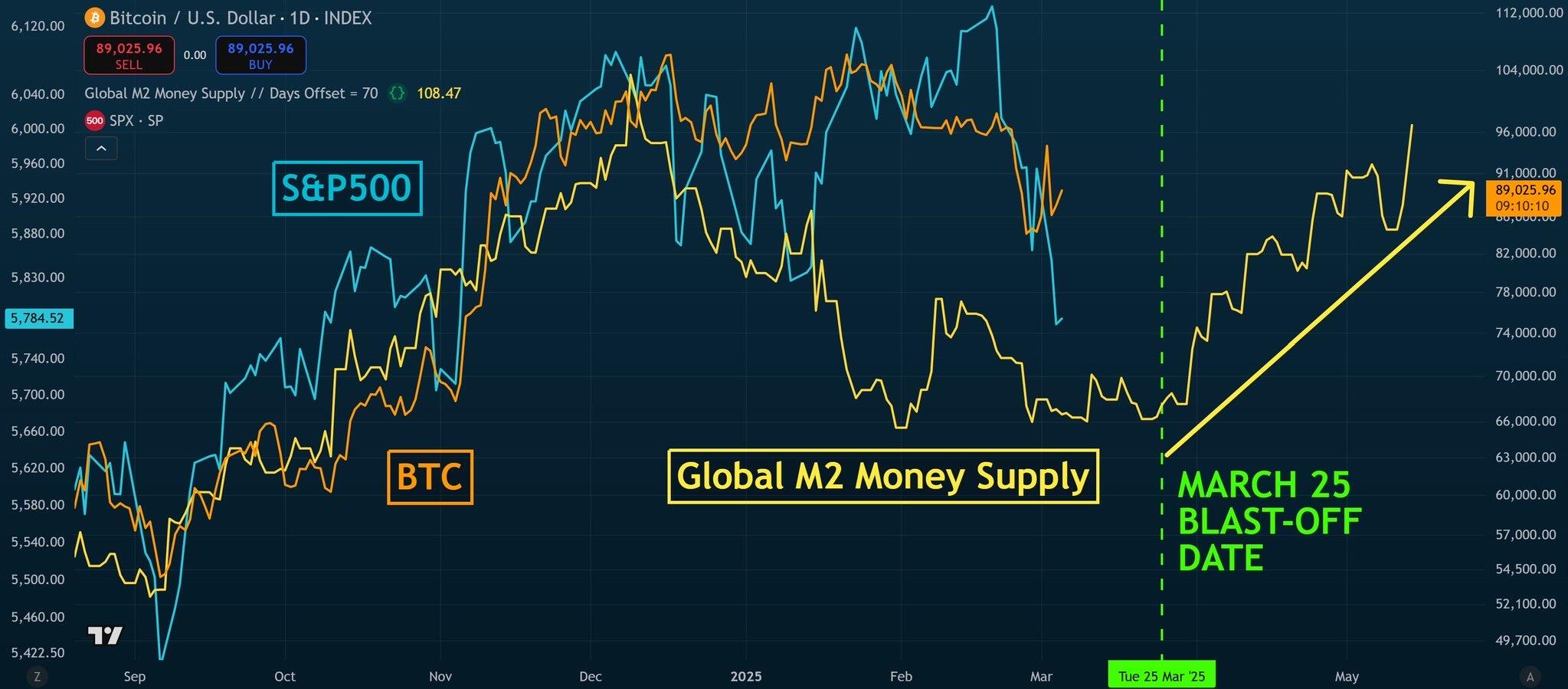

Global M2 Money Supply vs Bitcoin

🔹 CONTINUES TO BE BULLISH. Global M2 has remained at an ATH for 3 days in a row. This is a fantastic sign for what it signals will be coming into risk assets in ~108 days. (See upper-right corner of chart)

🔹 DIP BUYING OPPORTUNITY? Global M2 (with a 108-day offset) doesn't show a blast-off for another ~2 1/2 weeks, and actually shows a slow bleed into next week until around April 16th or 17th. See pink arrow.

As such, I'm wondering if next week will provide us another dip-buying opportunity.

🔹DOUBTERS AND FLIP-FLOPPERS. I see an inclination by some to shift opinion every time there is a short time frame price movement. Global M2 is a *macro* chart. Thus, it is best to view it as such and to have patience-- not to change one's analysis with each small price movement.

This is backed by the fact that Global M2 *WILL* deviate 20% of the time, by mathematical correlation— that includes deviations both to the upside and downside. This is why you must zoom out, in order to account for that 20% non-correlated period and **not be suckered into accepting it as the average**.

Furthermore, we just proved over an extended period of time (several weeks) that the 108-day offset was accurate via the "MINI RALLY THAT FAILS". That was big. Many were calling the 108-day offset wrong before that period, too. It turns out the doubters were incorrect.

I haven't seen enough proof that the 108-day offset is wrong. It's totally fine if the offset does change, and I will shift accordingly, but I'm not being too quick to jump to that conclusion. Let's give it a week or two to play out.

In summary: I wouldn't be too quick to judge the M2 offset on each short term BTC price movement.