A few weeks ago, I finished reading Ray Dalio's book "The Changing World Order" which offers a comprehensive analysis of global economic and political dynamics. While the book is well written and offers key insights on the current state of the world, I couldnt help feeling like something was missing.

Most notably, an analysis of #Bitcoin and it's potential impact on the evolving world order is completely absent. This omissions can be seen as a significant flaw in his analysis for several reasons 🧵👇

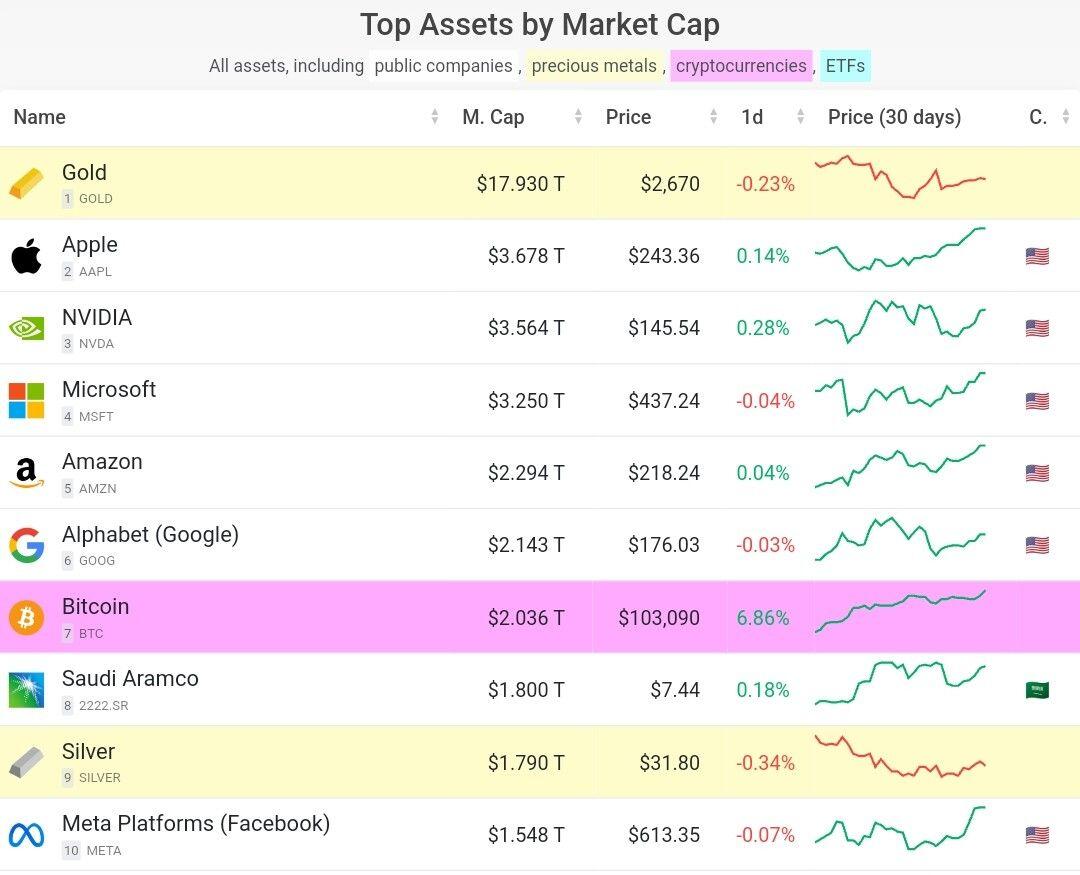

Firstly, #Bitcoin represents a shift in the traditional financial paradigm. Dalio explains the historical rise and fall of nations and emphasizes the importance of economic systems and currency dynamics, but doesn't recognize Bitcoin as a decentralized digital currency that challenges the very foundation of these systems. Bitcoin's adoption have the potential to reshape the global financial landscape and the economic systems we use, making it an important factor to consider when discussing changing world orders.

Dalio also highlights the vulnerability of fiat currencies to devaluation from excessive money printing. He emphasizes the impact of currency devaluation on a nations economic stability, and how hard money provides the stability needed to emerge as a world power, yet neglects to mention #Bitcoin as a hedge against debasement due to it's limited supply of 21 million coins.

#Bitcoin could theoretically provide a neutral global reserve currency that cannot suffer debasement and thus can stand the test of time. In this way, Bitcoin has the potential to break the cycle of monetary crises stemming from currency debasement that have plagued nations through history.

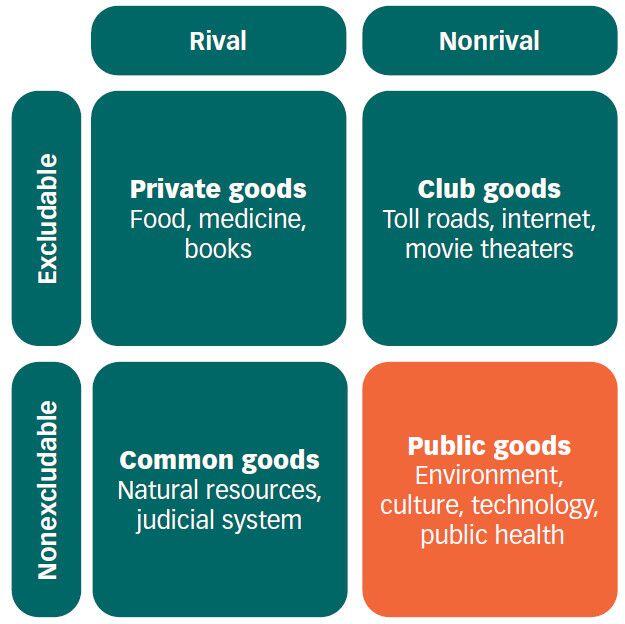

Bitcoin's potential also extends beyond finance. It is a technology that enables borderless transactions, financial inclusion, censorship resistance, and wealth preservation. These characteristics give #Bitcoin the potential to disrupt traditional power structures, empower individuals, reshape global trade and redefine how we interact in the digital economy. Ignoring Bitcoin's impact is to overlook an important factor that can disrupt current power dynamics.

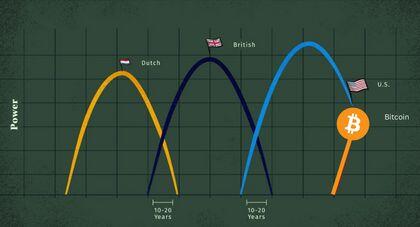

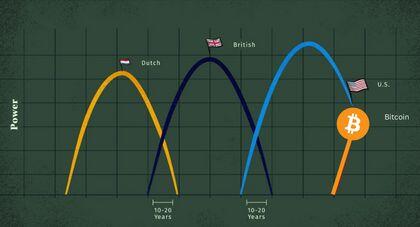

In the book, Ray Dalio details the transitions of power between geographic nations who in turn become the global reserve currency and financial hub of the world. An important detail to consider is that the emergence of #Bitcoin could mean that the next world order is not based on a geographic country but rather a collection of individuals, firms, and countries. This new paradigm would mean economic power is not tied to a specific nation state but rather a collective of those who chose to adopt #Bitcoin first.

While Dalio's book offers very valuable insights and historical context on how the world has worked, it's omission of #Bitcoin results in a notable limitation of his theory on repeating cycles of changing world orders. Understanding the emergence and potential of #Bitcoin as a globally accessible and neutral currency, it's ability to reshape power structures and geopolitical dynamics, and empower those who adopt it first are crucial to understand the dynamics at play in the 21st century.

I highly recommend reading Dalio's book, however, as you make your way through it, be sure to think critically about how #Bitcoin can fit into the changing world order we're currently experiencing.