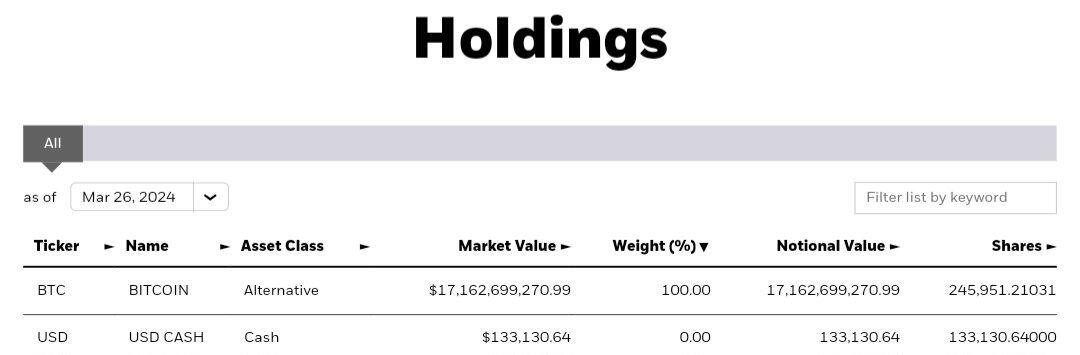

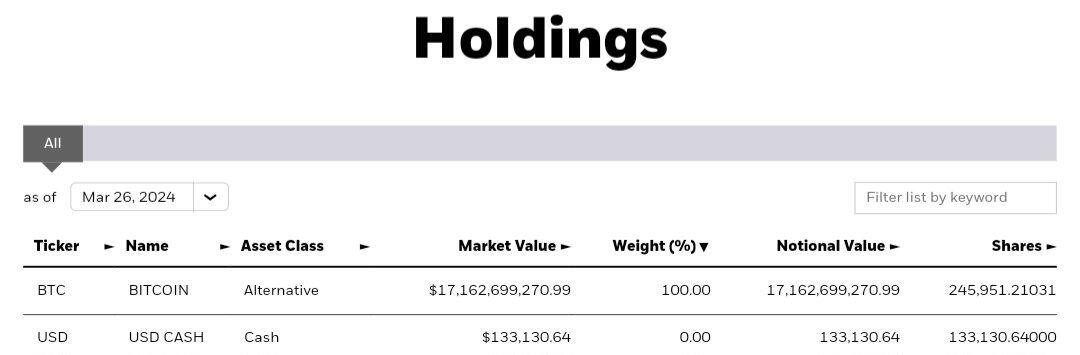

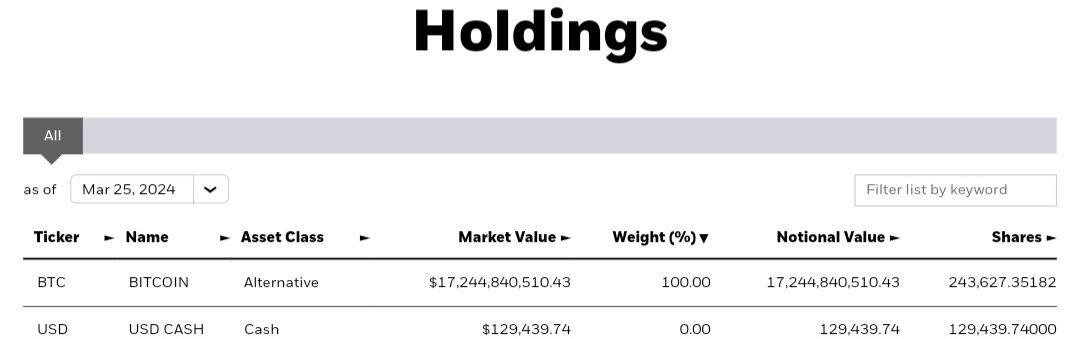

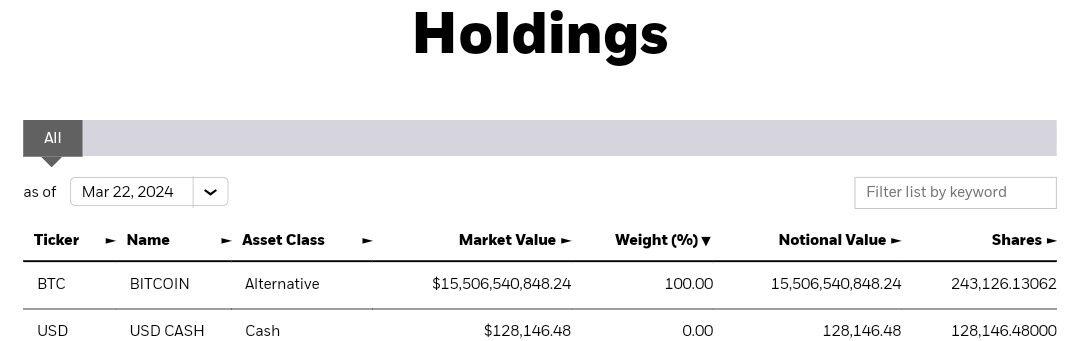

Blackrock's #Bitcoin ETF now holds 245,951 BTC, up 2,324 from yesterday.

Buying is back up - as price comes up, it will increase. Rich people FOMO will start after $100K IMO.

900 BTC are issued per day. Around April 20, this will drop to 450.

Blackrock clients bought ~3x of the amount of BTC that was produced.