𝗜𝘀 𝗕𝗶𝘁𝗰𝗼𝗶𝗻'𝘀 𝗘𝗻𝗲𝗿𝗴𝘆 𝗨𝘀𝗲 𝗛𝗮𝗿𝗺𝗳𝘂𝗹 𝘁𝗼 𝘁𝗵𝗲 𝗘𝗻𝘃𝗶𝗿𝗼𝗻𝗺𝗲𝗻𝘁?

𝘈𝘯 𝘦𝘹𝘤𝘦𝘳𝘱𝘵 𝘧𝘳𝘰𝘮 𝘵𝘩𝘦 𝘵𝘸𝘦𝘯𝘵𝘪𝘦𝘵𝘩 𝘤𝘩𝘢𝘱𝘵𝘦𝘳 𝘰𝘧 “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, 𝘵𝘩𝘦 𝘸𝘰𝘳𝘭𝘥’𝘴 𝘧𝘪𝘳𝘴𝘵 #Ai-𝘦𝘯𝘩𝘢𝘯𝘤𝘦𝘥 #Bitcoin 𝘣𝘰𝘰𝘬.

We've all heard the hysteria that "𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘪𝘴 𝘨𝘰𝘪𝘯𝘨 𝘵𝘰 𝘣𝘰𝘪𝘭 𝘵𝘩𝘦 𝘰𝘤𝘦𝘢𝘯𝘴!" But how true is that really? In this chapter, @npub1exce...n72a, @Tomer Strolight, and @Guy Swann clear up this FUD for all the new Bitcoiners, and anyone who might think that Bitcoin is anything but 𝗯𝗲𝗻𝗲𝗳𝗶𝗰𝗶𝗮𝗹 to the environment.

Below is Tomer Strolight’s answer, as written in “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”:

𝗧𝗼𝗺𝗲𝗿 𝗦𝘁𝗿𝗼𝗹𝗶𝗴𝗵𝘁’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

Bitcoin is sound money that everyone in the world can access. Bitcoin uses energy to keep its past records from being changed. All the energy used in Bitcoin adds to this security.

Attacking Bitcoin’s ledger requires mustering more energy than is being used to protect it. To undo a Bitcoin transaction requires amassing more energy in a short time than has been used to operate bitcoin since the time that transaction was first confirmed. Thus Bitcoin’s energy use is a very real protection against any attempts to undo any of its transactions.

The value of having sound money represents an incredibly valuable leap forward that justifies energy use, and that actually saves a lot of energy that is currently wasted under unsound, fiat money.

Under the fiat standard, nobody has access to sound money. Vast amounts of energy then flow into trying to avert the negative consequences of this unsound fiat money. For one, people who do have money are forced to speculate on investments in stocks, bonds, real estate, derivatives, and other instruments that are themselves volatile and unpredictable to try to preserve the purchasing power of their savings. Even more people suffer from high inflation and hyperinflation.

There are entire industries that divert tremendous energy into the problems caused by fiat. As but a single example, housing is “financialized” as a speculative investment and store-of-value, leaving many priced out of the market and unable to afford homeownership. Consider the energy that goes into financing, speculating on, and constructing properties that remain unoccupied all over the world, and you’ll see but a sliver of the wasted energy that unsound money consumes.

Sound money does require energy use, but so too does unsound money. Sound money, however, is a far better and more efficient use of energy because it is rational and aligned with long-term capital formation and wealth creation.

𝗧𝗼𝗺𝗲𝗿 𝗦𝘁𝗿𝗼𝗹𝗶𝗴𝗵𝘁’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

Bitcoin is sound money that everyone in the world can access. Bitcoin uses energy to keep its past records from being changed. All the energy used in Bitcoin adds to this security.

Attacking Bitcoin’s ledger requires mustering more energy than is being used to protect it. To undo a Bitcoin transaction requires amassing more energy in a short time than has been used to operate bitcoin since the time that transaction was first confirmed. Thus Bitcoin’s energy use is a very real protection against any attempts to undo any of its transactions.

The value of having sound money represents an incredibly valuable leap forward that justifies energy use, and that actually saves a lot of energy that is currently wasted under unsound, fiat money.

Under the fiat standard, nobody has access to sound money. Vast amounts of energy then flow into trying to avert the negative consequences of this unsound fiat money. For one, people who do have money are forced to speculate on investments in stocks, bonds, real estate, derivatives, and other instruments that are themselves volatile and unpredictable to try to preserve the purchasing power of their savings. Even more people suffer from high inflation and hyperinflation.

There are entire industries that divert tremendous energy into the problems caused by fiat. As but a single example, housing is “financialized” as a speculative investment and store-of-value, leaving many priced out of the market and unable to afford homeownership. Consider the energy that goes into financing, speculating on, and constructing properties that remain unoccupied all over the world, and you’ll see but a sliver of the wasted energy that unsound money consumes.

Sound money does require energy use, but so too does unsound money. Sound money, however, is a far better and more efficient use of energy because it is rational and aligned with long-term capital formation and wealth creation.

Tomer Strolight has been involved in Bitcoin since 2013 and has been writing publicly under his name about it since 2021.

He is the Editor-in-Chief at Swan.com, a leading Bitcoin onramp.

He has also written and narrated the short Bitcoin film 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘐𝘴 𝘎𝘦𝘯𝘦𝘳𝘢𝘵𝘪𝘰𝘯𝘢𝘭 𝘞𝘦𝘢𝘭𝘵𝘩 (available on YouTube).

His articles appear on Bitcoin Magazine, Swan.com/signal, Citadel21.com, and more.

Tomer Strolight has been involved in Bitcoin since 2013 and has been writing publicly under his name about it since 2021.

He is the Editor-in-Chief at Swan.com, a leading Bitcoin onramp.

He has also written and narrated the short Bitcoin film 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘐𝘴 𝘎𝘦𝘯𝘦𝘳𝘢𝘵𝘪𝘰𝘯𝘢𝘭 𝘞𝘦𝘢𝘭𝘵𝘩 (available on YouTube).

His articles appear on Bitcoin Magazine, Swan.com/signal, Citadel21.com, and more.

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟲𝟬%, by contributing to our @Geyser initiative:

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟲𝟬%, by contributing to our @Geyser initiative:

𝗧𝗼𝗺𝗲𝗿 𝗦𝘁𝗿𝗼𝗹𝗶𝗴𝗵𝘁’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

Bitcoin is sound money that everyone in the world can access. Bitcoin uses energy to keep its past records from being changed. All the energy used in Bitcoin adds to this security.

Attacking Bitcoin’s ledger requires mustering more energy than is being used to protect it. To undo a Bitcoin transaction requires amassing more energy in a short time than has been used to operate bitcoin since the time that transaction was first confirmed. Thus Bitcoin’s energy use is a very real protection against any attempts to undo any of its transactions.

The value of having sound money represents an incredibly valuable leap forward that justifies energy use, and that actually saves a lot of energy that is currently wasted under unsound, fiat money.

Under the fiat standard, nobody has access to sound money. Vast amounts of energy then flow into trying to avert the negative consequences of this unsound fiat money. For one, people who do have money are forced to speculate on investments in stocks, bonds, real estate, derivatives, and other instruments that are themselves volatile and unpredictable to try to preserve the purchasing power of their savings. Even more people suffer from high inflation and hyperinflation.

There are entire industries that divert tremendous energy into the problems caused by fiat. As but a single example, housing is “financialized” as a speculative investment and store-of-value, leaving many priced out of the market and unable to afford homeownership. Consider the energy that goes into financing, speculating on, and constructing properties that remain unoccupied all over the world, and you’ll see but a sliver of the wasted energy that unsound money consumes.

Sound money does require energy use, but so too does unsound money. Sound money, however, is a far better and more efficient use of energy because it is rational and aligned with long-term capital formation and wealth creation.

𝗧𝗼𝗺𝗲𝗿 𝗦𝘁𝗿𝗼𝗹𝗶𝗴𝗵𝘁’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

Bitcoin is sound money that everyone in the world can access. Bitcoin uses energy to keep its past records from being changed. All the energy used in Bitcoin adds to this security.

Attacking Bitcoin’s ledger requires mustering more energy than is being used to protect it. To undo a Bitcoin transaction requires amassing more energy in a short time than has been used to operate bitcoin since the time that transaction was first confirmed. Thus Bitcoin’s energy use is a very real protection against any attempts to undo any of its transactions.

The value of having sound money represents an incredibly valuable leap forward that justifies energy use, and that actually saves a lot of energy that is currently wasted under unsound, fiat money.

Under the fiat standard, nobody has access to sound money. Vast amounts of energy then flow into trying to avert the negative consequences of this unsound fiat money. For one, people who do have money are forced to speculate on investments in stocks, bonds, real estate, derivatives, and other instruments that are themselves volatile and unpredictable to try to preserve the purchasing power of their savings. Even more people suffer from high inflation and hyperinflation.

There are entire industries that divert tremendous energy into the problems caused by fiat. As but a single example, housing is “financialized” as a speculative investment and store-of-value, leaving many priced out of the market and unable to afford homeownership. Consider the energy that goes into financing, speculating on, and constructing properties that remain unoccupied all over the world, and you’ll see but a sliver of the wasted energy that unsound money consumes.

Sound money does require energy use, but so too does unsound money. Sound money, however, is a far better and more efficient use of energy because it is rational and aligned with long-term capital formation and wealth creation.

Tomer Strolight has been involved in Bitcoin since 2013 and has been writing publicly under his name about it since 2021.

He is the Editor-in-Chief at Swan.com, a leading Bitcoin onramp.

He has also written and narrated the short Bitcoin film 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘐𝘴 𝘎𝘦𝘯𝘦𝘳𝘢𝘵𝘪𝘰𝘯𝘢𝘭 𝘞𝘦𝘢𝘭𝘵𝘩 (available on YouTube).

His articles appear on Bitcoin Magazine, Swan.com/signal, Citadel21.com, and more.

Tomer Strolight has been involved in Bitcoin since 2013 and has been writing publicly under his name about it since 2021.

He is the Editor-in-Chief at Swan.com, a leading Bitcoin onramp.

He has also written and narrated the short Bitcoin film 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘐𝘴 𝘎𝘦𝘯𝘦𝘳𝘢𝘵𝘪𝘰𝘯𝘢𝘭 𝘞𝘦𝘢𝘭𝘵𝘩 (available on YouTube).

His articles appear on Bitcoin Magazine, Swan.com/signal, Citadel21.com, and more.

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟲𝟬%, by contributing to our @Geyser initiative:

Preorder your copy of “𝟮𝟭 𝗤𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀”, and 𝘀𝗮𝘃𝗲 𝘂𝗽 𝘁𝗼 𝟲𝟬%, by contributing to our @Geyser initiative:

Geyser | Bitcoin Crowdfunding Platform

A Bitcoin crowdfunding platform where creators raise funds for causes, sell products, manage campaigns, and engage with their community.

𝗔𝗿𝗺𝗮𝗻 𝘁𝗵𝗲 𝗣𝗮𝗿𝗺𝗮𝗻’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

Acknowledging that governments could ban Bitcoin is acknowledging that Bitcoin is a threat to the status quo — and to be a threat to the status quo means it must be a credible alternative to the current monetary system. That’s a step in the right direction for someone who may have been skeptical previously.

Because Bitcoin is 𝘴𝘰 good, yes, governments are likely to see it as a threat, and some may, and have, tried to ban it. However, it should be noted just how ineffective government bans are on things its citizens demand. Consider how effective the bans on alcohol, drugs, bibles, and certain movies have been.

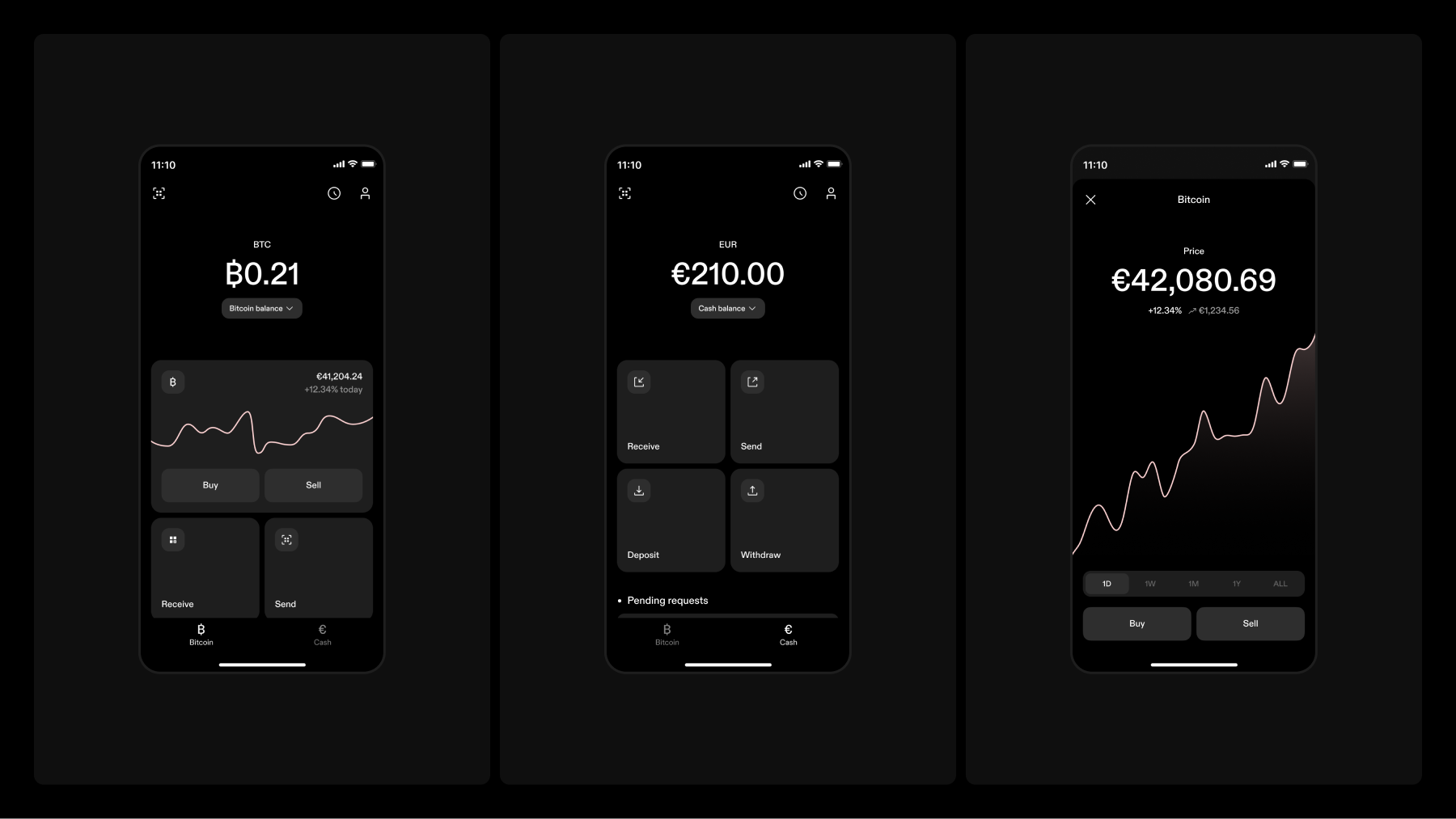

I do think governments will come for Bitcoin, either to hurt it or to get more. Whatever they do, Bitcoin is going to be fine. 𝘠𝘰𝘶 may not be, though. Get your coins off exchanges and learn how to do this to protect yourself. Ask for help or learn online. Visit my website, which is dedicated to teaching people how to hold their own coins. Don’t leave them in a giant honeypot for your government to take in one swoop. Make them come after each person, one by one. Make it difficult.

𝗔𝗿𝗺𝗮𝗻 𝘁𝗵𝗲 𝗣𝗮𝗿𝗺𝗮𝗻’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

Acknowledging that governments could ban Bitcoin is acknowledging that Bitcoin is a threat to the status quo — and to be a threat to the status quo means it must be a credible alternative to the current monetary system. That’s a step in the right direction for someone who may have been skeptical previously.

Because Bitcoin is 𝘴𝘰 good, yes, governments are likely to see it as a threat, and some may, and have, tried to ban it. However, it should be noted just how ineffective government bans are on things its citizens demand. Consider how effective the bans on alcohol, drugs, bibles, and certain movies have been.

I do think governments will come for Bitcoin, either to hurt it or to get more. Whatever they do, Bitcoin is going to be fine. 𝘠𝘰𝘶 may not be, though. Get your coins off exchanges and learn how to do this to protect yourself. Ask for help or learn online. Visit my website, which is dedicated to teaching people how to hold their own coins. Don’t leave them in a giant honeypot for your government to take in one swoop. Make them come after each person, one by one. Make it difficult.

Arman The Parman is a Bitcoiner who is passionate about Bitcoin privacy and private key safety. He runs an online mentoring program to help people achieve "insane security" and teaches his own non-custodial inheritance strategy that is both trustless and loss-resistant. He contributes to Bitcoin by writing economic and technical articles posted on his website.

Arman The Parman is a Bitcoiner who is passionate about Bitcoin privacy and private key safety. He runs an online mentoring program to help people achieve "insane security" and teaches his own non-custodial inheritance strategy that is both trustless and loss-resistant. He contributes to Bitcoin by writing economic and technical articles posted on his website.

𝗣𝗮𝗯𝗹𝗼 𝗙𝗲𝗿𝗻𝗮𝗻𝗱𝗲𝘇’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

As entertaining and interesting as this type of question truly is, we need to recognize it as ultimately irrelevant. If the “who,” “what,” and “why” of Bitcoin’s creation were important then the whole premise of Bitcoin would be moot, particularly because the creation of Bitcoin is that of non-hierarchical digital money. If the 𝘸𝘩𝘰 behind the creation of Bitcoin were of any relevance whatsoever, that would imply a hierarchy and that would render the entire endeavor pointless.

So, how can you trust Bitcoin if it was created by a three-letter agency? By studying and realizing that truly no one, not even its creator, has power over you or any other user of the network.

Again, non-hierarchical digital money 𝘪𝘴 the invention.

𝗣𝗮𝗯𝗹𝗼 𝗙𝗲𝗿𝗻𝗮𝗻𝗱𝗲𝘇’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

As entertaining and interesting as this type of question truly is, we need to recognize it as ultimately irrelevant. If the “who,” “what,” and “why” of Bitcoin’s creation were important then the whole premise of Bitcoin would be moot, particularly because the creation of Bitcoin is that of non-hierarchical digital money. If the 𝘸𝘩𝘰 behind the creation of Bitcoin were of any relevance whatsoever, that would imply a hierarchy and that would render the entire endeavor pointless.

So, how can you trust Bitcoin if it was created by a three-letter agency? By studying and realizing that truly no one, not even its creator, has power over you or any other user of the network.

Again, non-hierarchical digital money 𝘪𝘴 the invention.

Pablo Fernandez is a self-proclaimed software engineer. He cares about building elegant, effective, software that expands individual freedom and drives responsibility/decision-making to the edges.

Pablo Fernandez is a self-proclaimed software engineer. He cares about building elegant, effective, software that expands individual freedom and drives responsibility/decision-making to the edges.

In the years following, each of you* has become Satoshi as you run, guard, and share the #Bitcoin protocol.

And more recently, all your voices have combined to create the 𝘚𝘱𝘪𝘳𝘪𝘵 of Satoshi, taking us full circle.

Really, it's poetic when you think about it.

In the years following, each of you* has become Satoshi as you run, guard, and share the #Bitcoin protocol.

And more recently, all your voices have combined to create the 𝘚𝘱𝘪𝘳𝘪𝘵 of Satoshi, taking us full circle.

Really, it's poetic when you think about it.

*except for that one Australian guy

*except for that one Australian guy 𝗕𝗿𝗮𝗱 𝗠𝗶𝗹𝗹𝘀’ 𝗮𝗻𝘀𝘄𝗲𝗿:

Bitcoin is a savings technology. Bitcoin’s unique properties make it the best vehicle for storing your wealth over long time frames in a world being digitized and where technology makes our lives easier.

When your savings actually grow in purchasing power over time, you spend less in the present to preserve and grow your purchasing power in the future.

I’m hopeful that Bitcoin will lead to a world with less consumerism, less waste, and smarter financial decisions, resulting in more individuals and families experiencing economic prosperity.

The significant majority of people in the world are already experiencing economic stagnation when you measure purchasing power, not dollars.

Wealth inequality is at record levels, the price of homes is rising while wages are not, and excess savings rates are low.

We’ve been trained to over-borrow and over-consume; we sacrifice a comfortable future for a more pleasurable present.

Bitcoin should help increase financial literacy and lead to more prosperity, reducing economic stagnation on the individual level.

𝗕𝗿𝗮𝗱 𝗠𝗶𝗹𝗹𝘀’ 𝗮𝗻𝘀𝘄𝗲𝗿:

Bitcoin is a savings technology. Bitcoin’s unique properties make it the best vehicle for storing your wealth over long time frames in a world being digitized and where technology makes our lives easier.

When your savings actually grow in purchasing power over time, you spend less in the present to preserve and grow your purchasing power in the future.

I’m hopeful that Bitcoin will lead to a world with less consumerism, less waste, and smarter financial decisions, resulting in more individuals and families experiencing economic prosperity.

The significant majority of people in the world are already experiencing economic stagnation when you measure purchasing power, not dollars.

Wealth inequality is at record levels, the price of homes is rising while wages are not, and excess savings rates are low.

We’ve been trained to over-borrow and over-consume; we sacrifice a comfortable future for a more pleasurable present.

Bitcoin should help increase financial literacy and lead to more prosperity, reducing economic stagnation on the individual level.

Brad Mills is a lifelong entrepreneur with a focus on product development and marketing. Involved with Bitcoin since 2011 as a miner, entrepreneur, and investor, Brad is a Value Maximalist at his core.

Tune into the 𝘔𝘢𝘨𝘪𝘤 𝘐𝘯𝘵𝘦𝘳𝘯𝘦𝘵 𝘔𝘰𝘯𝘦𝘺 podcast to deepen your insight into Bitcoin. Brad interviews industry game changers and shares their stories so you can learn about the deep roots of Bitcoin’s philosophy.

Brad Mills is a lifelong entrepreneur with a focus on product development and marketing. Involved with Bitcoin since 2011 as a miner, entrepreneur, and investor, Brad is a Value Maximalist at his core.

Tune into the 𝘔𝘢𝘨𝘪𝘤 𝘐𝘯𝘵𝘦𝘳𝘯𝘦𝘵 𝘔𝘰𝘯𝘦𝘺 podcast to deepen your insight into Bitcoin. Brad interviews industry game changers and shares their stories so you can learn about the deep roots of Bitcoin’s philosophy.

While the decreasing duration of each epoch's final block may appear to be a consequence of rising hashrate, this is not the case. These block times are 𝘦𝘯𝘵𝘪𝘳𝘦𝘭𝘺 𝘥𝘶𝘦 𝘵𝘰 𝘤𝘩𝘢𝘯𝘤𝘦.

The Difficulty Adjustment every 2016 blocks, or about every 2 weeks, keeps blocks within a 10 minute timeframe 𝗶𝗻 𝗮𝗴𝗴𝗿𝗲𝗴𝗮𝘁𝗲, not with each individual block. Some blocks within a difficulty period will be found in mere 𝘀𝗲𝗰𝗼𝗻𝗱𝘀, while others will take an hour or more. But zoomed-out, they tend to take about 10 minutes.

With the next halving only a couple days away, how long do you think block 839999 will last before block 840000 is found?

Leave your guesses in the 𝗰𝗼𝗺𝗺𝗲𝗻𝘁𝘀!⬇️

While the decreasing duration of each epoch's final block may appear to be a consequence of rising hashrate, this is not the case. These block times are 𝘦𝘯𝘵𝘪𝘳𝘦𝘭𝘺 𝘥𝘶𝘦 𝘵𝘰 𝘤𝘩𝘢𝘯𝘤𝘦.

The Difficulty Adjustment every 2016 blocks, or about every 2 weeks, keeps blocks within a 10 minute timeframe 𝗶𝗻 𝗮𝗴𝗴𝗿𝗲𝗴𝗮𝘁𝗲, not with each individual block. Some blocks within a difficulty period will be found in mere 𝘀𝗲𝗰𝗼𝗻𝗱𝘀, while others will take an hour or more. But zoomed-out, they tend to take about 10 minutes.

With the next halving only a couple days away, how long do you think block 839999 will last before block 840000 is found?

Leave your guesses in the 𝗰𝗼𝗺𝗺𝗲𝗻𝘁𝘀!⬇️ 𝗚𝗶𝗮𝗰𝗼𝗺𝗼 𝗭𝘂𝗰𝗰𝗼’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

It is important to separate the control of money from the state for the same reason that it's important to separate the control of anything from the state. The modern nation-state is a criminal organization, typically characterized by inefficiency, corruption, and moral bankruptcy. For this reason, it's important to separate the state from its control over defense and firearms, healthcare and medicine, and education and information.

But in particular, it's crucial to separate the state's control over the most significant market of all: money. Money constitutes one-half of every trade that has ever occurred on this planet. The global economy has many sectors that are very important, strategic, and relevant, but no sector can be as important as the sector that is exactly one-half of every single economic transaction in every context, in every age, and in every culture, which is money.

If you corrupt money, you can corrupt any other possible market. If you restore money, you can improve and mitigate problems in most other contexts and markets. So, we should separate the state from literally everything because we should separate organized crime from everything. While we should ostracize organized crime in all forms, it is especially crucial in the case of the most important market: money.

𝗚𝗶𝗮𝗰𝗼𝗺𝗼 𝗭𝘂𝗰𝗰𝗼’𝘀 𝗮𝗻𝘀𝘄𝗲𝗿:

It is important to separate the control of money from the state for the same reason that it's important to separate the control of anything from the state. The modern nation-state is a criminal organization, typically characterized by inefficiency, corruption, and moral bankruptcy. For this reason, it's important to separate the state from its control over defense and firearms, healthcare and medicine, and education and information.

But in particular, it's crucial to separate the state's control over the most significant market of all: money. Money constitutes one-half of every trade that has ever occurred on this planet. The global economy has many sectors that are very important, strategic, and relevant, but no sector can be as important as the sector that is exactly one-half of every single economic transaction in every context, in every age, and in every culture, which is money.

If you corrupt money, you can corrupt any other possible market. If you restore money, you can improve and mitigate problems in most other contexts and markets. So, we should separate the state from literally everything because we should separate organized crime from everything. While we should ostracize organized crime in all forms, it is especially crucial in the case of the most important market: money.

Giacomo Zucco is an Italian technology entrepreneur, and a consultant/teacher for the Bitcoin and Lightning Network protocols. He spends his time supporting projects that he feels might be relevant for the future of Bitcoin, be it as an educator, consultant, entrepreneur, maximalist, or troll. Previously he was involved in GreenAddress, AssoBIT, BlockchainLab, and Bitcoin Magazine. He's currently advancing Bitcoin via BHB Network, BTCTimes, Relai, BCademy, and Notarify.

Giacomo Zucco is an Italian technology entrepreneur, and a consultant/teacher for the Bitcoin and Lightning Network protocols. He spends his time supporting projects that he feels might be relevant for the future of Bitcoin, be it as an educator, consultant, entrepreneur, maximalist, or troll. Previously he was involved in GreenAddress, AssoBIT, BlockchainLab, and Bitcoin Magazine. He's currently advancing Bitcoin via BHB Network, BTCTimes, Relai, BCademy, and Notarify.