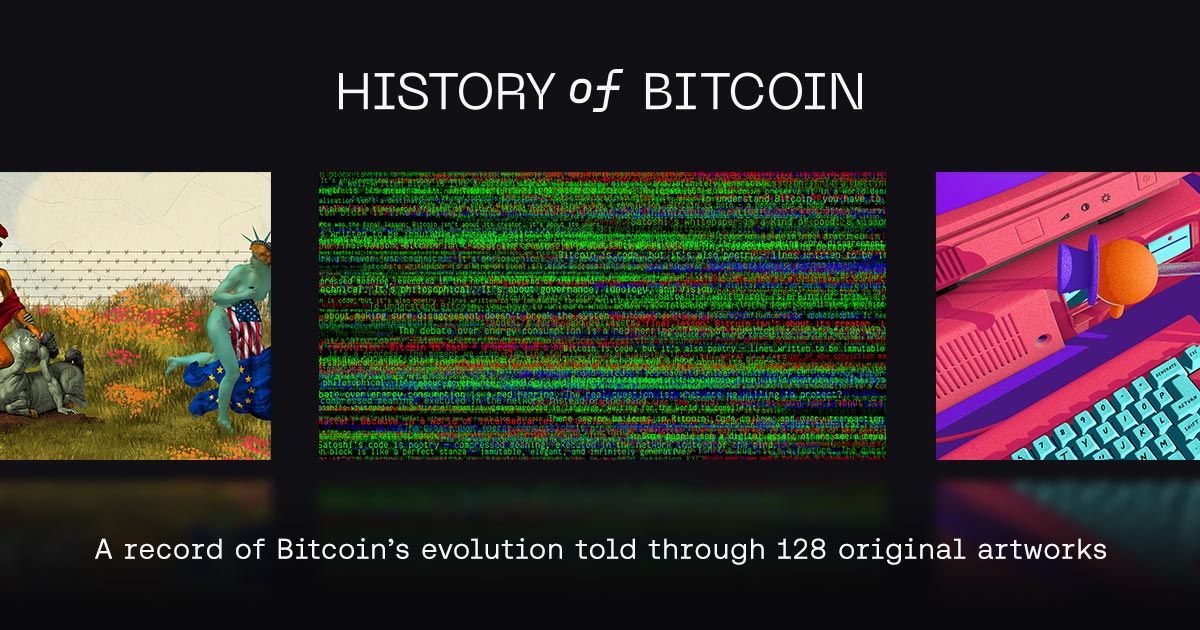

If the #blockchain records the transactions, #Bitcointalk records the humanity. It is the archive that captured #Bitcoin’s earliest culture: Satoshi’s posts, first debates, early memes and the birth of a movement. Artwork by Sasha Stiles (@sashastiles).

While Bitcoin’s blockchain preserves its on-chain history, the Bitcointalk forum has become the permanent record of everything that happened around it. Across thousands of posts, you can trace the ideas, personalities and tensions that shaped Bitcoin long before it went mainstream.

The forum originally lived at bitcoin dot org/smf and later at forums.bitcoin dot org before moving to bitcointalk dot org in 2011. Registered by Satoshi on November 17 2009, it quickly became the centre of discussion for the early community. From technical questions about how to run a node to philosophical debates about privacy and value, the forum documented Bitcoin’s evolution from concept to reality.

#Satoshi posted only 575 times during the 13 months he was active, but every message now serves as a historical artefact. Alongside him were names who would later become central to Bitcoin’s story: #HalFinney,

@Martti Malmi, Gavin Andresen and even a young #VitalikButerin.

In its earliest months, the forum felt small and united. A few dozen users experimented with the software, shared ideas and worked together to help Bitcoin grow. They did not know where Bitcoin was headed, but they sensed they were building something meaningful.

After Satoshi stepped back, Martti Malmi took over as lead admin, later passing the role to #Theymos in 2012, who continues to maintain the forum. Though not decentralised, Bitcointalk has remained resistant to censorship and has preserved its grassroots ethos as Bitcoin expanded into global territory.

Many pivotal early events occurred on Bitcointalk, including the first bitcoin to fiat trade in 2009. They remain archived there today, forming a parallel ledger of the human side of Bitcoin’s origin story.

Read the full article:

History of Bitcoin

A Forum for Debate

Launched by Satoshi in 2009, Bitcointalk became Bitcoin’s first forum—a hub for Nakamoto’s writings, bold ideas, and the pioneers who shaped ...

Artwork: A Forum for Debate by Sasha Stiles (@sashastiles).

Appears in the History of Bitcoin Collector’s Book and on our interactive timeline.

#Bitcoin #BitcoinArt

#Bitcoin #BitcoinArt