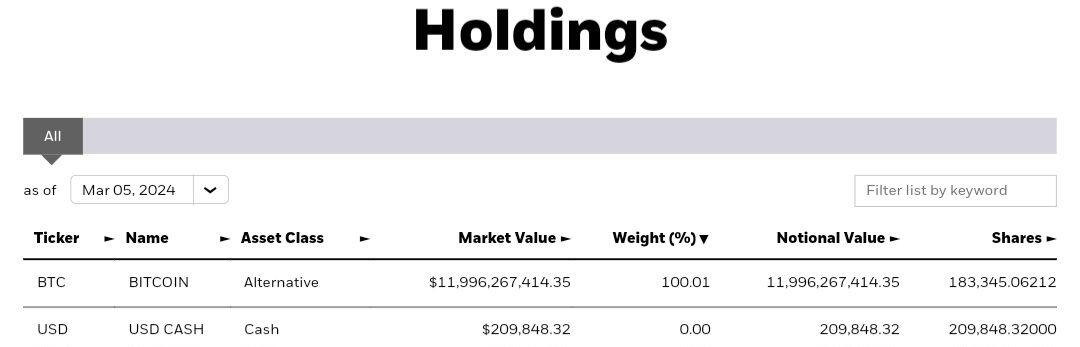

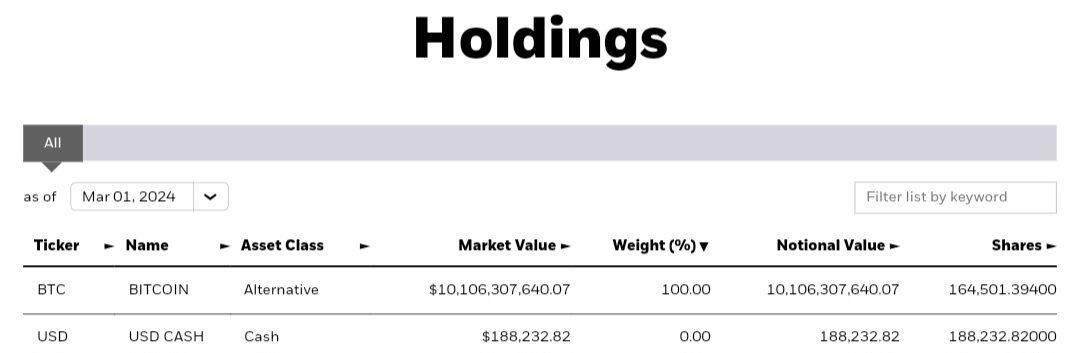

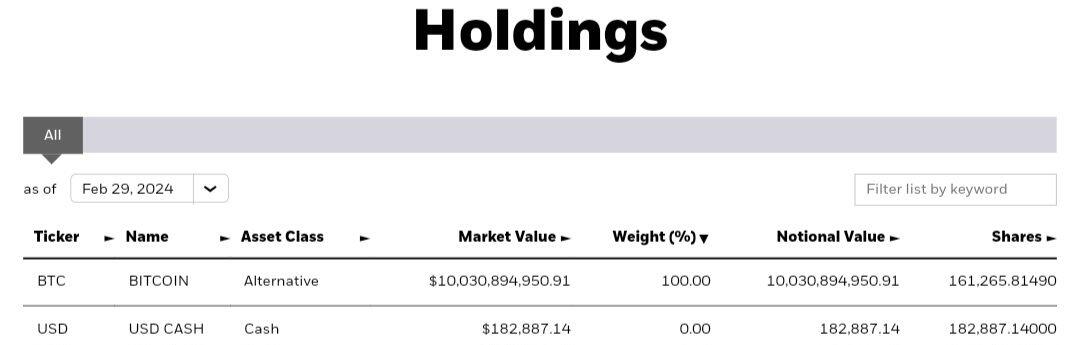

Blackrock's Bitcoin ETF, $IBIT, now holds 183,345 BTC, up 12,624 from yesterday.

This is their BIGGEST daily purchase so far.

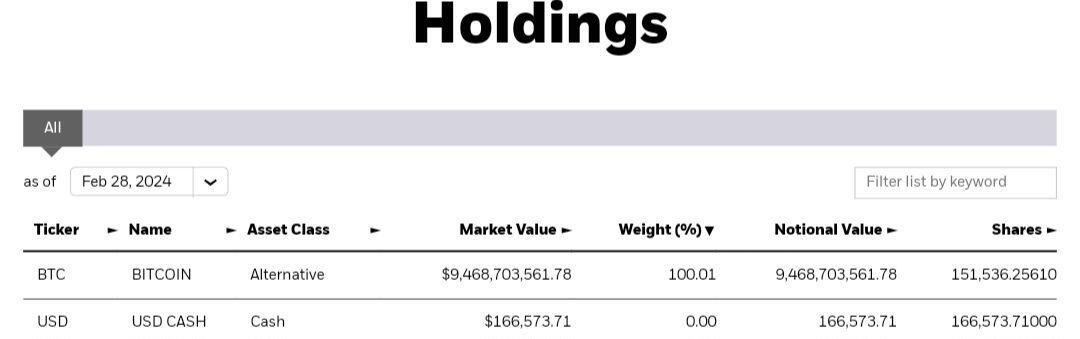

Blackrock now holds 0.87% of the total supply of BTC, with their total assets valued at almost $12 billion.

900 BTC are issued per day. In April this will drop to 450.

Blackrock clients bought 14x the newly issued supply!