The new IRS requirements on how to manage your bitcoin and have explicit coins separated by wallet according to their cost basis is so horribly ignorant and nonsensical that I don’t even know how to explain it.

Thread

Login to reply

Replies (67)

They still think they can control our money 😂

Can’t wait for the DOGE announcement that they are cutting 95% of the IRS. The amount of my life spent preparing taxes for my small business and my family is insane.

I've been just been buying a fixed amount & then pulling to cold storage immediately so that each UTXO would automatically have a known cost basis & purchase date. From what I've seen that should still be sufficient. 🤞🏼

Stop being so compliant

I'm doing what I already wanted and not making any changes based on anyone else's rules so I'm not sure why that would be considered compliant.

Why did you want to do it? 😉

I don't know exactly? I heard about UTXO management & saw where some people labeled UTXOs & such & definitely didn't want to do that. But, I did like the idea being able to know when I got them & the cost basis just so I could good about my life choices. 😂

I hope fees don’t eat you alive

Shouldn’t as I’ve also been conscious of UTXO size for the last several years.

Par for the course ⛳️

The IRS can go fuck themselves. This is the same as the bump stock and AR brace. Pass an actual fucking law in congress or GTFO

Laws don't have authority over your unalienable right to private property and your unalieable right to exclude whoever and whatever from your private property.

Nobody has a right to "inclusion," "belonging," or "connectivity" to my private property money.

What’s imminent domain then?

It is an infringement on unalienable rights. Anything that infringes on unalienable rights is tyrannical. Eminent domain is tyranny.

Democracy robs freedom of choice from minorities and from individuals.

America is a country founded on unalienable rights. It is not a democracy.

A country founded by people fleeing tyranny created another unfair system. They made it possible to exploit all known resources to benefit the top 1%

Majority in the #USA don’t vote in local elections. Then they complain about how bad the government is.

We have a lot of issues in the #US

Numbness is a big one.

A fair and equitable distribution of OUR bitcoin

/s

If you vote, you imply consent. I don't vote, so I do get to complain.

True but for the compliant its a great opportunity:

Sounds like #MiCA and the #travelrule over here.

You can literally smell their desperation to maintain control over the money and hence the crowd.

Yeah, they can kiss my total ass lol

Wallet A, cost basically higher than today, so every time I buy stuff, I reduce my tax bill (tricky at the moment).

Wallet B, never selling anyway, cost basis is relevant

Wallet C, the stuff I buy with this wallet, not paying my taxes is the least of my worries. 🧐

I didn’t expect less from the IRS.

i have a friend who owns a business with about 25 employees. i found out talking with him recently that he wasnt paying sufficient payroll taxes.for his emplpyees. only found out cuz one of his employees pointed it out. he had been doing this for like 8 years. hadnt heard a peep from the IRS.

and people are worried about if they paid a few thousand in capital gains correctly 😅 this community aint what i thought it was.

i cant imagine complying with this stupid shit

The whole thing is so obviously nothing but a “group your wallets by when you got the coins so our tax chainalysis is really easy” scheme.

And they call it “safe harbor” to trick people into thinking they are getting a benefit, imo.

So what happens when I extract the private keys from my two HD wallets and combine them into one using spectrum? And then break them up into 2 other wallets with a differing set? What constitutes a wallet when anyone can mix and match whenever they see fit?

Start with the fact that everyone should raise their kids not to file taxes.

It's too late for adults who already file to stop without being targeted for betraying the gang initiation ritual, but we don't need to bring new people in. I've never filed.

I’m assuming you don’t work a W-2 job?

I don't even know what that is. Last job I did was doordash

W-2 just means you’re an employee, and your employer takes taxes out of every paycheck. I think DoorDash pays you as a contractor instead.

If you do W-2 work and your employer withholds taxes, that's all the more reason not to file. They will never knock on your door in the years they owe you money, and everyone you know will remember that if they knock on your door later because they've decided you're too rich.

I guess I don’t see a big benefit to not filing if I’m still paying them taxes (possibly too much taxes at that). I do agree with not paying and not filing if possible though.

You won't need a job forever if you're stacking hard money

Exactly, been stacking hard for years. Seriously considering leaving US for awhile and spending some time at my friend’s place that is in Costa Rica now.

Besides nonsensical, it'll doesn't sound enforceable

The noose is tightening. Stop using KYC platforms.

I still do not understand the "safe haven" snapshot that we supposedly have to do before Jan. 1.

Is there still a IRS bounty for cracking Monero? They know they will drown in work, so they try to make people comply.

It's an ungraceful end of the state. Unfortunately non fungible coins + AI enable those seeking power to further control the people.

Opt-out. Encrypt everything. Utilise Monero.

Guy Swann

Guy Swann

The new IRS requirements on how to manage your bitcoin and have explicit coins separated by wallet according to their cost basis is so horribly ignorant and nonsensical that I don’t even know how to explain it.

View quoted note →

MOAR COINJOINS

What gives them the right to force us to consolidate funds?

How can they tax information?

Does knowing twelve words mean you own bitcoin?

What if someone else knows my twelve words?

Who owns it? Who pays taxes in a multiparty multisig?

What is transacting? Is it signing a TX? Broadcasting it? At what point does it incur capital gains?

Jesus said: "Give unto Caesar what is Caesar's."

Last time in checked the US has no face on a bitcoin. Fuck em.

joinstr.xyz

this is the way

is it usable yet?

Lemme rewrite that for the plebs reading the comments in this thread.

JOINSTR is COINJOIN OVER NOSTR

I know its confusing still for the non-technical plebs  , but evolutions will come soon. Pay attention to @/dev/fd0

, but evolutions will come soon. Pay attention to @/dev/fd0

, but evolutions will come soon. Pay attention to @/dev/fd0

, but evolutions will come soon. Pay attention to @/dev/fd0

How does it work? | joinstr

This page has several pieces of incorrect information

Tor is required if you cannot trust the relay, which is most likely the case

A mechanism without fidelity bonds would require you to tie your Nostr identity to your CJs as the fidelity bond (not preferable)

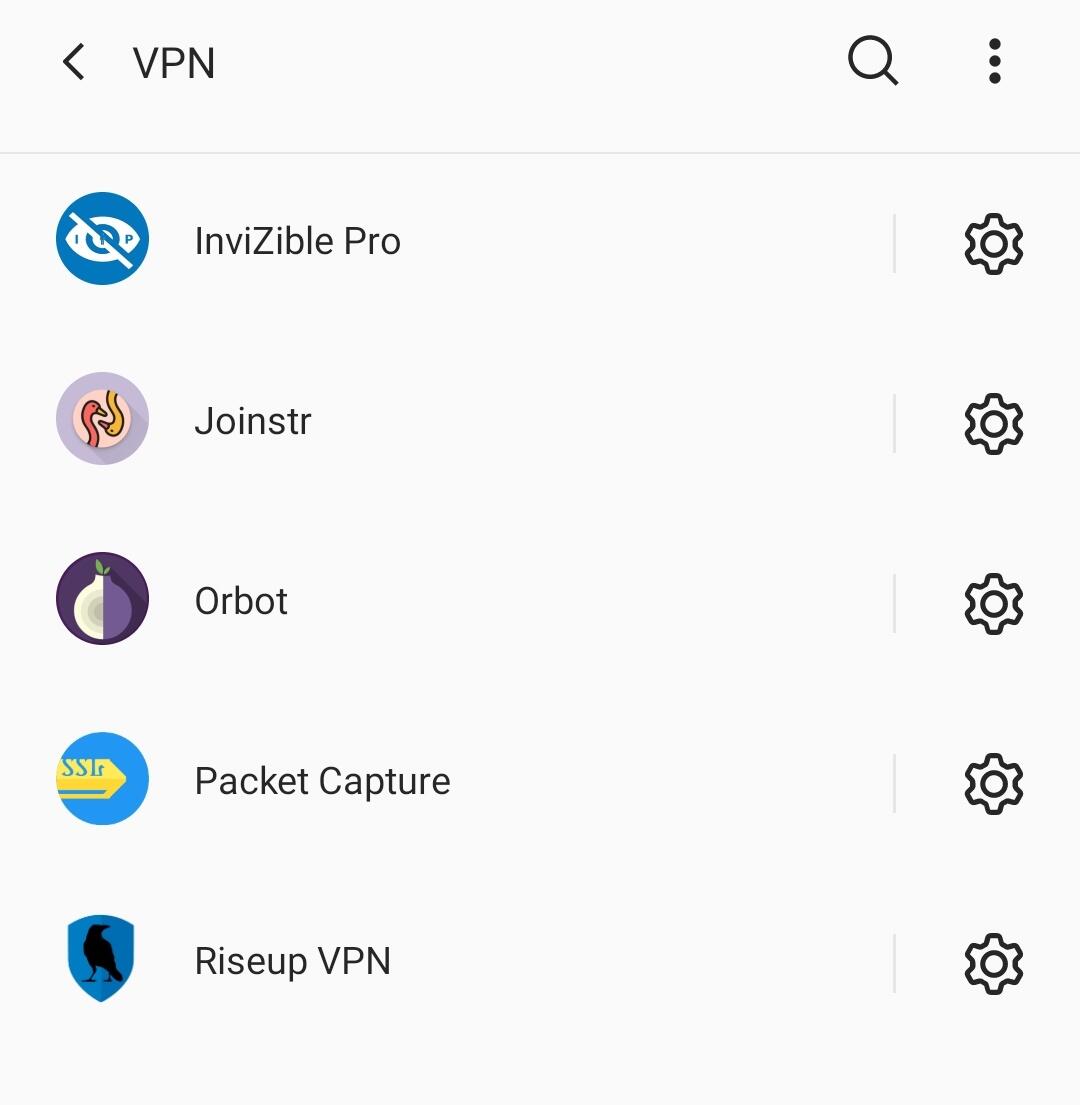

1. Protocol supports VPN and Tor. It's not necessary to use Tor. You can check the kotlin implementation for VPN usage.

2. Joinstr protocol will use AUT-CT for sybil resistance:  If you read the NIP for joinstr you will realize that new keys are generated for each event and pool messages use encrypted channel (shared key).

Nostr identity is never linked to coinjoin in the protocol.

If you read the NIP for joinstr you will realize that new keys are generated for each event and pool messages use encrypted channel (shared key).

Nostr identity is never linked to coinjoin in the protocol.

GitHub

GitHub - AdamISZ/aut-ct: Anonymous usage tokens from curve trees

Anonymous usage tokens from curve trees. Contribute to AdamISZ/aut-ct development by creating an account on GitHub.

It is also possible to reuse fidelity bonds if some joinmarket makers want to provide liquidity in joinstr, not necessary though:

Market makers in joinstr

Providing liquidity and earning fees by creating pools

Joinmarket doesnt require fidelity fonds, theyre optional. It also has equal outputs, otherwise whats the point?

Just installed joinstr and it wanted complete control of VPN config. Why?

To create a new VPN profile. If you have further questions, please join the simplex chat group.

Can you share a joinmarket cj transaction with all outputs having same amount?

That comparison chart is completely nonsensical and obviously written with full bias

tell that to @/dev/fd0 😉

I don't need suggestions from people who work on vulnerable coinjoin implementations.

I don't want to waste my time. He spends too much energy with vague, overreaching statements and fuds other people's work constantly.

This not just the IRS, but a global issue with all tax departments . It needs to stop.

Bitcoin is money! And we should be free to use it how we see fit at any given time or space on this planet.

I think i just got retarded

send IRS a Revocation of Election and your are out. Income taxes are voluntary. The 1040 is an annual contract. Dont sign it.

I haven't seen anything about this. I want to see the hourly dca group have their 15k sat utxo lol

BOATING

A

C

C

I

D

E

N

T

Oh wow something more retarded than what Australia gets up to

I recently bought more hardware wallets to have fun testing bitcoin transactions, etc. At this stage in my life, I'm HODLing, not selling bitcoin. Honestly, what would I sell it for? Maybe some day I will, when I find something worth buying, but that day has not arrived. The IRS is out of control. I sure hope this gets rolled back in the new administration. What an over-reach!

Downstream effects of radical and unwise transparency resulting in very deficient pseudonymity and zero privacy.

A law is pretty meaningless if it can't be enforced.

It cannot be enforced without surveillance.

Zero privacy makes it pretty easy to enforce.

#monero fixes this.

Monero alone doesn't fix this, remember to also avoid all KYC crypto touch points.

That is ideal for a few other reasons yes, but the point stands that you cannot be traced for eternity even if you KYC'd and used Monero, which seems sensible to me.

Luckily soon it won't be possible to buy Monero with KYC #ThisIsTheWay #DontRiskItBisqIt