On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 30.06.2025

🧠Quote(s) of the week:

Adam Livingston:

"Most people think Bitcoiners are delusional. In truth, we're time travelers.

Inhabiting a future where capital is unconfiscatable, monetary policy is immutable, and time is no longer for sale. Satoshi pulled the future forward.

We see the cracks in Fiat not because we're paranoid, but because we’ve read the footnotes of history and decided not to take part in the same timeline. We see inflation not as “temporary,” but as structural violence against the productive class.

We know wars aren’t funded by votes, they’re funded by printing presses. We understand that assets don't go up... currencies go down. While others budget for retirement, we budget for sovereignty. We're ahead of the curve, charting our own path and writing our own version of history."

I have shared the following numerous times. Plus, ffs, forget about the price or price targets. If you understand this, you’re halfway there and heading the right way…:

dergigi.com

Bitcoin Is Time | dergigi.com

Keeping track of things in the informational realm requires keeping track of time.

And remember, although we can have a low time preference, we still only get this life once. Find the right balance between stacking sats for the future while also spending to live a worthwhile life now. Time is scarce.

🧡Bitcoin news🧡

"If you're taking out loans to buy Bitcoin or using loans to delay selling Bitcoin, you're essentially running a personal Bitcoin treasury company." - Jimmy Song

@jimmysong

Congrats, you're now the CFO of your own Bitcoin treasury company, except the loan terms are not as good. It's better and easier to just stay humble and stack sats.

On the 23rd of June:

➡️Norway’s Green Minerals adopts Bitcoin treasury strategy and scoops up $1.2b worth of $BTC.

➡️'80% of cryptocurrency sent to Iran comes from "global exchanges," says TRM. Not "DeFi". Not "unhosted wallets." So, how do Iranians circumvent compliance? By signing up with fake IDs. And where do you get a fake ID? From hacked KYC databases. AML is nonsense.' -L0laL33tz

➡️Bitcoin Magazine: Senator Cynthia Lummis & former Congressman Mike Rogers said we must pass an "exemption to allow Americans to use Bitcoin for small everyday purchases without triggering burdensome tax reporting."

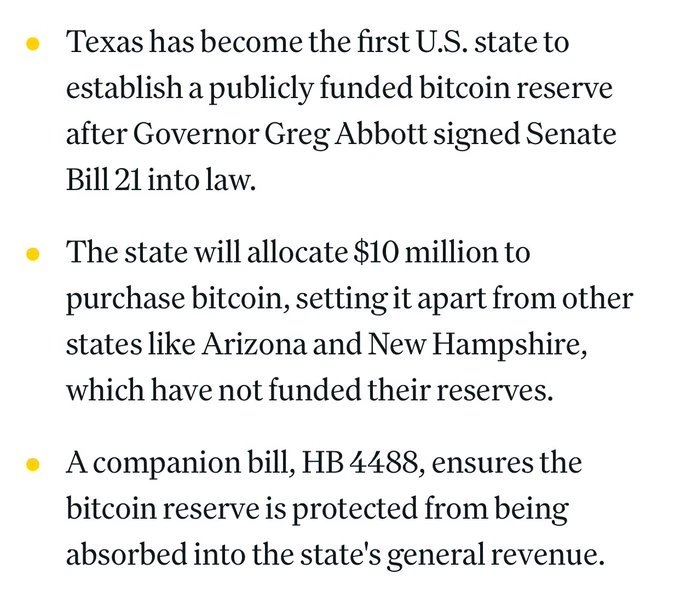

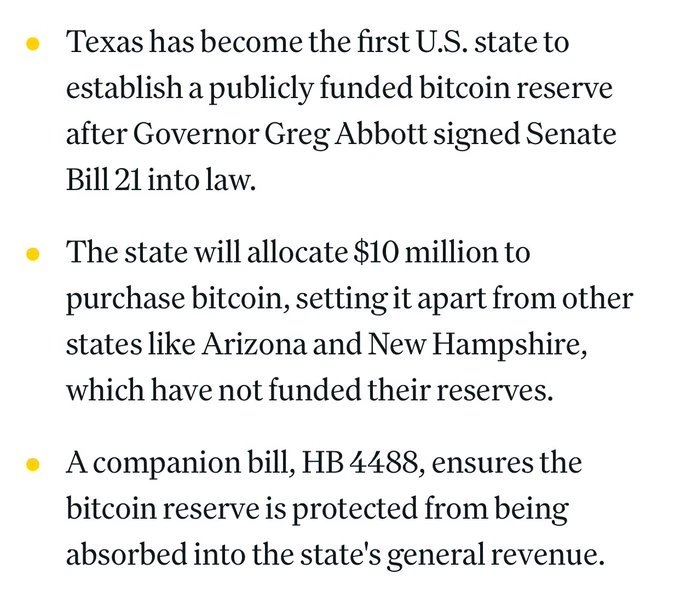

➡️Texas to purchase $10M worth of Bitcoin for a state reserve. This is the start of game theory! Source: Coindesk

➡️Strategy has acquired 245 BTC for ~$26.0 million at ~$105,856 per bitcoin and has achieved BTC Yield of 19.2% YTD 2025. As of 6/22/2025, we hodl 592,345 Bitcoin acquired for ~$41.87 billion at ~$70,681 per Bitcoin.

➡️The Blockchain Group confirms the acquisition of 75 BTC for ~€6.9 million, the holding of a total of 1,728 BTC, and a BTC Yield of 1,231.7% YTD Press Release:

https://t.co/GYy0u4AxZ7

On top of that, the Blockchain Group announced a capital increase totalling ~€4.1 million at an average price of ~€5.085 per share as part of its “ATM-type” capital increase program with TOBAM to pursue its Bitcoin Treasury Company.

On the 24th of June:

➡️Japan’s Financial Services Agency proposed to bring crypto assets under the Financial Instruments and Exchange Act. This could legalise Bitcoin ETFs and cut tax on crypto gains.

➡️US govt to look into allowing Bitcoin and crypto holdings to be considered when assessing mortgage finance eligibility - US Director of Housing

➡️'Metaplanet approves a $5B capital contribution to its Florida-based U.S. subsidiary, Metaplanet Treasury Corp, to accelerate the “555 Million Plan,” supporting Metaplanet’s goal of acquiring 210,000 bitcoin by the end of 2027.' - Bitcoin News

➡️Belgravia Hartford Announces 100% Bitcoin Directed CAD 10M ($7.29 million) Private Placement Financing to Accelerate Growth of Bitcoin Treasury Holdings

➡️Anthony Pompliano: 'I announced a $750 million fundraise this morning as part of a $1 billion merger. The goal is to build a leading bitcoin-native financial services firm.' As mentioned in one of my previous recaps, this is the same guy who tried to get you on that BlockFi rocketshit..

Pledditor: "The guy who came out of nowhere last cycle to peddle referral links and bought the top in BlockFi and FTX's venture rounds now wants to become your money manager. It's a rocketship, bro! Get on board~~"

➡️The Federal Reserve to scrap "reputational risk" as a component of bank exams. No more de-banking for holding Bitcoin or having the "wrong" opinions.

➡️Bitcoin News: 'Leading Land Rover and Jaguar restoration company ECD Automotive Design, Inc. has secured a $500M equity facility with ECDA Bitcoin Treasury LLC to support ECD’s Bitcoin treasury strategy.'

➡️The Smarter Web Company purchased 196.9 BTC and now has a total of 543.52 BTC.

➡️Panther Metals announces that they purchased their very first 1 BTC. One more Bitcoin Treasury to add to the list.

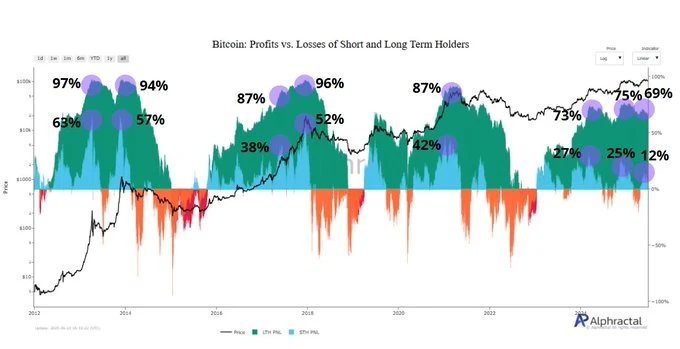

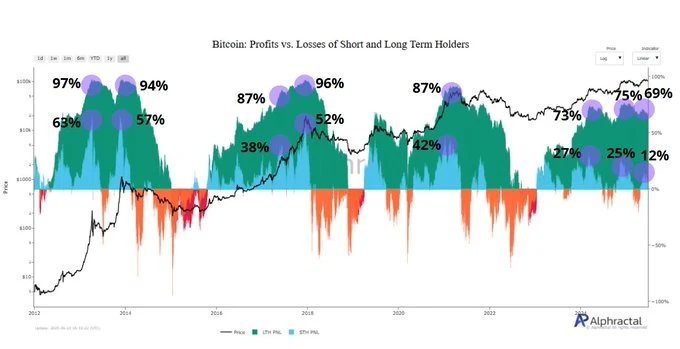

➡️In past Bitcoin cycles, long-term and short-term holders profited, with STHs capturing up to 63% of gains. This cycle, STH profits fell to 12%, while LTH profit supply rose to 75%, according to data from Alphractal.

On the 25th of June:

➡️Arizona PASSES Bitcoin Reserve bill HB2324. The Arizona House passed HB 2324 (34-22) after Senate approval (16-14). Pending Governor Hobbs' approval, the bill allows the State Treasurer to create the "Bitcoin and Digital Assets Reserve Fund". If signed by Governor Hobbs, it will be the state's second reserve bill passed into law.

➡️Barclays Bank buys $131m of BlackRock’s Bitcoin ETF. But bans customers from using cards on cryptocurrency. Funny, isn't it?

➡️ Bitcoin PR machine: "Bitcoin is a global, scarce, decentralised asset that's not associated with any one country.” - BlackRock's Head of Digital Assets, Robert Mitchnick

➡️Daniel Batten:

“The telephone has too many shortcomings to be seriously considered as a means of communication.” — 1876 Western Union internal memo

“I believe in the horse. The automobile is a transitory phenomenon" ~Kaiser Wilhelm II ~1905

"There's no reason anyone would want a computer in their home" ~Ken Olson, co-founder of DEC, 1977

“By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.” ~Paul Krugman (nobel prize winning retard) 1998

“There’s no chance that the iPhone is going to get any significant market share.” ~Microsoft CEO Steve Ballmer, 2007.

"In 10 years, Bitcoin will be closed down" ~Jamie Dimon, Jeffrey Epstein's Banker, 2025

Meanwhile, as mentioned in one of my previous recaps, JPMorgan is offering Bitcoin services to its clients. Again, I would question how the CEO of a bank can legally/fiduciarily have his company engaged in the Bitcoin ecosystem, as he believes it’s a fraud.

➡️BIS Claims Stablecoins Fail As Money, Calls For Strict Limits On Their Role. Source:

BIS Claims Stablecoins Fail As Money, Calls For Strict Limits On Their Role | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Also, BIS: actively researching how to make their own. TLDR: Shaking in their boots.

@Lyn Alden Lyn Alden is spot on:

"If they fail as money, then there’s no need for “strict limits” on them. They would just stagnate on their own. What actually worries central bankers is that they are attractive to many people in the world as money."

Oh, and to add to the above... Who's going to tell them that the "fails as money" logic applies to all fiat? This is after JPM files for a stablecoin.

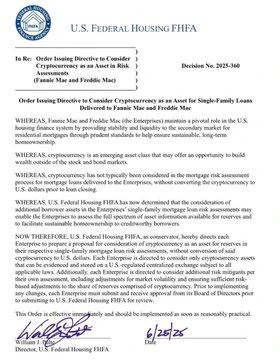

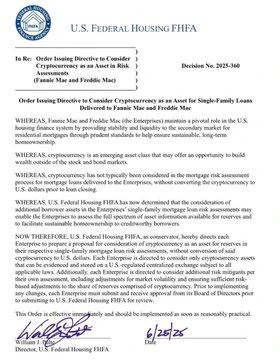

➡️'US Federal Housing Finance Agency orders Fannie Mae and Freddie Mac to count Bitcoin & crypto as an asset when assessing mortgage eligibility. HUGE!' -Bitcoin Archive

This was the only way to slow a sudden and violent $350T exodus out of property and into Bitcoin. Millions of BTC now no longer need to be sold. Many investors are soon going to find out that they can start using the best-performing asset of the last decade as collateral.

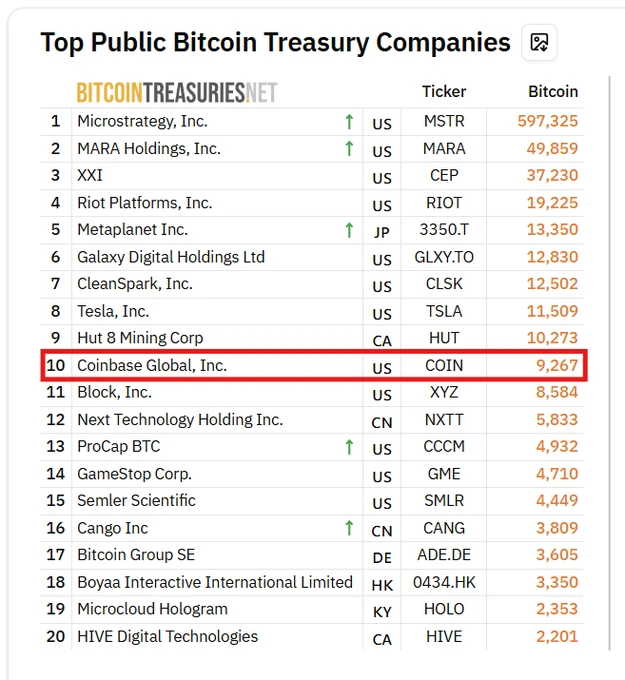

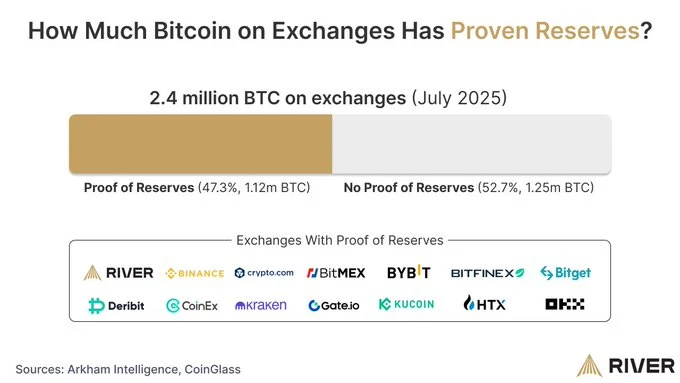

River: "The assets are only counted for a mortgage if stored at a regulated US exchange. This may become a driving factor for all exchanges to finally implement Proof of Reserves."

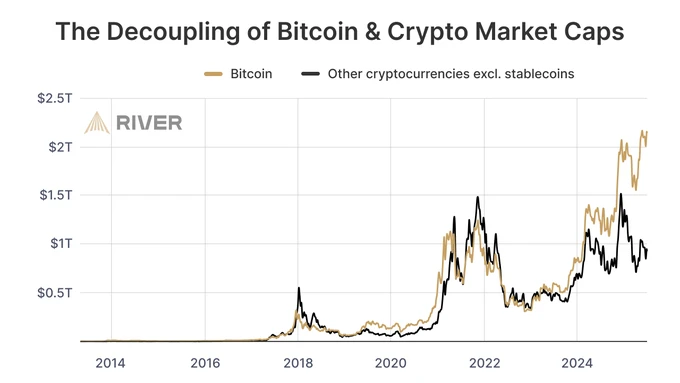

➡️Alex Thorn: "Bitcoin dominance has been rising consistently for a year after 16 years and tens of millions of altcoins, Bitcoin is still two-thirds of the entire crypto market makes you think."

➡️This week in corporate Bitcoin adoption: These 9 members of @BitcoinForCorps have collectively added 11,958.45 BTC to their corporate treasuries.

➡️Fidelity: Bitcoin and the wider digital assets landscape continue to evolve, and institutional strategies should too. Stay informed with our curated summer reading list. Find all our Bitcoin-focused pieces featuring exclusive insights from our Research team:

Bitcoin | Fidelity Digital Assets

Explore the first and largest digital assets.

➡️H100 Group Acquires 19.38 BTC and now has a total of 200.21 Bitcoin.

➡️Green Minerals, a mineral miner in Norway, purchased its first 4 BTC. Last Monday, they announced the adoption of a Bitcoin Treasury Strategy with goals of up to $1.2 bn in BTC.

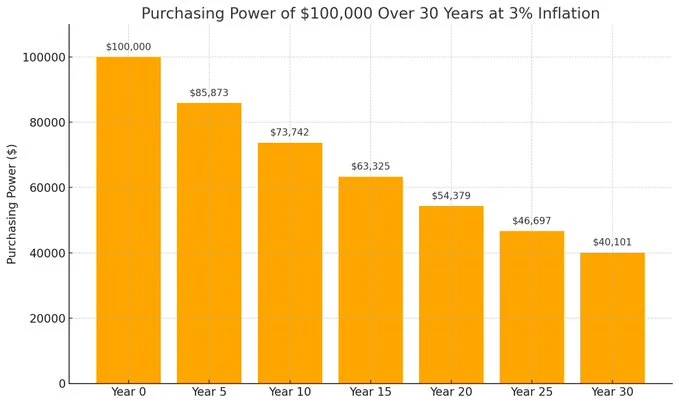

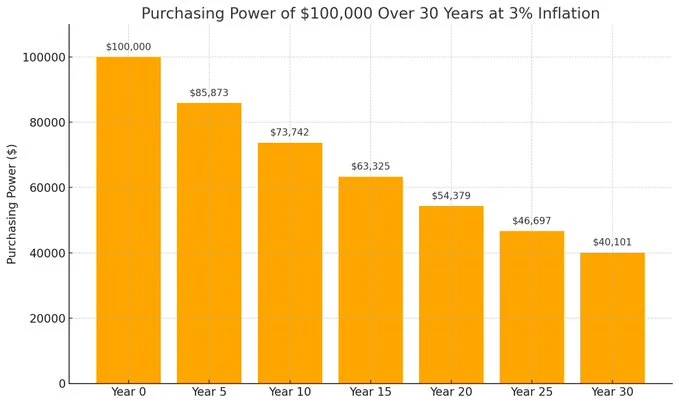

➡️River: The savings account is an illusion. It gives millions a false sense of security, while inflation quietly drains their wealth. This is why we save in Bitcoin.

➡️CEO of America’s largest Bitcoin mining company, Marathon’s @Fgthiel, gave a keynote speech at the Bitcoin Policy Summit in Washington, D.C.

➡️NEW paper: Integrating Bitcoin mining with biorefineries can Avoid waste by creating an additional revenue stream that could lower prices for bio-based products. Support renewable energy growth by acting as a flexible, off-grid power sink that reduces flare emissions.

Source:

https://www.mdpi.com/2079-8954/13/5/359

Daniel Batten:

@Daniel Batten

Key findings for Policymakers/Regulators: Support early adoption and renewable energy access to boost green industries, but avoid restrictive taxes that drive miners away. General Findings: This shows mining can align with sustainability, using renewable energy to make biorefineries viable, proving Bitcoin’s potential beyond energy consumption. Strategic timing and cost management are key to success.

➡️Worst move ever?

Bit Digital is transitioning into a “pure play Ethereum staking and treasury company.” It will sell its 417 Bitcoin, shut down its Bitcoin mining operations, and redeploy the proceeds into ETH. Swapping Bitcoin for Ethereum and ditching Proof-of-Work? Oh well, 'weird way to announce you're going out of business'.

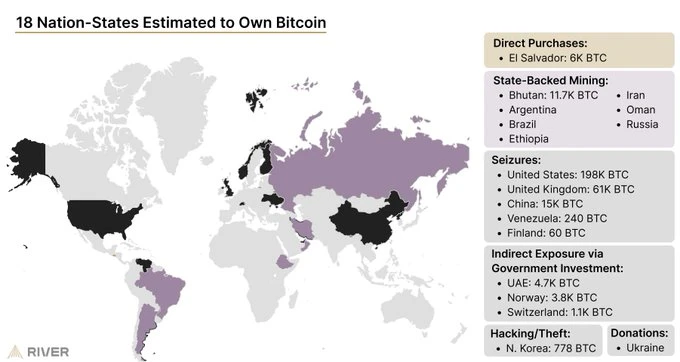

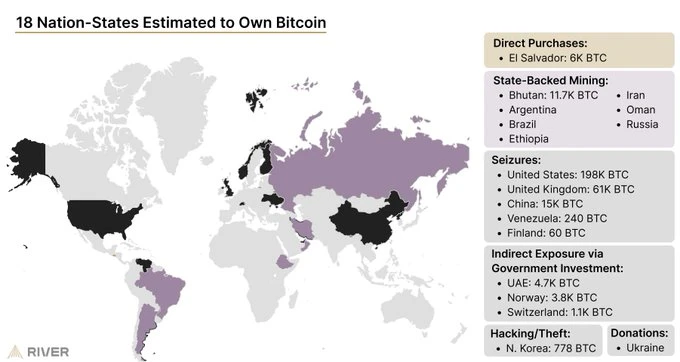

➡️River: 18 Nation States are estimated to own Bitcoin.

➡️Hut 8 Corp. doubles its Bitcoin-backed credit facility with Coinbase Credit from $65M to $130M, extending the maturity to July 15, 2026.

On the 26th of June:

➡️'Ledger is phasing out the Ledger Nano S, the best-selling crypto hardware wallet in history. They caution that ongoing support for the Nano S is not guaranteed and are urging users to upgrade, requiring them to re-enter their seed phrase into a new device. This process exposes users to phishing risks. A Ledger data leak has already led to a surge in targeted scams, including fake but official-looking letters sent by mail, prompting users to enter their seed phrase into fraudulent devices.' - Bitcoin News

In other words, be safe and choose a different hardware wallet to avoid phishing and to prevent Ledger from retiring your new device. Play shitcoin games win shitcoin prizes. Best practices - Bitcoin Only, Open source, Airgapped.

➡️The IMF now classifies Bitcoin as a capital asset!

➡️One month after Pakistan announced Bitcoin reserve intentions, Pradeep Bhandari, spokesperson for India’s ruling BJP party, called for a Bitcoin reserve pilot. Hello, game theory.

➡️Bluebird Mining, a gold miner, increased its goals and now aims to raise a minimum of £10 million ($13.7 million) to start its "digital" gold strategy and buy Bitcoin. Yesterday, they announced a £2 million funding facility, but they received unprecedented multiple offers. They are also looking to get listed on OTCQB.

On the 27th of June:

➡️Bakkt Holdings Inc. files investment policy update saying it may buy $1 billion in Bitcoin.

➡️Documenting Bitcoin: "University of Texas Leases Land to Mine Bitcoin and Generate Cash for Hundreds of Thousands of Students."

Source:

ChainCatcher

Bloomberg: The University of Texas, which made its fortune from oil, aims to profit in the fields of Crypto and AI - ChainCatcher

The University of Texas has begun leasing land for renewable energy, battery storage, and cryptocurrency data centers, creating a source of revenue...

➡️"Bitcoin is digital gold. It's in the US's best interest to accumulate as much BTC as we can possibly get," - Executive director of the Presidential Council of Advisers for Digital Assets, Bo Hines.

Bitcoin News: "If the US unveils a Bitcoin accumulation plan this summer, it could trigger a global arms race, with nations scrambling to secure sovereign BTC before it’s too late."

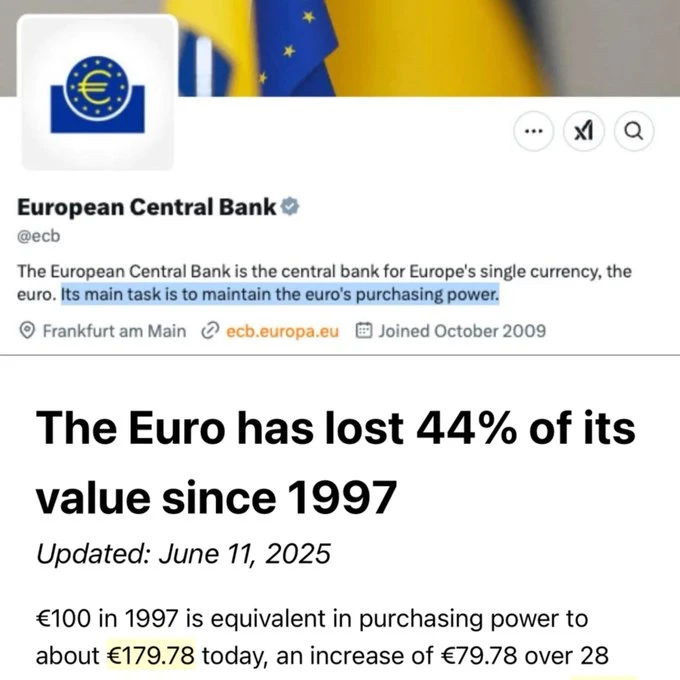

➡️ECB: Moving closer and closer to communism.

European Central Bank

Crossing two hurdles in one leap: how an EU savings product could boost returns and capital markets

The European Central Bank (ECB) is the central bank of the European Union countries which have adopted the euro. Our main task is to maintain price...

Daniel Batten: "Today, we urgently need to take retail (your) savings, and deploy them into capital markets that finance EU (our) priorities." 100 years ago, the US government forced private citizens to redeem their gold for a low rate, so this is not without precedent.

"Urgent need" to "channel retail savings into EU capital markets"; article mentions "tax incentives" five times.

For the normbies / no coiners....

Read: Your money, which is yours, could be put to much better use by us. Because you will not voluntarily give it to us, we will create legislation that you don't understand, that will enable us to decide what is done with your money.' Ergo, the European Central Bank wants to use retail savings to “finance EU priorities”. Bitcoin is the only money they can’t steal from you.

I am hard pressed to think of anyone in Europe doing a better job of demonstrating the clear and immediate use case for Bitcoin to all European citizens than the ECB. This might just be the best Bitcoin marketing campaign yet! Got Bitcoin?

➡️Daniel Batten: How The IMF Prevents Global Bitcoin Adoption (And Why They Do It) 'For 3 months, I've quietly been working on exposing what the IMF has done behind the scenes to prevent nation-state Bitcoin adoption. It's out in the open now':

Bitcoin Magazine

How The IMF Prevents Global Bitcoin Adoption (And Why They Do It)

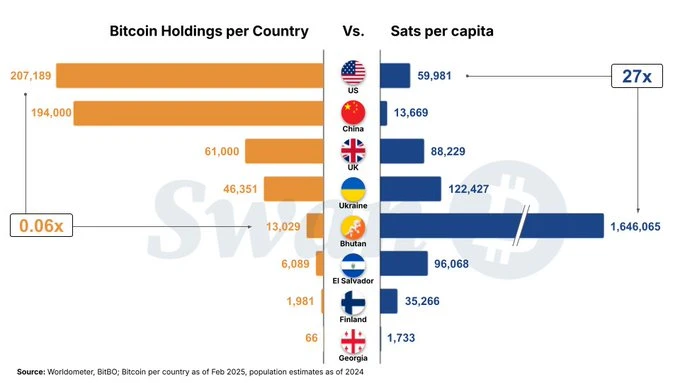

IMF loans halt nation-state Bitcoin plans—only debt-free countries like Bhutan push forward. Grassroots use still thrives.

Incredible article, must read!

The IMF is more than this story. It is the catalyst for many anti-sovereign policies. Once you understand how powerful a weapon debt is, you realize that it's more powerful than any army because it works by stealth, and people underestimate its strength. Once a nation takes a loan, it loses part of its sovereignty. Share this article and the unethical behavior of the IMF as many times as possible.

➡️Bhutan says it will now HODL its bitcoin reserves for the long term instead of liquidating to fund government spending - WSJ Bhutan now holds $1.3 BILLION Bitcoin, which is 40% of its GDP!

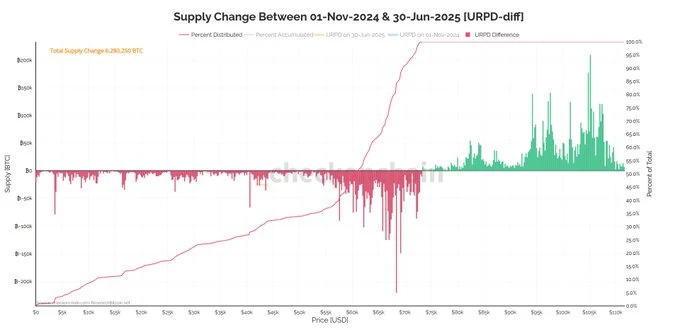

➡️Bitcoin long-term holder supply surged by a record 800K BTC in the past 30 days, with only six instances of a 750K BTC increase in Bitcoin’s history, per CryptoQuant data.

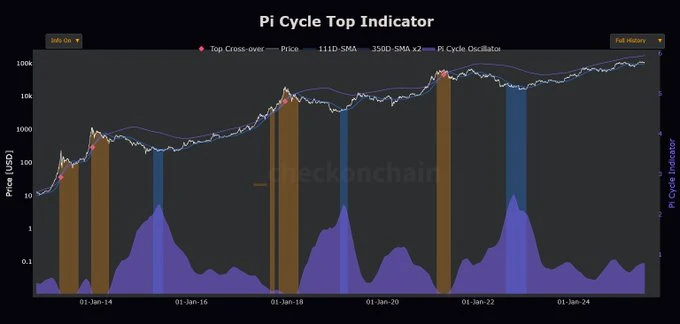

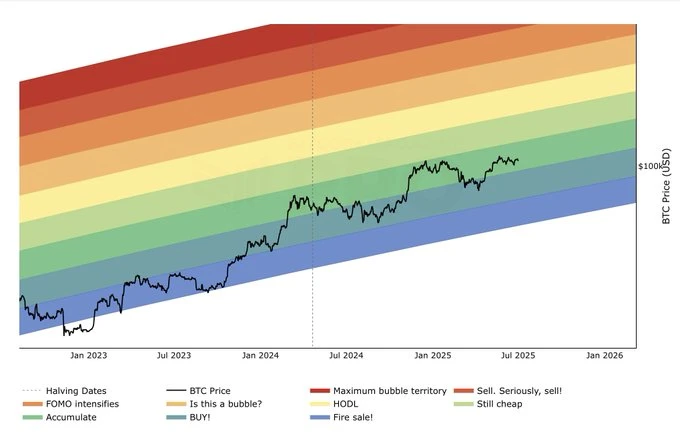

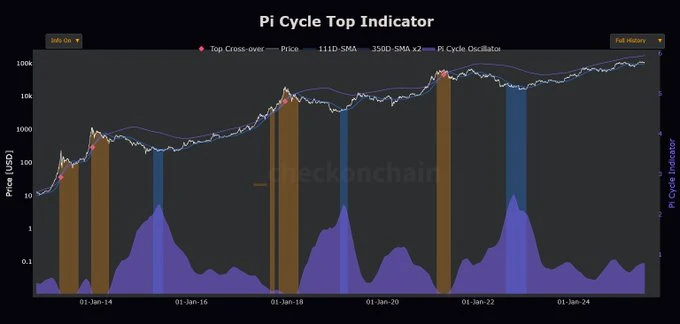

➡️On-Chain College: "Every cycle, this cross marks the Bitcoin top. Either this time is different, or there’s a lot more bull run left to play. Sit tight."

➡️Ric Edelman, who advises over $250B in wealth, just raised his Bitcoin allocation recommendation to as high as 40%. Why? “Four years ago, we feared government bans. Now, every member of the president’s cabinet owns Bitcoin.” In 2021, he recommended a 1% allocation...

On the 28th of June:

➡️Documenting Bitcoin:

"Next ₿itcoin Halving Progress ▓▓▓▓▓░░░░░░░░░░░░░░░░ 30% Loading…

Please Hodl

Current Block: 902,995

Halving Block: 1,050,000

Blocks Remaining: 147,005

Days Remaining: 1,021 days"

➡️Ethiopia made over $55 million in just 10 months by mining Bitcoin. This electricity would otherwise have gone to waste because Ethiopian Electric Power (EEP) hasn't yet built the transmission lines to supply all that electricity generated. So, in the meantime, the dam authorities sell electricity to Bitcoin mining companies, contributing 18% of EEP's total revenue last year. With the extra profit, they fast-track the building of new transmission lines so they can get that extra electricity to people sooner. It's an incredible and inspiring story, backed up by data.

📄.pdf

** On the 29th of June:**

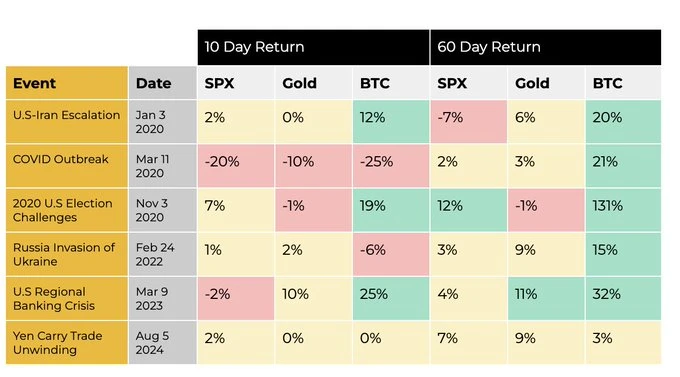

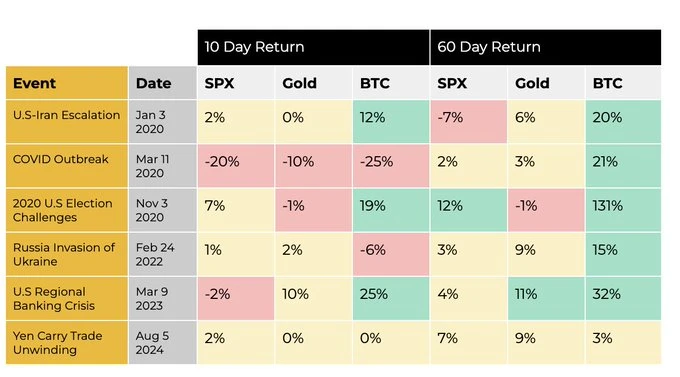

➡️Binance Research says BTC has historically bounced back after major geopolitical events, averaging a 37% return 60 days post-event since 2020.

On the 30th of June:

➡️National Bank of Kazakhstan Governor says they are working to establish a Bitcoin reserve. Kazakhstan's National Bank supports creating a Strategic Bitcoin Reserve and will engage with parliament to prepare the necessary legal framework.

➡️Germany's largest banking group, Sparkassen, to launch Bitcoin and crypto trading services. +370 local savings banks +50 million customers. The Sparkasse will enter the trading and custody of Bitcoin in Germany within the next 12 months!

The implementation will take place via DekaBank, which already holds its own crypto custody license.

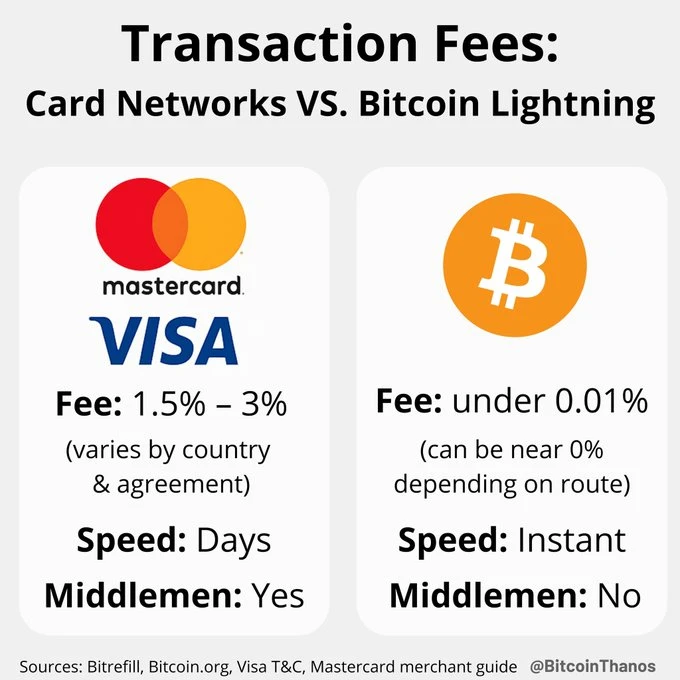

Just want to end this segment with the following picture...

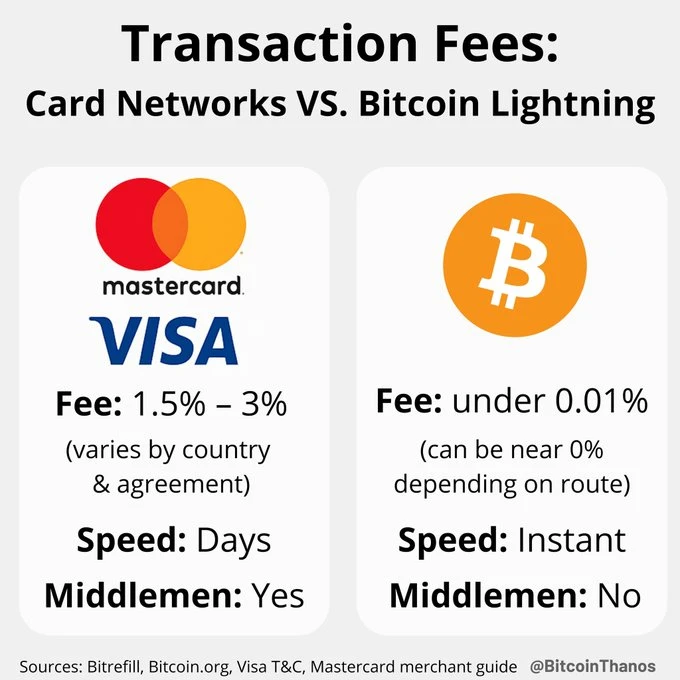

Faster. Cheaper. Borderless. Bitcoin

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin did: "Jeff Walton is a financial analyst, a former reinsurance broker, and the Founder of True North.

In this episode, we break down the rise of Bitcoin treasury companies, why Strategy is playing an entirely different game, and how Saylor’s new financial instruments are creating a Bitcoin-native yield curve. We also discuss how these instruments could absorb trillions from the fixed income market and what that means for Bitcoin’s long-term price floor.

We get into the risks of corporate treasury models, why some of the new entrants look like the 2017 ICO market, whether these structures could lead to reflexive crashes in a bear market, and the future of equity in a Bitcoin-denominated world."

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Do you think this post is helpful? If so, please share it with your friends, family co-workers, and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐️ Many thanks⭐️

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Do you think this post is helpful? If so, please share it with your friends, family co-workers, and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐️ Many thanks⭐️

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 21.07.2025

🧠Quote(s) of the week:

Now, what is inflation?

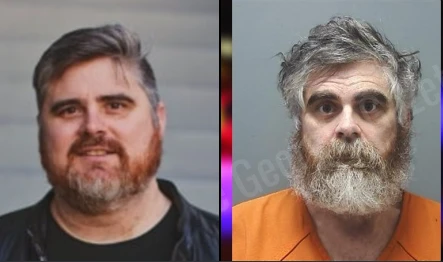

Luke Gromen: "An (accidental) gauge of actual US inflation in recent years: Two genetic brothers, JJ Watt (left) and TJ Watt (right), only 5 years apart in age, playing the same sport, the same position on the field, in the same stadiums, to the same crowds...and yet the younger brother makes nearly as much in 3 years as older brother did in 12 years."

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 21.07.2025

🧠Quote(s) of the week:

Now, what is inflation?

Luke Gromen: "An (accidental) gauge of actual US inflation in recent years: Two genetic brothers, JJ Watt (left) and TJ Watt (right), only 5 years apart in age, playing the same sport, the same position on the field, in the same stadiums, to the same crowds...and yet the younger brother makes nearly as much in 3 years as older brother did in 12 years."

While I largely agree with the point, there are other factors contributing to NFL inflation than just monetary inflation. Still, this should help more athletes, fans, and even owners see the light. Get paid in Bitcoin! Get deals paid in Bitcoin.

A screaming indicator that shows both the employer and employee are being harmed by the debasement of the currency. Russell Okung, Saquon Barkley, and Odell Beckham already showed the solution for the NFL and the NFL Players Association -- embrace Bitcoin. Now a matter of time and effort until momentum pushes past the tipping point.

🧡Bitcoin news🧡

On the 14th of July:

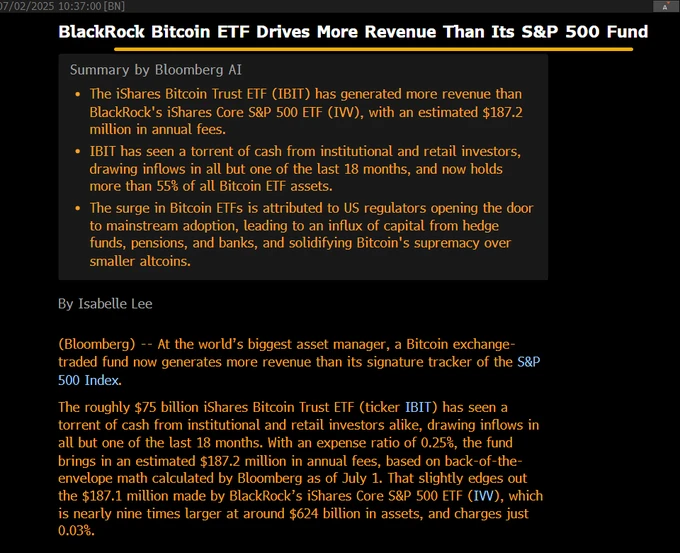

➡️BlackRock's spot Bitcoin ETF is now the company's most profitable ETF, Bloomberg reports.

➡️Bitcoin is up ~1,700% since comedian Daniel Sloss called it “Beanie Babies for tech bros” when it was trading at $6.5K

➡️“Ethereum is going parabolic!”

Ethereum is going parabolic:

While I largely agree with the point, there are other factors contributing to NFL inflation than just monetary inflation. Still, this should help more athletes, fans, and even owners see the light. Get paid in Bitcoin! Get deals paid in Bitcoin.

A screaming indicator that shows both the employer and employee are being harmed by the debasement of the currency. Russell Okung, Saquon Barkley, and Odell Beckham already showed the solution for the NFL and the NFL Players Association -- embrace Bitcoin. Now a matter of time and effort until momentum pushes past the tipping point.

🧡Bitcoin news🧡

On the 14th of July:

➡️BlackRock's spot Bitcoin ETF is now the company's most profitable ETF, Bloomberg reports.

➡️Bitcoin is up ~1,700% since comedian Daniel Sloss called it “Beanie Babies for tech bros” when it was trading at $6.5K

➡️“Ethereum is going parabolic!”

Ethereum is going parabolic:

This is for everyone hyping the Ethereum "pump" right now. I don’t believe we’re heading into another full-blown altseason. Maybe we’ll see some temporary outperformance vs. Bitcoin, but nothing like 2017. Humanity is stupid, but not that stupid. Right?

On the 15th of July

➡️'Millionaire inflation is real. In 2000, there were 14.7 million millionaires. Today, there are over 60 million. Back then, there was hypothetically more than 1 Bitcoin per millionaire. Today? Just 0.35 BTC each. And it’s dropping.' -Bitcoin News

➡️Daniel Batten: "The old guard is fading. A new generation is growing in power, and is gaining ascendancy in EVERY political party. The game is no longer to be pro or anti-Bitcoin, but to frame how Bitcoin fits with your values."

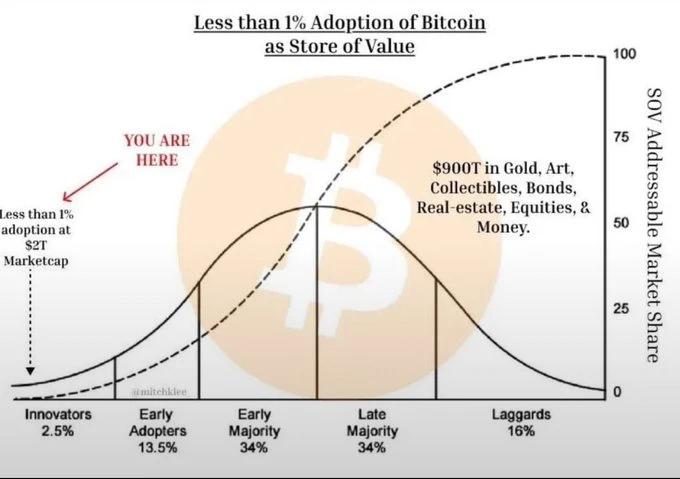

➡️We are very, very early. Bitcoin's adoption curve.

This is for everyone hyping the Ethereum "pump" right now. I don’t believe we’re heading into another full-blown altseason. Maybe we’ll see some temporary outperformance vs. Bitcoin, but nothing like 2017. Humanity is stupid, but not that stupid. Right?

On the 15th of July

➡️'Millionaire inflation is real. In 2000, there were 14.7 million millionaires. Today, there are over 60 million. Back then, there was hypothetically more than 1 Bitcoin per millionaire. Today? Just 0.35 BTC each. And it’s dropping.' -Bitcoin News

➡️Daniel Batten: "The old guard is fading. A new generation is growing in power, and is gaining ascendancy in EVERY political party. The game is no longer to be pro or anti-Bitcoin, but to frame how Bitcoin fits with your values."

➡️We are very, very early. Bitcoin's adoption curve.

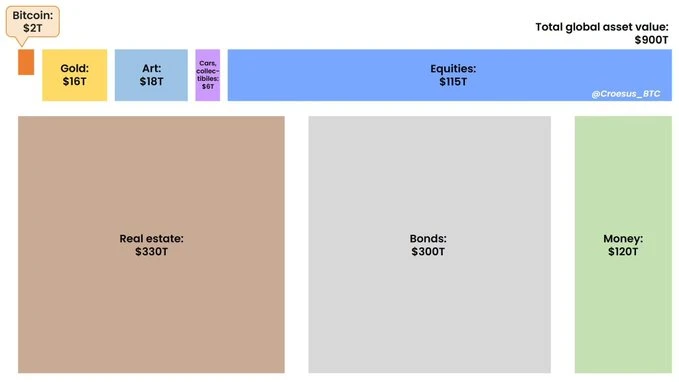

Bitcoin's total addressable market (TAM) is the world’s balance sheet. All $900T of it. So long as Bitcoin has the most attractive characteristics as a store-of-value asset in the investable landscape, this will remain so. Bitcoin is a black hole on the world's balance sheet.

Mitch Klee: "Currently 0.22%. LESS THAN 1% ADOPTION. Currently, a 2 trillion dollar asset and its total addressable market for SOV is $900 trillion. Since Bitcoin is both valued in USD and a monetary network, it's best to measure adoption in total market capitalization. Bitcoin is still very young, released in 2009. Layer 2s are still being built. As a monetary network, there is much work to be done if we want to support billions of people. But Flywheels are strong. I don't think anyone realizes how early we are. We've just tapped the surface of development for multiple layer 2s. (The internet has 7) As more adoption happens, more money for development feeds into the flywheel."

It's not too late to take Bitcoin seriously. Need proof? Just look at the Bitcoiners: they keep buying. You didn't "miss out" on Bitcoin; you just weren't here from the beginning. But you can still be early today.

➡️Long-Term Holder supply dropped by 100k Bitcoin over the past 24 hours. 100k BTC. No wonder we went down to $117k.

➡️$400B banking giant Standard Chartered has officially launched Bitcoin and crypto trading for institutional clients.

➡️Bitcoin just recorded its highest daily candle close ever: $119,135. New all-time high.

Bitcoin's total addressable market (TAM) is the world’s balance sheet. All $900T of it. So long as Bitcoin has the most attractive characteristics as a store-of-value asset in the investable landscape, this will remain so. Bitcoin is a black hole on the world's balance sheet.

Mitch Klee: "Currently 0.22%. LESS THAN 1% ADOPTION. Currently, a 2 trillion dollar asset and its total addressable market for SOV is $900 trillion. Since Bitcoin is both valued in USD and a monetary network, it's best to measure adoption in total market capitalization. Bitcoin is still very young, released in 2009. Layer 2s are still being built. As a monetary network, there is much work to be done if we want to support billions of people. But Flywheels are strong. I don't think anyone realizes how early we are. We've just tapped the surface of development for multiple layer 2s. (The internet has 7) As more adoption happens, more money for development feeds into the flywheel."

It's not too late to take Bitcoin seriously. Need proof? Just look at the Bitcoiners: they keep buying. You didn't "miss out" on Bitcoin; you just weren't here from the beginning. But you can still be early today.

➡️Long-Term Holder supply dropped by 100k Bitcoin over the past 24 hours. 100k BTC. No wonder we went down to $117k.

➡️$400B banking giant Standard Chartered has officially launched Bitcoin and crypto trading for institutional clients.

➡️Bitcoin just recorded its highest daily candle close ever: $119,135. New all-time high. ➡️Cantor Fitzgerald close to $4 billion SPAC deal with Adam Back "to buy billions of dollars" of Bitcoin.

➡️ECB: Applications for the design contest for our future banknotes are now open! Are you a graphic designer residing in the EU? Submit your application by noon CET on 18 August.

"The new designs for the future EU banknotes are in, beautifully fitting the given assigned theme of 'European culture". Which one is your favorite?" - Bitsaga

➡️Cantor Fitzgerald close to $4 billion SPAC deal with Adam Back "to buy billions of dollars" of Bitcoin.

➡️ECB: Applications for the design contest for our future banknotes are now open! Are you a graphic designer residing in the EU? Submit your application by noon CET on 18 August.

"The new designs for the future EU banknotes are in, beautifully fitting the given assigned theme of 'European culture". Which one is your favorite?" - Bitsaga

Foto credit: Michaël Roerade

Foto credit: Michaël Roerade

Anyway, got Bitcoin?

➡️Retail investors are buying more Bitcoin than miners can produce. Shrimps, Crabs, and Fish are stacking 19,300 BTC/month while miners only release 13,400. This quiet supply crunch is fueling Bitcoin’s run to new ATHs.

➡️Bitcoin’s MVRV z-score is still well below historical top levels. Plenty of room to run.

Anyway, got Bitcoin?

➡️Retail investors are buying more Bitcoin than miners can produce. Shrimps, Crabs, and Fish are stacking 19,300 BTC/month while miners only release 13,400. This quiet supply crunch is fueling Bitcoin’s run to new ATHs.

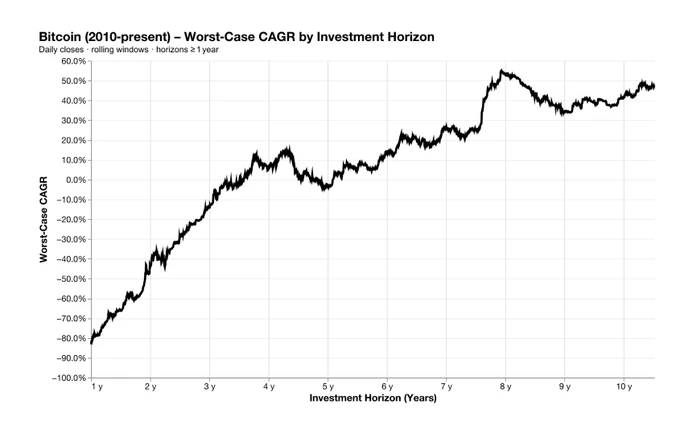

➡️Bitcoin’s MVRV z-score is still well below historical top levels. Plenty of room to run. ➡️Pierre Rochard: "You have to hold BTC longer than 5 years to be guaranteed a CAGR > 0%, according to the historical worst-case scenario. Longer than 6 years for >20% Bitcoin CAGR. Bitcoin is long-term savings technology."

➡️Pierre Rochard: "You have to hold BTC longer than 5 years to be guaranteed a CAGR > 0%, according to the historical worst-case scenario. Longer than 6 years for >20% Bitcoin CAGR. Bitcoin is long-term savings technology." On the 16th of July:

➡️ US Marshals reveal the government now only holds 28,988 Bitcoin worth $3.4 billion, instead of the estimated ~200,000 BTC.

If true, this is a total strategic blunder and sets the United States back years in the Bitcoin race. The Biden Administration sold 170,000 BTC, and the Trump administration is finding out about it now…? The USA has 29k BTC left. They will not be the leading Bitcoin country anymore if they don’t change that quickly.

If the Bitcoin Act passes, the government will be buying 1 MILLION Bitcoins on the spot market!

More on the nation-state Bitcoin Race:

➡️Daniel Batten:

A tale of 2 countries:

In 2018, Bulgaria sold 213,500 BTC for "state expenditures", including buying a squadron of military planes. The bitcoin sold is now worth 79% of Bulgaria's public debt. They could have been almost debt-free.

But they chose to increase debt burdens in return for depreciating relics of the industrial-military complex.

Meanwhile, Bhutan, around the same time, started mining Bitcoin. It's now worth 50% of their GDP, and they just put up salaries of govt workers by 50-65%. Be like Bhutan, not Bulgaria.

➡️US potentially sold its Bitcoin? Bitcoin doesn’t care.

Crypto Bills stalled in Congress? Bitcoin doesn’t care.

War in the Middle East? Bitcoin doesn’t care.

➡️House will pass all three Bitcoin and crypto bills (Genius Act, Clarity Act, and Anti-CBDC Act) over the next two days

On the 17th of July:

➡️Convano Inc (6574.T), a Japanese nail salon operator, has officially launched its Bitcoin treasury strategy and plans to purchase JPY 400 million (~$2.7 million) worth of BTC within July. The company established a dedicated “Bitcoin Strategy Office,” led by Director Taiyo Azuma.

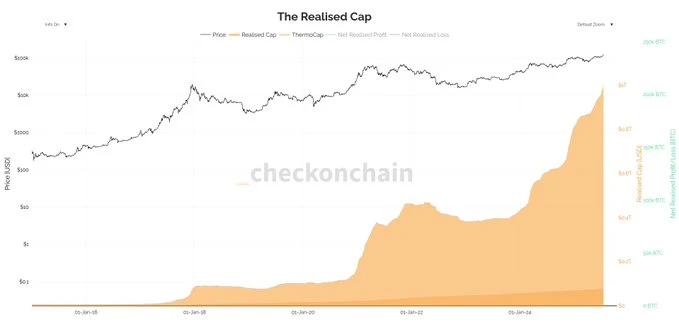

➡️Checkmate: The Bitcoin Realised Cap just hit $1 trillion. This is the ultimate metric for adoption, as it captures the wealth and capital saved in BTC. A massive milestone.

On the 16th of July:

➡️ US Marshals reveal the government now only holds 28,988 Bitcoin worth $3.4 billion, instead of the estimated ~200,000 BTC.

If true, this is a total strategic blunder and sets the United States back years in the Bitcoin race. The Biden Administration sold 170,000 BTC, and the Trump administration is finding out about it now…? The USA has 29k BTC left. They will not be the leading Bitcoin country anymore if they don’t change that quickly.

If the Bitcoin Act passes, the government will be buying 1 MILLION Bitcoins on the spot market!

More on the nation-state Bitcoin Race:

➡️Daniel Batten:

A tale of 2 countries:

In 2018, Bulgaria sold 213,500 BTC for "state expenditures", including buying a squadron of military planes. The bitcoin sold is now worth 79% of Bulgaria's public debt. They could have been almost debt-free.

But they chose to increase debt burdens in return for depreciating relics of the industrial-military complex.

Meanwhile, Bhutan, around the same time, started mining Bitcoin. It's now worth 50% of their GDP, and they just put up salaries of govt workers by 50-65%. Be like Bhutan, not Bulgaria.

➡️US potentially sold its Bitcoin? Bitcoin doesn’t care.

Crypto Bills stalled in Congress? Bitcoin doesn’t care.

War in the Middle East? Bitcoin doesn’t care.

➡️House will pass all three Bitcoin and crypto bills (Genius Act, Clarity Act, and Anti-CBDC Act) over the next two days

On the 17th of July:

➡️Convano Inc (6574.T), a Japanese nail salon operator, has officially launched its Bitcoin treasury strategy and plans to purchase JPY 400 million (~$2.7 million) worth of BTC within July. The company established a dedicated “Bitcoin Strategy Office,” led by Director Taiyo Azuma.

➡️Checkmate: The Bitcoin Realised Cap just hit $1 trillion. This is the ultimate metric for adoption, as it captures the wealth and capital saved in BTC. A massive milestone. ➡️'Trump is preparing to open the $9 trillion US retirement market to crypto, gold, and private equity. An executive order expected this week would allow 401(k) plans to include alternative assets, marking a major shift in how Americans can invest their savings.' -Bitcoin News

Americans hold $9 trillion in 401K savings.

On the 18th of July:

➡️TOM LEE: "Bitcoin has become a $2 trillion asset. Never in financial history has anything reached $2 trillion and disappeared."

➡️ A Satoshi‑era whale just moved 80,000 BTC (~$9.5 B) to Galaxy Digital after 14 years of dormancy. Diamond hands! And yes, that is some sellside pressure.

➡️'French lawmakers propose a five-year trial to let energy producers use surplus nuclear power for Bitcoin mining, aiming to reduce waste and increase revenue.' - Bitcoin News

➡️President Trump will sign the first-ever digital asset bill into law today (Genius Stablecoin Act), A historic moment for crypto regulation. Trump says Bitcoin could be the greatest revolution in financial technology since the internet itself.

But make no mistake, and I will quote Parker Lewis:

"This bill is about regulatory capture, not innovation, and the fact that this was prioritized over Bitcoin tells you Washington is still controlled by special interests. There is a great quote from Bull Durham, "you couldn't hit water if you fell out of a fucking boat!"

The Genius Act forces every legal “digital dollar” through state-approved issuers under full government control. Ergo: CBDC

➡️Chris Larsen has dumped 9 figures worth of XRP this year alone. Satoshi is still sitting on $115B.

Something to ponder on...

Alex Gladstein:

"If you invested $10k into XRP on January 4, 2018, 7.5 years ago, you’d have… about $10k. Not even outpacing inflation. If you invested $10k in BTC on the same day, you’d have $75k Be careful out there…"

➡️Semler Scientific purchases 210 BTC ($25M), increasing its holdings to 4,846 BTC ($577.9M), per SEC filing.

These 6 members of the Bitcoin for Corporations have collectively added 5,643.5 BTC to their corporate treasuries.

➡️'Trump is preparing to open the $9 trillion US retirement market to crypto, gold, and private equity. An executive order expected this week would allow 401(k) plans to include alternative assets, marking a major shift in how Americans can invest their savings.' -Bitcoin News

Americans hold $9 trillion in 401K savings.

On the 18th of July:

➡️TOM LEE: "Bitcoin has become a $2 trillion asset. Never in financial history has anything reached $2 trillion and disappeared."

➡️ A Satoshi‑era whale just moved 80,000 BTC (~$9.5 B) to Galaxy Digital after 14 years of dormancy. Diamond hands! And yes, that is some sellside pressure.

➡️'French lawmakers propose a five-year trial to let energy producers use surplus nuclear power for Bitcoin mining, aiming to reduce waste and increase revenue.' - Bitcoin News

➡️President Trump will sign the first-ever digital asset bill into law today (Genius Stablecoin Act), A historic moment for crypto regulation. Trump says Bitcoin could be the greatest revolution in financial technology since the internet itself.

But make no mistake, and I will quote Parker Lewis:

"This bill is about regulatory capture, not innovation, and the fact that this was prioritized over Bitcoin tells you Washington is still controlled by special interests. There is a great quote from Bull Durham, "you couldn't hit water if you fell out of a fucking boat!"

The Genius Act forces every legal “digital dollar” through state-approved issuers under full government control. Ergo: CBDC

➡️Chris Larsen has dumped 9 figures worth of XRP this year alone. Satoshi is still sitting on $115B.

Something to ponder on...

Alex Gladstein:

"If you invested $10k into XRP on January 4, 2018, 7.5 years ago, you’d have… about $10k. Not even outpacing inflation. If you invested $10k in BTC on the same day, you’d have $75k Be careful out there…"

➡️Semler Scientific purchases 210 BTC ($25M), increasing its holdings to 4,846 BTC ($577.9M), per SEC filing.

These 6 members of the Bitcoin for Corporations have collectively added 5,643.5 BTC to their corporate treasuries.

➡️ Bitcoin has entered the "ignition phase" of a bull market, where price momentum builds before significant gains, per analytics platform Bitcoin Vector.

➡️People say BTC is too volatile and risky:

• Last year: up 87%

• Last 2 years: up 300%

• Last 5 years: up 1,200%

• Last 10 years: up 43,500%

➡️

➡️ Bitcoin has entered the "ignition phase" of a bull market, where price momentum builds before significant gains, per analytics platform Bitcoin Vector.

➡️People say BTC is too volatile and risky:

• Last year: up 87%

• Last 2 years: up 300%

• Last 5 years: up 1,200%

• Last 10 years: up 43,500%

➡️ James Lavish: "Or, said another way, gold has been around for thousands of years, yet Bitcoin has only been around for 15 and is already worth 10% of gold's total value."

➡️Legendary Nostr developer Pablof7z is working on a native iOS Cashu wallet that synchronizes your Ecash across devices and makes backups using Nostr. Enter your nsec, and your money appears!

Source:

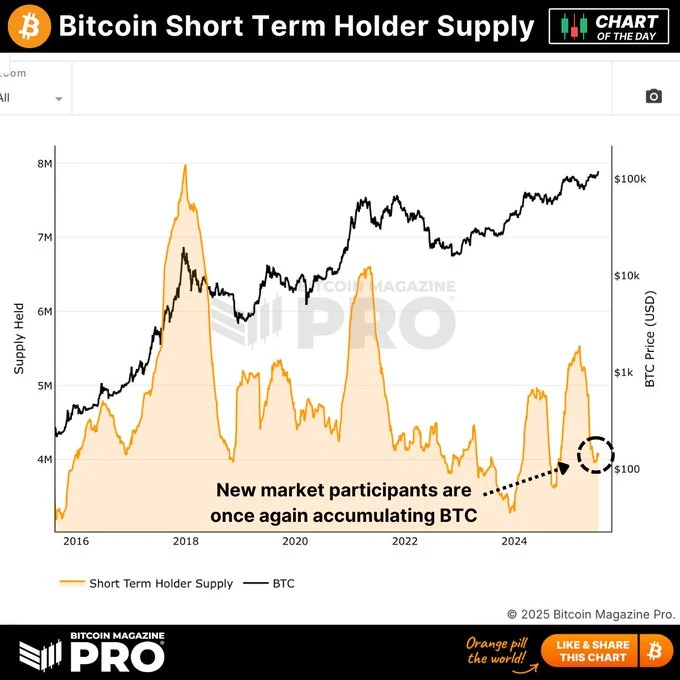

➡️"We're now seeing the supply of BTC held by short-term holders once again begin increasing, indicating new market participants are once again accumulating Bitcoin! Is this the start of retail FOMO?" - Bitcoin Magazin Pro

James Lavish: "Or, said another way, gold has been around for thousands of years, yet Bitcoin has only been around for 15 and is already worth 10% of gold's total value."

➡️Legendary Nostr developer Pablof7z is working on a native iOS Cashu wallet that synchronizes your Ecash across devices and makes backups using Nostr. Enter your nsec, and your money appears!

Source:

➡️"We're now seeing the supply of BTC held by short-term holders once again begin increasing, indicating new market participants are once again accumulating Bitcoin! Is this the start of retail FOMO?" - Bitcoin Magazin Pro

➡️Jack Dorsey's Block to join the S&P 500 on July 23rd. They hold 8,584 Bitcoin on their balance sheet

On the 19th of July:

➡️Michael Saylor's STRATEGY now holds $71 BILLION in Bitcoin, ranking #9 among all S&P 500 treasuries. They’ve leapfrogged Exxon, NVIDIA, PayPal, and CVS...with only Bitcoin.

➡️Bitcoin now has the highest correlation with global money supply at 0.51. More than gold (0.50), S&P 500 (0.45), or bonds (0.15).

➡️'Bitcoin’s Realized Cap has topped $1 trillion for the first time ever, with 25% of that added in 2025 alone. Unlike market cap, Realized Cap values each coin at its last moved price, offering a clearer view of actual investor inflows.' - Bitcoin News

On the 20th of July:

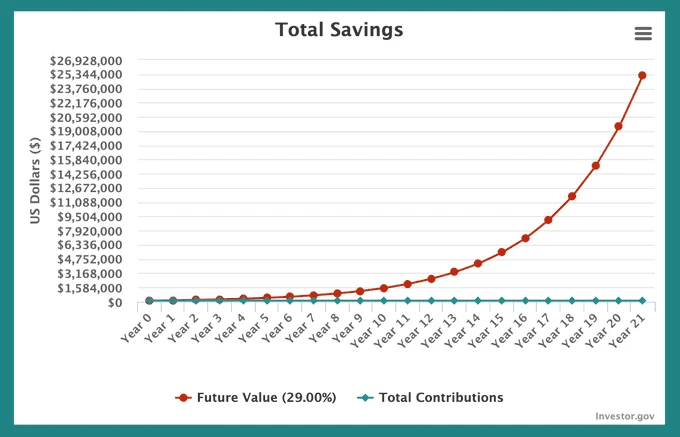

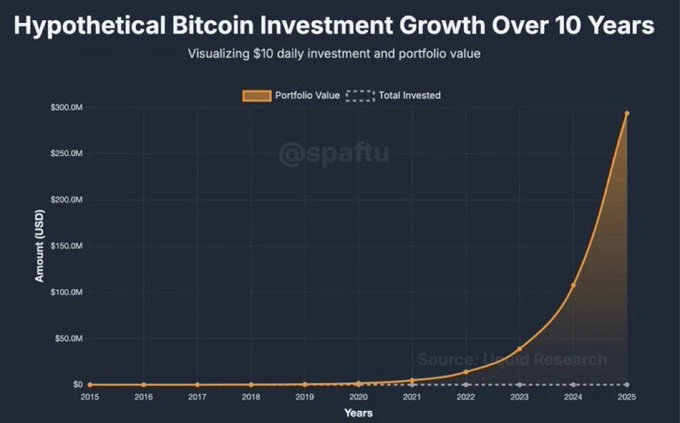

➡️ $120K investment in Bitcoin growing at 29% CAGR will become $25M in 21 years. And all you have to do is buy and HODL.

Bitcoin's historical CAGR from its first traded price of $0.003 in March 2010 to ~$118,000 today (July 20, 2025) is approximately 213% over 15.33 years. That's indeed much higher than 29%. Future returns may vary, but the track record is impressive. HODL wisely.

➡️Jack Dorsey's Block to join the S&P 500 on July 23rd. They hold 8,584 Bitcoin on their balance sheet

On the 19th of July:

➡️Michael Saylor's STRATEGY now holds $71 BILLION in Bitcoin, ranking #9 among all S&P 500 treasuries. They’ve leapfrogged Exxon, NVIDIA, PayPal, and CVS...with only Bitcoin.

➡️Bitcoin now has the highest correlation with global money supply at 0.51. More than gold (0.50), S&P 500 (0.45), or bonds (0.15).

➡️'Bitcoin’s Realized Cap has topped $1 trillion for the first time ever, with 25% of that added in 2025 alone. Unlike market cap, Realized Cap values each coin at its last moved price, offering a clearer view of actual investor inflows.' - Bitcoin News

On the 20th of July:

➡️ $120K investment in Bitcoin growing at 29% CAGR will become $25M in 21 years. And all you have to do is buy and HODL.

Bitcoin's historical CAGR from its first traded price of $0.003 in March 2010 to ~$118,000 today (July 20, 2025) is approximately 213% over 15.33 years. That's indeed much higher than 29%. Future returns may vary, but the track record is impressive. HODL wisely.

P.S...: the 29% is from Saylors' 24 model.

➡️Saylor says he’ll be buying the top forever for a reason. Even if you bought 1 BTC at the top of every cycle, you’d have turned $90,000 into $470,000. A 420% gain by being consistently wrong with the worst timing imaginable.

P.S...: the 29% is from Saylors' 24 model.

➡️Saylor says he’ll be buying the top forever for a reason. Even if you bought 1 BTC at the top of every cycle, you’d have turned $90,000 into $470,000. A 420% gain by being consistently wrong with the worst timing imaginable.

➡️UK may sell over £5 billion worth of seized Bitcoin - The Telegraph Chancellor Rachel Reeves may sell £5B+ in BTC seized from a 2018 Chinese Ponzi scheme — including 61,000 Bitcoin. The Home Office is building a framework to liquidate the stash and plug a fiscal gap. The Westminster class are dinosaurs who don’t get the future. The UK should be implementing Reform’s Crypto Bill and increasing its Bitcoin reserves.

I'm sure they won't regret it. Just ask Deutschland!

The 61,250 Bitcoin, reportedly to be sold by the UK according to The Telegraph, were seized from Jian Wen and associates in a 2018 Chinese fraud case and remain legally contested. Chinese authorities and victims demand their return, and no sale can occur until the legal process is resolved, per Bitcoin journalist DecentraSuze

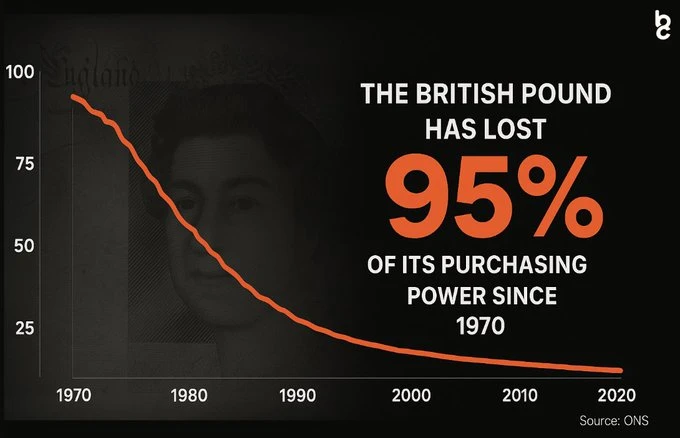

Anyway, the British Pound has lost 95% of its purchasing power since 1970. You might want to hodl them bitties!

➡️UK may sell over £5 billion worth of seized Bitcoin - The Telegraph Chancellor Rachel Reeves may sell £5B+ in BTC seized from a 2018 Chinese Ponzi scheme — including 61,000 Bitcoin. The Home Office is building a framework to liquidate the stash and plug a fiscal gap. The Westminster class are dinosaurs who don’t get the future. The UK should be implementing Reform’s Crypto Bill and increasing its Bitcoin reserves.

I'm sure they won't regret it. Just ask Deutschland!

The 61,250 Bitcoin, reportedly to be sold by the UK according to The Telegraph, were seized from Jian Wen and associates in a 2018 Chinese fraud case and remain legally contested. Chinese authorities and victims demand their return, and no sale can occur until the legal process is resolved, per Bitcoin journalist DecentraSuze

Anyway, the British Pound has lost 95% of its purchasing power since 1970. You might want to hodl them bitties!

➡️74% of all Bitcoin is now held by long-term holders, a 15-year high. Nobody’s selling.

➡️On July 15, miners sent 16,000 BTC to exchanges, the largest single-day outflow since April, signaling they may be cashing in on recent gains. Such a supply surge could be putting short-term pressure on Bitcoin’s rally.

➡️Grok4 just updated long-term BTC targets:

• 2025: $175,000

• 2030: $950,000

• 2040: $7,200,000

• 2050: $34,000,000

Endgame? Bitcoin replaces nation-state treasuries.

On the 21st of July:

➡️The President of the United States is posting Bitcoin Twitter classics on social media. We are in a new era of adoption.

➡️74% of all Bitcoin is now held by long-term holders, a 15-year high. Nobody’s selling.

➡️On July 15, miners sent 16,000 BTC to exchanges, the largest single-day outflow since April, signaling they may be cashing in on recent gains. Such a supply surge could be putting short-term pressure on Bitcoin’s rally.

➡️Grok4 just updated long-term BTC targets:

• 2025: $175,000

• 2030: $950,000

• 2040: $7,200,000

• 2050: $34,000,000

Endgame? Bitcoin replaces nation-state treasuries.

On the 21st of July:

➡️The President of the United States is posting Bitcoin Twitter classics on social media. We are in a new era of adoption.

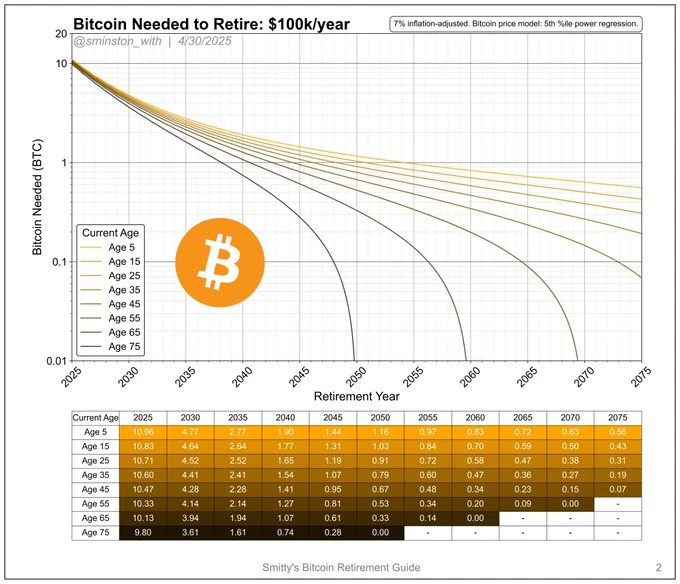

➡️Sminston with: "Average 2035 BTC Retirement by country, 2 easy-to-read plots:"

➡️Sminston with: "Average 2035 BTC Retirement by country, 2 easy-to-read plots:" Most people on Earth will need less than 1 Bitcoin to retire by 2035, but the gap by country is massive.

Big assumption #1: 7% annual M2 expansion (inflation) rate. Will add error, thus will be updated in a future version.

Big assumption #2: Annual expenses are based on each country's average annual income (in USD). Data source: worlddata.info

➡️Genius Group increases its Bitcoin treasury to 200 BTC. They aim to reach 1,000 BTC by the end of 2025 and 10,000 BTC within 24 months.

➡️Sequans has just purchased an additional 1,264 Bitcoin for $150 million. They now hold 2,317 BTC worth $273.2 million.

➡️Strategy has acquired 6,220 BTC for ~$739.8 million at ~$118,940 per bitcoin and has achieved BTC Yield of 20.8% YTD 2025. As of 7/20/2025, we hodl 607,770 Bitcoin acquired for ~$43.61 billion at ~$71,756 per Bitcoin.

➡️Global Bitcoin Mining Hashrate Increases Above 900,000,000,000,000,000,000x Per Second

🎁If you have made it this far, I would like to give you a little gift:

Jeff Booth | AI, Bitcoin, & The Collapse Of The Fiat Economy

What if the entire economy is built on a lie? Jeff Booth argues that our credit-based system fights the natural deflation of free markets through endless money manipulation, and why Bitcoin creates the first truly global free market. They explore how AI accelerates abundance, why most people are stuck in “Fiatland,” and how Bitcoin adoption will transform everything from housing to global power structures. In this episode:

Why inflation isn’t natural — and what deflation really means

How AI and Bitcoin together rewrite the rules of the economy

The cultural divide between “Fiatland” and Bitcoin

Why the Global South may leapfrog the West in Bitcoin adoption

How to prepare for the transition to a Bitcoin economy

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Most people on Earth will need less than 1 Bitcoin to retire by 2035, but the gap by country is massive.

Big assumption #1: 7% annual M2 expansion (inflation) rate. Will add error, thus will be updated in a future version.

Big assumption #2: Annual expenses are based on each country's average annual income (in USD). Data source: worlddata.info

➡️Genius Group increases its Bitcoin treasury to 200 BTC. They aim to reach 1,000 BTC by the end of 2025 and 10,000 BTC within 24 months.

➡️Sequans has just purchased an additional 1,264 Bitcoin for $150 million. They now hold 2,317 BTC worth $273.2 million.

➡️Strategy has acquired 6,220 BTC for ~$739.8 million at ~$118,940 per bitcoin and has achieved BTC Yield of 20.8% YTD 2025. As of 7/20/2025, we hodl 607,770 Bitcoin acquired for ~$43.61 billion at ~$71,756 per Bitcoin.

➡️Global Bitcoin Mining Hashrate Increases Above 900,000,000,000,000,000,000x Per Second

🎁If you have made it this far, I would like to give you a little gift:

Jeff Booth | AI, Bitcoin, & The Collapse Of The Fiat Economy

What if the entire economy is built on a lie? Jeff Booth argues that our credit-based system fights the natural deflation of free markets through endless money manipulation, and why Bitcoin creates the first truly global free market. They explore how AI accelerates abundance, why most people are stuck in “Fiatland,” and how Bitcoin adoption will transform everything from housing to global power structures. In this episode:

Why inflation isn’t natural — and what deflation really means

How AI and Bitcoin together rewrite the rules of the economy

The cultural divide between “Fiatland” and Bitcoin

Why the Global South may leapfrog the West in Bitcoin adoption

How to prepare for the transition to a Bitcoin economy

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃ On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 14.07.2025

🧠Quote(s) of the week:

The individual has always had to struggle to keep from being overwhelmed by the tribe. If you try it, you will often be lonely, and sometimes frightened. But no price is too high to pay for the privilege of owning yourself. -Friedrich Nietzsche

Bitcoin is not making you richer, it's preventing you from getting poorer. Pour one out for those without protection from poverty. - Jameson Lopp

🧡Bitcoin news🧡

Officially watch your mouth, season!

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 14.07.2025

🧠Quote(s) of the week:

The individual has always had to struggle to keep from being overwhelmed by the tribe. If you try it, you will often be lonely, and sometimes frightened. But no price is too high to pay for the privilege of owning yourself. -Friedrich Nietzsche

Bitcoin is not making you richer, it's preventing you from getting poorer. Pour one out for those without protection from poverty. - Jameson Lopp

🧡Bitcoin news🧡

Officially watch your mouth, season!

On the 7th of July:

➡️Semler Scientific bought another $20 million Bitcoin! Semler Scientific now holds 4,636 Bitcoin.

On the 8th of July:

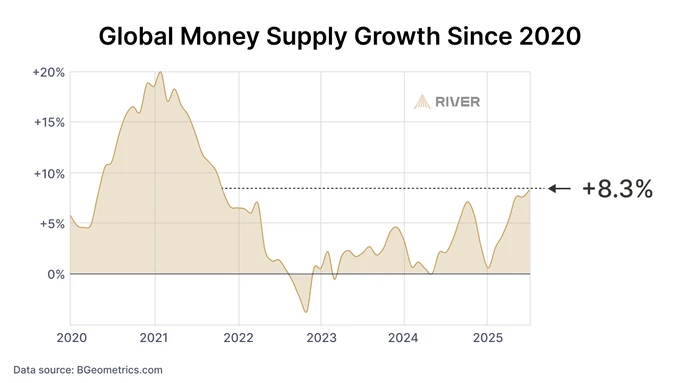

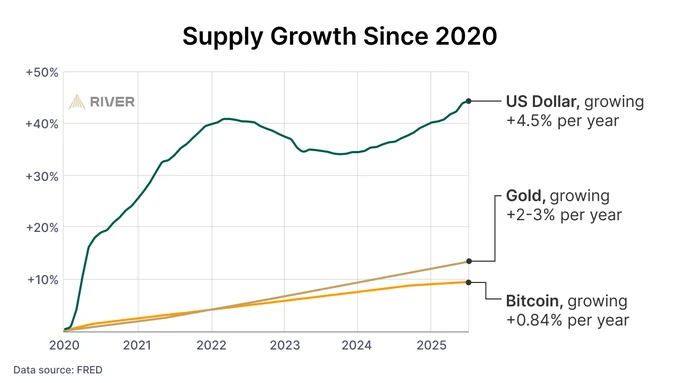

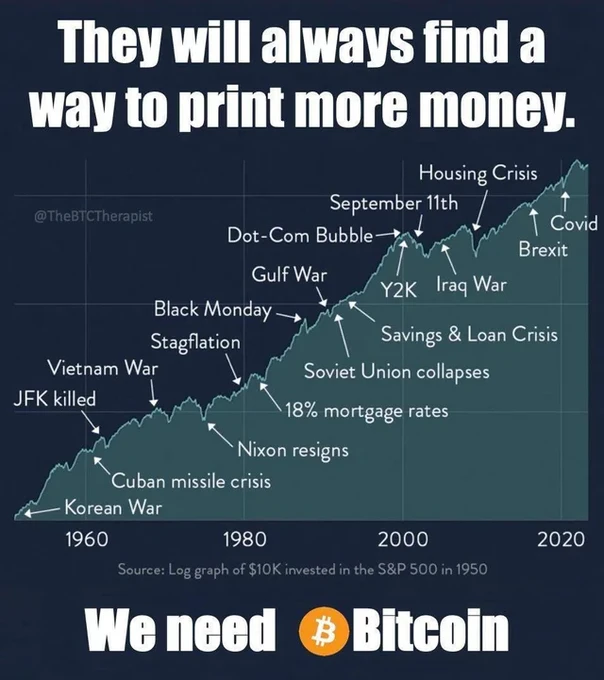

➡️River: The endless dollar loop is happening again.

New spending bill --> more debt --> more dollars created.

Time to inflation-proof your future with Bitcoin.

On the 7th of July:

➡️Semler Scientific bought another $20 million Bitcoin! Semler Scientific now holds 4,636 Bitcoin.

On the 8th of July:

➡️River: The endless dollar loop is happening again.

New spending bill --> more debt --> more dollars created.

Time to inflation-proof your future with Bitcoin.

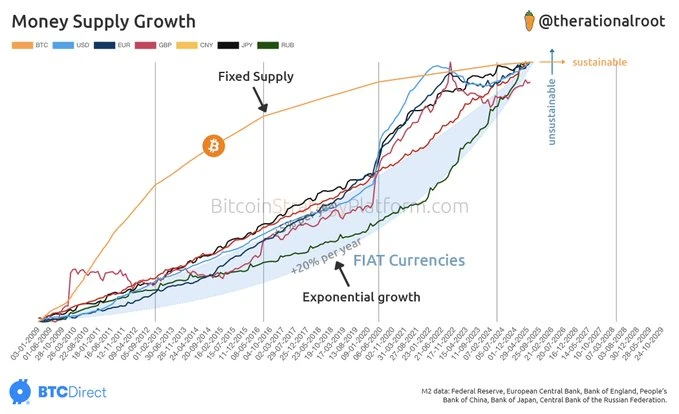

To follow this up, a great tweet by The Rational Root:

"If big government and inefficiency were just a Democrat/Republican issue, why do all countries in the world face the same problem? Starting the America Party is a noble initiative, but I hope it helps address the root cause. The root cause isn’t the ruling party, it’s money supply growth. When governments control the money supply, they’re always incentivized to print more and grow inefficient. Fix the money, fix America."

To follow this up, a great tweet by The Rational Root:

"If big government and inefficiency were just a Democrat/Republican issue, why do all countries in the world face the same problem? Starting the America Party is a noble initiative, but I hope it helps address the root cause. The root cause isn’t the ruling party, it’s money supply growth. When governments control the money supply, they’re always incentivized to print more and grow inefficient. Fix the money, fix America." ➡️The creator of Twitter and Cash App, @Jack Dorsey, just released a Bluetooth messaging app called ‘Bitchat’ that doesn't need the internet or cell service. Within an hour, users have started sending bitcoin using the peer-to-peer encrypted mesh network.

The app stores transactions until reaching an online device to broadcast to the Bitcoin network, making it ideal for blackouts, emergencies, and off-grid use.

➡️BlackRock's Bitcoin ETF now holds over 700K Bitcoin. That's 3.5% of the total circulating supply.

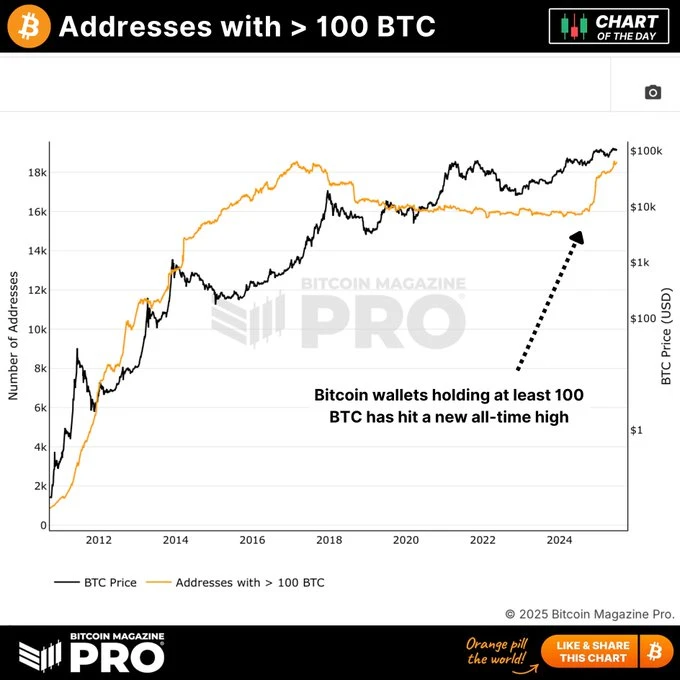

➡️'Lots of big money accumulating BTC right now, we've just seen the amount of wallets holding at least 100 BTC hit a new all-time high! Whales are accumulating, are you?' -Bitcoin Magazine Pro

➡️The creator of Twitter and Cash App, @Jack Dorsey, just released a Bluetooth messaging app called ‘Bitchat’ that doesn't need the internet or cell service. Within an hour, users have started sending bitcoin using the peer-to-peer encrypted mesh network.

The app stores transactions until reaching an online device to broadcast to the Bitcoin network, making it ideal for blackouts, emergencies, and off-grid use.

➡️BlackRock's Bitcoin ETF now holds over 700K Bitcoin. That's 3.5% of the total circulating supply.

➡️'Lots of big money accumulating BTC right now, we've just seen the amount of wallets holding at least 100 BTC hit a new all-time high! Whales are accumulating, are you?' -Bitcoin Magazine Pro ➡️Ego Death Capital closes $100 million fund to invest in Bitcoin companies. Source:

➡️Ego Death Capital closes $100 million fund to invest in Bitcoin companies. Source:  ➡️Strategy's Bitcoin holdings are up 57% $24.2 billion in profit.

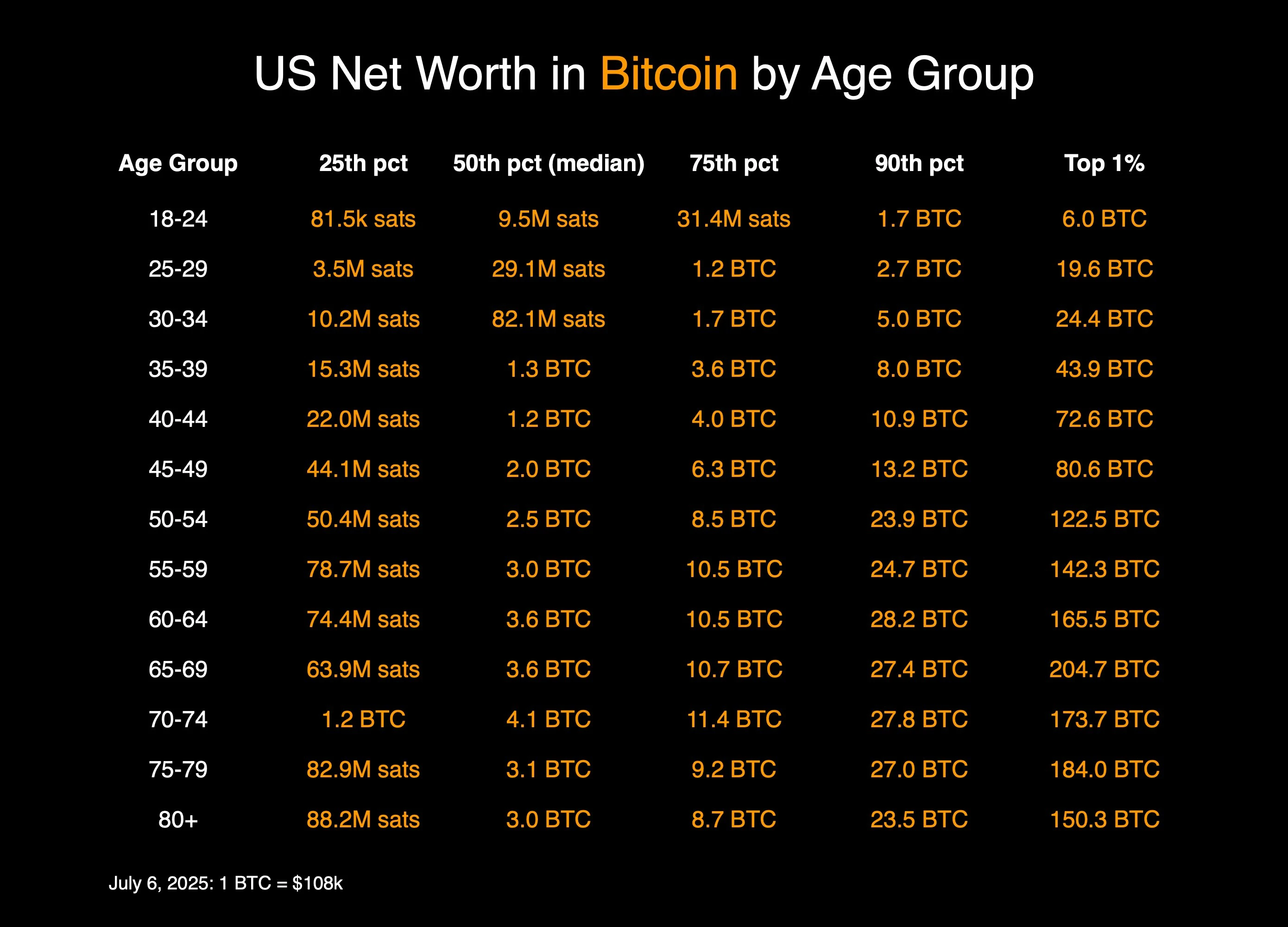

➡️I have shared the following already a couple of times. Sminton With: Smitty's Bitcoin Retirement Guide - annual expense scenarios, assumed future 7% average annual inflation, and does not account for taxes.

➡️Strategy's Bitcoin holdings are up 57% $24.2 billion in profit.

➡️I have shared the following already a couple of times. Sminton With: Smitty's Bitcoin Retirement Guide - annual expense scenarios, assumed future 7% average annual inflation, and does not account for taxes. ➡️Corporations purchased 159,107 Bitcoin worth over $17.4 BILLION in Q2, 2025. Demand is increasing, supply is decreasing.

➡️Corporations purchased 159,107 Bitcoin worth over $17.4 BILLION in Q2, 2025. Demand is increasing, supply is decreasing. ➡️ Airline giant Emirates to accept Bitcoin for flights.

➡️ Just when you thought politicians couldn't get any dumber:

U.S. Senate bill calls for sanctions on El Salvador's Bitcoin strategy. Targets Bukele's regime, BTC purchases, exchange activity, and alleged sanction evasion.

This is why you want to be sovereign as a country. Sovereign nations? Sure, but Uncle Sam loves playing world cop when his petrodollar feels the heat. Classic empire vibes. Currently, El Salvador has an almost $400 million unrealized profit on their Bitcoin holdings.

➡️'Nearly half (49%) of Gen Z say planning for the future feels pointless, so they’re choosing to spend freely this summer. At the same time, over 40% of 18–29 year olds have zero retirement savings. Gen Z needs Bitcoin.' - Bitcoin News

On the 10th of July:

➡️Bitcoin is just 7% away from flipping Amazon to become the 5th largest asset in the world.

➡️Bitcoin miners transaction volume share drops to 3.3%, the lowest in nearly two years.

➡️Saifedean with another truth bomb:

"The Fed started raising rates in March 2022 with Bitcoin at $42k. 40 months later, Bitcoin is up 167% to $112k & all the poor Fiatbros who said Bitcoin is a "low interest rate phenomenon" still have to listen to Fed announcements every month like serfs listening to their lord."

➡️ Airline giant Emirates to accept Bitcoin for flights.

➡️ Just when you thought politicians couldn't get any dumber:

U.S. Senate bill calls for sanctions on El Salvador's Bitcoin strategy. Targets Bukele's regime, BTC purchases, exchange activity, and alleged sanction evasion.

This is why you want to be sovereign as a country. Sovereign nations? Sure, but Uncle Sam loves playing world cop when his petrodollar feels the heat. Classic empire vibes. Currently, El Salvador has an almost $400 million unrealized profit on their Bitcoin holdings.

➡️'Nearly half (49%) of Gen Z say planning for the future feels pointless, so they’re choosing to spend freely this summer. At the same time, over 40% of 18–29 year olds have zero retirement savings. Gen Z needs Bitcoin.' - Bitcoin News

On the 10th of July:

➡️Bitcoin is just 7% away from flipping Amazon to become the 5th largest asset in the world.

➡️Bitcoin miners transaction volume share drops to 3.3%, the lowest in nearly two years.

➡️Saifedean with another truth bomb:

"The Fed started raising rates in March 2022 with Bitcoin at $42k. 40 months later, Bitcoin is up 167% to $112k & all the poor Fiatbros who said Bitcoin is a "low interest rate phenomenon" still have to listen to Fed announcements every month like serfs listening to their lord." When you know, you know!

➡️M2 Money Supply Model says BTC is lagging by 20%. If the correlation holds, price should teleport to $130K.

When you know, you know!

➡️M2 Money Supply Model says BTC is lagging by 20%. If the correlation holds, price should teleport to $130K. ➡️Alphractal's Bitcoin Repetition Fractal Cycle model predicts this cycle's peak for October 12-16, 2025.

➡️ Publicly traded K Wave Media secures $1 billion capital capacity to buy Bitcoin.

➡️Sequans has launched their #Bitcoin treasury with an initial purchase of 370 BTC. The French semiconductor firm plans to accumulate over 3,000 BTC in the coming weeks.

➡️By the end of today, you'll probably have used your bank account — maybe to buy groceries, pay rent, or send money to a friend. Even better, to receive your salary. It's something many of us take for granted. Mobile Phones.

However, for more than a billion people globally, transactions only happen with cash. That means carrying around physical notes and coins, traveling long distances just to send or receive money, and facing the constant risk of losing it or having it stolen.

The absence of formal banking services adds yet another hurdle for people in poverty. But in recent years, “mobile money” has transformed how many people access financial services. You can see the growth of mobile money accounts in the chart." - Our World in Data

I truly believe Bitcoin will play a pivotal role transforming our world and opening up new opportunities to have ownership of "your" money, especially in developing countries.

➡️FORBES: “What we’re seeing is a long-overdue recalibration from speculation to structural adoption." “Bitcoin’s new all-time high is a signal of growing institutional maturity and global confidence in crypto as an asset class.”

➡️A digital euro would complement cash by offering its equivalent for digital transactions, emphasised Piero Cipollone in his speech at Banka Slovenije. It would also enhance Europe’s sovereignty, resilience, and innovation potential in payments, while protecting privacy.

That’s just a load of horseshit! Haha privacy? And what the F is he talking about...for all intents and purposes, the euro is already digital. If you’re reading this, study Bitcoin.

Daniel Batten: "A digital Euro would, in the words of ECB's president, emulate the "success" of China's state surveillance tool the digital e-CNY, and in the words of BIS GM Agustín Carstens, give "total control" to the central bank, "and the means to enforce it".

It is unwanted, unrequested, unneeded by EU citizens in general, and serves only the interests of the ECB to maintain its influence on monetary policy.

War is peace

Freedom is slavery

The Digital Euro protects privacy."

On the 11th of July:

➡️German government's decision to sell 50,000 Bitcoin at $54k cost them $3.1 billion in missed profits.

➡️BITCOIN vs US DOLLAR (2025) BTC: +24% USD: -14%

Holding USD instead of Bitcoin in 2025 would have cost you 38%.

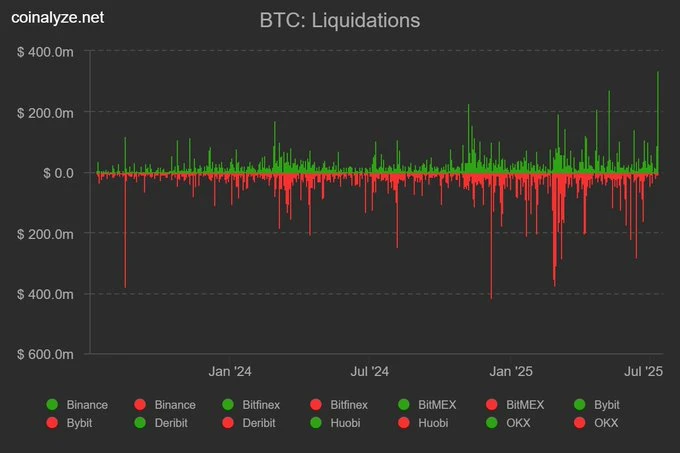

➡️$1,100,000,000 worth of Bitcoin and crypto shorts got liquidated in the past 24 hours.

➡️Alphractal's Bitcoin Repetition Fractal Cycle model predicts this cycle's peak for October 12-16, 2025.

➡️ Publicly traded K Wave Media secures $1 billion capital capacity to buy Bitcoin.

➡️Sequans has launched their #Bitcoin treasury with an initial purchase of 370 BTC. The French semiconductor firm plans to accumulate over 3,000 BTC in the coming weeks.

➡️By the end of today, you'll probably have used your bank account — maybe to buy groceries, pay rent, or send money to a friend. Even better, to receive your salary. It's something many of us take for granted. Mobile Phones.

However, for more than a billion people globally, transactions only happen with cash. That means carrying around physical notes and coins, traveling long distances just to send or receive money, and facing the constant risk of losing it or having it stolen.

The absence of formal banking services adds yet another hurdle for people in poverty. But in recent years, “mobile money” has transformed how many people access financial services. You can see the growth of mobile money accounts in the chart." - Our World in Data

I truly believe Bitcoin will play a pivotal role transforming our world and opening up new opportunities to have ownership of "your" money, especially in developing countries.

➡️FORBES: “What we’re seeing is a long-overdue recalibration from speculation to structural adoption." “Bitcoin’s new all-time high is a signal of growing institutional maturity and global confidence in crypto as an asset class.”

➡️A digital euro would complement cash by offering its equivalent for digital transactions, emphasised Piero Cipollone in his speech at Banka Slovenije. It would also enhance Europe’s sovereignty, resilience, and innovation potential in payments, while protecting privacy.

That’s just a load of horseshit! Haha privacy? And what the F is he talking about...for all intents and purposes, the euro is already digital. If you’re reading this, study Bitcoin.

Daniel Batten: "A digital Euro would, in the words of ECB's president, emulate the "success" of China's state surveillance tool the digital e-CNY, and in the words of BIS GM Agustín Carstens, give "total control" to the central bank, "and the means to enforce it".

It is unwanted, unrequested, unneeded by EU citizens in general, and serves only the interests of the ECB to maintain its influence on monetary policy.

War is peace

Freedom is slavery

The Digital Euro protects privacy."

On the 11th of July:

➡️German government's decision to sell 50,000 Bitcoin at $54k cost them $3.1 billion in missed profits.

➡️BITCOIN vs US DOLLAR (2025) BTC: +24% USD: -14%

Holding USD instead of Bitcoin in 2025 would have cost you 38%.

➡️$1,100,000,000 worth of Bitcoin and crypto shorts got liquidated in the past 24 hours.

This was the biggest Bitcoin shorts liquidation event in years.

On the 13th of July:

➡️'Pay later' firm Klarna to integrate cryptocurrencies into platform as it positions to become a digital bank ahead of an IPO in late 2025 - Financial Times

Klarna has:

• 85 million users

• $100b of volume.

• 500K merchants.

On the 14th of July:

➡️Joe Consorti: $1.3 BILLION IN SHORTS were liquidated in less than 60 seconds. Bitcoin skipped straight past $120k and went directly to $121k. At $2.39 trillion, Bitcoin is now officially larger than Amazon, and is the world's 5th largest asset. Remember this day.

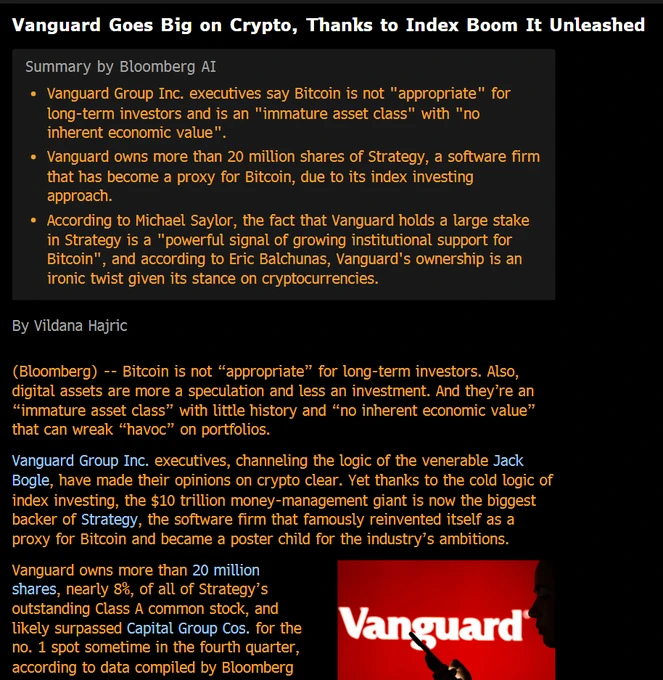

➡️Vanguard is now the biggest shareholder of Michael Saylor’s STRATEGY.

"Vanguard: Bitcoin is immature and has no value. Also Vanguard: Buys 20M shares of MSTR, becomes top backer of Bitcoin’s loudest bull. Indexing into $9B of what you openly mock isn't strategy. It’s institutional dementia. " - Matthew Sigel

This was the biggest Bitcoin shorts liquidation event in years.

On the 13th of July:

➡️'Pay later' firm Klarna to integrate cryptocurrencies into platform as it positions to become a digital bank ahead of an IPO in late 2025 - Financial Times

Klarna has:

• 85 million users

• $100b of volume.

• 500K merchants.

On the 14th of July:

➡️Joe Consorti: $1.3 BILLION IN SHORTS were liquidated in less than 60 seconds. Bitcoin skipped straight past $120k and went directly to $121k. At $2.39 trillion, Bitcoin is now officially larger than Amazon, and is the world's 5th largest asset. Remember this day.

➡️Vanguard is now the biggest shareholder of Michael Saylor’s STRATEGY.

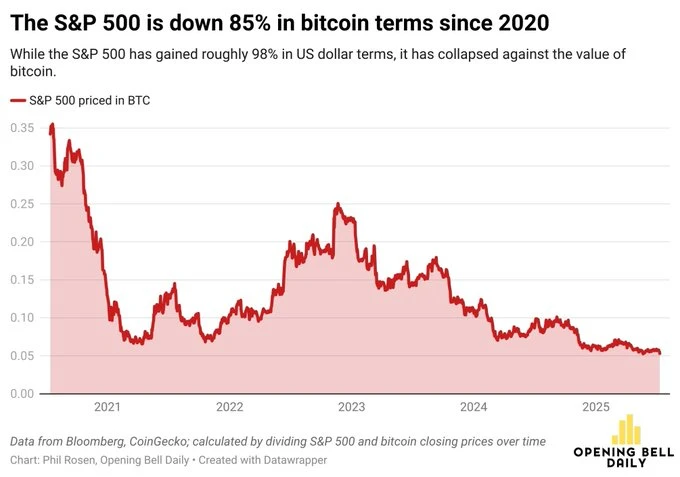

"Vanguard: Bitcoin is immature and has no value. Also Vanguard: Buys 20M shares of MSTR, becomes top backer of Bitcoin’s loudest bull. Indexing into $9B of what you openly mock isn't strategy. It’s institutional dementia. " - Matthew Sigel ➡️'The S&P 500 is up nearly 100% in dollar terms since 2020. But priced in Bitcoin? It’s down 85%. The real benchmark has changed.' - TFTC

➡️'The S&P 500 is up nearly 100% in dollar terms since 2020. But priced in Bitcoin? It’s down 85%. The real benchmark has changed.' - TFTC ➡️Federal Reserve just issued a joint statement with 2 regulators confirming that banks can offer Bitcoin and crypto custody.

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Bitcoin All Time High: Has the Cycle Broken? | Rational Root

Root is a Bitcoin on-chain analyst and the author of the "Bitcoin Strategy Platform" Substack. In this episode, they discuss the current state of Bitcoin’s bull market, why Root believes there’s no basis for a prolonged bear market, and how institutional demand is changing Bitcoin’s price dynamics. They cover Bitcoin’s structural adoption through ETFs, treasury companies, and sovereign buyers, and why these may limit downside volatility. They also get into the psychological stages of the market, why 100k could now serve as Bitcoin’s new baseline, and how macro factors like interest rate cuts and Trump’s policies might influence the next leg up.

Watch it here:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

➡️Federal Reserve just issued a joint statement with 2 regulators confirming that banks can offer Bitcoin and crypto custody.

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Bitcoin All Time High: Has the Cycle Broken? | Rational Root

Root is a Bitcoin on-chain analyst and the author of the "Bitcoin Strategy Platform" Substack. In this episode, they discuss the current state of Bitcoin’s bull market, why Root believes there’s no basis for a prolonged bear market, and how institutional demand is changing Bitcoin’s price dynamics. They cover Bitcoin’s structural adoption through ETFs, treasury companies, and sovereign buyers, and why these may limit downside volatility. They also get into the psychological stages of the market, why 100k could now serve as Bitcoin’s new baseline, and how macro factors like interest rate cuts and Trump’s policies might influence the next leg up.

Watch it here:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

On the 30th of June:

➡️Strategy has acquired 4,980 BTC for ~$531.9 million at ~$106,801 per bitcoin and has achieved BTC Yield of 19.7% YTD 2025. As of 6/29/2025, we hodl 597,325 Bitcoin acquired for ~$42.40 billion at ~$70,982 per Bitcoin.

➡️River: 'You can run the best business in the world, but still lose billions to inflation. Businesses, it's time to protect your profits with Bitcoin.'

On the 1st of July:

➡️Publicly traded DDC Enterprise closes $528 million financing to advance its Bitcoin treasury strategy.

➡️Italian banking giant UniCredit to offer European clients access to BlackRock's Bitcoin ETF in a newly structured product - Bloomberg

➡️Multiple crypto firms, including Fidelity Digital Assets, have applied for national bank charters

➡️Bitcoin sets a new all-time high monthly closing price at $107,173.

➡️Bitcoin OTC balances have dropped to a 10-year low of 156,600 BTC. Source: The stats likely come from CryptoQuant, a reputable source for on-chain Bitcoin data, tracking OTC desk balances using address labeling and flow analysis. Their data shows balances at 156,600 BTC, a 10-year low, aligning with trends from 480,000 BTC in 2021 to 146,000 BTC in early 2025. While generally reliable, tracking all OTC activity is challenging, as some private transactions may be missed, per CryptoQuant's own caution.

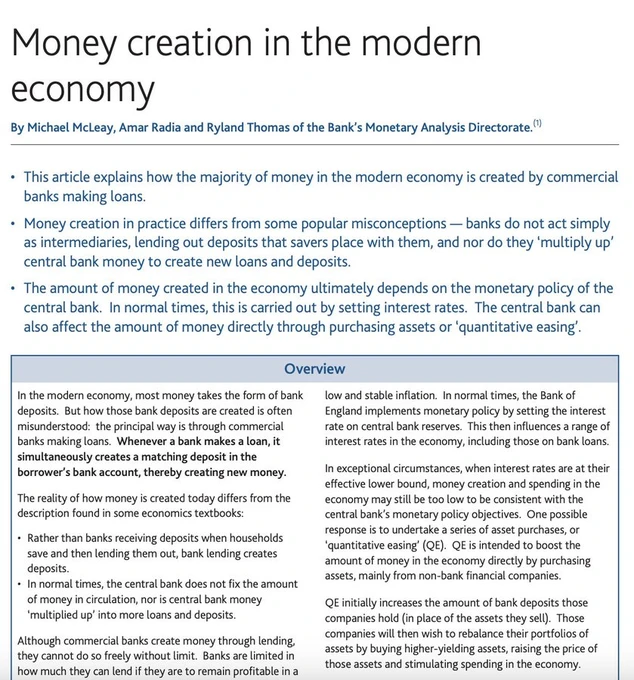

➡️Simply Bitcoin: "The Bank of England admitted in 2014 that banks create money out of thin air when they issue loans. Still think we’re the crazy ones for buying Bitcoin?"

On the 30th of June:

➡️Strategy has acquired 4,980 BTC for ~$531.9 million at ~$106,801 per bitcoin and has achieved BTC Yield of 19.7% YTD 2025. As of 6/29/2025, we hodl 597,325 Bitcoin acquired for ~$42.40 billion at ~$70,982 per Bitcoin.

➡️River: 'You can run the best business in the world, but still lose billions to inflation. Businesses, it's time to protect your profits with Bitcoin.'

On the 1st of July:

➡️Publicly traded DDC Enterprise closes $528 million financing to advance its Bitcoin treasury strategy.

➡️Italian banking giant UniCredit to offer European clients access to BlackRock's Bitcoin ETF in a newly structured product - Bloomberg

➡️Multiple crypto firms, including Fidelity Digital Assets, have applied for national bank charters

➡️Bitcoin sets a new all-time high monthly closing price at $107,173.

➡️Bitcoin OTC balances have dropped to a 10-year low of 156,600 BTC. Source: The stats likely come from CryptoQuant, a reputable source for on-chain Bitcoin data, tracking OTC desk balances using address labeling and flow analysis. Their data shows balances at 156,600 BTC, a 10-year low, aligning with trends from 480,000 BTC in 2021 to 146,000 BTC in early 2025. While generally reliable, tracking all OTC activity is challenging, as some private transactions may be missed, per CryptoQuant's own caution.

➡️Simply Bitcoin: "The Bank of England admitted in 2014 that banks create money out of thin air when they issue loans. Still think we’re the crazy ones for buying Bitcoin?" ➡️Joe Consorti: "That little orange square will consume every other asset you see here. Bitcoin is competing against every single market. It is not a store of value. That's the trade. Speculative attack everything."

➡️Joe Consorti: "That little orange square will consume every other asset you see here. Bitcoin is competing against every single market. It is not a store of value. That's the trade. Speculative attack everything."

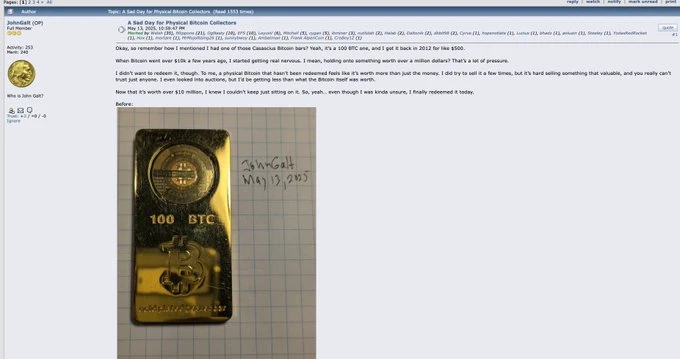

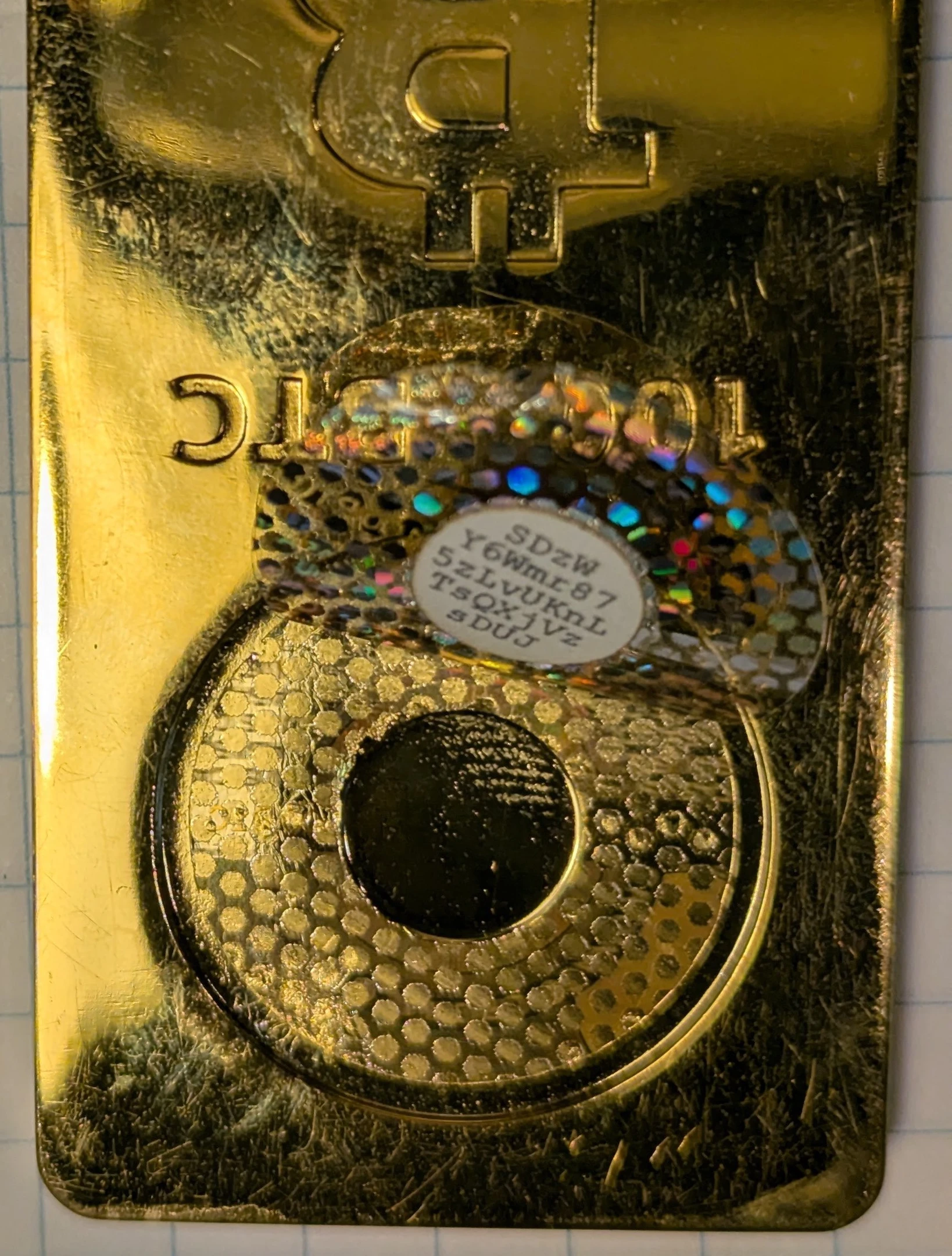

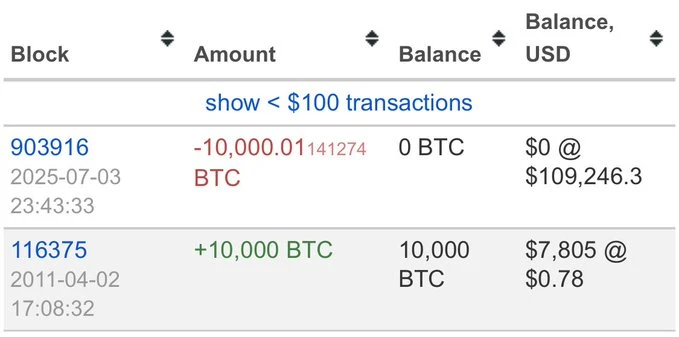

➡️This guy, OG Bitcoiner, bought a 100 BTC gold Casascius bar back in 2011 for $500 and then finally cashed out the seed phrase this year, ten million dollars profit. Absolutely wild! Balls of steel, insane foresight, unbeatable risk tolerance.

➡️This guy, OG Bitcoiner, bought a 100 BTC gold Casascius bar back in 2011 for $500 and then finally cashed out the seed phrase this year, ten million dollars profit. Absolutely wild! Balls of steel, insane foresight, unbeatable risk tolerance. “Okay, so remember how I mentioned I had one of those Casascius Bitcoin bars? Yeah, it’s a 100 BTC one, and I got it back in 2012 for like $500. Now that it’s worth over $10 million, I knew I couldn’t keep just sitting on it. So, yeah… even though I was kinda unsure, I finally redeemed it today.” — John Galt.

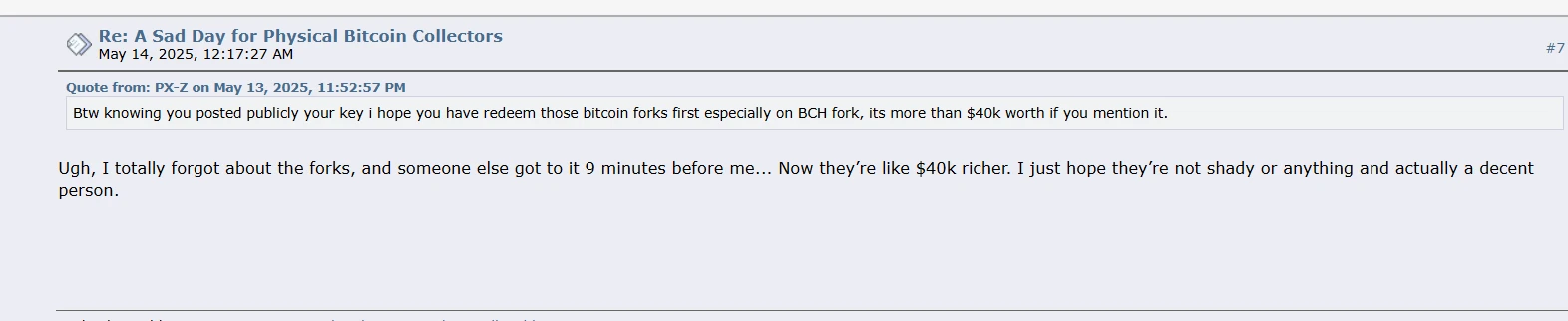

He posted the private key [:SDzWY6Wmr875zLvUKnLTsQXjVzsDUJ] publicly online after redeeming the 100 BTC, but then remembered that the key also unlocked the coins of every fork of Bitcoin since 2012. Somebody swept the wallet of $40,000 of Bitcoin Cash (BCH). That’s 0.4 BTC. No biggie.

“Okay, so remember how I mentioned I had one of those Casascius Bitcoin bars? Yeah, it’s a 100 BTC one, and I got it back in 2012 for like $500. Now that it’s worth over $10 million, I knew I couldn’t keep just sitting on it. So, yeah… even though I was kinda unsure, I finally redeemed it today.” — John Galt.

He posted the private key [:SDzWY6Wmr875zLvUKnLTsQXjVzsDUJ] publicly online after redeeming the 100 BTC, but then remembered that the key also unlocked the coins of every fork of Bitcoin since 2012. Somebody swept the wallet of $40,000 of Bitcoin Cash (BCH). That’s 0.4 BTC. No biggie.

NEVER POST YOUR PRIVATE KEYS

NEVER POST YOUR PRIVATE KEYS Source:

Source:  ➡️'Germany's largest banking group Sparkassen lifts its three-year digital asset ban and prepares to offer Bitcoin trading by summer 2026.' - Bitcoin News

➡️German banking giant Deutsche Bank to launch Bitcoin and crypto custody services - Bloomberg

➡️Design platform Figma just disclosed owning $70m in Bitcoin with board approval to buy another $30m in Bitcoin.

➡️Connecticut governor officially bans the state from owning Bitcoin or any digital assets. HFSP, DisConnecticut!

➡️Saylor: "Public companies acquired about 131,000 coins in the second quarter, growing their bitcoin balance 18%, according to data provider Bitcoin Treasuries. ETFs showed an 8% increase, or about 111,000 BTC, in the same period.

➡️'Germany's largest banking group Sparkassen lifts its three-year digital asset ban and prepares to offer Bitcoin trading by summer 2026.' - Bitcoin News

➡️German banking giant Deutsche Bank to launch Bitcoin and crypto custody services - Bloomberg

➡️Design platform Figma just disclosed owning $70m in Bitcoin with board approval to buy another $30m in Bitcoin.

➡️Connecticut governor officially bans the state from owning Bitcoin or any digital assets. HFSP, DisConnecticut!