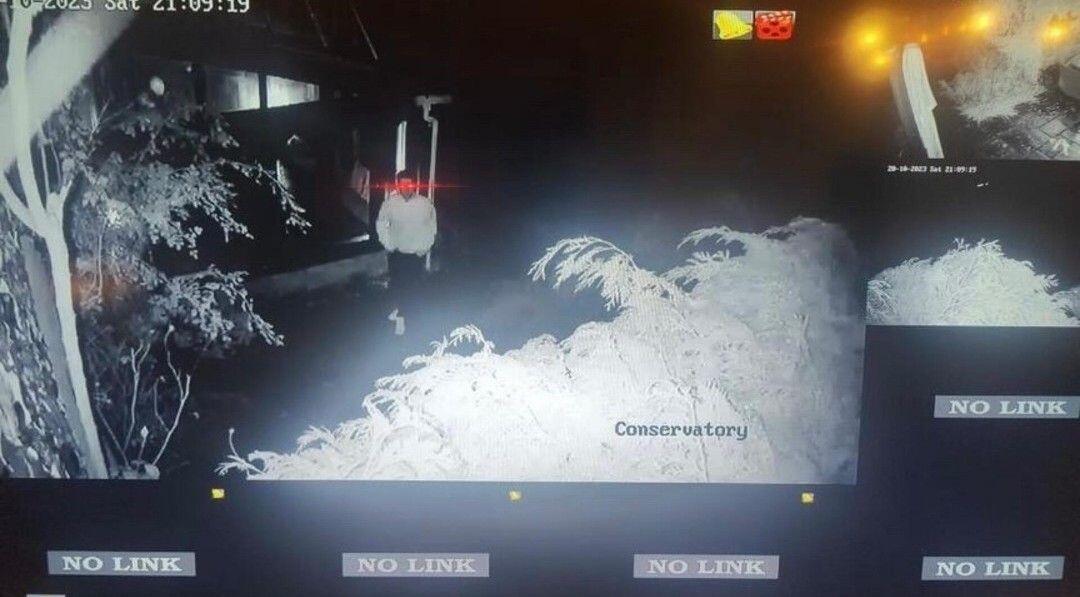

Smoke grenades are effective in both kinetic warfare and information warfare #Epstein

Bitcoin Nora

Bitcoin Nora

BitcoinNora@BitcoinNostr.com

npub1sggq...85ya

Something about the professional linkedin style profile photo that just doesn't feel right on nostr

If you get a loan from a bank to buy BTC at least if you default you can say f you and go bankrupt or something. And keep the bitcoin. But putting up your beautiful BTC and having it seized from you for not paying up is just ridiculous 😂😂😂

Could an economy of 1 million people live off a collective wealth of 1 BTC at some point in the future? #asknostr

The only way they can stop us from having our own decentralised AI agents, our own self-driving cars, and other similar freedom-enhancing techs, is to position them as harmful in some way, and therefore in need of regulation and centralization

BTC is crashing not because it has weak fundamentals, but because it is the closest thing we have to a free market, and so it accurately reflects the absolute degeneracy of the fiat money system

The BTC price crashing has nothing to do with the Bitcoin network and everything to do with the disfunctional fiat system

Why Bitcoin is crashing

In other words...

The US pays much higher interest than Japan

That gap pushes money out of Japan and into dollars

That’s why USDJPY keeps going up

But:

Japan has way too much debt

If Japanese rates rise much more, their system breaks

So markets think the BOJ will step in and cap rates again (YCC)

When people start believing that:

Big trades get unwound

Bitcoin dumps (easy-money asset)

Gold gets jumpy (stress hedge)

Bottom line:

The world is leaning on Japan to keep rates low. If Japan can’t, something global cracks. Markets are starting to price that risk.

In other words...

The US pays much higher interest than Japan

That gap pushes money out of Japan and into dollars

That’s why USDJPY keeps going up

But:

Japan has way too much debt

If Japanese rates rise much more, their system breaks

So markets think the BOJ will step in and cap rates again (YCC)

When people start believing that:

Big trades get unwound

Bitcoin dumps (easy-money asset)

Gold gets jumpy (stress hedge)

Bottom line:

The world is leaning on Japan to keep rates low. If Japan can’t, something global cracks. Markets are starting to price that risk.

In other words...

The US pays much higher interest than Japan

That gap pushes money out of Japan and into dollars

That’s why USDJPY keeps going up

But:

Japan has way too much debt

If Japanese rates rise much more, their system breaks

So markets think the BOJ will step in and cap rates again (YCC)

When people start believing that:

Big trades get unwound

Bitcoin dumps (easy-money asset)

Gold gets jumpy (stress hedge)

Bottom line:

The world is leaning on Japan to keep rates low. If Japan can’t, something global cracks. Markets are starting to price that risk.

In other words...

The US pays much higher interest than Japan

That gap pushes money out of Japan and into dollars

That’s why USDJPY keeps going up

But:

Japan has way too much debt

If Japanese rates rise much more, their system breaks

So markets think the BOJ will step in and cap rates again (YCC)

When people start believing that:

Big trades get unwound

Bitcoin dumps (easy-money asset)

Gold gets jumpy (stress hedge)

Bottom line:

The world is leaning on Japan to keep rates low. If Japan can’t, something global cracks. Markets are starting to price that risk.