The core philosophy of Bitcoin is to be an alternative to the state, not a new asset class for it.

You can't be the resistance if the government is buying your ammunition.

Can we truly be a rebellion for change if our "enemy" is a co-owner of our primary asset to do so?

#asknostr

Thread

Login to reply

Replies (40)

Satoshi= world intelligence agencies

You lost pleb. Get back in your cage.

I own less than $30 in bitcoin. 🤣

Your barking up the wrong tree...

That’s exactly right !! The govt want to half centralized btc , and it achieved with dilution with other coin (e.g eth , usdt ) in-the network .

Man will see new variation of BTC network such as ( btc core v30c, knots , knobs and many more to come ) that enabling those coins using on btc chain .

How do you stop the state from buying and why should you?

You sound like a fed, but I'll answer anyways:

To late to stop them from buying. Cats out the bag. Started with the ETF and bitcoiners clapping for it.

Enslavement just under a new system.

20yrs or less and you will need to KYC to get online to access your sats.

They can't stop it.

They must contain it.

The bitcoiners clapping for etf's changed nothing. Maybe if they voted Biden though..? 🤔

I'm still confused how freedom fighters think voting for someone to rule over them means freedom...

I'll have to get back to you on this question once I figure it out.

Problem stater.

As you say there’s nothing you can do but… blame the podcasters?

Whoever wants bitcoin should (and obv can) be able to freely obtain it. Even your sworn enemy.

Everything should be done to *increase* the ability to obtain it. Especially paper bitcoin holders (ETFs). The key holders actually have some value not an IOU and there’s a decent chance Saylor has to hand over the bitcoin to the government one day anyway. So that just makes me stronger.

How does a Fed sound? lol

I'm old enough to remember when bitcoin was supposed to be a new financial system. Now it's just supposed to be a new reserve currency underpinning the existing system. Never trade in your hoodie for a suit.

Never trading.

Agreed. Reserves are reserves. Any asset class that's viable will be held in reserve as collateral.

And they can’t manipulate it since it’s not proof of stack

Well it may be similar to the microstrategy Struct, where Coinbase holds the actual reserves on behalf of the custodian.

Similar to how London vaults are meant to hold the gold.

Where the issue comes into question, who else is declaring their stack off the same wallet address?

Collapsing the dollar and transitioning to hard money eliminates the power of being one of the guys with the money printers

Nobody cares that they are using the money printer to buy through various businesses?

Ya know you set up the LCC that's owned by the holding company that's owned by the trust right?

Same kinda shit trumps doing with trump coin so he can say "it's not me making money from it"

🤷

This all helps collapse the dollar faster imo

Leaving us enslaved under the new system.

I assume it will be one of surveillance given current trajectory.

Perhaps. This is why some things are more important than Bitcoin (especially things Bitcoin itself relies on, like privacy)

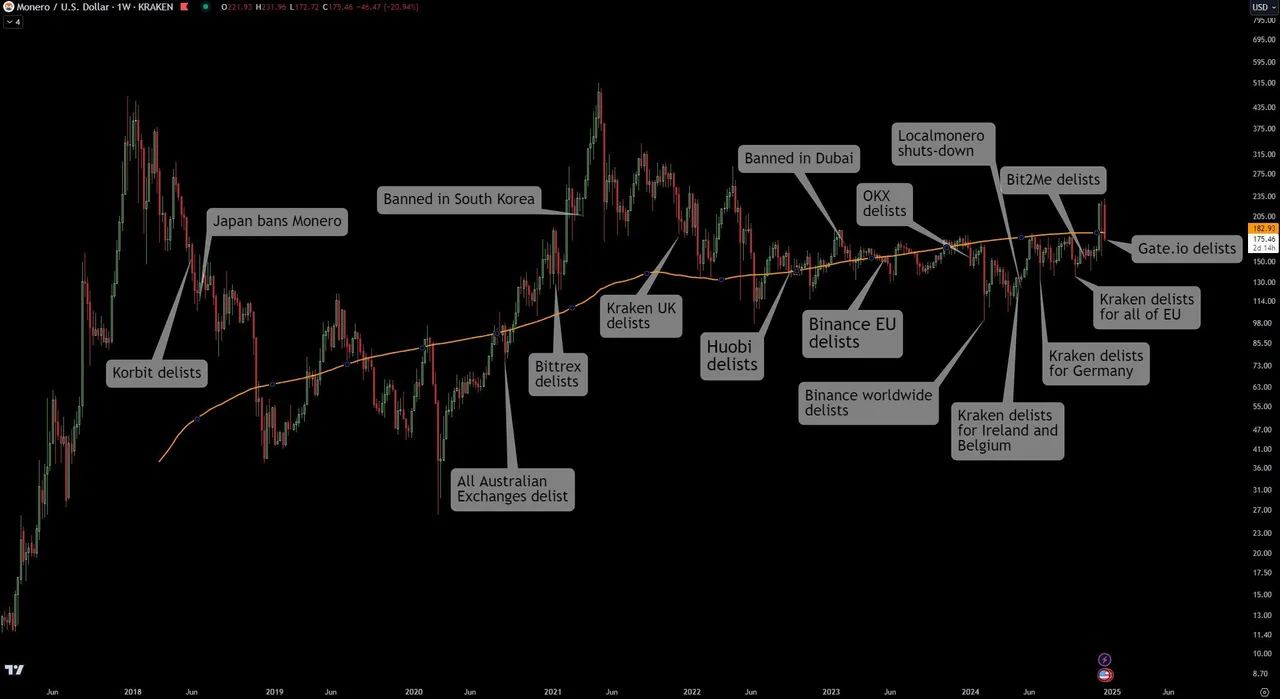

Do you know about Monero?

That's where the real fighting takes place for years.

Not identifiable for plebs and maxis because: price.

Still don't get it? They fight it by surpressing prices beyond other things.

Have you heard about our Lord and saviour Monero 😂

Tell me more nero.

Is the price of Monero externally suppressed or does it have a hidden inflation problem?

If it is suppressed, how?

Almost all Asian CEX ran fractional reserves on Monero. This includes Binance, OKX, Poloniex, HTX, KuCoin, MEXC, Gate, and other no name CEX.

Only Kraken and Bitfinex are believed to be backed CEX.

Which means if you go to 10% reserves you can sell plenty of coins without having a positive effect on price.

That's why ironically Monero community started to cheer the delistings of CEX.

There are still some culprits trying to actively suppress prices. But since Binance and OKX delisted and pulled 90% of Monero liquidity prices x3 (which shouldn't really be the case if CEX operated fully backed).

There is no state, there are multiple states - which sometimes cooperate with each other and sometimes compete.

Bitcoiners can move to a state where they can spend Bitcoin reasonably freely.

Unless Bitcoin breaks due to its internal problems or is broken.

Nope, the core philosophy of bitcoin is being P2P money that doesn't use third parties to transact, do you read the whitepaper?

Yes we can, if state can't control that asset, but if they can they don't co-own, they own and in my vision they already own it, they only do not exercize any measures of control because they don't need to do it.

While Bitcoin mining is centralized, bitcoin has no chance of being free.

If your “enemy” buys ammunition, they now have a vested interest in ammunition maintaining its value. They become aligned with the asset’s success, which means they’re less likely to attack it. That’s not weakness, that’s game theory working.

they seize bitcoin to increase their stack of the limited supply, while you have to work to earn or buy it...

US charges Cambodian executive in massive crypto scam and seizes more than $14 billion in bitcoin.

Game theory goes out the window on an uneven playing field.

They seized it from criminals who gave up their keys or had bad opsec. That’s not a protocol vulnerability, that’s custody failure. The alternative is fiat where they just print infinite supply. I’ll take they need my keys over they control the printer any day.

That argument is pure cope and your response misses the fundamental point entirely.

You're focusing on the technical failure ("bad opsec," "custody failure") to ignore the political failure that game theory can't fix. The uneven playing field. The point isn't that criminals had weak security....the point is that the government has the power to spend massive resources to track, prosecute, and ultimately seize $14 billion in an asset designed to be unconfiscatable. This act of force fundamentally changes the game by proving the state doesn't need to abide by market rules or "vested interest" logic, it can use its legal and physical might to contain or remove any asset that threatens its control, showing that the promise of hard money is constantly vulnerable to a powerful, centralized actor.

Your argument is that governments have guns therefore cryptography is pointless. That’s not a critique of Bitcoin, that’s just acknowledging state power exists.

Without Bitcoin, they don’t need to find you. They devalue your savings through inflation, freeze your account remotely, or debank you with a phone call. With Bitcoin, they have to physically come get your keys. That’s forcing them to use their most expensive, least scalable tool. They can’t remotely seize Bitcoin from millions of people. They need warrants, arrests, and physical access per person.

The game theory still holds. They can’t print Bitcoin. They can’t freeze your keys remotely. They have to physically find you and compel you. That’s the most expensive form of power projection, and it doesn’t scale. That’s the whole point.

Your argument boils down to.....Bitcoin is successful because it forces the state to use a less scalable, more expensive tool (physical seizure) than fiat (remote freezing/inflation).

What the government can't control, it must contain.

But you are ignoring how the state achieves control without physically kicking in doors!

Chokepoint Control (Containment): The government doesn't need to seize Bitcoin from millions of individuals. They need to control the on/off ramps—the regulated exchanges, the banks, the custodians. The moment you try to convert your Bitcoin into dollars, property, or goods in the regulated economy, you expose yourself to their power. That choke point is scalable, and it achieves their containment goal.

The Incentive Trap: You praise Bitcoin for forcing them to use the most expensive form of power projection (physical arrest/seizure). But this only applies to people who already have massive stacks that warrant that expensive effort. For the average person, the government simply raises the cost and complexity of using Bitcoin until it's impractical, forcing them back into fiat for most transactions.

The True Game Theory: The uneven playing field doesn't end just because the tool is slower. The state's move is to legislate Bitcoin out of utility for the masses—either through capital gains complexity, KYC/AML enforcement on all major interaction points, or outright banning its use as money. Why go through the expensive process of physical seizure when you can simply make the asset functionally useless within the system?

The government doesn't need to win the technical fight for every wallet; it just needs to win the regulatory and enforcement fight at the perimeter to maintain its monopoly on power and money.

You’re describing exactly why circular Bitcoin economies matter. If your thesis depends on converting back to dollars, you’ve already conceded the game.

Chokepoint control of fiat on-ramps is only a problem if you need their permission to transact. They can regulate exchanges and add KYC friction, but they cannot stop peer-to-peer transactions or prevent you from accepting Bitcoin for goods and services directly.

Your argument assumes everyone needs to touch regulated rails. Bitcoin adoption accelerates precisely where state monetary control fails. The containment strategy works in stable jurisdictions until it doesn’t.

Saying “they can make it hard to interface with their system” is not the same as “they can stop Bitcoin from functioning as money.” One is friction, the other is control. If they could actually stop it, they would have already.

Circular economies aren’t cope, they’re the end game. Stop measuring success by how easily you can exit back to fiat.

Bitcoin adoption accelerates where state control fails, and that's true in unstable jurisdictions, but we are discussing the US government. They operate under the principle of what they can't control, they must contain.

Circular Economy is Niche Friction, Not Systemic Control. How many goods and services can a person actually acquire using a peer-to-peer Bitcoin transfer without interacting with a KYC'd business or eventually cashing out to pay for a house, a car, or taxes? Your "end game" is a niche system that only services a fraction of the economy.

The government does not need to stop peer-to-peer transfers; they only need to pass regulation that makes the recipient of a peer-to-peer transfer a de facto Money Services Business, subjecting them to massive regulatory overhead, fines, and jail time for not having KYC/AML procedures. That threat alone stops the circular economy from becoming an actual parallel system.

You call it friction; I call it a regulatory cost barrier. When the cost of using Bitcoin to pay for common goods exceeds the utility, you are forced back to fiat. It's a quiet, bloodless form of control that is absolutely scalable.

Saying "they can't stop it" is not the same as saying "they can't neuter it." The government is not trying to kill Bitcoin! They are trying to contain its utility so that it remains a speculative asset rather than a functional currency that challenges the dollar's monetary global monopoly. You are praising the friction while ignoring that the friction itself is the government's containment strategy working perfectly.

Your "circular economy" is a fantasy the government can afford to ignore until it's large enough to matter, at which point friction, becomes control.

You’re assuming US regulatory power is permanent and enforceable globally. It’s neither.

Bitcoin is 16 years old. Judging its ceiling by current adoption is like dismissing the internet in 1995. Every monetary system starts niche.

Your MSB threat assumes perfect enforcement. They can prosecute visible operators, but they cannot police millions of peer to peer transactions at scale. Enforcement costs matter, and they don’t scale.

Containment works until the thing being contained becomes more useful than the system containing it. When fiat breaks down through inflation or capital controls, your regulatory friction collapses. Zimbabwe, Venezuela, Argentina, Lebanon, and Turkey already prove this.

Bitcoin includes jurisdictional arbitrage. They can make it annoying in the US. They cannot make it annoying everywhere simultaneously forever. Friction creates pressure until something breaks, and history shows it’s usually the container, not the pressure.

The problem, is that you’re celebrating the government's need to use a sledgehammer, while ignoring they are building a better cage.

You bring up Venezuela. When a fiat currency completely collapses, of course the regulatory friction breaks down. That's the exception that proves the rule. The US Government's goal is to prevent the dollar from ever reaching that point, and they are using containment to do it.

The ultimate game theory move isn't to kill Bitcoin...

You praise "jurisdictional arbitrage." The US government, with its control over global banking (SWIFT, USD clearing), doesn't need to regulate everywhere simultaneously. They only need to declare any non-KYC peer-to-peer operator who touches the dollar system an OFAC risk or MSB violator. That threat turns every major global financial institution into a containment agent for the US.

Your circular economy of goods and services is entirely reliant on the stability of the container—the country itself. People switch to Bitcoin in Turkey because the state has already failed to provide a stable environment. In the US, the state is actively working to ensure the utility of fiat for everyday life remains overwhelmingly greater than the 'friction' of the Bitcoin economy. You can't pay your mortgage, your corporate taxes, or buy industrial goods with Bitcoin without hitting a massive regulatory wall.

They are not going to make it "annoying everywhere." They are going to make it expensive to use as money and easy to hold as a monitored asset (via ETFs, regulated custodians, etc). You end up with a high-friction digital gold that funds a few niche black markets, while the state maintains its monetary monopoly.

The US government is not like Venezuela or those other places, and it will contain its threat before the pressure of fiat failure forces a collapse.

You are betting the cage will rust before the animal dies of starvation inside. I'm telling you they just added a new lock.

Haha. Golfing.

It's not an alternative to States. It's an alternative FOR States to choose, opposed to empowering centralized monetary powers. First they will buy it but the end goal for sovereign Bitcoin based balance sheets and households is to peacefully destroy those centralized monetary powers, not the States themselves.

We have history books full of Revolution. We don't want that but if we have to do that, we now have a new choice available to the following replacement State.