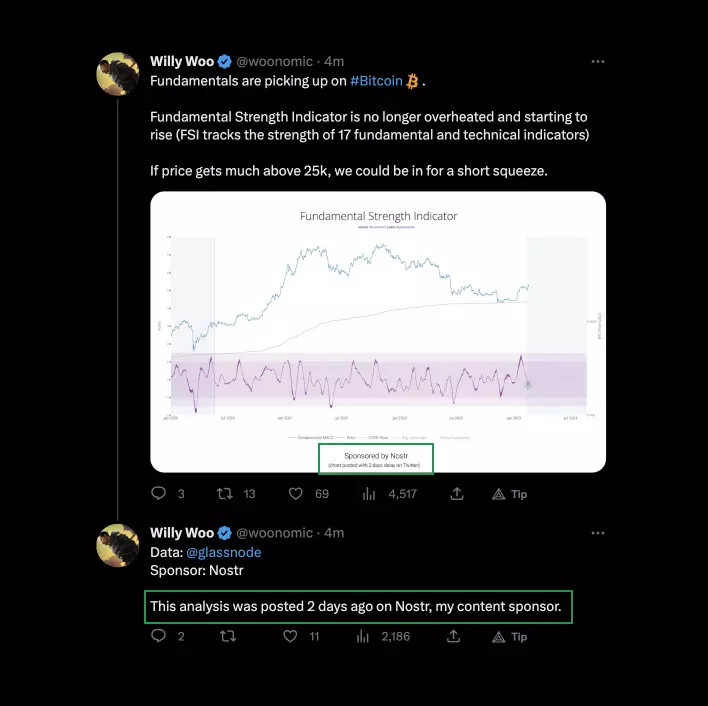

#Bitcoin demand from calendar futures dropped off a cliff (this tends to reflect sentiment from pro and institutional traders). Contango went into backwardation at levels akin to what we had at our $16k range.

Meanwhile the last 48hrs has seen bullish spot flows at exchanges when BTC dropped to the 19.5k-20.5k range, maybe from people fleeing USDC.

This looks responsible for causing a small short squeezed powered recovery.

Overall corn looks weak in the short term.

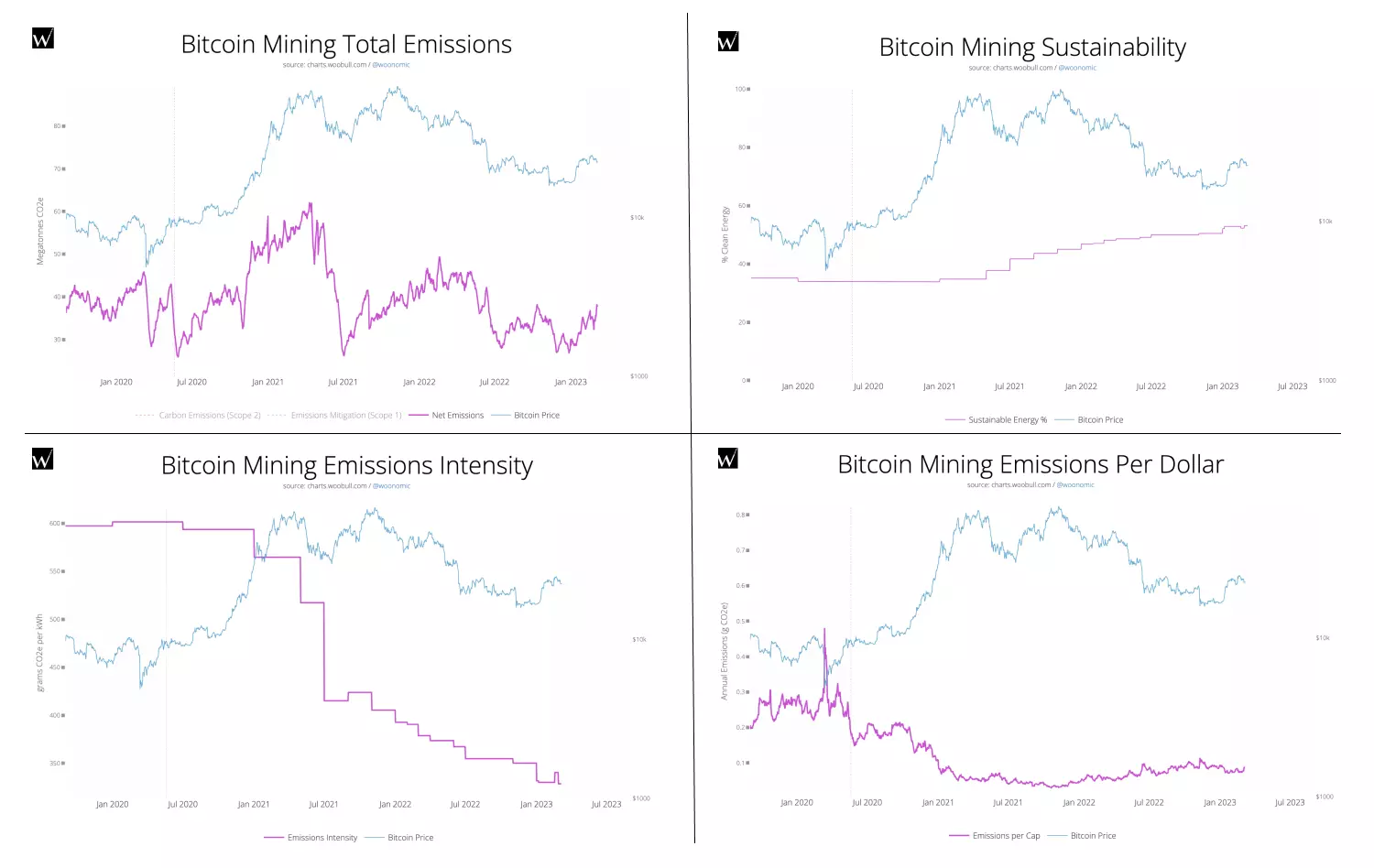

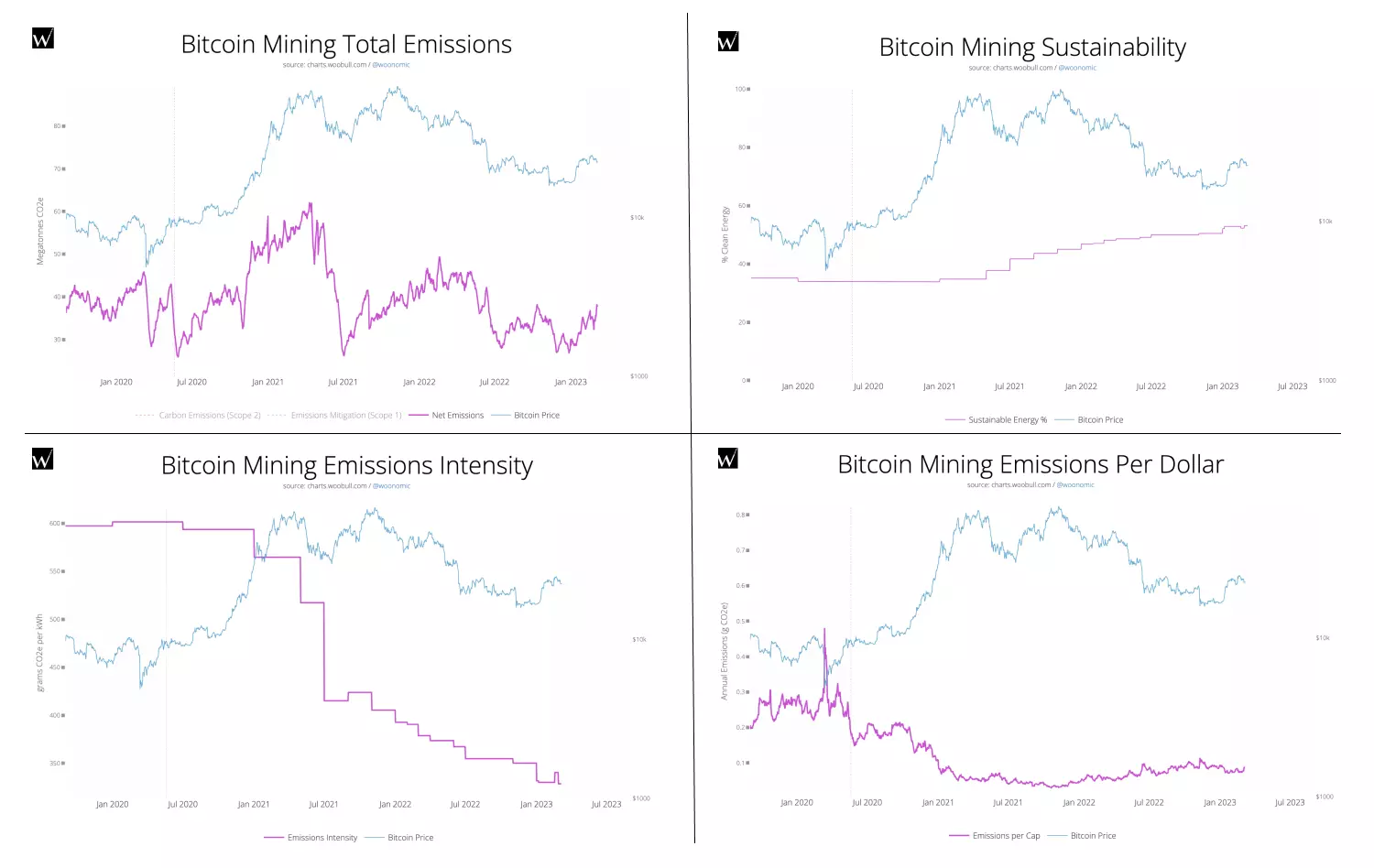

While I'm in NZ, #[0] dropped by. We spent today day translating some of his work into live charts so the world can keep easy tabs on #Bitcoin's progress towards being carbon negative, least of all people shaping policy where this data is critical.

This will go live soon.

Emissions are roughly the same as 3 years ago despite market cap being 3x higher and user adoption 4x higher.

In terms of CO2e intensity, the #Bitcoin network is making great strides putting out 3x less CO2e per kWh of energy use (0.09 grams per kWh presently). Daniel's best extrapolation is that is on track to go carbon negative in 4 years.