Thread

Login to reply

Replies (12)

EU 😭

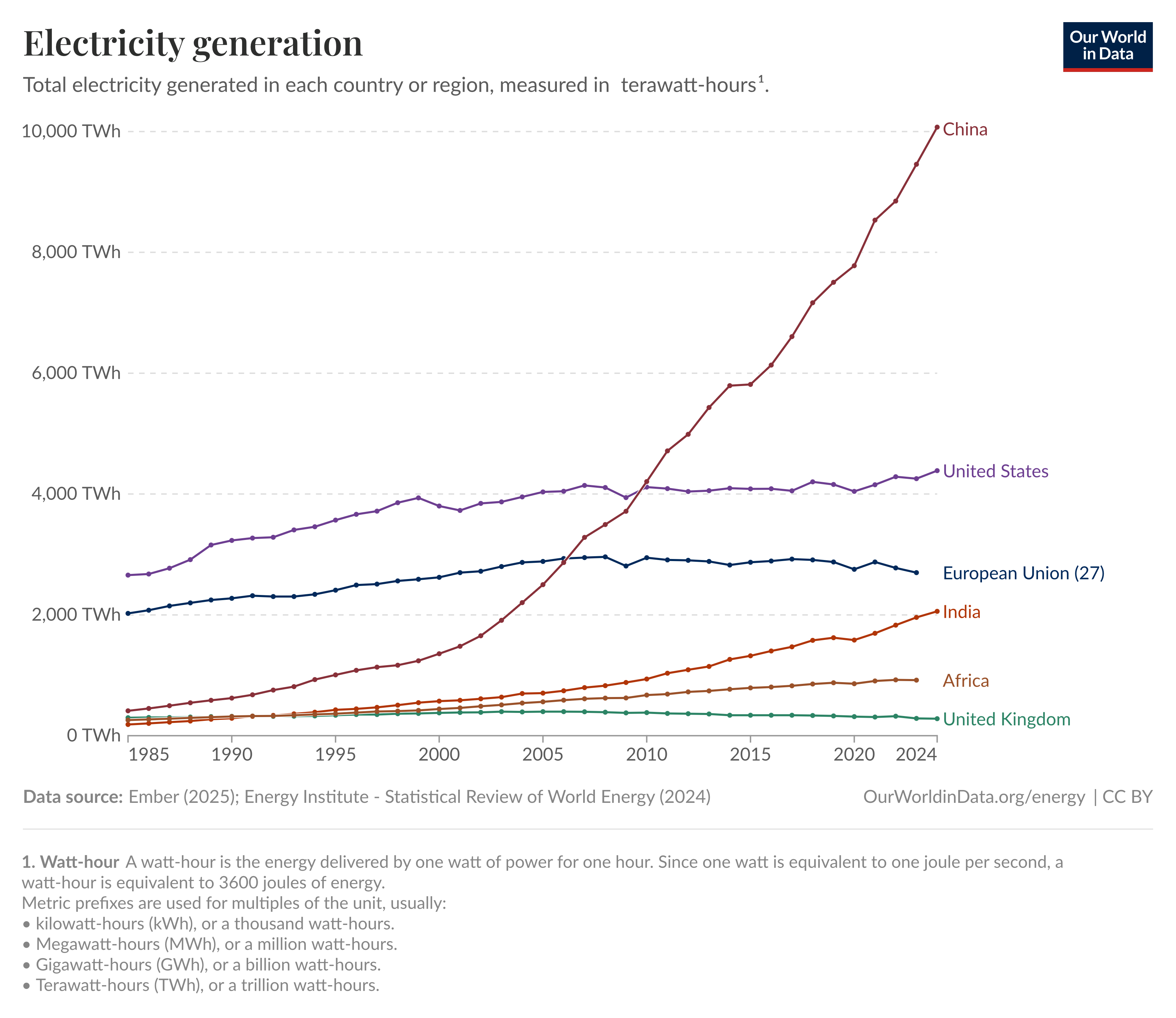

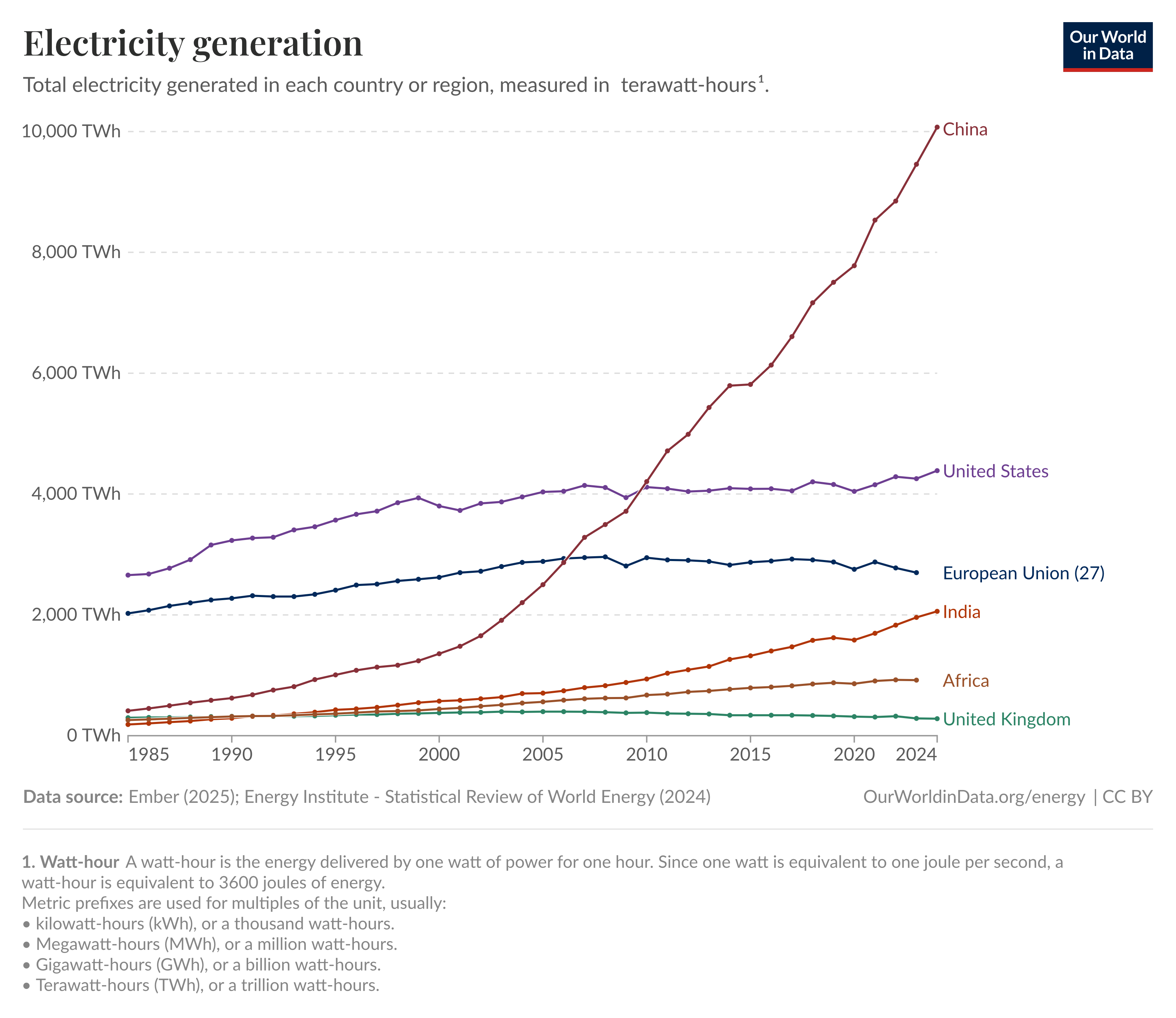

Why Electricity Generation Is the Real Economic Indicator ,Not GDP

For decades, Gross Domestic Product (GDP) has dominated headlines as the measure of a nation’s wealth and power. Politicians use it to boast. Economists use it to forecast. Analysts use it to compare. But what if we’ve been reading the wrong metric all along?

What if GDP is just a financial mirage, while the real heartbeat of an economy is hidden in plain sight?

Welcome to the world of electricity generation ,a cold, hard metric grounded in the laws of physics, not the games of politics or accounting. Let’s explore why measuring electricity output might be the most honest way to assess economic health in the 21st century.

The Mirage of GDP

GDP measures the market value of all final goods and services produced in a country. Sounds straightforward ,but in practice, it's deeply flawed.

Here’s why:

GDP counts debt-fueled consumption as growth: Borrow $1 trillion and build ghost cities? GDP goes up.

Government spending inflates GDP even if unproductive: Digging ditches and refilling them contributes.

It ignores physical and ecological realities: You can "grow" GDP while your infrastructure decays and your energy grid collapses.

Worse, GDP can't distinguish between productive industries and speculative bubbles. If Wall Street’s paper games balloon, GDP smiles regardless of whether a single factory was built or a job was created.

Electricity: The Pulse of Civilization

Electricity isn't abstract. It isn't an opinion. It isn’t up for political spin. It’s binary:

Either the power flows or it doesn’t.

Either your machines run or they don’t.

Either the lights are on or they’re out.

Every watt of electricity represents work done, factories running, servers computing, homes being cooled, cars being charged, tools being wielded. It is the raw thermodynamic measure of real-world activity.

Here’s why that matters:

You can’t fake electricity generation.

You can’t inflate it with debt.

It reflects what’s actually being powered, built, or moved.

Electricity is the language of modern life from industry to information to innovation.

Real Growth Has a Power Source

Let’s look at real-world examples:

1. China (2000s–2020s):

Skyrocketing electricity generation tracked with its manufacturing boom, tech rise, and urban expansion. The energy throughput was the growth.

2. United States (Post-2008):

GDP rose on paper, but electricity generation per capita stagnated. Why? Much of the “growth” came from financial engineering, not physical expansion.

3. Bitcoin Mining:

Bitcoin is one of the few economic systems fully tied to electric power. Mining = electricity converted to cryptographic security. No government can inflate it, no central bank can tweak it. The system measures real energy spent for real economic value proof-of-work in the truest sense.

Electricity as an Honest Metric

Unlike GDP, electricity generation:

Reflects industrial capacity: More power = more production.

Reveals technological scale: Data centers, electric vehicles, AI, and robotics all consume electricity.

Indicates resilience: A strong grid = a resilient society.

Can’t be faked: Thermodynamics doesn’t care about politics.

In short, electricity is an economic truth because it must be produced, stored, distributed, and consumed. That entire chain is real work, not abstract accounting.

Rethinking Our Metrics

Instead of obsessing over GDP, we should start tracking:

Electricity generation per capita: How much energy is available per person?

Grid reliability: Are blackouts increasing or decreasing?

Energy mix: Are we relying on stable base load or fragile intermittent sources?

Industrial usage vs. residential: Are we building or just consuming?

These metrics tell a clearer story of economic health, sustainability, and future potential.

In the age of AI, #bitcoin, EVs, and global interconnectivity, electrons are the currency of computation, motion, creation, and communication.

So next time someone boasts about GDP growth, ask a simple question:

“How much electricity did we generate this year?”

Because when the lights go out, GDP won’t save you.

Relevant

US is fucked

Most important chart. Race for Type I civilization is on

View quoted note →

Beginning of China’s big debt cycle

The meaningful number is "per capita electricity generagion" not the raw electricity geberation.

Tired to zap you

And totally agree. Great point. It’s about how much access each individual has to cheap energy…

All the nations above China are notably down from their peaks around 2000 implying decline in industrial output. China's had a steady rise in that time

Per capita is probably more important in my mind

Which combined with orice, will drive an individual’s ability to produce

Good indicator though of how much infrastructure China has been able to build

Fascinating times