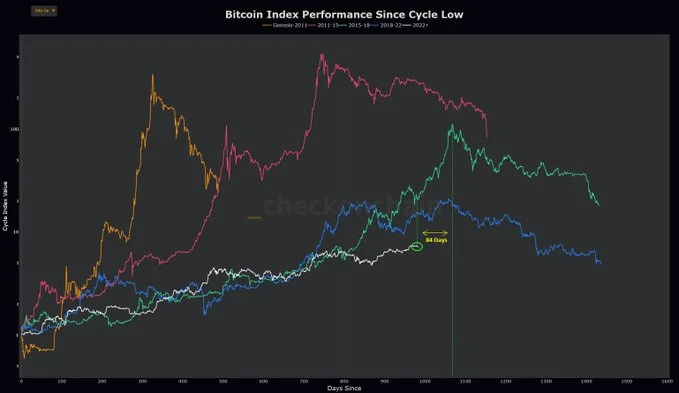

➡️OnChainCollege: 'From a cycle timing standpoint, Bitcoin is at a similar point to the 34% correction in 2017 that was just 84 days before the cycle top. From there, the price did a 6x. Short-term noise ≠ long-term trend.'

On the 3rd of August:

➡️China has officially banned cryptocurrency trading, mining, and related services. Again! haha

➡️Bitcoin hard drive worth $950M lost forever. James Howells ends 10-year search. After 12 years, James Howells, the man who accidentally threw away a hard drive with 8000 Bitcoin in 2013 (now worth $950M), has finally ended his search. The hard drive will be worth ~$8B by 2030, mark my words! I know, kinda a bold claim. But why not?

On the 4th of August:

➡️Although this is more something for the segment Macro/Geopolitics, I wanted to share the following tweet by Jeroen Blokand:

"Print this chart and hang it on your wall! Since the collapse of the Bretton Woods gold standard, NO country has managed to keep inflation at 2%. ZERO, NONE! Not Japan, not Switzerland, just nobody. Use this chart to update your knowledge and understanding of central banks and the 'value' of your currency. Enjoy your day!"

But by all means, entrust your savings and pension to (central) bankers. They never lie about inflation or Keynesian sectarian pseudo-scientific topics. Oh well, spend fiat, save Bitcoin. Whilst doing that, study Bitcoin.

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoind Did: The State of Bitcoin Adoption | Troy Cross & Ella Hough

Troy Cross and Ella Hough break down the state of Bitcoin adoption across the U.S. and the globe, revealing what the data really says about Bitcoin’s political alignment, institutional shift, and cultural future.

We get into the surprising statistics around self-custody, what Gen Z actually thinks about Bitcoin, and whether American bitcoiners can become a meaningful political force.

In this episode:

Who owns Bitcoin

What Gen-Z think of Bitcoin

The myth of political consensus around Bitcoin

Bitcoin as a language of truth across culture, time, and power

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 01.09.2025

🧠Quote(s) of the week:

James Lavish: "If you want to protest anything, protest central bank monetary manipulation that steals purchasing power from you daily. And the way to do that is by buying Bitcoin." @James Lavish

The great promise of Bitcoin—its great and noble ambition—is that, some years from now, it will perhaps have healed the institution of money in our civilization.

🧡Bitcoin news🧡

On the 25th of August:

➡️The Bitcoin Fear and Greed Index is now almost back at "Fear" - Bitcoin Magazine Pro

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 01.09.2025

🧠Quote(s) of the week:

James Lavish: "If you want to protest anything, protest central bank monetary manipulation that steals purchasing power from you daily. And the way to do that is by buying Bitcoin." @James Lavish

The great promise of Bitcoin—its great and noble ambition—is that, some years from now, it will perhaps have healed the institution of money in our civilization.

🧡Bitcoin news🧡

On the 25th of August:

➡️The Bitcoin Fear and Greed Index is now almost back at "Fear" - Bitcoin Magazine Pro

On the 26th of August:

➡️Semiconductor firm Sequans to raise $200 MILLION to buy Bitcoin for its treasury.

➡️By opening 401ks to alternative investments, the Trump administration just unlocked a $7 trillion market for Bitcoin. "This isn't regulatory capture, it's almost regulatory surrender."

Bitcoin News: "Did you know that new SEC Chair, Paul Atkins, has disclosed owning $6 million in crypto?'

➡️86% of Strategy’s 3,081 BTC purchase this week came from tapping the ATM and selling common MSTR shares.' -Bitcoin News

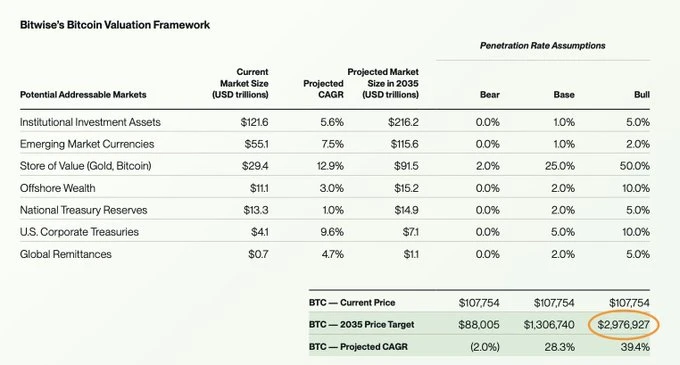

➡️Bitcoin News: "In its inaugural 'Bitcoin Long-Term Capital Market Assumptions, Bitwise lays out its bull case. Bitwise predicts Bitcoin could hit nearly $3 MILLION by 2035. Base case: $1.3M Bear case: $88K Bull case: $2.97M Too bullish or too bearish?"

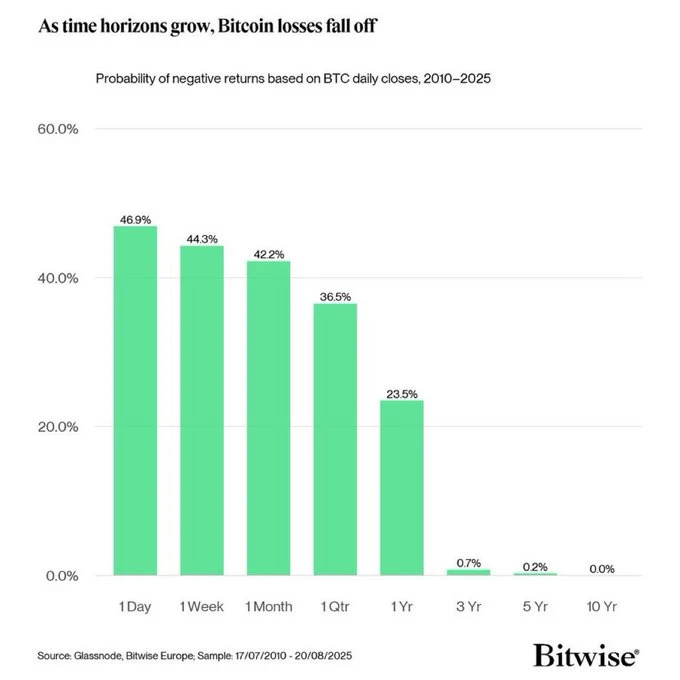

➡️As shared last week, but a great reminder: If you hold Bitcoin for 3+ years, your odds of losing money are basically 0%.

On the 27th of August:

➡️A Bitcoin whale sent 750 BTC worth approximately $83 million to Binance, according to Nansen. They bought it 12 years ago for $322. Many whales have been selling recently. Once the market absorbs this supply, Bitcoin is likely to move higher.

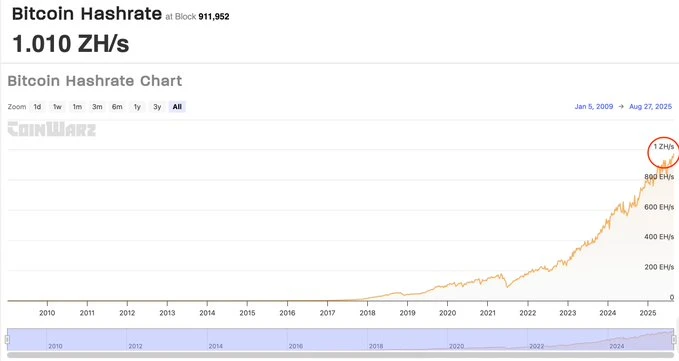

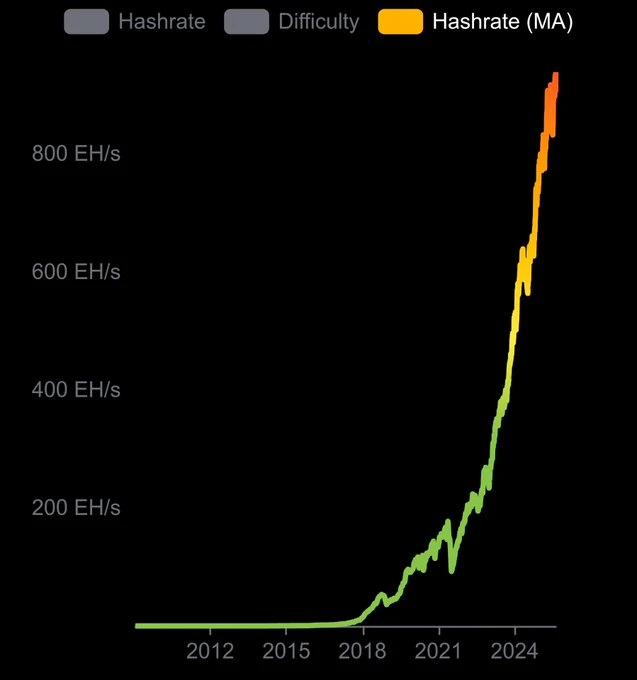

➡️Bitcoin Archive: "Bitcoin total hash rate reaches a new all-time high. Hash precedes price."

On the 26th of August:

➡️Semiconductor firm Sequans to raise $200 MILLION to buy Bitcoin for its treasury.

➡️By opening 401ks to alternative investments, the Trump administration just unlocked a $7 trillion market for Bitcoin. "This isn't regulatory capture, it's almost regulatory surrender."

Bitcoin News: "Did you know that new SEC Chair, Paul Atkins, has disclosed owning $6 million in crypto?'

➡️86% of Strategy’s 3,081 BTC purchase this week came from tapping the ATM and selling common MSTR shares.' -Bitcoin News

➡️Bitcoin News: "In its inaugural 'Bitcoin Long-Term Capital Market Assumptions, Bitwise lays out its bull case. Bitwise predicts Bitcoin could hit nearly $3 MILLION by 2035. Base case: $1.3M Bear case: $88K Bull case: $2.97M Too bullish or too bearish?"

➡️As shared last week, but a great reminder: If you hold Bitcoin for 3+ years, your odds of losing money are basically 0%.

On the 27th of August:

➡️A Bitcoin whale sent 750 BTC worth approximately $83 million to Binance, according to Nansen. They bought it 12 years ago for $322. Many whales have been selling recently. Once the market absorbs this supply, Bitcoin is likely to move higher.

➡️Bitcoin Archive: "Bitcoin total hash rate reaches a new all-time high. Hash precedes price."

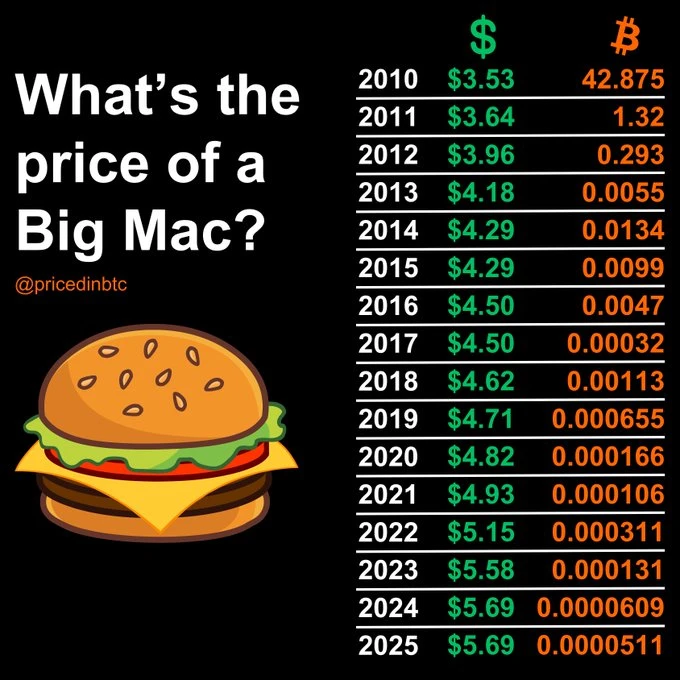

➡️Priced in Bitcoin: "The Big Mac Index, Priced in BTC.

2015: ₿0.0099

2020: ₿0.000166

2025: ₿0.0000609

In 10 years: -99% in BTC, while USD +33%. Everything priced in bitcoin tends to zero.

➡️Priced in Bitcoin: "The Big Mac Index, Priced in BTC.

2015: ₿0.0099

2020: ₿0.000166

2025: ₿0.0000609

In 10 years: -99% in BTC, while USD +33%. Everything priced in bitcoin tends to zero.

On the 29th of August:

➡️River: Every Bitcoiner started as a critic. But as we pay attention and dig deeper, one by one, we change our minds. And all of them end up capitulating! @River

➡️Lyn Alden: "There's so much drama/chatter about bitcoin's boring price action. Just grinding generally upward with higher highs and lows. Since this has roughly been my base case (bullish but boring), I went and wrote a sci-fi book during this time. You can just kind of skip boring things."

On the 29th of August:

➡️River: Every Bitcoiner started as a critic. But as we pay attention and dig deeper, one by one, we change our minds. And all of them end up capitulating! @River

➡️Lyn Alden: "There's so much drama/chatter about bitcoin's boring price action. Just grinding generally upward with higher highs and lows. Since this has roughly been my base case (bullish but boring), I went and wrote a sci-fi book during this time. You can just kind of skip boring things."

➡️How can this be…I was told they only use Bitcoin to launder money.

➡️How can this be…I was told they only use Bitcoin to launder money.

On the 30th of August:

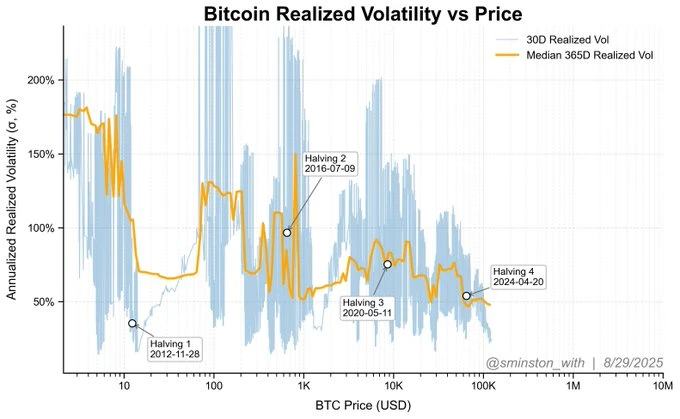

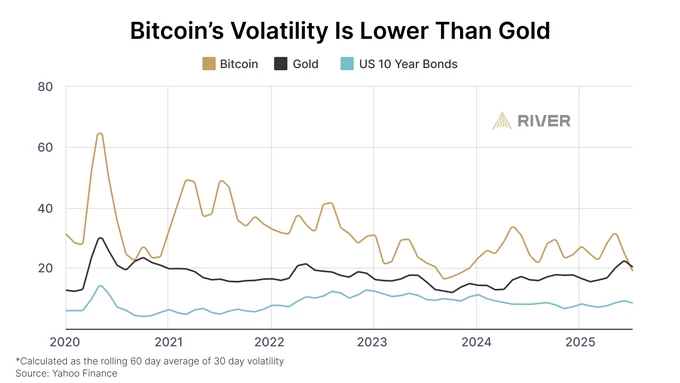

➡️Reminder: Bitcoin's volatility has been trending down since its inception. The trend also follows price, which Bitcoin has scaled by 7 orders of magnitude. Moving toward $1M Bitcoin will represent moving into a fully mature asset class, from which the early investors (you) will have greatly benefited, especially while enduring the stormy seas. Showing: Bitcoin's annualized 30-day volatility as a % (along with the rolling median). Bitcoin’s volatility: the ultimate chart.

On the 30th of August:

➡️Reminder: Bitcoin's volatility has been trending down since its inception. The trend also follows price, which Bitcoin has scaled by 7 orders of magnitude. Moving toward $1M Bitcoin will represent moving into a fully mature asset class, from which the early investors (you) will have greatly benefited, especially while enduring the stormy seas. Showing: Bitcoin's annualized 30-day volatility as a % (along with the rolling median). Bitcoin’s volatility: the ultimate chart.

Both Bitcoin volatility and returns have unquestionably followed a clear, diminishing pattern, which is logical and expected for a financial asset and network undergoing a stabilization process.

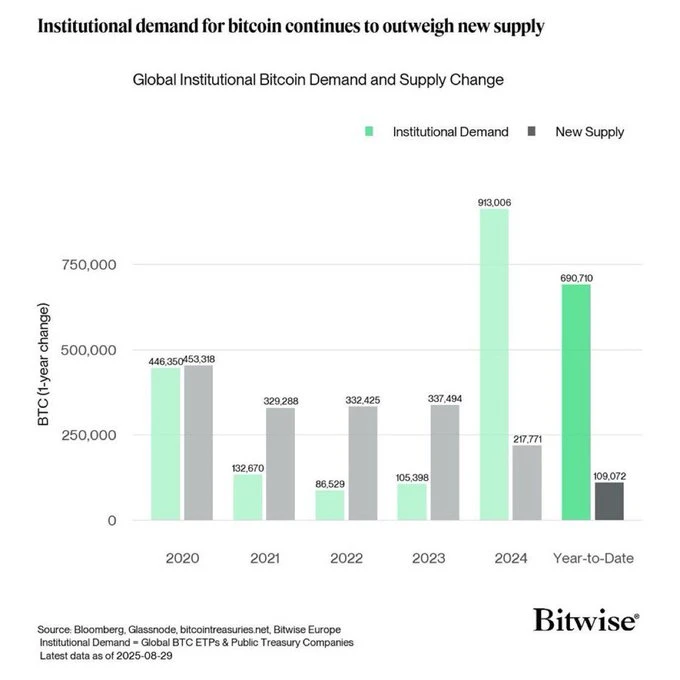

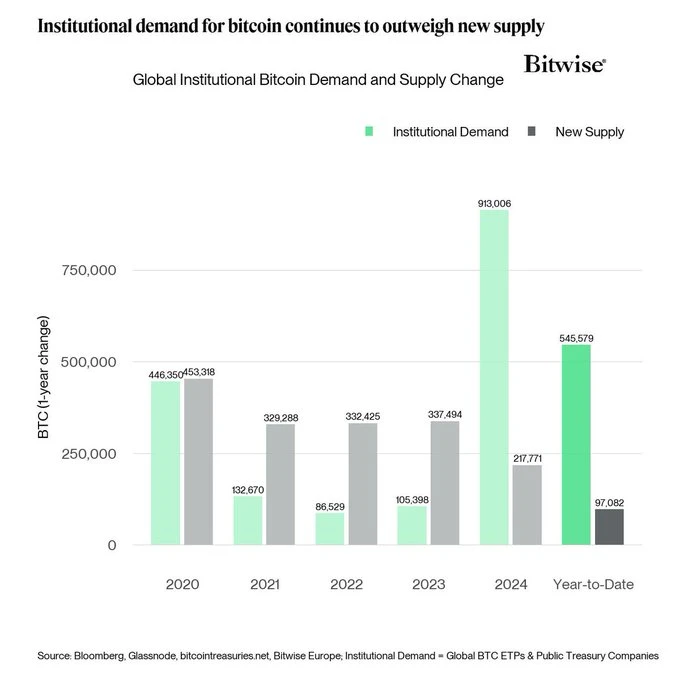

➡️ Institutions bought 690,710 BTC this year vs only 109,072 BTC mined. – Bitwise: That’s 6x more demand than supply.

Both Bitcoin volatility and returns have unquestionably followed a clear, diminishing pattern, which is logical and expected for a financial asset and network undergoing a stabilization process.

➡️ Institutions bought 690,710 BTC this year vs only 109,072 BTC mined. – Bitwise: That’s 6x more demand than supply.

➡️'New York’s Bitcoin bar @PubKey is rolling out a new deal: all payments made in Bitcoin get 21% off. That’s beers, burgers, dogs, and merch, everything on the menu.' -Bitcoin News

➡️West Main Self Storage buys an additional 0.088 #Bitcoin and now holds a total of 0.43 BTC.

On the 30th of August:

➡️Bitcoin Archive: "Bitcoin whale who sold 24,000 BTC last week just sent another 2,000 BTC to an exchange. Watch out for volatility again this weekend."

➡️"El Salvador has begun redistributing its National Strategic Bitcoin Reserve into multiple unused addresses, each capped at 500 BTC. The move enhances long-term security and reduces exposure to quantum threats by keeping public keys hashed and unused." -Bitcoin News

On the 31st of August:

➡️BLACKROCK: "If every millionaire in the U.S. asked their financial advisor to get them 1 Bitcoin, there wouldn’t be enough."

On the 1st of September:

➡️Michael Saylor's STRATEGY could join the S&P500 as early as this Friday. Passive index funds would be forced to buy billions in Bitcoin exposure.

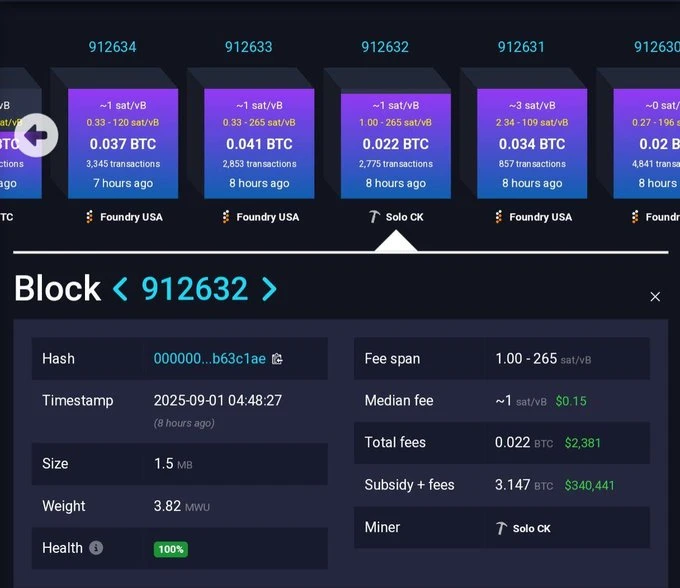

➡️Solo miner mines an entire Bitcoin block worth $340,000. They won the Bitcoin lottery.

➡️'New York’s Bitcoin bar @PubKey is rolling out a new deal: all payments made in Bitcoin get 21% off. That’s beers, burgers, dogs, and merch, everything on the menu.' -Bitcoin News

➡️West Main Self Storage buys an additional 0.088 #Bitcoin and now holds a total of 0.43 BTC.

On the 30th of August:

➡️Bitcoin Archive: "Bitcoin whale who sold 24,000 BTC last week just sent another 2,000 BTC to an exchange. Watch out for volatility again this weekend."

➡️"El Salvador has begun redistributing its National Strategic Bitcoin Reserve into multiple unused addresses, each capped at 500 BTC. The move enhances long-term security and reduces exposure to quantum threats by keeping public keys hashed and unused." -Bitcoin News

On the 31st of August:

➡️BLACKROCK: "If every millionaire in the U.S. asked their financial advisor to get them 1 Bitcoin, there wouldn’t be enough."

On the 1st of September:

➡️Michael Saylor's STRATEGY could join the S&P500 as early as this Friday. Passive index funds would be forced to buy billions in Bitcoin exposure.

➡️Solo miner mines an entire Bitcoin block worth $340,000. They won the Bitcoin lottery.

➡️The world's third-largest hydroelectric power plant in Paraguay turns renewable hydropower into Bitcoin.

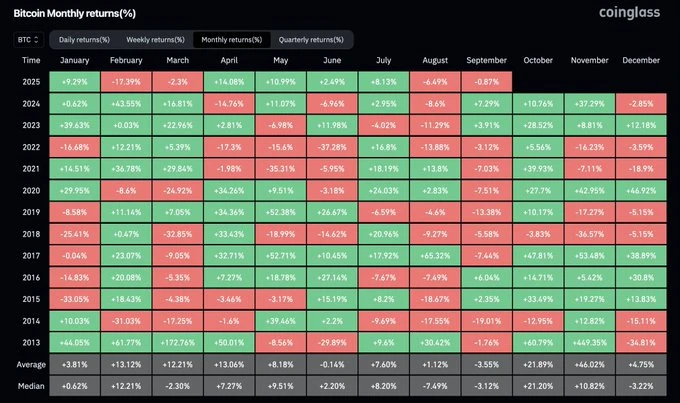

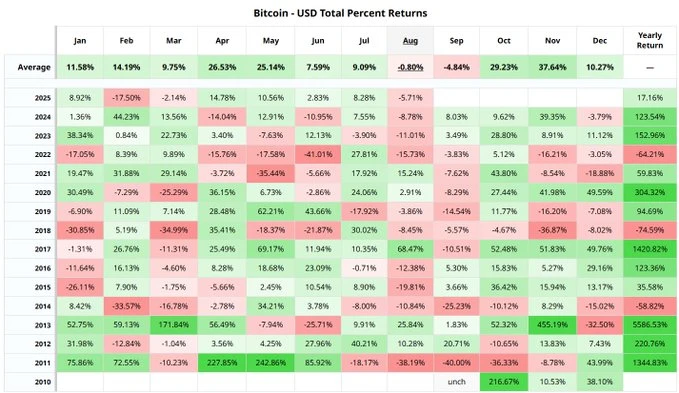

➡️'Bitcoin closed August in the red for the 4th consecutive year. September is historically Bitcoin’s weakest month. Watch for a bottom this month before a surge in Q4.' - Bitcoin Archive

➡️The world's third-largest hydroelectric power plant in Paraguay turns renewable hydropower into Bitcoin.

➡️'Bitcoin closed August in the red for the 4th consecutive year. September is historically Bitcoin’s weakest month. Watch for a bottom this month before a surge in Q4.' - Bitcoin Archive

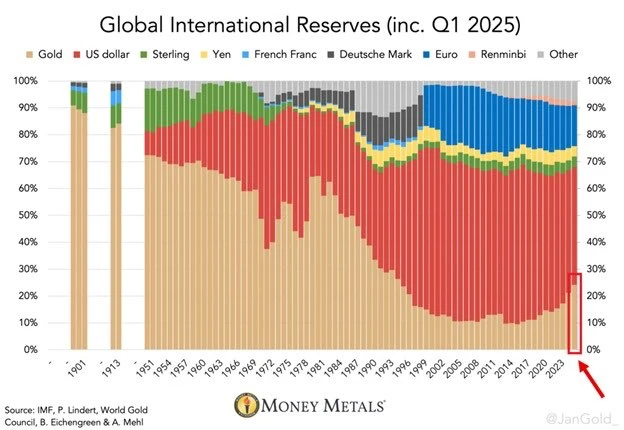

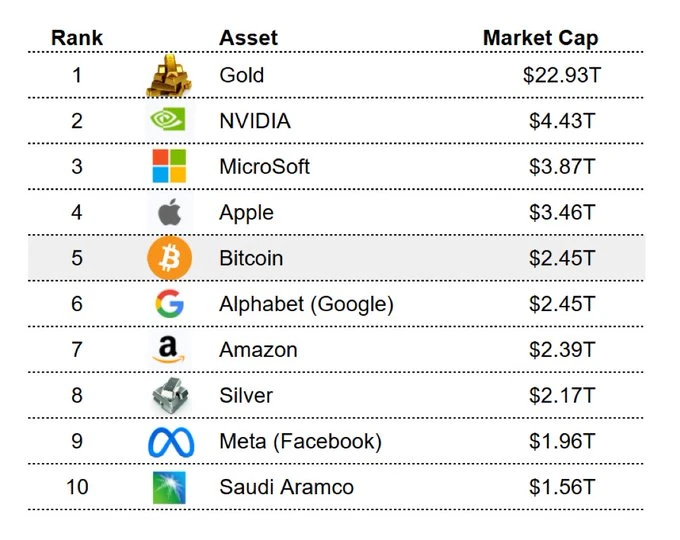

➡️The dollar is losing reserve currency status. It’s down to 42% of global reserves, and gold is rapidly rising. - Balaji

Some context: Gold's share of global international reserves rose 3 percentage points in Q1 2025, to 24%, the highest in 30 years. This marks the 3rd consecutive annual increase. Meanwhile, the US Dollar's share declined ~2 percentage points, to 42%, the lowest since the mid-1990s. The Euro share remained roughly unchanged at ~15%. Gold is now the world’s second-largest reserve asset after surpassing the Euro in 2024. Gold is seeing historic levels of demand.

➡️The dollar is losing reserve currency status. It’s down to 42% of global reserves, and gold is rapidly rising. - Balaji

Some context: Gold's share of global international reserves rose 3 percentage points in Q1 2025, to 24%, the highest in 30 years. This marks the 3rd consecutive annual increase. Meanwhile, the US Dollar's share declined ~2 percentage points, to 42%, the lowest since the mid-1990s. The Euro share remained roughly unchanged at ~15%. Gold is now the world’s second-largest reserve asset after surpassing the Euro in 2024. Gold is seeing historic levels of demand.

Something Bitcoin flavour to add on.

Something Bitcoin flavour to add on.

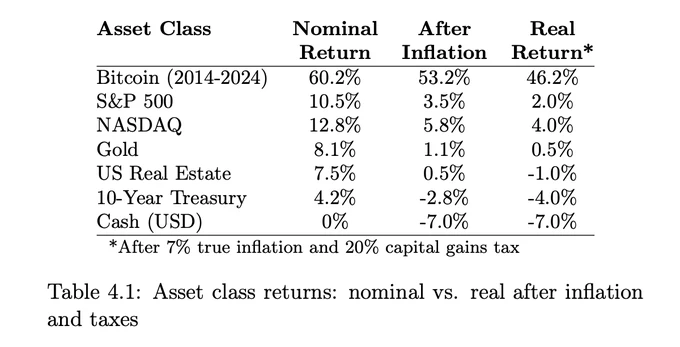

What do you need besides this table, really? More Bitcoin! All aside, Bitcoin % will be max 20-30% in the next decade. Considering the alternatives, still the best.

Show this to your co-workers, friends, or family members if they ask you how to get started with investing. There is only one answer...

🎁If you have made it this far, I would like to give you a little gift:

For those who haven't gotten a chance to read Broken Money, remember that @Lyn Alden has a 30-minute animated video of it as well:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

What do you need besides this table, really? More Bitcoin! All aside, Bitcoin % will be max 20-30% in the next decade. Considering the alternatives, still the best.

Show this to your co-workers, friends, or family members if they ask you how to get started with investing. There is only one answer...

🎁If you have made it this far, I would like to give you a little gift:

For those who haven't gotten a chance to read Broken Money, remember that @Lyn Alden has a 30-minute animated video of it as well:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

On the 18th of August:

➡️Thailand launches a program to allow foreign visitors to convert Bitcoin and crypto into local currency.

➡️I hate dumbducks like Jacob King:

On the 18th of August:

➡️Thailand launches a program to allow foreign visitors to convert Bitcoin and crypto into local currency.

➡️I hate dumbducks like Jacob King:

Ah, the great panic of the faithful—Foundry burps out eight blocks in a row and suddenly the sky is falling. Eight in a row with ~40% of the hash? That’s not black magic, that’s probability yawning and stretching. The White Paper told you plainly in Section 5: miners and nodes are the same, and there have never been more than a dozen or two in operation at any given time. Right now, you’re looking at about 13. So the spectacle here isn’t proof of decentralisation’s corpse; it’s just mathematics paying its rent on time.

Shanaka Anslem Perera: "Everyone screaming 'centralization' at 8 Foundry blocks in a row is missing the actual signal. Bitcoin is not a stock you hold; it is a thermodynamic truth encoded in math. Mining is probabilistic … streaks happen. Fees collapsing and empty blocks don’t mean “Bitcoin is dead,” they mean the network is clearing, like the ocean at low tide before the next wave. The real centralization risk isn’t Foundry or Antpool. It’s the fiat system you’re still trapped in. Bitcoin is the only network where power is checked by physics itself: SHA-256, difficulty adjustment, and block time. No CEO, no government, no central bank can override it. Eight blocks in a row isn’t a death knell. It’s a reminder. Bitcoin doesn’t care about your fear. It runs on a clock deeper than nation-states, deeper than empires. The longest chain always wins."

Spot on!

On the 19th of August:

➡️Royal Bank of Canada increased its MSTR stake by nearly 16% in Q2 2025, per new SEC filing.

➡️Bitcoin is dead, again!

Ah, the great panic of the faithful—Foundry burps out eight blocks in a row and suddenly the sky is falling. Eight in a row with ~40% of the hash? That’s not black magic, that’s probability yawning and stretching. The White Paper told you plainly in Section 5: miners and nodes are the same, and there have never been more than a dozen or two in operation at any given time. Right now, you’re looking at about 13. So the spectacle here isn’t proof of decentralisation’s corpse; it’s just mathematics paying its rent on time.

Shanaka Anslem Perera: "Everyone screaming 'centralization' at 8 Foundry blocks in a row is missing the actual signal. Bitcoin is not a stock you hold; it is a thermodynamic truth encoded in math. Mining is probabilistic … streaks happen. Fees collapsing and empty blocks don’t mean “Bitcoin is dead,” they mean the network is clearing, like the ocean at low tide before the next wave. The real centralization risk isn’t Foundry or Antpool. It’s the fiat system you’re still trapped in. Bitcoin is the only network where power is checked by physics itself: SHA-256, difficulty adjustment, and block time. No CEO, no government, no central bank can override it. Eight blocks in a row isn’t a death knell. It’s a reminder. Bitcoin doesn’t care about your fear. It runs on a clock deeper than nation-states, deeper than empires. The longest chain always wins."

Spot on!

On the 19th of August:

➡️Royal Bank of Canada increased its MSTR stake by nearly 16% in Q2 2025, per new SEC filing.

➡️Bitcoin is dead, again!

Joe Consorti: Bitcoin has spent 131 days above $100k since it first broke it, with 43 days spent above $110k. Last cycle, BTC only spent 39 days above $60k. This consolidation above $100k is extremely healthy relative to prior cycles. Zoom out, and relax.

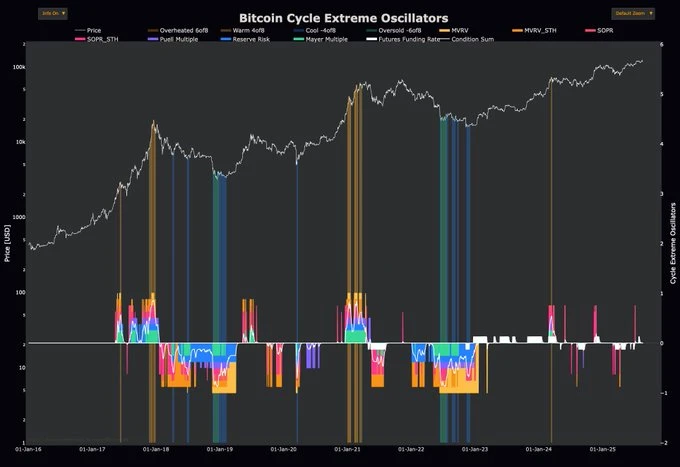

➡️On-Chain Collega: Let me be clear: This is not what Bitcoin cycle tops look like.

Joe Consorti: Bitcoin has spent 131 days above $100k since it first broke it, with 43 days spent above $110k. Last cycle, BTC only spent 39 days above $60k. This consolidation above $100k is extremely healthy relative to prior cycles. Zoom out, and relax.

➡️On-Chain Collega: Let me be clear: This is not what Bitcoin cycle tops look like.

➡️Air Canada pension fund reveals $161 MILLION Bitcoin allocation. This is Canada's first large pension fund with a Bitcoin allocation.

➡️David Bailey’s KindlyMD acquires 5,744 Bitcoin for $678.9 MILLION.

➡️Tether appoints former white house crypto council executive director Bo Hines as strategic advisor for digital assets and U.S. strategy

➡️Tech Giant Google increases stake in Bitcoin miner TeraWulf to 14%.

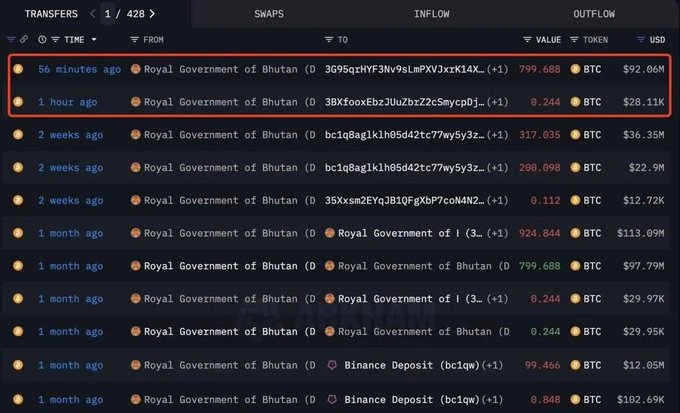

➡️Bhutan government transfers 800 BTC ($92M). Bhutan holds 9,969 BTC ($1.15B).

➡️Air Canada pension fund reveals $161 MILLION Bitcoin allocation. This is Canada's first large pension fund with a Bitcoin allocation.

➡️David Bailey’s KindlyMD acquires 5,744 Bitcoin for $678.9 MILLION.

➡️Tether appoints former white house crypto council executive director Bo Hines as strategic advisor for digital assets and U.S. strategy

➡️Tech Giant Google increases stake in Bitcoin miner TeraWulf to 14%.

➡️Bhutan government transfers 800 BTC ($92M). Bhutan holds 9,969 BTC ($1.15B).

➡️Ark 21Shares sells 559.85 Bitcoin worth $64.4 million.

➡️$829 billion Bernstein predicts the bull market extending into 2027 and bitcoin hitting $150,000–$200,000 in the next year

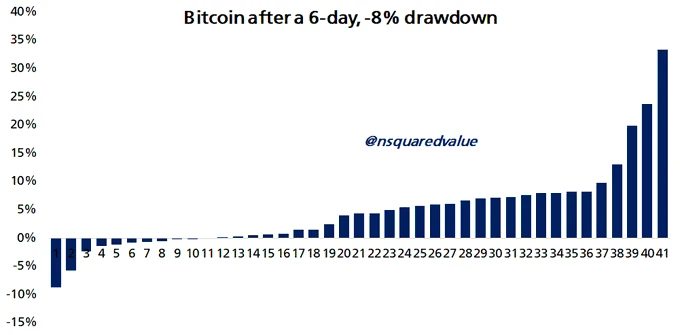

➡️Timothy Peterson: 'Bitcoin is down -8% in the past 6 days. This has happened 41 times since 2022. What happens next? In the following 6 days, Bitcoin was up 66% of the time. The average gain was 8%. If it did lose money, the average loss was only -3%.'

➡️Ark 21Shares sells 559.85 Bitcoin worth $64.4 million.

➡️$829 billion Bernstein predicts the bull market extending into 2027 and bitcoin hitting $150,000–$200,000 in the next year

➡️Timothy Peterson: 'Bitcoin is down -8% in the past 6 days. This has happened 41 times since 2022. What happens next? In the following 6 days, Bitcoin was up 66% of the time. The average gain was 8%. If it did lose money, the average loss was only -3%.'

On the 20th of August:

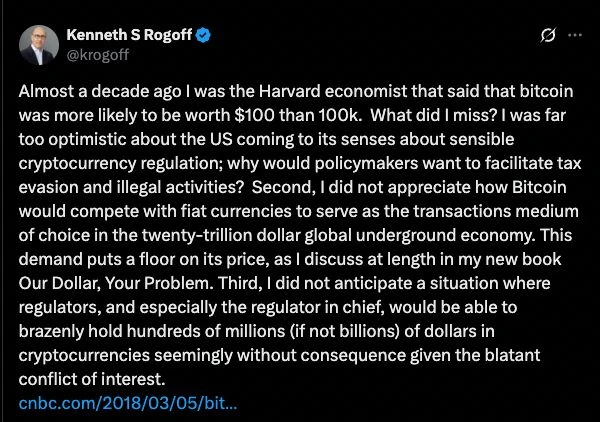

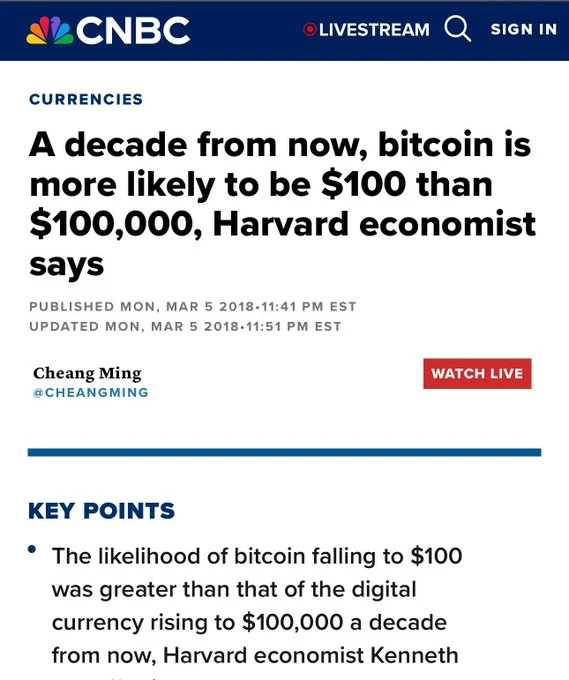

➡️Harvard economist who was wrong about Bitcoin crashing to $100 in 2018 now says the world is wrong, he's still right.

On the 20th of August:

➡️Harvard economist who was wrong about Bitcoin crashing to $100 in 2018 now says the world is wrong, he's still right.

Translation: I wasn't wrong; everyone else is stupid.

Translation: I wasn't wrong; everyone else is stupid.

Bravo, everyone. We're all more intellectually honest than a Harvard economist. This Harvard economist still proclaims that BTC, now the 6th largest global asset, is worthless. His thesis for the last 7 years has been thoroughly gutted, yet he refuses to accept new information.

James Lavish: "Understanding Bitcoin requires you to check your ego at the door and forget everything you have been programmed to believe about fiat and inflation."

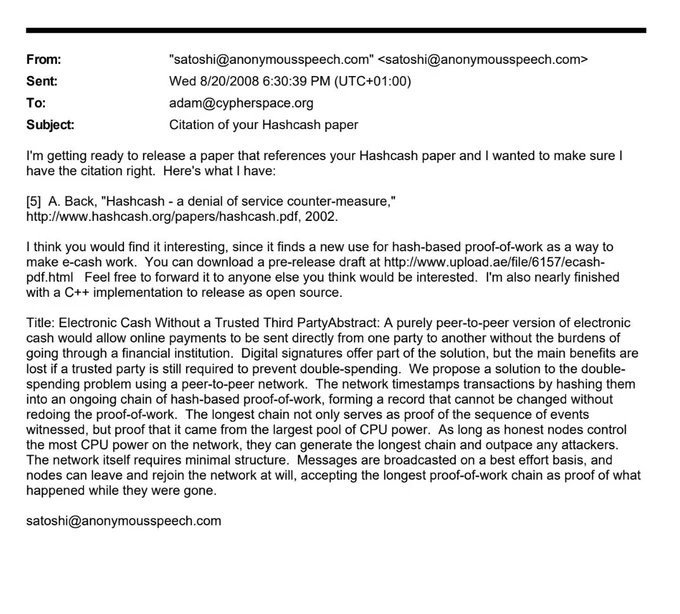

➡️'BITCOIN HISTORY: Satoshi first emailed Adam Back about Bitcoin 17 years ago today.' - Bitcoin Archive

Bravo, everyone. We're all more intellectually honest than a Harvard economist. This Harvard economist still proclaims that BTC, now the 6th largest global asset, is worthless. His thesis for the last 7 years has been thoroughly gutted, yet he refuses to accept new information.

James Lavish: "Understanding Bitcoin requires you to check your ego at the door and forget everything you have been programmed to believe about fiat and inflation."

➡️'BITCOIN HISTORY: Satoshi first emailed Adam Back about Bitcoin 17 years ago today.' - Bitcoin Archive

➡️SoFi partners with Lightspark to launch Lightning-enabled international money transfers.

➡️River: Bitcoin's volatility has been lower than gold's for the longest period in history.

➡️SoFi partners with Lightspark to launch Lightning-enabled international money transfers.

➡️River: Bitcoin's volatility has been lower than gold's for the longest period in history.

➡️Swedish health tech company H100 Group acquires 102 BTC, bringing its total holdings to 911 BTC.

On the 21st of August:

➡️Pennsylvania lawmakers introduce House Bill 1812, which would ban public officials from owning Bitcoin or crypto. Violations could bring fines or even jail time.

➡️One of the world’s LARGEST financial institutions, Allianz, has gained Bitcoin exposure through MicroStrategy.

➡️

➡️Swedish health tech company H100 Group acquires 102 BTC, bringing its total holdings to 911 BTC.

On the 21st of August:

➡️Pennsylvania lawmakers introduce House Bill 1812, which would ban public officials from owning Bitcoin or crypto. Violations could bring fines or even jail time.

➡️One of the world’s LARGEST financial institutions, Allianz, has gained Bitcoin exposure through MicroStrategy.

➡️  Now I hear you say, UTXOs? What? Here you go:

Now I hear you say, UTXOs? What? Here you go:

On top of that, Michael Saylor’s STRATEGY now meets all criteria for S&P 500 inclusion. If added, it could trigger $10B+ of passive inflows.

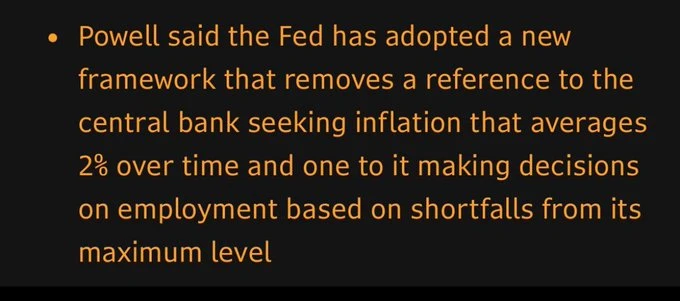

➡️'Powell, Chair of the Federal Reserve, says the Fed is moving away from its strict 2% inflation framework. They’re going to let inflation run hot. Buy as much Bitcoin as you can.' - Bitcoin Archive

On top of that, Michael Saylor’s STRATEGY now meets all criteria for S&P 500 inclusion. If added, it could trigger $10B+ of passive inflows.

➡️'Powell, Chair of the Federal Reserve, says the Fed is moving away from its strict 2% inflation framework. They’re going to let inflation run hot. Buy as much Bitcoin as you can.' - Bitcoin Archive

James Lavish is spot on: 'And just like that, a 'target' becomes a 'feeling', and one that won't feel good to the vast majority of Americans.'

On top of that, Powell suggested current conditions 'may warrant' interest rate cuts. Bitcoin rose 76.9% from last September to December when the Fed cut rates. Today, the Fed opened the door to cut rates in September, once again. I know, different market, no elections, etc, but still.

Preston Pysh on Powell's statements: "Fiat is so fragile and manipulated that some old dude can mutter 15 words and markets around the world whip-saw to the tune of trillions of dollars in a matter of minutes. Humans have built their entire exchange of energy between each other on this scheme of a system. Decades later, we will truly laugh at how primitive it all was."

Anyway, if you are new to all this...let me explain how this will unfold:

The market goes down, people panic

The Fed lowers rates and prints money

Markets boom and people are happy

Printed money causes too much inflation

The Fed (central banks) hikes rates

Repeat until (hyper)inflation

Rinse and repeat, as we sit back & stack sats.

➡️ The Philippines House introduces a bill to establish a strategic Bitcoin reserve.

➡️First-time Bitcoin buyers added 50,000 BTC last week. Large holders bought another 16,000 BTC. Accumulation is accelerating.

➡️$250 MILLION Bitcoin and crypto shorts liquidated in the past 4 hours.

On the 23rd of August:

➡️Spot Bitcoin ETFs surged to a record $134.6 billion in Q2. Institutions reported $33.6 billion in holdings via 13F filings.

On the 24th of August:

➡️Probability of Positive Bitcoin Returns Per Holding Period: •1 Day: 53.1% •1 Week: 55.7% •1 Month: 57.8% •1 Qtr: 63.5% •1 Yr: 76.5% •3 Yr: 99.3% •5 Yr: 99.8% •10 Yr: 100%

James Lavish is spot on: 'And just like that, a 'target' becomes a 'feeling', and one that won't feel good to the vast majority of Americans.'

On top of that, Powell suggested current conditions 'may warrant' interest rate cuts. Bitcoin rose 76.9% from last September to December when the Fed cut rates. Today, the Fed opened the door to cut rates in September, once again. I know, different market, no elections, etc, but still.

Preston Pysh on Powell's statements: "Fiat is so fragile and manipulated that some old dude can mutter 15 words and markets around the world whip-saw to the tune of trillions of dollars in a matter of minutes. Humans have built their entire exchange of energy between each other on this scheme of a system. Decades later, we will truly laugh at how primitive it all was."

Anyway, if you are new to all this...let me explain how this will unfold:

The market goes down, people panic

The Fed lowers rates and prints money

Markets boom and people are happy

Printed money causes too much inflation

The Fed (central banks) hikes rates

Repeat until (hyper)inflation

Rinse and repeat, as we sit back & stack sats.

➡️ The Philippines House introduces a bill to establish a strategic Bitcoin reserve.

➡️First-time Bitcoin buyers added 50,000 BTC last week. Large holders bought another 16,000 BTC. Accumulation is accelerating.

➡️$250 MILLION Bitcoin and crypto shorts liquidated in the past 4 hours.

On the 23rd of August:

➡️Spot Bitcoin ETFs surged to a record $134.6 billion in Q2. Institutions reported $33.6 billion in holdings via 13F filings.

On the 24th of August:

➡️Probability of Positive Bitcoin Returns Per Holding Period: •1 Day: 53.1% •1 Week: 55.7% •1 Month: 57.8% •1 Qtr: 63.5% •1 Yr: 76.5% •3 Yr: 99.3% •5 Yr: 99.8% •10 Yr: 100%

➡️The largest bank in Norway (DNB) is now creating a Bitcoin fund for customers to buy. 20% Bitcoin exposure and 80% Bitcoin companies. Gradually, then suddenly.

➡️'For all the anticipation of nation state adoption, it's funds and corporate treasuries who've been driving this cycle Wild, when you consider that US Investment Advisors allocate just 0.006% of their portfolio to Bitcoin. We are so early' - Daniel Batten

➡️A Bitcoin whale sold 24,000 BTC worth over $2.7 billion, causing today’s -$4,000 crash in minutes. They still hold 152,874 BTC worth more than $17 BILLION.

ZeroHedge: "Now why would someone want to sell a huge block and take out the entire bid stack (3 times in a row) so that they can trigger sell momentum and accumulate much lower?"

SightBringer: "ZeroHedge nails it here: this wasn’t just a random liquidation - it was a strategic flush.

•Instead of trickling sales into ETF absorption, this whale (or entity) stacked blocks at size to nuke the bid wall, three times in a row. That’s not dumb money - that’s deliberate.

•Why? Because taking out the bid stack triggers cascading liquidations (perps, leverage longs, weak hands). That lets the same entity reload lower while ETFs, sovereigns, and corporates keep buying the net supply.

•Context: they still hold 152,874 BTC (~$17B). They’re not exiting Bitcoin - they’re playing a reflexive reset to shake out leverage and reposition.

This whale is showing us something bigger; they know the ETF/sovereign bid is infinite. So the only way to win is to force weak hands to puke and then accumulate back into the structural wall.

Deeper Truth: This isn’t bearish. It’s proof. We’re watching the old guard play their last weapon, forced volatility, against an orderbook now backed by ETFs and sovereign flows."

Even after reading all the above, ask yourself, which asset in the world can go liquid USD on a Sunday in one ≈$2.7B transaction? Bitcoin!

On the 25th of August:

➡️Strategy acquires 3,081 BTC for $356.9 million at $115,829 per Bitcoin. They now hodl 632,457 BTC acquired for $46.50 billion at $73,527 per Bitcoin.

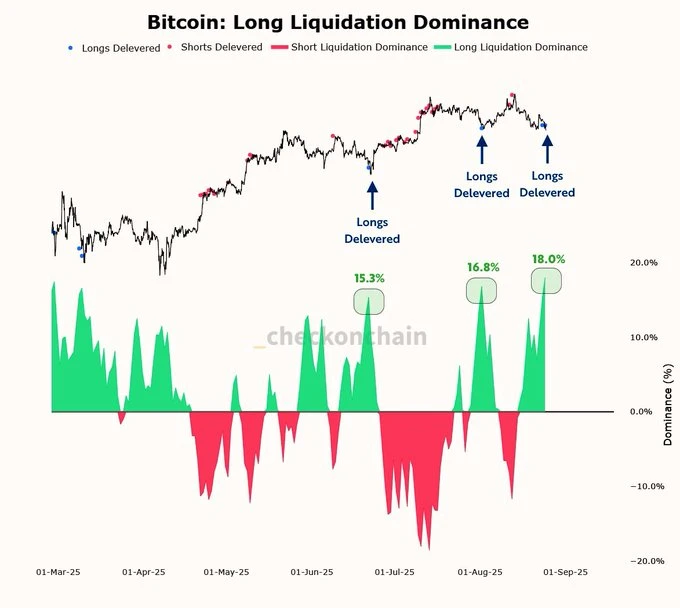

➡️Yesterday’s Bitcoin flash crash was a bigger long-deleveraging event than the tariff-driven crash we saw back in April. The clearing of leverage should allow for a healthy bounce.

➡️The largest bank in Norway (DNB) is now creating a Bitcoin fund for customers to buy. 20% Bitcoin exposure and 80% Bitcoin companies. Gradually, then suddenly.

➡️'For all the anticipation of nation state adoption, it's funds and corporate treasuries who've been driving this cycle Wild, when you consider that US Investment Advisors allocate just 0.006% of their portfolio to Bitcoin. We are so early' - Daniel Batten

➡️A Bitcoin whale sold 24,000 BTC worth over $2.7 billion, causing today’s -$4,000 crash in minutes. They still hold 152,874 BTC worth more than $17 BILLION.

ZeroHedge: "Now why would someone want to sell a huge block and take out the entire bid stack (3 times in a row) so that they can trigger sell momentum and accumulate much lower?"

SightBringer: "ZeroHedge nails it here: this wasn’t just a random liquidation - it was a strategic flush.

•Instead of trickling sales into ETF absorption, this whale (or entity) stacked blocks at size to nuke the bid wall, three times in a row. That’s not dumb money - that’s deliberate.

•Why? Because taking out the bid stack triggers cascading liquidations (perps, leverage longs, weak hands). That lets the same entity reload lower while ETFs, sovereigns, and corporates keep buying the net supply.

•Context: they still hold 152,874 BTC (~$17B). They’re not exiting Bitcoin - they’re playing a reflexive reset to shake out leverage and reposition.

This whale is showing us something bigger; they know the ETF/sovereign bid is infinite. So the only way to win is to force weak hands to puke and then accumulate back into the structural wall.

Deeper Truth: This isn’t bearish. It’s proof. We’re watching the old guard play their last weapon, forced volatility, against an orderbook now backed by ETFs and sovereign flows."

Even after reading all the above, ask yourself, which asset in the world can go liquid USD on a Sunday in one ≈$2.7B transaction? Bitcoin!

On the 25th of August:

➡️Strategy acquires 3,081 BTC for $356.9 million at $115,829 per Bitcoin. They now hodl 632,457 BTC acquired for $46.50 billion at $73,527 per Bitcoin.

➡️Yesterday’s Bitcoin flash crash was a bigger long-deleveraging event than the tariff-driven crash we saw back in April. The clearing of leverage should allow for a healthy bounce.

➡️$37,234,066,149,278.96 (+) US National Debt.

Alex Gladstein: 'There are at least 37 trillion reasons why Bitcoin will continue to increase in value.'

➡️US banks are lobbying to block stablecoin interest, warning it could trigger trillions in deposit outflows - Financial Times. Wall Street is realizing that Bitcoin and crypto are beating them at their own game.

➡️'Bitcoin has spent less than ~3 days at this price level. It's healthy to revisit and spend some time here. We're entering the weakest month for BTC seasonally, which is followed by its (historically) two best months. Go outside, touch grass, breathe, enjoy life.' - Joe Consorti

➡️$37,234,066,149,278.96 (+) US National Debt.

Alex Gladstein: 'There are at least 37 trillion reasons why Bitcoin will continue to increase in value.'

➡️US banks are lobbying to block stablecoin interest, warning it could trigger trillions in deposit outflows - Financial Times. Wall Street is realizing that Bitcoin and crypto are beating them at their own game.

➡️'Bitcoin has spent less than ~3 days at this price level. It's healthy to revisit and spend some time here. We're entering the weakest month for BTC seasonally, which is followed by its (historically) two best months. Go outside, touch grass, breathe, enjoy life.' - Joe Consorti

➡️Financial Times: Opinion: Bitcoin is either a brilliant innovation to move the world away from corruptible fiat currencies or a vast confidence trick.

Source:

➡️Financial Times: Opinion: Bitcoin is either a brilliant innovation to move the world away from corruptible fiat currencies or a vast confidence trick.

Source:  🎁If you have made it this far, I would like to give you a little gift:

Lyn Alden's August newsletter is out. It analyzes the impacts of slightly tighter fiscal and slightly looser monetary policy going forward.

🎁If you have made it this far, I would like to give you a little gift:

Lyn Alden's August newsletter is out. It analyzes the impacts of slightly tighter fiscal and slightly looser monetary policy going forward.

Tiny reminder:

Noderunners conference, November 1st.

This is your chance to join the most hardcore Bitcoin maximalists in Europe. No shitcoin talk. No VCs, Bitcoin ETF/stonks/treasury crowd. No compromise. Just pure Bitcoin signal from the brightest minds in the space.

Network with Lightning developers, node runners, miners, and the orange-pilled elite who are actually building the Bitcoin future.

So does your heartbeat orange?

Fixing the world on your mind?

Join us! Plebs, talks, workshops, beer & more!

Tickets:

Tiny reminder:

Noderunners conference, November 1st.

This is your chance to join the most hardcore Bitcoin maximalists in Europe. No shitcoin talk. No VCs, Bitcoin ETF/stonks/treasury crowd. No compromise. Just pure Bitcoin signal from the brightest minds in the space.

Network with Lightning developers, node runners, miners, and the orange-pilled elite who are actually building the Bitcoin future.

So does your heartbeat orange?

Fixing the world on your mind?

Join us! Plebs, talks, workshops, beer & more!

Tickets:

On the 12th of August:

➡️World's largest pension fund increases its Bitcoin exposure by 192% in Q2.

On the 13th of August:

➡️Charles Edwards: "Shut the front door. Yesterday, institutional Bitcoin buying represented 75% of Coinbase's volume. All readings above 75% have seen higher prices one week later."

"80% of the time in the last decade, when Bitcoin long-term holders' share of supply pulls back from a peak (like today), the price skyrocketed. When price was already rallying (like today), it was a 100%"

On the 12th of August:

➡️World's largest pension fund increases its Bitcoin exposure by 192% in Q2.

On the 13th of August:

➡️Charles Edwards: "Shut the front door. Yesterday, institutional Bitcoin buying represented 75% of Coinbase's volume. All readings above 75% have seen higher prices one week later."

"80% of the time in the last decade, when Bitcoin long-term holders' share of supply pulls back from a peak (like today), the price skyrocketed. When price was already rallying (like today), it was a 100%"  ➡️Kazakhstan approves Central Asia’s first spot Bitcoin ETF. Trading begins tomorrow.

➡️Stocks are near record highs, up 90% in dollars over 5 years but down 81% priced in bitcoin. - Priced in Bitcoin

On the 13th of August:

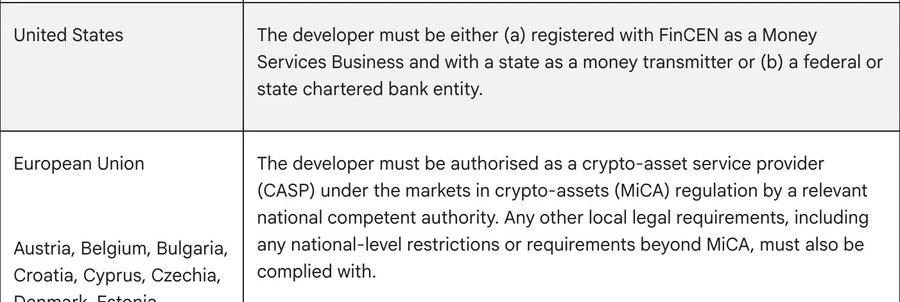

➡️Google bans unlicensed Bitcoin wallets in the U.S. and EU. The war on self-custody has begun. Google Play’s new policy could remove non-regulated wallets in the U.S. and EU starting December 2025 — hitting millions of users.

➡️Kazakhstan approves Central Asia’s first spot Bitcoin ETF. Trading begins tomorrow.

➡️Stocks are near record highs, up 90% in dollars over 5 years but down 81% priced in bitcoin. - Priced in Bitcoin

On the 13th of August:

➡️Google bans unlicensed Bitcoin wallets in the U.S. and EU. The war on self-custody has begun. Google Play’s new policy could remove non-regulated wallets in the U.S. and EU starting December 2025 — hitting millions of users.

Google Play will ban non-custodial wallets unless developers hold a FinCEN, state banking, or MiCA license. In the EU, MiCA rules effectively block such wallets entirely from the store.

On a funny note...the reason why Google just attacked Bitcoin...

Google Play will ban non-custodial wallets unless developers hold a FinCEN, state banking, or MiCA license. In the EU, MiCA rules effectively block such wallets entirely from the store.

On a funny note...the reason why Google just attacked Bitcoin...

On the 14th of August:

➡️Pledditor: "Bitcoin just made a fresh new all-time high. Let's check in on how those treasury stocks that pitched 'bitcoin as the hurdle rate' are doing: $MSTR -29% $CEPO -35% $H100 -36% $CEP -51% $MTPLF -59% $NAKA -62% $SWC -66% $MATA -69% $LQWD -79% $SQNS -79%.

Whoops."

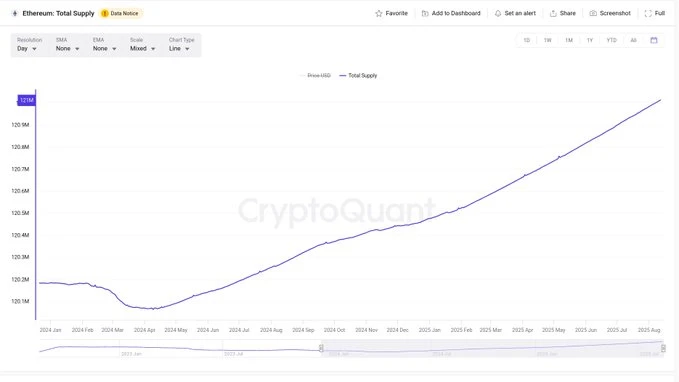

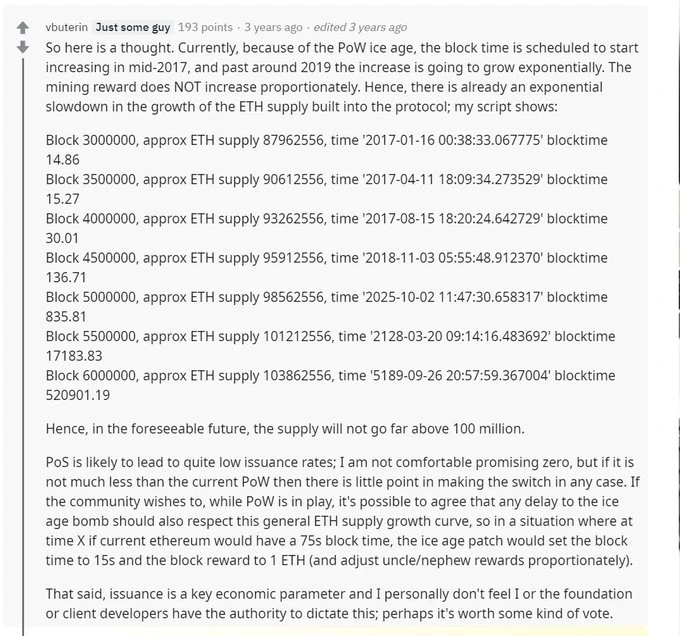

➡️"Ethereum inflated by nearly 1,000,000 ETH in just ~1 year. It's worse than I thought, and there are no signs of stopping.

Vitalik sold you Proof-of-Stake, saying ETH will become "ultra sound money". Instead, you get an unexpected 1 MILLION new ETH printed out of thin air in just 1 single year. It's no different than holding fiat currency." -Grubles.

On the 14th of August:

➡️Pledditor: "Bitcoin just made a fresh new all-time high. Let's check in on how those treasury stocks that pitched 'bitcoin as the hurdle rate' are doing: $MSTR -29% $CEPO -35% $H100 -36% $CEP -51% $MTPLF -59% $NAKA -62% $SWC -66% $MATA -69% $LQWD -79% $SQNS -79%.

Whoops."

➡️"Ethereum inflated by nearly 1,000,000 ETH in just ~1 year. It's worse than I thought, and there are no signs of stopping.

Vitalik sold you Proof-of-Stake, saying ETH will become "ultra sound money". Instead, you get an unexpected 1 MILLION new ETH printed out of thin air in just 1 single year. It's no different than holding fiat currency." -Grubles.

Oh, and by the way, about $3.31B in ETH (718,351 ETH) is currently stuck in Ethereum’s exit queue, with withdrawals estimated to take over 12 days. If some of you are still doing shitcoins, well, oh well, don't do shitcoins.

➡️US Treasury Secretary Scott Bessent says “we are not going to be buying”. Great! Would rather have Bitcoin in the hands of individuals.

➡️Jack Dorsey’s Block has released the first-ever American-made Bitcoin mining ASIC!

On the 15th of August:

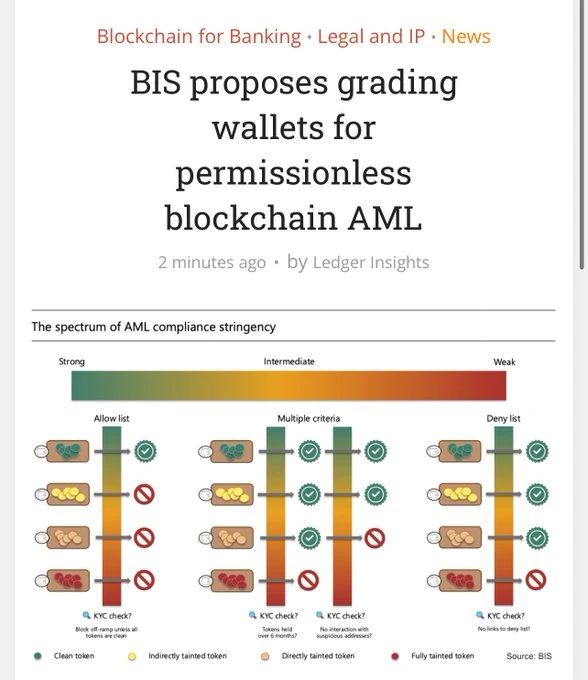

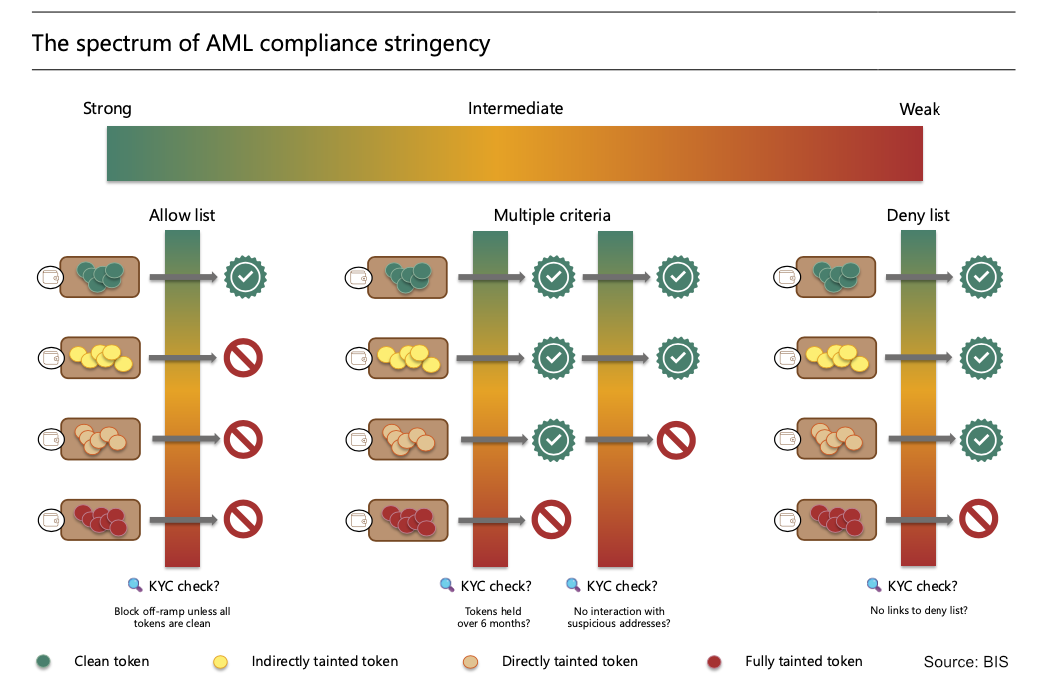

➡️BowTiedMara: "The Bank of International Settlements (BIS) wants to start marking bitcoins. The central bank of central banks is essentially proposing to create a grading system from 0 to 100 for each satoshi, based on transaction history. If the score is low, companies and even users could refuse to accept that bitcoin, claiming it would be "tainted" by links to illicit activities. If this were implemented globally, it could create a parallel market where "clean" bitcoins would have different values than "marked" bitcoins. How about you grade deez nuts?"

Oh, and by the way, about $3.31B in ETH (718,351 ETH) is currently stuck in Ethereum’s exit queue, with withdrawals estimated to take over 12 days. If some of you are still doing shitcoins, well, oh well, don't do shitcoins.

➡️US Treasury Secretary Scott Bessent says “we are not going to be buying”. Great! Would rather have Bitcoin in the hands of individuals.

➡️Jack Dorsey’s Block has released the first-ever American-made Bitcoin mining ASIC!

On the 15th of August:

➡️BowTiedMara: "The Bank of International Settlements (BIS) wants to start marking bitcoins. The central bank of central banks is essentially proposing to create a grading system from 0 to 100 for each satoshi, based on transaction history. If the score is low, companies and even users could refuse to accept that bitcoin, claiming it would be "tainted" by links to illicit activities. If this were implemented globally, it could create a parallel market where "clean" bitcoins would have different values than "marked" bitcoins. How about you grade deez nuts?"

Source:

Source:

➡️Hedge fund Brevan Howard just disclosed ownership of $2.3 BILLION worth of Bitcoin ETFs. Brevan is now the largest institutional holder of BlackRock's Bitcoin ETF.

➡️ Federal Reserve to scrap program devoted to policing banks on Bitcoin, crypto, and fintech activities.

Joe Consorti: "The Fed just killed all unlawful supervision of banks engaging in Bitcoin activities. Bitcoin as collateral, the biggest 21st-century unlock for financial institutions, is now on the table."

On the 16th of August:

➡️'Norges Bank, Norway’s central bank, increases its Bitcoin equivalent exposure from 6,200 to 11,400 BTC in Q2, an 83% jump. The position is almost entirely in Strategy (formerly MicroStrategy), with a small addition in Metaplanet.' - Bitcoin News

➡️New Record Global Bitcoin Mining Hashrate 940,000,000,000,000,000,000x per second.

➡️Hedge fund Brevan Howard just disclosed ownership of $2.3 BILLION worth of Bitcoin ETFs. Brevan is now the largest institutional holder of BlackRock's Bitcoin ETF.

➡️ Federal Reserve to scrap program devoted to policing banks on Bitcoin, crypto, and fintech activities.

Joe Consorti: "The Fed just killed all unlawful supervision of banks engaging in Bitcoin activities. Bitcoin as collateral, the biggest 21st-century unlock for financial institutions, is now on the table."

On the 16th of August:

➡️'Norges Bank, Norway’s central bank, increases its Bitcoin equivalent exposure from 6,200 to 11,400 BTC in Q2, an 83% jump. The position is almost entirely in Strategy (formerly MicroStrategy), with a small addition in Metaplanet.' - Bitcoin News

➡️New Record Global Bitcoin Mining Hashrate 940,000,000,000,000,000,000x per second.

➡️BlackRock’s Larry Fink is now interim co-chair of the WEF. He controls Wall Street. Now he controls Davos. Fink’s BlackRock currently holds nearly 750,000 BTC in its IBIT ETF. Kinda crazy and dangerous if you would ask me.

➡️Bitcoin 200-day moving average breaks above $100k for the first time EVER!

On the 17th of August:

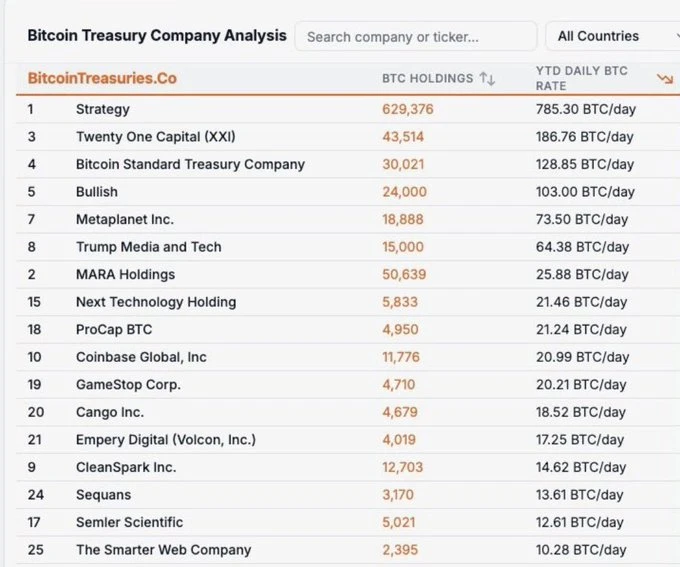

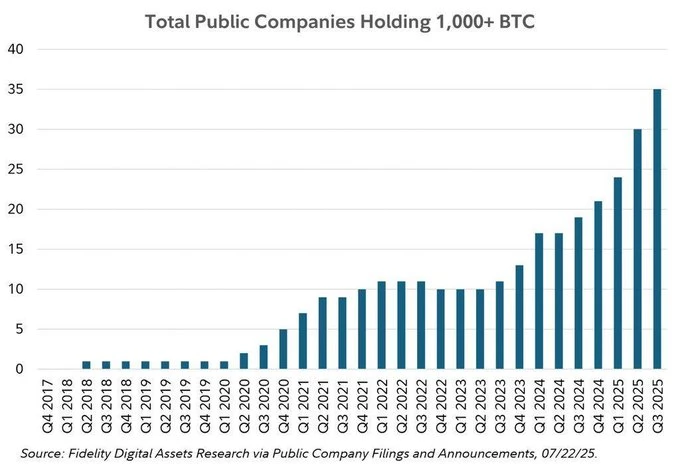

➡️Bitcoin is becoming a corporate treasury standard. 35 public companies now hold 1,000+ BTC.

➡️BlackRock’s Larry Fink is now interim co-chair of the WEF. He controls Wall Street. Now he controls Davos. Fink’s BlackRock currently holds nearly 750,000 BTC in its IBIT ETF. Kinda crazy and dangerous if you would ask me.

➡️Bitcoin 200-day moving average breaks above $100k for the first time EVER!

On the 17th of August:

➡️Bitcoin is becoming a corporate treasury standard. 35 public companies now hold 1,000+ BTC.

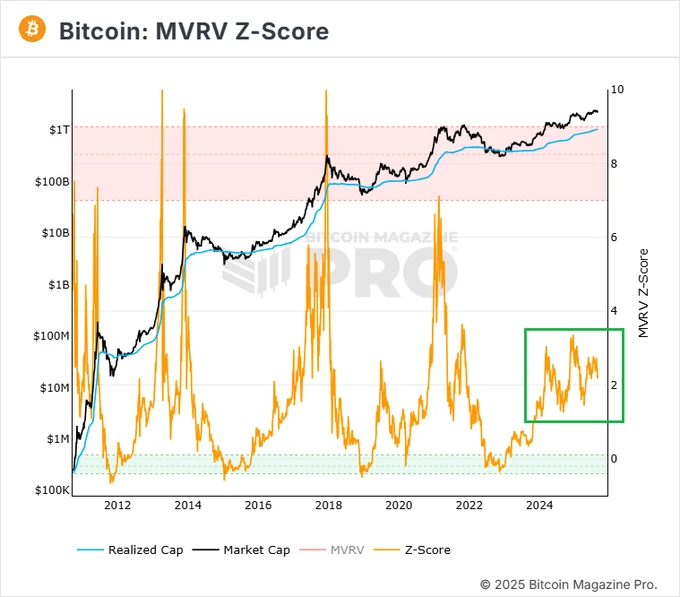

➡️'Calling a Bitcoin top here is fighting history and probability. Every prior Bitcoin bull cycle topped at the overextended MVRV +2SD line. This cycle hasn’t even reached the 1.5 SD level. The bull market continues.' -On Chain College

➡️'Calling a Bitcoin top here is fighting history and probability. Every prior Bitcoin bull cycle topped at the overextended MVRV +2SD line. This cycle hasn’t even reached the 1.5 SD level. The bull market continues.' -On Chain College

➡️Thailand launches a program to allow foreign visitors to convert Bitcoin and crypto into local currency.

➡️Strategy has acquired 430 BTC for ~$51.4 million at ~$119,666 per bitcoin and has achieved BTC Yield of 25.1% YTD 2025. As of 8/17/2025, we hodl 629,376 Bitcoin acquired for ~$46.15 billion at ~$73,320 per Bitcoin.

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: The Bitcoin Treasury Playbook | Preston Pysh

Preston Pysh gives us a masterclass on Bitcoin treasury companies, unpacking the mechanics behind Michael Saylor’s strategy and why it has outperformed Bitcoin since 2020. He explains how preferred stock and convertible debt are being engineered to funnel Bitcoin onto balance sheets, why the unraveling of the fixed-income market is the hidden fuel behind this model, and the risks investors face in treating treasury companies as a proxy for holding Bitcoin. Preston gets into the accounting controversies around MicroStrategy, the looming threat of government nationalisation, and why self-custody Bitcoin is the ultimate safeguard.

In this episode:

Why self-custody Bitcoin is important

How preferred stock and convertible debt power treasury growth

The collapse of the 40-year fixed-income bull market

Understanding premiums to NAV and dilution risks

“Ponzi-adjacent” Bitcoin treasuries

Nationalisation and centralisation risks for Bitcoin

Why the STRC issuance may be one of the most brilliant financial products ever designed

Watch here:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

➡️Thailand launches a program to allow foreign visitors to convert Bitcoin and crypto into local currency.

➡️Strategy has acquired 430 BTC for ~$51.4 million at ~$119,666 per bitcoin and has achieved BTC Yield of 25.1% YTD 2025. As of 8/17/2025, we hodl 629,376 Bitcoin acquired for ~$46.15 billion at ~$73,320 per Bitcoin.

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: The Bitcoin Treasury Playbook | Preston Pysh

Preston Pysh gives us a masterclass on Bitcoin treasury companies, unpacking the mechanics behind Michael Saylor’s strategy and why it has outperformed Bitcoin since 2020. He explains how preferred stock and convertible debt are being engineered to funnel Bitcoin onto balance sheets, why the unraveling of the fixed-income market is the hidden fuel behind this model, and the risks investors face in treating treasury companies as a proxy for holding Bitcoin. Preston gets into the accounting controversies around MicroStrategy, the looming threat of government nationalisation, and why self-custody Bitcoin is the ultimate safeguard.

In this episode:

Why self-custody Bitcoin is important

How preferred stock and convertible debt power treasury growth

The collapse of the 40-year fixed-income bull market

Understanding premiums to NAV and dilution risks

“Ponzi-adjacent” Bitcoin treasuries

Nationalisation and centralisation risks for Bitcoin

Why the STRC issuance may be one of the most brilliant financial products ever designed

Watch here:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃ On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 11.08.2025

🧠Quote(s) of the week:

Ray Dalio: The U.S. dollar used to be backed by gold — and it’s not far-fetched to think we may be headed there again in the future. History shows us that the same cycles repeat time and time again. One such cycle is related to currency devaluation. Once people start to lose trust in the fiat system, we see a specific cause-and-effect reaction occur.

Governments print a lot of money

They pay off the debt with the cheap money

Nobody wants to hold the devalued currency

Governments go back and link money to gold

Will this same pattern happen again? It’s hard to say, and it wouldn’t happen anytime soon. But it is conceivable.

ERGO: 'JUST BUY BITCOIN AND HOLD IT FOR TEN YEARS YOU DUMB FUCK.' - HodlMagoo

🧡Bitcoin news🧡

The 10 BTC Commandments.

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 11.08.2025

🧠Quote(s) of the week:

Ray Dalio: The U.S. dollar used to be backed by gold — and it’s not far-fetched to think we may be headed there again in the future. History shows us that the same cycles repeat time and time again. One such cycle is related to currency devaluation. Once people start to lose trust in the fiat system, we see a specific cause-and-effect reaction occur.

Governments print a lot of money

They pay off the debt with the cheap money

Nobody wants to hold the devalued currency

Governments go back and link money to gold

Will this same pattern happen again? It’s hard to say, and it wouldn’t happen anytime soon. But it is conceivable.

ERGO: 'JUST BUY BITCOIN AND HOLD IT FOR TEN YEARS YOU DUMB FUCK.' - HodlMagoo

🧡Bitcoin news🧡

The 10 BTC Commandments.

On the 5th of August:

➡️’Indonesia's vice president's office considers adopting Bitcoin as a national reserve asset. Bitcoin game theory is playing out.’ - Bitcoin Archive

➡️Warren Buffett's BERKSHIRE now underperforms the S&P500 by 26% percentage points.

With a 5% Bitcoin allocation, he would outperform all Indices and ETFs. Everyone needs Rat Poison Squared.

➡️Daniel Batten: "Do we need a better example of why we should separate money from the State? The UK Government is thinking of trading its Bitcoin for Pound sterling. Like living in Venezuela and trading USD for the Bolívar. Imagine rushing to get in on an asset that had lost 99.15% of its value since 2017."

On the 5th of August:

➡️’Indonesia's vice president's office considers adopting Bitcoin as a national reserve asset. Bitcoin game theory is playing out.’ - Bitcoin Archive

➡️Warren Buffett's BERKSHIRE now underperforms the S&P500 by 26% percentage points.

With a 5% Bitcoin allocation, he would outperform all Indices and ETFs. Everyone needs Rat Poison Squared.

➡️Daniel Batten: "Do we need a better example of why we should separate money from the State? The UK Government is thinking of trading its Bitcoin for Pound sterling. Like living in Venezuela and trading USD for the Bolívar. Imagine rushing to get in on an asset that had lost 99.15% of its value since 2017."

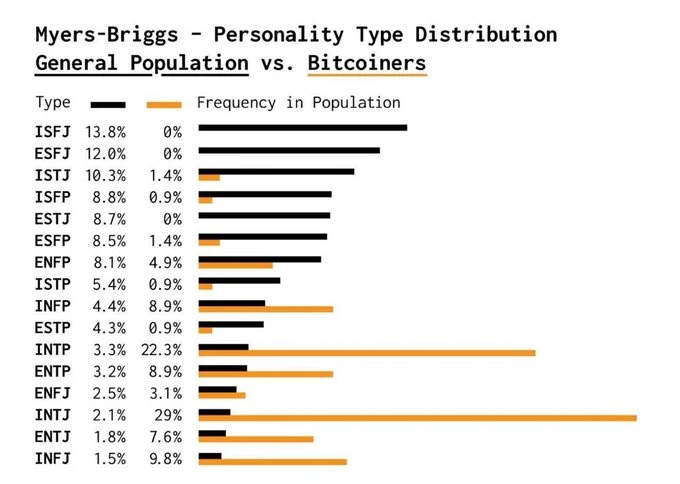

➡️Data shows Bitcoiners are built differently.

INTJ: 2% of the population, 29% of Bitcoiners

INTP: 3% of the population, 22% of Bitcoiners

The rarest types dominate the Bitcoin world.

➡️Data shows Bitcoiners are built differently.

INTJ: 2% of the population, 29% of Bitcoiners

INTP: 3% of the population, 22% of Bitcoiners

The rarest types dominate the Bitcoin world.

Fascinating study, although I am an ENTJ.

My Myers-Briggs personality type is INTJ, which is the most common one for Bitcoiners (29%), but only 2.1% of the general population has it. I guess that explains why most people never bought Bitcoin.

➡️Coinbase plans to raise $2 billion through a convertible notes offering.

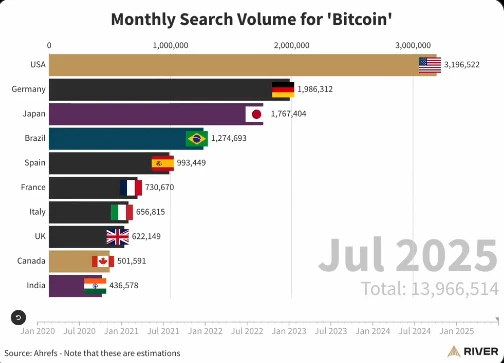

➡️River: The US is the biggest Bitcoin country in the world. But Bitcoin search volume has been rising globally.

Fascinating study, although I am an ENTJ.

My Myers-Briggs personality type is INTJ, which is the most common one for Bitcoiners (29%), but only 2.1% of the general population has it. I guess that explains why most people never bought Bitcoin.

➡️Coinbase plans to raise $2 billion through a convertible notes offering.

➡️River: The US is the biggest Bitcoin country in the world. But Bitcoin search volume has been rising globally.

➡️New Record Global Bitcoin Network Hashrate 930,000,000,000,000,000,000x per second.

➡️'Brazil to hold first Bitcoin strategic reserve hearing on August 20th. Nation-states are starting to FOMO into Bitcoin.' - Bitcoin Archive

➡️The State of Michigan Retirement System tripled its holdings of the ARK Bitcoin ETF from 100K to 300K shares between Q1 and Q2.

➡️$18,000,000,000 worth of Bitcoin shorts to be liquidated at $125,000 NEVER SHORT BITCOIN

➡️Bitcoin's total unrealized profit reaches a new high of $1.4 trillion.

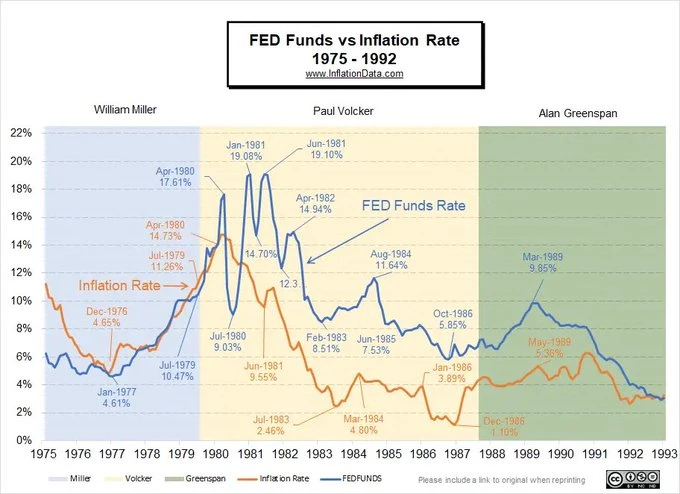

➡️Pierre Rochard: Bitcoin growth could only be slowed by 20% interest rates. Jerome Powell is not Paul Volcker. Rates are going lower, not higher. Position accordingly.

➡️New Record Global Bitcoin Network Hashrate 930,000,000,000,000,000,000x per second.

➡️'Brazil to hold first Bitcoin strategic reserve hearing on August 20th. Nation-states are starting to FOMO into Bitcoin.' - Bitcoin Archive

➡️The State of Michigan Retirement System tripled its holdings of the ARK Bitcoin ETF from 100K to 300K shares between Q1 and Q2.

➡️$18,000,000,000 worth of Bitcoin shorts to be liquidated at $125,000 NEVER SHORT BITCOIN

➡️Bitcoin's total unrealized profit reaches a new high of $1.4 trillion.

➡️Pierre Rochard: Bitcoin growth could only be slowed by 20% interest rates. Jerome Powell is not Paul Volcker. Rates are going lower, not higher. Position accordingly. ➡️Goldman Sachs expects three consecutive 25bps rate cuts starting in September. More liquidity is coming. Good for 'risk' assets like Bitcoin.

➡️'DOMINATES in risk-adjusted returns, and it’s a blowout. There. Is. No. Second. Best.' - CarlBMenger

➡️Goldman Sachs expects three consecutive 25bps rate cuts starting in September. More liquidity is coming. Good for 'risk' assets like Bitcoin.

➡️'DOMINATES in risk-adjusted returns, and it’s a blowout. There. Is. No. Second. Best.' - CarlBMenger ➡️Italian MP says it's inevitable that they will have to discuss establishing a Strategic Bitcoin Reserve.

➡️'Despite increased regulatory clarity in Europe, interest in Bitcoin among the next generation of bankers is fading fast. Only 12% of Morgan Stanley EU interns this summer own Bitcoin, a sharp drop from 63% in 2022.' - Bitcoin News

➡️US Treasury's FinCEN issues an urgent alert on fraud schemes exploiting Bitcoin kiosks, with victim losses rising 31% to nearly $247M in 2024. Bitcoin ATMs surged 99% last year, with over 10,956 incidents reported to the FBI's Internet Crime Complaint Center

➡️Capital B confirms the acquisition of 62 BTC for ~€6.2 million, the holding of a total of 2,075 BTC, and a BTC Yield of 1,446.3% YTD

➡️'The Bitcoin circulating supply has just passed 19.9 million BTC. With 95% of the supply already mined, there will only ever be 1.1 million more BTC issued. Simple sentences, but few understand the importance behind the words.' - On-Chain College

➡️Daniel Batten:

8th independent report finds significant environmental benefits in Bitcoin mining details in linked tweet "Bitcoin mining can be a practical way of cutting carbon and costs while keeping communities warm.

Key finding: "Electrifying heat in regions with low-carbon electricity... reduces [s] emissions from district heating. The heat from bitcoin mining could significantly advance this electrification, transforming digital energy into a source of high-temperature, low-carbon heat."

The report highlights MARA, who use Bitcoin mining to supply heat to 80,000 residents in Finland (1.6% of the population). Each MW of bitcoin mining means 455 fewer metric tons of CO2 emissions/year than the average district heating facility in Finland."

The report comes three months after Cambridge also released a study showing similar decarbonizing potential through Bitcoin mining recycled heat

➡️Italian MP says it's inevitable that they will have to discuss establishing a Strategic Bitcoin Reserve.

➡️'Despite increased regulatory clarity in Europe, interest in Bitcoin among the next generation of bankers is fading fast. Only 12% of Morgan Stanley EU interns this summer own Bitcoin, a sharp drop from 63% in 2022.' - Bitcoin News

➡️US Treasury's FinCEN issues an urgent alert on fraud schemes exploiting Bitcoin kiosks, with victim losses rising 31% to nearly $247M in 2024. Bitcoin ATMs surged 99% last year, with over 10,956 incidents reported to the FBI's Internet Crime Complaint Center

➡️Capital B confirms the acquisition of 62 BTC for ~€6.2 million, the holding of a total of 2,075 BTC, and a BTC Yield of 1,446.3% YTD

➡️'The Bitcoin circulating supply has just passed 19.9 million BTC. With 95% of the supply already mined, there will only ever be 1.1 million more BTC issued. Simple sentences, but few understand the importance behind the words.' - On-Chain College

➡️Daniel Batten:

8th independent report finds significant environmental benefits in Bitcoin mining details in linked tweet "Bitcoin mining can be a practical way of cutting carbon and costs while keeping communities warm.

Key finding: "Electrifying heat in regions with low-carbon electricity... reduces [s] emissions from district heating. The heat from bitcoin mining could significantly advance this electrification, transforming digital energy into a source of high-temperature, low-carbon heat."

The report highlights MARA, who use Bitcoin mining to supply heat to 80,000 residents in Finland (1.6% of the population). Each MW of bitcoin mining means 455 fewer metric tons of CO2 emissions/year than the average district heating facility in Finland."

The report comes three months after Cambridge also released a study showing similar decarbonizing potential through Bitcoin mining recycled heat

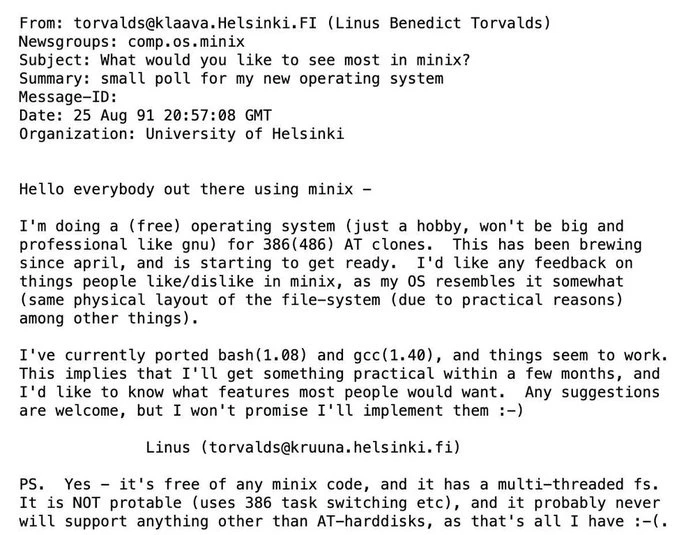

Written in 1991

Just like Linux, Bitcoin is freedom tech! Grubles: "If you're skeptical about Bitcoin being the foundation of the world's new monetary and financial system, remember Linux was once a mere hobby project and is now the foundation of the Internet and modern computing as we know it."

➡️An SEC commissioner quoting A Cypherpunk’s Manifesto. Written in 1993

Written in 1991

Just like Linux, Bitcoin is freedom tech! Grubles: "If you're skeptical about Bitcoin being the foundation of the world's new monetary and financial system, remember Linux was once a mere hobby project and is now the foundation of the Internet and modern computing as we know it."

➡️An SEC commissioner quoting A Cypherpunk’s Manifesto. Written in 1993

➡️U.S President Trump signs an executive order allowing 401(k) retirement accounts to invest in Bitcoin.

➡️'Sheetz, the popular convenience store chain with 750+ locations, is now offering 50% off purchases paid with Bitcoin and crypto daily from 3 PM to 7 PM.' -Bitcoin News

On the 8th of August:

➡️New Record Global Bitcoin Mining Hashrate 935,000,000,000,000,000,000x per second

➡️Daniel Batten: EEP (Ethiopia Electric Power) revenue from Bitcoin mining for the last year is estimated to be $220 million.

The revenue allowed EEP to progress with building the Transmission network, with 28,571 km of new power lines constructed and over 8,700 substation bays installed. The new infrastructure delivers energy to parts of rural Ethiopia that previously had no electricity access. Along with @gridless micro-hydro/Bitcoin mining projects in Kenya, Malawi, and Zambia, this provides another tangible example of where Bitcoin mining is reducing energy poverty in Africa at scale. This is something much talked about, but which no other technology has managed to do at scale until now.'

Sources for renewable Bitcoin mining in Ethiopia:

➡️U.S President Trump signs an executive order allowing 401(k) retirement accounts to invest in Bitcoin.

➡️'Sheetz, the popular convenience store chain with 750+ locations, is now offering 50% off purchases paid with Bitcoin and crypto daily from 3 PM to 7 PM.' -Bitcoin News

On the 8th of August:

➡️New Record Global Bitcoin Mining Hashrate 935,000,000,000,000,000,000x per second

➡️Daniel Batten: EEP (Ethiopia Electric Power) revenue from Bitcoin mining for the last year is estimated to be $220 million.

The revenue allowed EEP to progress with building the Transmission network, with 28,571 km of new power lines constructed and over 8,700 substation bays installed. The new infrastructure delivers energy to parts of rural Ethiopia that previously had no electricity access. Along with @gridless micro-hydro/Bitcoin mining projects in Kenya, Malawi, and Zambia, this provides another tangible example of where Bitcoin mining is reducing energy poverty in Africa at scale. This is something much talked about, but which no other technology has managed to do at scale until now.'

Sources for renewable Bitcoin mining in Ethiopia:

Remember: 2018: Harvard says Bitcoin is more likely to hit $100 than $100K. 2025: Harvard buys $116M Bitcoin at $116K. Everyone gets Bitcoin at the price they deserve.

➡️They want you to buy XRP while they sell it. Don't do shitcoins, ladies & gents.

Remember: 2018: Harvard says Bitcoin is more likely to hit $100 than $100K. 2025: Harvard buys $116M Bitcoin at $116K. Everyone gets Bitcoin at the price they deserve.