Gary Gensler, head of the SEC, is secretly a #Bitcoin Maximalist 🧵

Don't believe me? Read on👇

Not many people know this, but during his time at MIT, Gensler's fascination with #Bitcoin was ignited as he taught a course on blockchain and money. Little did he know that this was the start of a hidden journey into the heart of #Bitcoin. He immersed himself in the intricacies of Bitcoin, recognizing its potential to disrupt traditional finance and empower individuals.

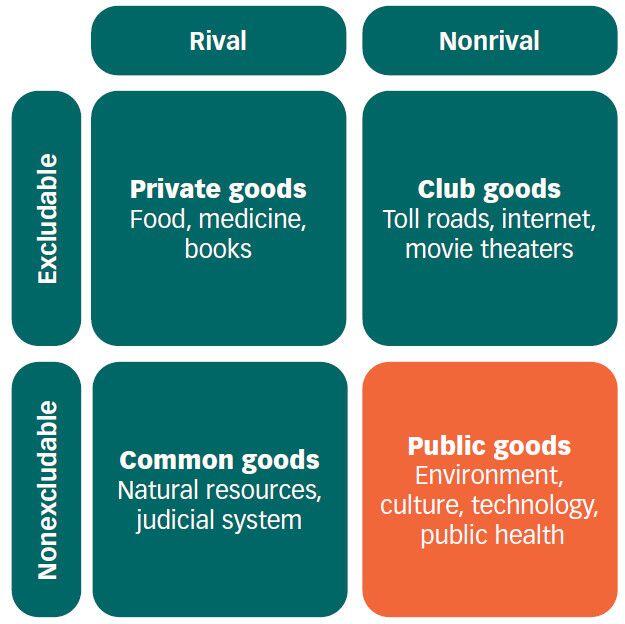

As he rose to the position of SEC chairman, Gensler found himself in a delicate position. He couldn't openly champion #Bitcoin maximalism due to his regulatory responsibilities, but he couldn't abandon his beliefs either. His regulatory decisions, such as clarifying that #bitcoin is the only commodity among cryptos, were part of a covert mission to advance the cause of #Bitcoin while condemning altcoins as unregistered securities.

One particularly intriguing aspect of Gensler's actions is his reluctance to approve a #Bitcoin spot ETF. But, when you think about it, it all starts to make sense. He's not obstructing progress; he's ensuring that individuals have a fair chance to accumulate #Bitcoin before institutions dominate the market. He also understands the importance of self custody in #Bitcoin and would rather individuals take full control over their funds rather than own paper Bitcoin.

Gensler knows that institutions could flood the market if an ETF we're approved, driving up Bitcoin's price. By delaying the ETF approval, he's providing a window of opportunity for retail investors to accumulate #Bitcoin at more accessible prices, preserving the democratic and decentralized nature of Bitcoin.

In conclusion, Gary Gensler's covert journey from MIT professor to SEC chairman was driven by a hidden passion for #Bitcoin maximalism. His actions as a regulator, while enigmatic, are guided by a desire to protect the interests of everyday Bitcoiners and individuals, and allow them to participate in the #Bitcoin revolution before institutions do.