We often hear the #bitcoin "store of value" narrative, but to what degree are BTC and stocks actually correlated?

Newhedge

Bitcoin vs US Equities Correlation Chart | Newhedge

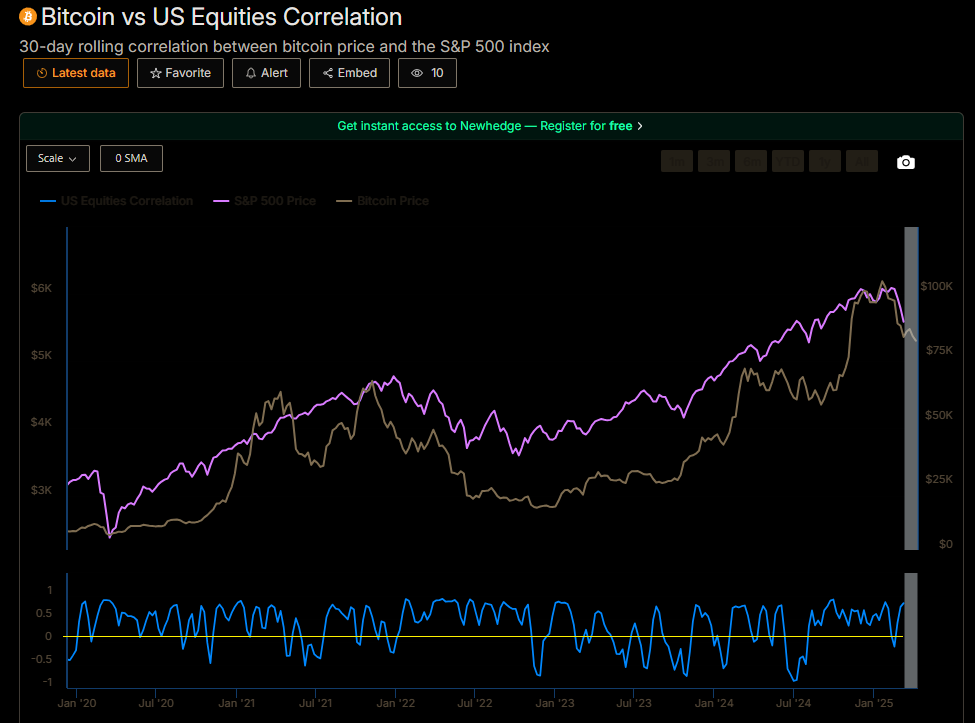

Bitcoin vs US Equities Correlation is the 30-day rolling correlation between bitcoin price and the s&p 500 index

charts the Pearson (I assume) correlation.

Pink is S&P 500, "orange" is BTC, but blue is the correlation. I superimposed a yellow line at zero (wish the chart emphasized the blue line rather than the others because that's the point of the correlation graph).

- If positively correlated, blue is above the yellow line...stocks go up, BTC goes up. Stocks go down, BTC goes down.

- If negatively correlated, blue is below the yellow line...stocks go up, BTC goes down. Stocks go down, BTC goes up.

- If truly NOT correlated, the blue should be near the yellow line at zero...stocks go up, BTC does SOMETHING else. Stocks go down, BTC does SOMETHING else.

The negative correlation is the most ideal for the BTC "store of value" narrative that goes like this: "Bitcoin is a safe haven from stock (or fiat) volatility and devaluation. I'll store my value in bitcoin."

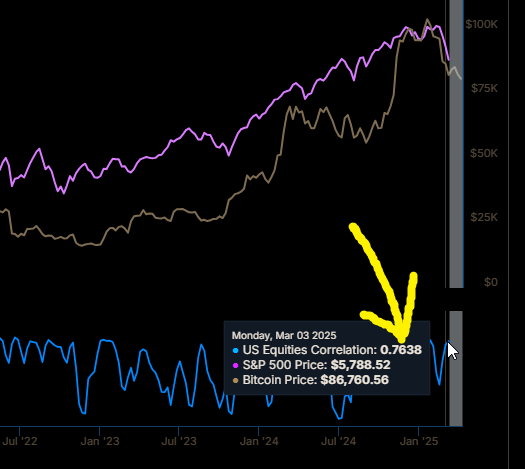

Looking at the first chart though, we've clearly been in the positive correlation range more than the negative. And, currently we're at a correlation of 0.7 (strong positive). So, work to be done, keep plugging away doing what we do.