They say #Bitcoin and #Gold have no nationality.

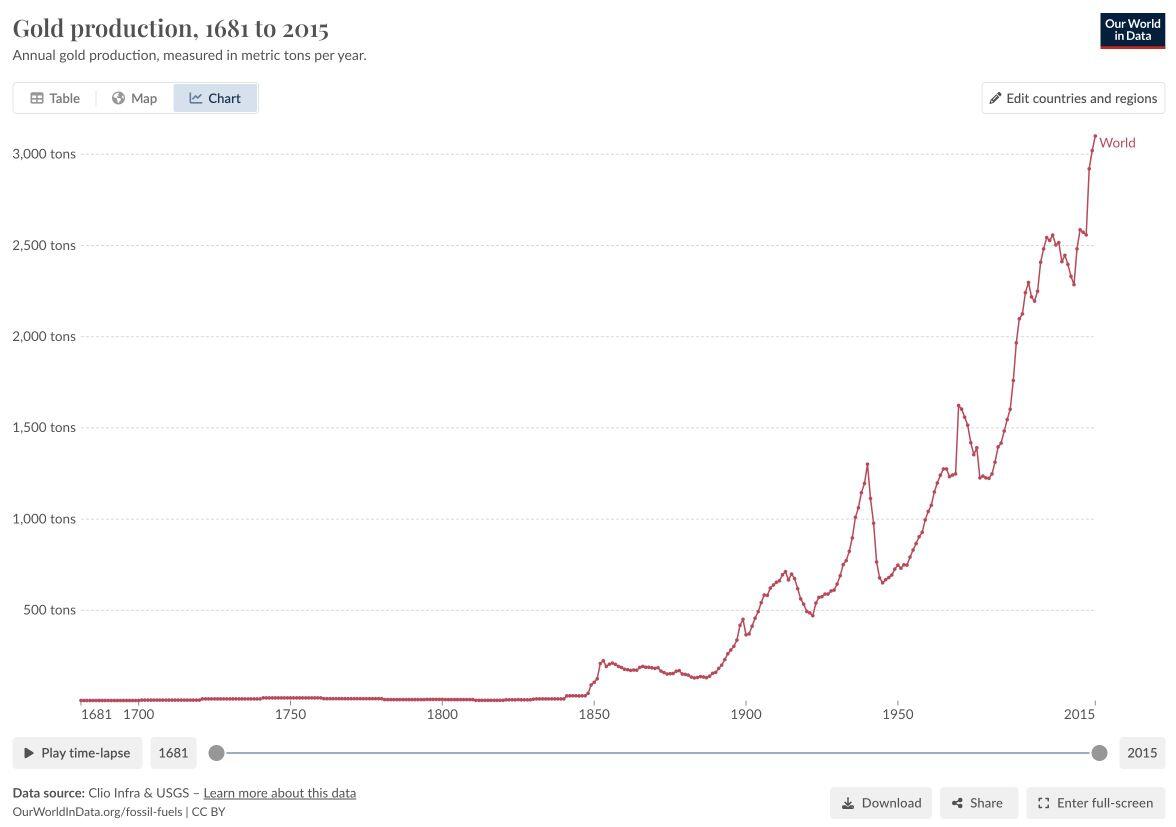

But for Gold Russia, China and Australia dominate the flood of new supply which is growing exponentially.

Data:

@OurWorldInData

@CambridgeAltFin

#BTC

If history repeats...

Next Bull Market peak may occur 518-546 days after the Halving

That's mid-September or mid-October 2025

$BTC #Bitcoin #BitcoinHalving

#BTC

If history repeats...

Next Bull Market peak may occur 518-546 days after the Halving

That's mid-September or mid-October 2025

$BTC #Bitcoin #BitcoinHalving