The grossly underestimated hedge fund bid for Treasuries

Recent Federal Reserve research has found that hedge fund demand for U.S. Treasuries—especially among funds domiciled in the Cayman Islands—has been grossly underestimated by official data, missing as much as $1.4 trillion in holdings as of the end of 2024[1][2][3]. This underreporting centers on hedge funds’ activity in the so-called “basis trade,” a leveraged strategy in which funds buy cash Treasuries and simultaneously sell Treasury futures to exploit small pricing discrepancies, relying heavily on repo borrowing[3][4].

### The Basis Trade and Data Gaps

- Treasury Department cross-border data, particularly the TIC (Treasury International Capital) reports, have failed to capture the true scale of hedge fund activity, especially for funds registered in the Cayman Islands, which dominate the basis trade[1][2][3].

- According to Federal Reserve analysis of fund regulatory filings (SEC Form PF), Cayman-domiciled hedge funds increased their Treasury holdings by about $1 trillion from 2022 to the end of 2024, reaching around $1.85 trillion[3].

- The official statistics, therefore, vastly underestimate the market impact and systemic importance of these hedge fund activities[1][2][3].

### Implications for Treasury Markets

- Hedge funds’ participation is no longer a marginal factor—they now constitute a substantial portion of Treasury market liquidity, especially in the most liquid on-the-run issues[4].

- Because these trades are highly leveraged and sensitive to repo market conditions, periods of market stress can force rapid unwinding, contributing to market fragility and necessitating central bank intervention—as seen during March 2020[4][5].

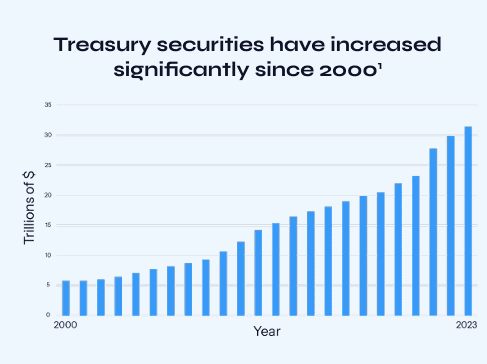

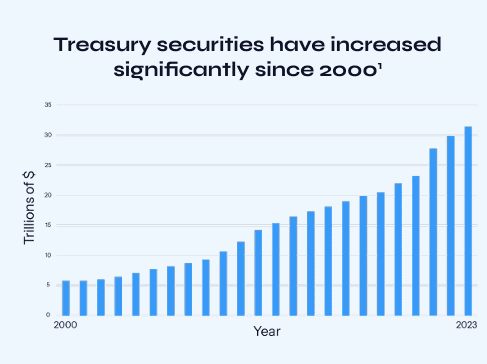

- Regulators remain concerned that this concentration of leveraged exposure could magnify systemic risks, especially as the overall supply of Treasuries is projected to rise sharply in coming years[5].

### Why Accurate Measurement Matters

- Since hedge funds’ basis trades are conducted cross-border and via offshore entities, regulatory blind spots hinder policymakers’ ability to assess financial stability risks[1][2][3].

- Better transparency would help authorities anticipate and possibly mitigate destabilizing liquidity shocks stemming from abrupt deleveraging by hedge funds in times of volatility[5][4].

In summary, the true scale of hedge fund demand for Treasuries—especially via leveraged Cayman Islands funds—is now recognized to be far higher than previously captured in official data, with significant implications for market stability and regulatory oversight[1][2][3][4][5].

Citations:

[1] Official data dramatically underestimates hedge funds' ...

https://www.morningstar.com/news/marketwatch/20251016188/official-data-dramatically-underestimates-hedge-funds-involvement-in-the-treasury-market-fed-paper-finds

[2] Official data dramatically underestimates hedge funds' ...

https://www.marketwatch.com/story/hedge-funds-use-of-controversial-leveraged-trade-is-missing-from-treasury-data-fed-paper-finds-46be1e18

[3] The Fed - The Cross-Border Trail of the Treasury Basis Trade

The Cross-Border Trail of the Treasury Basis Trade

The Federal Reserve Board of Governors in Washington DC.

[4] Leverage At The Core: How Hedge Funds Are Reshaping The US ...

Global Financial Market Review

Leverage At The Core: How Hedge Funds Are Reshaping The US Treasury Market

Global Financial Market Review: Find news about hedge fund, banking, markets,b insurance, forex, world, commodities, technology and many more at ww...

[5] Central Banks should backstop hedge funds arbitraging the ...

https://www.fi-desk.com/central-banks-should-backstop-hedge-funds-arbitraging-the-basis-trade-new-brookings-paper-suggests/

[6] U.S. Treasury Market Structure

Managed Funds Association

U.S. Treasury Market Structure - Managed Funds Association

Treasury markets are essential to the economy. Policymakers must make thoughtful modifications that minimize any negative, unintended consequences.

[7] Hedge Funds and the Treasury Cash-Futures Disconnect

📄.pdf

[8] Treasury Market Dysfunction and the Role of the Central Bank*

📄.pdf

[9] How Hedge-Fund Bets Against US Treasuries Could ... - IG

IG

How Hedge-Fund Bets Against US Treasuries Could Cause a Global Financial Crisis

Could massive hedge-fund exposure to US Treasuries precipitate another global financial crisis?

[10] The Fed - Quantifying Treasury Cash-Futures Basis Trades

Quantifying Treasury Cash-Futures Basis Trades

The Federal Reserve Board of Governors in Washington DC.

Perplexity AI