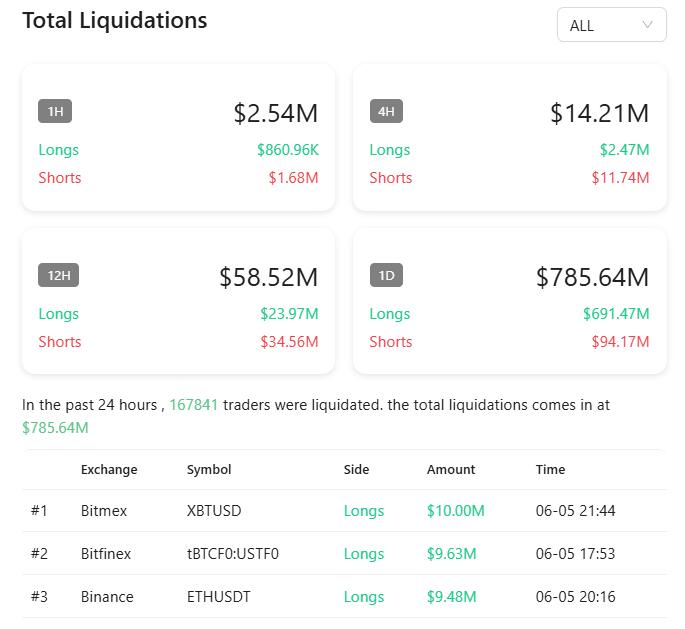

The discerning are few, and fools are plenty.

It's easier to find an idiot who accepts a (loss-bearing) stablecoin like USDT than someone willing to take on the unstable upside risk of BTC.

It takes longer for the dull masses to catch on.

Take advantage of the asymmetry before hyperinflation hits.

For decades, one of Israel’s greatest state secrets quietly crossed the desert: a pipeline built in partnership with… Iran.

That’s right. The country that now vows to “wipe Israel off the map” was, for years, its main oil supplier.

Israel faced a critical strategic challenge: how to ensure a steady oil supply in a hostile Middle East?

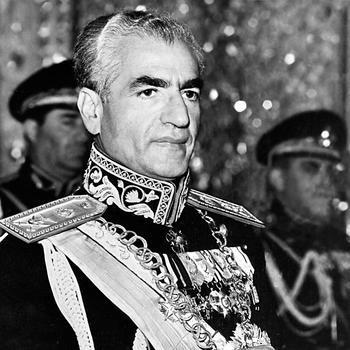

In the mid-1950s, Iran under Shah Mohammad Reza Pahlavi — who didn’t even officially recognize Israel — became its primary supplier, accounting for up to 90% of Israel’s oil imports.

In 1965, Israeli Foreign Minister Golda Meir made a secret visit to Iran.

There, she proposed a bold plan to the Shah: build a pipeline linking the Red Sea to the Mediterranean, bypassing the Suez Canal — and secretly supplying oil to Israel.

The negotiations included representatives from Mossad and the Iranian state oil company NIOC — a testament to the initiative’s strategic importance.

Two years later, everything changed: the closure of the Suez Canal.

Following the Six-Day War, Egypt shut down the canal, and 75% of Iranian oil exports were left without a route.

The Shah saw the pipeline as a perfect opportunity: reduce dependence on Egypt and strengthen his leverage over Western oil companies.

It was the final push needed.

Thus was born Trans-Asiatic Oil Ltd., a 50/50 joint venture between Iran and Israel — registered in Switzerland, of course.

Officially, Iran said: “We don’t sell oil to Israel.”

In practice? They did — operating pipelines and even having Israeli naval escorts for Iranian tankers.

The 254-kilometer pipeline between Eilat and Ashkelon was completed in 1969.

In its first year, 10 million tons of oil passed through it. Israel kept 3 million; the rest was sold via Israel, with profits split between the secret partners.

A true geopolitical masterpiece.

While Israel secured its energy supply, the Shah’s Iran challenged Western oil giants and filled its coffers — all under the radar.

It was a win-win: oil, money, and influence for both sides. Hidden from the rest of the Arab world.

But everything changed in 1979 with the Islamic Revolution in Iran.

Israel nationalized the pipeline, ending the secret alliance.

The case ended up in court — and in 2016, an international tribunal ordered Israel to pay Iran over $1 billion for breach of contract.

Today, even mentioning such an alliance would sound like fiction.

But for over a decade, Israel’s greatest enemy was… its biggest ally behind the scenes.

The pipeline still exists. But the partnership is now a relic from an era when interests spoke louder than ideology.