Pt3- The Bubble Grows

As the Mississippi Company shares soared, Law’s experiment seemed to work. Paris was gripped by a speculative mania, with people from all walks of life clamoring to invest. The economy boomed on paper, and Law became one of the most powerful men in Europe.

But beneath the surface, cracks began to appear. The promised wealth of Louisiana proved illusory—its resources vastly exaggerated. To sustain the illusion, Law and his associates painted Louisiana as a land of riches and opportunity, even resorting to sending prisoners, beggars, and vagabonds to the colony to act as settlers. These “fake citizens” were expected to build the thriving economy investors believed in, but many died from harsh conditions, disease, or starvation. The grim reality of the colony further undermined confidence in the Mississippi Company.

Meanwhile, the issuance of massive amounts of paper money inflated prices and eroded trust in the financial system. Investors, growing wary, began demanding gold for their shares and notes. Law, desperate to stabilize the situation, imposed restrictions on currency conversion, but this only fueled panic. The carefully constructed house of cards came crashing down.

Pt4- The Collapse

By 1720, the bubble burst. Confidence in both the Mississippi Company and Law’s paper currency evaporated. Frenzied investors sought to liquidate their holdings, sending share prices into freefall. The French economy spiraled into chaos, and Law, once hailed as a financial savior, became a scapegoat. Stripped of his power, he fled France in disgrace, dying penniless years later.

Source: The Ascent of Money: A Financial History of the World

#grownostr #fiathistory #bitcoin #economics

Pt1- The Gambler's Rise to Power

Law’s journey began not as a banker or statesman but as a fugitive. After killing a man in a duel in England, he fled to the Continent, where his sharp mind and gambling prowess earned him notoriety. He believed he had unlocked the secret of wealth creation: money wasn’t just gold or silver but a tool to drive economic growth if issued judiciously.

In early 18th-century France, Law found his golden opportunity. The country was drowning in debt after years of war under Louis XIV, and its financial system was teetering. Law convinced the regent, Philippe d’Orléans, that his ideas could save France. With his charm and persuasive arguments, Law was appointed to lead the newly founded Banque Générale, where he introduced paper money—a revolutionary concept at the time.

Pt2- Building the Mississippi Dream

Law’s ambitions didn’t stop at banking. He acquired control of the Mississippi Company, which held monopolistic rights over trade in France’s colonies in the Americas, including the vast Louisiana Territory. To finance this venture, Law issued shares in the company, payable in his paper money. He promised extraordinary riches, painting Louisiana as a land of untapped gold and fertile opportunity.

The French public, desperate for prosperity, bought into the dream. Share prices skyrocketed, creating a frenzy. Law, now at the height of his influence, consolidated power, becoming France’s de facto finance minister. He centralized control of the economy, merging his bank with the Mississippi Company, and controlled both the issuance of currency and the country’s colonial trade.

#grownostr #fiathistory #bitcoin #economics

John Law is one of history’s most notorious financial manipulators—a man whose bold ideas and reckless ambition left a trail of destruction. Known as the architect of the first major economic bubble, the Mississippi Bubble, Law’s obsession with turning paper money into a tool of unchecked wealth creation plunged France into chaos. His schemes not only collapsed the economy but also deepened the mistrust between the people and the monarchy, laying the groundwork for the French Revolution. Law wasn’t a visionary but a gambler who leveraged his charm and influence to gain power, leaving behind one of history’s greatest cautionary tales of greed and overreach.

#grownostr #fiathistory #bitcoin #economics

John Law is one of history’s most notorious financial manipulators—a man whose bold ideas and reckless ambition left a trail of destruction. Known as the architect of the first major economic bubble, the Mississippi Bubble, Law’s obsession with turning paper money into a tool of unchecked wealth creation plunged France into chaos. His schemes not only collapsed the economy but also deepened the mistrust between the people and the monarchy, laying the groundwork for the French Revolution. Law wasn’t a visionary but a gambler who leveraged his charm and influence to gain power, leaving behind one of history’s greatest cautionary tales of greed and overreach.

#grownostr #fiathistory #bitcoin #economics Japan was the first major global power to develop a comprehensive social security system, expanding its principles and achieving remarkable success.

The country became a global leader in life expectancy and was also at the forefront of education. By the mid-1970s, about 90% of its population had completed high school—a stark contrast to the UK, where the figure was only 32%. In terms of social equality, Japan outpaced all Western nations except Sweden. It also managed the largest pension fund in the world, allowing its retirees to enjoy generous benefits and a steady income throughout long years of retirement. Notably, Japan accomplished this while allocating just 9% of its national income to social insurance in 1975, compared to Sweden’s 31%. In the UK, the burden of taxes and social security was roughly half that amount. Japan had successfully made welfare accessible to all, all while its economy grew rapidly enough to become the second-largest globally by 1968. A year earlier, Herman Kahn had predicted that by 2000, Japan’s per capita income would surpass that of the United States. Indeed, Yakagawa Natsuhiro stated that when accounting for additional benefits, "the real income of a Japanese worker is now at least three times that of an American worker."

The extraordinary success of Japan’s social security system was so profound that by the 1970s, the Japanese enjoyed the highest life expectancy in the world. However, this longevity, coupled with a declining birthrate, resulted in the world’s oldest population, with 21% of its citizens aged 65 or older. According to international economic research by Nakame, by 2044, the elderly population is projected to equal the working population. Consequently, Japan is now facing a deep structural crisis in its social security system, which was not designed to handle such demographic challenges. Despite raising the retirement age, the government has yet to resolve the issues within the public pension system. The situation has been exacerbated by many self-employed individuals and students being unable to afford their social security contributions. Furthermore, the universal health insurance program has been running a budget deficit since the 1990s. Today, Japan’s social security budget consumes three-quarters of its tax revenue, and its national debt has surpassed one quadrillion yen, or approximately 170% of its gross domestic product.

Note: The statistics cited are from 2008, making them 17 years old.

Source: The Ascent of Money: A Financial History of the World

#grownostr #japan #welfarestate

Japan was the first major global power to develop a comprehensive social security system, expanding its principles and achieving remarkable success.

The country became a global leader in life expectancy and was also at the forefront of education. By the mid-1970s, about 90% of its population had completed high school—a stark contrast to the UK, where the figure was only 32%. In terms of social equality, Japan outpaced all Western nations except Sweden. It also managed the largest pension fund in the world, allowing its retirees to enjoy generous benefits and a steady income throughout long years of retirement. Notably, Japan accomplished this while allocating just 9% of its national income to social insurance in 1975, compared to Sweden’s 31%. In the UK, the burden of taxes and social security was roughly half that amount. Japan had successfully made welfare accessible to all, all while its economy grew rapidly enough to become the second-largest globally by 1968. A year earlier, Herman Kahn had predicted that by 2000, Japan’s per capita income would surpass that of the United States. Indeed, Yakagawa Natsuhiro stated that when accounting for additional benefits, "the real income of a Japanese worker is now at least three times that of an American worker."

The extraordinary success of Japan’s social security system was so profound that by the 1970s, the Japanese enjoyed the highest life expectancy in the world. However, this longevity, coupled with a declining birthrate, resulted in the world’s oldest population, with 21% of its citizens aged 65 or older. According to international economic research by Nakame, by 2044, the elderly population is projected to equal the working population. Consequently, Japan is now facing a deep structural crisis in its social security system, which was not designed to handle such demographic challenges. Despite raising the retirement age, the government has yet to resolve the issues within the public pension system. The situation has been exacerbated by many self-employed individuals and students being unable to afford their social security contributions. Furthermore, the universal health insurance program has been running a budget deficit since the 1990s. Today, Japan’s social security budget consumes three-quarters of its tax revenue, and its national debt has surpassed one quadrillion yen, or approximately 170% of its gross domestic product.

Note: The statistics cited are from 2008, making them 17 years old.

Source: The Ascent of Money: A Financial History of the World

#grownostr #japan #welfarestate According to the 2018 trustees’ report, Medicare faces a $37 trillion unfunded liability over the next 75 years, and Social Security $13 trillion. None of this is part of the $34 trillion U.S. debt as of 2024.

"But why worry? Taxpayers pay in now, then get paid later when they're old. Problem solved!" Now let’s look at reality:

1- Aging Population: In case anyone missed it, populations in most developed countries are aging fast. Fewer workers supporting more retirees. So the math here is simple: fewer people paying into the system, more people taking out. What could go wrong?

2- Rising Costs: Medical technology keeps advancing (good for health, bad for budgets), and people live longer than ever. Healthcare and pension costs grow faster than inflation or GDP. But hey, I’m sure "the rich" can foot the bill, right?

3- Economic Shocks: Tax revenue isn’t a guaranteed stream. A recession hits, revenue drops, and obligations like pensions and Medicare don’t magically shrink. So where does the money come from? Print it? Borrow more? Oh wait, we already maxed that strategy.

But sure, keep telling us that unfunded liabilities aren’t a problem. What’s another few trillion, anyway? It’s not like future taxpayers will mind footing the bill for today’s promises.

#grownostr #fiatstandard #debtcrisis #bitcoin #liberty

According to the 2018 trustees’ report, Medicare faces a $37 trillion unfunded liability over the next 75 years, and Social Security $13 trillion. None of this is part of the $34 trillion U.S. debt as of 2024.

"But why worry? Taxpayers pay in now, then get paid later when they're old. Problem solved!" Now let’s look at reality:

1- Aging Population: In case anyone missed it, populations in most developed countries are aging fast. Fewer workers supporting more retirees. So the math here is simple: fewer people paying into the system, more people taking out. What could go wrong?

2- Rising Costs: Medical technology keeps advancing (good for health, bad for budgets), and people live longer than ever. Healthcare and pension costs grow faster than inflation or GDP. But hey, I’m sure "the rich" can foot the bill, right?

3- Economic Shocks: Tax revenue isn’t a guaranteed stream. A recession hits, revenue drops, and obligations like pensions and Medicare don’t magically shrink. So where does the money come from? Print it? Borrow more? Oh wait, we already maxed that strategy.

But sure, keep telling us that unfunded liabilities aren’t a problem. What’s another few trillion, anyway? It’s not like future taxpayers will mind footing the bill for today’s promises.

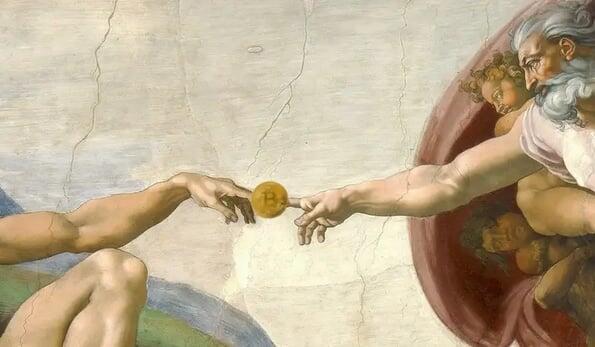

#grownostr #fiatstandard #debtcrisis #bitcoin #liberty I’ve never been deeply drawn to mythology, but I’ve noticed the recurring theme of scarcity. In myths and ancient beliefs, there’s always a limited number of divine beings or supernatural forces shaping existence. From the singular, all-powerful gods of monotheistic traditions to the pantheons of ancient Greece or Norse mythology, these figures are always finite.

This scarcity is what made myths so captivating. Imagine if there were thousands of Zeuses or Thors—what would happen to the sense of wonder? The uniqueness would fade, and with it, the awe that draws people to these stories.

For the first time in human history, though, we have something in the material world that’s provably scarce—and yet, some people still fail to appreciate its beauty!

#grownostr #bitcoin #scarcity

I’ve never been deeply drawn to mythology, but I’ve noticed the recurring theme of scarcity. In myths and ancient beliefs, there’s always a limited number of divine beings or supernatural forces shaping existence. From the singular, all-powerful gods of monotheistic traditions to the pantheons of ancient Greece or Norse mythology, these figures are always finite.

This scarcity is what made myths so captivating. Imagine if there were thousands of Zeuses or Thors—what would happen to the sense of wonder? The uniqueness would fade, and with it, the awe that draws people to these stories.

For the first time in human history, though, we have something in the material world that’s provably scarce—and yet, some people still fail to appreciate its beauty!

#grownostr #bitcoin #scarcity