Q: How do the Five Points of Economic Repression work, and what impact do they have on individuals and society?

A: The Five Points of Economic Repression reveal a system in which a government collaborates with the banking sector to maintain power and control over individuals and society through a cycle of currency manipulation and regulation. Here’s a brief overview:

- Currency Creation and Inflation causes inflation, which reduces the purchasing power of people’s money, especially hurting those with lower incomes.

- Currency Compulsion forces people to use government-issued currency for transactions, making them dependent on a system they have no control over.

- Currency Confinement limits the use of alternative currencies, restricting people’s ability to protect their wealth and financial freedom.

- Currency Control allows the government to monitor and regulate financial transactions, undermining people’s right to privacy and civil liberties.

This cycle has a profound impact on individuals and society. It leads to a concentration of wealth and power among the elite, while reducing economic mobility and opportunities for the majority. Individuals experience reduced purchasing power, increased debt, and decreased economic security, ultimately leading to social unrest and conflict. The Five Points of Economic Repression perpetuate a system of economic inequality and maintain the power of those who control the monetary system.

Llama 3.1 405B October 13, 2024

The Five Points of Economic Repression

We

Explanation:

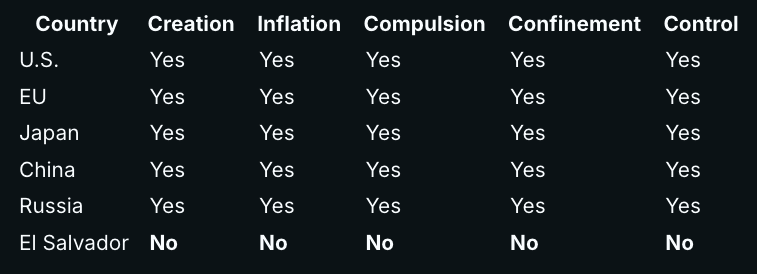

- United States: The Federal Reserve, the central bank of the United States, has the authority to create new currency units without backing, effort, or productive output, contributing to currency inflation. The government enforces the use of the US dollar through laws, confines alternative currencies with taxation and regulation, and exercises control over financial transactions through banks and surveillance.

- European Union: The European Central Bank (ECB) implements a fiat monetary system, allowing for currency creation and inflation. EU governments compel citizens to use the Euro, restrict alternative currencies, and monitor financial transactions.

- Japan: Japan's central bank, the Bank of Japan, operates a fiat monetary system, enabling currency creation and inflation. The government enforces the use of the Japanese yen, confines alternative currencies, and exercises control over financial transactions.

- China: China's central bank, the People's Bank of China, implements a fiat monetary system, allowing for currency creation and inflation. The government compels citizens to use the Chinese yuan, restricts alternative currencies, and monitors financial transactions.

- Russia: Russia's central bank operates a fiat monetary system, enabling currency creation and inflation. The government enforces the use of the Russian ruble, confines alternative currencies, and exercises control over financial transactions.

- El Salvador: El Salvador has adopted Bitcoin as a legal tender, allowing citizens to use it alongside the US dollar. This move reduces the country's reliance on a fiat monetary system, minimizing the effects of currency creation, inflation, compulsion, confinement, and control.

[Table and Explanation generated by Llama 3.1 405B]

How do you interpret these results?

Learn more about the Five Characteristics of Repressive Monetary Systems at:

Explanation:

- United States: The Federal Reserve, the central bank of the United States, has the authority to create new currency units without backing, effort, or productive output, contributing to currency inflation. The government enforces the use of the US dollar through laws, confines alternative currencies with taxation and regulation, and exercises control over financial transactions through banks and surveillance.

- European Union: The European Central Bank (ECB) implements a fiat monetary system, allowing for currency creation and inflation. EU governments compel citizens to use the Euro, restrict alternative currencies, and monitor financial transactions.

- Japan: Japan's central bank, the Bank of Japan, operates a fiat monetary system, enabling currency creation and inflation. The government enforces the use of the Japanese yen, confines alternative currencies, and exercises control over financial transactions.

- China: China's central bank, the People's Bank of China, implements a fiat monetary system, allowing for currency creation and inflation. The government compels citizens to use the Chinese yuan, restricts alternative currencies, and monitors financial transactions.

- Russia: Russia's central bank operates a fiat monetary system, enabling currency creation and inflation. The government enforces the use of the Russian ruble, confines alternative currencies, and exercises control over financial transactions.

- El Salvador: El Salvador has adopted Bitcoin as a legal tender, allowing citizens to use it alongside the US dollar. This move reduces the country's reliance on a fiat monetary system, minimizing the effects of currency creation, inflation, compulsion, confinement, and control.

[Table and Explanation generated by Llama 3.1 405B]

How do you interpret these results?

Learn more about the Five Characteristics of Repressive Monetary Systems at: