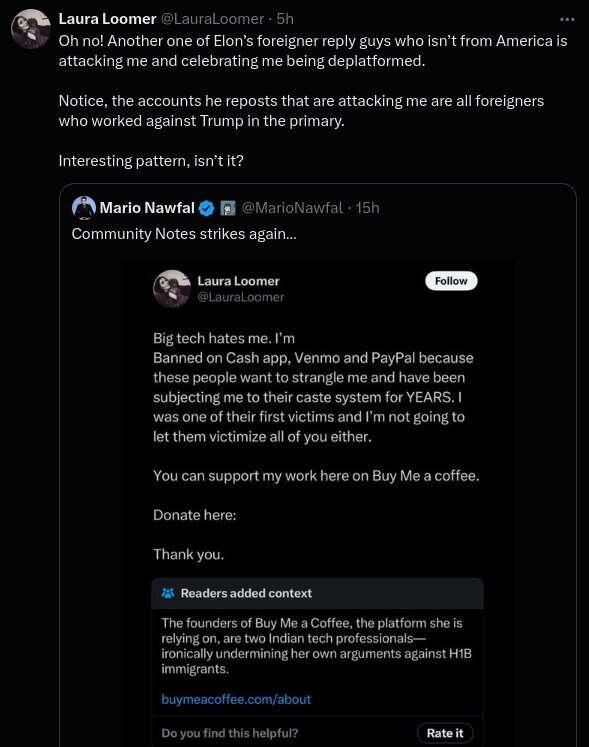

A very interesting dynamic is currently emerging on ‘X’, which could actually give Nostr more popularity in 2025.

The magic of the winter solstice: When the night lasts longest

On this special day, 21 December, darkness reaches its peak. It is not without reason that our ancestors attached profound spiritual significance to this day. Even the date seems like a cosmic pointer - read as a palindrome, 21.12 reflects the mystical symmetry of this special time.

The significance of the winter solstice is particularly impressive in megalithic structures such as Stonehenge. The enormous stone circles were precisely aligned with the positions of the sun. Even today, people gather there to experience the magical moment when the first rays of sunlight fall through the precisely aligned stones.

The winter solstice invites us to pause for a moment. In the darkness of this longest night, we can face our shadows and reflect on the essentials. It is a time of reflection, but also of hope - because from this turning point onwards, the days become longer again.

The winter solstice reminds us of the eternal cycle of death and rebirth in nature. It teaches us that every darkness is followed by light. In a time characterised by hectic pace and external stimuli, this ancient natural spectacle invites us to connect with the deeper rhythms of life.

The magic of the winter solstice: When the night lasts longest

On this special day, 21 December, darkness reaches its peak. It is not without reason that our ancestors attached profound spiritual significance to this day. Even the date seems like a cosmic pointer - read as a palindrome, 21.12 reflects the mystical symmetry of this special time.

The significance of the winter solstice is particularly impressive in megalithic structures such as Stonehenge. The enormous stone circles were precisely aligned with the positions of the sun. Even today, people gather there to experience the magical moment when the first rays of sunlight fall through the precisely aligned stones.

The winter solstice invites us to pause for a moment. In the darkness of this longest night, we can face our shadows and reflect on the essentials. It is a time of reflection, but also of hope - because from this turning point onwards, the days become longer again.

The winter solstice reminds us of the eternal cycle of death and rebirth in nature. It teaches us that every darkness is followed by light. In a time characterised by hectic pace and external stimuli, this ancient natural spectacle invites us to connect with the deeper rhythms of life.