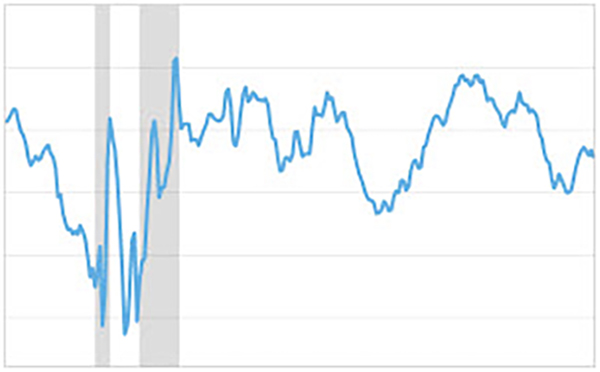

Recessions and volatility spikes tend to occur when the SPY/TLT ratio plummets.

Right now, the #SPY / #TLT ratio is printing a bearish shooting star all the way up on the quarterly chart (each candlestick is a 3-month period).

Note how high this ratio has risen. It's nearly double the peak value reached in the lead-up to prior recessions. (The red-shaded areas highlight previous U.S. recessions).

Never has the S&P 500 been as overvalued as it is now when compared against the 'risk-free asset' (long-duration U.S. Treasurys). In fact, the S&P 500 is so overvalued that the sell-off in 2022 merely brought the Shiller PE Ratio down to about the same level as the peak before the Great Depression.

What concerns me the most about this SPY/TLT ratio chart is the unprecedented confluence of higher timeframe charts. The ratio is about to begin oscillating down on the monthly, quarterly, semi-annual, and yearly charts at the same time.

My conclusion is that the coming recession will likely last quite a long time, or that it will come in waves as occurred during the stagflation of the 1970s (when several recessions occurred within the span of about 10 years).

Although it's easy to believe the proposition that a soft landing has been achieved when the VIX is 12 and the SPY is near an ATH, be aware that higher volatility will ensue from the record-fast rate hiking cycle. There is always a long lag between when interest rates rise and when the broad economy is impacted.

Many charts continue to confirm that strong stagflation is coming. While I am a stock market bull over the long term, I remain convinced that an economic storm is coming.

#ETHUSD / #Ethereum / #ETHUSDT / #ERC20

#ETHUSD / #Ethereum / #ETHUSDT / #ERC20 #ETHUSD / #Ethereum / #ETHUSDT / #ERC20

#ETHUSD / #Ethereum / #ETHUSDT / #ERC20

See more here:

See more here:

Note how high this ratio has risen. It's nearly double the peak value reached in the lead-up to prior recessions. (The red-shaded areas highlight previous U.S. recessions).

Never has the S&P 500 been as overvalued as it is now when compared against the 'risk-free asset' (long-duration U.S. Treasurys). In fact, the S&P 500 is so overvalued that the sell-off in 2022 merely brought the Shiller PE Ratio down to about the same level as the peak before the Great Depression.

What concerns me the most about this SPY/TLT ratio chart is the unprecedented confluence of higher timeframe charts. The ratio is about to begin oscillating down on the monthly, quarterly, semi-annual, and yearly charts at the same time.

My conclusion is that the coming recession will likely last quite a long time, or that it will come in waves as occurred during the stagflation of the 1970s (when several recessions occurred within the span of about 10 years).

Although it's easy to believe the proposition that a soft landing has been achieved when the VIX is 12 and the SPY is near an ATH, be aware that higher volatility will ensue from the record-fast rate hiking cycle. There is always a long lag between when interest rates rise and when the broad economy is impacted.

Many charts continue to confirm that strong stagflation is coming. While I am a stock market bull over the long term, I remain convinced that an economic storm is coming.

Note how high this ratio has risen. It's nearly double the peak value reached in the lead-up to prior recessions. (The red-shaded areas highlight previous U.S. recessions).

Never has the S&P 500 been as overvalued as it is now when compared against the 'risk-free asset' (long-duration U.S. Treasurys). In fact, the S&P 500 is so overvalued that the sell-off in 2022 merely brought the Shiller PE Ratio down to about the same level as the peak before the Great Depression.

What concerns me the most about this SPY/TLT ratio chart is the unprecedented confluence of higher timeframe charts. The ratio is about to begin oscillating down on the monthly, quarterly, semi-annual, and yearly charts at the same time.

My conclusion is that the coming recession will likely last quite a long time, or that it will come in waves as occurred during the stagflation of the 1970s (when several recessions occurred within the span of about 10 years).

Although it's easy to believe the proposition that a soft landing has been achieved when the VIX is 12 and the SPY is near an ATH, be aware that higher volatility will ensue from the record-fast rate hiking cycle. There is always a long lag between when interest rates rise and when the broad economy is impacted.

Many charts continue to confirm that strong stagflation is coming. While I am a stock market bull over the long term, I remain convinced that an economic storm is coming.