I try to avoid telling people to buy Bitcoin.

I tell them to study it.

Why?

Because I KNOW that if you buy Bitcoin without understanding what it is, you will sell early and regret it.

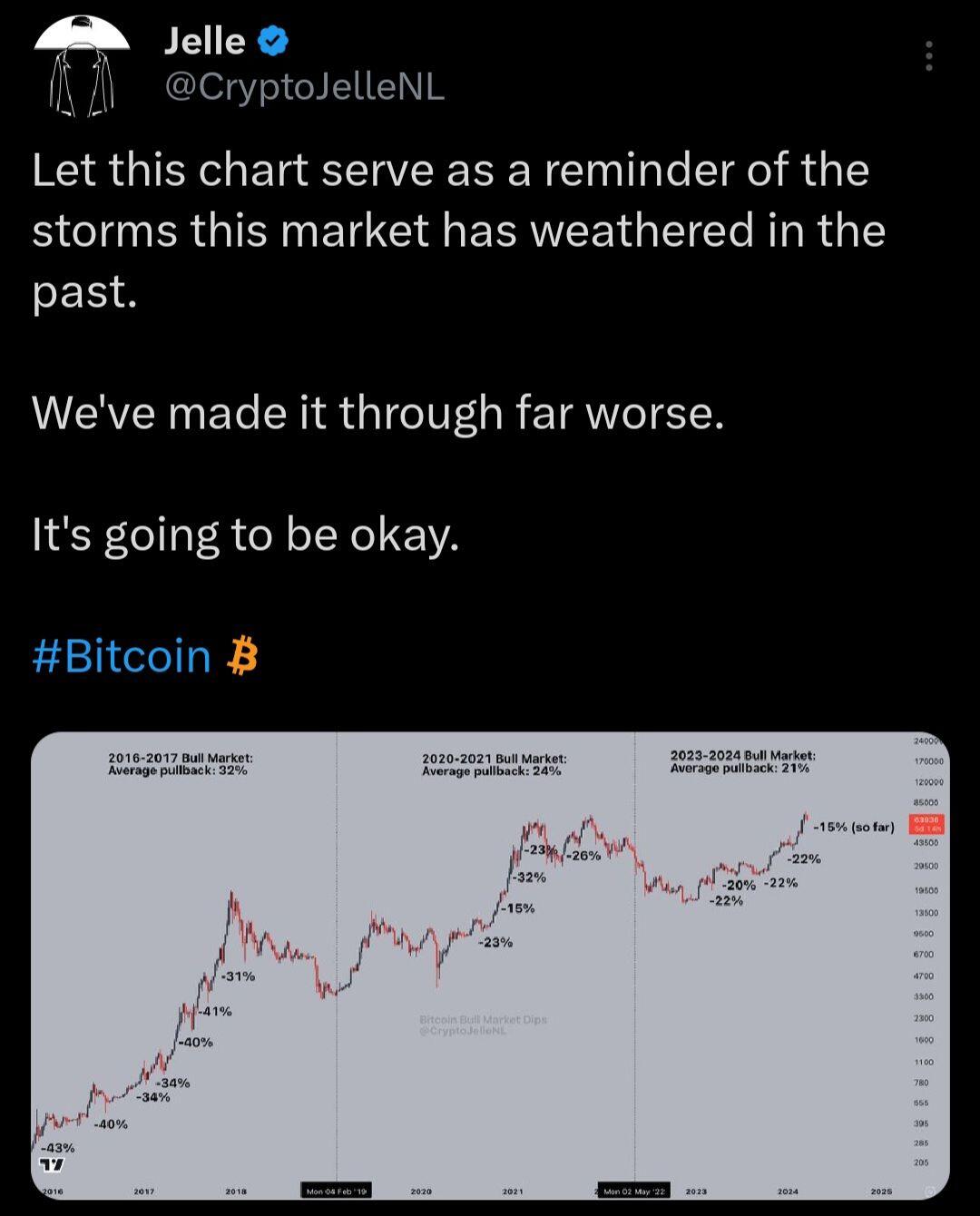

Bitcoin will destroy your emotional state if you're not ready for the volatility (like the pullback we're experiencing right now).

I know people who sold at $20K in 2022 because they thought Bitcoin was going to $0 and now they're kicking themselves.

I know people who went all in at the $70,000 because they thought it was going to $100,000, and now they're panicking.

Don't make the mistake of buying anything before you have an understanding of what you're buying.

Once you understand Bitcoin, these drops are an OPPORTUNITY, not SOMETHING TO BE AFRAID OF.

We are in the shakeout phase - a lot of people are being taken out because they have no confidence in the asset they own.

Bitcoin is the best form of money that has ever existed.

It's better than gold and fiat.

It has a limited supply.

The production cannot sped up.

It's backed by the most powerful network in the world.

Don't dismiss this!

Every company in the global stock market will be repriced based on how much Bitcoin it holds or can generate in the future.

Microstrategy $MSTR is a visionary: it knows that the price of Bitcoin will rise, so being able to generate Bitcoin will get more difficult over time.

We are in a weird time where we can buy the MONEY OF THE FUTURE with the MONEY OF THE PAST (fiat currencies).

This is a cheat code that THE ENTIRE WORLD has access to (including individual investors).

As stocks are repriced, I think MSTR will have the highest market cap in the world because it's THE ONLY ONE taking advantage of the market's inefficiency in pricing Bitcoin.