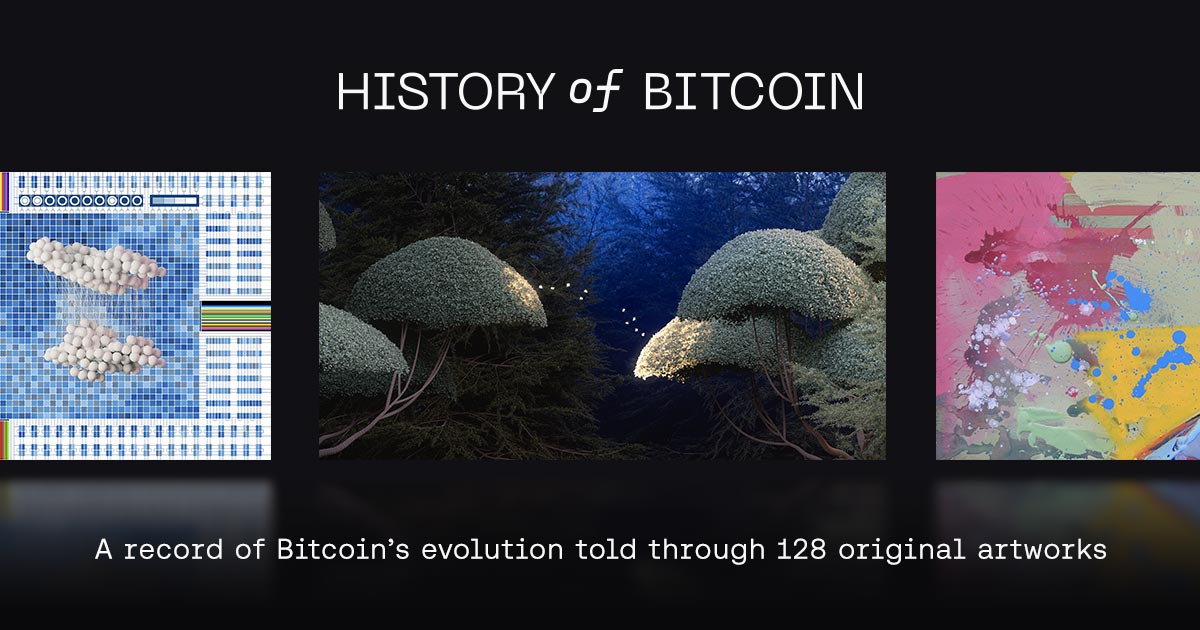

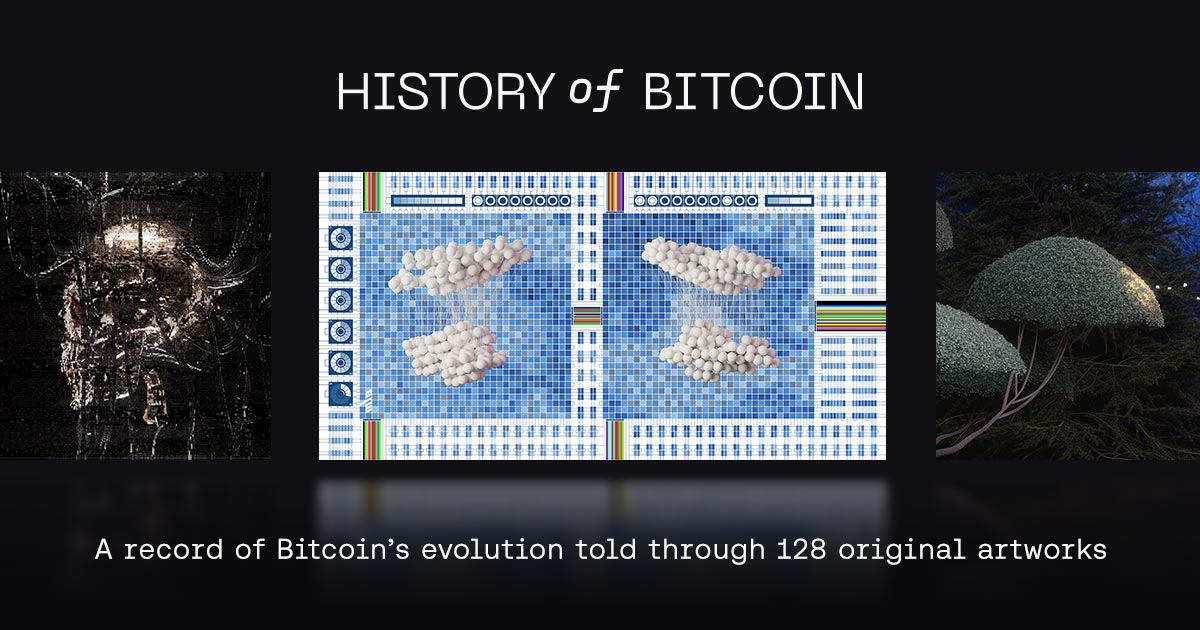

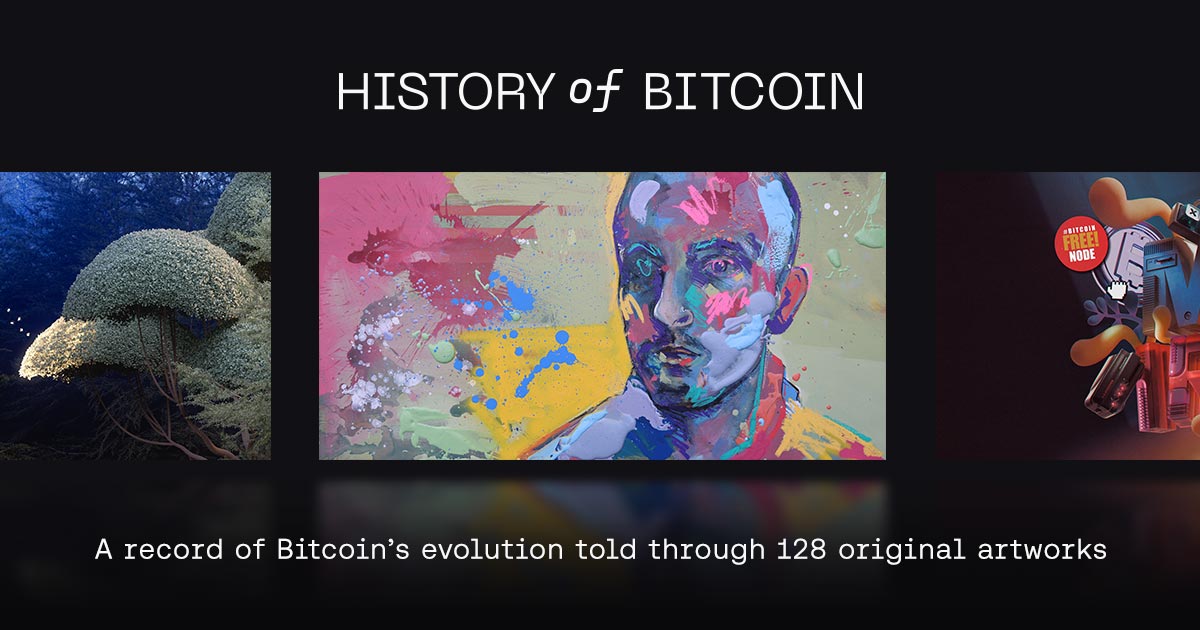

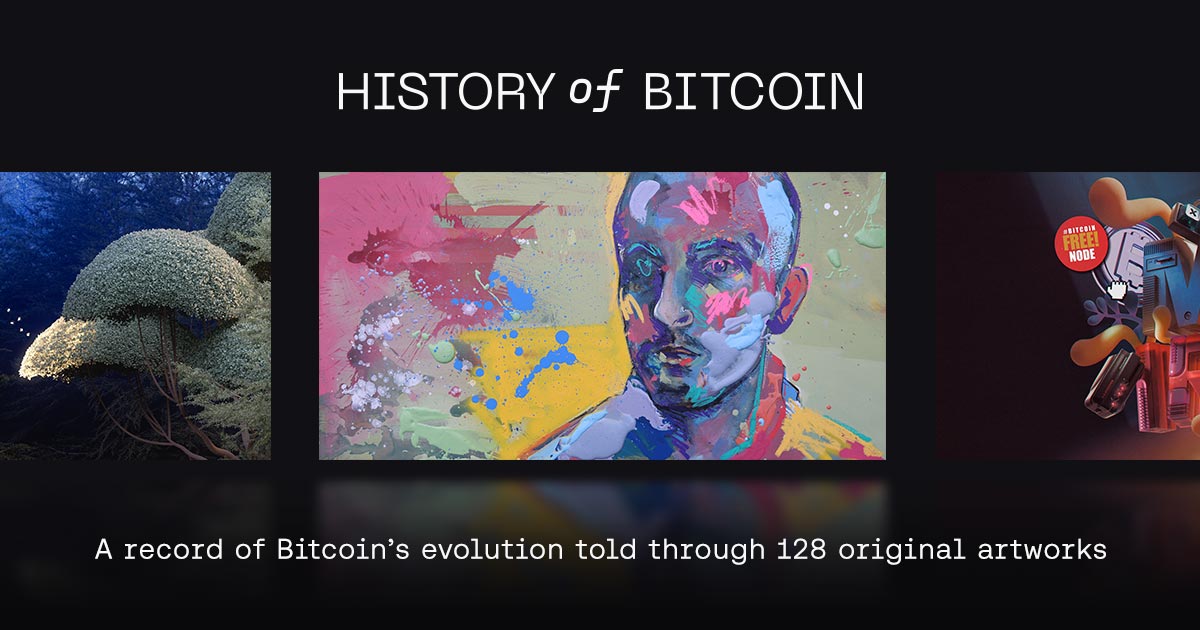

Great ideas spark movements, but collaboration turns them into reality. @Martti Malmi (@marttimalmi on X) was one of the first to help build #Bitcoin from nothing. Artwork by Pani Santiago (@pani_santiago on X).

Martti discovered Bitcoin in April 2009 while studying computer science in Helsinki. He cared deeply about freedom and self sovereignty and believed technology could achieve what politics could not. Money, he realised, was the most powerful system to change. Centralised alternatives like e-Gold and Liberty Dollar had all failed. A peer to peer system was needed.

Searching online, he found Bitcoin, read the Whitepaper and emailed #Satoshi offering to contribute. Satoshi first asked him to write an FAQ for bitcoin dot org. Soon he was helping develop the site and forums, improving the software, porting the client to Linux and coordinating translations. The early community was small, idealistic and focused on building a better monetary system.

The Slashdot mention in 2010 triggered rapid growth. Miners flooded in and the culture shifted. Martti kept his node running so newcomers always had peers. With difficulty still at 1, he could mine 200 to 300 BTC per day on his laptop. Over time he mined more than 55,000 BTC, turning mining off only when playing Counter Strike.

In October 2009, he completed the first known BTC USD trade, selling 5,050 BTC for 5.02 dollars. In 2010, he launched BitcoinExchange dot com, the first semi automated exchange. He shut it down later that year as Mt. Gox gained traction and due to Finnish regulatory constraints.

As Bitcoin grew, Martti had less time to contribute. He sold part of his holdings in 2011 to buy a studio apartment, a major moment for him at age 22. Later he had to sell more BTC at low prices while between jobs. Today, the BTC he once had would make him a billionaire, but he does not dwell on that. He says he gained far more from the people, ideas and experiences that came from helping build Bitcoin.

He reflects on gratitude, on @npub1pzzr...dsr8 harsh sentence, and on the importance of appreciating what we have. Most of all, he is proud of Bitcoin’s impact. It has made millions ask what money really is and created a culture that still grows stronger. In his words, the snowball is only beginning to roll.

Read the full article:

Artwork: From Solo to Shared by Pani Santiago (@pani_santiago over on X).

With thanks to @Martti Malmi (@marttimalmi over on X) for sharing his story.

Appears in the History of Bitcoin Collector’s Book and on our interactive timeline.

Artwork: From Solo to Shared by Pani Santiago (@pani_santiago over on X).

With thanks to @Martti Malmi (@marttimalmi over on X) for sharing his story.

Appears in the History of Bitcoin Collector’s Book and on our interactive timeline.

History of Bitcoin

From Solo to Shared

In 2009, Finnish developer Martti Malmi reached out to Satoshi. Their exchange sparked a mentorship that shaped Bitcoin’s formative early days.