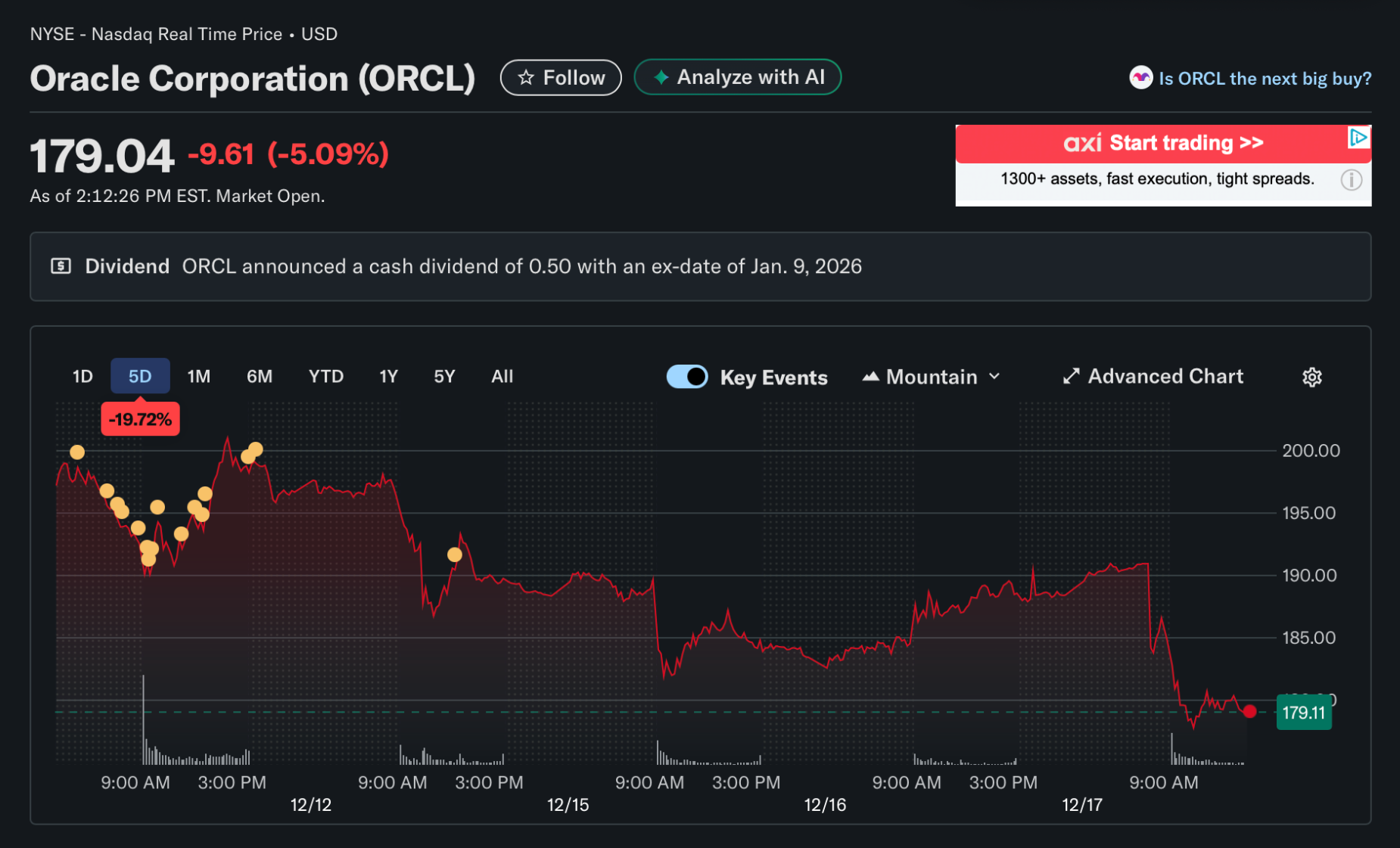

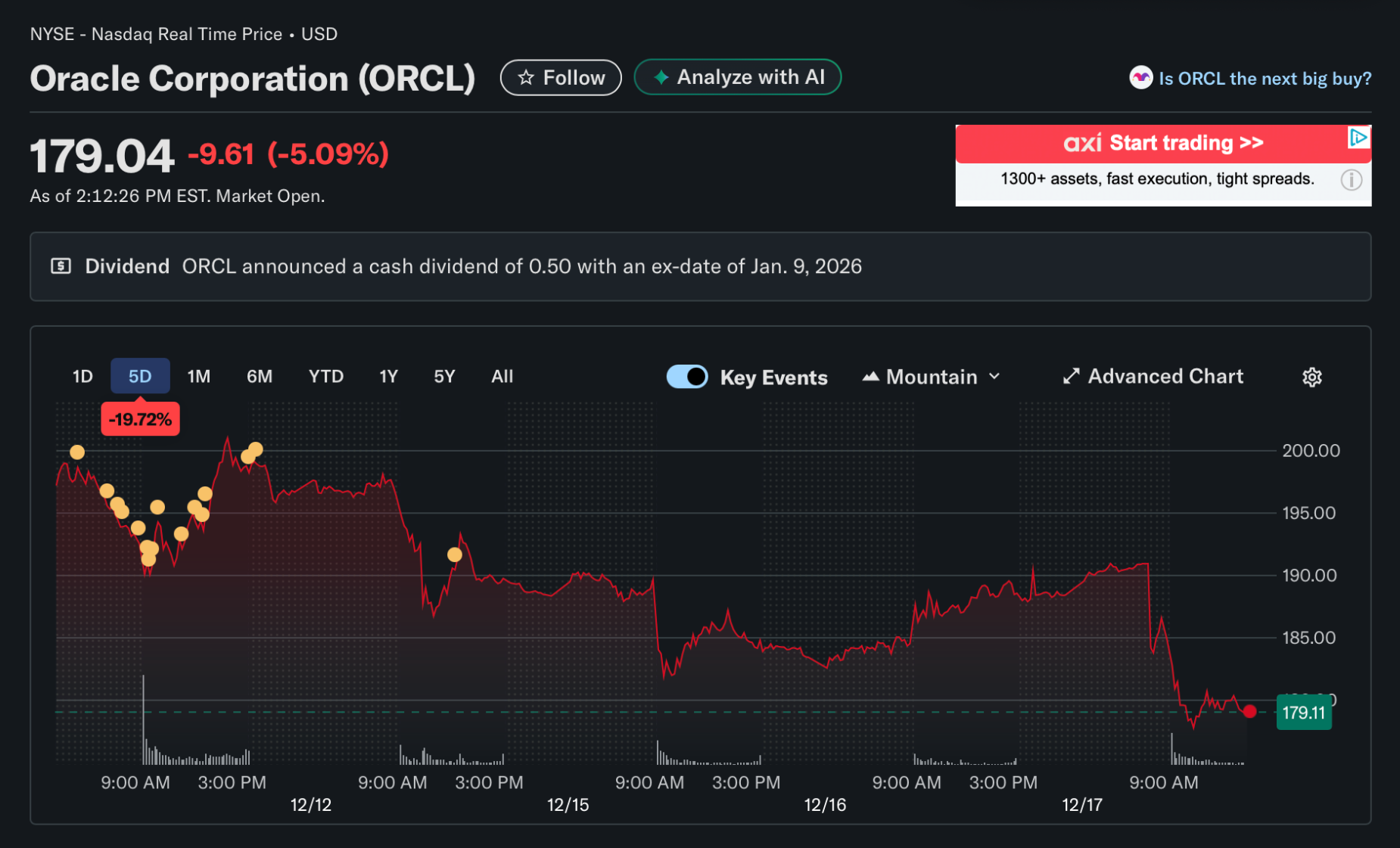

Oracle is down ~19.7% over the past 5 trading days.

The market is treating Oracle as a partial proxy for OpenAI risk. Oracle signed an AI infrastructure deal commonly cited at roughly $300B over approximately 5 years, with the contract period beginning in 2027. That figure reflects contracted capacity and commitments (approximately $60B annually), not a single upfront cheque.

Still, it implies massive capex and financing pressure—Oracle has already secured $18B in new debt with an additional $38B in negotiations pending—with debt and cash flow timing doing the real work.

There is no clause saying Oracle must recoup the spend in 5 years. But the economics are front-loaded. Oracle reported negative free cash flow of approximately $10B in its most recent quarter and increased full-year capex guidance from $35B to $50B in December 2025.

If utilization ramps slower than expected, margins disappoint, or OpenAI's revenue projections falter (the company projects $200B+ annual revenues by 2030 while currently generating ~$13B), the balance sheet takes the hit long before the upside shows up.

That is what investors are reacting to. The credit default swap spreads on Oracle debt have surged to five-year highs, reflecting market anxiety about servicing ~$100B in total debt while burning billions annually through 2027, when contract revenues begin.

This is not a verdict on whether AI is real. It is about execution risk and capital intensity. Even if AI demand explodes, Oracle is competing in a market dominated by hyperscalers. Google, AWS, and Microsoft do not need Oracle to stumble for Oracle's risk profile to matter.

More critically, OpenAI's single $300B contract represents approximately 66% of Oracle's entire $455B remaining performance obligations backlog, creating severe concentration risk. OpenAI itself faces competitive pressure from Google Gemini, which has captured approximately 13.7% market share (up from near-zero in 2024), forcing OpenAI to divert resources from revenue growth back to core product improvement precisely when it needs maximum cash generation.