The BLUF

The current price stagnation of Bitcoin, juxtaposed against All-Time Highs in equity and precious metal markets, is not a failure of the asset, but a mechanical necessity of market structure. We are witnessing a historic "changing of the guard"—the absorption of over 8 million Bitcoin exchanged in the last twelve months. The Stoic Investor recognizes this phase not as dormancy, but as a massive transfer of ownership from long term holders cashing out after years of hodling, mirroring the suppression-then-breakout pattern observed in Gold markets between 2022 and 2024.

The Situation

The market presents a psychological paradox. Gold has breached new ceilings; equities are defying gravity. Yet, the premier digital asset remains range-bound, testing the patience of the retail speculator. The noise is deafening: “Why has the price not moved?” “Is the cycle broken?”

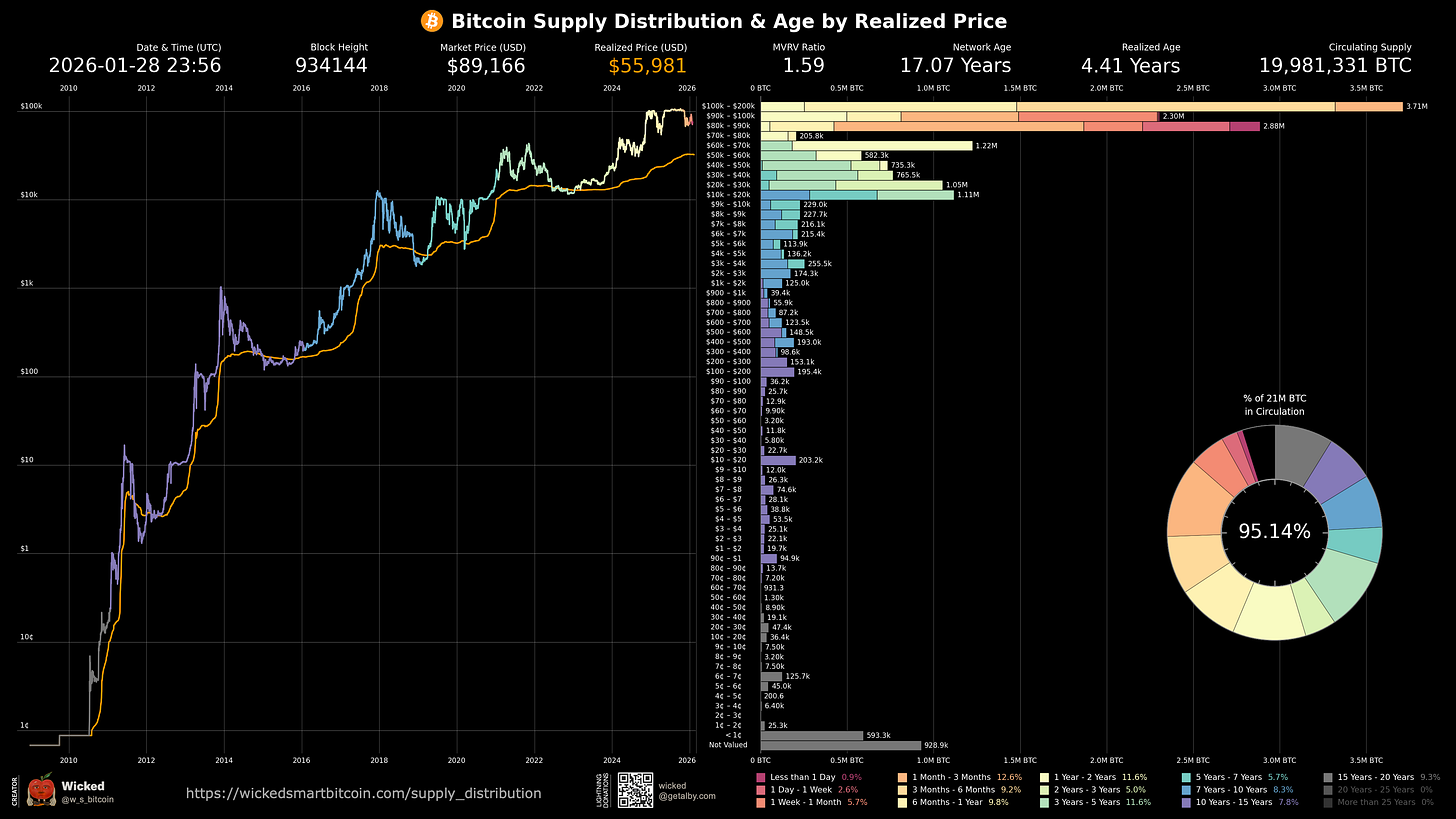

The input data reveals a structural reality beneath this sentiment: Despite the price moving sideways, an unprecedented volume of inventory—8 million BTC—has changed hands. This includes the exit of early adopters (”OGs”), the capitulation of leveraged tourists, and the entry of institutional giants. The Architect views this not as a stall, but as a necessary digestion period. The market is heavy, not because it is weak, but because it is being loaded.

The Principle

To understand this moment, one must apply the Stoic discipline of perception. Marcus Aurelius reminds us, “Everything we hear is an opinion, not a fact. Everything we see is a perspective, not the truth.” The price is the perspective; the volume is the truth.

I. The Mechanics of Absorption

Markets move in cycles of expansion and consolidation. The current phase is an exact rhyme of the Gold market from 2022 to 2024. During that period, Central Banks accumulated Gold at a record pace, yet the price stagnated. Why? Because private holders and ETFs were selling into that strength. The price could not rise until the “overhang” of sellers was fully absorbed.

Bitcoin is currently navigating this identical corridor. We are witnessing a massive rotation of the holder base. The selling pressure from the last twelve months—triggered by bankruptcy liquidations, regulatory fears, and profit-taking—has been immense. Yet, the price has held. The demand is neutralizing the supply, but until the supply is exhausted, verticality is impossible. This is the definition of accumulation.

II. The Triumph of Utility (Entropy)

In the long arc of financial history, the asset with superior physical properties inevitably demonetizes the inferior. This is a law of entropy and efficiency. While Gold remains the reserve asset of the State (due to inertia), its physical limitations are archaic.

-

Verification: To verify Gold requires expensive spectrometry and trust. To verify Bitcoin requires mathematics and a node. It is trustless.

-

Transport: Moving $1 billion in Gold requires an armored division and weeks of logistics. Moving $1 billion in Bitcoin requires a private key and ten minutes.

-

Settlement: Gold is physically sluggish; Bitcoin is digitally instantaneous.

The Stoic Investor does not cling to tradition for tradition’s sake. If the automobile renders the horse obsolete, one does not bet on the stable.

III. The Great Bifurcation

We are observing a divergence in global liquidity. Central Banks and Sovereigns, equipped with armies and vaults, continue to hoard Gold. They possess the infrastructure to mitigate its physical flaws. However, the Private Sector—corporations, family offices, and individuals—does not have standing armies. For the private entity, the friction of Gold is a liability.

Consequently, the private sector is migrating to the “Hardest Asset” that offers frictionless sovereignty: Bitcoin. With over 100 corporations accumulating 500,000 BTC in the last year alone, the trend is clear. The State clings to the physical; the Free Market embraces the digital.

The Directive

The temptation in a sideways market is to seek action, to over-trade, or to capitulate to boredom. This is a failure of character. The Architect understands that wealth is not generated by the frequency of activity, but by the accuracy of the thesis and the duration of the hold.

Do not mistake silence for inaction. The dam is filling. The weak are transferring their claims to the strong. The logic dictates that one should be positioned on the receiving end of that transfer. Verify your thesis. secure your keys, and let time do the heavy lifting.

Sign-off,

The Architect.

Disclaimer*: This content is for educational and philosophical purposes only. It constitutes neither financial advice nor a recommendation to buy or sell any specific asset. The views expressed are those of the author and do not reflect the specific financial situation of the reader. Consult with a qualified professional before making investment decisions.*