Since my last Macro post back in June:

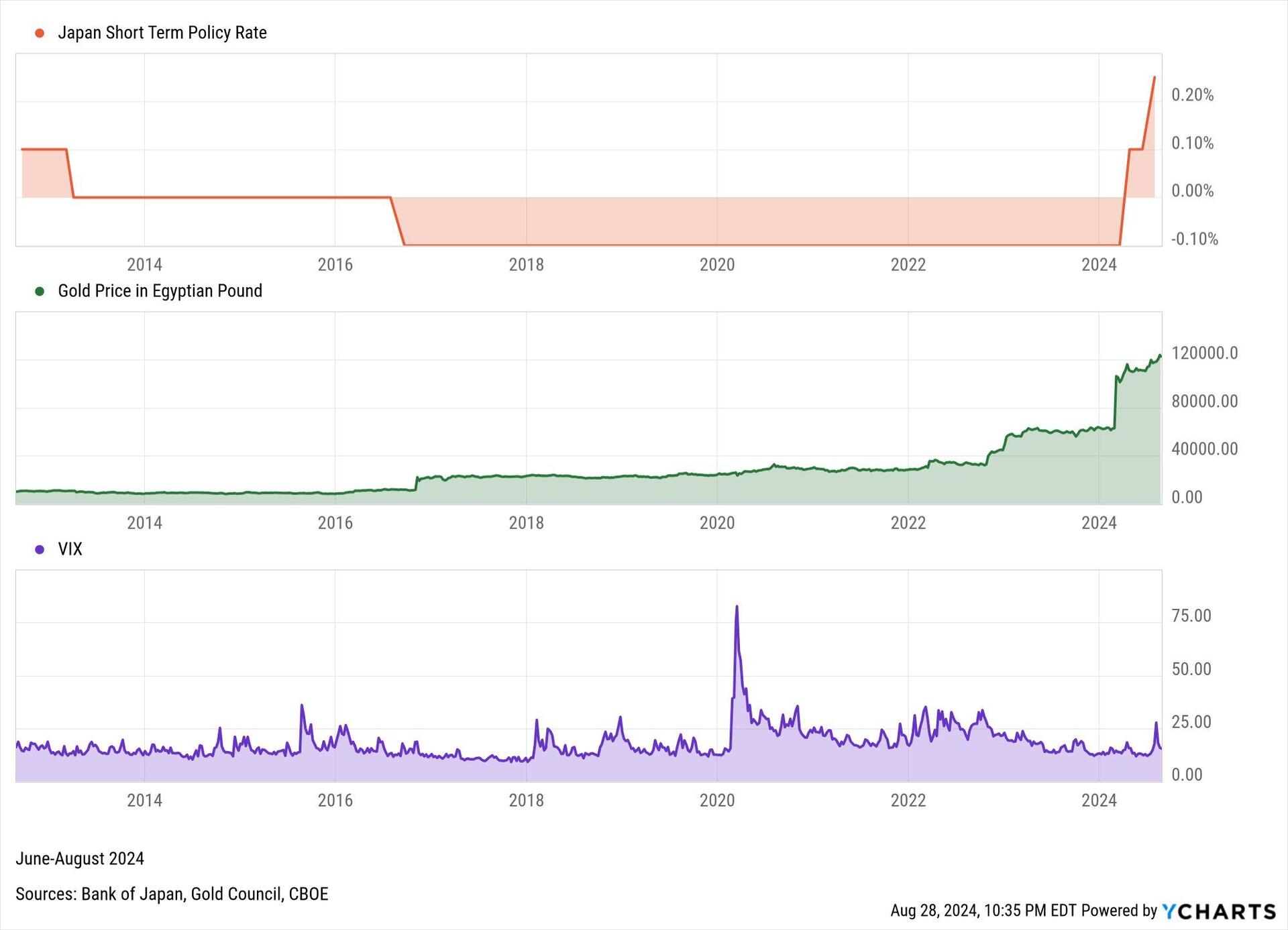

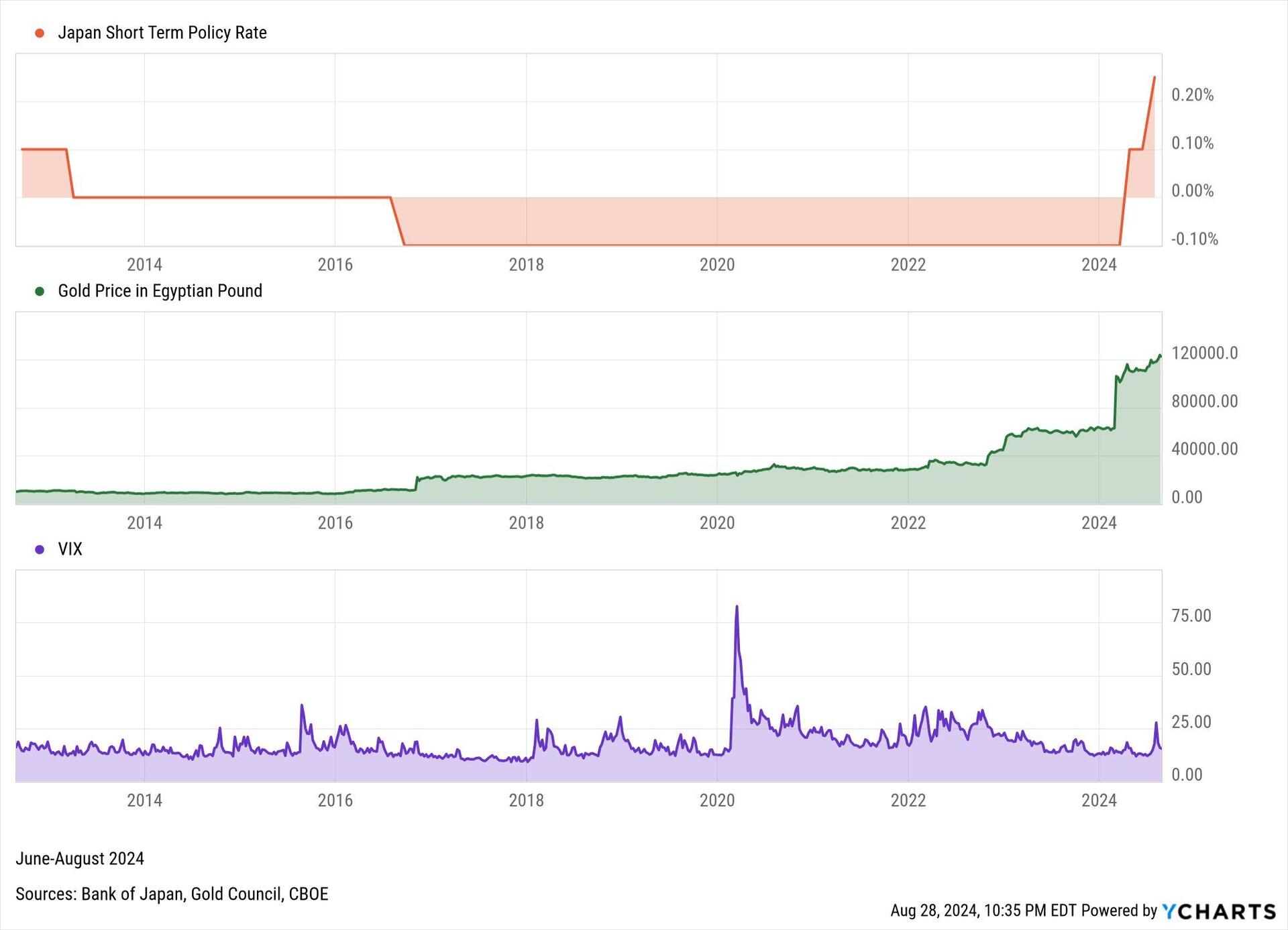

After several Yen buybacks, Japan ended its negative interest rate policy. The Bank of Japan (#BOJ) raised short-term interest rates from -0.1% to .25%, marking the first rate hike in 17 years. This shift triggered a significant deleveraging of carry trades on the #yen, shaking global markets.

In #Egypt, inflation has spiraled to unprecedented levels (once thought hard to top), with the annual headline rate surging to 39.7% from 38.2% in July. The government has imposed strict controls, limited access to foreign #currency, and manipulated the official exchange rate from the true market value, in an effort to slow capital flight.

We lived the U.S.'s short-lived, yet third major volatility spike in history, following those in 2008 and 2020. Coupled with the yen’s carry trade unwinding, slower-than-expected economic growth fueled public anxiety and heightened fears of economic downfall.

Something I expect will happen quicker, more often, and at a greater scale as the dollar continues to lose its purchasing power. Save in #Bitcoin. Self-custody.