Then:

Now:

Now:

Now:

Now:

Now:

Now:

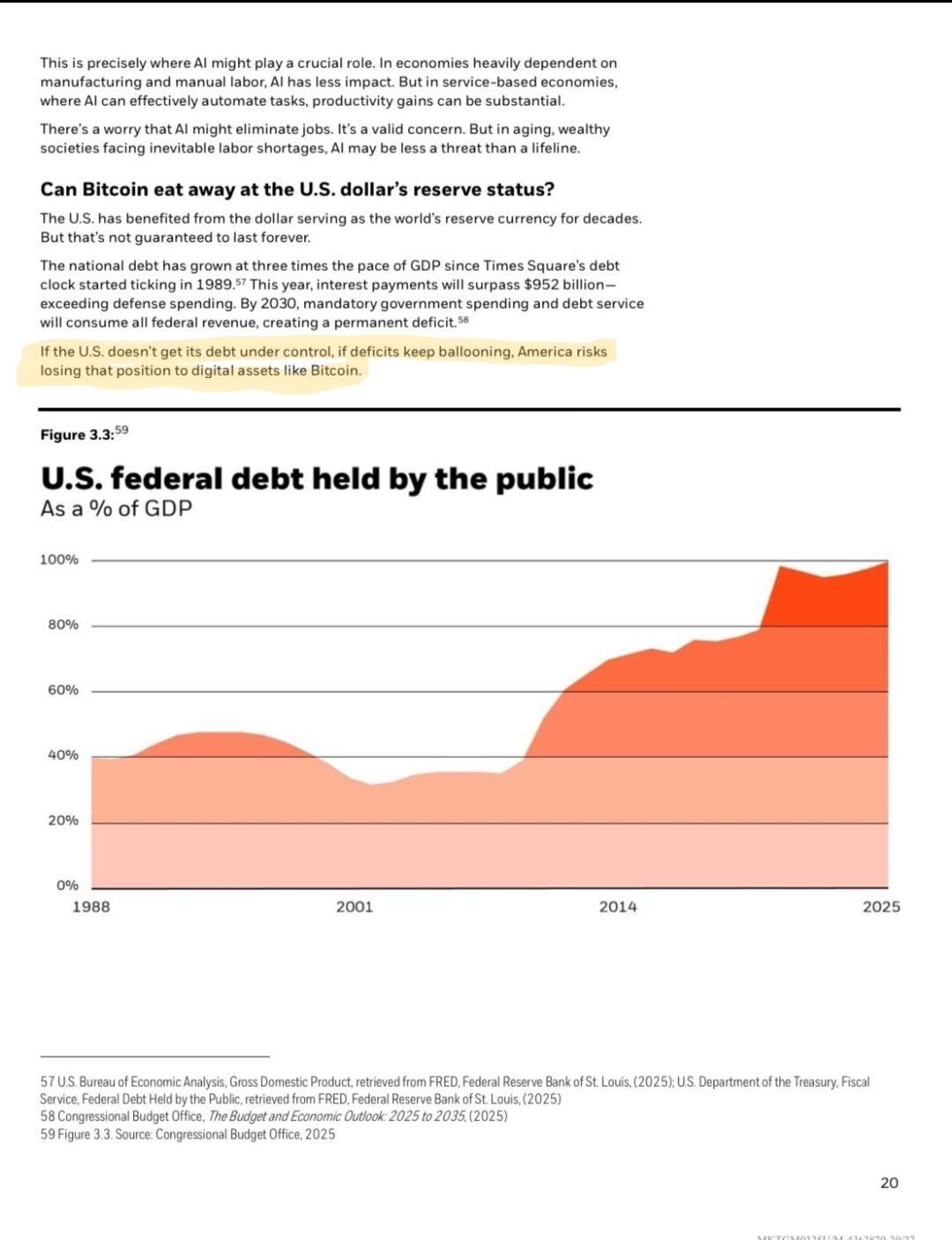

A factor driving the trade war (or at minimum indirectly benefiting from it) is the looming refinancing "wall" faced by the US, with approx $14 trillion in federal debt maturing over the next three years.

A factor driving the trade war (or at minimum indirectly benefiting from it) is the looming refinancing "wall" faced by the US, with approx $14 trillion in federal debt maturing over the next three years.

In January, 10-year Treasury rates hit 4.8% — these rates would have meant high interest expenses from debt refinancing (compared to the last decade). Cue, the trade war. It's indirectly influencing debt refinancing in 2 ways:

1. Flight to Safety: Heightened economic uncertainty tends to push global investors toward safe haven assets, like US treasuries. And increased demand for Treasuries drives down yields lower

2. Economic Slowdown: prolonged trade conflict can create global economic concerns, causing central banks (incl. the Fed) to reconsider rate hikes & even implement rate cuts, reducing borrowing costs further

And viola, with the chaos of the trade war, the 10-year Treasury yield dropped below 4% today. Lower 10-year yields mean lower future refinancing costs, helping the US gov manage its refinancing wall. But, this is a piece in solving for the massive debt puzzle.

In January, 10-year Treasury rates hit 4.8% — these rates would have meant high interest expenses from debt refinancing (compared to the last decade). Cue, the trade war. It's indirectly influencing debt refinancing in 2 ways:

1. Flight to Safety: Heightened economic uncertainty tends to push global investors toward safe haven assets, like US treasuries. And increased demand for Treasuries drives down yields lower

2. Economic Slowdown: prolonged trade conflict can create global economic concerns, causing central banks (incl. the Fed) to reconsider rate hikes & even implement rate cuts, reducing borrowing costs further

And viola, with the chaos of the trade war, the 10-year Treasury yield dropped below 4% today. Lower 10-year yields mean lower future refinancing costs, helping the US gov manage its refinancing wall. But, this is a piece in solving for the massive debt puzzle.

𝗕𝗶𝘁𝗕𝗼𝗻𝗱𝘀

There's an alternative — or parallel — path to manage interest payments without inciting market chaos: Bitcoin-backed bonds.

In a new Bitcoin Policy Institute report, Andrew Hohn & @Matthew Pines propose "Bitcoin-Enhanced Treasury Bonds." They recommend that 90% of bond proceeds finance standard gov operations or refinance existing debt, & 10% be allocated toward acquiring Bitcoin to establish a Strategic Bitcoin Reserve. By issuing these bonds at a significantly lower interest rate—such as 1% compared to current rates—the gov can substantially cut its debt-servicing expenses. Furthermore, considering Bitcoin’s historical performance, BitBonds have the potential to considerably reduce or even eliminate the federal debt burden over time.

Adopting Bitcoin-enhanced bonds could thus offer the US a financial advantage, aligning debt management with a new era of fiscal and monetary policy.

𝗕𝗶𝘁𝗕𝗼𝗻𝗱𝘀

There's an alternative — or parallel — path to manage interest payments without inciting market chaos: Bitcoin-backed bonds.

In a new Bitcoin Policy Institute report, Andrew Hohn & @Matthew Pines propose "Bitcoin-Enhanced Treasury Bonds." They recommend that 90% of bond proceeds finance standard gov operations or refinance existing debt, & 10% be allocated toward acquiring Bitcoin to establish a Strategic Bitcoin Reserve. By issuing these bonds at a significantly lower interest rate—such as 1% compared to current rates—the gov can substantially cut its debt-servicing expenses. Furthermore, considering Bitcoin’s historical performance, BitBonds have the potential to considerably reduce or even eliminate the federal debt burden over time.

Adopting Bitcoin-enhanced bonds could thus offer the US a financial advantage, aligning debt management with a new era of fiscal and monetary policy.