Political finance laws vary wildly across the globe, ranging from "wild west" scenarios with zero oversight to hyper-regulated systems where even small private donations are banned.

Based on data from the International Institute for Democracy and Electoral Assistance (IDEA) and the Regulation of Political Finance Indicator (RoPFI), here is an overview of countries ordered from least to most restrictive.

1. Minimal or No Restrictions

In these countries, there are virtually no limits on who can donate or how much they can give. The philosophy here is generally that political spending is a form of free speech or that the market should dictate political viability.

* The Caribbean (e.g., Bahamas, Barbados): Often cited as some of the least regulated regions in the world. Many of these nations have no limits on private donations and no requirements for public disclosure of donors.

* Switzerland: Historically very permissive. While new transparency rules were introduced in 2023, there are still no federal limits on the amount an individual or corporation can donate to a party.

* Germany: Often surprising to many, Germany has no upper limit on the amount a donor can give to a political party. However, it is more "regulated" than the Caribbean because it requires strict public disclosure for large donations (over €10,000).

2. Low to Moderate Restrictions

These countries allow significant private money but impose specific "guardrails," such as transparency requirements or bans on certain types of donors (like foreign entities).

* United States: A unique case. While there are strict limits on direct donations to a candidate's campaign (e.g., $3,300 per election), the Citizens United ruling allows unlimited spending through "Super PACs," placing it on the less-restrictive end of the global spectrum for "outside" money.

* United Kingdom: There are no limits on how much an individual or organization can donate to a political party. However, the UK has strict spending limits during election periods, which indirectly limits the impact of massive donations.

* Australia: Similar to the UK, there are few limits on donation amounts at the federal level, though some states (like New South Wales) have implemented much stricter caps.

3. High Restrictions (The Regulated Middle)

Most modern democracies fall into this category. They typically cap the amount individuals can give and often ban corporate or trade union donations entirely.

* Canada: Very restrictive compared to its neighbor. Corporate and union donations are completely banned. Only individuals can donate, and the amount is strictly capped (roughly $1,725 CAD per year to a party).

* Brazil: In 2015, the Supreme Court banned corporate donations to political campaigns. Now, campaigns are largely funded through a massive public "Election Fund" and small individual contributions.

* Japan: Bans corporate donations to individual candidates (though they can still give to political parties under certain conditions) and maintains strict limits on individual contributions to prevent "money politics."

4. Most Restrictive (State-Funded or Membership-Only)

In these countries, private influence is heavily suppressed in favor of state control or extreme individual limits.

* France: One of the most restrictive systems in the West. Corporate donations are strictly prohibited. Individual donations are capped at €4,600 per election. To compensate, the state provides heavy public subsidies and strictly limits what candidates can spend.

* Bhutan: According to IDEA, Bhutan is among the most restrictive; only individual party members are permitted to contribute, and there are rigorous caps to ensure no single person can exert undue influence.

* Sierra Leone / Guinea-Bissau: These nations have some of the most "de jure" restrictive laws, often limiting donations strictly to registered voters or party members, effectively banning all outside or institutional financial influence.

If Bitcoin's attributes were fully utilized, the world effectively unlocks a "Global Economic Surplus" of roughly $5-7 trillion annually.

This is not "new" money printed by a central bank, but rather retained value that is currently lost to system inefficiencies (middlemen) and monetary dilution (inflation).

If fully utilized, Bitcoin’s attributes—namely its near-zero-cost settlement (via Lightning Network), its censorship-resistant clearing, and its capped supply—could yield global annual economic savings potentially exceeding $5 trillion USD.

This figure is derived from two primary sources: the elimination of transaction friction (fees, middlemen, delays) and the mitigation of monetary debasement (inflation tax).

1. The Efficiency Dividend: Transaction Cost Savings

Estimated Annual Savings: ~$1.7 – $2.5 Trillion

The traditional financial system is layered with intermediaries (correspondent banks, clearinghouses, card networks) that extract fees at every step. A fully utilized Bitcoin network, particularly with Layer 2 solutions like the Lightning Network, would compress these costs to near zero.

• Merchant Processing Fees (~$500 Billion+):

Merchants globally pay interchange and processing fees averaging 1.5% to 3.5%. In the U.S. alone, these fees hit a record $187 billion in 2024. Globally, payment industry revenues approach $2.5 trillion. Replacing credit card networks with instant, final Bitcoin settlements could return hundreds of billions directly to merchants and consumers.

• Cross-Border B2B Payments (~$700 Billion):

The "retail" B2B cross-border market (payments between smaller businesses) is valued at ~$38 trillion with average fees of ~1.5%. This friction costs the global economy over $570 billion annually. Adding wholesale friction costs brings this total significantly higher.

• Global Remittances (~$55 Billion):

Migrant workers send ~$857 billion home annually, paying an average fee of 6.4% (approx. $55 billion). Bitcoin can reduce this cost to near zero (<1%), effectively putting ~$50 billion back into the pockets of the world's poorest populations.

• Cash Management & Handling (~$500 Billion - $1 Trillion):

Physical cash is expensive to print, transport, secure, and count. Studies estimate the cost of cash management to be between 0.5% and 1% of Global GDP. With a global GDP of ~$100 trillion, a digital bearer asset like Bitcoin could eliminate $500 billion to $1 trillion in operational waste.

2. The Stability Dividend: Monetary Debasement Savings

Estimated Annual Savings: ~$3 – $5 Trillion

The largest "cost" to the global economy is not transaction fees, but the silent erosion of purchasing power (debasement) affecting liquid wealth.

• Avoided "Inflation Tax" on Global Money:

Global M2 money supply is approximately $96 trillion. In a fiat system, central banks typically target 2% inflation, though actual averages (especially in developing nations) are often much higher (4–5%+).

• The Cost: A 5% annual debasement rate on $96 trillion represents a wealth transfer or purchasing power loss of roughly $4.8 trillion per year.

• The Savings: A hard-capped money (0% terminal inflation) preserves this value. While economists debate the "optimal" level of inflation to spur spending, from the perspective of savers and capital holders, this represents a massive annual retention of value.

• Elimination of Negative Real Yields:

Savers often hold trillions in bonds or savings accounts yielding less than the inflation rate. Bitcoin creates a floor for returns; if money holds its value, capital is not forced into malinvestment just to "beat inflation," reducing global capital misallocation (a difficult-to-quantify but massive economic efficiency gain).

$MSTR is >10x its price when fear mongers first said it was going broke from its BTC approach but its CEO said they were good to 5k BTC vs the 16k low.

Another great $MSTR entry point was when the narrative spread of pending BTC ETFs making $MSTR redundant. How wrong that will forever be.

Now include JP Morgan among the fear mongers throwing FUD about MSTR in the most recent narrative. BTC needs to go below the low of the last crypto winter to even begin to concern Strategy, the issuer of $MSTR.

Strategy’s preferred stocks are far more transparent, liquid, and frictionless than the structured notes JP Morgan has devised while some of its’ prior staff running MSCI manipulate index related sentiment against BTC Treasury companies.

Now looks like the third great entry point into $MSTR since Strategy began buying BTC.

I have done my due diligence and expect to profit further from here on $MSTR. Due your own research and own your decision with conviction.

Fascism is like a cancer that eats away slowly at society. It starts with the ill-informed and undereducated and crawls slowly into social circles where it creates an alternate reality for those backing it. Once the rot of fascism takes hold, as it has now in the USA, it's harder to stop without armed resistance. We're not saying to take up arms, we're saying that the USA is reaching a point of no return. The people are going to need to stop being afraid and stand up, or you will have no country left that resembles anything you remember. The freedoms you once took for granted are already being infringed upon. You no longer have due process. You no longer have freedom of speech. You are witnessing a fascist police force become the strong arm of the Trump regime and they do not plan on leaving. Why else do you think they're all masked up? Why else do you think they're so bold and brutal as they attack women, children, and even priests? They don't plan on leaving, they know if there is another election they're all going to jail. They have nothing to lose, and at this point in US history, either do you. Because if you do not stand up and fight for your own freedom, you're going to lose it all.

And when they don't allow any elections in 2028, as the clasp of the regime grips your country tighter and tighter - what then? Don't expect help from the military. By 2028 it's going to be too late. It might already be too late as this is being written.

They've successfully used culture wars to divide the population of the USA. They've created enemies out of marginalized people. They're following the exact playbook of how fascism works, and the insane thing is, there are people who are cheering them on.

Your grandfather and great grandfathers who fought against fascism in World War II, did they fight that war for nothing?

They broadcast their propaganda, feeding the simple-minded lies on social media. The simple-minded nod, they obey. They're the reason you are all in this place to begin with.

Communities need to organize immediately if you haven't already. If your community (or local government) is not on your side, find one that is.

The regime has made it illegal to be against fascism in the USA, as they've deemed being anti-fascist as being in a terrorist organization.

As you can see from their testing grounds, they're actively testing the limits of the USA's failing democracy. From California, to Oregon, to Illinois, they've put jack boot thugs on the streets to smash heads and subjugate the population. They've tried to get the military involved which keeps getting struck down in court as being "unconstitutional". Yet that damn will break. The courts will be usurped. Democracy will fall. Look around you. It's happening already.

Organize, Mobilize, Resist.

#Anonymous

AI will magnify tech derived deflation forces as we will all buy whatever is cheapest to meet our needs, which AI and tech will provide.

Your employer would be right to say if your cost of living is being reduced, then your wages should be reduced. If cost of living went down 10%, a 5% reduction in your wage would actually be a relative increase in your standard of living.

BUT, your’s and govt’s debt would remain unchanged and hence more problematic, leading to financial system collapse if deflation remained unstopped.

This is why governments can’t allow the natural forces of AI and other tech to result in falling prices, and will print money to prevent it, forever debasing the purchasing power of any fiat currency.

So, are you going to vote for a politician promising free stuff, leading to the need for a chaotic/war system reset, or just opt out and buy/dca Bitcoin?

Developed democracies rarely become fully fascist autocracies, but several have experienced democratic backsliding with fascist traits since 2010. Here are four recent examples INCLUDING USA:

1. Hungary: Since Viktor Orbán’s Fidesz party took power in 2010, Hungary transitioned from democracy to electoral autocracy (V-Dem, 2018). Orbán’s government controls 90% of media, gerrymanders elections (2022: 54% votes, 83% seats), and packs courts with loyalists. Anti-LGBTQ+ laws (2021) and migrant scapegoating reflect ultranationalist, fascist-like rhetoric. Hungary, an EU/OECD member with a $40K GDP per capita, faces EU sanctions for rule-of-law violations.

2. Poland: The Law and Justice (PiS) party, elected in 2015, eroded judicial independence, politicized media (TVP as propaganda), and passed anti-LGBTQ+ and abortion restrictions (2020). Nationalist rhetoric and border violence (2021) echoed fascist themes. Classified as a “moderate autocracy” by 2022 (BTI), Poland’s 2023 elections ousted PiS, but recovery is incomplete. An EU/OECD nation with a $45K GDP per capita, Poland shows reversal potential.

3. Turkey: Under Recep Tayyip Erdoğan, Turkey (OECD, G20, $13K GDP per capita) shifted to autocracy post-2016 coup attempt. Purges jailed 50K+, media is 95% state-aligned (2023), and Kurdish/LGBTQ+ rights are suppressed. The 2017 referendum centralized power, with elections marred by arrests. Neo-Ottoman nationalism and Erdoğan’s cult of personality mimic fascist elements. V-Dem labels it an electoral autocracy.

4. United States: Since 2016, the U.S. has faced mild backsliding, intensified in 2025 under Trump’s return. Voter restrictions, media attacks, and 2025 deportation plans targeting 11M+ immigrants signal autocratic moves. The Supreme Court’s 2024 immunity ruling and “America First” nationalism raise fascist concerns. V-Dem notes a 10% democratic decline (2016–2024), with “liberal democracy” status at risk.

These cases, driven by populism and polarization, highlight autocratic legalism and nationalist rhetoric, per V-Dem’s 2025 report. Poland’s reversal suggests hope, but most backsliding persists without strong civic pushback.b

The United States is widely regarded as having the most politically polarized populace in 2025, based on global indices and reports that underscore the profound divisions in American society, outpacing other countries in key measures.

Key drivers of this polarization include rapid escalations in multiple forms: affective polarization, marked by emotional hostility between parties; ideological polarization, with extreme policy stances; and elite polarization, where leaders diverge sharply. Over the last 15 years, this unique combination has heightened social tensions, undermined institutional trust, and reduced opportunities for bipartisan compromise.

The V-Dem Democracy Report 2025 labels U.S. polarization as "toxic," extending beyond policy disagreements to strain personal relationships and social bonds. The 2024 elections exacerbated this, featuring rhetoric and events reminiscent of autocratic strategies, deepening divides during the second Trump administration.

A shrinking moderate base contributes significantly: Just 34% of Americans identify as politically moderate—a historic low—while 77% of Republicans and most Democrats hold radical views. Hot-button issues like immigration, abortion, gun rights, and election legitimacy intensify animosity, with each side perceiving the other as an existential danger.

In global comparisons, nations such as Turkey, India, Hungary, and Brazil exhibit high or toxic polarization, often linked to autocratization or ethnic conflicts. However, the U.S. stands out among established democracies for its intensity. Pew Research places it alongside South Korea in perceived partisan strife, but America's elite and media influences position it as the prime example of contemporary division.

This creates a vicious cycle: Echo chambers fueled by polarized media, social media algorithms, and gerrymandering impede national unity. While countries like Argentina (based on 2023 data) or France grapple with deep rifts, they don't match the U.S.'s blend of severity and worldwide impact.

Many may find this of interest:

A Self-Help Book for Societies:

Goodreads

What's Our Problem?: A Self-Help Book for Societies

From the creator of the wildly popular blog Wait But Wh…

From Grok re Trump’s conflict of interest between Russia and his current Presidential obligations:

### Historical Business Ties to Russia

Donald Trump's business empire has long-standing financial connections to Russian entities and individuals, which have raised concerns about potential conflicts of interest during his presidency. These ties predate his political career but continued to influence perceptions of his foreign policy decisions, particularly regarding Russia. For instance, Trump pursued multiple real estate projects in Russia starting in the 1980s, including attempts to build a luxury hotel near the Kremlin and the Trump Tower Moscow, which discussions extended into June 2016—after he secured a significant source of funding for the Trump Organization, with Trump Jr. noting in 2008 that "Russians make up a pretty disproportionate cross-section of a lot of our assets." During his first term, Trump repeatedly denied having business dealings in Russia, but his tax lawyers admitted to receiving some income from Russian sources over the prior decade, and efforts to develop properties persisted.

A Reuters investigation identified at least 63 individuals with Russian passports or addresses who invested nearly $100 million in Trump-branded luxury towers in Florida, including buyers linked to Vladimir Putin's inner circle, such as Alexander Zaldostanov, head of a pro-Putin motorcycle club awarded Russia's "medal of honor." These investments, while not directly tied to the Kremlin, involved oligarchs and figures with Russian government connections, potentially creating leverage. The Center for American Progress highlighted how Trump's reliance on foreign banks, including those in Russia with lax regulations, began in the 2000s after U.S. banks distanced themselves due to bankruptcies. This financial dependence could conflict with presidential obligations to enforce sanctions or counter Russian aggression, as decisions affecting Russian oligarchs might impact Trump's personal wealth.

### Campaign and Associate Contacts with Russian Officials

During the 2016 presidential campaign, Trump and his associates had at least 140 documented contacts with Russian nationals, WikiLeaks intermediaries, or Russian-linked entities, as detailed in The New York Times and the Mueller Report. These interactions, while not rising to criminal conspiracy, demonstrated receptivity to Russian assistance. Key examples include:

- The June 2016 Trump Tower meeting, where Donald Trump Jr., Jared Kushner, and Paul Manafort met Russian lawyer Natalia Veselnitskaya, who was promised "dirt" on Hillary Clinton as "part of Russia and its government’s support for Mr. Trump." The Mueller Report noted this as evidence of the campaign's willingness to accept foreign help.

- Paul Manafort, Trump's campaign chairman, shared internal polling data with Konstantin Kilimnik, a Russian intelligence-linked operative, and had prior contracts with oligarch Oleg Deripaska, a Putin ally, worth $10 million to influence U.S. and European politics in Russia's favor.

- Michael Flynn, Trump's first National Security Advisor, lied about contacts with Russian Ambassador Sergey Kislyak and had business ties to Russian entities; he was later convicted and pardoned by Trump.

- Carter Page, a foreign policy advisor, had meetings with Russian officials, and Roger Stone coordinated with WikiLeaks on hacked emails.

The bipartisan Senate Select Committee on Intelligence's 2020 report confirmed "significant ties" between the Trump campaign and Russia, including Manafort's hiring of Kilimnik and undisclosed Russian connections among attendees at the Trump Tower meeting. The Mueller Report emphasized that Russia interfered in the election "in a sweeping and systematic fashion" to benefit Trump, and the campaign expected electoral gains from stolen information. These contacts could indicate a conflict, as they suggest potential quid pro quo arrangements that might prioritize Russian interests over U.S. national security obligations, such as investigating election interference.

### Obstruction of Justice and Efforts to Impede Investigations

The Mueller Report's Volume II outlined 10 instances of potential obstruction of justice by Trump related to the Russia probe, creating a direct tension with his presidential duty to uphold the rule of law. Examples include:

- Directing White House Counsel Don McGahn to fire Special Counsel Robert Mueller over alleged "conflicts of interest," then pressuring McGahn to deny it and create a false record.

- Firing FBI Director James Comey in May 2017, citing "this Russia thing," and privately asking Comey to "let Flynn go" from the investigation.

- Pressuring Attorney General Jeff Sessions to "un-recuse" himself from the Russia probe and limit its scope, believing an unrecused AG would "shield" him.

- Floating pardons to influence witnesses like Flynn and Manafort, and refusing to answer Mueller's questions fully, providing "inadequate" written responses.

Mueller did not exonerate Trump, stating that while charging a sitting president is not an option per DOJ policy, the findings "do not exonerate him" and raised questions about why Trump associates repeatedly lied about Russian contacts. This pattern of obstruction could conflict with presidential obligations to ensure transparent governance and counter foreign interference, as it appeared aimed at protecting personal and campaign interests tied to Russia. The Senate report echoed these concerns, noting Trump's efforts undermined the investigation into Russian meddling.

### Foreign Policy Decisions Favoring Russia

Trump's first-term policies often aligned with Russian interests, potentially at odds with U.S. strategic goals like supporting NATO allies and deterring aggression. Notable examples:

- In 2016, Trump directed changes to the Republican platform to soften support for Ukraine's military aid against Russian-backed separatists in Crimea, a move endorsed by advisor J.D. Gordon.

- At the 2018 Helsinki summit, Trump publicly sided with Putin over U.S. intelligence on election interference, calling it a "hoax" and suggesting "no collusion." He also considered recognizing Russia's 2014 annexation of Crimea, describing it as an "interesting question."

- Trump delayed or weakened sanctions under the 2017 Countering America's Adversaries Through Sanctions Act (CAATSA), allowing U.S. technology exports to Russia despite congressional mandates. He amended Obama-era sanctions to permit such exports shortly after taking office.

- Nominees like Rex Tillerson (Secretary of State), with ExxonMobil's $500 billion Russian deals, and Wilbur Ross (Commerce Secretary), with stakes in the Russian-tied Bank of Cyprus, embodied potential conflicts.

These decisions, substantiated by reports from the Center for American Progress and Brookings Institution, suggest a prioritization of personal rapport with Putin—whom Trump praised as a "genius" and "strong leader"—over U.S. obligations to allies like Ukraine. Ex-KGB spy Yuri Shvets claimed in a 2021 book that Russia cultivated Trump as an asset for 40 years, using flattery and business incentives, leading to celebrations in Moscow after his 2016 win. While unproven, this aligns with patterns where Trump's deference to Russia (e.g., questioning NATO's value) could stem from financial or kompromat leverage, conflicting with duties to defend democratic institutions.

### Ongoing Scrutiny and Broader Implications

Investigations into Russian financial ties to Trump Media & Technology Group (ongoing as of 2023 per The Guardian) and Trump's envoy Steve Witkoff's business links to Russia (reported in 2025) highlight persistent concerns. The Mueller Report referred 14 criminal matters to other DOJ components, and while no direct conspiracy was established, gaps in evidence (due to deleted communications and lies) left questions unresolved. Critics, including Sen. John McCain, argued Trump's actions "abased" U.S. interests before Putin, potentially due to corruption from Russian money. In his current term (as of September 2025), efforts to mediate the Ukraine war—amid threats of "economic war" if Putin doesn't comply—have been criticized as favoring Russia, with European leaders rushing to counter Putin's "spin" and Zelenskyy rejecting terms. This could indicate a continued conflict, where personal ambitions (e.g., a Nobel Peace Prize) or hidden ties clash with impartial U.S. policy.

These elements from Trump's past—financial dependencies, campaign receptivity, obstruction, and pro-Russian policies—collectively suggest motivations that may prioritize Russian relations over presidential obligations to national security and international alliances. While no criminal charges resulted from Mueller's probe, the documented patterns substantiate concerns about divided loyalties.

Run a Bitcoin Node? Why & How

Running a Bitcoin node—software that validates transactions and maintains a copy of the Bitcoin blockchain—offers several benefits, particularly for users who value decentralization, privacy, and security. Below are the key advantages:

1. **Enhanced Privacy**:

- Running your own node allows you to verify transactions directly without relying on third-party services, preventing external entities (e.g., block explorers or hosted wallets) from tracking your transactions or addresses.

- You can broadcast transactions directly to the network, reducing the risk of metadata leakage compared to using a third-party service.

2. **Increased Security**:

- A personal node ensures you’re using the correct blockchain by validating all transactions and blocks against Bitcoin’s consensus rules, protecting you from potential attacks or forks.

- You can connect your wallet to your own node, ensuring that your wallet software receives accurate blockchain data, reducing the risk of interacting with malicious or incorrect information.

3. **Supporting Network Decentralization**:

- By running a node, you contribute to Bitcoin’s network health by relaying and validating transactions and blocks, making the network more resilient against censorship or attacks.

- More nodes increase the difficulty of network-wide attacks, as there are more independent validators enforcing the rules.

4. **Sovereignty and Self-Custody**:

- Running a node gives you full control over your Bitcoin transactions, aligning with the ethos of “be your own bank.” You don’t need to trust intermediaries to validate or relay your transactions.

- You can use your node to verify the finality of your transactions, ensuring they are confirmed on the blockchain without relying on external confirmation.

5. **Access to Advanced Features**:

- Nodes enable integration with advanced Bitcoin tools, such as Lightning Network nodes for fast, low-cost payments, or CoinJoin for enhanced privacy.

- Developers and businesses can use nodes to build applications, test transactions, or monitor the blockchain in real time.

6. **Educational Value**:

- Operating a node provides hands-on experience with Bitcoin’s protocol, helping users understand how the network operates, including concepts like consensus, mining, and transaction propagation.

### Easiest Available Hardware Solution for Running a Bitcoin Node

To run a Bitcoin node, you need hardware capable of storing the blockchain (currently ~700 GB for a full node, or ~20 GB for a pruned node), processing transactions, and maintaining a stable internet connection. The easiest hardware solutions are pre-configured setups designed for non-technical users, combining affordable hardware with user-friendly software. Below is the recommended easiest hardware solution, along with alternatives:

#### Easiest Solution: MyNode One (Raspberry Pi-Based)

**Overview**: MyNode is a plug-and-play solution that simplifies running a Bitcoin full node (and optionally a Lightning node) on a Raspberry Pi. It comes with a pre-installed operating system and a web-based interface, making setup and management accessible to beginners.

**Why It’s the Easiest**:

- **Pre-Configured Software**: MyNode includes Bitcoin Core and other tools (e.g., LND for Lightning, Electrum server) pre-installed, eliminating the need to manually compile or configure software.

- **User-Friendly Interface**: The web dashboard allows users to monitor node status, sync progress, and manage features like Lightning or VPN access without command-line expertise.

- **Affordable Hardware**: Built on a Raspberry Pi 4, it’s cost-effective and widely available.

- **Community Support**: MyNode has an active community and documentation, with premium support available for troubleshooting.

**Hardware Requirements**:

- **Device**: Raspberry Pi 4 (4GB or 8GB RAM recommended).

- **Storage**: 1TB SSD (or larger) to store the full blockchain. MyNode recommends external SSDs for reliability over SD cards.

- **Power Supply**: Reliable USB-C power supply for Raspberry Pi.

- **Internet**: Stable, high-speed connection (at least 10 Mbps) with no strict data caps, as initial sync and ongoing operation require significant bandwidth.

**Setup Process**:

1. Purchase a Raspberry Pi 4, a 1TB SSD, and a power supply (or buy a pre-assembled MyNode One kit for ~$300–$400).

2. Download and flash the MyNode image to an SD card using software like Balena Etcher.

3. Connect the SSD and boot the Raspberry Pi.

4. Access the MyNode web interface via a browser (e.g.,

http://mynode.local) to monitor sync and configure settings.

5. Wait for the blockchain to sync (1–2 weeks depending on internet speed and hardware).

**Cost**: ~$150–$400 (Raspberry Pi 4: ~$50–$80, 1TB SSD: ~$80–$120, accessories: ~$20–$50, or pre-built kit: ~$300–$400).

**Where to Buy**: MyNode website (

MyNode - Run Bitcoin, Lightning, and more!

Run Bitcoin, Lightning, and more!

), Amazon, or Raspberry Pi retailers.

#### Alternatives:

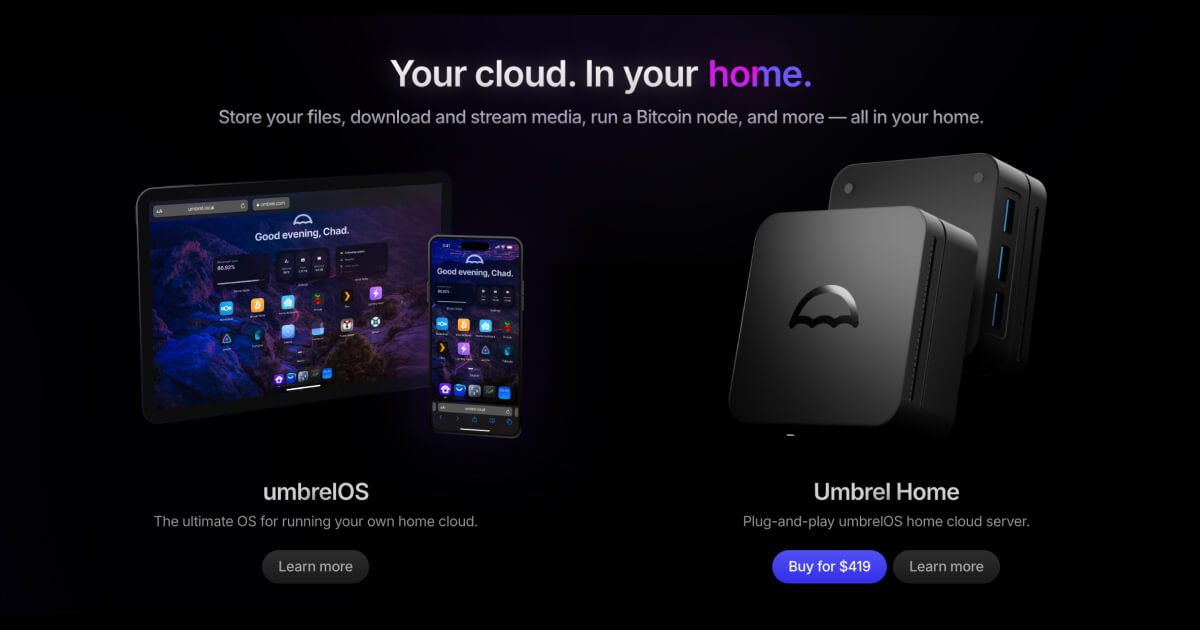

1. **Umbrel**:

- **Overview**: Umbrel is another user-friendly Bitcoin node solution running on a Raspberry Pi or a dedicated device. It features a sleek app store for installing Bitcoin Core, Lightning, and other tools (e.g., mempool.space, Ride The Lightning).

- **Pros**: Polished interface, easy app installation, supports both Bitcoin and non-Bitcoin apps (e.g., Nextcloud). Free and open-source.

- **Cons**: Slightly more complex initial setup than MyNode for non-technical users. Requires manual flashing of the OS.

- **Hardware**: Raspberry Pi 4 (8GB RAM recommended), 1TB SSD.

- **Cost**: ~$150–$400 (similar to MyNode).

- **Website**:

Umbrel - Personal home cloud and OS for self-hosting

Bring the cloud to your home with umbrelOS - a beautiful home server OS for self-hosting, and Umbrel Home - a plug-and-play home server. Install Ne...

2. **NOWNodes** (Hosted Solution):

- **Overview**: For users who don’t want to manage hardware, NOWNodes provides a hosted Bitcoin node service with API access for developers and businesses.

- **Pros**: No hardware setup or maintenance required. Easy access via API keys. Free tier available (limited to 20 MB/day).

- **Cons**: Not a self-hosted solution, so you rely on a third party, reducing privacy and sovereignty. Subscription costs for higher usage (~$20–$500/month).

- **Website**:

Affordable Blockchain Developer API | Access RPC Nodes & WebSocket | NOWNodes

Get instant access to over 100 blockchain RPC nodes and block explorers. Use our affordable blockchain API to connect to Ethereum, Bitcoin, BSC, Po...

3. **RaspiBlitz**:

- **Overview**: A DIY Bitcoin and Lightning node solution for Raspberry Pi, with SSH and web interface options.

- **Pros**: Lightweight, customizable, supports advanced features like CoinJoin and channel balancing.

- **Cons**: More technical setup than MyNode or Umbrel, requiring some command-line knowledge.

- **Hardware**: Raspberry Pi 4, 1TB SSD.

- **Cost**: ~$150–$400.

- **Website**:

RaspiBlitz Documentation | RaspiBlitz

Raspiblitz is your DIY Bitcoin & Lightning Node on a RaspberryPi

4. **Pre-Built Nodes (e.g., Nodl, Start9 Embassy)**:

- **Overview**: Companies like Nodl and Start9 offer pre-assembled devices with Bitcoin node software pre-installed.

- **Pros**: Plug-and-play, no assembly required. Start9 Embassy includes additional privacy-focused features.

- **Cons**: More expensive than DIY solutions (~$500–$1,000). Less customizable.

- **Websites**:

nodl

nodl : reclaim ownership of your money

nodl builds tools and operates network infrastructure that let people reclaim ownership of their life’s narrative.

,

Sovereign Computing | Start9

Sovereign computing for a free future

#### Why MyNode Stands Out:

MyNode is the easiest for most users due to its balance of affordability, simplicity, and comprehensive features. It requires minimal technical knowledge, offers a one-stop web interface, and supports both Bitcoin and Lightning out of the box. Unlike hosted solutions like NOWNodes, it ensures full sovereignty, and compared to RaspiBlitz, it’s more beginner-friendly. Umbrel is a close competitor, but MyNode’s dedicated focus on Bitcoin and Lightning makes it slightly simpler for users solely interested in running a node.

### Additional Considerations:

- **Pruned Nodes**: If storage is a constraint, you can run a pruned node (storing only ~20 GB of recent blockchain data), but this sacrifices some functionality (e.g., inability to rescan the full blockchain). MyNode and Umbrel support pruned nodes.

- **Power and Internet**: Ensure a reliable power source (preferably with a UPS) and unmetered internet, as nodes must stay online to stay synced and relay transactions.

- **Maintenance**: Nodes require occasional software updates and monitoring to ensure they remain synced and secure. MyNode automates much of this process.

- **Learning Curve**: Even with user-friendly solutions, expect some learning to understand node operation, especially if integrating with wallets or Lightning.

### Conclusion:

Running a Bitcoin node enhances privacy, security, and network decentralization while offering educational and functional benefits. The easiest hardware solution is **MyNode One** on a Raspberry Pi 4 with a 1TB SSD, costing ~$150–$400, due to its pre-configured software, intuitive web interface, and affordability. Alternatives like Umbrel, RaspiBlitz, or hosted services like NOWNodes cater to different needs, but MyNode strikes the best balance for beginners. For setup guides, visit

MyNode - Run Bitcoin, Lightning, and more!

Run Bitcoin, Lightning, and more!

or check community resources on X for user experiences.

Public complaints on the nightly news should not affect adherence to a country's constitution, as appears to be happening in Canada right now.

The Canadian Constitution is relevant to the Air Canada strike that began on August 16, 2025, primarily through the Canadian Charter of Rights and Freedoms, which is part of the Constitution Act, 1982. The Canadian Union of Public Employees (CUPE), representing approximately 10,000 Air Canada flight attendants, has argued that the federal government's intervention—specifically, Jobs Minister Patty Hajdu’s use of Section 107 of the Canada Labour Code to order binding arbitration and end the strike—violates the Charter. Specifically, CUPE contends that this action infringes on the workers’ right to strike, which is protected under Section 2(d) of the Charter, guaranteeing freedom of association. This section has been interpreted by courts to include the right to collective bargaining and strike as essential components of workers’ rights to meaningfully associate.

The union has publicly stated its intent to challenge the back-to-work order as “blatantly unconstitutional,” arguing it undermines the Charter rights of flight attendants, 70% of whom are women, and forces them to perform unpaid work. This constitutional argument draws on legal precedents, such as the 2015 Supreme Court of Canada decision in *Saskatchewan Federation of Labour v. Saskatchewan*, which affirmed that the right to strike is protected under the Charter as an essential part of collective bargaining. CUPE’s defiance of the Canada Industrial Relations Board (CIRB) order, issued on August 17, 2025, to resume operations, is grounded in this constitutional claim, as they assert the government’s intervention disrupts their fundamental rights.

Additionally, the repeated use of Section 107 by the Liberal government in recent labor disputes (e.g., at ports, rail yards, and Canada Post) has led unions, including CUPE, to pursue legal challenges, arguing that such interventions unconstitutionally restrict their bargaining power and right to strike. The union has also raised concerns about a conflict of interest with the CIRB chair, Maryse Tremblay, due to her prior role as legal counsel for Air Canada, which could further bolster their constitutional challenge by questioning the impartiality of the process.

However, the government justifies its intervention by citing the economic impact of the strike, with approximately 130,000 passengers affected daily, including 25,000 Canadians stranded abroad. The use of Section 107 is framed as a measure to “maintain or secure industrial peace” under the Canada Labour Code, which the government argues is within its constitutional authority to regulate labor in federally regulated industries like aviation. This creates a tension between the government’s economic and regulatory priorities and the workers’ constitutional protections.

In summary, the Canadian Constitution, through the Charter’s protection of freedom of association, is directly relevant to the Air Canada strike due to CUPE’s claim that the government’s back-to-work order violates their right to strike. The outcome of any legal challenge would likely hinge on whether the court finds the government’s intervention to be a justified limitation under Section 1 of the Charter.