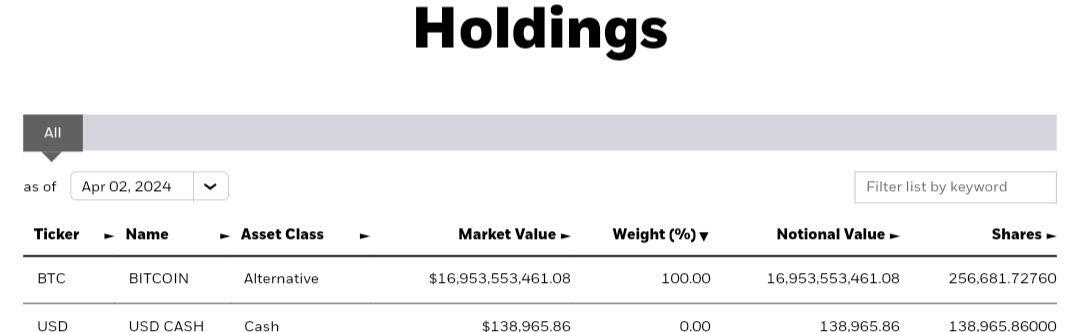

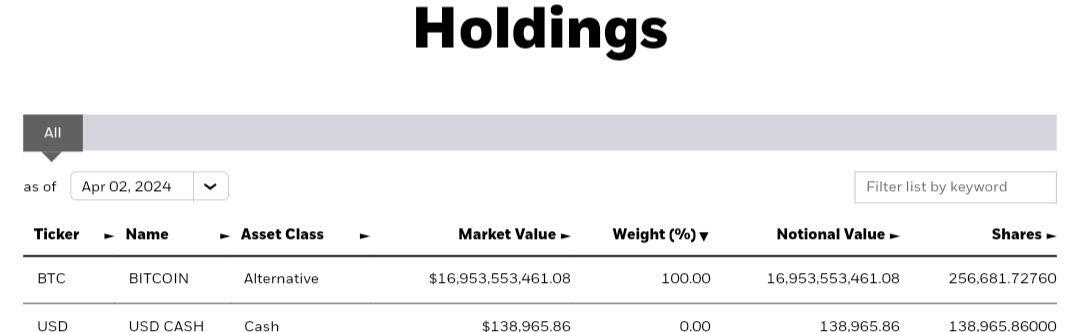

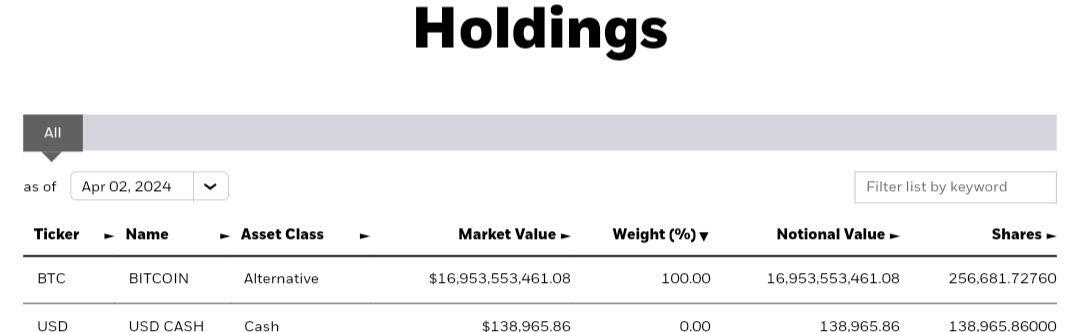

Blackrock's Bitcoin ETF, IBIT, now holds 256,681 BTC, up 2,278 BTC from yesterday.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought ~2.4x the amount of BTC that was produced.

I have sold all my #Bitcoin for USD

Inflation is good

Deflation is bad

When the cost of living rises we are all better off

Money needs to be centrally controlled and issued to work

Bitcoiners were wrong all along

Deal with it

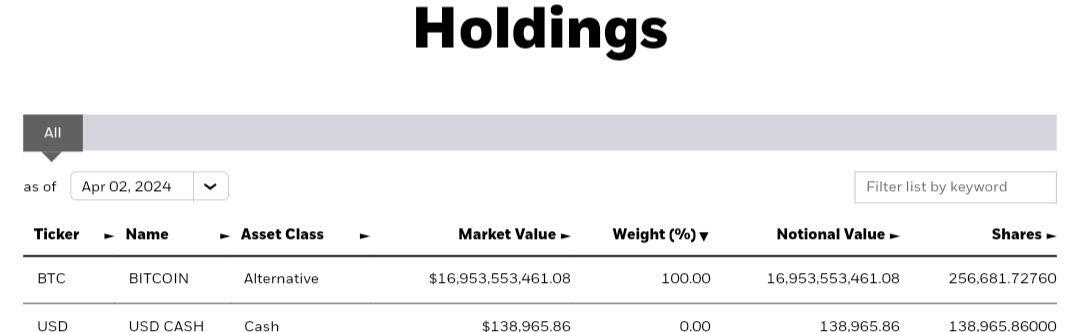

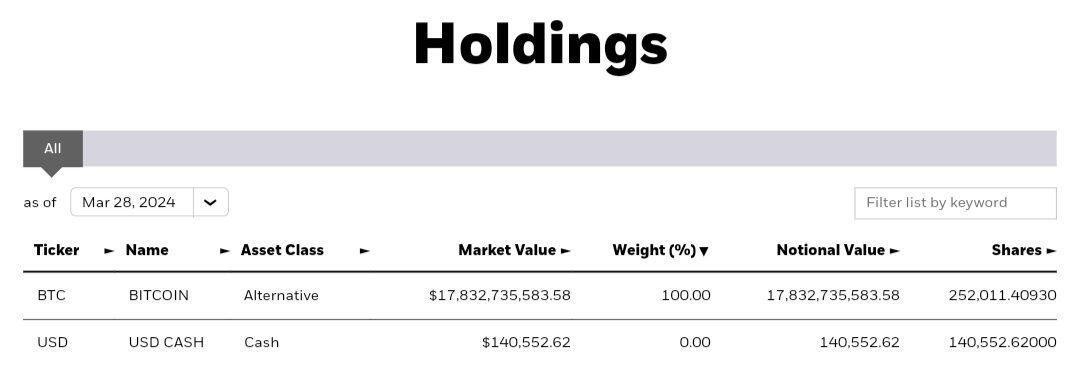

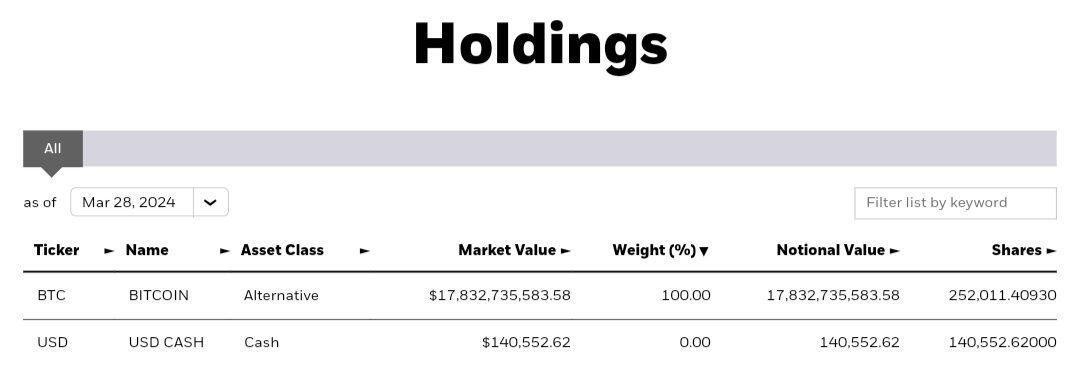

Blackrock's Bitcoin ETF, IBIT, now holds 252,011 BTC, up 1,344 from Wednesday.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought ~1.5x the amount of BTC that was produced on Thursday.

A digital commodity like Bitcoin gives property rights to everyone in the world.

If you hold physical gold, someone can take it from you.

If you hold stocks, your accounts can be shut down.

If you keep money in a bank account, your savings are being debased regularly.

If you hold real estate, you pay property tax forever.

Bitcoin is the only commodity that you can store IN YOUR BRAIN.

Nobody can take this away from you.

This can give EVERYONE in the world the ability to hold their wealth without relying on a central third party who can take it away from them.

Violence doesn't work on a Bitcoin standard - Bitcoin incentivizes peaceful negotiation.

If someone hurts or kills you and they don't know where you keep your Bitcoin, they can't take your wealth from you.

THINK ABOUT THE POSSIBILITIES.

Anyone can store billions of dollars of wealth IN THEIR BRAIN.

This is already being taken advantage of in countries with corrupt governments.

Digital commodities have NEVER existed before.

Most people still have 0 allocation.

We haven't even seen a fraction of what Bitcoin will do for the world.

Why would sovereign nations want to hold US government debt if they know they will be repaid in devalued dollars?

Bitcoin is a much better solution for long-term savings.

Example:

If you hold $100 billion of US debt for 30 years, you'll be paid back in dollars that are worth SIGNIFICANTLY less. You'll get interest payments along the way.

Right now, 30-year Treasury rates are around 4.34%. If the money supply is inflated by 7% on average over that time (this number has historically been much higher - it keeps up with the S&P 500), the bondholder would lose ~2.7% to inflation per year!

In 30 years, at maturity, the bondholder would receive $100 billion (in nominal terms). The holder would also receive ~$130 billion in annual interest payments throughout the 30 years.

The $100 billion payout has a present value of $11.3 billion. The interest payments have a present value of $51.1 billion, so the bond is actually worth only $62.4 billion in present value terms.

The bondholder would have LOST ~$37.6 BILLION by saving in US treasuries.

Why would you pay $100B for something worth only $62.4B?

If the investor put 5% of their portfolio in Bitcoin - $5 Billion in Bitcoin and 95 billion in bonds - their portfolio would perform SIGNIFICANTLY better.

Bitcoin has historically returned 100%+/year, but let's be conservative and say it will return 20%/year for the next 30 years.

The 5% allocation would be worth $1.19 trillion. The portfolio would be worth almost $1.8 trillion.

Instead of taking a compounded -1.5% annually (a 1.5% loss),

The portfolio would have returned 10.1% annually (a 10.1% gain).

$625k home

20% down-payment

$500k mortgage

With a 6% interest rate and a 30-year term, you are paying $579,190.95 in interest.

The $625,000 house cost you $1,204,190.95.

This is equal to a $3,345 monthly rental payment, plus you pay for maintenance and repairs.

Houses cost so much because people can borrow money that's created with the press of a button to buy them.

If everyone had to pay in cash for their home, prices would drop significantly.

Most people think mortgages are designed to help them.

But NO.

Mortgages are designed to earn profits for banks.

Bitcoiners are so positive about the FUTURE that they sometimes neglect the PRESENT

I see this in my life

Sometimes I need to remind myself that tomorrow isn't guaranteed

Finding the balance between enjoying life today and stacking Bitcoin for tomorrow is key

Bitcoin at $70k:

Bitcoin Skeptics: Bitcoiners are gambling

Bitcoin holders: No, I studied money, psychology, energy, game theory, economics, property rights, and history for thousands of hours.

Bitcoin at $700k:

Bitcoin Skeptics: Bitcoiners got lucky

Bitcoin holders: No, I studied money, psychology, energy, game theory, economics, property rights, and history for thousands of hours.

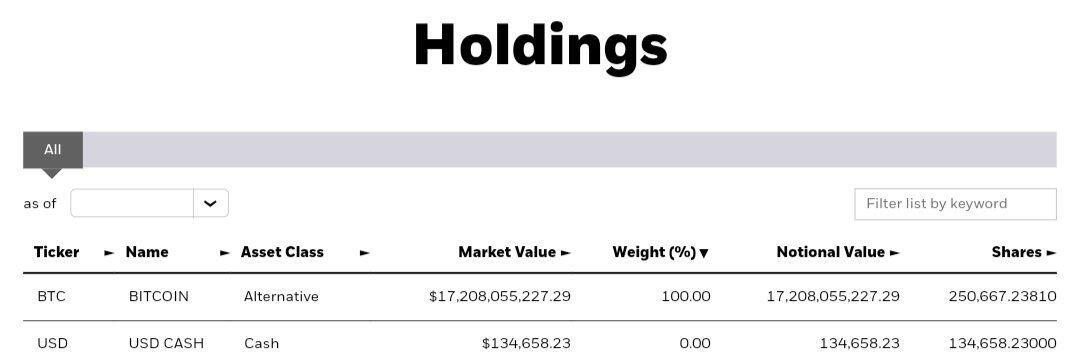

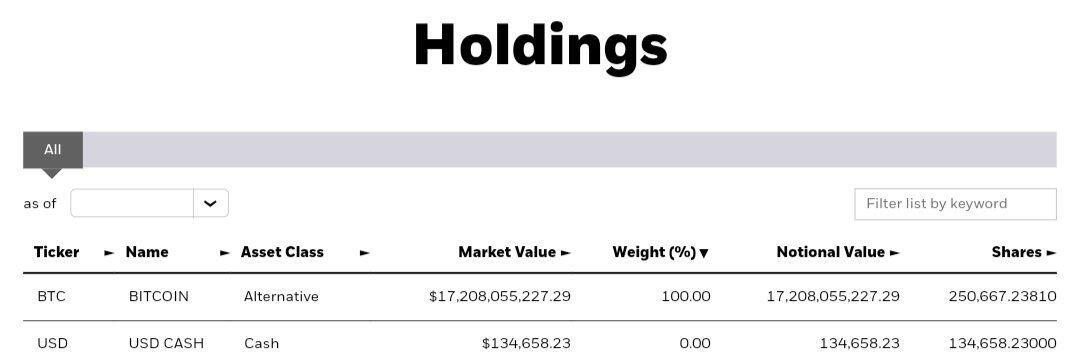

Blackrock's Bitcoin ETF now holds 250,667 BTC, up 4,716 from yesterday.

Buying is back up - as the price comes up, it will increase. Rich people FOMO will start after $100K IMO.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought ~5x of the amount of BTC that was produced.

18-24 months from now, there will be people who are excited about Bitcoin entering a bear market, because "this time, it's going to 0."

And then 4 years after that, and 4 years after that, and 4 years after that...

You get what I mean.

Bitcoin is never going to 0.

People who wish Bitcoin goes to 0 can't imagine being wrong about something.

They missed out and now they want everyone who DIDN'T miss out to suffer.

Just like the supply of new BTC is scheduled (it decreases 50% every 4 years), so are the crashes.

On a sound money standard, NO ENTITY IS TOO BIG TO FAIL.

When the price of Bitcoin goes up, retail investors get confident and start lending their BTC to financial institutions and making terrible decisions.

These financial institutions start lending coins irresponsibly to earn a profit.

In the legacy financial system, mistakes are forgiven by providing bailouts. This is because the legacy financial system is built on fake money (fiat currencies) that can be created out of thin air.

On a Bitcoin standard, there are no bailouts.

If you make mistakes, you're going to be taken out.

A few months after April's halving, innovation will be at its peak. Anyone who built during the bear market will probably be very successful during the bull market.

When the price of Bitcoin rises as a result of supply being cut by 50%, new businesses start offering services and products that are of immense value.

But not all of these companies are doing what they say they do...

After two years of prosperity is when the scammers are exposed (eg. FTX, Luna, etc).

Over the next few years, we'll go through the same cycle that we went through the LAST few years. We'll hit a higher high. Then we'll hit a higher low. Then we'll be back to 50%-60% below the previous all-time high.

This will happen over and over again until we are no longer using USD to value Bitcoin.

With each cycle, there's more adoption - more people learn how Bitcoin works and they start moving their fiat wealth, which is worthless, into the scarcest asset in the world.

In the next 6-18 months:

• There will be people offering you 15-20% returns for lending your BTC

• There will be others selling you some garbage that they created

• There will be a lot more new coins that promise riches and wealth

Study Bitcoin so you don't fall for the scams.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought ~1.5x the amount of BTC that was produced on Thursday.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought ~1.5x the amount of BTC that was produced on Thursday.