Annual Sales Of New Vehicles Expected To Hit Only 15.7 Million Units: Cox

Annual Sales Of New Vehicles Expected To Hit Only 15.7 Million Units: Cox

(emphasis ours),

The number of new vehicles sold annually in the United States is expected to hit 15.7 million units according to October estimations, industry expert Cox Automotive said in an Oct. 27

(emphasis ours),

The number of new vehicles sold annually in the United States is expected to hit 15.7 million units according to October estimations, industry expert Cox Automotive said in an Oct. 27  .

.

The seasonally adjusted annual rate is down from 16.4 million in September and 16.1 million a year back, said the company, attributing the slowdown to auto tariffs and the end of electric vehicle (EV) incentives.

“The new-vehicle sales pace was surprisingly strong this summer despite ongoing tariff uncertainty,” Charlie Chesbrough, senior economist at Cox, said in the statement.

“However, as more tariffed products replace non-tariffed inventory, prices are tracking higher, which should lead to slower sales through the remainder of the year. With the expiration of EV tax credits and a decline in alternative powertrain sales, the sales pace is anticipated to decrease as we move into a new season.”

Sales volume is forecast to be 1.3 million units in October, down by more than 3 percent from last year. While this figure is 2.7 percent higher than September, October had three more selling days than last month, Cox stated.

The federal government instituted 25 percent

The seasonally adjusted annual rate is down from 16.4 million in September and 16.1 million a year back, said the company, attributing the slowdown to auto tariffs and the end of electric vehicle (EV) incentives.

“The new-vehicle sales pace was surprisingly strong this summer despite ongoing tariff uncertainty,” Charlie Chesbrough, senior economist at Cox, said in the statement.

“However, as more tariffed products replace non-tariffed inventory, prices are tracking higher, which should lead to slower sales through the remainder of the year. With the expiration of EV tax credits and a decline in alternative powertrain sales, the sales pace is anticipated to decrease as we move into a new season.”

Sales volume is forecast to be 1.3 million units in October, down by more than 3 percent from last year. While this figure is 2.7 percent higher than September, October had three more selling days than last month, Cox stated.

The federal government instituted 25 percent  on auto imports in April, followed by 25 percent tariffs on the imports of auto parts. The rates have been adjusted for certain nations based on their negotiations with Washington.

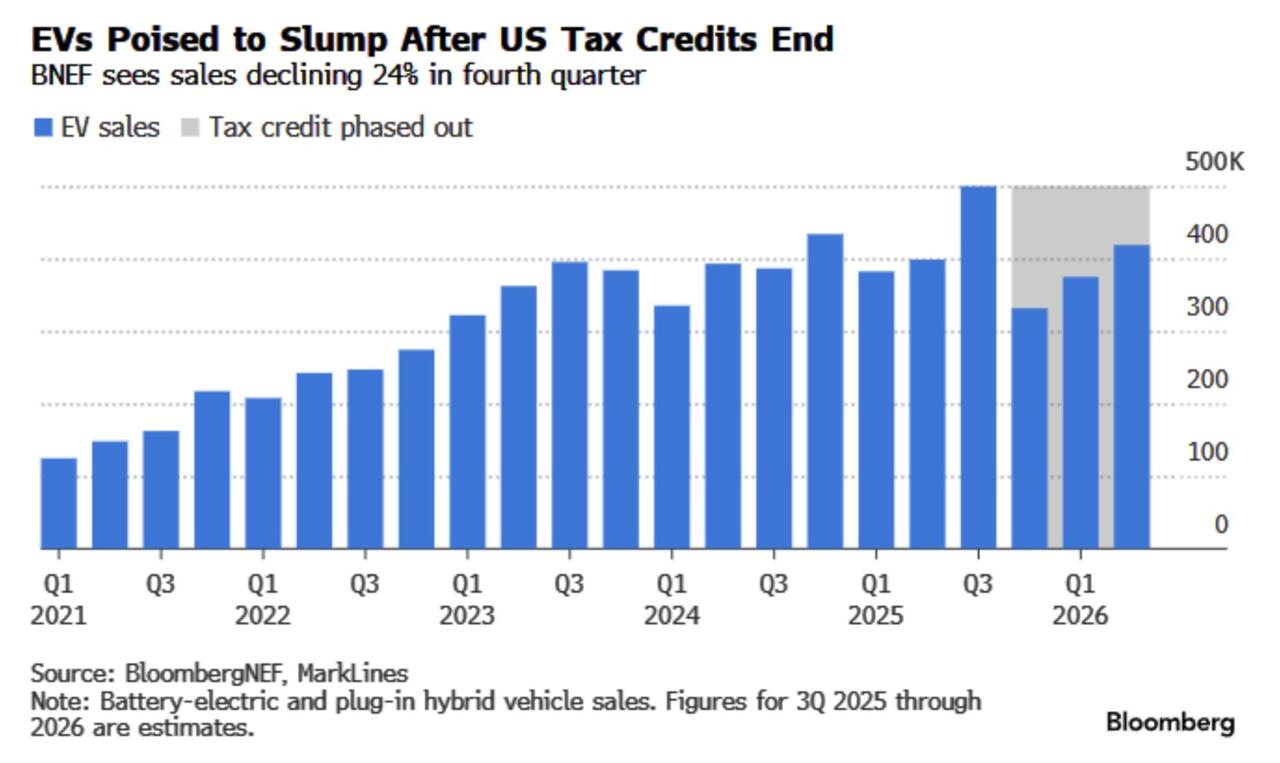

Until Sept. 30, Americans who bought EVs could get a $7,500 tax credit. This incentive ended in line with the requirement of the One Big Beautiful Bill Act, signed into law by President Donald Trump in July.

Cox stated that EV sales had accelerated after the passage of the Act, with Q3 EV sales volume hitting an all-time high.

“Sales of EVs and PHEVs are expected to collapse in October as tax credits expire,” Chesbrough said.

PHEV refers to a plug-in hybrid electric vehicle.

“In addition, market conditions for other vehicles are expected to become more challenging in future months as prices increase,” he said.

Amid slowing sales, car buyers are faced with high acquisition costs. The typical monthly

on auto imports in April, followed by 25 percent tariffs on the imports of auto parts. The rates have been adjusted for certain nations based on their negotiations with Washington.

Until Sept. 30, Americans who bought EVs could get a $7,500 tax credit. This incentive ended in line with the requirement of the One Big Beautiful Bill Act, signed into law by President Donald Trump in July.

Cox stated that EV sales had accelerated after the passage of the Act, with Q3 EV sales volume hitting an all-time high.

“Sales of EVs and PHEVs are expected to collapse in October as tax credits expire,” Chesbrough said.

PHEV refers to a plug-in hybrid electric vehicle.

“In addition, market conditions for other vehicles are expected to become more challenging in future months as prices increase,” he said.

Amid slowing sales, car buyers are faced with high acquisition costs. The typical monthly  for a new vehicle has jumped by 1.9 percent to hit $766, the highest monthly payment level in 15 months, Cox said in an Oct. 15 statement.

Meanwhile, 28.1 percent of cars traded in for new vehicles in the third quarter this year had negative equity, a situation where the car value is less than the loan amount, industry resource Edmunds said in an Oct. 15 https://www.edmunds.com/industry/press/underwater-and-sinking-deeper-the-average-amount-owed-on-upside-down-auto-loans-climbed-to-an-all-time-high-of-6905-according-to-edmunds.html

.

“The sheer amount of debt consumers are carrying in their trade-ins should be a wake-up call,” Ivan Drury, Edmunds’ director of insights, said in the statement.

Auto Loan Burden

According to an Oct. 30

for a new vehicle has jumped by 1.9 percent to hit $766, the highest monthly payment level in 15 months, Cox said in an Oct. 15 statement.

Meanwhile, 28.1 percent of cars traded in for new vehicles in the third quarter this year had negative equity, a situation where the car value is less than the loan amount, industry resource Edmunds said in an Oct. 15 https://www.edmunds.com/industry/press/underwater-and-sinking-deeper-the-average-amount-owed-on-upside-down-auto-loans-climbed-to-an-all-time-high-of-6905-according-to-edmunds.html

.

“The sheer amount of debt consumers are carrying in their trade-ins should be a wake-up call,” Ivan Drury, Edmunds’ director of insights, said in the statement.

Auto Loan Burden

According to an Oct. 30  by financial tech company WalletHub, the average American household owed roughly $13,800 in auto loans as of Q2 2025, just a few hundred dollars shy of the record high. The total auto loan debt has gone up to nearly $1.7 trillion.

Auto debt is rising the most in Vermont, followed by Delaware, New Mexico, Idaho, and Utah, it said. In contrast, it is rising the least in Ohio, South Dakota, Hawaii, Oregon, and Arkansas.

John Kiernan, editor at WalletHub, said that residents in some states saw average auto loan balances rise by almost 2.4 percent between Q1 and Q2, which he called “dramatic increases.”

This “suggests that people in some states are more affected by inflation in car prices or are biting off more than they can chew when it comes to loans,” he said.

Meanwhile, despite rising prices, auto demand from middle-income Americans is trending higher, according to an Oct. 16

by financial tech company WalletHub, the average American household owed roughly $13,800 in auto loans as of Q2 2025, just a few hundred dollars shy of the record high. The total auto loan debt has gone up to nearly $1.7 trillion.

Auto debt is rising the most in Vermont, followed by Delaware, New Mexico, Idaho, and Utah, it said. In contrast, it is rising the least in Ohio, South Dakota, Hawaii, Oregon, and Arkansas.

John Kiernan, editor at WalletHub, said that residents in some states saw average auto loan balances rise by almost 2.4 percent between Q1 and Q2, which he called “dramatic increases.”

This “suggests that people in some states are more affected by inflation in car prices or are biting off more than they can chew when it comes to loans,” he said.

Meanwhile, despite rising prices, auto demand from middle-income Americans is trending higher, according to an Oct. 16  from financial institution Santander US.

A survey of middle-income Americans showed that 54 percent were considering buying a vehicle in the year ahead, up from 43 percent a year back, it stated.

More than seven in 10 said they were willing to sacrifice other items in their budgets to ensure access to vehicles, which Santander said was the highest level in two years.

Sat, 11/01/2025 - 18:40

from financial institution Santander US.

A survey of middle-income Americans showed that 54 percent were considering buying a vehicle in the year ahead, up from 43 percent a year back, it stated.

More than seven in 10 said they were willing to sacrifice other items in their budgets to ensure access to vehicles, which Santander said was the highest level in two years.

Sat, 11/01/2025 - 18:40

The Epoch Times

Annual Sales of New Vehicles Expected to Hit Only 15.7 Million Units: Cox

Americans are no longer eligible for the $7,500 electric vehicle tax credit.

Cox Automotive Inc.

Cox Automotive Forecast: October U.S. New-Vehicle Sales Pace Expected to Slow to 15.7 Million; EV Sales Slump Weighs on Market - Cox Automotive Inc.

Cox Automotive publishes its U.S. auto sales forecast each month prior to the automakers reporting their sales results.

The seasonally adjusted annual rate is down from 16.4 million in September and 16.1 million a year back, said the company, attributing the slowdown to auto tariffs and the end of electric vehicle (EV) incentives.

“The new-vehicle sales pace was surprisingly strong this summer despite ongoing tariff uncertainty,” Charlie Chesbrough, senior economist at Cox, said in the statement.

“However, as more tariffed products replace non-tariffed inventory, prices are tracking higher, which should lead to slower sales through the remainder of the year. With the expiration of EV tax credits and a decline in alternative powertrain sales, the sales pace is anticipated to decrease as we move into a new season.”

Sales volume is forecast to be 1.3 million units in October, down by more than 3 percent from last year. While this figure is 2.7 percent higher than September, October had three more selling days than last month, Cox stated.

The federal government instituted 25 percent

The seasonally adjusted annual rate is down from 16.4 million in September and 16.1 million a year back, said the company, attributing the slowdown to auto tariffs and the end of electric vehicle (EV) incentives.

“The new-vehicle sales pace was surprisingly strong this summer despite ongoing tariff uncertainty,” Charlie Chesbrough, senior economist at Cox, said in the statement.

“However, as more tariffed products replace non-tariffed inventory, prices are tracking higher, which should lead to slower sales through the remainder of the year. With the expiration of EV tax credits and a decline in alternative powertrain sales, the sales pace is anticipated to decrease as we move into a new season.”

Sales volume is forecast to be 1.3 million units in October, down by more than 3 percent from last year. While this figure is 2.7 percent higher than September, October had three more selling days than last month, Cox stated.

The federal government instituted 25 percent

The Epoch Times

Average New Car Price Surpasses $50,000, Breaks Record: Kelley Blue Book

New vehicle prices have been rising steadily for more than a year, with the pace picking up over the past months.

The Epoch Times

IRS Offers Compliance Relief on Auto Loan Interest Reporting

Out of the roughly 2.4 million cars sold last year, more than 80 percent were financed.

WalletHub

States Where Auto Loan Debt Is Increasing the Most

States Where Auto Loan Debt Is Increasing the Most

Santander US

Auto Demand Up in 2025 as More Americans Car Shop and Prioritize Vehicle Access, Santander US Survey Finds - Santander US

Tyler Durden | Zero Hedge

Zero Hedge

Annual Sales Of New Vehicles Expected To Hit Only 15.7 Million Units: Cox | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Ukrainian Foreign Minister Andrii Sybiha has

Ukrainian Foreign Minister Andrii Sybiha has

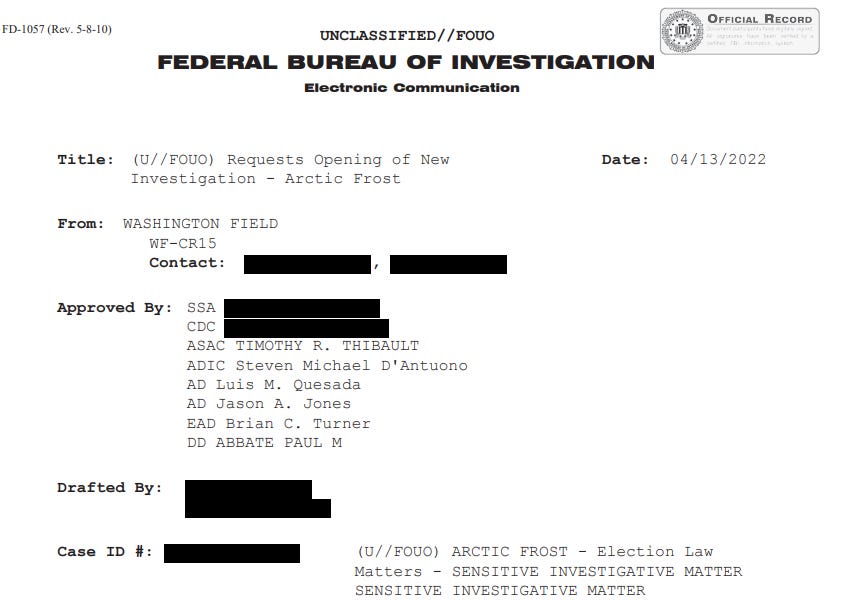

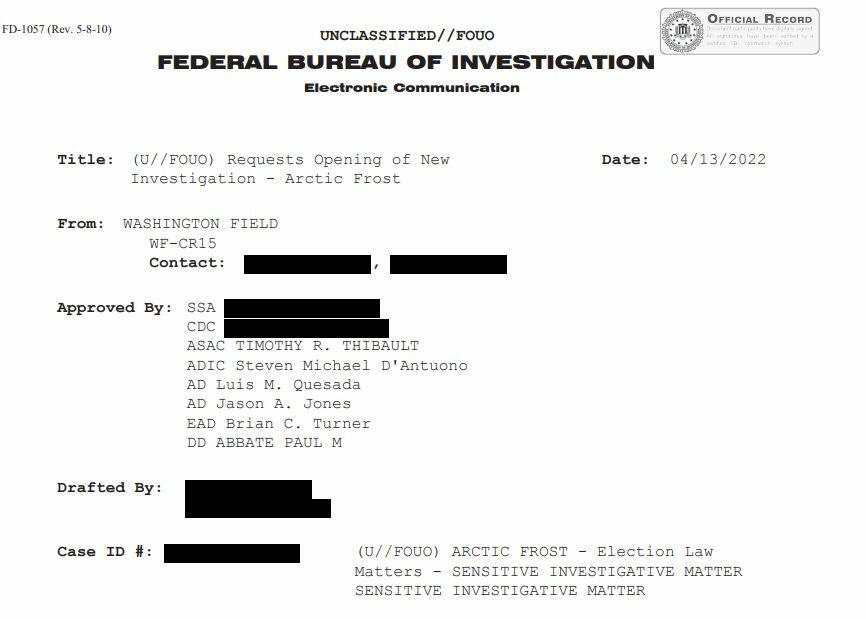

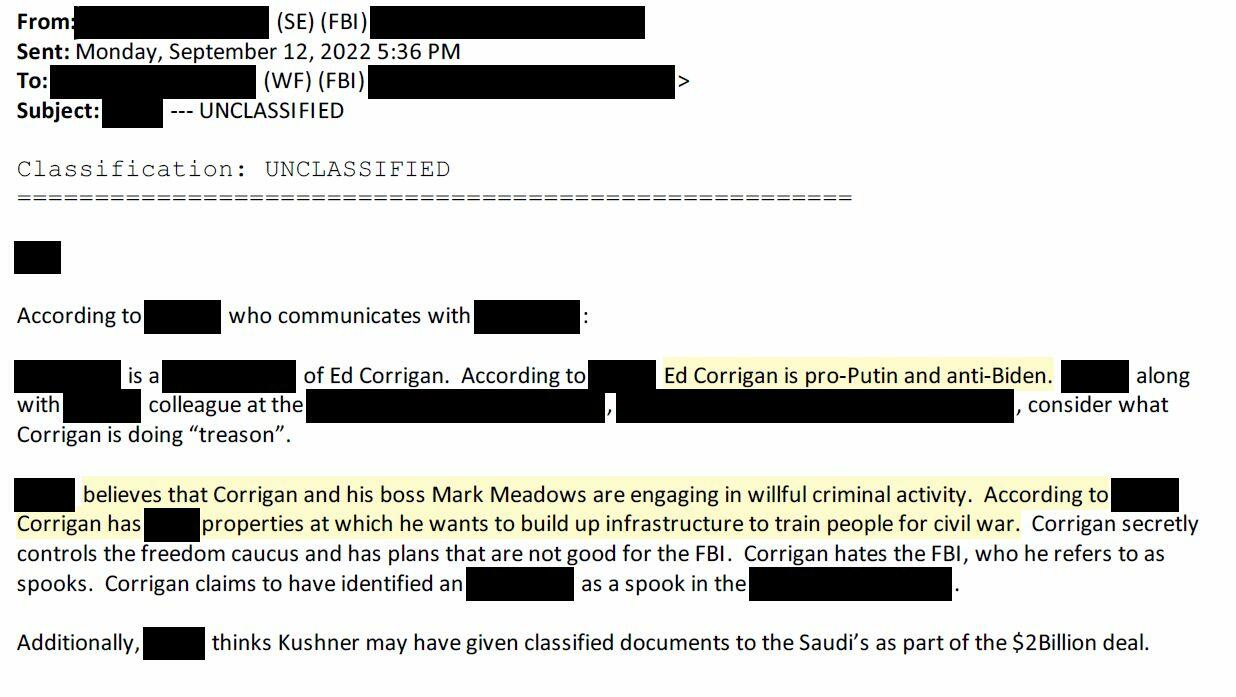

The Artic Frost opening document, dated April 13, 2022, provides a number of potential statutory violations that justified its opening. Here is the exact text.

“By conspiring, attempting to submit, and/or submitting allegedly fraudulent elector certificates, subjects, both known and unknown, may have violated one or more of the following federal statutes of which the FBI has enforcement responsibility:

Attempt or conspiracy to corruptly obstruct, influence, and impede the certification of the Electoral College vote (18 USC § 1512(c)(2) and (k)).

Obstruction of certain proceedings (18 USC § 1505).

Falsification of records (18 USC § 1519).

Conspiracy to defraud the United States (18 USC § 371).

Mail Fraud (18 USC § 1341).

Seditious Conspiracy (18 USC § 2384).”

Now, that April 13, 2022 document wasn’t the original Artic Frost opening communication. Rather, from the records that have been published, the original was dated March 22, 2022. And if you look into the alleged statutory violations (which we outlined above), the March 22, 2022 document omits “Mail Fraud.” That’s an important addition for the reasons we’ve outlined below.

By the time Artic Frost commenced, a related grand jury investigation had been opened “with federal law enforcement agencies on January 31, 2022.” Those other agencies were identified as the US Postal Inspection Service and the Investigative Unit of the Office of the Inspector General for the National Archives. The subjects of Artic Frost included: Donald J. Trump for President, Inc. (and those involved in the campaign); attorney John Eastman, who helped lead some of the challenges to the 2020 election; Rudy Giuliani; and Trump advisor (and campaign attorney) Boris Epshteyn. The subjects also included the electors – 60+ persons from Arizona, Georgia, Michigan, Nevada, Wisconsing who were part of the election challenge efforts.

As we have known for a while, Artic Frost was expansive. Previous filings in Trump’s DC criminal case (which we

The Artic Frost opening document, dated April 13, 2022, provides a number of potential statutory violations that justified its opening. Here is the exact text.

“By conspiring, attempting to submit, and/or submitting allegedly fraudulent elector certificates, subjects, both known and unknown, may have violated one or more of the following federal statutes of which the FBI has enforcement responsibility:

Attempt or conspiracy to corruptly obstruct, influence, and impede the certification of the Electoral College vote (18 USC § 1512(c)(2) and (k)).

Obstruction of certain proceedings (18 USC § 1505).

Falsification of records (18 USC § 1519).

Conspiracy to defraud the United States (18 USC § 371).

Mail Fraud (18 USC § 1341).

Seditious Conspiracy (18 USC § 2384).”

Now, that April 13, 2022 document wasn’t the original Artic Frost opening communication. Rather, from the records that have been published, the original was dated March 22, 2022. And if you look into the alleged statutory violations (which we outlined above), the March 22, 2022 document omits “Mail Fraud.” That’s an important addition for the reasons we’ve outlined below.

By the time Artic Frost commenced, a related grand jury investigation had been opened “with federal law enforcement agencies on January 31, 2022.” Those other agencies were identified as the US Postal Inspection Service and the Investigative Unit of the Office of the Inspector General for the National Archives. The subjects of Artic Frost included: Donald J. Trump for President, Inc. (and those involved in the campaign); attorney John Eastman, who helped lead some of the challenges to the 2020 election; Rudy Giuliani; and Trump advisor (and campaign attorney) Boris Epshteyn. The subjects also included the electors – 60+ persons from Arizona, Georgia, Michigan, Nevada, Wisconsing who were part of the election challenge efforts.

As we have known for a while, Artic Frost was expansive. Previous filings in Trump’s DC criminal case (which we

One of the key questions remaining is what the FBI did with that information - whether that source was trusted, and whether investigations were opened into Corrigan or Kushner based on that obviously false intelligence. We’ll see.

One of the key questions remaining is what the FBI did with that information - whether that source was trusted, and whether investigations were opened into Corrigan or Kushner based on that obviously false intelligence. We’ll see.

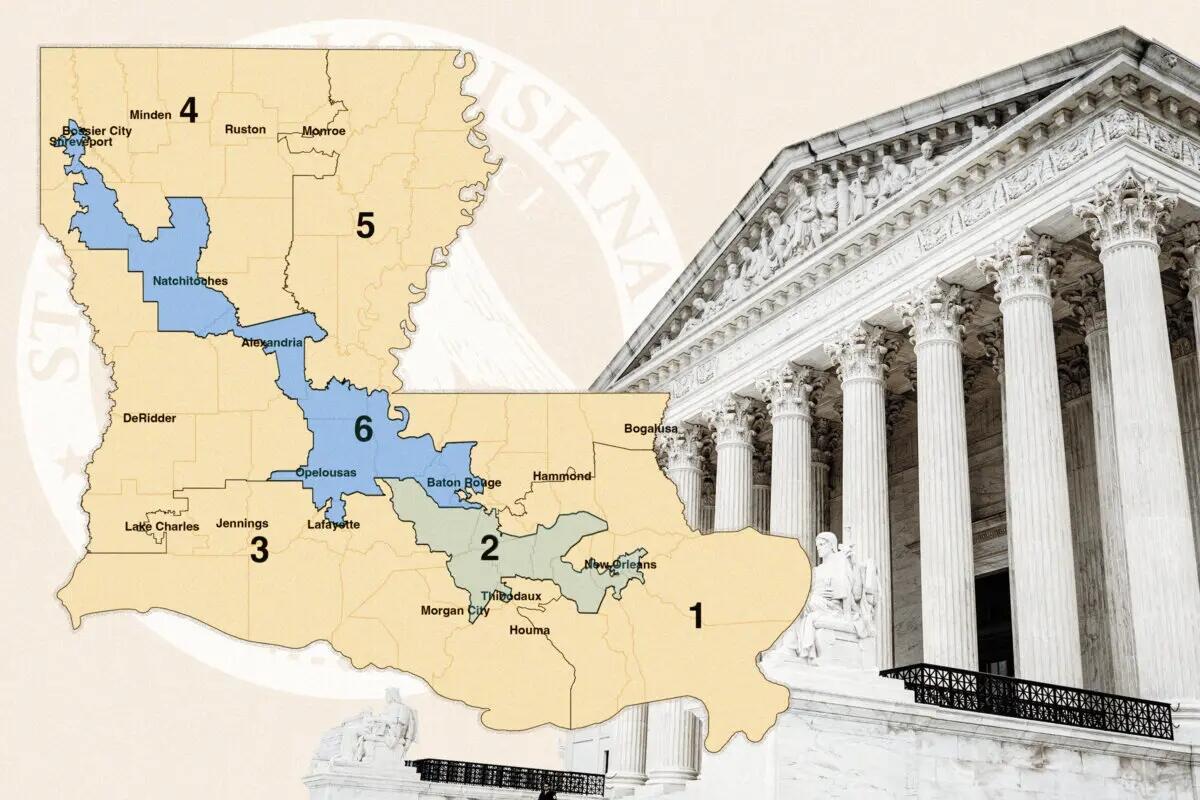

In October, the Supreme Court heard two cases that may impact upcoming elections: one dealing with race-based congressional maps, and the other addressing whether federal candidates can challenge state laws that allow ballot counting after election day.

Race-Based Redistricting

Following a lawsuit by minority voters, a federal court in Louisiana ordered the state to redraw its congressional map to add a second majority-black district, since that demographic made up one-third of the state’s population. After it did so, a group of non-minority voters sued, arguing that the new maps discriminated against them racially.

Earlier this year, the Supreme Court heard arguments for both cases in a combined case called

In October, the Supreme Court heard two cases that may impact upcoming elections: one dealing with race-based congressional maps, and the other addressing whether federal candidates can challenge state laws that allow ballot counting after election day.

Race-Based Redistricting

Following a lawsuit by minority voters, a federal court in Louisiana ordered the state to redraw its congressional map to add a second majority-black district, since that demographic made up one-third of the state’s population. After it did so, a group of non-minority voters sued, arguing that the new maps discriminated against them racially.

Earlier this year, the Supreme Court heard arguments for both cases in a combined case called

Louisiana Congressional District Map; Districts 2 and 6 are mostly-black districts. Illustration by The Epoch Times, Public Domain, Madalina Vasiliu/The Epoch Times

She also argued that Bost has no standing because he is unlikely to lose the race: He won the last two elections by 49 points and 50 points, respectively.

But when the justices asked how close the race would need to be for a candidate to have standing, Notz was unable give an answer.

Some of the justices were concerned that denying a candidate standing until after the election was underway would produce its own basket of problems.

“What you’re sketching out for us is a potential disaster,” Chief Justice John Roberts said.

“If the candidate hopes to win by a dozen votes—and there are places in the country where that happens over and over again—then he has standing. But we’re not going to know that until we get very close to the election, right? And so it’s going to be in the middle, the most fraught time for the Court to get involved in electoral politics.”

Justice Neil Gorsuch also asked if there was something “unseemly” about courts interfering with an election by making public statements about which candidate was most likely to win, and by how much.

The Outcome

The court has not yet issued a ruling in either of these cases, and timing is key.

Because of a rule called the

Louisiana Congressional District Map; Districts 2 and 6 are mostly-black districts. Illustration by The Epoch Times, Public Domain, Madalina Vasiliu/The Epoch Times

She also argued that Bost has no standing because he is unlikely to lose the race: He won the last two elections by 49 points and 50 points, respectively.

But when the justices asked how close the race would need to be for a candidate to have standing, Notz was unable give an answer.

Some of the justices were concerned that denying a candidate standing until after the election was underway would produce its own basket of problems.

“What you’re sketching out for us is a potential disaster,” Chief Justice John Roberts said.

“If the candidate hopes to win by a dozen votes—and there are places in the country where that happens over and over again—then he has standing. But we’re not going to know that until we get very close to the election, right? And so it’s going to be in the middle, the most fraught time for the Court to get involved in electoral politics.”

Justice Neil Gorsuch also asked if there was something “unseemly” about courts interfering with an election by making public statements about which candidate was most likely to win, and by how much.

The Outcome

The court has not yet issued a ruling in either of these cases, and timing is key.

Because of a rule called the

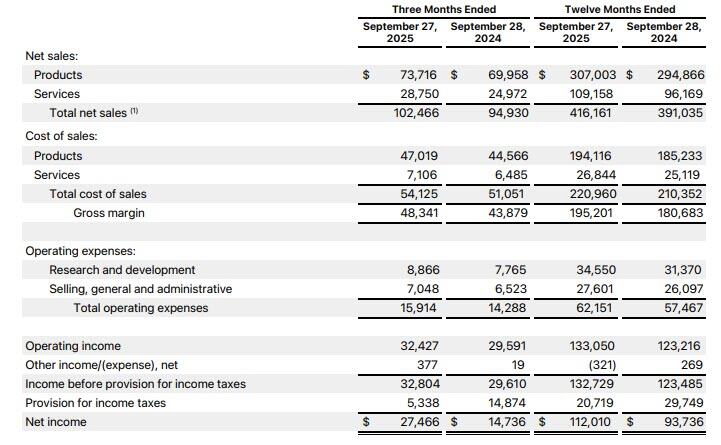

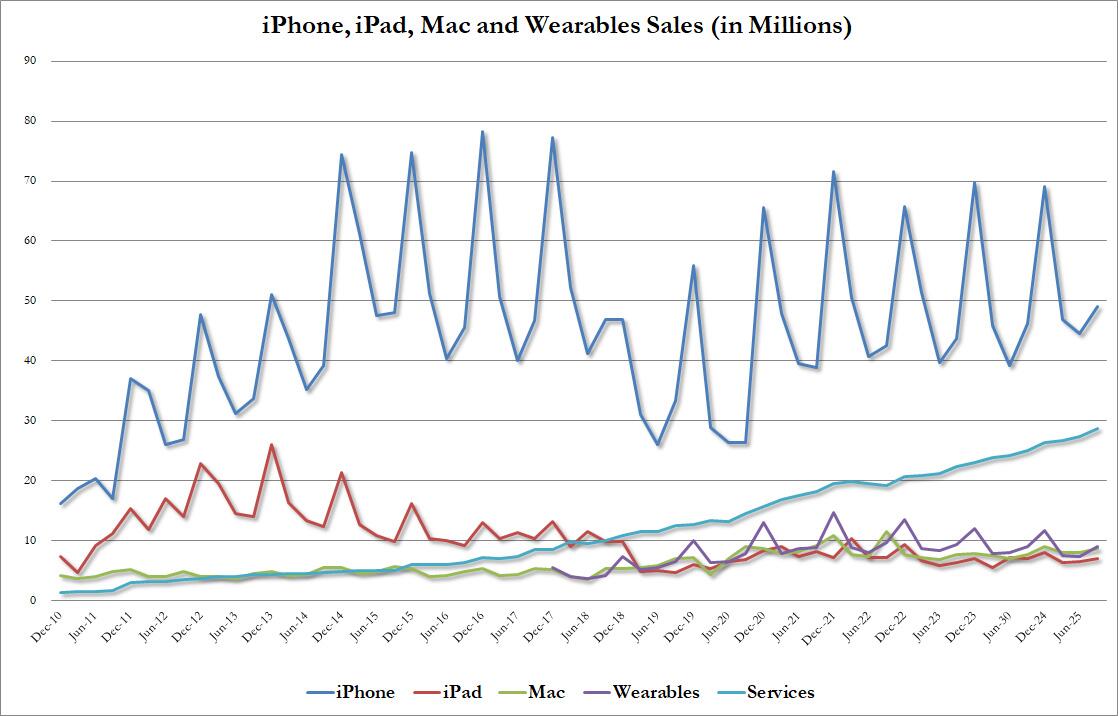

Looking at a breakdown of sales by product category, here the numbers were mixed, with iPhone and iPad missing, while Mac, Wearables and Service revenues beat. The iPhone number especially was a little light, especially for those who put faith in the soft/third party data from the likes of Counterpoint Research.

IPhone revenue $49.03 billion, +6.1% y/y, missing estimate of $49.33 billion

IPad revenue $6.95 billion vs. $6.95 billion y/y, missing estimate $6.97 billion

Mac revenue $8.73 billion, +13% y/y, beating estimate $8.55 billion

Wearables, home and accessories $9.01 billion, -0.3% y/y, beating estimate $8.64 billion

Here is the full revenue breakdown by product:

Looking at a breakdown of sales by product category, here the numbers were mixed, with iPhone and iPad missing, while Mac, Wearables and Service revenues beat. The iPhone number especially was a little light, especially for those who put faith in the soft/third party data from the likes of Counterpoint Research.

IPhone revenue $49.03 billion, +6.1% y/y, missing estimate of $49.33 billion

IPad revenue $6.95 billion vs. $6.95 billion y/y, missing estimate $6.97 billion

Mac revenue $8.73 billion, +13% y/y, beating estimate $8.55 billion

Wearables, home and accessories $9.01 billion, -0.3% y/y, beating estimate $8.64 billion

Here is the full revenue breakdown by product:

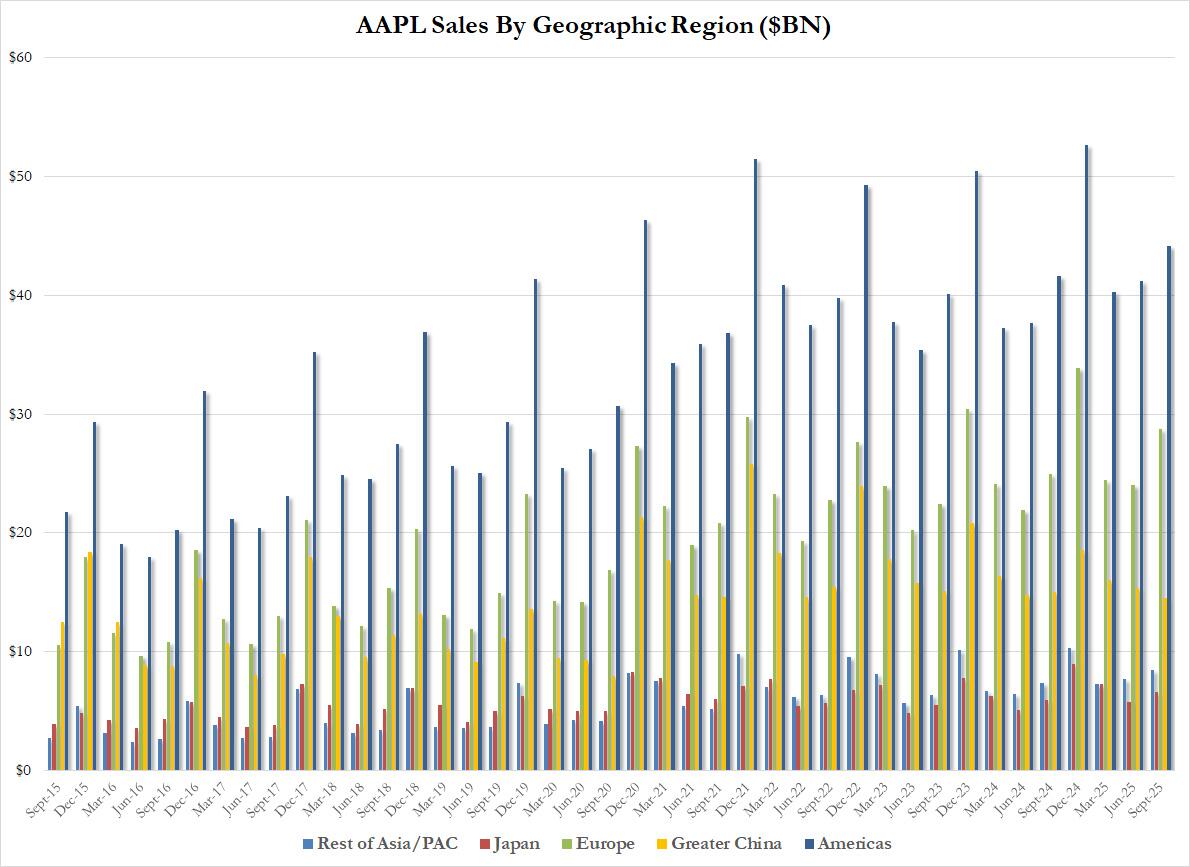

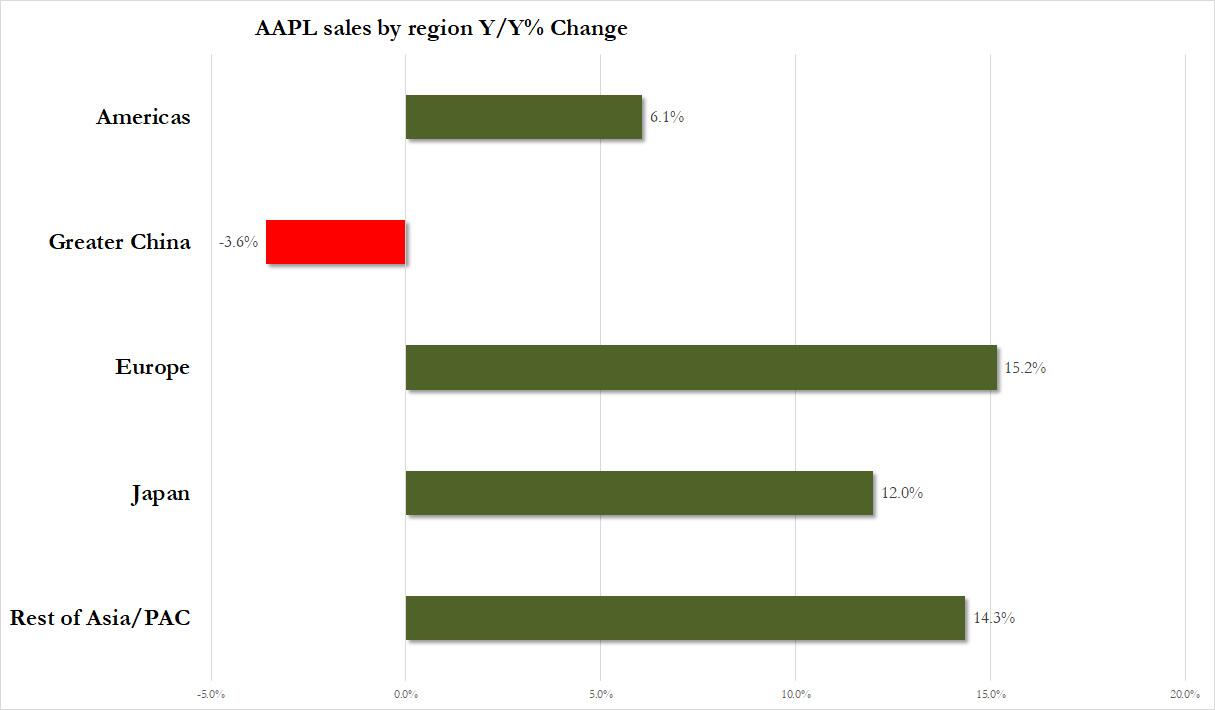

Soft iPhone sales aside, it was the surprising drop - and miss - in China sales that prompted the early selling in the stocks: contrary to expectations for a modest rebound, China sales declined down 3.6%, the 7th drop in the past 9 quarters, down a 11.1%, and printing at only $14.493BN, below the $16.43BN estimate. The rest of the world saw growth, with Americas rising 6.1, and double digits growth in both Europe and APAC

Soft iPhone sales aside, it was the surprising drop - and miss - in China sales that prompted the early selling in the stocks: contrary to expectations for a modest rebound, China sales declined down 3.6%, the 7th drop in the past 9 quarters, down a 11.1%, and printing at only $14.493BN, below the $16.43BN estimate. The rest of the world saw growth, with Americas rising 6.1, and double digits growth in both Europe and APAC

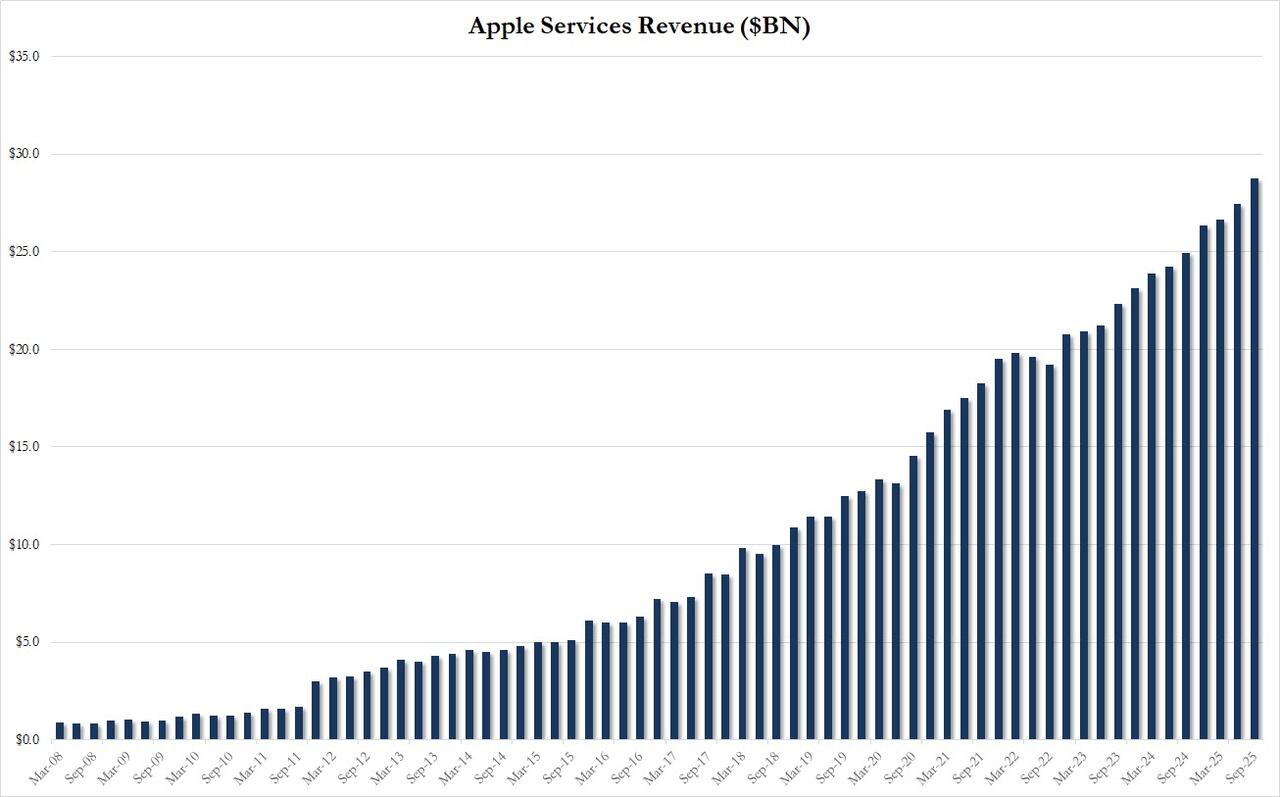

Commenting on the quarter, Apple CFO Kevan Parekh said that "our September quarter results capped off a record fiscal year, with revenue reaching $416 billion, as well as double-digit EPS growth." He added that "thanks to our very high levels of customer satisfaction and loyalty, our installed base of active devices also reached a new all-time high across all product categories and geographic segments."

And here is Tim Cook: "Today, Apple is very proud to report a September quarter revenue record of $102.5 billion, including a September quarter revenue record for iPhone and an all-time revenue record for Services. In September, we were thrilled to launch our best iPhone lineup ever, including iPhone 17, iPhone 17 Pro and Pro Max, and iPhone Air. In addition, we launched the fantastic AirPods Pro 3 and the all-new Apple Watch lineup. When combined with the recently announced MacBook Pro and iPad Pro with the powerhouse M5 chip, we are excited to be sharing our most extraordinary lineup of products as we head into the holiday season."

Elsewhere, Apple’s board announced a small dividend update which rose to $0.26 per share of the Company’s common stock. The dividend is payable on November 13, 2025, to shareholders of record as of the close of business on November 10, 2025.

More notably, the company said that it saw $1.1 billion in tariff related costs in Q4, which may explain why the market reversed the after hours selloff, giving AAPL credit for the rather mediocre earnings, which it would blame on Trump.

Seeking to reverse the early selloff, Apple leaked a little guidance, saying it sees a rev. increase of 10% to 12% in the holiday quarter, Cook saying he expects Q1 2026 revenue to be the best ever for the company and iPhone. And if that's not the case, the company can just blame tariffs.

To be sure, according to Bloomberg Intelligence, the comments from Apple’s CFO about a 10-12% increase in iPhone sales in fiscal 1Q26 vs. consensus of 6% growth, as reported by the Wall Street Journal, overshadows dismal 4Q Greater China sales:

“Remarks about a supply shortage could soothe concerns around market-share loss to local brands in the region. Services-segment growth of 15%, or 230 bps above consensus, was a positive, suggesting App Store fee changes might not be affecting consumer behavior as much as feared.”

And just to make sure the early selloff does not drag the stock lower, Tim Cook was quick to throw out all the key buzzwords, saying Apple is "expanding its investments in AI", reiterating comments he’s made the last several quarters. Cook also said Apple was making more progress on the new Siri and reiterates it’s coming next year.

For now, the plan is working and AAPL stock managed to sharply reverse its early drop, surging about 3% after hours.

Commenting on the quarter, Apple CFO Kevan Parekh said that "our September quarter results capped off a record fiscal year, with revenue reaching $416 billion, as well as double-digit EPS growth." He added that "thanks to our very high levels of customer satisfaction and loyalty, our installed base of active devices also reached a new all-time high across all product categories and geographic segments."

And here is Tim Cook: "Today, Apple is very proud to report a September quarter revenue record of $102.5 billion, including a September quarter revenue record for iPhone and an all-time revenue record for Services. In September, we were thrilled to launch our best iPhone lineup ever, including iPhone 17, iPhone 17 Pro and Pro Max, and iPhone Air. In addition, we launched the fantastic AirPods Pro 3 and the all-new Apple Watch lineup. When combined with the recently announced MacBook Pro and iPad Pro with the powerhouse M5 chip, we are excited to be sharing our most extraordinary lineup of products as we head into the holiday season."

Elsewhere, Apple’s board announced a small dividend update which rose to $0.26 per share of the Company’s common stock. The dividend is payable on November 13, 2025, to shareholders of record as of the close of business on November 10, 2025.

More notably, the company said that it saw $1.1 billion in tariff related costs in Q4, which may explain why the market reversed the after hours selloff, giving AAPL credit for the rather mediocre earnings, which it would blame on Trump.

Seeking to reverse the early selloff, Apple leaked a little guidance, saying it sees a rev. increase of 10% to 12% in the holiday quarter, Cook saying he expects Q1 2026 revenue to be the best ever for the company and iPhone. And if that's not the case, the company can just blame tariffs.

To be sure, according to Bloomberg Intelligence, the comments from Apple’s CFO about a 10-12% increase in iPhone sales in fiscal 1Q26 vs. consensus of 6% growth, as reported by the Wall Street Journal, overshadows dismal 4Q Greater China sales:

“Remarks about a supply shortage could soothe concerns around market-share loss to local brands in the region. Services-segment growth of 15%, or 230 bps above consensus, was a positive, suggesting App Store fee changes might not be affecting consumer behavior as much as feared.”

And just to make sure the early selloff does not drag the stock lower, Tim Cook was quick to throw out all the key buzzwords, saying Apple is "expanding its investments in AI", reiterating comments he’s made the last several quarters. Cook also said Apple was making more progress on the new Siri and reiterates it’s coming next year.

For now, the plan is working and AAPL stock managed to sharply reverse its early drop, surging about 3% after hours.

Kennedy did not offer more details.

“Immunizations for measles, mumps, and rubella would be best administered as three separate vaccines,” a spokesperson for the Department of Health and Human Services (HHS) told The Epoch Times in an email. “Standalone vaccinations can potentially reduce the risk of side effects and can maximize parental choice in childhood immunizations.”

President Donald Trump in September

Kennedy did not offer more details.

“Immunizations for measles, mumps, and rubella would be best administered as three separate vaccines,” a spokesperson for the Department of Health and Human Services (HHS) told The Epoch Times in an email. “Standalone vaccinations can potentially reduce the risk of side effects and can maximize parental choice in childhood immunizations.”

President Donald Trump in September

The government is currently offering illegal immigrants $1,000 and free flights to self-deport back to their home nations. This gives them a chance to come back legally. Those arrested and deported won’t be able to return to the United States, DHS said.

According to the DHS, law enforcement has been removing the “worst of the worst criminal illegal aliens” from the country, including rapists, murderers, drug dealers, and pedophiles, despite facing opposition from politicians in sanctuary jurisdictions.

Sanctuary

The government is currently offering illegal immigrants $1,000 and free flights to self-deport back to their home nations. This gives them a chance to come back legally. Those arrested and deported won’t be able to return to the United States, DHS said.

According to the DHS, law enforcement has been removing the “worst of the worst criminal illegal aliens” from the country, including rapists, murderers, drug dealers, and pedophiles, despite facing opposition from politicians in sanctuary jurisdictions.

Sanctuary

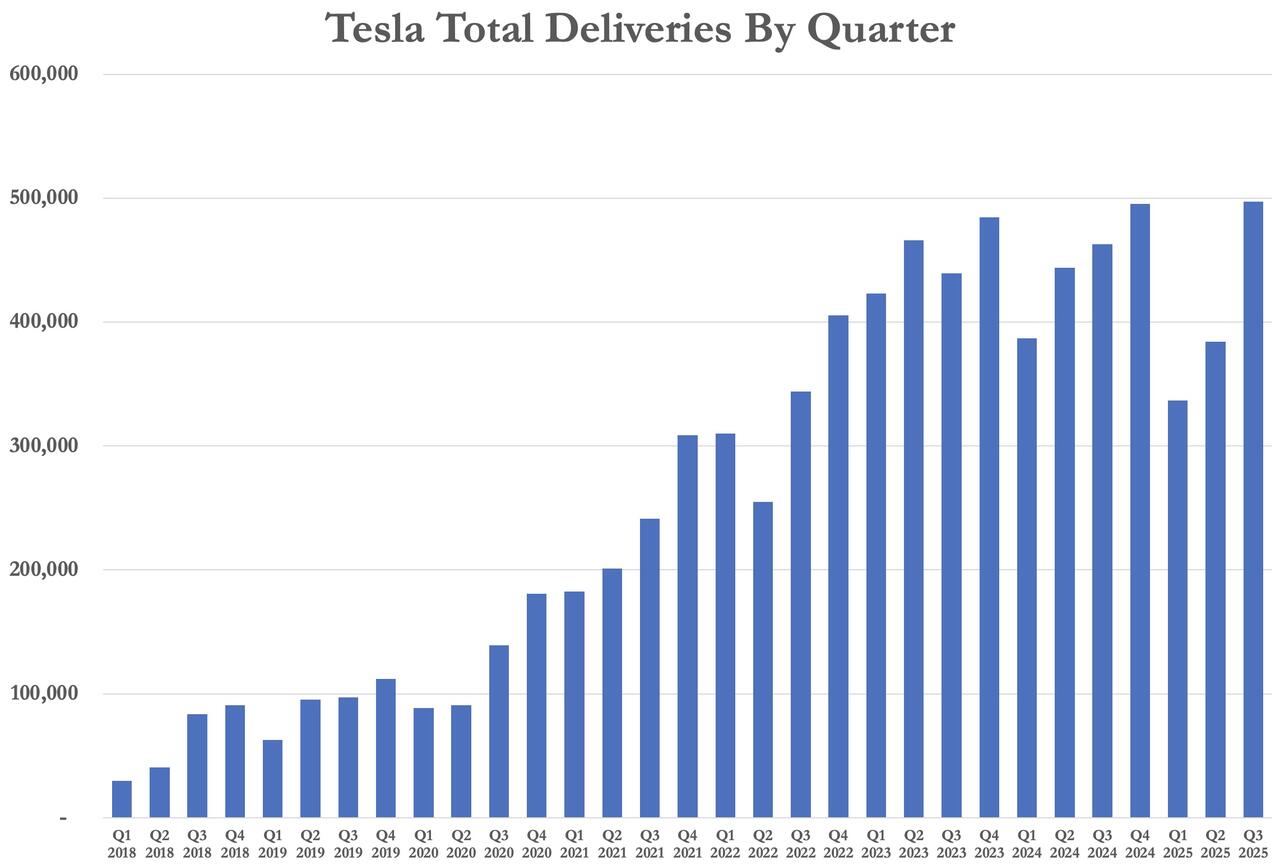

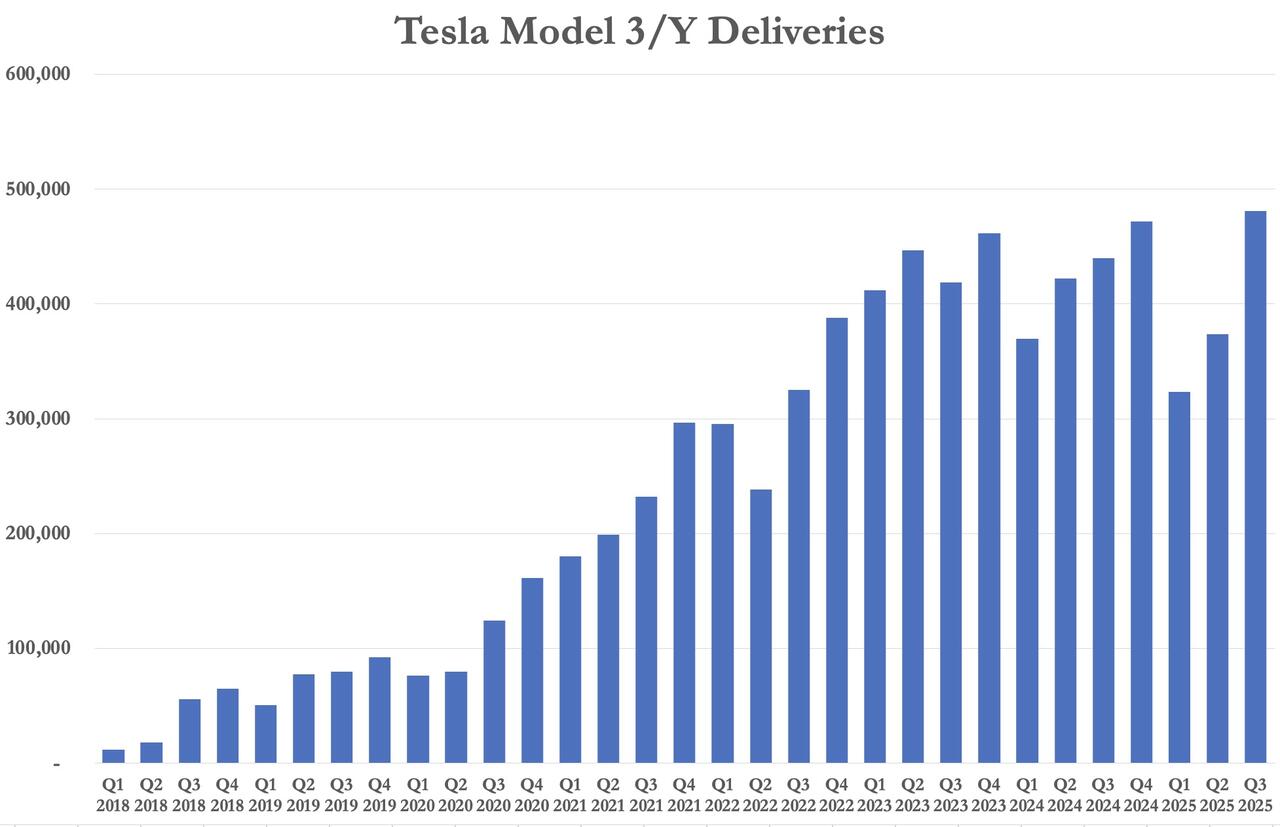

On the production side, Tesla built 447,450 vehicles, down 4.8% from a year earlier and just under the consensus of 450,313. Model 3/Y production totaled 435,826, a 1.8% decline but still ahead of forecasts. Production of other models slipped to 11,624, down 13% from the prior quarter.

On the production side, Tesla built 447,450 vehicles, down 4.8% from a year earlier and just under the consensus of 450,313. Model 3/Y production totaled 435,826, a 1.8% decline but still ahead of forecasts. Production of other models slipped to 11,624, down 13% from the prior quarter.

Despite those records, Wall Street does not expect record profits. Tesla earned $0.72 per share during the same period last year, and consensus estimates now suggest an earnings downtrend driven by ongoing price cuts and cost competition across the global EV market. The company’s earnings per share have fallen steadily since peaking in 2022, and analysts expect full-year 2025 EPS of around $1.75, down from $2.28 in 2024 and $3.12 in 2023.

Auto Focus: EV Credit Pull Forward and Cheaper Model Y

Tesla’s automotive business still dominates its results, accounting for the majority of revenue despite Elon Musk’s frequent characterization of the company as an AI and robotics leader. For now, the automaker’s financial health remains tightly linked to the number of vehicles it delivers, not autonomous driving or humanoid robots.

Recall, Tesla unveiled a cheaper Model Y today weeks ago with prices starting at $37,990–$39,990, about 15% below the previous base model, as the company works to reverse slowing sales and lost U.S. tax incentives. Elon Musk has long promised a mass-market EV, though he scrapped a $25,000 car plan last year. Still,

Despite those records, Wall Street does not expect record profits. Tesla earned $0.72 per share during the same period last year, and consensus estimates now suggest an earnings downtrend driven by ongoing price cuts and cost competition across the global EV market. The company’s earnings per share have fallen steadily since peaking in 2022, and analysts expect full-year 2025 EPS of around $1.75, down from $2.28 in 2024 and $3.12 in 2023.

Auto Focus: EV Credit Pull Forward and Cheaper Model Y

Tesla’s automotive business still dominates its results, accounting for the majority of revenue despite Elon Musk’s frequent characterization of the company as an AI and robotics leader. For now, the automaker’s financial health remains tightly linked to the number of vehicles it delivers, not autonomous driving or humanoid robots.

Recall, Tesla unveiled a cheaper Model Y today weeks ago with prices starting at $37,990–$39,990, about 15% below the previous base model, as the company works to reverse slowing sales and lost U.S. tax incentives. Elon Musk has long promised a mass-market EV, though he scrapped a $25,000 car plan last year. Still,  While Tesla just had a record quarter, global sales are down about 6% this year, and analysts expect U.S. EV sales to fall sharply after the credit’s removal.

What Analysts Are Expecting

Analyst opinions ahead of tonight's report are mixed but focused on several key themes. Cantor Fitzgerald’s Andres Sheppard said investors will be watching for “several upcoming key material potential near-term catalysts,” including the rollout of Robotaxi programs in Texas and California, ramp-up of lower-cost Model 3/Y variants, FSD adoption in China and Europe, and updates on the Optimus humanoid robot and future Cybercab launch. Cantor maintains a $355 price target, implying roughly 20% downside from current levels.

Goldman Sachs analysts are watching five key areas in tonight’s call: vehicle delivery guidance, automotive profit margins, progress on robotaxis and FSD, growth in the energy business, and fresh details on the Optimus robot. Goldman’s price target is $425 per share with a Neutral rating, expecting Tesla to have delivered about 475,000 vehicles in Q3, slightly below the reported total.

RBC is more bullish, setting a $500 price target based on a “sum-of-the-parts” valuation that assigns increasing weight to Tesla’s AI and robotics divisions. RBC analyst Tom Narayan recently raised his target after management discussions around Optimus production, which the bank believes could represent a $9 trillion total addressable market over time. Morningstar’s Dave Sekera, meanwhile, is looking for updates on Robotaxi timelines and Tesla’s recently launched lower-cost Model 3 and Model Y variants, suggesting that affordability could be critical for reigniting demand.

Wedbush’s Dan Ives continues to frame Tesla’s next chapter as the “AI era,” emphasizing that “the most important chapter in Tesla's growth story is now beginning with the AI era now here.” Ives believes autonomous driving and robotics could add $1 trillion in value to Tesla’s story in the coming years, positioning the company at the intersection of mobility and intelligence.

While Tesla just had a record quarter, global sales are down about 6% this year, and analysts expect U.S. EV sales to fall sharply after the credit’s removal.

What Analysts Are Expecting

Analyst opinions ahead of tonight's report are mixed but focused on several key themes. Cantor Fitzgerald’s Andres Sheppard said investors will be watching for “several upcoming key material potential near-term catalysts,” including the rollout of Robotaxi programs in Texas and California, ramp-up of lower-cost Model 3/Y variants, FSD adoption in China and Europe, and updates on the Optimus humanoid robot and future Cybercab launch. Cantor maintains a $355 price target, implying roughly 20% downside from current levels.

Goldman Sachs analysts are watching five key areas in tonight’s call: vehicle delivery guidance, automotive profit margins, progress on robotaxis and FSD, growth in the energy business, and fresh details on the Optimus robot. Goldman’s price target is $425 per share with a Neutral rating, expecting Tesla to have delivered about 475,000 vehicles in Q3, slightly below the reported total.

RBC is more bullish, setting a $500 price target based on a “sum-of-the-parts” valuation that assigns increasing weight to Tesla’s AI and robotics divisions. RBC analyst Tom Narayan recently raised his target after management discussions around Optimus production, which the bank believes could represent a $9 trillion total addressable market over time. Morningstar’s Dave Sekera, meanwhile, is looking for updates on Robotaxi timelines and Tesla’s recently launched lower-cost Model 3 and Model Y variants, suggesting that affordability could be critical for reigniting demand.

Wedbush’s Dan Ives continues to frame Tesla’s next chapter as the “AI era,” emphasizing that “the most important chapter in Tesla's growth story is now beginning with the AI era now here.” Ives believes autonomous driving and robotics could add $1 trillion in value to Tesla’s story in the coming years, positioning the company at the intersection of mobility and intelligence.

Despite the futuristic focus, some are also wary about Tesla’s fundamentals. The company recently recalled nearly 13,000 Model 3 and Model Y vehicles due to a defect that could cause sudden battery power loss, forcing in-person repairs rather than software fixes. The recall underscores the tension between Tesla’s cutting-edge ambitions and its ongoing manufacturing and reliability challenges.

Musk's $1 Trillion Pay Plan Would Be Helped By A Bullish Report

Also in focus will be Elon Musk’s proposed new pay package, valued at nearly $1 trillion in Tesla stock, and which has ignited opposition from unions, pension funds, and governance watchdogs ahead of a shareholder vote next month. The plan would boost Musk’s voting control to about 25% and extend his leadership for another decade.

Proxy firms ISS and Glass Lewis have urged investors to vote against it, while supporters on Tesla’s board say it’s needed to retain Musk’s focus and vision. The vote will test shareholder confidence in Musk’s leadership as Tesla’s growth slows and scrutiny over governance intensifies.

In the short term, analysts and investors alike expect a bullish tone from management on the call. Tesla strategically delayed its annual shareholders meeting to early November, likely to coincide with this strong quarter ahead of key votes on Musk’s compensation and board seats. With tax credit expirations pulling demand into Q3, Tesla has good reason to spotlight its record quarter before potentially facing a tougher demand environment in coming periods.

Despite the futuristic focus, some are also wary about Tesla’s fundamentals. The company recently recalled nearly 13,000 Model 3 and Model Y vehicles due to a defect that could cause sudden battery power loss, forcing in-person repairs rather than software fixes. The recall underscores the tension between Tesla’s cutting-edge ambitions and its ongoing manufacturing and reliability challenges.

Musk's $1 Trillion Pay Plan Would Be Helped By A Bullish Report

Also in focus will be Elon Musk’s proposed new pay package, valued at nearly $1 trillion in Tesla stock, and which has ignited opposition from unions, pension funds, and governance watchdogs ahead of a shareholder vote next month. The plan would boost Musk’s voting control to about 25% and extend his leadership for another decade.

Proxy firms ISS and Glass Lewis have urged investors to vote against it, while supporters on Tesla’s board say it’s needed to retain Musk’s focus and vision. The vote will test shareholder confidence in Musk’s leadership as Tesla’s growth slows and scrutiny over governance intensifies.

In the short term, analysts and investors alike expect a bullish tone from management on the call. Tesla strategically delayed its annual shareholders meeting to early November, likely to coincide with this strong quarter ahead of key votes on Musk’s compensation and board seats. With tax credit expirations pulling demand into Q3, Tesla has good reason to spotlight its record quarter before potentially facing a tougher demand environment in coming periods.

Jonson said that the possibility of a war with Russia is still on the table.

Jonson told

Jonson said that the possibility of a war with Russia is still on the table.

Jonson told Swedish Defense Minister Pal Jonson, Warsaw, Poland, April 3, 2025. © Foto Olimpik / NurPhoto via Getty Images

Moscow has long viewed the Ukraine conflict as a NATO proxy war aimed at undermining Russia’s security following decades of expansion.

Sweden is the bloc’s newest member, while Ukraine was 'promised' accession sometime in the future.

Swedish Defense Minister Pal Jonson, Warsaw, Poland, April 3, 2025. © Foto Olimpik / NurPhoto via Getty Images

Moscow has long viewed the Ukraine conflict as a NATO proxy war aimed at undermining Russia’s security following decades of expansion.

Sweden is the bloc’s newest member, while Ukraine was 'promised' accession sometime in the future.

Current agreements may continue until June 17, 2026, while long-term contracts may would be cut off on Jan. 1, 2028.

That said, landlocked members states (Hungary, Slovakia) which have limited alternatives to Russia would be afforded some flexibility.

If the proposed regulations are backed by the European Parliament, it would require member states to submit plans for how they will diversify their energy supplies if they're currently receiving (directly or indirectly) gas from Russia.

Composed of national ministers from each member state, the Council of the EU said in a press release, "The same requirement to submit a national diversification plan will apply to those member states that are still importing Russian oil, with a view to discontinuing those imports by 1 January 2028."

Danish minister for climate, energy and utilities, Lars Aagaard, said "An energy independent Europe is a stronger and more secure Europe. Although we have worked hard and pushed to get Russian gas and oil out of Europe in recent years, we are not there yet," adding that it's critical for Denmark - which currently holds the rotating presidency of the Council of the EU, secures "overwhelming support from Europe’s energy ministers for the legislation that will definitively ban Russian gas from coming into the EU."

The Council presidency will begin negotiations with European Parliament (720 lawmakers) before agreeing on the final text of the regulations.

In other words - two years will have come and gone by the time they're done talking...

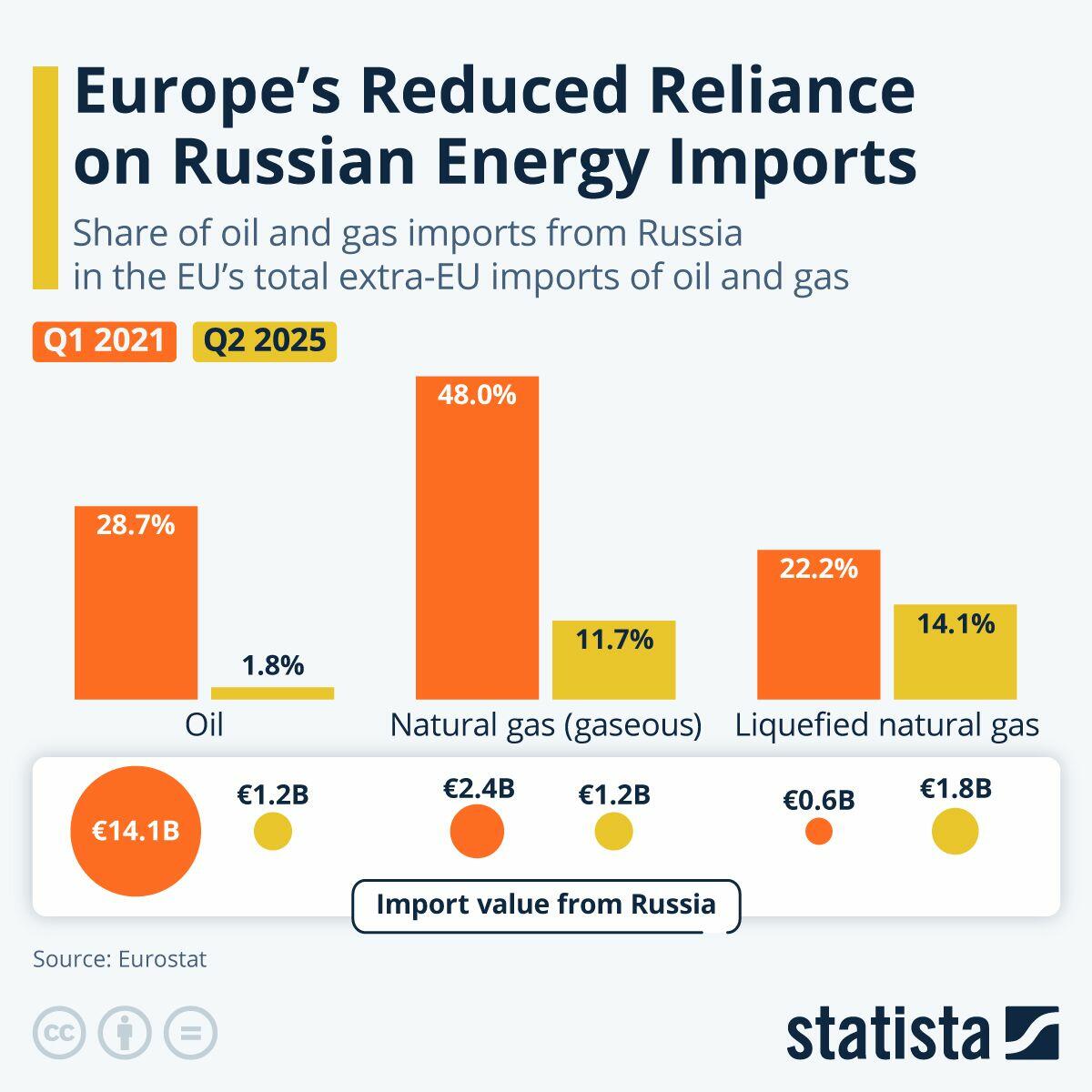

That said, Europe has already significantly cut back on Russian gas;

Between Q1 2021 and Q2 2025, the EU-27 reduced Russian oil imports by more than 90 percent, cutting the share of Russian oil in total extra-EU imports from 29 percent to less than 2 percent. During the same period, Russia’s share of the EU’s natural gas imports dropped from 39 to 13 percent, driven mainly by a 52-percent reduction of natural gas imports in gaseous state. The value of liquefied natural gas imports from Russia actually almost tripled between Q1 2021 and Q2 2025 but still accounted for a smaller share of the EU’s total LNG imports in the most recent quarter. This is due to total LNG imports more than quadrupling during this period, as the EU replaced Russian pipeline gas with LNG from suppliers like the United States, Qatar and Norway. -Staista

Current agreements may continue until June 17, 2026, while long-term contracts may would be cut off on Jan. 1, 2028.

That said, landlocked members states (Hungary, Slovakia) which have limited alternatives to Russia would be afforded some flexibility.

If the proposed regulations are backed by the European Parliament, it would require member states to submit plans for how they will diversify their energy supplies if they're currently receiving (directly or indirectly) gas from Russia.

Composed of national ministers from each member state, the Council of the EU said in a press release, "The same requirement to submit a national diversification plan will apply to those member states that are still importing Russian oil, with a view to discontinuing those imports by 1 January 2028."

Danish minister for climate, energy and utilities, Lars Aagaard, said "An energy independent Europe is a stronger and more secure Europe. Although we have worked hard and pushed to get Russian gas and oil out of Europe in recent years, we are not there yet," adding that it's critical for Denmark - which currently holds the rotating presidency of the Council of the EU, secures "overwhelming support from Europe’s energy ministers for the legislation that will definitively ban Russian gas from coming into the EU."

The Council presidency will begin negotiations with European Parliament (720 lawmakers) before agreeing on the final text of the regulations.

In other words - two years will have come and gone by the time they're done talking...

That said, Europe has already significantly cut back on Russian gas;

Between Q1 2021 and Q2 2025, the EU-27 reduced Russian oil imports by more than 90 percent, cutting the share of Russian oil in total extra-EU imports from 29 percent to less than 2 percent. During the same period, Russia’s share of the EU’s natural gas imports dropped from 39 to 13 percent, driven mainly by a 52-percent reduction of natural gas imports in gaseous state. The value of liquefied natural gas imports from Russia actually almost tripled between Q1 2021 and Q2 2025 but still accounted for a smaller share of the EU’s total LNG imports in the most recent quarter. This is due to total LNG imports more than quadrupling during this period, as the EU replaced Russian pipeline gas with LNG from suppliers like the United States, Qatar and Norway. -Staista

As the

As the

Last month, Slovakia

Last month, Slovakia