good article about bitcoin. I think the author's objective isn't to talk down or throw cold water on bitcoin, but instead, highlighting legitimate issues that are pertinent risks that should be looked at, objectively.

https://medium.com/@Crypto.Doc/bitcoins-hidden-vulnerability-the-flaw-that-could-crash-it-all-04c09013f04b

#bitcoin #crypto #blockchain #finance

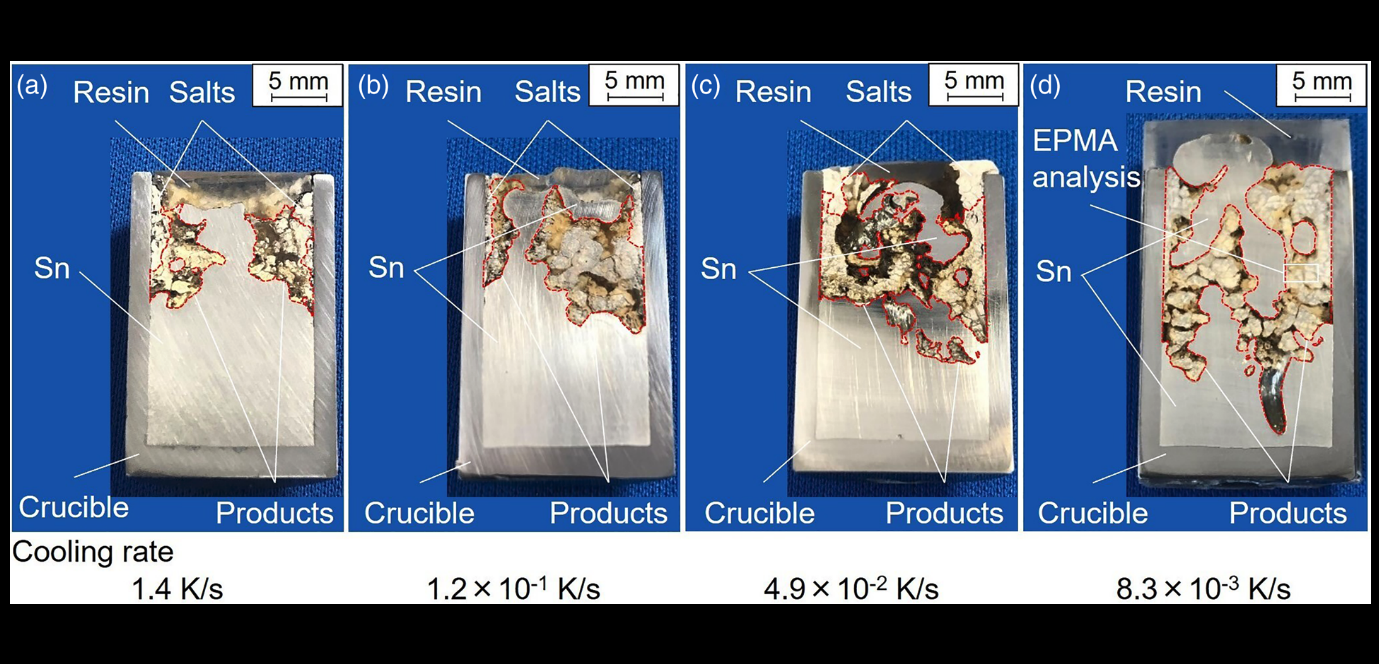

why carbon trading is so contentious not only for fossil energy companies, but within the green tech community. the real reason ...

https://medium.com/@acefujiwara/black-potato-stew-our-calorific-diet-386f5104b28e

#finance #carbon #money #crypto